|

市場調查報告書

商品編碼

1910719

北美商用LED照明市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2032年)North America Commercial LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2032) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

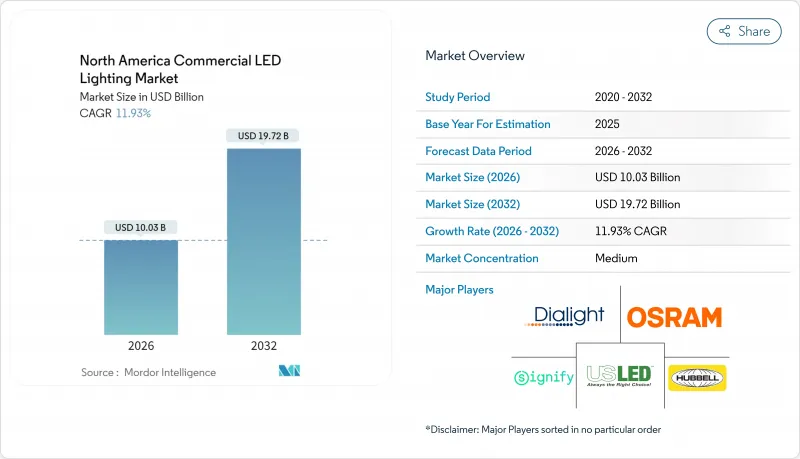

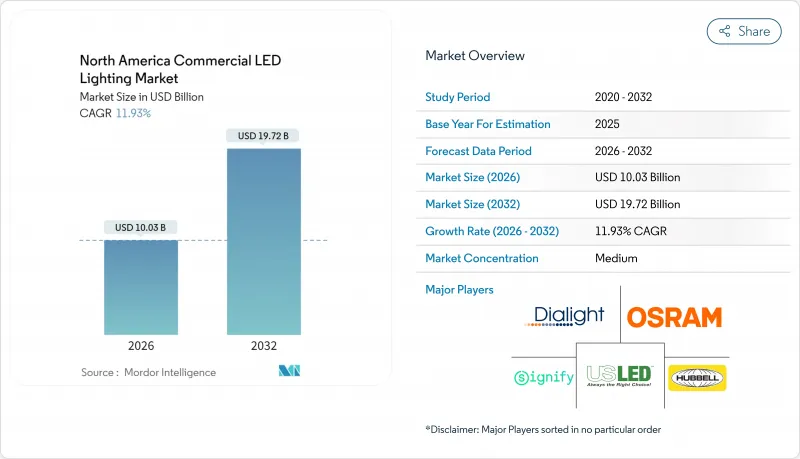

預計北美商業 LED 照明市場將從 2025 年的 896 萬美元成長到 2026 年的 1,003 萬美元,到 2032 年將達到 1,972 萬美元,2026 年至 2032 年的複合年成長率為 11.93%。

北美商業LED照明市場正從單純追求效率的升級轉向與智慧建築理念相契合的全聯網、高感測器系統。儘管日益嚴格的法規,特別是美國能源局將於2028年7月生效的每瓦120流明的強制性規定,正在逐步淘汰老舊的螢光技術,但企業淨零排放目標仍然是推動維修需求持續成長的動力。照明燈具價格的下降進一步擴大了整體擁有成本(TCO)優勢,使得即使在中型設施中,大規模部署LED照明也具有經濟可行性。同時,人性化的照明功能和物聯網連接正在提升LED提案在節能之外的價值主張。隨著供應商在應對大宗商品利潤壓力的同時尋求高階軟體解決方案帶來的機遇,市場競爭日益激烈。

北美商用LED照明市場趨勢與洞察

嚴格的節能法規和建築規範推動市場轉型

聯邦和州政府的政策正在重塑北美商業LED照明市場的採購標準,強制要求更高的能源效率標準和更先進的控制技術。美國能源部計劃要求2028年7月之後銷售的通用燈具的最低能源效率達到120 lm/W,這將加速淘汰約佔商業燈具一半的緊湊型螢光。同時,ASHRAE/IES 90.1-2022標準強制要求更嚴格的照明功率密度和日光響應控制,從而有利於採用整合感測器的LED系統。加州第24章第6部分法規進一步加快了實施進度,導致區域維修活動激增。這些多層次的法規提高了市場進入門檻,有利於擁有合規產品系列和認證技術的成熟製造商。因此,北美商業LED照明市場的需求前景更加明朗,供應商可以擴大組件採購範圍並穩定價格。

LED燈具價格下降和整體擁有成本(TCO)優勢推動了其商業應用。

LED構裝和驅動器成本的快速下降降低了燈具的初始價格,使得許多商業維修計劃能夠在不到兩年的時間內收回投資。現代槽型燈具的光效可達110 lm/W(比螢光基準高出40%),額定壽命延長至約85,000小時。這意味著維護週期相應縮短,有助於設施管理人員降低營運成本。透過將高棚照明更換為LED,物流中心實現了50-70%的節能,大型設施每年可節省高達10萬美元的電費。此外,美國多個州實施的公用事業補貼計畫可降低10-15%的資本成本,進一步鞏固了採用LED的資金籌措決策。這些經濟因素共同推動了北美商業LED照明市場的近期成長勢頭,因為投資回報對預算有限的業主來說更具吸引力。

價格下跌擠壓供應商利潤空間,競爭壓力加劇。

基本照明燈具的商品化加劇了價格壓力,使製造商難以維持盈利。從市場領導昕諾飛(Signify)到中階品牌,各家公司都面臨股價波動,因為投資人質疑平均售價下降帶來的成長前景。 Acquity Brands 則是逆勢而行,優先發展智慧空間解決方案。儘管銷售額下滑,該公司在 2024 會計年度仍實現了 16.7% 的成長,每股收益成長了 24.9%。北美商用 LED 照明市場的整合正在加速,規模較小或缺乏專業知識的製造商正在考慮合併或退出。關稅的不確定性,特別是擬議對墨西哥組裝的照明燈具徵收 25% 的關稅,增加了成本風險,並使擁有跨境供應鏈的供應商的定價策略更加複雜。

細分市場分析

到2025年,辦公領域將佔據北美商業LED照明市場29.65%的佔有率,主要得益於企業為實現ESG目標和提升員工體驗而進行的大規模維修。為了提高能源效率並更好地支援晝夜節律,辦公室正擴大採用人性化的可調光白光照明燈具和人體感應器。這些高價值需求推高了平均售價,使供應商能夠彌補其他領域利潤率的下降。同時,設施管理人員更傾向於選擇能夠與暖通空調(HVAC)和門禁系統無縫整合的網路化燈具,這推動了北美商業LED照明市場轉型為整合式建築平台。

儘管零售環境目前銷售額不高,但它是成長最快的細分市場,預計到2032年將以16.95%的複合年成長率成長。零售商表示,得益於能夠提升產品可見度並影響消費者情緒的策略性重點照明,銷售額成長高達25%。連鎖店正更頻繁地更新照明系統,以配合不斷更新的品牌體驗,從而形成持續的需求循環。飯店、醫療保健和教育產業為擁有特殊需求的製造商提供了差異化的機遇,例如為病房提供晝夜節律支援照明,以及為教室提供防眩光下照燈。工業和倉儲設施正在採用高棚維修,該方案投資回報迅速,但價格仍是競爭的關鍵因素。這些跨行業的成長勢頭支撐著北美商業LED照明市場,使其免受任何單一行業放緩的影響。

北美商業LED照明市場按應用領域(零售、辦公室、酒店、建築照明、醫療保健等)、外形尺寸(槽型燈、下照燈、高棚燈、軌道燈、吊燈等)、配銷通路(直銷、零售/批發、節能服務公司/照明服務供應商、線上/電商)和地區進行細分。市場預測以美元計價。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的節能和建築規範

- LED燈具價格下降和整體擁有成本(TCO)優勢

- 智慧互聯物聯網照明的發展

- 向以人性化、以健康為中心的照明轉變

- 企業淨零排放和ESG目標加速了維修

- 來自室內垂直農業和微型倉配中心的需求

- 市場限制

- 價格下跌給供應商利潤率帶來壓力。

- 現有設施的維修和安裝成本很高。

- 關鍵零件(磷光體、驅動器、積體電路)短缺

- 與OLED/microLED照明面板的競爭

- 價值/供應鏈分析

- 監管環境

- 技術展望

第5章 市場規模及成長預測(以金額為準,2022-2030 年)

- 透過使用

- 零售商店(展示室、購物中心、商店)

- 辦公室

- 飯店餐飲業(餐廳、賭場、飯店)

- 建築(裝飾)

- 醫療設施

- 教育機構

- 工業/倉庫

- 戶外商業設施(停車場、建築幕牆)

- 按外形規格

- 特羅弗

- 下照燈

- 高棚照明

- 軌道燈

- 吊燈

- 面板燈

- 直條

- 其他

- 透過分銷管道

- 直銷

- 零售/批發

- 節能服務公司/照明服務供應商

- 線上/電子商務

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市佔率分析

- 公司簡介

- Signify Holding(Philips Lighting & Cooper Lighting)

- Acuity Brands Inc.

- Hubbell Inc.

- Cree Lighting(IDEAL Industries)

- Dialight PLC

- US LED Ltd.

- Osram Licht AG

- Technical Consumer Products Inc.

- Current Lighting Solutions LLC(GE Current)

- Zumtobel Group

- Lutron Electronics Co.

- Legrand SA

- Leviton Manufacturing Co.

- Samsung Electronics America

- LG Innotek USA

- Nichia America Corp.

- Orion Energy Systems Inc.

- Energy Focus Inc.

- Digital Lumens Inc.

- Fagerhult Group(North America)

- Revolution Lighting Technologies

- Cooper Lighting Solutions

第7章 市場機會與未來展望

The North America Commercial LED Lighting market is expected to grow from USD 8.96 million in 2025 to USD 10.03 million in 2026 and is forecast to reach USD 19.72 million by 2032 at 11.93% CAGR over 2026-2032.

The North America Commercial LED Lighting market is transitioning from purely efficiency-driven upgrades toward fully networked, sensor-rich systems that align with smart-building initiatives. Regulatory tightening most notably the Department of Energy's 120 lumens-per-watt mandate effective July 2028 removes legacy fluorescent technologies, while corporate net-zero targets sustain retrofit momentum. Price declines across luminaires deepen the total-cost-of-ownership advantage, making broad adoption economical even for mid-sized facilities. Simultaneously, human-centric lighting features and IoT connectivity strengthen value propositions that go beyond energy savings. Competitive intensity increases as vendors balance margin pressure from commodity products with opportunities in premium, software-enabled solutions.

North America Commercial LED Lighting Market Trends and Insights

Stringent Energy-Efficiency Regulations and Building Codes Drive Market Transformation

Federal and state policies reshape purchasing criteria across the North America Commercial LED Lighting market by enforcing higher efficacy thresholds and advanced control requirements. The Department of Energy will compel all general-service lamps sold after July 2028 to deliver at least 120 lm/W, accelerating retirement of compact fluorescent lamps that still populate nearly half of commercial sockets ASHRAE/IES 90.1-2022 concurrently sets stricter lighting power densities and daylight-responsive controls that favor LED systems with integrated sensors. California's Title 24 Part 6 pushes even more aggressive timelines, creating regional surges in retrofit activity. These layered regulations raise entry barriers, benefiting incumbent manufacturers with compliant product portfolios and certification expertise. Consequently, the North America Commercial LED Lighting market gains predictable demand visibility, allowing vendors to scale component procurement and stabilize pricing.

Declining LED Luminaire Prices and Total-Cost-of-Ownership Advantage Accelerate Commercial Adoption

Rapid cost compression across LED packages and drivers lowers upfront fixture prices, enabling projects to justify payback periods shorter than two years in many commercial retrofits. Contemporary troffer designs deliver 110 lm/W efficacy-40% higher than fluorescent references-while extending rated life to roughly 85,000 hours; maintenance cycles drop proportionally, cutting operating expenses for facility managers . High-bay conversions record energy savings of 50-70% in distribution centers, generating six-figure annual utility reductions in large venues. Utility incentives across multiple U.S. states further shave 10-15% from capital costs, tipping financing decisions decisively toward LED. Together, these economic levers reinforce the North America Commercial LED Lighting market's momentum in the short term as payback math becomes compelling even for budget-constrained property owners

Price Erosion Squeezing Vendor Margins Intensifies Competitive Pressure

Commoditization in basic luminaires fuels downward price pressure, challenging manufacturers to protect profitability. Market leaders such as Signify and mid-tier brands alike witness share price volatility as investors question growth prospects amid falling average selling prices Acuity Brands counters the trend by prioritizing intelligent-spaces solutions, which expanded 16.7% in fiscal 2024 and lifted earnings per share 24.9% despite a topline dip. Smaller manufacturers lacking scale or specialization explore mergers or exit, accelerating consolidation within the North America Commercial LED Lighting market. Tariff uncertainty-especially proposals to levy 25% duties on Mexican-assembled luminaires-adds cost risk, complicating pricing strategies for vendors with cross-border supply chains.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Smart, Connected, and IoT-Enabled Lighting Creates New Value Propositions

- Shift Toward Human-Centric and Wellness-Focused Lighting Drives Premium Segment Growth

- High Retrofit and Installation Costs in Legacy Facilities Limit Market Penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The office category commanded 29.65% of the North America Commercial LED Lighting market share in 2025, underpinned by large-scale corporate retrofits aimed at meeting ESG commitments and boosting employee experience. Offices increasingly deploy human-centric, tunable-white luminaires and occupancy sensors to optimize energy while enhancing circadian support. These premium requirements sustain higher average selling prices, helping vendors offset margin compression elsewhere. Concurrently, facility managers prefer networked fixtures that integrate seamlessly with HVAC and access-control systems, reinforcing the North America Commercial LED Lighting market's shift toward converged building platforms.

Retail environments, while smaller in revenue today, are the fastest-growing segment at a 16.95% CAGR through 2032. Merchandisers cite sales uplifts up to 25% from strategic accent lighting that sharpens product visibility and shapes shopper mood. Store chains also refresh lighting more frequently to align with brand-experience updates, creating recurring demand cycles. Hospitality, healthcare, and education follow with specialized requirements-ranging from circadian support in patient rooms to glare-controlled downlights in classrooms-offering differentiated avenues for manufacturers. Industrial and warehouse settings deploy high-bay retrofits that realize quick paybacks, but the competitive landscape there remains price-sensitive. Collectively, cross-vertical momentum sustains the breadth of the North America Commercial LED Lighting market, protecting it against single-sector slowdowns.

North America Commercial LED Lighting Market is Segmented by Application (Retail Stores, Office, Hospitality, Architectural, Healthcare Facilities, and More), Form Factor (Troffers, Downlights, High-Bay, Track Lights, Suspended Pendants, and More), Distribution Channel (Direct Sales, Retail/Wholesale, ESCO/Lighting-as-a-Service Providers, Online/E-commerce), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Signify Holding (Philips Lighting & Cooper Lighting)

- Acuity Brands Inc.

- Hubbell Inc.

- Cree Lighting (IDEAL Industries)

- Dialight PLC

- US LED Ltd.

- Osram Licht AG

- Technical Consumer Products Inc.

- Current Lighting Solutions LLC (GE Current)

- Zumtobel Group

- Lutron Electronics Co.

- Legrand S.A.

- Leviton Manufacturing Co.

- Samsung Electronics America

- LG Innotek USA

- Nichia America Corp.

- Orion Energy Systems Inc.

- Energy Focus Inc.

- Digital Lumens Inc.

- Fagerhult Group (North America)

- Revolution Lighting Technologies

- Cooper Lighting Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent energy-efficiency regulations and building codes

- 4.2.2 Declining LED luminaire prices and TCO advantage

- 4.2.3 Growth of smart, connected and IoT-enabled lighting

- 4.2.4 Shift toward human-centric and wellness-focused lighting

- 4.2.5 Corporate net-zero and ESG targets accelerating retrofits

- 4.2.6 Demand from indoor vertical farming and micro-fulfilment hubs

- 4.3 Market Restraints

- 4.3.1 Price erosion squeezing vendor margins

- 4.3.2 High retrofit and installation costs in legacy facilities

- 4.3.3 Critical component shortages (phosphors, drivers, ICs)

- 4.3.4 Competition from OLED / micro-LED illumination panels

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

5 MARKET SIZE and GROWTH FORECASTS (VALUE, 2022-2030)

- 5.1 By Application

- 5.1.1 Retail Stores (Showrooms, Malls, Shops)

- 5.1.2 Office

- 5.1.3 Hospitality (Restaurants, Casinos, Hotels)

- 5.1.4 Architectural (Decorative)

- 5.1.5 Healthcare Facilities

- 5.1.6 Educational Institutions

- 5.1.7 Industrial and Warehouse

- 5.1.8 Outdoor Commercial (Parking, Facades)

- 5.2 By Form Factor

- 5.2.1 Troffers

- 5.2.2 Downlights

- 5.2.3 High-Bay

- 5.2.4 Track Lights

- 5.2.5 Suspended Pendants

- 5.2.6 Panel Lights

- 5.2.7 Linear Strips

- 5.2.8 Others

- 5.3 By Distribution Channel

- 5.3.1 Direct Sales

- 5.3.2 Retail / Wholesale

- 5.3.3 ESCO / Lighting-as-a-Service Providers

- 5.3.4 Online / E-commerce

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.2.1 Signify Holding (Philips Lighting & Cooper Lighting)

- 6.2.2 Acuity Brands Inc.

- 6.2.3 Hubbell Inc.

- 6.2.4 Cree Lighting (IDEAL Industries)

- 6.2.5 Dialight PLC

- 6.2.6 US LED Ltd.

- 6.2.7 Osram Licht AG

- 6.2.8 Technical Consumer Products Inc.

- 6.2.9 Current Lighting Solutions LLC (GE Current)

- 6.2.10 Zumtobel Group

- 6.2.11 Lutron Electronics Co.

- 6.2.12 Legrand S.A.

- 6.2.13 Leviton Manufacturing Co.

- 6.2.14 Samsung Electronics America

- 6.2.15 LG Innotek USA

- 6.2.16 Nichia America Corp.

- 6.2.17 Orion Energy Systems Inc.

- 6.2.18 Energy Focus Inc.

- 6.2.19 Digital Lumens Inc.

- 6.2.20 Fagerhult Group (North America)

- 6.2.21 Revolution Lighting Technologies

- 6.2.22 Cooper Lighting Solutions

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment