|

市場調查報告書

商品編碼

1910704

感測器:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

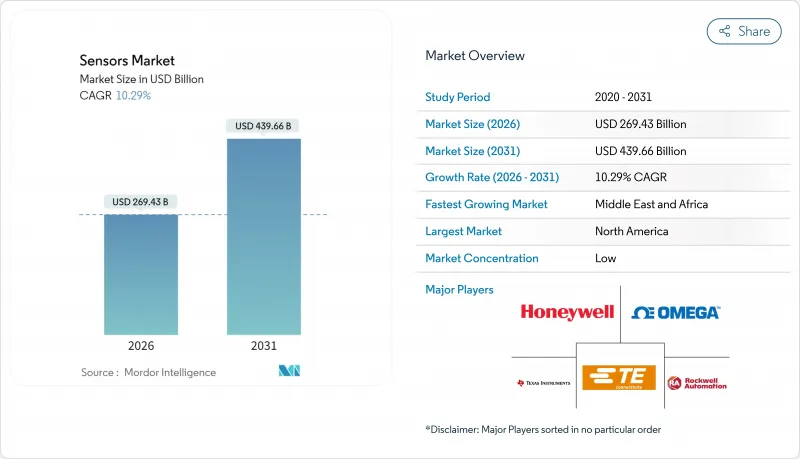

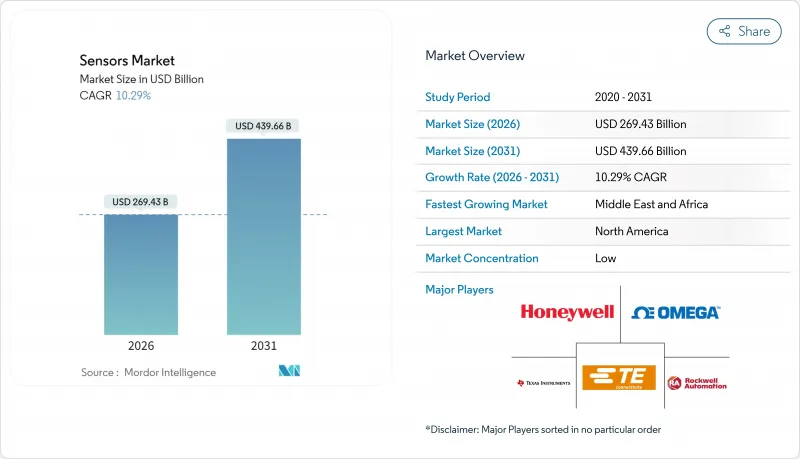

預計感測器市場將從 2025 年的 2,443.1 億美元成長到 2026 年的 2,694.3 億美元,並預計到 2031 年將達到 4,396.6 億美元,2026 年至 2031 年的複合年成長率為 10.29%。

這一成長主要得益於自主行動平台的日益普及、工業自動化技術的快速發展以及互聯連線健診應用場景的不斷擴展。人工智慧與感測器硬體的融合使得預測維修系統成為可能,可將工廠計劃外停機時間減少高達 50%。目前,溫度測量設備在感測器市場主導,市場佔有率達 23%,而化學感測器預計將以 14.8% 的複合年成長率實現最快成長。市場需求主要受中國智慧製造計畫、日本汽車產業的強勁創新以及長期穩定的半導體供應鏈的推動。同時,在大規模設施數位化和清潔能源部署的推動下,中東和非洲正在崛起為成長最快的地區。儘管市場競爭依然激烈,仍處於分散狀態,但近期的合資企業和定向收購正在加速圍繞多模態和人工智慧賦能產品系列的整合。

全球感測器市場趨勢與洞察

自動駕駛汽車中多感測器融合技術的應用日益廣泛

雷射雷達、雷達和攝影機的資料流被整合到一個統一的感知堆疊中,提供冗餘機制,以滿足歐盟通用安全法規 2019/2144 對高級駕駛輔助系統的要求。特斯拉的全自動駕駛電腦以 144 TOPS 的運算速度處理來自八個攝影機、十二個超音波單元和一個雷達的輸入,樹立了性能標竿。一級供應商提供預先已調整的感知套件,以降低整合成本、縮減材料清單並加快產品上市速度。

亞洲現有工廠智慧工廠改造的普及

中國的「十四五」規劃撥款1.4兆美元用於數位基礎建設,其中大部分資金用於升級現有設備,增強其感測器性能,從而實現預測性維護,並將設備使用壽命延長20%至30%。安裝在現有生產線上的振動、溫度和流量測量裝置可以將數據傳輸到雲端進行分析,從而減少停機時間,提高整體設備效率(OEE),而無需對整個工廠進行徹底改造。

汽車級MEMS代工產能供應緊張

AEC-Q100認證週期最長可達兩年,亞太地區只有少數晶圓廠能達到如此嚴格的標準。意法半導體正在擴大其無塵室,但電動車的普及帶來了新的電池管理和熱監控要求,給公司帶來了更大的壓力。

細分市場分析

到2025年,溫度感測器將佔據感測器市場22.74%的佔有率,並在汽車熱感迴路和工業製程控制中繼續發揮關鍵作用。化學感測器將以14.12%的複合年成長率快速成長,主要受排放氣體監測和職場安全法規日益嚴格的推動。流量、振動和壓力感測器將憑藉其預測性維護功能進一步拓展感測器市場,而接近感測器則可確保機器防護裝置的合規性。

持續的微型化技術使得人工智慧引擎能夠整合到溫度感測器中,從而實現無需雲端延遲的本地異常檢測。慣性感測器、磁性感測器、光學感測器和濕度感測器完善了產品線,其應用範圍涵蓋智慧型手機方向檢測到智慧城市空氣品質監測網路等。

到2025年,電阻式感測器將佔據感測器市場19.18%的佔有率,這主要得益於其低成本以及在工業和汽車儀錶板中的廣泛應用。雷射雷達系統是自主導航的關鍵組成部分,預計到2031年將以16.74%的複合年成長率成長,這反映了價格下降以及向固體陣列的轉變,後者無需機械部件。光學、壓電、壓電式、壓電、磁性和聲學等多種感測器模式涵蓋了廣泛的應用領域,可滿足視覺、壓力、振動、觸覺和聲音等方面的需求。

Velodyne 的 4D LiDAR 等先進技術將速度向量與距離和角度相結合,以提高駕駛員輔助功能的物件分類精度;而壓電採集器則可為遠端管道中無電池感測器節點提供微焦耳級的電力。

市場按測量參數(溫度、流量等)、工作模式(光學、壓阻式、壓電等)、技術(MEMS、光子學等)、整合度(分立感測器、整合/嵌入式感測器)、輸出(類比、數位)、終端用戶產業(汽車、工業製造等)和地區進行細分。市場預測以以金額為準。

區域分析

到2025年,亞太地區將佔全球收入的36.21%,這主要得益於中國1.4兆美元的數位基礎建設投入、日本先進的汽車供應鏈以及韓國在光刻技術的主導。政府激勵措施降低了晶圓廠和嵌入式感測器新興企業的資本門檻,從而形成了區域性的設計和生產技術叢集。供應商受益於靠近大多數消費性電子產品組裝線,從而縮短了前置作業時間並降低了物流成本。

在歐洲,嚴格的安全和環保法規正在推動穩定且高價值的需求。強制性的高階駕駛輔助系統(ADAS)和產業脫碳目標正在促使消費者購買功能更強大、安全性更高的產品。歐盟《晶片法案》的津貼以及歐洲投資銀行的融資(例如恩智浦半導體10億歐元的貸款)正在推動汽車級晶片產能的提升。

隨著波灣合作理事會國家實施智慧電網、海水淡化監測和大規模可再生能源項目,中東和非洲預計將以14.58%的複合年成長率成長。非洲的採礦和運輸走廊正擴大部署能夠承受灰塵、振動和電力不穩定的堅固型感測器。儘管規模較小,但拉丁美洲巴西和墨西哥的智慧農業試點計畫正逐步提高產量。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大多感測器融合技術在自動駕駛車輛的應用

- 亞洲現有工廠智慧工廠維修的普及

- 海上能源產業向基於狀態的資產管理轉型

- 下一代歐盟車輛將被要求配備高級駕駛輔助系統(ADAS)感測套件。

- 用於無電池物聯網標籤的超低功耗環境感測技術

- 市場限制

- 汽車級MEMS代工產能供應緊張

- 長壽命振動感測器的校準漂移問題

- 無線通訊協定標準碎片化阻礙了智慧感測器的互通性

- 價值與供應鏈分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 軟性及印刷感測器的發展趨勢(現況及預測)

- 宏觀經濟和疫情影響評估

第5章 市場規模與成長預測

- 透過測量參數

- 溫度

- 流動

- 化學

- 振動

- 壓力

- 接近性

- 慣性

- 其他參數

- 按操作模式

- 光學

- 壓電元件

- 壓電

- 電阻

- 影像

- LiDAR

- 其他模式

- 透過技術

- MEMS

- 光子

- CMOS

- 電子機械系統(NEMS)

- 依整合程度

- 分立感測器

- 整合/嵌入式感測器

- 按產量計

- 模擬

- 數位的

- 按最終用戶行業分類

- 車

- 工業製造

- 醫療保健

- 航太

- 家用電子電器

- 石油和天然氣

- 建造

- 防禦

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Honeywell International Inc.

- Bosch Sensortec GmbH

- Texas Instruments Inc.

- TE Connectivity Ltd

- Rockwell Automation Inc.

- OMEGA Engineering inc.

- STMicroelectronics NV

- Infineon Technologies AG

- NXP Semiconductors NV

- ams OSRAM AG

- Analog Devices Inc.

- Renesas Electronics Corp.

- Microchip Technology Inc.

- ROHM Semiconductor

- Omron Corp.

- ABB Ltd

- Sick AG

- Qualcomm Technologies Inc.

- Velodyne Lidar Inc.

- LeddarTech Inc.

- TDK Corp.

第7章 市場機會與未來展望

The sensors market is expected to grow from USD 244.31 billion in 2025 to USD 269.43 billion in 2026 and is forecast to reach USD 439.66 billion by 2031 at 10.29% CAGR over 2026-2031.

The growth is propelled by wider adoption of autonomous mobility platforms, rapid industrial automation, and expanding use-cases in connected healthcare. Convergence between artificial intelligence and sensor hardware is enabling predictive maintenance systems that cut unplanned factory downtime by up to 50%. Temperature devices currently dominate the sensors market with 23% share, while chemical variants are on track for the fastest expansion at a 14.8% CAGR. Asia-Pacific leads demand on the back of Chinese smart manufacturing programs, strong automotive innovation in Japan, and long-standing semiconductor supply chains. At the same time, Middle East & Africa is emerging as the quickest-growing region, supported by large-scale infrastructure digitalization and clean-energy buildouts. Competitive intensity remains high and fragmented, yet recent joint ventures and targeted acquisitions are accelerating consolidation around multimodal and AI-enabled product portfolios.

Global Sensors Market Trends and Insights

Increasing adoption of multi-sensor fusion in autonomous mobility

LiDAR, radar, and camera streams are now integrated into unified perception stacks, creating redundancy that meets the EU General Safety Regulation 2019/2144 for advanced driver assistance in all new vehicles. Tesla's full self-driving computer already processes inputs from 8 cameras, 12 ultrasonic units, and a radar at 144 TOPS, setting a performance benchmark. Tier-1 suppliers are responding with pre-calibrated perception suites that lower integration cost, compress bill-of-materials, and accelerate time-to-market.

Proliferation of smart-factory retrofits in brown-field Asian plants

China's 14th Five-Year Plan earmarked USD 1.4 trillion for digital infrastructure, much of which targets sensor-rich upgrades of legacy machinery to unlock predictive maintenance and 20-30% lifecycle extensions. Vibration, temperature, and flow devices fitted to existing lines feed cloud analytics that cut downtime and lift overall equipment effectiveness without full plant reconstruction.

Supply tightness of automotive-grade MEMS foundry capacity

AEC-Q100 qualification cycles span up to two years and only a few Asia-Pacific fabs meet the stringent criteria. STMicroelectronics is expanding clean-room footprints, yet EV proliferation adds pressure by introducing fresh battery-management and thermal-monitoring loads.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward condition-based asset monitoring in offshore energy

- Mandatory inclusion of ADAS sensing suites in next-gen EU vehicles

- Calibration drift challenges in long-life vibration sensors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Temperature devices held 22.74% sensors market share in 2025 and remain indispensable for automotive thermal loops and industrial process control. Chemical variants are scaling fastest, on course for 14.12% CAGR through 2031 on rising emissions monitoring and workplace-safety mandates. Flow, vibration, and pressure categories together deepen the sensors market with predictive maintenance reach, while proximity units ensure machine-guarding compliance.

Continued miniaturization now allows integrated AI engines inside temperature elements, enabling local anomaly detection without cloud latency. Inertial, magnetic, optical, and humidity devices round out the portfolio, serving everything from smartphone orientation to smart-city air-quality grids.

Electrical-resistance designs accounted for 19.18% of the sensors market in 2025 thanks to low cost and broad design-in across industrial and vehicle dashboards. LiDAR systems, critical for autonomous navigation, are projected to rise at 16.74% CAGR through 2031, reflecting price drops and movement to solid-state arrays that shed mechanical parts. Optical, piezoresistive, piezoelectric, capacitive, magnetic, and acoustic modes complete a diverse field addressing vision, pressure, vibration, touch, and sound requirements.

Advances such as Velodyne's 4D LiDAR integrate velocity vectors with distance and angle, sharpening object classification for driver-assist functions. Meanwhile, piezoelectric harvesters supply micro-joule power budgets for battery-less sensor nodes in remote pipelines.

Sensors Market Segmented by Parameter Measured (Temperature, Flow and More), Mode of Operation (Optical, Piezoresistive, Piezoelectric, and More), Technology (MEMS, Photonic, and More), Integration Level (Discrete Sensors, Integrated/Embedded Sensors), Output (Analog, Digital), End-User Industry (Automotive, Industrial Manufacturing, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 36.21% of global revenue in 2025, anchored by China's USD 1.4 trillion digital-infrastructure push, Japan's advanced automotive supply chains, and South Korea's lithography leadership. Government incentives lower capital hurdles for fabs and embedded-sensor startups alike, translating into a dense regional cluster of design and production know-how. Suppliers enjoy proximity to the bulk of consumer-electronics assembly lines, compressing lead times and logistics costs.

Europe delivers steady high-value demand around stringent safety and environmental regulations. Mandatory ADAS fitment and industrial decarbonization targets push purchasing toward higher-performance, functionally safe products. The EU's Chips Act grants and European Investment Bank loans such as NXP's EUR 1 billion facilities funnel fresh capacity into on-shore automotive-grade production.

Middle East & Africa is projected to expand at 14.58% CAGR as Gulf Cooperation Council states embed smart grids, desalination monitoring, and large-scale renewables. African mining and transport corridors increasingly deploy ruggedized sensors that tolerate dust, vibration, and power instability. Latin America, though smaller, sees smart-agriculture pilots across Brazil and Mexico, adding incremental volume.

- Honeywell International Inc.

- Bosch Sensortec GmbH

- Texas Instruments Inc.

- TE Connectivity Ltd

- Rockwell Automation Inc.

- OMEGA Engineering inc.

- STMicroelectronics N.V.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- ams OSRAM AG

- Analog Devices Inc.

- Renesas Electronics Corp.

- Microchip Technology Inc.

- ROHM Semiconductor

- Omron Corp.

- ABB Ltd

- Sick AG

- Qualcomm Technologies Inc.

- Velodyne Lidar Inc.

- LeddarTech Inc.

- TDK Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing adoption of multi-sensor fusion in autonomous mobility

- 4.2.2 Proliferation of smart-factory retrofits in brown-field Asian plants

- 4.2.3 Shift toward condition-based asset monitoring in offshore energy

- 4.2.4 Mandatory inclusion of ADAS sensing suites in next-gen EU vehicles

- 4.2.5 Ultra-low-power environmental sensing for battery-free IoT tags

- 4.3 Market Restraints

- 4.3.1 Supply tightness of automotive-grade MEMS foundry capacity

- 4.3.2 Calibration drift challenges in long-life vibration sensors

- 4.3.3 Fragmented wireless protocol standards hindering smart-sensor interoperability

- 4.4 Value and Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Flexible and Printed Sensors Dynamics (current status, projections)

- 4.8 Macroeconomic and Pandemic Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Parameter Measured

- 5.1.1 Temperature

- 5.1.2 Flow

- 5.1.3 Chemical

- 5.1.4 Vibration

- 5.1.5 Pressure

- 5.1.6 Proximity

- 5.1.7 Inertial

- 5.1.8 Other Parameters

- 5.2 By Mode of Operation

- 5.2.1 Optical

- 5.2.2 Piezoresistive

- 5.2.3 Piezoelectric

- 5.2.4 Electrical Resistance

- 5.2.5 Image

- 5.2.6 LiDAR

- 5.2.7 Other Modes

- 5.3 By Technology

- 5.3.1 MEMS

- 5.3.2 Photonic

- 5.3.3 CMOS

- 5.3.4 Nano-electromechanical (NEMS)

- 5.4 By Integration Level

- 5.4.1 Discrete Sensors

- 5.4.2 Integrated / Embedded Sensors

- 5.5 By Output

- 5.5.1 Analog

- 5.5.2 Digital

- 5.6 By End-user Industry

- 5.6.1 Automotive

- 5.6.2 Industrial Manufacturing

- 5.6.3 Medical and Wellness

- 5.6.4 Aerospace

- 5.6.5 Consumer Electronics

- 5.6.6 Oil and Gas

- 5.6.7 Construction

- 5.6.8 Defense

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 Middle East

- 5.7.4.1 Israel

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 United Arab Emirates

- 5.7.4.4 Turkey

- 5.7.4.5 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Bosch Sensortec GmbH

- 6.4.3 Texas Instruments Inc.

- 6.4.4 TE Connectivity Ltd

- 6.4.5 Rockwell Automation Inc.

- 6.4.6 OMEGA Engineering inc.

- 6.4.7 STMicroelectronics N.V.

- 6.4.8 Infineon Technologies AG

- 6.4.9 NXP Semiconductors N.V.

- 6.4.10 ams OSRAM AG

- 6.4.11 Analog Devices Inc.

- 6.4.12 Renesas Electronics Corp.

- 6.4.13 Microchip Technology Inc.

- 6.4.14 ROHM Semiconductor

- 6.4.15 Omron Corp.

- 6.4.16 ABB Ltd

- 6.4.17 Sick AG

- 6.4.18 Qualcomm Technologies Inc.

- 6.4.19 Velodyne Lidar Inc.

- 6.4.20 LeddarTech Inc.

- 6.4.21 TDK Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment