|

市場調查報告書

商品編碼

1910682

環氧固化劑:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Epoxy Curing Agent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

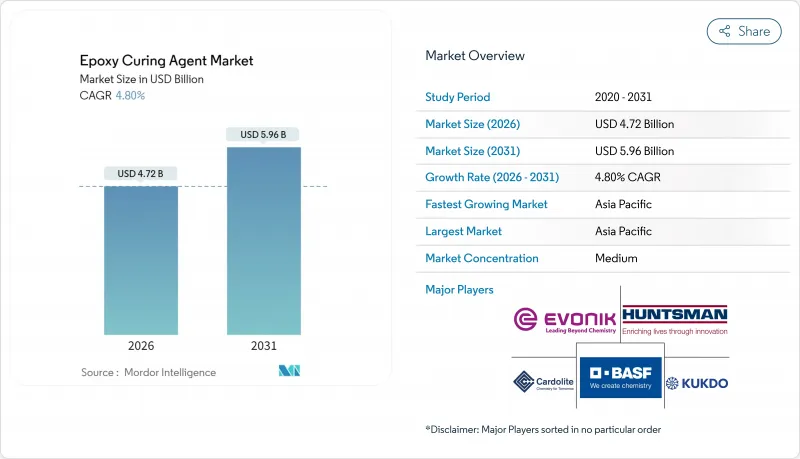

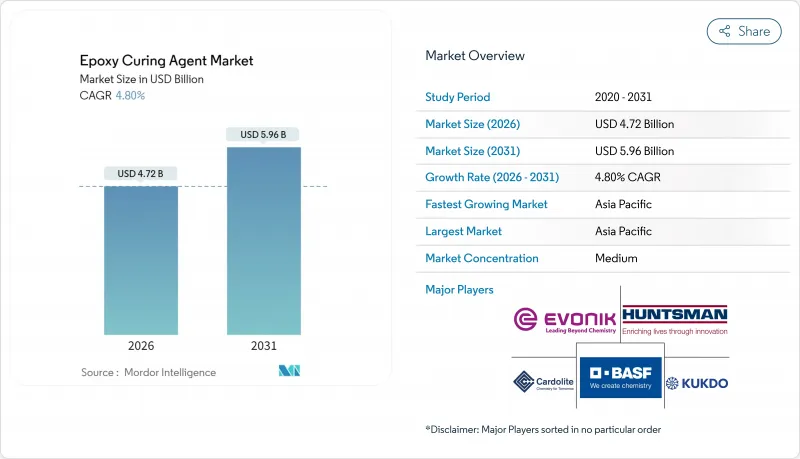

預計到2026年,環氧固化劑市場規模將達到47.2億美元,高於2025年的45億美元。預計到2031年,該市場規模將達到59.6億美元,2026年至2031年的複合年成長率為4.8%。

亞太地區的基礎設施建設、可再生能源資產的穩步部署以及交通運輸和航太領域對輕質複合材料的強勁需求,共同推動了這一成長。隨著反傾銷稅改變全球貿易流向,競爭格局正在發生變化,促使西方生產商將重點轉向利潤更高的特種化學品。產品創新正朝著低揮發性有機化合物(VOC)、生物基和快速固化系統的方向發展,從而縮短生產週期。同時,北美和歐洲的供應鏈舉措正在推動籌資策略的重組。因此,環氧固化劑市場正在整合,但專注於永續性的新興利基企業仍在不斷湧現,進一步加劇了競爭格局的複雜性。

全球環氧固化劑市場趨勢與洞察

基礎設施建設熱潮推動了對高性能地坪塗料的需求

亞洲大型計劃持續成長,對工業地板材料的性能提出了更高的要求,要求其能夠承受化學品腐蝕、機械衝擊和高人流量。中國、印度和東南亞的公共部門支出正用於建造資料中心園區、地鐵網路和可再生能源設施,這些項目都需要耐用、防靜電且快速固化的塗料。因此,配方師正在客製化低排放環氧樹脂系統,以減少承包商的停機時間,同時滿足更嚴格的環保法規。這種轉變也延伸到了智慧建築領域,導電地地板材料能夠實現資產追蹤和能源管理技術的整合。能夠提供成本績效均衡方案的供應商正在獲得多年供貨契約,從而鞏固了環氧固化劑市場的成長勢頭。

亞太和歐洲風力發電機葉片產量激增

預計到2024年,全球風電裝置容量將超過115吉瓦,葉片製造商正競相縮短生產週期以解決訂單。大型轉子設計需要低熱釋放、低空隙率和高層間韌性的固化劑。BASF的Baxxodur系列產品就是一個很好的例子,它展示了最佳化的胺混合物如何在不犧牲機械強度的前提下縮短生產週期。歐洲原始設備製造商(OEM)正在設定降低溫度和提高可回收性的目標,推動可逆化學技術的研發,以簡化葉片零件的拆卸。同時,中國葉片工廠正利用其本地原料和物流優勢,鼓勵西方製造商實現製造地線本地化,從而擴大亞洲參與企業對環氧固化劑的區域需求。

對溶劑型胺系統的VOC法規更加嚴格

美國國家氣霧劑塗料規則的修訂以及南海岸空氣品質管理區 (AQMD) 提出的修訂提案,大幅降低了揮發性有機化合物 (VOC) 的允許閾值,迫使配方師轉向水性、高固態和無溶劑的化學技術。雖然監管措施擴大了綠色替代品的市場機會,但也增加了研發和認證成本,尤其是在性能不容妥協的領域。快速固化的生物基替代品正在研發中,但面臨規模化生產的障礙,這可能會限制近期的供應,並阻礙環氧固化劑市場的整體加速成長。

細分市場分析

胺類化合物預計將佔2025年銷售額的41.12%,鞏固其作為大多數複合材料、塗料和黏合劑體系核心化學品的地位。在這個類別中,脂肪族胺和環脂族胺具有抗紫外線性能,而聚醚胺則在需要柔軟性的環境中表現出色,例如船舶防護塗料。酸酐在高溫電絕緣材料和汽車引擎室部件中仍然發揮關鍵作用,這些應用通常在180°C的高溫下進行。酚醛烷基胺雖然應用範圍較小,但在潮濕環境和寒冷施工現場能夠快速固化,這對於追求全天候高效施工的安裝人員來說提案價值。即使永續性趨勢催生出新的競爭化學品,該類別化合物適應性強的性能也確保其仍將處於環氧固化劑市場的核心地位。

儘管胺基體系佔據主導地位,但競爭壓力依然存在。聚醯胺供應商強調其生物基二聚體酸工藝,聲稱其具有減少碳排放的優勢。同時,酸酐生產商則大力宣傳其卓越的熱循環性能。特種化學品生產商正在嘗試使用胺-酸酐混合配方,以平衡固化延遲、固化速度和機械性能。在預測期內,胺化學領域的大量研發工作將集中於整合潛伏催化劑和奈米填料,以提高韌性而不延長固化週期。這些持續的改進將使該細分市場繼續引領整個環氧固化劑市場。

區域分析

到2025年,亞太地區將佔據35.12%的市場佔有率,年複合成長率達5.66%,主要得益於公共基礎設施投資、可再生能源計畫以及電子製造業的區域集中。中國的風力發電機葉片工廠和印度的半導體組裝叢集正在大量消耗胺基體系。區域製造商正利用其在環氧氯丙烷和芐胺等原料方面的地理接近性,降低物流成本並縮短前置作業時間。儘管永續性法規日益嚴格,但成本競爭力仍是重中之重,凸顯了環氧固化劑市場建構區域整合供應鏈的必要性。

北美市場佔有率雖落後,但受益於製造業回流和在航太複合材料領域的主導地位。美國國際貿易委員會於2025年正式對亞洲環氧樹脂進口徵收反傾銷稅,這將提升美國國內產能運轉率,並鼓勵對特種環氧樹脂的投資。美國和墨西哥電動車電池工廠的擴建將刺激對高固態黏合劑的需求,而大西洋沿岸離岸風力發電容量的擴張將為葉片級固化劑創造新的消費市場。

歐洲面臨能源成本上漲和來自亞洲的激烈競爭,迫使企業調整大宗商品生產,專注於高附加價值細分市場。威斯萊克公司在荷蘭的資產減損正是這種調整的體現。然而,歐洲在汽車複合材料和可再生風力渦輪機葉片研發領域的領先地位,支撐著對新一代化學品的特定需求。監管機構對循環經濟的重視,正在加速生物基和低VOC固化系統的推廣應用,為該地區環氧固化劑市場開闢了創新主導的發展道路。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 基礎設施的擴建正在推動對高性能地板塗料的需求。

- 亞太和歐洲風力發電機葉片產量激增

- 由於電子設備小型化,對低封裝的需求不斷成長。

- 輕質碳纖維增強複合材料在汽車和航太領域的應用

- 熱固性3D列印超快速固化系統的興起

- 市場限制

- 對溶劑型胺系統揮發性有機化合物(VOC)排放制定更嚴格的法規

- 揮發性環氧氯丙烷和芐胺原料價格

- 腰果衍生的苯乙胺原料供不應求

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 胺類

- 聚醯胺

- 酸酐

- 其他類型(酚類烷胺、醯胺類胺等)

- 透過使用

- 油漆和塗料

- 黏合劑和密封劑

- 複合材料

- 電氣和電子設備

- 其他(工業地板材料及維修等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Aditya Birla Group

- Air Products Inc.

- Atul Ltd.

- BASF

- Cardolite Corporation

- DIC Corporation

- Evonik Industries AG

- Huntsman International LLC

- KUKDO CHEMICAL CO., LTD.

- Kumho P&B Chemicals Inc.

- Mitsubishi Chemical Group Corporation

- Olin Corporation

- Shandong Deyuan Epoxy Resin Co. Ltd

- Toray Industries Inc.

- Westlake Corporation

第7章 市場機會與未來展望

Epoxy Curing Agent Market size in 2026 is estimated at USD 4.72 Billion, growing from 2025 value of USD 4.5 Billion with 2031 projections showing USD 5.96 Billion, growing at 4.8% CAGR over 2026-2031.

This growth rests on Asia-Pacific infrastructure upgrades, the steady rollout of renewable-energy assets, and surging demand for lightweight composites in mobility and aerospace. Competitive dynamics are shifting as antidumping duties alter global trade flows, prompting Western producers to pivot toward high-margin specialty chemistries. Product innovation is skewing toward low-Volatile Organic Compound (VOC), bio-based, and fast-cure systems that enable shorter production cycles, while supply-chain security initiatives in North America and Europe are re-ordering sourcing strategies. As a result, the epoxy curing agents market is consolidating, yet niche entrants focusing on sustainability continue to emerge, adding complexity to the competitive landscape.

Global Epoxy Curing Agent Market Trends and Insights

Infrastructure Boom Driving Demand for High-performance Floor Coatings

Asian infrastructure megaprojects continue multiplying, spawning stringent performance specifications for industrial floors that withstand chemicals, mechanical shock, and heavy traffic. Public-sector spending across China, India, and Southeast Asia is channeling funds into data-center campuses, metro rail networks, and renewable-power facilities, all requiring durable, anti-static, and rapid-cure coatings. Consequently, formulators are tailoring low-emission epoxy systems that lower downtime for contractors while complying with tougher environmental mandates . The shift extends to smart-building concepts, where conductive floors enable integrated asset-tracking and energy-management technologies. Suppliers able to deliver balanced cost-performance packages are winning multi-year supply contracts, reinforcing the growth trajectory of the epoxy curing agents market.

Wind-turbine Blade Production Surge in APAC and Europe

Global wind-energy capacity additions crossed the 115 GW mark in 2024, and blade makers are chasing tighter takt times to meet order backlogs. Large-rotor designs demand curing agents that generate low exotherms, minimize voids, and elevate interlaminar toughness. BASF's Baxxodur range illustrates how optimized amine blends reduce cycle times without sacrificing mechanical integrity. European original equipment manufacturers (OEMs) have set temperature-reduction and recyclability targets, spurring research and development (R&D) into reversible chemistries that simplify blade component disassembly. Meanwhile, China's blade factories leverage local feedstock and logistics advantages, nudging Western players to localize production lines, thereby amplifying regional demand for epoxy curing agents market participants with Asian manufacturing footprints.

Stricter VOC Caps on Solvent-borne Amine Systems

Revisions to the U.S. National Aerosol Coatings Rule and proposed South Coast AQMD (Air Quality Management District) updates are slashing allowable VOC thresholds, forcing formulators to migrate toward water-borne, high-solids, or solvent-free chemistries . While compliance widens the addressable market for greener alternatives, it raises R&D and qualification costs, especially where performance cannot be compromised. Rapid-cure, bio-based alternatives are in development but face scale-up hurdles that could constrain near-term supply availability and hamper overall epoxy curing agents market acceleration.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization in Electronics Requiring Low-void Encapsulants

- Lightweight CFRP Adoption in Automotive and Aerospace

- Volatile Epichlorohydrin and Benzylamine Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Amines controlled 41.12% of 2025 revenue, cementing their role as the backbone chemistry for most composite, coating, and adhesive systems. Within the category, aliphatic and cycloaliphatic versions deliver UV resistance, while polyetheramines excel in flexibility-demanding environments such as protective marine coatings. Anhydrides maintain relevance in high-temperature electrical insulation and under-hood automotive components where 180°C service is routine. Phenalkamines, though niche, unlock rapid cure in humid or low-temperature jobsites, a value proposition gaining recognition among contractors pursuing all-weather productivity. The segment's adaptable performance profile collectively ensures it stays at the core of the epoxy curing agents market even as sustainability trends invite competing chemistries.

Despite amines' dominance, competitive tension persists. Polyamide suppliers stress bio-sourced dimer-acid routes to claim a carbon-reduction edge, while anhydride producers tout superior heat-cycling endurance. Specialty players experiment with hybrid amine-anhydride packages to balance latency, cure speed, and mechanical performance. Over the forecast horizon, targeted R&D in amine chemistry aims to integrate latent catalysts and nano-fillers that elevate toughness without extending cure cycles. This steady pipeline of upgrades positions the segment to keep fueling the broader epoxy curing agents market.

The Epoxy Curing Agents Market Report is Segmented by Type (Amines, Polyamides, Anhydrides, and Other Types (Phenalkamines, Amidoamines, Etc. )), Application (Paints and Coatings, Adhesives and Sealants, Composites, Electrical and Electronics, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 35.12% share in 2025 and is expanding at a 5.66% CAGR on the back of public infrastructure outlays, renewable-energy commitments, and electronics manufacturing gravitation toward the region. China's wind-turbine blade factories and India's semiconductor-assembly clusters absorb vast volumes of amine-based systems. Regional producers leverage proximity to epichlorohydrin and benzylamine feedstocks, reducing logistics costs and lead times. Sustainability regulations are tightening, but cost competitiveness remains paramount, reinforcing the need for locally integrated supply chains in the epoxy curing agents market.

North America trails in share but benefits from reshoring missions and aerospace composites leadership. Antidumping duties on Asian epoxy imports, formalized by the United States International Trade Commission in 2025, raise domestic capacity utilization and spur investment in specialty grades. Electric Vehicle (EV) battery-plant expansions in the United States and Mexico stimulate high-solids adhesive demand, while offshore-wind buildouts along the Atlantic corridor introduce a new consumption stream for blade-grade curing agents.

Europe confronts high energy costs and fierce Asian competition, forcing companies to rationalize commodity output and double down on high-value niches. Westlake's impairment of Dutch assets exemplifies this recalibration. Yet Europe's leadership in automotive composites and recyclable wind-blade R&D sustains selective demand for next-generation chemistries. Regulatory emphasis on circularity is accelerating adoption of bio-based and low-VOC curing systems, carving an innovation-led path for the regional epoxy curing agents market.

- Aditya Birla Group

- Air Products Inc.

- Atul Ltd.

- BASF

- Cardolite Corporation

- DIC Corporation

- Evonik Industries AG

- Huntsman International LLC

- KUKDO CHEMICAL CO., LTD.

- Kumho P&B Chemicals Inc.

- Mitsubishi Chemical Group Corporation

- Olin Corporation

- Shandong Deyuan Epoxy Resin Co. Ltd

- Toray Industries Inc.

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure Boom Driving Demand for High-performance Floor Coatings

- 4.2.2 Wind-turbine Blade Production Surge in APAC and Europe

- 4.2.3 Miniaturization in Electronics Requiring Low-void Encapsulants

- 4.2.4 Lightweight CFRP Adoption in Automotive and Aerospace

- 4.2.5 Emergence of Ultra-fast Latent Systems for 3D-printing of Thermosets

- 4.3 Market Restraints

- 4.3.1 Stricter VOC Caps on Solvent-borne Amine Systems

- 4.3.2 Volatile Epichlorohydrin and Benzylamine Feedstock Prices

- 4.3.3 Supply Crunch in Cashew-derived Phenalkamine Feedstock

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Amines

- 5.1.2 Polyamides

- 5.1.3 Anhydrides

- 5.1.4 Other Types (Phenalkamines, Amidoamines, etc.)

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Composites

- 5.2.4 Electrical and Electronics

- 5.2.5 Others (Industrial Flooring and Repairs, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.4.1 Aditya Birla Group

- 6.4.2 Air Products Inc.

- 6.4.3 Atul Ltd.

- 6.4.4 BASF

- 6.4.5 Cardolite Corporation

- 6.4.6 DIC Corporation

- 6.4.7 Evonik Industries AG

- 6.4.8 Huntsman International LLC

- 6.4.9 KUKDO CHEMICAL CO., LTD.

- 6.4.10 Kumho P&B Chemicals Inc.

- 6.4.11 Mitsubishi Chemical Group Corporation

- 6.4.12 Olin Corporation

- 6.4.13 Shandong Deyuan Epoxy Resin Co. Ltd

- 6.4.14 Toray Industries Inc.

- 6.4.15 Westlake Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

- 7.2 Bio-Based Epoxy Curing Agents