|

市場調查報告書

商品編碼

1910680

浸漬樹脂:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Impregnating Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

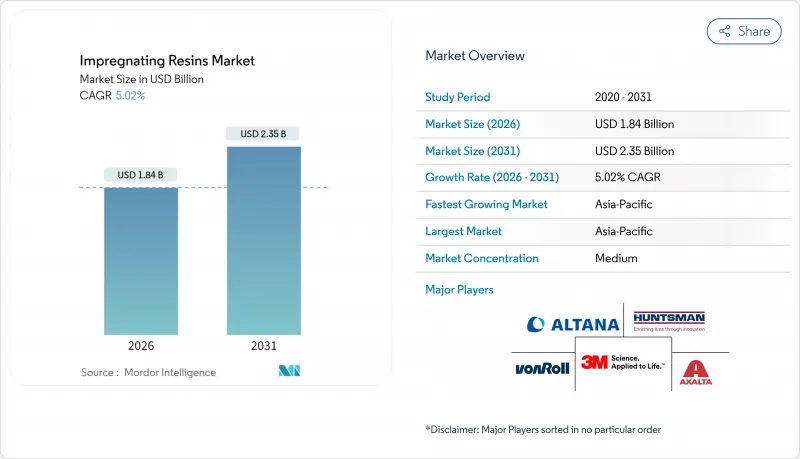

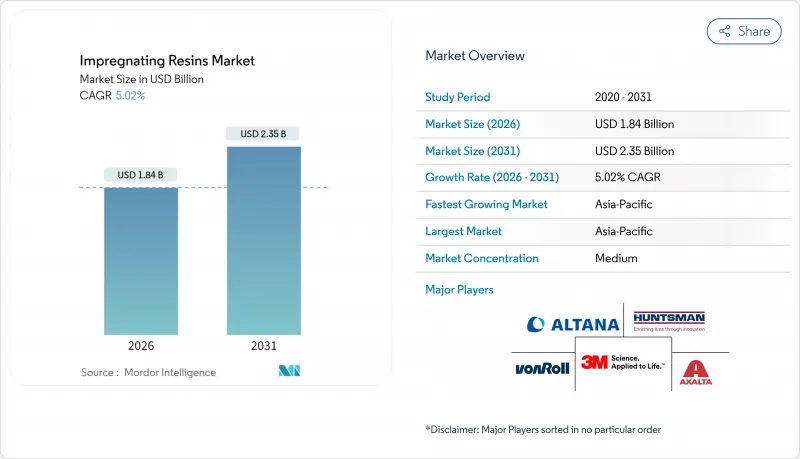

預計到 2025 年,浸漬樹脂市場價值將達到 17.5 億美元,到 2026 年將成長至 18.4 億美元,到 2031 年將成長至 23.5 億美元,在預測期(2026-2031 年)內複合年成長率為 5.02%。

馬達、發電機、變壓器和電力電子模組對高效電絕緣材料的強勁需求推動了這一市場擴張。原始設備製造商 (OEM) 擴大指定採用真空壓力浸漬 (VPI) 系統,以提高介電強度並降低局部放電損耗,從而確保可再生能源和電動車平台的持久性能。大型離岸風力發電機、高壓電動車的普及以及智慧電網的日益複雜化,都推動了高品質液體絕緣材料未來多年的採購需求。對先進 VPI 設備的持續資金需求有利於擁有垂直整合的樹脂和機械產品線的成熟製造商,並逐步提高浸漬樹脂市場的集中度。

全球浸漬樹脂市場趨勢及展望

對高效電動機的需求正在成長

全球法規正推動工業馬達損耗限制的日益嚴格。在美國,能源部修訂的法規規定了各功率等級的最低額定效率。這些基準值促使馬達繞組採用真空浸漬(VPI)處理,從而降低熱點溫度、抑制振動並延長重繞週期。為了滿足能源審核標準,製造商指定使用耐溫等級為180°C且損耗係數低的浸漬樹脂。隨著工廠尋求降低營運成本,浸漬樹脂市場對維修套件和現場服務樹脂的售後需求持續成長。類似的更換週期也在東南亞和拉丁美洲的中型工業區出現,增強了中期成長動能。

原始設備製造商轉向無溶劑浸漬工藝

美國環保署 (EPA) 2025 年氣溶膠塗料反應性修正案以及日益嚴格的歐洲揮發性有機化合物 (VOC)排放限值,正在加速向 100%固態、不排放任何受管制溶劑的系統過渡。無溶劑樹脂可在真空條件下高效滲透捲繞線圈,並在可控溫度下快速聚合,從而消除工人接觸風險,並有助於獲得 ISO 14001 認證。像 Gehring 的 IMFLEX 這樣的感應加熱滴塗生產線展現出工藝柔軟性,與傳統的浸漬烘烤生產線相比,可將循環時間縮短 20%。通風負載的降低和廢棄物處理方案的簡化所帶來的成本節約,使得無溶劑生產線實際上成為新建工廠的首選資本投資方案。這些營運優勢正在增強已開發國家和新興市場浸漬樹脂市場的成長動能。

加強揮發性有機化合物和高空氣污染綜合症法規

全球監管機構持續降低工業塗料中揮發性有機化合物(VOC)的容許量。加拿大2024年的法規對130種產品設定了濃度限制,要求重新配製或退出市場。南加州修訂後的汽車塗料1151號規則意味著對電氣絕緣應用的監管也將收緊,導致合規文件和測試成本增加。小規模的樹脂配方商通常缺乏內部環境人員或溶劑回收設施,這限制了它們在優先考慮綠色化學的原始設備製造商(OEM)合約競爭中的能力。兩年或更短的過渡期壓縮了資本規劃時間,導致一些區域企業選擇退出浸漬樹脂市場,而不是承擔升級成本。

細分市場分析

預計到2025年,無溶劑配方將佔據浸漬樹脂市場64.12%的佔有率,並在2031年之前以5.10%的複合年成長率超越所有其他替代配方。此優勢源自於其100%固態的化學特性,此特性使得定子疊片能夠在真空環境下進行無氣泡浸漬,從而達到H級和N級熱等級。這減少了局部放電事件,並延長了牽引和風力發電機定子的使用壽命。電廠營運人員指出,無溶劑配方消除了消防法規的限制,並顯著降低了煙氣洗滌設備的負荷,從而在維修的兩年內降低了營運成本。

我們的創新研發管線持續改進用於自動化滴塗和輥塗製程的無溶劑流變技術。近期經RSC認證的聚酯網路材料實現了331°C (700°F)的劣化起始溫度,介電損耗較基準降低了38%,從而拓展了其在高頻逆變器領域的應用範圍。 IEEE 275-1992和1553-2002評估通訊協定指導OEM製造商的認證,並確保新型樹脂能夠與現有絕緣系統無縫整合。雖然溶劑型樹脂仍被用於一些注重延長適用期的小型複繞廠,但隨著監管和保險政策的利好,其市場佔有率正在逐年下降。因此,早期投資固態溶劑設備的製造商獲得了溢價和特許權使用費,鞏固了在主導地位。

浸漬樹脂報告依技術(無溶劑樹脂與溶劑型樹脂)、樹脂類型(環氧樹脂、聚酯樹脂、聚酯醯亞胺樹脂及其他樹脂類型)、應用領域(馬達及發電機、家用電器、變壓器、電氣及電子元件等)及地區(亞太地區、北美地區、歐洲地區等)進行細分。市場預測以美元以金額為準。

區域分析

預計到2025年,亞太地區將佔全球浸漬樹脂市場收入的41.20%,並在2031年之前保持5.11%的複合年成長率,成為成長最快的地區。中國在電機生產領域的領先地位將保持區域需求的強勁,而福建和廣東兩省針對離岸風力發電叢集的定向獎勵也確保了樹脂需求的成長。印度針對高效能家用電器的績效獎勵為下游企業帶來了巨大的發展機遇,因為國內製造商正在擴大其真空浸漬(VPI)生產線。東南亞國家憑藉其具有競爭力的勞動力成本和不斷成長的電子產品出口,正在鞏固其本地浸漬樹脂產能,為構建區域供應鏈、供應全球原始設備製造商(OEM)網路奠定基礎。

北美市場正經歷成熟但強勁的需求,這主要得益於車輛電氣化、工業資本投資的復甦以及電網現代化項目。主要樹脂製造商目前正使用再生能源運作其在美國和墨西哥的工廠,從而降低產品的碳足跡,並為原始設備製造商 (OEM) 提供範圍 3排放優勢。美國能源局的馬達和變壓器標準正在推動維修,並將監管措施與可預測的樹脂銷售掛鉤。加拿大將於 2024 年生效的 VOC 法規將進一步推動無溶劑解決方案的發展,並為技術先進的供應商提供市場機會。

儘管面臨能源價格波動,歐洲仍持續推行有利於低排放樹脂的前瞻性政策,例如將於2026年生效的REACH法規附件十七甲醛限制。北海和波羅的海離岸風力發電裝置量的快速成長鞏固了對高性能矽酮的需求,部分抵消了家用電器生產放緩的影響。對進口環氧樹脂徵收的反傾銷稅支持了國內樹脂生產,但也給下游加工帶來了成本壓力。整體而言,浸漬樹脂市場保持著均衡的地理分佈,亞太地區的規模、北美地區以標準主導的升級改造以及歐洲在環境技術領域的領先地位,共同構成了互補的成長支柱。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對高效電動機的需求正在成長

- 原始設備製造商轉向無溶劑浸漬工藝

- 電網級風力發電機裝機量的成長

- 加快電動車驅動馬達的生產

- 家用電子電器的微型化

- 市場限制

- 加強對揮發性有機化合物(VOCs)和有害空氣污染物(HAPS)的監管

- 雙酚A和苯乙烯原料的價格波動

- 資本密集型真空和壓力設備

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過技術

- 無溶劑樹脂

- 溶劑型樹脂

- 依樹脂類型

- 環氧樹脂

- 聚酯纖維

- 聚酯醯亞胺

- 其他樹脂類型(聚氨酯、矽酮等)

- 透過使用

- 馬達和發電機

- 家用電器

- 變壓器

- 電氣和電子元件

- 汽車零件

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- AEV Group

- Axalta Coating Systems, LLC

- BASF

- Borger GmbH

- Chetak Manufacturing Company

- ALTANA(ELANTAS)

- Henkel AG and Co. KGaA

- Huntsman International LLC

- Momentive

- NIPPON RIKA INDUSTRIES CORPORATION

- Resonac Holdings Corporation

- Von Roll

- Wacker Chemie AG

第7章 市場機會與未來展望

The Impregnating Resins Market was valued at USD 1.75 billion in 2025 and estimated to grow from USD 1.84 billion in 2026 to reach USD 2.35 billion by 2031, at a CAGR of 5.02% during the forecast period (2026-2031).

Robust demand for high-efficiency electrical insulation in motors, generators, transformers, and power-electronics modules underpins this expansion. Original-equipment manufacturers increasingly specify vacuum pressure impregnation (VPI) systems that elevate dielectric strength and cut partial-discharge losses, supporting durable performance in renewables and e-mobility platforms. Scale-up of offshore wind turbines, higher-voltage electric vehicles, and smart-grid upgrades reinforce multi-year procurement pipelines for premium liquid insulation. Persistent capital requirements for advanced VPI equipment favor established players with vertically integrated resin and machinery offerings, gradually concentrating the impregnating resins market.

Global Impregnating Resins Market Trends and Insights

Surging Demand for High-Efficiency Electric Motors

Global regulations now mandate tighter loss limits for industrial motors; in the United States, updated Department of Energy rules require minimum nominal efficiencies across horsepower classes. These thresholds spur retrofits with VPI-treated windings that cut hot-spot temperatures, reduce vibration, and extend rewind intervals. Manufacturers consequently specify impregnating resins that tolerate 180 °C thermal classes and exhibit a low dissipation factor to meet energy audits. As plants chase operational expense reductions, the impregnating resins market sees stable aftermarket demand for rewind kits and field-service resins. Mid-size industrial hubs in Southeast Asia and Latin America replicate this replacement cycle, reinforcing the medium-term growth impulse.

OEM Shift Toward Solvent-Free Impregnation Processes

The U.S. Environmental Protection Agency's 2025 amendments on aerosol-coating reactivity, plus Europe's evolving VOC caps, accelerate the transition to 100% solids systems that release no regulated solvents. Solventless resins penetrate winding stacks efficiently under vacuum, polymerize faster under controlled heat, and remove worker-exposure liabilities, enabling ISO 14001 certification. Induction-heated trickle lines such as Gehring's IMFLEX illustrate process agility, cutting cycle times by 20% versus conventional dip-and-bake lines. Cost savings accrue from lower ventilation loads and simpler waste-treatment schemes, making solventless lines the de-facto capex choice for greenfield plants. These operational gains reinforce the impregnating resins market trajectory in developed and emerging economies alike.

VOC and HAPS Regulatory Tightening

Authorities worldwide keep lowering permissible VOC thresholds for industrial coatings; Canada's 2024 rules cap concentrations across 130 product classes, requiring reformulation or market withdrawal. Southern California's revised Rule 1151 on automotive coatings signals similar tightening for electrical-insulation applications, adding compliance documentation and lab-testing expenses. Smaller resin formulators often lack in-house environmental staff and solvent-recovery infrastructure, constraining their ability to compete for OEM contracts prioritizing green chemistry. Transition timelines of two years or less compress capital-planning windows, prompting some regional players to exit the impregnating resins market rather than absorb upgrade costs.

Other drivers and restraints analyzed in the detailed report include:

- Grid-Scale Wind-Turbine Installation Growth

- Miniaturization of Consumer Electronics

- Price Volatility of Bisphenol-A and Styrene Feedstocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solventless formulations account for 64.12% of the impregnating resins market share in 2025, outpacing all alternatives with a 5.10% CAGR to 2031. This dominance derives from the ability of 100% solids chemistries to impregnate stator stacks under high vacuum without entrapped air pockets, yielding class H and class N thermal ratings. The resulting reduction in partial-discharge inception bolsters service lives of traction and wind-generator stators. Plant operators emphasize solvent elimination because it removes fire-code constraints and slashes exhaust-scrubber loads, shrinking operating costs within two years of retrofit.

Innovation pipelines continue to refine solventless rheology for automated trickling and roll-dip methods. Recent RSC-documented polyester networks achieve 331 °C onset degradation and 38% lower dielectric loss versus baseline, expanding suitability for high-frequency inverters. IEEE 275-1992 and 1553-2002 evaluation protocols guide OEM qualifications, ensuring that new resin grades integrate seamlessly with existing insulation systems. Solvent-based grades persist in niche rewind shops that value extended pot life, yet their share erodes annually as regulatory and insurance incentives favor solids technology. Consequently, producers that invested early in solventless assets enjoy pricing premiums and loyalty contracts, solidifying leadership positions across the global impregnating resins market.

The Impregnating Resins Report is Segmented by Technology (Solventless Resins and Solvent-Based Resins), Resin Type (Epoxy, Polyester, Polyester-Imide, and Other Resin Types), Application (Motors and Generators, Home Appliances, Transformers, Electrical and Electronic Components, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 41.20% of 2025 sales in the impregnating resins market and posts the quickest 5.11% CAGR to 2031. China's dominance in electric-motor production keeps regional demand vibrant, while targeted incentives for offshore wind clusters in Fujian and Guangdong provinces guarantee resin pull-through. India's performance incentives for high-efficiency appliances signal a sizable downstream opportunity as domestic manufacturers scale VPI lines. Southeast Asian nations leverage competitive labor costs and growing electronics exports to source localized impregnating capacity, anchoring regional supply chains that feed global OEM networks.

North America exhibits mature but resilient demand underpinned by automotive electrification, rebounding industrial capex, and grid modernization programs. Major resin suppliers now run U.S. and Mexican plants on renewable electricity, shrinking product carbon footprints and giving OEMs a Scope 3 emissions advantage. U.S. Department of Energy motor and transformer standards drive retrofits, translating regulatory action into predictable resin sales. Canada's VOC rules, effective 2024, further push solventless adoption, giving technologically advanced suppliers a market opening.

Europe navigates energy-price volatility yet sustains forward-looking policy drivers such as REACH Annex XVII formaldehyde limits effective 2026, which favor low-emission resins. Offshore-wind installation rates in the North Sea and Baltic Sea lock in high-performance silicone demand, partially offsetting weaker appliance production. Anti-dumping tariffs on foreign epoxy imports shore up domestic resin manufacturing, though they add cost pressure downstream. Overall, the impregnating resins market retains a balanced geographic footprint with Asia-Pacific's scale, North America's standards-driven upgrades, and Europe's environmental-technology leadership acting as complementary growth pillars.

- 3M

- AEV Group

- Axalta Coating Systems, LLC

- BASF

- Borger GmbH

- Chetak Manufacturing Company

- ALTANA (ELANTAS)

- Henkel AG and Co. KGaA

- Huntsman International LLC

- Momentive

- NIPPON RIKA INDUSTRIES CORPORATION

- Resonac Holdings Corporation

- Von Roll

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for High-Efficiency Electric Motors

- 4.2.2 OEM Shift toward Solvent-Free Impregnation Processes

- 4.2.3 Grid-Scale Wind-Turbine Installation Growth

- 4.2.4 EV Traction-Motor Production Acceleration

- 4.2.5 Miniaturisation of Consumer Electronics

- 4.3 Market Restraints

- 4.3.1 VOC and HAPS Regulatory Tightening

- 4.3.2 Price Volatility of Bisphenol-A and Styrene Feedstocks

- 4.3.3 Capital-Intensive Vacuum-Pressure Equipment

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Solventless Resins

- 5.1.2 Solvent-based Resins

- 5.2 By Resin Type

- 5.2.1 Epoxy

- 5.2.2 Polyester

- 5.2.3 Polyester-imide

- 5.2.4 Other Resin Types (Polyurethane, silicone, etc.)

- 5.3 By Application

- 5.3.1 Motors and Generators

- 5.3.2 Home Appliances

- 5.3.3 Transformers

- 5.3.4 Electrical and Electronic Components

- 5.3.5 Automotive Components

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Russia

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 AEV Group

- 6.4.3 Axalta Coating Systems, LLC

- 6.4.4 BASF

- 6.4.5 Borger GmbH

- 6.4.6 Chetak Manufacturing Company

- 6.4.7 ALTANA (ELANTAS)

- 6.4.8 Henkel AG and Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 Momentive

- 6.4.11 NIPPON RIKA INDUSTRIES CORPORATION

- 6.4.12 Resonac Holdings Corporation

- 6.4.13 Von Roll

- 6.4.14 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment