|

市場調查報告書

商品編碼

1910715

聚醚胺:市佔率分析、產業趨勢與統計、成長預測(2026-2031)Polyetheramine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

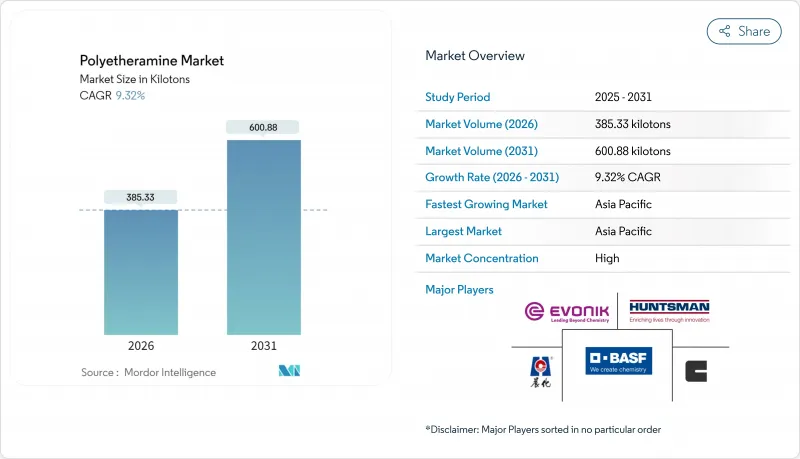

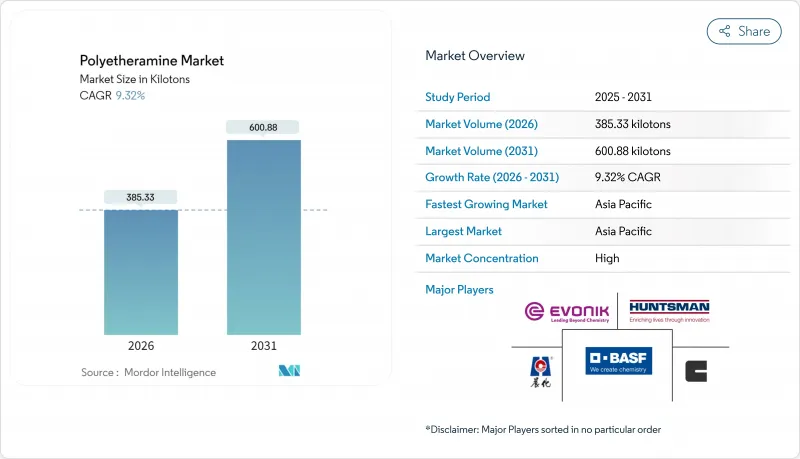

預計到 2026 年,聚醚胺市場規模將達到 385.33 千噸。

這代表著從 2025 年的 352.47 千噸成長到 2031 年的 600.88 千噸,2026 年至 2031 年的複合年成長率為 9.32%。

下游產業對更輕、更耐用的材料的需求不斷成長,推動了風力發電機葉片生產、複合材料製造和高性能塗料領域的需求,從而帶動了這一成長勢頭。二胺類產品佔據主導地位,其均衡的反應活性使其非常適合大規模葉片固化和結構複合材料。離岸風力發電的擴張、汽車輕量化和基礎設施韌性計劃持續推動對特種胺的需求,而3D列印配方師則採用聚醚胺固化環氧樹脂來滿足複雜幾何形狀的需求。儘管原料價格波動和日益嚴格的胺類排放法規限制了短期利潤率,但生物基產品、亞太地區產能的提升以及垂直整合策略正在為領先供應商的持續收入成長奠定基礎。

全球聚醚胺市場趨勢及展望

對黏合劑和密封劑產業的投資增加

隨著建築商和汽車製造商尋求輕質、耐腐蝕的黏合劑解決方案,對先進建築和電動車黏合劑的資本投入也在增加。聚醚胺改質體係因其低VOC含量和在極端溫度下仍具有高剝離強度而價格高昂。BASF的Baxxodur產品線(透過Univar Solutions在北美銷售)就是一個很好的例子,它展示了整合物流如何提高市場滲透率。永續性的需求也在推動新產品的推出,例如贏創的生物基聚醚胺Ancamide 2853/2865,並促進了ISO 14001認證工廠對聚醚胺的應用。

複合材料製造領域的需求不斷成長

航太認證和日益嚴格的汽車燃油經濟性法規正迫使樹脂製造商轉向使用能夠延長適用期並提高抗疲勞性的固化劑。全球風電裝置容量已超過743吉瓦,長度超過100公尺的葉片需要使用聚醚胺固化環氧樹脂,以在低溫環境下進行大型零件加工時保持結構完整性。光纖感測系統的廣泛應用進一步推動了對光學透明、低收縮率固化劑的需求。中國領先的石化企業,如恆力、盛宏等,正在整合其下游工藝,以確保原料供應並縮短前置作業時間,從而加劇競爭並增強供應鏈的韌性。

胺排放引發的環境問題

美國環保署 (EPA) 國家排放標準和危害評估程序 (NESHAP) 的擴展迫使工廠維修現有設備或安裝封閉式系統,這增加了中型生產商的資本支出。排放法規也影響民眾對胺基碳捕集溶劑的看法,間接影響了聚醚胺的聲譽。供應商正在透過促銷低氣味和生物含量等級的產品,並與設備原始設備製造商 (OEM) 合作,共同開發低排放加工通訊協定來應對這項挑戰。

細分市場分析

到 2025 年,二胺級產品將佔出貨量的 49.05%,為需要兼具反應活性和柔軟性的風力葉片和結構複合材料應用提供支持,預計到 2031 年將以 9.88% 的複合年成長率成長。亨斯邁的 Jeffamine D 系列涵蓋 230 至 2,000 的分子量範圍,並提供可調交聯密度,適用於設計使用壽命為 20 年的葉片。

單胺和三胺產量較小,主要滿足特定需求。單胺可改善塗料的表面潤濕性,而三胺則可提高高玻璃化轉變溫度(Tg)航太面板的交聯密度。中國製造商淄博德信聯邦化工已將年產量擴大至3萬噸,為注重成本的買家提供了更多原料選擇。生物基二胺(例如贏創的安卡明2880)的研發,體現了向永續原料的轉型,同時保持了戶外套件所需的紫外線穩定性。

聚醚胺報告按類型(單胺、二胺、三胺)、應用(聚脲、燃料添加劑、複合材料、環氧塗料、黏合劑和密封劑、其他)、最終用戶產業(汽車、建築和施工、風力發電、電子和電氣、其他最終用戶產業)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。

區域分析

預計到2025年,亞太地區將佔據聚醚胺市場53.42%的佔有率,主要得益於中國、印度和東南亞地區葉片和複合材料零件產量的成長。產能擴張方面,BASF南京特種胺工廠和草倉工廠的年產能將提升至18,800噸,增強了區域供應並縮短了交貨時間。

北美一直是創新中心,匯聚了許多領先的航太製造商和先進的3D列印服務供應商。遵守美國環保署 (EPA) 的 NESHAP 法規有利於擁有良好環保資質的供應商,並鼓勵使用者採用低揮發性有機化合物 (VOC) 的二胺化學品。BASF的 Baxxodur 產品由 Univar Solutions 獨家供應,可增強技術服務網路,並支援汽車和建築行業一級原始設備製造商 (OEM) 快速完成規格製定。

歐洲的能源轉型政策正在推動對可再生葉片和循環經濟塗料的持續需求。 TPI Composites位於土耳其的工廠正在擴大產能,以滿足歐洲風力發電廠的需求。 REACH法規也有利於那些能夠處理複雜文件的現有供應商。新興地區(如南美和中東)對可再生能源設備和工業塗料的需求正在成長,但這些地區主要依賴從亞太地區進口,因此正在考慮建立當地混合設施。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對黏合劑和密封劑產業的投資增加

- 複合材料製造領域的需求不斷成長

- 擴大風力發電機葉片生產

- 對高性能聚脲防護塗料的需求激增

- 環氧樹脂體系在3D列印的應用

- 市場限制

- 原料環氧丙烷價格波動

- 與胺排放相關的環境問題

- 食品接觸黏合劑等級審核延遲

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 單胺

- 二胺

- 三胺

- 透過使用

- 聚脲

- 燃油添加劑

- 複合材料

- 環氧樹脂塗層

- 黏合劑和密封劑

- 其他

- 按最終用戶行業分類

- 車

- 建築/建築設計

- 風力發電

- 電學

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BASF

- Clariant

- Evonik Industries AG

- Huntsman International LLC

- Qingdao IRO Surfactant Co., Ltd.

- Shandong Longhua New Materials Co., Ltd.

- Wuxi Akeli Technology Co., Ltd.

- Yangzhou Chenhua New Material Co., Ltd.

- Yantai Dasteck Chemicals Co., Ltd.

- Zibo Zhengda Polyurethane Co., Ltd.

第7章 市場機會與未來展望

Polyetheramine market size in 2026 is estimated at 385.33 kilotons, growing from 2025 value of 352.47 kilotons with 2031 projections showing 600.88 kilotons, growing at 9.32% CAGR over 2026-2031.

Momentum stems from escalating demand in wind-turbine blade production, composites manufacturing, and high-performance coatings as downstream industries target lighter, more durable materials. Diamine grades dominate because their balanced reactivity suits large-scale blade curing and structural composites. Offshore wind expansion, automotive lightweighting, and infrastructure resilience projects continue to pull specialty amine volumes, while 3D-printing formulators adopt polyetheramine-cured epoxies for complex geometries. Feedstock price swings and tightening amine-emission regulations temper short-term margins, yet bio-based variants, capacity builds in Asia-Pacific, and vertical integration strategies position leading suppliers for sustained earnings growth.

Global Polyetheramine Market Trends and Insights

Increasing Investments in Adhesives and Sealants Industry

Capital allocation into advanced construction and e-mobility adhesives is rising as builders and automakers seek lighter, corrosion-resistant bonding options. Polyetheramine-modified systems command a premium because they deliver low-VOC profiles and high peel strength under extreme temperatures. BASF's Baxxodur portfolio, distributed in North America via Univar Solutions, illustrates how integrated logistics strengthen market penetration. Sustainability mandates also spur launches such as Evonik's bio-content Ancamide 2853/2865, reinforcing polyetheramine uptake in ISO 14001-certified plants.

Growing Demand from Composites Manufacturing

Aerospace certification and automotive fuel-efficiency rules push resin suppliers toward curing agents that lengthen pot life yet boost fatigue resistance. With global wind capacity already above 743 GW, blades exceeding 100 meters require polyetheramine-cured epoxies that maintain structural integrity during low-temperature, large-part processing. Embedded fiber-optic sensing systems further raise the need for optically clear, low-shrinkage hardeners. Chinese petrochemical majors such as Hengli and Shenghong are integrating downstream to secure feedstocks and compress lead times, which intensifies competitive pricing but also broadens supply resilience.

Environmental Concerns over Amine Emissions

Expanded EPA NESHAP scopes compel plants to retrofit scrubbers or adopt closed-loop systems, raising capex for mid-scale producers. Emission caps also influence public perception of amine-based carbon-capture solvents, indirectly affecting polyetheramine reputations. Suppliers counter by marketing low-odor, bio-content grades and partnering with equipment OEMs to co-develop lower-emission processing protocols.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Wind-Turbine Blade Production

- Surge in High-Performance Polyurea Protective Coatings

- Slow Approval for Food-Contact Adhesive Grades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diamine grades accounted for 49.05% of 2025 shipments, underpinning wind-blade and structural composite uses that demand balanced reactivity and flexibility, and is on track for a 9.88% CAGR to 2031. Huntsman's JEFFAMINE D-series ranges from molecular weight 230 to 2,000, letting processors tune crosslink density for blades designed to last 20 years.

Monoamine and triamine volumes trail but address niche needs: monoamines improve surface wetting in coatings, while triamines hike crosslink density for high-Tg aerospace panels. Chinese producer Zibo Dexin Lianbang Chemical scaled to 30,000 tons per year, widening raw material choice for cost-sensitive buyers. Bio-based diamine research and development from Evonik's Ancamine 2880 evidences a shift to sustainable feedstocks while retaining UV stability for outdoor kits.

The Polyetheramine Report is Segmented by Type (Monoamine, Diamine, and Triamine), Application (Polyurea, Fuel Additives, Composites, Epoxy Coatings, Adhesives and Sealants, and Others), End-User Industry (Automotive, Building and Construction, Wind Energy, Electronics and Electrical, and Other End-User Industries), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific commanded 53.42% of the polyetheramine market share in 2025 as China, India, and Southeast Asia intensified blade and composite part output. Capacity additions include BASF's Nanjing specialty amine plant and a Caojing expansion to 18,800 tons per year, consolidating regional supply and shortening delivery times.

North America remains an innovation nucleus anchored by aerospace primes and advanced 3D-printing service bureaus. EPA NESHAP compliance rewards suppliers with robust environmental credentials and motivates users to adopt low-VOC diamine chemistries. BASF's exclusive Baxxodur distribution via Univar Solutions strengthens technical-service reach, supporting rapid specification cycles among tier-one auto and construction OEMs.

Europe's energy-transition agenda sustains demand for recyclable blades and circular-economy coatings. TPI Composites' Turkish site adds capacity serving European wind parks, and the REACH regulation favors established suppliers able to navigate documentation complexity. Emerging regions in South America and the Middle East ramp up renewable capacity and industrial coatings needs, depending chiefly on imports from APAC hubs, though local blending facilities are under evaluation.

- BASF

- Clariant

- Evonik Industries AG

- Huntsman International LLC

- Qingdao IRO Surfactant Co., Ltd.

- Shandong Longhua New Materials Co., Ltd.

- Wuxi Akeli Technology Co., Ltd.

- Yangzhou Chenhua New Material Co., Ltd.

- Yantai Dasteck Chemicals Co., Ltd.

- Zibo Zhengda Polyurethane Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing investments in adhesives and sealants industry

- 4.2.2 Growing demand from composites manufacturing

- 4.2.3 Expansion of wind-turbine blade production

- 4.2.4 Surge in high-performance polyurea protective coatings

- 4.2.5 Adoption in 3-D-printing-grade epoxy systems

- 4.3 Market Restraints

- 4.3.1 Volatile propylene-oxide feedstock prices

- 4.3.2 Environmental concerns over amine emissions

- 4.3.3 Slow approval for food-contact adhesive grades

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Monoamine

- 5.1.2 Diamine

- 5.1.3 Triamine

- 5.2 By Application

- 5.2.1 Polyurea

- 5.2.2 Fuel Additives

- 5.2.3 Composites

- 5.2.4 Epoxy Coatings

- 5.2.5 Adhesives and Sealants

- 5.2.6 Others

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Building and Construction

- 5.3.3 Wind energy

- 5.3.4 Electronics and Electrical

- 5.3.5 Other End-User Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Clariant

- 6.4.3 Evonik Industries AG

- 6.4.4 Huntsman International LLC

- 6.4.5 Qingdao IRO Surfactant Co., Ltd.

- 6.4.6 Shandong Longhua New Materials Co., Ltd.

- 6.4.7 Wuxi Akeli Technology Co., Ltd.

- 6.4.8 Yangzhou Chenhua New Material Co., Ltd.

- 6.4.9 Yantai Dasteck Chemicals Co., Ltd.

- 6.4.10 Zibo Zhengda Polyurethane Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment