|

市場調查報告書

商品編碼

1910653

模塑纖維包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Molded Fiber Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

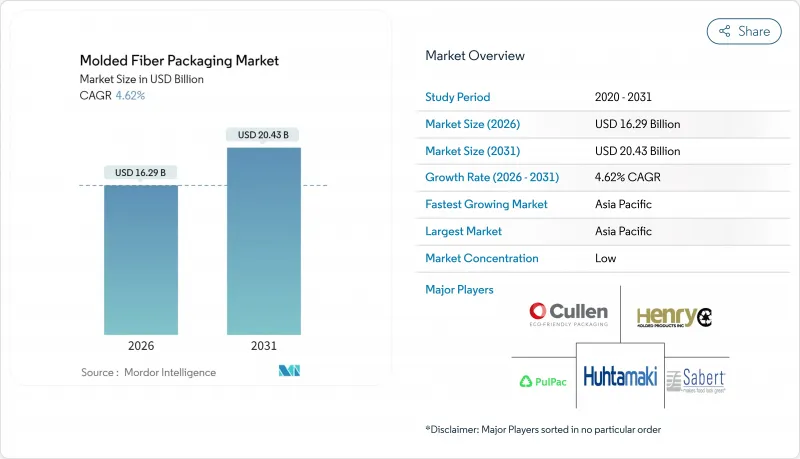

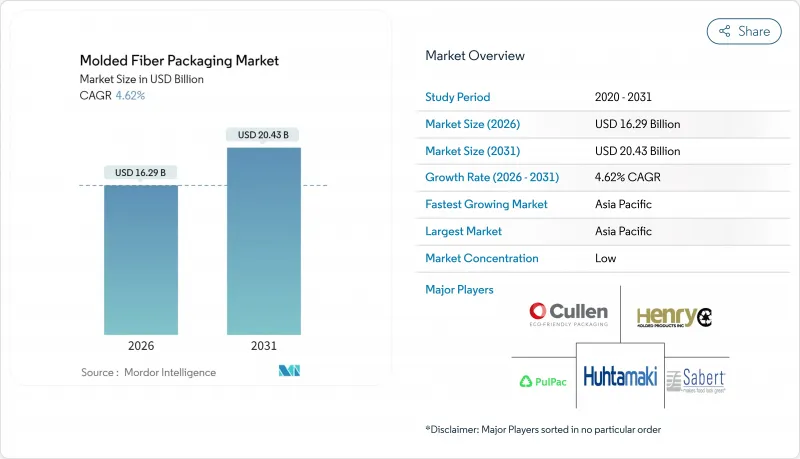

預計到 2026 年,模塑纖維包裝市場規模將達到 162.9 億美元,高於 2025 年的 155.7 億美元。預計到 2031 年,該市場規模將達到 204.3 億美元,2026 年至 2031 年的複合年成長率為 4.62%。

一次性塑膠禁令的擴大、乾式模塑纖維技術的快速普及(該技術可減少80%的二氧化碳排放並使產量提高十倍)以及電子商務交易量的成長,共同支撐著市場需求。生產商正在加速研發混合纖維,以平衡成本、機械強度和永續性。同時,速食店(QSR)正在增加對可堆肥包裝的投入,從而擴大了大眾消費終端市場。儘管市場整合加劇正在改變買賣雙方的動態,但由於歐洲紙漿價格在2024年4月達到每噸1,380歐元(1,496美元)的峰值,利潤率壓力依然存在。

全球模塑纖維包裝市場趨勢與洞察

禁止使用一次性塑膠製品

快速變化的法規正將合規風險轉移到模塑纖維產品的即時訂單。維吉尼亞針對大型食品供應商的發泡聚苯乙烯禁令將於2025年7月生效,奧勒岡州也於2025年1月推出了類似規定。此外,歐盟第2025/40號法規要求到2040年,65%的塑膠包裝必須使用可回收材料製成。澳洲2024年的包裝改革引入了生產者延伸責任制,以將處置成本內部化。這些一致的法規正在加速替代,使模塑纖維包裝市場成為零售商和食品品牌的首選。

電子商務和食品配送通路的成長

消費者食材自煮包和雜貨配送服務需要隔熱和抗衝擊保護,而輕質塑膠難以永續實現這些功能。 TemperPack 的纖維基準測試表明,透過減少運輸量,每年只有一個客戶就能節省 400 輛卡車,從而節省運輸成本,抵消材料價格溢價。持續的客戶訂單積壓顯示市場需求尚未獎勵,這促使模塑纖維包裝市場擴大產能。

優質再生纖維的價格波動

預計2024年4月歐洲紙漿現貨價格將達到每噸1,380歐元(1,496美元),較前一年上漲14%。這對尚未實施避險策略的加工業者來說是一個挑戰。北歐地區的供應中斷和日益嚴格的森林砍伐限制正在導致工廠關閉,並加劇成本波動。模塑纖維包裝產業的中小型企業正面臨營運資金壓力,迫使它們尋求合作或退出市場。

細分市場分析

預計到2025年,轉注成型纖維將佔據49.62%的模塑纖維佔有率,這主要得益於其龐大的裝機量和廣泛的適用性。熱成型產品雖然規模較小,但預計將以6.45%的複合年成長率成長,其阻隔塗層和更佳的美觀性吸引了許多高階品牌。厚壁模塑產品作為工業緩衝材料仍然十分重要,而改性等級的產品則適用於裝飾性表面處理。輕度脫木素處理可使拉伸強度提高22%,進而增強其在電子封裝領域的應用。由於3D乾式成型技術縮短了生產週期並降低了模具成本,熱成型產品的模塑纖維封裝市場預計將穩定成長。

技術創新趨勢正轉向混合層壓技術,可提高傳動部件的耐油性和耐濕性。製造商正利用計算流體力學(CFD) 來最佳化真空循環,並將纖維用量減少高達 12%。競爭優勢則依賴專有的成型篩網和水回收系統來降低營運成本。

托盤仍將是核心產品,預計到2025年將佔銷售額的34.07%,而翻蓋式容器和普通容器預計將以5.17%的複合年成長率成長,因為快餐連鎖店對鉸鏈強度和承重效率的需求日益成長。便利的零食和餐點宅配服務的成長也進一步推動了這項需求。端蓋和內襯滿足了電子產品和家用電器對衝擊吸收的需求,而無聚乙烯阻隔材料的出現也推動了對杯子的需求。

碳酸鈣和高嶺土等礦物填料可以提高材料的剛度和亮度,從而在不顯著增加成本的情況下提高生產線速度。然而,過量添加礦物填充會降低材料的抗衝擊強度,因此混煉商需要謹慎調整填料的添加量。如果目前的普及趨勢持續下去,未來十年內,以泡殼為主的模塑纖維包裝市場規模可望達到10億美元左右。

區域分析

預計到2025年,亞太地區將佔模塑纖維包裝市場38.45%的佔有率,並在2031年之前以6.65%的複合年成長率成長,這主要得益於中國和印度逐步放寬對難回收塑膠的禁令。政府對永續材料的補貼推動了國內機械設備的採購,而人事費用優勢則縮短了投資回收期。強勁的中產階級消費推動了對簡便食品、電子產品和藥品的需求。

在北美,諸如加州SB 54法案(該法案要求到2032年減少25%的塑膠使用量)等法規正在推動產業發展。品牌承諾促使纖維泡殼的早期應用,而國內紙漿資源則緩解了原物料價格的波動。然而,勞動力市場緊張和能源成本高企迫使大型加工商投資自動化,這對它們有利。

在歐洲,循環經濟日益重要,2025/40號法規加強了再生材料含量的標準。奧地利和芬蘭的製造商正利用先進的纖維模塑生產線來滿足歐盟各地的需求。在日本,一項修訂後的正面表列制度將於2025年6月生效,該制度要求進行嚴格的過渡測試,這為自律的供應商設置了准入壁壘。在南美洲以及中東和非洲,不斷加快的都市化、不斷完善的廢棄物基礎設施以及較低的人均塑膠使用量,都為模塑纖維的應用提供了尚未開發的成長空間。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 消費者偏好轉向可回收和環保包裝

- 對一次性塑膠製品的監管禁令

- 電子商務和食品配送通路的成長

- 速食店(QSR)採用可生物分解翻蓋式容器的現狀

- 3D乾式模塑纖維技術的商業化

- 品牌層面的碳中和聲明

- 市場限制

- 優質再生纖維的價格波動

- 生質塑膠和塗佈紙板替代品

- 濕食品的阻隔性能限制

- 資本密集型客製化模具需求

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 激烈的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 模塑纖維型

- 厚的

- 轉注成型

- 熱成型

- 已處理

- 依產品類型

- 托盤

- 翻蓋式容器和容器

- 杯子和杯架

- 盤子和碗

- 其他產品類型

- 按原料來源

- 再生紙

- 原生紙漿

- 混合纖維混合物

- 按最終用戶行業分類

- 食品/飲料

- 電子產品和家用電器

- 醫療和醫療設備

- 產業

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 肯亞

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Huhtamaki Oyj

- Brodrene Hartmann A/S

- Sonoco Products Company

- UFP Technologies Inc.

- Omni-PAC Group UK

- Henry Molded Products Inc.

- Pactiv Evergreen Inc.

- Cullen Packaging Ltd.

- Genpak LLC

- Sabert Corporation

- International Paper Co.

- Enviropak Corporation

- Keiding Inc.

- PulPac AB

- Stora Enso Oyj

- Heracles Packaging SA

- Earthpac(US)

- Fiber Mold A/S

- Fabri-Kal Corporation

- TMP Technologies

第7章 市場機會與未來展望

The molded fiber packaging market size in 2026 is estimated at USD 16.29 billion, growing from 2025 value of USD 15.57 billion with 2031 projections showing USD 20.43 billion, growing at 4.62% CAGR over 2026-2031.

Rising single-use plastic bans, rapid scale-up of dry molded fiber technology that cuts CO2 emissions by 80% and boosts throughput tenfold, and growing e-commerce volumes collectively underpin demand. Producers are accelerating hybrid fiber R&D to balance cost, mechanical strength, and sustainability, while quick service restaurant (QSR) commitments to compostable formats are expanding high-volume end-markets. Intensifying mergers are reshaping buyer-supplier dynamics, yet margin pressure persists because European pulp prices peaked at EUR 1,380 (USD 1,496) per metric ton in April 2024.

Global Molded Fiber Packaging Market Trends and Insights

Regulatory bans on single-use plastics

Fast-moving legislation is converting compliance risk into immediate molded fiber orders. Virginia's expanded polystyrene prohibition for large food vendors takes effect in July 2025, Oregon implemented similar rules in January 2025, and the European Union Regulation 2025/40 mandates 65% recycled content in plastic packaging by 2040. Australia's 2024 packaging reform embeds extended producer responsibility that internalizes disposal costs. These aligned mandates accelerate substitution, making the molded fiber packaging market a default choice for retailers and food brands.

Growth of e-commerce and food-delivery channels

Direct-to-consumer meal kits and grocery delivery require insulation and shock protection that lightweight plastics struggle to provide sustainably. TemperPack's fiber-based liners reduce outbound shipments enough to remove 400 trucks annually for a single client, illustrating freight savings that offset material price premiums. Unmet demand, documented by repeated customer backlogs, is pushing the molded fiber packaging market toward capacity expansion incentives.

Price volatility of high-grade recycled fiber

European pulp spot prices hit EUR 1,380 (USD 1,496) per metric ton in April 2024, a 14% year-over-year jump that squeezed converters unable to hedge. Nordic supply disruptions and stricter deforestation rules spur mill closures, amplifying cost swings. Smaller firms in the molded fiber packaging industry face working-capital strain, prompting alliances or exit.

Other drivers and restraints analyzed in the detailed report include:

- QSR adoption of compostable clamshells

- Commercialization of 3-D dry-molded fiber technology

- Barrier-property limitations for wet foods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transfer-molded fiber captured a commanding 49.62% share in 2025, anchoring the molded fiber packaging market through its installed base and versatility. Thermoformed formats, though smaller, are projected to grow at 6.45% CAGR as improved barrier coatings and aesthetics attract premium brands. Thick wall molding remains vital for industrial cushioning, and processed grades cater to decorative finishes. Light delignification boosts tensile strength by 22%, enhancing viability for electronics packaging. The molded fiber packaging market size for thermoformed items is forecast to increase steadily as 3D dry molding reduces cycle times and tooling costs.

Innovation momentum is shifting toward hybrid laminations that enhance the grease and moisture resistance of transfer parts. Producers leverage computer-aided fluid dynamics to optimize vacuum cycles, trimming fiber usage by up to 12%. Competitive dynamics thus hinge on proprietary forming screens and water-recovery systems that lower operating costs.

Trays remained the backbone with 34.07% of 2025 revenues, yet clamshells and containers are set for 5.17% CAGR because QSR chains require hinge integrity and stacking efficiency. Growth of convenience snacking and meal-delivery services further accelerates demand. End-caps and inserts meet electronics and appliance shock-absorption needs, while cups gain traction as polyethylene-free barriers emerge.

Mineral fillers such as calcium carbonate and kaolin improve rigidity and whiteness, raising line speeds without prohibitive cost increases. However, overdosing minerals can drop impact resistance, so formulators calibrate filler ratios carefully. The molded fiber packaging market size attributable to clamshells could reach a mid-single-digit billion-dollar level by decade-end if current adoption curves sustain.

The Molded Fiber Packaging Market Report is Segmented by Molded Fiber Type (Thick Wall, Transfer Molded, Thermoformed, and Processed), Product Type (Trays, Clamshells and Containers, and More), Raw-Material Source (Recycled Paper, Virgin Pulp, and More), End-User Industry (Food and Beverages, Electronics and Appliances, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region led the molded fiber packaging market with a 38.45% share in 2025 and is projected to compound at a 6.65% rate through 2031, as China and India scale back bans on difficult-to-recycle plastics. Government subsidies for sustainable materials encourage domestic machinery purchases, and labor cost advantages shorten payback periods. Robust middle-class consumption lifts volumes for convenience foods, electronics, and pharmaceuticals.

North America benefits from regulatory catalysts, such as California SB 54, which mandates a 25% reduction in plastic by 2032. Brand pledges drive early adoption of fiber clamshells, while domestic pulp resources cushion raw-material volatility. Nevertheless, tight labor markets and high energy costs compel investments in automation that favor large converters.

Europe emphasizes circularity, with Regulation 2025/40 tightening recycled-content thresholds. Manufacturers in Austria and Finland leverage advanced fiber-forming lines to supply EU-wide demand. Japan's updated positive list regime, effective June 2025, requires rigorous migration testing, creating entry barriers that disciplined suppliers can exploit. South America and the Middle East and Africa offer untapped growth pockets where urbanization and waste infrastructure upgrades converge with lower per-capita plastic use, paving pathways for molded fiber adoption.

- Huhtamaki Oyj

- Brodrene Hartmann A/S

- Sonoco Products Company

- UFP Technologies Inc.

- Omni-PAC Group UK

- Henry Molded Products Inc.

- Pactiv Evergreen Inc.

- Cullen Packaging Ltd.

- Genpak LLC

- Sabert Corporation

- International Paper Co.

- Enviropak Corporation

- Keiding Inc.

- PulPac AB

- Stora Enso Oyj

- Heracles Packaging SA

- Earthpac (US)

- Fiber Mold A/S

- Fabri-Kal Corporation

- TMP Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift in consumer preference toward recyclable and eco-friendly packaging

- 4.2.2 Regulatory bans on single-use plastics

- 4.2.3 Growth of e-commerce and food-delivery channels

- 4.2.4 QSR adoption of compostable clamshells

- 4.2.5 Commercialization of 3-D dry-molded fiber technology

- 4.2.6 Brand-level carbon-neutral pledges

- 4.3 Market Restraints

- 4.3.1 Price volatility of high-grade recycled fiber

- 4.3.2 Bioplastics and coated paperboard substitutes

- 4.3.3 Barrier-property limitations for wet foods

- 4.3.4 Capital-intensive custom tooling requirements

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Molded Fiber Type

- 5.1.1 Thick Wall

- 5.1.2 Transfer Molded

- 5.1.3 Thermoformed

- 5.1.4 Processed

- 5.2 By Product Type

- 5.2.1 Trays

- 5.2.2 Clamshells and Containers

- 5.2.3 Cups and Cup-Carriers

- 5.2.4 Plates and Bowls

- 5.2.5 Other Product Types

- 5.3 By Raw-Material Source

- 5.3.1 Recycled Paper

- 5.3.2 Virgin Pulp

- 5.3.3 Hybrid Fiber Blends

- 5.4 By End-user Industry

- 5.4.1 Food and Beverages

- 5.4.2 Electronics and Appliances

- 5.4.3 Healthcare and Medical Devices

- 5.4.4 Industrial

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huhtamaki Oyj

- 6.4.2 Brodrene Hartmann A/S

- 6.4.3 Sonoco Products Company

- 6.4.4 UFP Technologies Inc.

- 6.4.5 Omni-PAC Group UK

- 6.4.6 Henry Molded Products Inc.

- 6.4.7 Pactiv Evergreen Inc.

- 6.4.8 Cullen Packaging Ltd.

- 6.4.9 Genpak LLC

- 6.4.10 Sabert Corporation

- 6.4.11 International Paper Co.

- 6.4.12 Enviropak Corporation

- 6.4.13 Keiding Inc.

- 6.4.14 PulPac AB

- 6.4.15 Stora Enso Oyj

- 6.4.16 Heracles Packaging SA

- 6.4.17 Earthpac (US)

- 6.4.18 Fiber Mold A/S

- 6.4.19 Fabri-Kal Corporation

- 6.4.20 TMP Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment