|

市場調查報告書

商品編碼

1910632

塑膠薄膜:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Plastic Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

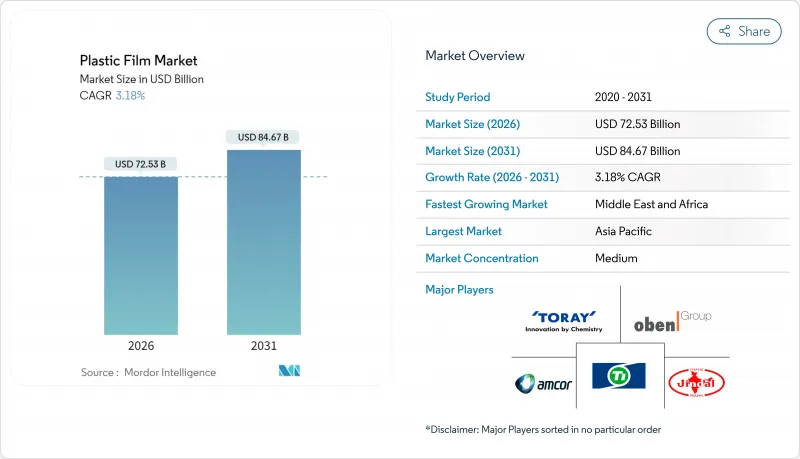

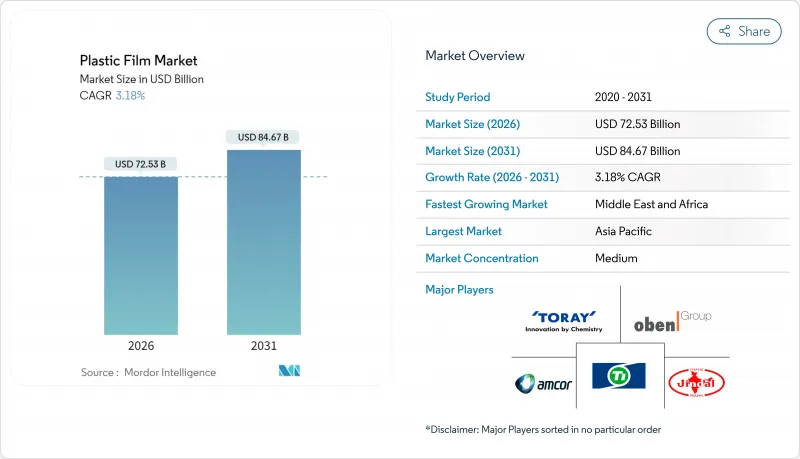

預計塑膠薄膜市場將從 2025 年的 703 億美元成長到 2026 年的 725.3 億美元,到 2031 年將達到 846.7 億美元,2026 年至 2031 年的複合年成長率為 3.18%。

這一趨勢反映出市場日趨成熟,以高附加價值特種高阻隔薄膜為主導,這些薄膜主要銷往醫療、電子和電子商務產業。日益嚴格的監管壓力推動了循環經濟目標的實現,加速了向可回收的整體式結構和經認證的可堆肥等級產品的轉變,而原料價格的持續波動則給加工商的利潤率帶來了壓力。那些對樹脂和薄膜資產進行垂直管理的製造商,正透過減薄、阻隔塗層和回收等措施來降低價格波動的影響,並獲得溢價。

全球塑膠薄膜市場趨勢與洞察

向消費後單一材料可回收薄膜結構過渡

循環經濟政策正迅速以單組分薄膜取代傳統的多層結構,這些單組分薄膜既符合回收標準,又不影響性能。為了響應歐洲在2030年實現全面回收的法規,像Uzel Plastić這樣的加工商已經推出了聚乙烯寵物食品薄膜,這種薄膜無需黏合劑層,同時仍能保持氧氣阻隔性。品牌商正透過與永續性指標掛鉤的多年供應合約來獎勵早期採用者,但對新型擠出和黏合劑系統的初始投資正在擠壓短期利潤空間。製藥業也在進行轉型,Klöckner Pentaplast推出了一種單組分泡殼薄膜,這種薄膜簡化了下游回收流程,同時又符合嚴格的醫療法規。預計到2030年,這種發展勢頭將推動單組分薄膜的市佔率從2024年的60%成長到塑膠薄膜市場的三分之二。

由於監管更加嚴格,可生物分解和可堆肥薄膜的使用量增加。

各州和國家層級的法規交織在一起,推動了對經認證的可堆肥薄膜的需求,尤其是在餐飲服務和農產品包裝領域。華盛頓州的標籤和工廠認證規客製化定了全球供應商必須遵守的技術標準。明尼蘇達州的工業可堆肥性強制令正在影響超級市場的自有品牌規格。像DNP集團這樣擁有雄厚研發預算的供應商,正在將多層可堆肥結構商業化,這種結構能夠在90天內完全分解,同時保持良好的氣體阻隔性能,從而保護零食食品。缺乏統一的全球標準仍然是一個障礙,迫使加工商生產特定國家的產品,從而推高了合規成本。

聚烯和PET原料價格波動

現貨PET和LDPE價格每季波動15-20%,對利潤率帶來壓力,尤其是對於非一體化生產商的加工商而言。根據ChemOrbis的數據,2024年PET價格預計在每噸1200美元至1450美元之間波動,這使得依賴現貨樹脂的供應商簽訂長期合約風險較高。亞洲BOPET市場的供應過剩已將實際價格推至歷史低點。 Firsta集團的部分產品利潤率甚至低於每公斤15印度盧比,導致部分廠房暫時停產。更長的運輸時間進一步加劇了庫存管理的複雜性,迫使小規模加工商在價格回落時承擔損失。

細分市場分析

到2025年,聚乙烯仍將佔總產量的39.12%,這主要得益於茂金屬觸媒技術的進步。該技術可在不犧牲剛度和透明度的前提下,將薄膜厚度降低高達20%。即使在原物料價格受石油價格波動影響的時期,這項優勢也能確保穩定的現金流。同時,生質塑膠雖然目前基數小規模,但預計將以5.87%的複合年成長率成長,因為品牌所有者正不斷嘗試使用可堆肥包裝來實現其ESG(環境、社會和治理)目標。甘蔗渣和藻油等第二代原料供應量的增加,縮小了生物塑膠與傳統樹脂之間的價格差距。然而,由於水解穩定性方面的局限性,大多數生質塑膠在用於阻隔性的醫療和電子應用方面仍然面臨挑戰。

生質塑膠加工商正與樹脂Start-Ups洽談多年承購協議,以規避價格波動風險。歐盟和北美地區圍繞堆肥設施形成的區域叢集也影響著工廠的位置決策。聚丙烯因其優異的耐熱性和阻隔性,在殺菌袋應用領域持續擴張。同時,雙向拉伸聚酯薄膜(BOPET)生產商正尋求在美國等市場獲得反傾銷保護,以避免亞洲市場供應過剩。環烯烴共聚物(COC)等特殊聚合物在醫療診斷領域發揮獨特的作用,凸顯了性能主導差異化在塑膠薄膜市場的重要性。

到2025年,袋裝產品將佔銷售額的47.95%,這主要得益於其便捷的份量控制和能減少食物廢棄物的密封強度。零食和寵物食品工廠常用的自動灌裝封口生產線也對這種包裝形式青睞有加,而數位印刷技術則能為短期宣傳活動提供高度客製化的圖案。然而,隨著全通路雜貨店和食材自煮包服務對耐穿孔薄膜的需求日益成長,預計外包裝和覆膜包裝的年複合成長率將達到4.56%,因為這些薄膜需要與高速裝袋機器人相容。對低溫運輸支援日益成長的需求推動了對即使在零下溫度下仍能保持延展性的防潮材料的需求,而基於雙向拉伸聚丙烯(BOPP)的複合材料最近在該領域備受關注。

加工商正將資料矩陣碼整合到二級包裝中,以追蹤最後一公里配送,從而在材料銷售之外創造分析收入來源。無底紙標籤膜和多件裝收縮商品搭售仍然很重要,但隨著碳酸飲料市場的成熟,其成長速度正在放緩。在所有應用領域,資源高效的薄膜形式,例如具有可控透氣性的穿孔農產品包裝膜,都符合零售商的永續性,並確保產品在高價位上獲得貨架空間。

區域分析

亞太地區憑藉著規模經濟和快速成長的國內消費,預計到2025年將佔據塑膠薄膜市場37.98%的佔有率。中國在雙向拉伸聚酯薄膜(BOPET)和雙向拉伸聚丙烯薄膜(BOPP)領域保持領先地位,但產能成長速度比國內需求高出約26萬噸/年,擠壓了利潤空間,並推動了中型加工商之間的併購活動。印度正利用茂金屬觸媒技術來支援先進的軟包裝規格,並快速引進新的BOPP生產線。日本成熟的先進技術生態系統為光學薄膜和電池隔膜的創新提供了支持。

北美市場需求更為穩定,而生產回流趨勢和永續性正在推動電商領域對可再生聚乙烯(PE)包裝的需求。 Polyplex計劃在阿拉巴馬州投資1億美元擴建PET薄膜生產線,凸顯了區域供應鏈以及貿易政策確定性的重要性。加工商正擴大位置基地遷至物流樞紐附近,以縮短前置作業時間,這對於食材自煮包和藥品運輸至關重要。

歐洲持續引領政策發展,透過生產者延伸責任制(EPR)附加稅抑制不可可再生材料的使用,並鼓勵對單一材料升級改造的研發投資。機械回收能力正在不斷提升,同時創業投資資金也在支持針對硬質和軟質混合原料的化學回收試點計畫。

預計到2031年,中東和非洲地區的複合年成長率將達到7.86%,主要得益於進口替代計畫和監管激勵措施。埃及已啟動一項合資項目,投資5,480萬美元建造一條再生聚酯纖維生產線,顯示當地對循環解決方案的需求日益成長。波灣合作理事會(GCC)成員國正利用油氣整合優勢,以具競爭力的價格供應聚乙烯(PE),並建立下游薄膜產業叢集,旨在保障區域糧食安全。撒哈拉以南非洲地區人口成長和消費品快速普及推動了需求成長。然而,有限的廢棄物管理基礎設施可能會限制高品質、永續薄膜的應用。

預計南美洲將實現中等個位數成長,因為品牌食品和個人保健產品跨國公司正在拓展其在農村零售市場的業務,從而帶動包裝需求成長。南方共同市場成員國之間的貨幣波動和監管差異使產能規劃變得複雜,但家庭收入的成長有助於維持基準消費水準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 向消費後單一材料可回收薄膜結構過渡

- 隨著監管日益嚴格,可生物分解和可堆肥薄膜的應用範圍不斷擴大。

- 醫療和電子包裝領域對高阻隔薄膜的需求不斷成長

- 農業薄膜在垂直農業和溫室自動化的應用日益廣泛

- 先進的茂金屬催化劑能夠實現更薄的薄膜

- 由於該地區電子商務低溫運輸需求激增,對特種薄膜的需求正在擴大。

- 市場限制

- 聚烯和PET原料價格波動

- 新興經濟體嚴格禁止使用一次性塑膠製品

- 醫用PVC樹脂供應緊張

- 同步雙軸拉伸線的資本密集度

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 依樹脂類型

- 聚丙烯(PP)

- 聚乙烯(PE)

- 聚對苯二甲酸乙二醇酯(BOPET)

- 聚苯乙烯(OPS)

- 生質塑膠

- 其他材料類型

- 透過使用

- 包裝和覆材

- 袋裝和襯裡

- 小袋

- 其他用途

- 電影特輯

- 低阻隔單材料薄膜

- 中等阻隔金屬化薄膜

- 高阻隔多層膜

- 用於特殊用途的活性抗菌膜

- 按最終用途行業分類

- 食物

- 糖果和糖果甜點

- 冷凍食品

- 生鮮食品

- 乳製品

- 肉類、家禽和魚貝類

- 寵物食品

- 其他食品

- 飲料

- 醫療和藥品

- 個人及居家護理

- 工業包裝

- 其他終端用戶產業

- 食物

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 越南

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- Toray Industries, Inc.

- Oben Holding Group SA

- Taghleef Industries LLC

- Jindal Poly Films Limited

- Cosmo First Limited

- Uflex Limited

- DuPont Teijin Films Japan Ltd.

- Sealed Air Corporation

- Mondi plc

- Huhtamki Oyj

- Polifilm GmbH

- CCL Industries Inc.

- Klckner Pentaplast Group

- Innovia Films Ltd.

- Mitsui Chemicals Tohcello, Inc.

- Inteplast Group Corporation

- AR Metallizing NV

- Guangdong Decro Film New Materials Co., Ltd.

第7章 市場機會與未來展望

The plastic film market is expected to grow from USD 70.30 billion in 2025 to USD 72.53 billion in 2026 and is forecast to reach USD 84.67 billion by 2031 at 3.18% CAGR over 2026-2031.

This performance underscores a maturing landscape where incremental value now arises from specialty, high-barrier films sold into medical, electronics, and e-commerce channels. Heightened regulatory attention to circular-economy goals is accelerating a pivot toward recyclable mono-material structures and certified compostable grades, while persistent raw-material price swings continue to test converter margins. Integrated producers with vertical control over resin and film assets are mitigating volatility and capturing premium spreads through downgauging, barrier-coating, and recycling initiatives.

Global Plastic Film Market Trends and Insights

Consumer Shift Toward Mono-Material Recyclable Film Structures

Circular-economy policies are swiftly converting legacy multilayer formats into mono-material films that meet recyclability thresholds without sacrificing performance. European regulations mandating full recyclability by 2030 have already spurred converters such as Uzel Plastik to roll out polyethylene pet-food films that eliminate tie-layer adhesives while preserving oxygen barriers. Brand owners are rewarding early adopters with multi-year supply contracts linked to sustainability metrics, yet initial capital outlays for new extrusion and adhesive systems are trimming near-term margins. Pharmaceutical players are also transitioning; Klockner Pentaplast introduced a mono-material blister film that meets stringent medical compliance while simplifying downstream recycling. This momentum is expected to lift mono-material share from 60% in 2024 toward two-thirds of the plastic film market by 2030.

Growing Adoption of Biodegradable and Compostable Films Amid Regulations

A mosaic of state and national mandates is fueling demand for certified compostable films, particularly in food service and produce packaging. Washington State's labeling and facility-certification rules set a technical benchmark that global suppliers must now match. Minnesota's legislation requiring industrial-composting compatibility is influencing private-label specifications for supermarket chains. Suppliers with robust R&D budgets, such as DNP Group, are commercializing multilayer compostable structures capable of 90-day degradation while sustaining gas-barrier properties that protect snack foods. Lack of harmonized global standards remains a hurdle, forcing converters to produce country-specific SKUs and inflating compliance costs.

Volatility in Polyolefin and PET Feedstock Prices

Quarterly swings of 15-20% in PET and LDPE spot prices have compressed converter spreads, particularly among non-integrated players. ChemOrbis data show PET values oscillating between USD 1,200 and USD 1,450 per ton in 2024, making long-term contracts risky for suppliers dependent on spot resin. Overcapacity in Asia's BOPET segment has driven realizations to historical lows; Firsta Group recorded instances where margins dipped below INR 15/kg, triggering temporary plant shutdowns. Inventory management is further complicated by lengthy transit times, causing small converters to absorb losses during price retracements.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for High-Barrier Films in Medical and Electronics Packaging

- Expansion of Agri-Film Usage in Vertical Farming and Greenhouse Automation

- Stringent Single-Use Plastic Bans in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene retained 39.12% of 2025 volume, underpinned by metallocene catalyst technology that slashed film gauge by up to 20% without surrendering stiffness or clarity. This dominance supplied predictable cash flows even when oil-linked feedstock costs spiked. In contrast, bioplastics, though representing a modest baseline, are set to post a 5.87% CAGR as brand owners deploy compostable packaging pilots to meet ESG targets. Rising supply of second-generation feedstock, including sugarcane bagasse and algae oils, has clipped the cost premium to conventional resins. Still, high-barrier medical and electronics uses remain out of reach for most bioplastics due to hydrolytic-stability constraints.

Converters courting the bioplastic subsector are negotiating multi-year off-take pacts with resin start-ups to hedge price-volatility risk. Regional clustering around EU and North-American compost facilities also influences plant-location decisions. Polypropylene continues expanding within retort pouch applications, benefiting from heat-resistance and grease-barrier traits, while BOPET producers seek anti-dumping shelters in markets like the United States to escape Asian oversupply. Specialty polymers such as cyclic olefin copolymers fill niche roles in medical diagnostics, emphasizing the value of performance-led differentiation within the plastic film market.

The pouch format delivered 47.95% of 2025 sales thanks to portion-control convenience and seal-integrity that reduces food waste. Automated form-fill-seal lines, common in snack and pet-food factories, favor its geometry, while digital printing allows hyper-customized graphics for short campaigns. However, wraps and overwraps are forecast to grow at 4.56% CAGR as omnichannel grocery and meal-kit services demand puncture-resistant films compatible with high-speed bagging robots. Cold-chain compliance amplifies the need for moisture barriers that stay ductile at sub-zero temperatures, an area where BOPP-based laminates have recently gained traction.

Converters are integrating data-matrix codes into secondary wraps to track last-mile delivery conditions, creating analytics revenue streams beyond the material sale itself. Linerless label films and shrink-bundling for multipacks remain important, though growth is slower due to maturation in carbonated-drink markets. Across applications, film formats enabling resource efficiency such as perforated produce wraps that modulate respiration align with retailer sustainability pledges and thus secure shelf space despite premium pricing.

The Plastic Film Market Report is Segmented by Resin Type (Polypropylene, Polyethylene, BOPET, Polystyrene, Bioplastics, and More), Application (Wraps and Overwraps, Bags and Linings, and More), Film Functionality (Low-Barrier Mono-Material, Medium-Barrier Metallised, and More), End-Use Industry (Food, Beverages, Healthcare and Pharmaceutical, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific secured a 37.98% share of the plastic film market in 2025 by pairing scale economies with burgeoning domestic consumption. China maintains dominance in BOPET and BOPP, though capacity additions have outstripped local demand by roughly 260,000 t a year, pressing margins and catalyzing M&A among mid-tier converters. India leverages metallocene-catalyst technology to serve upgraded pouch formats and is onboarding new BOPP lines at a brisk pace. Japan's mature yet highly technical ecosystem sustains innovation in optical and battery-separator films.

North America's demand is steadier, buoyed by on-shoring trends and sustainability mandates that push recyclable PE wraps for e-commerce. Polyplex's USD 100 million PET-film expansion in Alabama illustrates the pull of regional supply chains aligned with trade-policy certainty. Converters increasingly co-locate with logistics hubs to shrink lead times, a factor critical for meal-kit and pharmaceutical shipments.

Europe continues to act as a policy bellwether; extended-producer-responsibility (EPR) fees penalize non-recyclable formats, driving R&D dollars into mono-material upgrades. Mechanical-recycling capacity additions are ramping, and venture funds are backing chemical-recycling pilots aimed at rigid-flexible feedstock mixes.

The Middle East and Africa is poised for a 7.86% CAGR through 2031 on the back of import-substitution plans and regulatory incentives. Egypt's joint venture to build a recycled-polyester fiber line worth USD 54.8 million signals rising local appetite for circular solutions. Gulf Cooperation Council members leverage hydrocarbon integration to supply competitively priced PE, spawning downstream film clusters that aim to capture regional food-security programs. Sub-Saharan Africa's demand growth is driven by population expansion and fast-moving consumer-goods uptake, though infrastructure gaps in waste management may moderate adoption of premium sustainable films.

South America delivers mid-single-digit growth as branded food and personal-care multinationals widen rural retail penetration, creating incremental packaging needs. Currency volatility and regulatory divergence between Mercosur nations complicate capacity planning, yet rising household incomes sustain baseline consumption.

- Amcor plc

- Toray Industries, Inc.

- Oben Holding Group S.A.

- Taghleef Industries LLC

- Jindal Poly Films Limited

- Cosmo First Limited

- Uflex Limited

- DuPont Teijin Films Japan Ltd.

- Sealed Air Corporation

- Mondi plc

- Huhtamki Oyj

- Polifilm GmbH

- CCL Industries Inc.

- Klckner Pentaplast Group

- Innovia Films Ltd.

- Mitsui Chemicals Tohcello, Inc.

- Inteplast Group Corporation

- AR Metallizing N.V.

- Guangdong Decro Film New Materials Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consumer shift toward mono-material recyclable film structures

- 4.2.2 Growing adoption of biodegradable and compostable films amid regulations

- 4.2.3 Rising demand for high-barrier films in medical and electronics packaging

- 4.2.4 Expansion of agri-film usage in vertical farming and greenhouse automation

- 4.2.5 Film downgauging enabled by advanced metallocene catalysts

- 4.2.6 Surge in regional e-commerce cold-chain requiring specialty films

- 4.3 Market Restraints

- 4.3.1 Volatility in polyolefin and PET feedstock prices

- 4.3.2 Stringent single-use plastic bans in emerging economies

- 4.3.3 Supply tightness of medical-grade PVC resin

- 4.3.4 Capital intensity of synchronous biax orientation lines

- 4.4 Industry Value Chain Analysis

- 4.5 Porters Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Resin Type

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene (PE)

- 5.1.3 Polyethylene-terephthalate (BOPET)

- 5.1.4 Polystyrene (OPS)

- 5.1.5 Bioplastics

- 5.1.6 Other Material Types

- 5.2 By Application

- 5.2.1 Wraps and Overwraps

- 5.2.2 Bags and Linings

- 5.2.3 Pouches

- 5.2.4 Other Applications

- 5.3 By Film Functionality

- 5.3.1 Low-Barrier Mono-material Films

- 5.3.2 Medium-Barrier Metallised Films

- 5.3.3 High-Barrier Multilayer Films

- 5.3.4 Specialty Active and Antimicrobial Films

- 5.4 By End-use Industry

- 5.4.1 Food

- 5.4.1.1 Candy and Confectionery

- 5.4.1.2 Frozen Foods

- 5.4.1.3 Fresh Produce

- 5.4.1.4 Dairy Products

- 5.4.1.5 Meat, Poultry and Seafood

- 5.4.1.6 Pet Food

- 5.4.1.7 Other Food Products

- 5.4.2 Beverages

- 5.4.3 Healthcare and Pharmaceutical

- 5.4.4 Personal Care and Home Care

- 5.4.5 Industrial Packaging

- 5.4.6 Other End-use Industries

- 5.4.1 Food

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Vietnam

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Toray Industries, Inc.

- 6.4.3 Oben Holding Group S.A.

- 6.4.4 Taghleef Industries LLC

- 6.4.5 Jindal Poly Films Limited

- 6.4.6 Cosmo First Limited

- 6.4.7 Uflex Limited

- 6.4.8 DuPont Teijin Films Japan Ltd.

- 6.4.9 Sealed Air Corporation

- 6.4.10 Mondi plc

- 6.4.11 Huhtamki Oyj

- 6.4.12 Polifilm GmbH

- 6.4.13 CCL Industries Inc.

- 6.4.14 Klckner Pentaplast Group

- 6.4.15 Innovia Films Ltd.

- 6.4.16 Mitsui Chemicals Tohcello, Inc.

- 6.4.17 Inteplast Group Corporation

- 6.4.18 AR Metallizing N.V.

- 6.4.19 Guangdong Decro Film New Materials Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment