|

市場調查報告書

商品編碼

1910667

包裝印刷:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Packaging Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

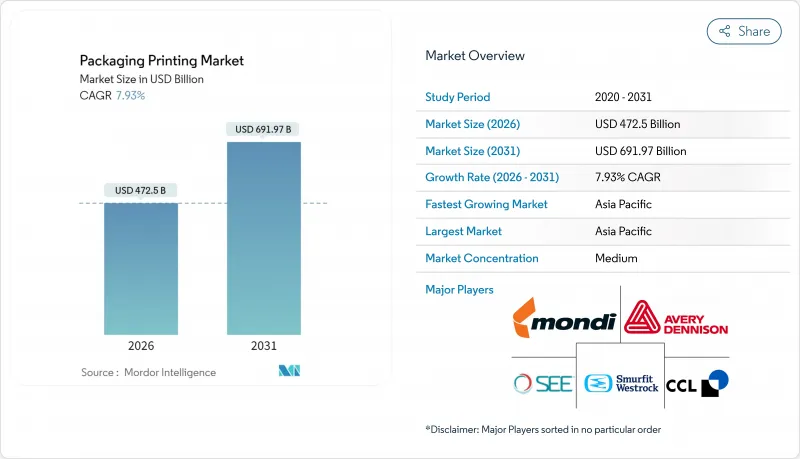

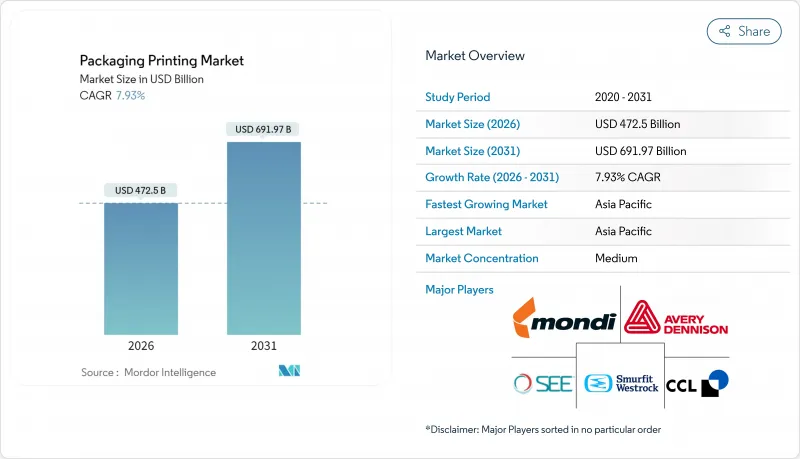

預計到 2026 年,包裝印刷市場規模將達到 4,725 億美元,高於 2025 年的 4,377.8 億美元,預計到 2031 年將達到 6919.7 億美元,2026 年至 2031 年的複合年成長率為 7.93%。

快速的數位轉型、蓬勃發展的電子商務以及嚴格的永續性政策正在重塑技術選擇、基材選擇和區域投資重點。儘管柔版印刷憑藉其長版印刷的高生產率在大批量生產中仍保持優勢,但品牌所有者現在更傾向於採用數位平台進行小批量生產,以支援SKU多樣化、可變數據和智慧包裝功能。隨著加工商尋求低能耗和高速加工,UV固化油墨技術正日益普及,而RFID包裝則提高了供應鏈的可視性。在策略層面,加工商正在將混合印刷生產線、本地化微型工廠和閉合迴路材料方案相結合,以在印刷品質、速度和環境影響決定品牌忠誠度的市場中保護利潤。

全球包裝印刷市場趨勢與洞察

具備RFID功能和數位印刷的需求

物聯網連接的蓬勃發展正將每個包裝轉變為一個資料節點。高價值藥品正逐漸成為標配,並配備嵌入式RFID的感壓標籤。數位印刷機無需更換印版即可整合序號,從而降低單位成本並實現即時認證。消費者應用程式讀取這些標識符,以顯示產品來源資訊和會員優惠,加深用戶互動並協助產品召回管理。將柔版印刷的高效性與在線連續噴墨模組相結合的加工商,正滿足可追溯性要求,並憑藉快速響應贏得合約。

不斷擴大的電子商務包裝量

直接面對消費者的物流優先考慮輕便的包裝形式,以保護產品、突出圖案並快速送達。像Gelato這樣的客製印刷網路將配送距離縮短了90%,證明了透過從類比設備過渡到數位工作流程來擴大本地生產的可行性。小批量生產(通常少於1萬件)降低了傳統膠印的競爭力,促使企業投資高速噴墨印刷機和碳粉印刷機,以實現隔天交貨的商店市級印刷品質。包裝印刷市場受益於開箱影片提供的免費廣告,這鼓勵品牌更頻繁地更新其設計。

高資本投資需求

一條高速八色柔版印刷生產線造價高達294萬美元,需要輔助切斷機、裝版機和溶劑回收設備。東南亞的小型加工商正在推遲升級,眼看品牌所有者對公差要求越來越高,他們的設備將面臨淘汰的風險。雖然有租賃方案,但高利率推高了總擁有成本。這促使財力雄厚的集團收購家族式工廠,得以擴張並協商更有利的基材合約。

細分市場分析

到2025年,柔版印刷將佔據包裝印刷市場34.78%的佔有率,這主要得益於其在膠片和紙張捲筒紙上無與倫比的印刷速度。混合印刷平台如今將噴墨單元堆疊在柔版印刷單元上,從而實現連續碼和區域圖形的印刷,而不會降低印刷速度。隨著加工商追求更短的交貨時間和更豐富的產品種類,數位印刷設備到2031年將以10.15%的複合年成長率成長。凹版印刷在高階菸草和化妝品領域仍佔據著一席之地,因為在這些領域,圖像的保真度足以彌補滾筒雕刻的成本。膠印主要應用於折疊紙盒,而網版印刷和其他一些小眾印刷方式則專注於觸感光油和金屬效果。

投資數據也印證了這一趨勢:2025年安裝的包裝生產線將配備預測性維護感測器,從而減少18%的計劃外停機時間;基於雲端的色彩伺服器將實現工廠間即時協調圖稿;採用混合模式的加工商報告稱,準備工作廢棄物減少了28%,促銷包裝的上市時間縮短了一半。為此,設備供應商正將印刷機與工作流程軟體捆綁銷售,以獲取業務收益並提高包裝印刷市場的售後利潤率。

截至2025年,溶劑型系統在包裝印刷市場仍佔39.62%的佔有率。然而,隨著LED燈將電力消耗降低至每平方公尺0.3-0.5千瓦時(相較之下,熱風乾燥機的能耗為每平方公尺1.2-1.8千瓦時),UV固化油墨的出貨量正以9.52%的複合年成長率成長。水性油墨在紙基應用領域成長最快,因為食品接觸法規對揮發性有機化合物(VOC)的含量有限制。乳膠和LED-UV技術使得一些以前無法用汞燈固化的應用成為可能,例如收縮標籤和熱敏薄膜。

在混合生產環境中,總成本模型更有利於UV固化。 UV固化可以省去洗版站,減少溶劑庫存,並可按需固化,進而減少在製品。樹脂揮發性仍然是一個風險,但多供應商合作和內部配方可以部分抵消價格波動。油墨供應商正在投資研發通過可堆肥性測試的生物基單體和光引發劑,使化學技術的進步與包裝印刷市場面臨的永續性挑戰相契合。

區域分析

亞太地區將引領全球生產,預計到2024年,該地區新增印刷機裝置量將佔全球一半以上。中國加工企業正在增設多層包裝袋生產線,以滿足國內零食需求。印度在生產連結獎勵計畫計劃下提供資本投資激勵。越南和泰國的軟包裝生產商受益於近岸外包,為服裝出口商提供快速吊牌和塑膠袋。跨境投資正在提升區域技術水平,與日本油墨生產商的合資企業則有助於提高產品品質的穩定性。

北美企業正積極擁抱科技與合規。對數位瓦楞紙印刷機的投資使當日達電商包裝盒的產能提升了兩倍。各州立法機構引入生產者延伸責任制(EPR)收費機制,以表彰可回收的印刷材料。美國印刷加工商在UV-LED改造方面處於領先地位,據稱可節能25%。加拿大與美國食品藥物管理局(FDA)協調食品接觸限制,促進跨境採購。同時,墨西哥正吸引著尋求在美墨加協定(USMCA)下享受免稅准入的頂級品牌。

歐洲在監管方面引領潮流。該地區設定的88%包裝可回收率目標正推動品牌指南轉向單一材料複合材料,而這需要使用特殊油墨。德國機械出口產品正利用工業4.0的即時黏度控制等功能,而義大利印刷機製造商則正在將在線連續冷燙印技術標準化,以吸引高階品牌。東歐,尤其是波蘭,以低於西方國家的人事費用消化過剩產能,同時維持高技能水準。荷蘭的創新津貼正在資助紙質阻隔包裝的試點生產線,從而維持包裝印刷市場的良好發展勢頭。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 具備RFID功能和數位印刷的需求

- 不斷擴大的電子商務包裝量

- 永續性:推廣環保油墨和基材

- 新興市場的消費繁榮

- 品牌擁有者採用智慧包裝序列化

- 在地化、客製印刷微型工廠的興起

- 市場限制

- 需要大量資金投入

- 複雜多元的全球印刷法規

- 光引發劑和樹脂價格波動

- 熟練柔版印刷操作人員短缺

- 產業價值鏈分析

- 監管環境

- 技術展望

- 影響市場的宏觀經濟因素

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業生態系分析

第5章 市場規模與成長預測

- 透過印刷技術

- 膠印

- 凹版印刷

- 柔版印刷

- 數位印刷

- 其他印刷技術

- 按墨水類型

- 溶劑型油墨

- UV固化油墨

- 水性油墨

- 乳膠墨水

- LED-UV油墨

- 透過包裝材料

- 標籤

- 塑膠容器和薄膜

- 玻璃容器

- 金屬罐和鋁箔

- 紙和紙板箱

- 軟包裝袋

- 瓦楞紙箱和托盤

- 按最終用途行業分類

- 食品/飲料

- 製藥和醫療保健

- 化妝品和個人護理

- 家用和工業用途

- 電子電器設備

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 越南

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- Smurtfit WestRock

- Tetra Pak Group

- Mondi plc

- Huhtamaki Oyj

- CCL Industries Inc.

- Avery Dennison Corporation

- Sealed Air Corporation

- International Paper Company

- Stora Enso Oyj

- Sonoco Products Company

- Georgia-Pacific LLC

- Constantia Flexibles GmbH

- Mayr-Melnhof Karton AG

- Ahlstrom-Munksj Oyj

- Clondalkin Group Holdings BV

- Autajon Group SA

- SATO Holdings Corp.

- Rotocontrol GmbH

第7章 市場機會與未來展望

packaging printing market size in 2026 is estimated at USD 472.5 billion, growing from 2025 value of USD 437.78 billion with 2031 projections showing USD 691.97 billion, growing at 7.93% CAGR over 2026-2031.

Rapid digital transformation, soaring e-commerce activity, and stringent sustainability policies are reshaping technology selection, substrate choice, and regional investment priorities. Flexography keeps its volume edge thanks to productivity on long runs, yet brand owners now favor digital platforms for short batches that support SKU proliferation, variable data, and smart-pack functionality. UV-curable ink chemistry gains ground as converters look for lower energy use and faster throughput, while RFID-enabled packs strengthen supply-chain visibility. At a strategic level, converters combine hybrid press lines, localized micro-factories, and closed-loop material programs to defend margins in a market where brand loyalty depends on print quality, speed, and environmental footprint.

Global Packaging Printing Market Trends and Insights

Demand for RFID-enabled and Digital Printing

Widespread IoT connectivity is turning each package into a data node, and pressure-sensitive labels embedded with RFID are now common on high-value pharmaceuticals. Digital presses integrate serialized codes without plate changes, cutting unit costs and enabling real-time authentication. Consumer-facing apps read these identifiers to reveal provenance or loyalty offers, deepening engagement while assisting recall management. Converters that combine flexo efficiency with inline inkjet modules meet traceability mandates and win contracts that reward responsiveness.

Expansion of E-commerce Packaging Volumes

Direct-to-consumer logistics prioritize lightweight formats that protect goods, showcase graphics, and arrive swiftly. Print-on-demand networks such as Gelato's cut shipping distance by 90%, proving localized production scales once digital workflows replace analog set-up. Shorter run lengths - often below 10,000 units - push traditional offset out of contention, encouraging investment in high-speed inkjet and toner machines that deliver shelf-ready quality overnight. The packaging printing market benefits as every unboxing video becomes free advertising, pushing brands to refresh artwork more often.

High Capital Investment Requirements

A high-speed eight-color flexo line costs up to USD 2.94 million and demands auxiliary slitters, plate mounters, and solvent-recovery units. Smaller converters in Southeast Asia delay upgrades, risking obsolescence as brand owners insist on tighter tolerances. Leasing programs exist, but interest rates elevate the total cost of ownership. Consolidation, therefore, accelerates deep-pocketed groups buying family-run shops to unlock scale and negotiate better substrate contracts.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Push for Eco-friendly Inks and Substrates

- Emerging-Market Consumption Boom

- Complex and Varying Global Printing Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexography held a 34.78% share of the packaging printing market size in 2025, supported by unrivaled speed on film and paper webs. Hybrid press platforms now layer inkjet stations onto flexo units, enabling serial codes and regional graphics without slowing the run. Digital equipment records a 10.15% CAGR through 2031 as converters chase shorter cycles and SKU proliferation. Rotogravure retains a niche status in premium tobacco and cosmetics, where image fidelity justifies cylinder engraving costs. Offset lithography concentrates on folding cartons, while screen printing and other niche methods address tactile varnishes and metallic effects.

Investment data confirms the trajectory. Pack lines installed in 2025 feature predictive-maintenance sensors that cut unplanned downtime by 18%, and cloud-based color servers align artwork across plants in real time. Converters adopting the hybrid model report making ready waste down by 28% and TTM (time to market) halved for promotional packs. As such, equipment suppliers bundle workflow software with presses, locking in service revenue and strengthening aftermarket margins within the packaging printing market.

Solvent systems maintained a 39.62% share of the packaging printing market size in 2025. Yet UV-curable ink volumes rise at 9.52% CAGR as LED lamps curb power draw to 0.3-0.5 kWh per square meter versus 1.2-1.8 kWh for thermal ovens. Aqueous formulations grow fastest in paper-heavy segments where food contact regulations restrict VOCs. Latex and LED-UV chemistries address shrink labels and heat-sensitive films once off-limits to mercury-lamp curing.

Total-cost models favor UV in high-mix environments: plate washout stations disappear, inventory of solvents shrinks, and cure-on-demand lowers WIP. Resin volatility remains a risk, but multi-sourcing and in-house blending partly offset spikes. Ink suppliers invest in bio-based monomers and photoinitiators that pass compostability tests, aligning chemistry advances with the sustainability agenda permeating the packaging printing market.

The Packaging Printing Market Report is Segmented by Printing Technology (Offset Lithography, Rotogravure, and More), Ink Type (Solvent-Based Ink and More), Packaging Material (Labels, Plastic Containers and Films, Glass Containers, Metal Cans and Foils, and More), End-Use Industry (Food and Beverage, Pharmaceutical and Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads global output, housing more than half of new press installations in 2024. China's converters add multi-layer pouch lines to feed domestic snack demand, while India offers incentives for capital purchases under its Production-Linked Incentive scheme. Flexible packaging makers in Vietnam and Thailand gain from near-shoring, serving apparel exporters that need rapid swing tags and polybags. Cross-border investments elevate regional know-how, and joint ventures with Japanese ink suppliers improve quality consistency.

North American operators' position on technology and compliance. Investments in digital corrugated presses triple capacity for same-day e-commerce boxes, and state legislatures adopt extended producer responsibility fees that reward recyclable prints. U.S. converters also pioneer UV-LED retrofits, claiming 25% energy savings. Canada harmonizes food-contact limits with the FDA, easing cross-border sourcing, while Mexico attracts Tier-1 brands searching for tariff-free access under USMCA.the

Europe sets the regulatory tempo. The bloc's 88% packaging recycling target nudges brand guidelines toward mono-material laminates that rely on specialized inks. German machinery exports leverage Industrie 4.0 features such as real-time viscosity control, and Italian press builders bundle in-line cold-foil to court luxury houses. Eastern Europe, notably Poland, captures overflow work as labor rates undercut Western peers, yet workforce skills remain high. Innovation grants in the Netherlands fund pilot lines for paper-based barrier packs, sustaining momentum in the packaging printing market.

- Amcor plc

- Smurtfit WestRock

- Tetra Pak Group

- Mondi plc

- Huhtamaki Oyj

- CCL Industries Inc.

- Avery Dennison Corporation

- Sealed Air Corporation

- International Paper Company

- Stora Enso Oyj

- Sonoco Products Company

- Georgia-Pacific LLC

- Constantia Flexibles GmbH

- Mayr-Melnhof Karton AG

- Ahlstrom-Munksj Oyj

- Clondalkin Group Holdings BV

- Autajon Group SA

- SATO Holdings Corp.

- Rotocontrol GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for RFID-enabled and Digital Printing

- 4.2.2 Expansion of E-commerce Packaging Volumes

- 4.2.3 Sustainability Push for Eco-friendly Inks and Substrates

- 4.2.4 Emerging-market Consumption Boom

- 4.2.5 Brand-owner Adoption of Smart Pack Serialization

- 4.2.6 Rise of Localised Print-on-Demand Micro-Factories

- 4.3 Market Restraints

- 4.3.1 High Capital Investment Requirements

- 4.3.2 Complex and Varying Global Printing Regulations

- 4.3.3 Volatile Photoinitiator and Resin Prices

- 4.3.4 Shortage of Skilled Flexographic Press Operators

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 The Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Industry Ecosystem Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Technology

- 5.1.1 Offset Lithography

- 5.1.2 Rotogravure

- 5.1.3 Flexography

- 5.1.4 Digital Printing

- 5.1.5 Other Printing Technologies

- 5.2 By Ink Type

- 5.2.1 Solvent-based Ink

- 5.2.2 UV-curable Ink

- 5.2.3 Aqueous Ink

- 5.2.4 Latex Ink

- 5.2.5 LED-UV Ink

- 5.3 By Packaging Material

- 5.3.1 Labels

- 5.3.2 Plastic Containers and Films

- 5.3.3 Glass Containers

- 5.3.4 Metal Cans and Foils

- 5.3.5 Paper and Paperboard Cartons

- 5.3.6 Flexible Pouches

- 5.3.7 Corrugated Boxes and Trays

- 5.4 By End-Use Industry

- 5.4.1 Food and Beverage

- 5.4.2 Pharmaceutical and Healthcare

- 5.4.3 Cosmetics and Personal Care

- 5.4.4 Household and Industrial

- 5.4.5 Electronics and Electrical

- 5.4.6 Other End-Use Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Vietnam

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Smurtfit WestRock

- 6.4.3 Tetra Pak Group

- 6.4.4 Mondi plc

- 6.4.5 Huhtamaki Oyj

- 6.4.6 CCL Industries Inc.

- 6.4.7 Avery Dennison Corporation

- 6.4.8 Sealed Air Corporation

- 6.4.9 International Paper Company

- 6.4.10 Stora Enso Oyj

- 6.4.11 Sonoco Products Company

- 6.4.12 Georgia-Pacific LLC

- 6.4.13 Constantia Flexibles GmbH

- 6.4.14 Mayr-Melnhof Karton AG

- 6.4.15 Ahlstrom-Munksj Oyj

- 6.4.16 Clondalkin Group Holdings BV

- 6.4.17 Autajon Group SA

- 6.4.18 SATO Holdings Corp.

- 6.4.19 Rotocontrol GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment