|

市場調查報告書

商品編碼

1910664

光學顯微鏡:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Optical Microscopes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

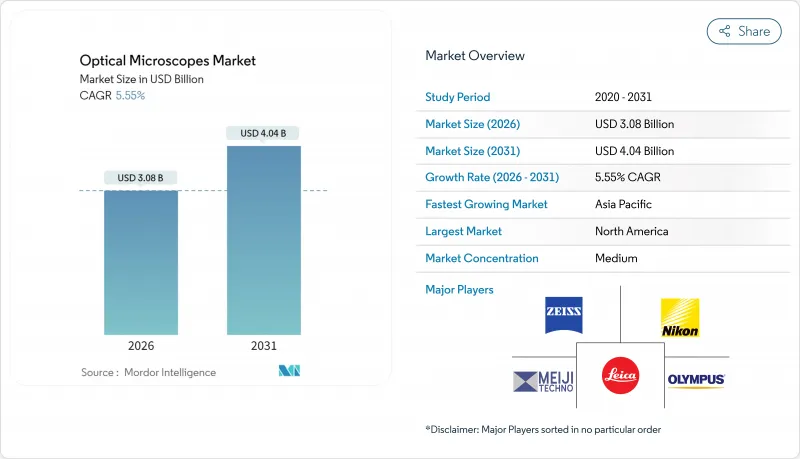

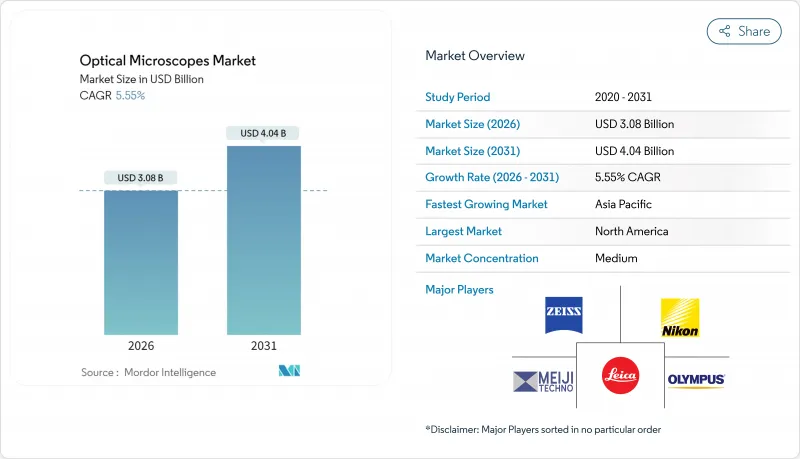

預計到 2026 年,光學顯微鏡市值將達到 30.8 億美元,高於 2025 年的 29.2 億美元。

預計到 2031 年將達到 40.4 億美元,2026 年至 2031 年的複合年成長率為 5.55%。

機器學習演算法實現了影像擷取和解讀的自動化,將分析時間從數小時縮短至數分鐘,使實驗室能夠處理日益成長的樣本量。量子感測器的整合將空間解析度提升至10奈米,為分子生物學和奈米材料研究開闢了新的探索窗口。大量資金的湧入,特別是來自美國衛生研究院(NIH)共用設備津貼,正在支持學術和臨床機構的強勁更新換代。同時,諸如售價低於50美元的全3D列印光學組件等普及化的製造技術,正開始降低資源匱乏環境下的應用門檻。

全球光學顯微鏡市場趨勢及展望

增加對生命科學研發的投入

聯邦政府和慈善機構的項目正在支持下一代成像設施的建設,例如美國國立衛生研究院 (NIH) 斥資 1.3 億美元擴建的冷凍電子顯微鏡 (cryo-EM) 項目,以及普林斯頓大學捐贈的光學核心設備升級項目。津貼傾向於共用模式,推動了多功能模組化平台的利用率和採購量的成長。資金獲取的便利性尤其惠及螢光和超高解析度顯微鏡,這些價格分佈較高,但非常適合先進的生物醫學應用。這使得學術聯盟和區域研究網路的光學顯微鏡訂單週期延長至數年。

數位化和基於人工智慧的圖像分析

深度學習流程在腫瘤分級方面已達到與病理專家相當甚至更高的準確率,使顯微鏡能夠近乎即時地提供可操作的洞察。諸如 ATOMIC 的框架實現了零樣本材料表徵,消除了預訓練模型的瓶頸,並擴展了其工業應用範圍。直接整合到相機感測器中的邊緣運算顯著降低了延遲,而人工智慧驅動的自適應照明則將光毒性暴露降低了兩位數百分比。因此,光學顯微鏡市場對整合硬體和軟體套裝的需求正在成長,超過了對獨立光學儀器的需求。

與電子顯微鏡的解析度差異

光學系統受限於繞射極限,可見光解析度約200奈米,而電子顯微鏡通常可達到亞埃級解析度。儘管MINFLUX及相關技術已使生物成像解析度達到1-3奈米級,但電子顯微鏡平台仍是材料科學領域晶格級細節分析的主流平台。利用標準穿透式電子顯微鏡(TEM)的電子光學技術進步進一步拉大了這種差距,無需昂貴的像差校正即可實現0.44埃的解析度。因此,一些企業的預算正轉向建造多技術實驗室,而非單純的光學設備升級,這限制了高精度金屬加工和半導體製造工廠中光學顯微鏡市場的潛在成長。

細分市場分析

預計到2025年,數位顯微鏡將佔光學顯微鏡市場36.55%的佔有率,這反映出市場正朝著以相機為中心的架構發生決定性轉變,這種架構整合了光學元件和圖形處理單元,可實現即時渲染和註釋。研究人員和臨床醫生青睞整合式電動載物台、頻譜分解和人工智慧檔案格式,這些功能可縮短端到端的分析時間。同時,螢光顯微鏡和超高解析度系統正在推動市場成長,預計到2031年將以7.28%的複合年成長率成長,這主要得益於具有λ/33軸向解析度的確定性奈米顯微鏡等突破性創新,該技術能夠對細胞內機制進行體積成像。複式顯微鏡仍然是血液學和課堂教學中的常用設備,而立體顯微鏡則用於生命科學領域的電子裝置檢測和解剖。新興的量子感測器配置能夠將磁共振轉換為10奈米尺度的光學訊號,這正在模糊傳統產品線的界限,並有望為光學顯微鏡市場帶來更高水準的多功能性。

開放原始碼生態系統正在加速產品開發週期。大學正在發布售價低於50美元的3D列印設備,這些設備能夠進行精細的細胞級觀察,從而促進其在媒介傳播疾病現場監測中的應用。市場領導正透過整合人工智慧引導的自動對焦和雲端遙測技術來應對這一趨勢,進一步增強其軟體差異化優勢。由於活細胞培養室能夠實現長期觀察,倒置式顯微鏡在生物加工設施中越來越受歡迎。因此,即使入門級產品面臨價格壓縮,預計未來五年內,數位和螢光光學顯微鏡市場規模仍將佔據新增收入的很大一部分。

區域分析

預計到2025年,北美將以33.80%的收入貢獻率引領光學顯微鏡市場,這主要得益於美國國立衛生研究院(NIH)資助的冷凍電子顯微鏡(cryo-EM)中心以及成熟的臨床病理工作流程。然而,實驗室人員長期短缺(據報道,2024年空缺率高達46%)限制了醫療能力,迫使醫院優先考慮採用自動化和整合人工智慧平台。隨著遠距醫療的普及,數位病理學也日益流行,市場參與者將掃描器、分析工具和雲端儲存打包成訂閱模式,以確保用戶支出可預測。

亞太地區是成長最快的區域,預計到2031年將以10.55%的複合年成長率成長。在中國,地方政府正在撥出多年預算升級三級醫院,引進多光子顯微鏡和量子感測器設備。同時,印度的診斷產業正在為分散式成像技術的發展創造有利條件。供應商正在加速本地化進程。蔡司在蘇州開設了一個佔地13,000平方公尺的研發和製造地,旨在開發符合當地通訊協定的光學設備和軟體。然而,部分市場監管的不確定性和報銷延遲導致收入確認延遲,促使供應商擴大採用以夥伴關係主導的市場拓展模式。

在「地平線歐洲」研究津貼和統一的CE認證框架的支持下,歐洲保持著均衡成長,該框架簡化了跨境銷售。中東、非洲和南美洲在光學顯微鏡市場中所佔佔有率小規模,但成長迅速,這得益於各國政府優先發展醫療自主能力,以及與七國集團機構的學術合作促進了技術轉移。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 生命科學領域研發投入增加

- 數位化和基於人工智慧的圖像分析

- 奈米科技主導顯微鏡需求激增

- 顯微鏡在臨床環境中的發展

- 開放原始碼硬體和3D列印光學元件

- 晶片實驗室/微流體控整合

- 市場限制

- 與電子顯微鏡的解析度差異

- 低價品牌導致價格下降

- 高技能顯微鏡技師短缺

- 低成本替代品的可用性

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(金額)

- 依產品

- 複式顯微鏡

- 立體顯微鏡

- 數位顯微鏡

- 倒置顯微鏡

- 螢光和超高解析度顯微鏡

- 其他光學顯微鏡

- 最終用戶

- 醫院和診所

- 學術和研究機構

- 診斷實驗室

- 製藥和生物技術公司

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 亞太其他地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 市佔率分析

- 公司簡介

- Carl Zeiss AG

- Nikon Instruments Inc.

- Leica Microsystems(Danaher)

- Olympus Corporation

- Bruker Corporation

- Hitachi High-Tech Corp.

- Agilent Technologies

- Keyence Corp.

- Thermo Fisher Scientific

- Meiji Techno

- Labomed Inc.

- AmScope

- Celestron

- Accu-Scope Inc.

- Motic Microscope

- Andor Technology(Oxford Instr.)

- Jenoptik AG

- Prior Scientific Instruments

- Dino-Lite(AnMo Electronics)

- OPTO-Tech

第7章 市場機會與未來展望

Optical Microscopes market size in 2026 is estimated at USD 3.08 billion, growing from 2025 value of USD 2.92 billion with 2031 projections showing USD 4.04 billion, growing at 5.55% CAGR over 2026-2031.

Machine-learning algorithms now automate image acquisition and interpretation, cutting analysis times from hours to minutes and allowing laboratories to cope with mounting sample volumes. Quantum-sensor integrations are pushing spatial resolution to 10 nanometers, opening new investigative windows in molecular biology and nanomaterials research. Funding inflows particularly the National Institutes of Health's shared instrumentation grants underpin robust upgrade cycles in academic and clinical facilities. Meanwhile, democratized fabrication such as fully 3D-printed optical assemblies priced below USD 50 has begun to lower adoption barriers in resource-limited settings.

Global Optical Microscopes Market Trends and Insights

Rising Funding for Life-Science R&D

Federal and philanthropic programs are underwriting next-generation imaging facilities, such as NIH's USD 130 million cryo-EM expansion and Princeton University's endowment-backed optical core upgrades. Grant mechanisms favor shared-use models, elevating utilization rates and steering procurement toward versatile, modular platforms. Higher capital availability particularly benefits fluorescence and super-resolution instruments whose premium pricing aligns with advanced biomedical use cases. The optical microscopes market therefore locks in multi-year order visibility across academic consortia and regional research networks.

Digitization & AI-Enabled Image Analytics

Deep-learning pipelines now equal or exceed expert pathologists in tumor grading tasks, enabling microscopes to deliver actionable insights in near real time. Frameworks such as ATOMIC demonstrate zero-shot material characterization, removing pre-trained model bottlenecks and widening industrial applicability. Edge computing embedded directly into camera sensors slashes latency, and adaptive illumination guided by AI reduces phototoxic exposure by double-digit percentages. As a result, the optical microscopes market sees escalating demand for integrated hardware-software bundles rather than standalone optics.

Resolution Gap vs. Electron Microscopes

Optical systems remain bounded by diffraction, capping visible-light resolution near 200 nanometers, whereas electron setups routinely push into the sub-angstrom realm. Although MINFLUX and related modalities shrink biological imaging to the 1-3 nanometer domain, materials science still gravitates toward electron platforms for lattice-level insights. Advances in electron ptychography using standard TEMs intensify the comparison by delivering 0.44-angstrom resolution without costly aberration correction. Consequently, some capital budgets tilt toward multi-technique labs rather than pure-play optical upgrades, trimming optical microscopes market growth potential in high-precision metallurgy and semiconductor fabs.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Nanotechnology-Driven Microscopy Demand

- Growth of Clinical Point-of-Care Microscopy

- Price Erosion from Low-Cost Brands

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The digital sub-category accounted for 36.55% of the optical microscopes market in 2025, reflecting a decisive shift toward camera-centric architectures that merge optics with graphics-processing units for instantaneous rendering and annotation. Researchers and clinicians value integrated motorized stages, spectral unmixing, and AI-ready file formats that shrink end-to-end analysis times. Meanwhile, fluorescence and super-resolution systems lead growth, projected at a 7.28% CAGR through 2031, driven by breakthroughs such as λ/33 axial resolution deterministic nanoscopy that unlocks volumetric imaging of intracellular machinery. Compound microscopes remain staples in hematology and classroom instruction, while stereo variants serve electronics inspection and life-science dissection. Emerging quantum-sensor configurations capable of converting magnetic resonance into optical signals at 10 nanometers start to blur traditional product lines, promising a new echelon of versatility within the optical microscopes market.

Open-source ecosystems accelerate iteration cycles: universities now release 3D-printable rigs that hit sub-cellular clarity for under USD 50, catalyzing adoption in field surveillance of vector-borne diseases. Market leaders respond by embedding AI-guided autofocus and cloud telemetry, reinforcing differentiation through software. Inverted formats gain traction inside bioprocessing facilities thanks to live-cell chambers supporting long-term observation. Consequently, the optical microscopes market size for digital and fluorescence lines is projected to command the bulk of incremental revenue over the next half-decade, even as entry-level segments wrestle with price compression.

The Optical Microscopes Market Report is Segmented by Product (Compound Microscopes, Stereo Microscopes, Digital Microscopes, Inverted Microscopes, and More), End User (Hospitals & Clinics, Academic & Research Institutes, Diagnostic Laboratories, Pharmaceutical & Biotech Companies), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads the optical microscopes market with a 33.80% revenue contribution in 2025, supported by NIH-funded cryo-EM hubs and well-established clinical pathology workflows. Yet chronic laboratory technologist shortages 46% vacancy reported in 2024 limit throughput, prompting hospitals to prioritize automation and integrated AI platforms. Digital pathology penetration rises as teleconsultation becomes standard, and market players package scanners, analytics, and cloud storage in subscription models that ensure predictable spending.

Asia Pacific is the fastest mover, expanding at an 10.55% CAGR through 2031. China's provincial governments allocate multi-year budgets for tertiary-hospital upgrades that include multi-photon and quantum-sensor units, while India's diagnostics sector, creating fertile ground for decentralized imaging. Suppliers accelerate localization ZEISS inaugurated a 13,000 square-meter R&D and manufacturing site in Suzhou to tailor optics and software for local protocols. Still, regulatory uncertainty and reimbursement lag in some markets introduce revenue recognition delays, encouraging vendors to adopt partnership-led go-to-market models.

Europe maintains balanced growth, buoyed by Horizon Europe research grants and a cohesive CE-mark framework that simplifies cross-border sales. Middle East & Africa and South America collectively account for a modest but accelerating slice of the optical microscopes market as governments emphasize healthcare self-sufficiency and academic collaborations with G7 institutions drive technology transfers.

- Carl Zeiss

- Nikon Instruments

- Danaher

- Olympus

- Bruker

- Hitachi High-Tech Corp.

- Agilent Technologies

- Keyence Corp.

- Thermo Fisher Scientific

- Meiji Techno

- Labomed Inc.

- AmScope

- Celestron

- Accu-Scope Inc.

- Motic Microscope

- Andor Technology (Oxford Instr.)

- Jenoptik AG

- Prior Scientific Instruments

- Dino-Lite (AnMo Electronics)

- OPTO-Tech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Funding for Life-Science R&D

- 4.2.2 Digitization & AI-Enabled Image Analytics

- 4.2.3 Surge in Nanotechnology-Driven Microscopy Demand

- 4.2.4 Growth Of Clinical Point-Of-Care Microscopy

- 4.2.5 Open-Source Hardware & 3-D-Printed Optical Components

- 4.2.6 Lab-On-Chip / Micro-Fluidic Integration

- 4.3 Market Restraints

- 4.3.1 Resolution Gap Vs. Electron Microscopes

- 4.3.2 Price Erosion from Low-Cost Brands

- 4.3.3 Shortage of Advanced Microscopy Technicians

- 4.3.4 Availability of Low-Cost Alternatives

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Compound Microscopes

- 5.1.2 Stereo Microscopes

- 5.1.3 Digital Microscopes

- 5.1.4 Inverted Microscopes

- 5.1.5 Fluorescence & Super-Resolution Microscopes

- 5.1.6 Other Optical Microscopes

- 5.2 By End User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Academic & Research Institutes

- 5.2.3 Diagnostic Laboratories

- 5.2.4 Pharmaceutical & Biotech Companies

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Carl Zeiss AG

- 6.3.2 Nikon Instruments Inc.

- 6.3.3 Leica Microsystems (Danaher)

- 6.3.4 Olympus Corporation

- 6.3.5 Bruker Corporation

- 6.3.6 Hitachi High-Tech Corp.

- 6.3.7 Agilent Technologies

- 6.3.8 Keyence Corp.

- 6.3.9 Thermo Fisher Scientific

- 6.3.10 Meiji Techno

- 6.3.11 Labomed Inc.

- 6.3.12 AmScope

- 6.3.13 Celestron

- 6.3.14 Accu-Scope Inc.

- 6.3.15 Motic Microscope

- 6.3.16 Andor Technology (Oxford Instr.)

- 6.3.17 Jenoptik AG

- 6.3.18 Prior Scientific Instruments

- 6.3.19 Dino-Lite (AnMo Electronics)

- 6.3.20 OPTO-Tech

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment