|

市場調查報告書

商品編碼

1910643

噴墨列印:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Inkjet Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

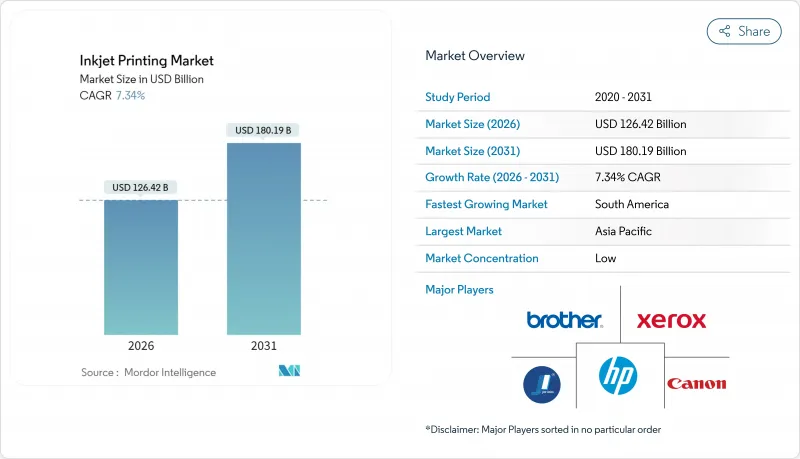

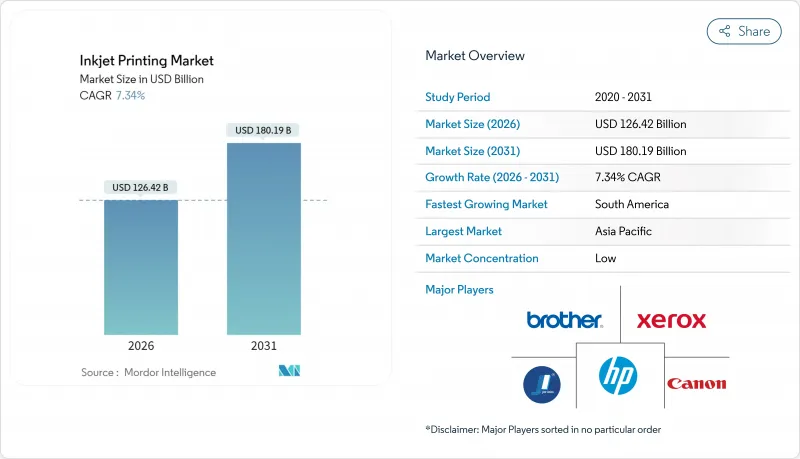

預計到 2025 年,噴墨列印市場規模將達到 1,177.7 億美元,到 2026 年將達到 1,264.2 億美元,到 2031 年將達到 1,801.9 億美元,預測期(2026-2031 年)的複合年成長率為 7.34%。

當前成長動能主要由三大支柱驅動:對數據密集型包裝的需求不斷成長、時尚產業向按需紡織品生產轉型,以及有利於水性化學品的監管壓力。供應商正從以硬體為中心的提案轉向更互聯、服務更豐富的生態系統,以降低整體擁有成本並支援大規模客製化。印表機頭技術創新者的整合,以及區域在地化製造舉措,正在重塑競爭格局,同時也為直接成型、功能性電子產品和裝飾應用等尚未開發的領域開闢了機會。噴墨列印市場正透過將這些結構性因素轉化為可擴展的數位化工作流程而持續成長,這些工作流程正在包裝、出版、紡織和工業領域取代類比系統。

全球噴墨列印市場趨勢與洞察

快速消費品和食品產業的數據日常消費品包裝需求

嚴格的可追溯性法規和防偽措施迫使品牌所有者應對即時可變數據,而只有噴墨列印市場才能有效率地擴展這種能力。 Graphic Packaging International 的壓印技術能夠在保持生產線速度的同時實現批次級序列化,證明高解析度熱感噴墨技術可以在高吞吐量環境中並存。 MapleJet 的模組化編碼系統進一步展示了在線連續整合如何最大限度地減少停機時間並確保可再生薄膜符合法規要求。與 SUDPACK-LEIBINGER 等公司的合作正在將這種方法擴展到單一材料包裝,展示了合規油墨和可再生基材的結合如何確保在即將到來的歐盟目標下實現未來的營運目標。在各個市場,嵌入QR碼和動態設計元素的能力正在將包裝從被動的容器轉變為互動式的品牌資產,從而鞏固了對創新噴墨平台的持續需求。

短期按需出版的擴張

隨著出版商調整庫存以應對波動的消費者需求,首印量持續下降。尼爾森圖書掃描數據顯示,首印訂單量出現兩位數下滑,這促使出版商採用單張紙和捲筒紙噴墨設備,以期在1000張以下的印量下實現與膠印相媲美的經濟效益。Canon新款B2幅面印表機每小時可列印8700張,降低了盈虧平衡點,並支援「缺口」印刷策略,以在社群媒體主導的銷售高峰期補充供應。惠普的數位生產平台透過自動化作業排序和表面處理工程、降低人事費用以及整合雲端分析,進一步加速了這一轉變。隨著出版商轉向小批量補貨和個人化版本,噴墨列印市場脫穎而出,成為唯一能夠在不增加倉儲成本的情況下實現這些新工作流程獲利的技術。

廣告支出加速向數位管道轉移

隨著行銷預算日益轉向程序化平台,商業印刷產能受到限制。傳統上依賴大量傳單和產品目錄的印刷服務供應商面臨挑戰,因為廣告公司優先考慮點擊率指標和即時歸因。為了應對這項挑戰,企業正在轉向利用數據驅動的個人化技術,製作高影響力的廣告信和促銷印刷品。印刷商透過將獨特的QR碼與忠誠度計畫相結合,保持競爭力並獲得更高的利潤。然而,整體印刷量的下降仍然對噴墨印刷市場的傳統商業領域構成壓力。

細分市場分析

到2025年,按需噴墨(DoD)平台將佔總收入的45.88%,這表明其能夠適應各種承印物,並滿足客戶對高影像品質的需求。儘管DoD平台佔據主導地位,但其成長速度正在放緩,而連續噴墨9.10%的複合年成長率(CAGR)正吸引著尋求不間斷高速噴碼的包裝生產線。由連續噴墨驅動的噴墨列印市場預計到2031年將超過336億美元,這表明對於許多加工商而言,速度正變得與品質同等重要。 DoD供應商正在透過整合循環噴頭和人工智慧輔助的墨滴控制技術來應對這項挑戰,以在不犧牲1200 dpi解析度的前提下,實現超過80公尺/分鐘的列印速度。

投資決策越來越圍繞著產品種類(SKU)的複雜性和停機接受度。每天管理數百個批次代碼的食品飲料生產線正在轉向連續列印技術,而裝飾和照片列印領域由於灰度調製優勢,仍然以按需噴墨列印為主導。將按需噴墨預塗與連續清漆油層結合的混合架構,代表了噴墨列印市場未來的融合方向。

水性墨水因其低VOC含量和廣泛的紙張相容性而備受青睞,預計到2025年將佔據34.22%的市場佔有率。雖然更嚴格的法規正在加速水性墨水的普及,但乳膠墨水(將水性載體與聚合物顆粒相結合)也因其優異的戶外耐久性而日益受到關注。乳膠墨水的複合年成長率(CAGR)為10.78%,預計到2031年,其在噴墨列印市場的佔有率將達到約四分之一。憑藉大容量儲墨罐和無異味的特性,乳膠墨水正擴大應用於先前由溶劑型墨水主導的店內標誌和裝飾領域。

儘管溶劑型油墨在需要極高附著力和耐化學性的領域仍被應用,但就連汽車配件產業也在嘗試使用UV-LED和乳膠油墨作為替代方案。 Mimaki的固定裝置CMR UV油墨和HP的Latex R系列油墨展現了研發週期的加速,其重點在於在不犧牲耐用性的前提下實現永續性。隨著監管機構標準的日益嚴格,噴墨列印產業正在轉向將合規性融入價值提案而非事後考慮的化學技術。

本噴墨列印市場報告按列印技術(例如,按需噴墨、連續噴墨)、墨水類型(例如,水性墨水、溶劑型墨水、UV固化墨水)、組件(例如,印表機、墨盒、散裝墨水)、應用領域(例如,書籍出版、廣告)、承印物(例如,紙張和紙板、塑膠薄膜和箔材)以及地區(例如,北美)進行分析。市場預測以美元為以金額為準。

區域分析

亞太地區的領先地位反映了以大規模生產為導向的中國加工商與高精度日本噴頭製造商之間無與倫比的協同效應。從廣東到泰米爾納德邦的紡織中心正透過加大對自動化和人工智慧印刷機的投資,鞏固其區域主導地位。韓國正利用其電子產業生態系統,試點用於OLED和PCB製造的功能性噴墨生產線,從而擴展支持噴墨印刷市場的技術基礎。

南美洲的加速成長依賴政策主導的本地化,這不僅能保護加工商免受進口關稅的影響,也能刺激就業成長。財政激勵措施將支持中小型工廠升級到數位化生產線,尤其是在食品包裝領域,該領域對可追溯性和快速交貨的需求與噴墨技術不謀而合。 2024年的供應鏈中斷將凸顯國內印刷能力的戰略價值,並推動2031年之前的資本投資。

北美和西歐透過研發叢集和嚴格的環境標準,持續引領技術發展方向。德國的印刷油墨法規和REACH法規的擴展,促進了向低VOC化學品的快速過渡,並確立了事實上的全球標準。在中東和非洲,電子商務的蓬勃發展推動了對標籤和軟包裝的需求,但基礎設施的匱乏限制了規模化生產。然而,海灣地區的先導計畫展示了一條用於飲料編碼的高速單一途徑生產線,預示著噴墨列印市場的未來成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 快速消費品和食品產業的數據日常消費品包裝需求

- 小批量按需出版的普及

- 工業裝飾印刷和直接成型印刷的成長

- 單一途徑高速噴墨印刷機的出現

- 利用基於物聯網的預測性維護降低整體擁有成本 (TCO)

- 使用水性油墨以符合更嚴格的VOC法規

- 市場限制

- 廣告支出正擴大轉向數位管道

- 與傳統的柔版印刷機和網版印刷機相比,資本投資成本持續偏高。

- 印字頭設計專利正變得越來越複雜。

- 特種顏料原料價格波動

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 透過印刷技術

- 按需噴墨

- 連續噴墨

- 其他印刷技術

- 按墨水類型

- 水溶液

- 溶劑型

- 紫外線固化型

- 乳膠

- 熱昇華列印

- 其他墨水類型

- 按組件

- 印表機

- 墨盒和散裝墨水

- 列印頭

- 軟體和服務

- 透過使用

- 圖書與出版

- 商業印刷

- 廣告

- 交易型

- 標籤

- 包裝

- 紡織印花

- 電子元件和基板印刷

- 其他用途

- 按基礎材料

- 紙和紙板

- 塑膠薄膜和鋁箔

- 纖維

- 金屬

- 玻璃和陶瓷

- 其他基質

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 新加坡

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- HP Inc.

- Canon Inc.

- Seiko Epson Corp.

- Brother Industries Ltd.

- Ricoh Company Ltd.

- Xerox Holdings Corp.

- Fujifilm Holdings Corp.

- Konica Minolta Inc.

- Kyocera Corp.

- Lexmark International

- Durst Group AG

- Mimaki Engineering Co. Ltd.

- Roland DG Corp.

- Hitachi Industrial Equipment Systems

- Videojet Technologies Inc.

- Domino Printing Sciences

- Inkjet Inc.

- Jet Inks Pvt Ltd.

- King Printing Co. Ltd.

- Electronics For Imaging(EFI)

- Nazdar Ink Technologies

第7章 市場機會與未來展望

The inkjet printing market was valued at USD 117.77 billion in 2025 and estimated to grow from USD 126.42 billion in 2026 to reach USD 180.19 billion by 2031, at a CAGR of 7.34% during the forecast period (2026-2031).

Current momentum rests on three pillars: rising demand for data-rich packaging, the fashion sector's pivot to on-demand textile output, and regulatory pressure that favors water-based chemistries. Vendors are shifting from hardware-centric propositions toward connected, service-rich ecosystems that lower the total cost of ownership and support mass customization. Consolidation among printhead innovators, coupled with region-specific incentives for localized production, is reshaping competitive dynamics while opening white-space opportunities in direct-to-shape, functional electronics, and decor applications. The inkjet printing market continues to thrive by translating these structural forces into scalable, digitally enabled workflows that replace analog systems across packaging, publishing, textile, and industrial verticals.

Global Inkjet Printing Market Trends and Insights

Data-driven Packaging Demand from FMCG and Food Sectors

Stringent traceability mandates and anti-counterfeiting initiatives are pushing brand owners toward real-time, variable data capabilities that only the inkjet printing market can scale efficiently. Graphic Packaging International's deployment of imprinting technology embeds batch-level serialization while maintaining line speeds, proving that high-resolution thermal inkjet can coexist with high-throughput environments. MapleJet's modular coding systems further illustrate how inline integration minimizes downtime and ensures regulatory compliance on recyclable films. Collaborations such as SUDPACK-LEIBINGER extend this approach to mono-material packaging, demonstrating how compliant inks combined with recyclable substrates future-proof operations under forthcoming EU targets. Across markets, the ability to embed QR codes and dynamic design elements is transforming packaging from a passive container to an interactive brand asset, locking in sustained demand for innovative inkjet platforms.

Proliferation of Short-run, On-demand Publishing

Average first-print runs continue to contract as publishers align inventory with volatile consumer demand. Nielsen BookScan data show double-digit drops in initial orders, prompting adoption of sheetfed and web inkjet devices that deliver offset-like economics at runs below 1,000 copies. Canon's new B2 device prints 8,700 sheets per hour, reducing breakeven points and enabling "gap" printing strategies that bridge supply during social-media-driven sales spikes. HP's digital production platforms reinforce this shift by automating job sequencing and finishing, trimming labor costs, and integrating cloud-based analytics. As publishers pivot to micro-batch replenishment and personalized editions, the inkjet printing market stands out as the only technology able to monetize these emerging workflows without inflating warehousing costs.

Accelerating Shift of Ad-spend into Digital Channels

The ongoing transition of marketing budgets to programmatic platforms limits addressable volumes for commercial print. Agencies favor click-through metrics and real-time attribution, challenging print service providers that were once reliant on high-volume flyers and catalogs. In response, firms reposition toward high-impact direct mail and transpromo pieces that leverage data-driven personalization. By coupling unique QR codes with loyalty programs, printers preserve relevance and capture premium margins, yet overall volume shrinkage remains a drag on the inkjet printing market's legacy commercial segment.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Industrial Decor and Direct-to-shape Printing

- Advent of Single-pass, High-speed Inkjet Presses

- Persistent Cap-ex Premium over Legacy Flexo/Screen Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drop-on-Demand (DoD) platforms delivered 45.88% of 2025 revenue, underscoring their versatility across substrates and the high image fidelity clients require. Despite leadership, DoD growth decelerates as Continuous Inkjet's 9.10% CAGR appeals to packaging lines seeking uninterrupted, high-velocity coding. The inkjet printing market size attributable to Continuous Inkjet is projected to surpass USD 33.6 billion by 2031, indicating that speed now carries equal weight with quality for many converters. DoD vendors respond by integrating recirculation heads and AI-assisted droplet control to push speeds past 80 m/min without sacrificing 1,200 dpi resolution.

Investment decisions increasingly revolve around SKU complexity and downtime tolerance. Food and beverage lines that manage hundreds of batch codes daily gravitate toward Continuous technology, while decor and photographic segments remain DoD strongholds due to grayscale modulation advantages. Hybrid architectures that blend DoD pre-coats with Continuous varnish layers illustrate the convergence path ahead for the inkjet printing market.

Aqueous formulations held 34.22% share in 2025, benefiting from low VOC profiles and broad paper compatibility. Regulatory headwinds expedite adoption, yet they also elevate Latex chemistries that combine water-based carriers with polymer particles to deliver exterior durability. Latex's 10.78% CAGR could lift its slice of the inkjet printing market to nearly one-quarter by 2031. High-capacity bulk tanks and odor-free operation position Latex for in-store signage and decor, segments historically served by solvent inks.

Solvent-based lines persist where extreme adhesion or chemical resistance prevails, but even automotive fixtures now pilot UV-LED and Latex alternatives. Mimaki's CMR-free UV inks and HP's Latex R-series underscore an accelerating R&D cycle focused on sustainability without durability trade-offs. As regulators harden thresholds, the inkjet printing industry is pivoting toward chemistries that embed compliance into their value proposition rather than treating it as a retrofit.

The Inkjet Printing Market Report is Segmented by Printing Technology (Drop-On-Demand, Continuous Inkjet, and More), Ink Type (Aqueous, Solvent, UV-Curable, and More), Component (Printers, Ink Cartridges and Bulk Inks, and More), Application (Books and Publishing, Advertising, and More), Substrate (Paper and Paperboard, Plastic Films and Foils, and More), and Geography (North America, and More). Market Forecasts in Value (USD).

Geography Analysis

Asia-Pacific's dominance reflects unparalleled synergy between volume-oriented Chinese converters and high-precision Japanese head manufacturers. Investments in automation and AI-enabled presses proliferate across textile hubs from Guangdong to Tamil Nadu, reinforcing regional leadership. South Korea leverages its electronics ecosystem to pilot functional inkjet lines for OLED and PCB fabrication, widening the technology pool that feeds the inkjet printing market.

South America's acceleration hinges on policy-driven localization that shields converters from import tariffs while fostering job creation. Fiscal incentives help smaller plants upgrade to digital lines, especially in food packaging, where demand for traceability and shorter lead times aligns with inkjet capabilities. Supply chain disruptions in 2024 illustrated the strategic value of domestic print capacity, spurring cap-ex through 2031.

North America and Western Europe continue to shape technological trajectories via R&D clusters and stringent environmental norms. The German Printing Ink Ordinance and REACH expansions catalyze rapid migration to low-VOC chemistries, setting de facto global benchmarks. In the Middle East and Africa, rising e-commerce elevates label and flexible-packaging demand, yet infrastructure gaps temper scale. Nonetheless, pilot projects in Gulf states demonstrate high-speed single-pass lines for beverage coding, hinting at future momentum in the inkjet printing market.

- HP Inc.

- Canon Inc.

- Seiko Epson Corp.

- Brother Industries Ltd.

- Ricoh Company Ltd.

- Xerox Holdings Corp.

- Fujifilm Holdings Corp.

- Konica Minolta Inc.

- Kyocera Corp.

- Lexmark International

- Durst Group AG

- Mimaki Engineering Co. Ltd.

- Roland DG Corp.

- Hitachi Industrial Equipment Systems

- Videojet Technologies Inc.

- Domino Printing Sciences

- Inkjet Inc.

- Jet Inks Pvt Ltd.

- King Printing Co. Ltd.

- Electronics For Imaging (EFI)

- Nazdar Ink Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Data-driven packaging demand from FMCG and food sectors

- 4.2.2 Proliferation of short-run, on-demand publishing

- 4.2.3 Growth of industrial decor and direct-to-shape printing

- 4.2.4 Advent of single-pass, high-speed inkjet presses

- 4.2.5 IoT-enabled predictive maintenance lowering TCO

- 4.2.6 Adoption of water-based inks to meet stricter VOC caps

- 4.3 Market Restraints

- 4.3.1 Accelerating shift of ad-spend into digital channels

- 4.3.2 Persistent cap-ex premium over legacy flexo/screen lines

- 4.3.3 Widening patent thicket around print-head designs

- 4.3.4 Raw-material price volatility for specialty pigments

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of the Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Printing Technology

- 5.1.1 Drop-on-Demand Inkjet

- 5.1.2 Continuous Inkjet

- 5.1.3 Other Printing Technologies

- 5.2 By Ink Type

- 5.2.1 Aqueous

- 5.2.2 Solvent-based

- 5.2.3 UV-curable

- 5.2.4 Latex

- 5.2.5 Dye-Sublimation

- 5.2.6 Other Ink Type

- 5.3 By Component

- 5.3.1 Printers

- 5.3.2 Ink Cartridges and Bulk Inks

- 5.3.3 Print-heads

- 5.3.4 Software and Services

- 5.4 By Application

- 5.4.1 Books and Publishing

- 5.4.2 Commercial Print

- 5.4.3 Advertising

- 5.4.4 Transactional

- 5.4.5 Labels

- 5.4.6 Packaging

- 5.4.7 Textile Printing

- 5.4.8 Electronics and PCB Printing

- 5.4.9 Other Applications

- 5.5 By Substrate Material

- 5.5.1 Paper and Paperboard

- 5.5.2 Plastic Films and Foils

- 5.5.3 Textile

- 5.5.4 Metal

- 5.5.5 Glass and Ceramics

- 5.5.6 Other Substrate Material

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Singapore

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 HP Inc.

- 6.4.2 Canon Inc.

- 6.4.3 Seiko Epson Corp.

- 6.4.4 Brother Industries Ltd.

- 6.4.5 Ricoh Company Ltd.

- 6.4.6 Xerox Holdings Corp.

- 6.4.7 Fujifilm Holdings Corp.

- 6.4.8 Konica Minolta Inc.

- 6.4.9 Kyocera Corp.

- 6.4.10 Lexmark International

- 6.4.11 Durst Group AG

- 6.4.12 Mimaki Engineering Co. Ltd.

- 6.4.13 Roland DG Corp.

- 6.4.14 Hitachi Industrial Equipment Systems

- 6.4.15 Videojet Technologies Inc.

- 6.4.16 Domino Printing Sciences

- 6.4.17 Inkjet Inc.

- 6.4.18 Jet Inks Pvt Ltd.

- 6.4.19 King Printing Co. Ltd.

- 6.4.20 Electronics For Imaging (EFI)

- 6.4.21 Nazdar Ink Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment