|

市場調查報告書

商品編碼

1910634

劑量計:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Dosimeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

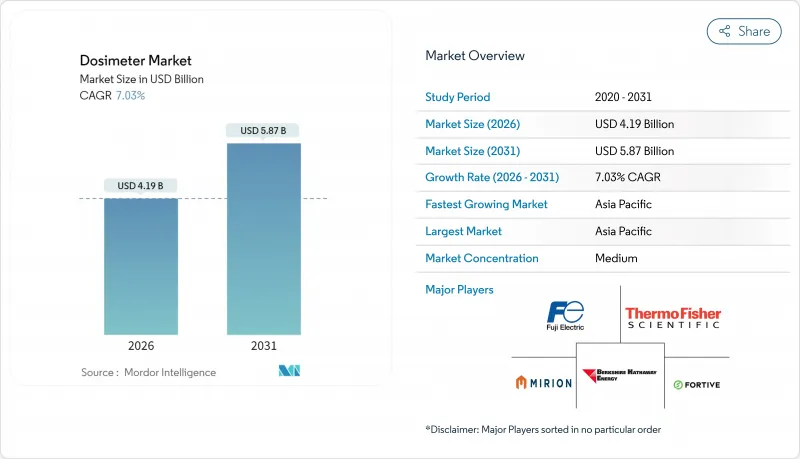

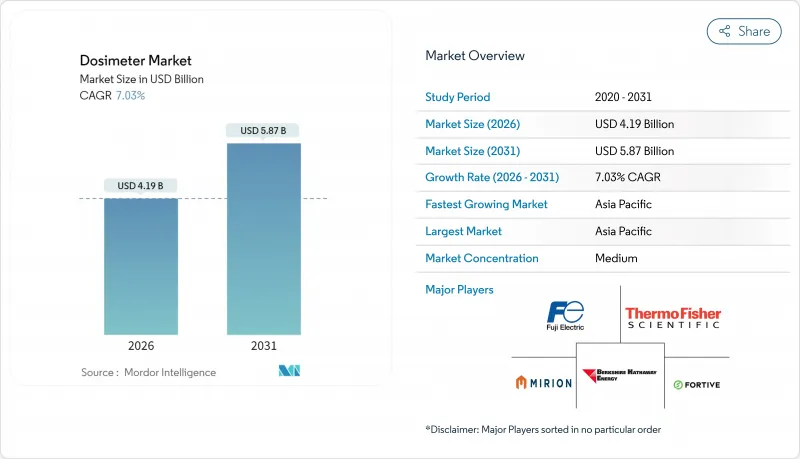

2025年劑量計市值為39.1億美元,預計到2031年將達到58.7億美元,而2026年為41.9億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 7.03%。

近期營收成長與輻射安全法規的加強、小型模組化反應器的引入以及可即時傳輸劑量資料的聯網電子個人劑量計 (EPD) 技術的快速發展密切相關。在國際監管機構大幅降低年度允許輻射計量限值後,醫療機構增加了人工水晶體監測器的採購。同時,工業無損檢測 (NDT) 團隊正擴大採用無線劑量計,從而簡化了跨多個地點的合規性文件記錄。供應商還將人工智慧 (AI) 分析技術整合到現有硬體中,使安全團隊能夠預測累積暴露趨勢並實現報告自動化。在亞太地區,核能發電廠建設的擴張以及診斷影像的快速發展,使該地區成為劑量解決方案需求量最大且成長最快的地區。同時,由於主要製造商不斷收購利基技術公司、擴大其區域服務範圍並提供基於訂閱的數據平台以確保長期客戶,市場仍然保持著一定的分散性。

全球劑量計市場趨勢與洞察

對腫瘤影像和放射治療的需求不斷成長

對精準放射治療和高通量診斷影像檢查日益成長的需求,促使越來越多的放射工作人員需要持續監測。現代線性加速器會發射高能量散射中子,因此各醫療機構紛紛採用氣泡檢測器和半導體劑量計來監測混合輻射場。質子治療中心率先採用多點微劑量計,用於繪製複雜輻射場內的劑量分佈圖。醫院將劑量計數據與人工智慧儀表板結合,使管理人員能夠預測累積輻射暴露量,甚至在達到限值之前輪換員工。最終,醫院的輻射劑量監測方式發生了顯著轉變,從季度膠片劑量計監測轉向與醫院資訊系統整合的即時輻射計量估算(EPD),以確保符合更嚴格的職業暴露限值。

擴大核能發電能(小型模組化反應器和延壽計劃)

亞太地區數十家電力公司已核准部署小型模組化反應器 (SMR)。與傳統核子反應爐相比,SMR 需要更高的單位裝置容量劑量計密度。老舊核子反應爐的延壽計畫透過無線電子劑量計 (EPD) 取代傳統的膠片劑量計,進一步刺激了對劑量計的需求,從而實現集中式劑量記錄。像 Million 這樣的供應商已經發布了專用於 SMR 的監測套件,並報告稱該領域的收入實現了兩位數的成長。業界奉行的「盡可能低輻射劑量 (ALARA)」原則要求更高的測量精度,促使電力公司為低水平伽馬輻射環境採購高靈敏度的半導體檢測器。

放射性校準材料短缺和同位素供應鏈中斷

鉬-99、銫-137和鈷-60的長期短缺擾亂了校準計劃,迫使服務實驗室延長認證週期,並削弱了人們對輻照度計精度的信心。新興市場受影響最為嚴重,因為它們依賴進口資源且國內輻照設施有限。儘管一些實驗室正在嘗試使用替代光子源,但監管機構核准新方法的速度緩慢,導致認證週期延長,輻照度計採購延遲。

細分市場分析

到2025年,電子個人劑量計將佔劑量計市場38.72%的佔有率,年複合成長率(CAGR)為8.75%,主要得益於醫療機構向即時劑量回饋的過渡。無線連接、GPS定位以及人工智慧分析(可在累積劑量趨勢加速時發出警報)是該細分市場的關鍵優勢。螢光劑量計仍然受到對價格敏感且追求可靠精度的機構的青睞。同時,光激發螢光劑量計在快速讀數至關重要的細分市場中越來越受歡迎。膠片劑量計在一些發展中地區仍然適用,但隨著監管機構優先考慮支援快速審核週期的系統,其市場佔有率持續下降。混合型直接電離劑量計結合了被動式劑量計的長壽命和電子讀數的便捷性,為那些對全面部署電子劑量計猶豫不決的運營商提供了一條平穩的過渡路徑。

EPD供應商正在整合環境感測器,用於記錄溫度、濕度和氣壓,使安全負責人能夠將輻射暴露與不斷變化的工作環境關聯。大規模工業設施部署了數千台設備,這些設備連接到雲端儀表板,以可視化各部門的劑量分佈。韌體更新增加了新的感測器功能,延長了設備的中期更換週期,而來自SaaS合約的經常性收入則強化了對供應商的鎖定。

到2025年,被動式劑量計將佔劑量計市場規模的52.10%,主要得益於監管機構的認可。然而,主動式劑量計系統的成長速度更快,複合年成長率(CAGR)達到8.52%。醫院在實施高劑量介入性心臟病手術室時,需要配備聲音警報和即時劑量儀表板,這推動了主動式劑量計的採購。核能發電廠在停機檢修期間更傾向於使用主動式劑量計系統,因為此時工作時間縮短,輻射計量波動劇烈。服務供應商正在整合基於雲端的分析功能,以實現限值追蹤的自動化,從而減輕輻射安全負責人的行政負擔。

由於成本低、重量輕且使用者培訓要求低,被動式徽章在團體篩檢計畫中仍然很受歡迎。在低收入地區,政府衛生機構正在向診所分發膠片式被動式徽章;而現在,由捐助方資助的先導計畫正在部署光刺激發光(OSL)讀取器以加快檢測速度。能夠提供涵蓋被動式和主動式技術的兼容生態系統的供應商,更有能力為客戶提供完整的升級生命週期服務。

區域分析

到2025年,亞太地區將佔據劑量計市場28.45%的佔有率,年複合成長率將達到8.63%,主要得益於中國、印度和東南亞國家批准新建核子反應爐並擴大放射治療能力。中國的核能建設計畫和大規模同位素生產設施將確保電力和製藥業對劑量計的穩定需求。日本在福島第一核能發電廠事故後的維修工作中優先考慮數位化劑量追蹤,而馬來西亞和菲律賓正在推進小型模組化反應器(SMR)的部署,這兩種反應器都需要在模組化設施周圍建立高密度個人劑量監測網路。

北美仍然擁有大量老舊核子反應爐和遍布全國的醫療影像設備。美國美國核能管理委員會強調對工作人員進行即時監控,這促使醫院從季度性徽章發放計畫轉向即時EPD儀錶板。加拿大CANDU核子反應爐維修和鈾礦開採作業正在採購中子檢測器,而墨西哥工業射線照相承包商正在擴大其徽章發放訂閱範圍,以符合國家職業健康法規。

在歐洲,從核子反應爐延壽計劃劑量計的更新到為拆除德國已關閉核子反應爐的技術人員配備去污團隊,劑量計的應用正在逐步增加。英國先進反應器試點計畫從計劃開始就整合了新一代半導體檢測器。 GDPR法規正在影響產品設計,促使供應商對資料加密模組進行認證並提供本地伺服器。在東歐,正在考慮建造小型模組化反應器(SMR)的國家正在建立本地化的劑量測定服務機構,以進一步促進區域銷售。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對腫瘤影像和放射治療的需求不斷成長

- 擴大核能發電能(小型模組化反應器和延壽計劃)

- 強制執行眼科鏡片劑量限制和即時合規性審核

- 工業輻射偵測數位化(管道焊接品管、5G基礎設施建設)

- 整合了EPD硬體的AI驅動劑量分析平台

- 增加新興市場的生物劑量實驗室並加強緊急應變能力

- 市場限制

- 校準源短缺和同位素供應鏈中斷

- 低能中子場中持續存在的精度差距

- 資料整合中的網路安全責任

- 徽章處理訂閱成本給最終用戶帶來負擔

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 電子個人劑量計(EPD)

- 熱釋光劑量計(TLD)

- 光刺激發光(OSL)

- 電影徽章

- 直接離子儲存和DIS-OSL

- 透過使用

- 積極的

- 被動的

- 按最終用戶行業分類

- 衛生保健

- 核能發電和燃料循環

- 石油和天然氣

- 採礦和金屬

- 工業無損檢測/製造

- 國防/安全

- 透過檢測技術

- 半導體(矽、碳化矽、PIN)

- 基於閃爍體的

- 充氣式GM/比例

- 固體鈍化元件(LiF、Al2O3、BeO)

- 氣泡/過熱液滴

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mirion Technologies Inc.

- LANDAUER(Berkshire Hathaway Energy)

- Thermo Fisher Scientific Inc.

- Fuji Electric Co., Ltd.

- Fortive Corp.(Fluke Biomedical)

- ATOMTEX JSC

- Polimaster Ltd.

- Ludlum Measurements Inc.

- Panasonic Industrial Devices

- Arrow-Tech Inc.

- SE International Inc.

- Automess Automation & Measurement GmbH

- Radiation Detection Company Inc.

- Unfors RaySafe AB

- ECOTEST Group Ukraine

- Dosimetrics GmbH

- Kromek Group PLC

- Electronic & Engineering Co.(I)P. Ltd.

- Bubble Technology Industries Inc.

- Qingdao TLead International Co. Ltd.

第7章 市場機會與未來展望

The dosimeter market was valued at USD 3.91 billion in 2025 and estimated to grow from USD 4.19 billion in 2026 to reach USD 5.87 billion by 2031, at a CAGR of 7.03% during the forecast period (2026-2031).

Recent revenue expansion is closely tied to stricter radiation-safety regulations, the roll-out of small modular reactors, and rapid innovation in connected electronic personal dosimeters (EPDs) that stream dose data in real time. Health-care providers are purchasing higher volumes of eye-lens monitors after international regulators slashed permissible annual exposure limits, while industrial non-destructive-testing (NDT) crews are upgrading to wireless badges that simplify multi-site compliance documentation. Suppliers are also layering artificial-intelligence analytics onto existing hardware so safety teams can predict cumulative exposure trends and automate reporting. Asia-Pacific's nuclear build-out, coupled with its fast-growing diagnostic-imaging sector, positions the region as the largest and fastest-advancing demand center for dosimetry solutions. Meanwhile, moderate market fragmentation persists because leading manufacturers continue to acquire niche technology firms, expand regional service bureaus, and offer subscription-based data platforms that lock in long-term customers.

Global Dosimeter Market Trends and Insights

Heightened Oncology Imaging and Radiotherapy Volumes

Growing demand for precision radiotherapy and high-throughput diagnostic imaging is swelling the population of radiation workers who need continuous monitoring. Modern linear accelerators emit higher-energy stray neutrons, prompting facilities to add bubble detectors and semiconductor badges that capture mixed-field exposure. Proton-therapy centers are early adopters of multi-site microdosimeters that map dose distributions inside complex radiation fields. Hospitals are also layering AI dashboards onto badge data so managers can forecast cumulative exposure and rotate staff before limits are reached. The result is a clear shift from quarterly film badges to real-time EPDs that integrate with hospital information systems, ensuring compliance with tightened occupational limits.

Expansion of Nuclear-Power Capacity (SMRs and Life-Extension Projects)

Dozens of Asia-Pacific utilities have approved small modular reactors that require a denser network of dosimeters per installed megawatt than conventional units. Life-extension programs in aging fleets add further demand by replacing legacy film badges with wireless EPDs capable of centralized dose logging. Vendors such as Mirion have released SMR-specific monitoring suites and report double-digit revenue gains from the segment. The industry's ALARA culture calls for even finer measurement granularity, encouraging utilities to purchase high-sensitivity semiconductor detectors for low-level gamma fields.

Calibration-Source Shortages and Isotope Supply Chain Shocks

Chronic shortages of molybdenum-99, cesium-137, and cobalt-60 disrupt calibration schedules and force service bureaus to extend certification cycles, undermining confidence in badge accuracy. Emerging markets suffer most because they rely on imported sources and have limited domestic irradiation facilities. Some labs experiment with alternative photon sources, but regulatory bodies are slow to approve new methods, lengthening qualification timelines and slowing badge procurement.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Eye-Lens Dose Limits and Real-Time Compliance Audits

- Industrial Radiography Digitization (Pipe-Weld QC, 5G Infra Build-Out)

- Persistent Accuracy Gaps for Low-Energy Neutron Fields

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electronic Personal Dosimeters captured 38.72% dosimeter market share in 2025 and are forecast to expand at a 8.75% CAGR as facilities pivot toward instant exposure feedback. The segment benefits from wireless connectivity, GPS tagging, and AI analytics that warn users when cumulative dose trends accelerate. Thermoluminescent Dosimeters still appeal to price-sensitive programs seeking proven accuracy, while Optically Stimulated Luminescence gains niche traction where faster readout is critical. Film badges persist in some developing regions, but their share continues to shrink as regulatory bodies favor systems that support rapid audit cycles. Hybrid Direct Ion Storage devices now bridge passive longevity with electronic readout ease, smoothing migration paths for operators cautious of full-scale EPD deployment.

EPD vendors are integrating environmental sensors that record temperature, humidity, and air pressure so safety officers can correlate exposure with changing work conditions. Larger industrial sites deploy thousands of units tied into cloud dashboards that visualize dose distribution across departments. As firmware updates add new sensor modalities, mid-cycle replacement rates lengthen, but software-as-a-service contracts keep revenue recurring, reinforcing vendor lock-in.

Passive monitoring accounted for 52.10% of the dosimeter market size in 2025, thanks to entrenched regulatory acceptance, yet active systems are growing faster at an 8.52% CAGR. Hospitals rolling out high-dose interventional cardiology suites want audible alarms and real-time dose dashboards, pushing procurement toward active badges. Nuclear utilities favor active systems for outage work where job times are compressed and exposure rates fluctuate sharply. Service providers bundle cloud-based analytics that automate limit tracking, reducing administrative load on radiation-safety officers.

Passive badges remain popular in large-scale screening programs because they are inexpensive, lightweight, and require minimal user training. In lower-income regions, government health agencies still distribute passive film badges to clinics, though donor-funded pilot projects now introduce optically stimulated luminescence readers to accelerate result turnaround. Vendors that offer compatible ecosystems spanning both passive and active technologies position themselves well to capture the full lifecycle of customer upgrades.

The Dosimeter Market Report is Segmented by Product Type (Electronic Personal Dosimeter, Thermoluminescent Dosimeter, and More), Application (Active, and Passive), End-User Industry (Healthcare, Oil and Gas, Mining and Metals, and More), Detection Technology (Semiconductor, Scintillator-Based, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the dosimeter market with 28.45% share in 2025 and is accelerating at a 8.63% CAGR as China, India, and Southeast Asian countries greenlight new reactors and expand radiotherapy capacity. China's nuclear construction pipeline, coupled with large-scale isotope-production facilities, secures steady badge demand across utility and pharmaceutical segments. Japan's post-Fukushima retrofits prioritize digital dose tracking, while Malaysia and the Philippines embrace SMRs, each requiring dense personal-dosimetry networks around modular sites.

North America retains a substantial installed base of legacy reactors and nationwide medical imaging fleets. The U.S. Nuclear Regulatory Commission's focus on real-time worker monitoring drives hospitals to swap quarterly badge programs for live EPD dashboards. Canada's CANDU refurbishments and uranium mining operations procure neutron-capable detectors, whereas Mexico's industrial-radiography contractors expand their badge subscriptions to meet national occupational-health mandates.

Europe witnesses incremental uptake as reactor life-extension projects roll out dosimeter upgrades and decommissioning teams outfit technicians dismantling shuttered German plants. The United Kingdom's advanced-reactor pilots integrate next-generation semiconductor detectors from project inception. GDPR constraints influence product design, pushing suppliers to certify data-encryption modules and offer on-premises servers. Eastern European states exploring SMR options establish locally hosted dosimetry service bureaus, further propelling regional sales.

- Mirion Technologies Inc.

- LANDAUER (Berkshire Hathaway Energy)

- Thermo Fisher Scientific Inc.

- Fuji Electric Co., Ltd.

- Fortive Corp. (Fluke Biomedical)

- ATOMTEX JSC

- Polimaster Ltd.

- Ludlum Measurements Inc.

- Panasonic Industrial Devices

- Arrow-Tech Inc.

- SE International Inc.

- Automess Automation & Measurement GmbH

- Radiation Detection Company Inc.

- Unfors RaySafe AB

- ECOTEST Group Ukraine

- Dosimetrics GmbH

- Kromek Group PLC

- Electronic & Engineering Co. (I) P. Ltd.

- Bubble Technology Industries Inc.

- Qingdao TLead International Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened oncology imaging and radiotherapy volumes

- 4.2.2 Expansion of nuclear-power capacity (SMRs and life-extension projects)

- 4.2.3 Tightening eye-lens dose limits and real-time compliance audits

- 4.2.4 Industrial radiography digitization (pipe-weld QC, 5-G infra build-out)

- 4.2.5 AI-enabled dose-analytics platforms bundled with EPD hardware

- 4.2.6 Rising emerging-market biodosimetry labs for emergency surge response

- 4.3 Market Restraints

- 4.3.1 Calibration-source shortages and isotope supply chain shocks

- 4.3.2 Persistent accuracy gaps for low-energy neutron fields

- 4.3.3 Data-integration cyber-security liabilities

- 4.3.4 End-user fatigue from badge-processing subscription costs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Electronic Personal Dosimeter (EPD)

- 5.1.2 Thermoluminescent Dosimeter (TLD)

- 5.1.3 Optically Stimulated Luminescence (OSL)

- 5.1.4 Film Badge

- 5.1.5 Direct Ion Storage and DIS-OSL

- 5.2 By Application

- 5.2.1 Active

- 5.2.2 Passive

- 5.3 By End-user Industry

- 5.3.1 Healthcare

- 5.3.2 Nuclear Power and Fuel Cycle

- 5.3.3 Oil and Gas

- 5.3.4 Mining and Metals

- 5.3.5 Industrial NDT / Manufacturing

- 5.3.6 Defence and Security

- 5.4 By Detection Technology

- 5.4.1 Semiconductor (Si, SiC, PIN)

- 5.4.2 Scintillator-based

- 5.4.3 Gas-filled GM / Proportional

- 5.4.4 Solid-State Passive (LiF, Al2O3, BeO)

- 5.4.5 Bubble / Superheated-Drop

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mirion Technologies Inc.

- 6.4.2 LANDAUER (Berkshire Hathaway Energy)

- 6.4.3 Thermo Fisher Scientific Inc.

- 6.4.4 Fuji Electric Co., Ltd.

- 6.4.5 Fortive Corp. (Fluke Biomedical)

- 6.4.6 ATOMTEX JSC

- 6.4.7 Polimaster Ltd.

- 6.4.8 Ludlum Measurements Inc.

- 6.4.9 Panasonic Industrial Devices

- 6.4.10 Arrow-Tech Inc.

- 6.4.11 SE International Inc.

- 6.4.12 Automess Automation & Measurement GmbH

- 6.4.13 Radiation Detection Company Inc.

- 6.4.14 Unfors RaySafe AB

- 6.4.15 ECOTEST Group Ukraine

- 6.4.16 Dosimetrics GmbH

- 6.4.17 Kromek Group PLC

- 6.4.18 Electronic & Engineering Co. (I) P. Ltd.

- 6.4.19 Bubble Technology Industries Inc.

- 6.4.20 Qingdao TLead International Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment