|

市場調查報告書

商品編碼

1910618

飯店物業管理軟體(PMS)-市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Hospitality Property Management Software (PMS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

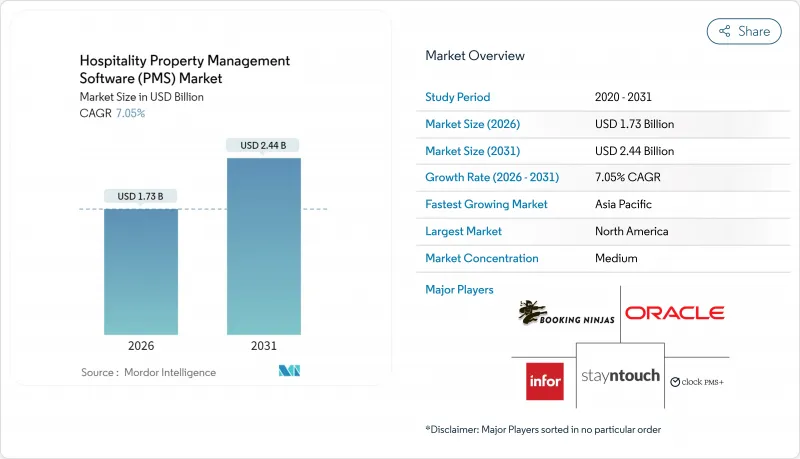

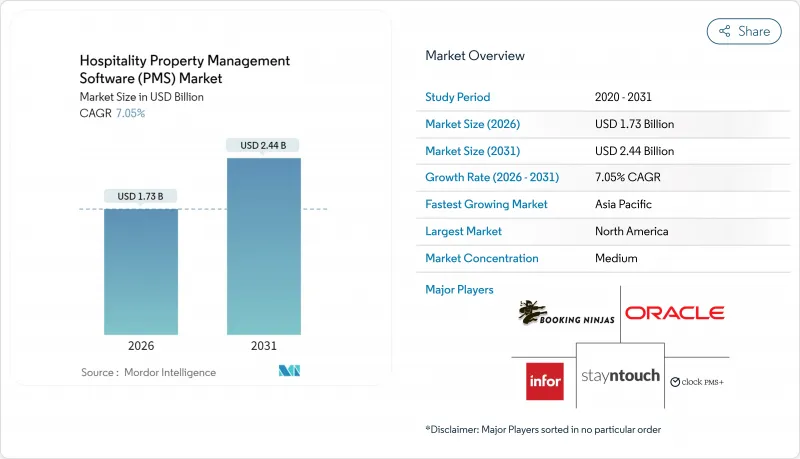

預計到 2026 年,飯店物業管理軟體市場價值將達到 17.3 億美元,從 2025 年的 16.2 億美元成長到 2031 年的 24.4 億美元。

預計從 2026 年到 2031 年,其複合年成長率將達到 7.05%。

對舊有系統升級的需求不斷成長、雲端遷移加速以及人工智慧驅動的收益工具的引入,共同支撐著這一穩步成長的價值。雲端採用淘汰本地硬體持續重塑成本結構,而API優先架構則縮短了整合時間,並開啟了新的收益共享夥伴關係。獨立飯店和民宿業者正在採用曾經只有全球連鎖飯店才能使用的先進模組,這擴大了潛在市場規模,也加劇了競爭。同時,亞太地區正在推出區域性數位化項目,新興市場預計將為未來的授權成長做出重大貢獻。北美地區則越來越重視採用高階功能。

全球酒店物業管理軟體(PMS)市場趨勢與洞察

擴大中小型工廠的採用率

訂閱式定價和簡化的實施流程也促使小規模企業將現代飯店管理系統 (PMS) 解決方案視為策略必需品,而非可選項。獨立飯店在實施整合通路管理和賓客體驗功能的雲端 PMS 解決方案後,收入實現了兩位數的成長。較低的前期成本使中小企業能夠將資金重新投入行銷、服務創新和品牌推廣。供應商也積極回應,提供自助式實施嚮導,將實施時間從數月縮短至數週。由此形成良性循環,成千上萬的中小型酒店加速採用各項功能,從而推動了酒店 PMS 市場的擴張。

從本地部署快速遷移到基於雲端的SaaS模式

雲端原生套件無需硬體更新,並透過自動版本更新確保物業安全和合規性。大規模遷移可在數週內完成,citizenM 的 7,500 間客房部署便證明了這一點。即時分析支援地理位置分散的團隊進行精細化決策。多租戶架構集中管理災害復原通訊協定,並降低審核負擔和保險費用。從不定期資本支出 (CAPEX) 到定期訂閱費用的轉變,為財務長 (CFO) 提供了可預測性,進一步推動了飯店物業管理軟體市場的發展。

與舊有系統和第三方系統整合的複雜性

許多老牌飯店仍在使用20年前開發的客製化預訂引擎和POS模組,阻礙了資料的順暢交換。客製化連接器往往會導致預算超支和工期延長,使得一些飯店即使看到明顯的投資報酬率,也選擇延後升級。新舊系統並行運作增加了訓練需求和操作失誤的風險。供應商正在透過擴展低程式碼整合工具包來應對這一問題,但由於專有資料模式缺乏文件記錄,仍存在一些缺口。在淘汰舊有系統的速度加快之前,這種摩擦可能會限制飯店物業管理軟體市場某些細分領域的短期成長。

細分市場分析

到2025年,雲端平台將佔據64.92%的市場佔有率,隨著飯店物業優先考慮擴充性和降低維修成本,預計其主導地位將進一步擴大。預計到2031年,雲端部署的飯店物業管理軟體市場規模將達到20.2億美元,與前述12.38%的複合年成長率相符。飯店物業受益於全球內容傳遞網路,即使在偏遠地區也能保持快速回應。供應商將持續的功能更新整合到訂閱層級中,並自動套用安全性修補程式。將工作負載遷移異地也有助於多物業整合,使區域集團能夠共用支援統一客戶檔案的資料倉儲。

在資料主權法律嚴格的地區,本地部署仍然普遍存在,但隨著硬體老化,成本差距正在擴大。雲彈性在季節性波動期間特別重要,度假村可以根據需要,在高峰期增加實例數量,在淡季減少實例數量,從而節省資金。圍繞主流雲端PMS套件所建構的增強型API生態系統,可輕鬆整合聊天機器人和物聯網客房控制系統,實現新的服務組合。最後,雲端的低成本優勢正在推動酒店物業管理軟體市場中成長最快的管道。

預計到2025年,中小企業將佔酒店管理系統(PMS)收入的57.05%,到2031年,其在PMS市場規模中的佔有率預計將超過16.8億美元。簡易的設定精靈和免費試用降低了缺乏內部技術負責人的業者採用PMS的門檻。培訓模組通常包含多語言微學習內容,以滿足小規模飯店員工多樣化的需求。中小企業也重視與設備無關的介面,這使得員工可以使用個人智慧型手機進行操作,從而避免了PC短缺的問題。

大型企業正穩步地從專有平台升級到全球標準平台,儘管複雜的品牌標準可能會延長採購週期和整合測試時間。隨著中小企業在各個觸點累積數據,他們開始採用以前只有連鎖企業才能使用的會員插件和定向電子郵件宣傳活動,這進一步印證了普及化理論。這種轉變正在推動酒店物業管理軟體市場銷量顯著成長,儘管單價有所下降。

區域分析

到2025年,北美將佔據全球34.20%的市場佔有率,這主要得益於其與供應商建立的長期合作關係、較高的雲端滲透率以及成熟的分銷網路。目前,酒店業正致力於利用基於屬性的銷售和能耗儀表板等先進功能來提高利潤率的穩定性。該地區的監管環境穩定也有助於加快第三方認證的核准速度,並縮短新興模組的上市時間。

亞太地區預計將成為成長最快的地區,複合年成長率將達到12.18%,這主要得益於東南亞地區不斷成長的中檔酒店項目以及政府主導的數位化項目。光是菲律賓的獨立飯店預計到2025年將新增超過1萬名雲端平台有效用戶,顯示雲端平台的普及率呈指數級成長。當地產業正逐漸放棄本地部署解決方案,轉而採用行動住宿管理系統(PMS),這些系統能夠與該地區盛行的QR碼支付生態系統無縫整合。

歐洲市場規模龐大且多元化,ESG報告和資料隱私法規對採購決策產生影響。跨境滑雪度假村和島嶼市場網路連線不穩定,因此對多幣種支援和強大的離線存取能力尤為重視。儘管傳統介面仍存在挑戰,但歐盟永續性指令正在推動升級,為飯店管理系統(PMS)市場創造新的機遇,因為飯店需要將詳細的公用事業追蹤資訊整合到PMS工作流程中。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 市場促進因素

- 擴大中小型工廠的採用率

- 從本地部署快速遷移到基於雲端的SaaS模式

- 透過加強OTA/元搜尋整合來促進統一庫存管理。

- 以 API 為先導、可設定的 PMS 架構助力生態系創新

- 借助人工智慧驅動的收入管理附加元件提高投資收益(ROI)

- ESG報告要求強制要求在PMS中收集使用資料。

- 市場限制

- 與舊有系統和第三方系統整合的複雜性

- 資料安全和隱私合規成本不斷增加

- OTA API收費系統不斷上漲,推高了整體擁有成本。

- 獨立酒店缺乏熟練的IT人才

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業生態系分析

- 主要用例和案例研究

- 宏觀經濟趨勢評估

- 投資分析

第5章 市場規模與成長預測

- 透過部署

- 本地部署

- 雲

- 按物業面積

- 小規模和中型物業

- 大面積房產

- 按屬性類型

- 飯店和度假村

- 汽車旅館和旅館

- 民宿住宿設施

- 服務式公寓

- 其他物業類型

- 依所有權類型

- 獨立財產

- 連鎖附屬設施

- 按功能模組

- 前台營運

- 預訂和安排

- 收益管理

- 通路管理

- 管理工作

- 其他模組

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 荷蘭

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 新加坡

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Oracle Corporation

- Infor, Inc.

- Agilysys, Inc.

- Mews Systems BV

- Planet Payment Group Holdings Limited

- StayNTouch, Inc.

- Cloudbeds, LLC

- Maestro PMS(Northwind Canada Inc.)

- Springer-Miller Systems, LLC

- Guestline Limited

- innRoad, Inc.

- AppFolio, Inc.

- RMS Cloud(RMS(Aust)Pty Ltd)

- Hotelogix(HMS InfoTech Pvt. Ltd.)

- Protel Hotelsoftware GmbH

- RoomKeyPMS(NSightUSA)

- SkyTouch Technology, Inc.

- Sabre Hospitality Solutions, LLC

- Frontdesk Anywhere, Inc.

- Clock Software Ltd.

第7章 市場機會與未來展望

Hospitality Property Management Software market size in 2026 is estimated at USD 1.73 billion, growing from 2025 value of USD 1.62 billion with 2031 projections showing USD 2.44 billion, growing at 7.05% CAGR over 2026-2031.

Growing replacement of legacy systems, accelerated cloud migration, and the embedding of artificial-intelligence revenue tools underpin this steady value expansion. Cloud deployment continues to reshape cost structures by removing on-premise hardware, while API-first architectures cut integration time and open new revenue-sharing partnerships. Independent hotels and homestay operators now adopt sophisticated modules once limited to global chains, widening the total addressable pool and boosting competitive intensity. Meanwhile, region-specific digitalization programs in Asia-Pacific position emerging markets as outsized contributors to future license growth, even as North America focuses on advanced feature uptake.

Global Hospitality Property Management Software (PMS) Market Trends and Insights

Growing adoption among small- and medium-scale properties

Small operators now view modern PMS solutions as strategic necessities rather than discretionary upgrades, a shift enabled by subscription pricing and simplified onboarding. Independent hotels report double-digit revenue lifts after implementing cloud PMS that bundle channel management and guest-experience functions. Lower upfront cost structures let SMEs redirect capital toward marketing and service innovation, strengthening brand visibility. Vendors reciprocate by releasing self-service implementation wizards that cut deployment time from months to weeks. The result is a virtuous cycle in which feature uptake accelerates across thousands of lower-tier properties, broadening the Hospitality Property Management Software market footprint.

Rapid shift from on-premise to cloud-based SaaS models

Cloud-native suites eliminate hardware refresh cycles and provide automatic version updates that keep properties secure and compliant. Large migrations such as citizenM's 7,500-room rollout demonstrate that even enterprise portfolios can convert in weeks. Real-time access to analytics supports granular decision-making across geographically dispersed teams. Multitenant architectures also centralize disaster-recovery protocols, easing audit burdens and insurance premiums. With recurring subscription fees replacing lumpy capex, CFOs gain predictability, further propelling Hospitality Property Management Software market adoption.

Integration complexity with legacy and third-party systems

Many heritage properties still operate bespoke booking engines and point-of-sale modules built two decades ago, hampering smooth data exchange. Custom connectors frequently exceed budget and extend timelines, prompting some hotels to delay upgrades despite clear ROI. Dual-running old and new stacks inflates training needs and risks operational errors. Vendors respond by expanding low-code integration toolkits, yet gaps persist where proprietary data schemas remain undocumented. Until legacy attrition accelerates, this friction will temper near-term growth in segments of the Hospitality Property Management Software market.

Other drivers and restraints analyzed in the detailed report include:

- AI-driven revenue-management add-ons boosting ROI

- API-first, composable PMS architectures unlocking ecosystem innovation

- Escalating OTA API-fee structure inflating total cost of ownership

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud platforms represented 64.92% of 2025 value and are forecast to widen their lead as properties prioritize scalability and lower upkeep. The Hospitality Property Management Software market size for cloud deployments is on track to reach USD 2.02 billion by 2031, reflecting the 12.38% CAGR cited earlier. Properties benefit from global content-delivery networks that sustain rapid response times, even in remote locations. Vendors bundle continuous feature updates into subscription tiers, pushing security patches without human intervention. Moving workloads off-site also facilitates multi-property consolidation, allowing regional groups to share data warehouses that power uniform guest profiles.

On-premise installations continue in jurisdictions with strict data-sovereignty laws, yet the cost differential widens as hardware ages. Cloud elasticity proves invaluable during seasonal swings, letting resorts scale instances in peak months and downgrade afterward to conserve cash. Enhanced API ecosystems around leading cloud PMS suites enable straightforward integrations with chatbots and IoT room controls, unlocking new service combinations. Ultimately, capital-light cloud economics underpin the fastest expanding channel of the Hospitality Property Management Software market.

SMEs held 57.05% revenue in 2025, and their share of the Hospitality Property Management Software market size is expected to surpass USD 1.68 billion by 2031. Easier set-up wizards and freemium trials lower adoption hurdles for operators lacking in-house technologists. Training modules often include micro-learning content in multiple languages, aligning with the diverse talent pool typical of small hotels. SMEs also value device-agnostic interfaces that staff can run from personal smartphones, circumventing PC shortages.

Large enterprises display slower yet steady upgrades as they phase out proprietary platforms in favor of global standards. However, complex brand standards can prolong procurement cycles and integration testing. As SMEs accumulate data across customer touchpoints, they leverage loyalty plug-ins and targeted email campaigns previously reserved for chains, reinforcing the democratization thesis. This shift contributes substantial volume to the Hospitality Property Management Software market, even if absolute ticket sizes are smaller.

Hospitality PMS Market Report is Segmented by Deployment (On-Premise, and Cloud), Property Size (SMEs and Large Enterprises), Property Type (Hotels and Resorts, and More), Ownership Model (Independent Properties and Chain-Affiliated Properties), Functionality Module (Front Desk and Operations, Booking and Reservations, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 34.20% of 2025 value because of long-standing vendor relationships, high cloud penetration, and mature distribution networks. Hotels now focus on advanced feature utilization, such as attribute-based selling and energy-consumption dashboards, to enhance margin resilience . The region's regulatory stability also speeds third-party certification, shortening time-to-market for emerging modules.

Asia-Pacific is the fastest growing at 12.18% CAGR, propelled by expanding mid-scale hotel pipelines in Southeast Asia and government-funded digital programs. Philippines-based independents alone added more than 10,000 active users to cloud platforms in 2025, validating leapfrog adoption dynamics. Local operators often bypass on-premise entirely, installing mobile-first PMS versions that synchronize seamlessly with QR-code payment ecosystems popular in the region.

Europe remains sizable but heterogeneous, with ESG reporting and data-privacy regulations shaping purchase decisions. Multi-currency support and strong offline access matter in cross-border ski or island markets that experience patchy connectivity. While legacy interface challenges persist, EU sustainability directives are catalyzing upgrades as properties need granular utility tracking embedded in PMS workflows, driving incremental opportunity within the Hospitality Property Management Software market.

- Oracle Corporation

- Infor, Inc.

- Agilysys, Inc.

- Mews Systems B.V.

- Planet Payment Group Holdings Limited

- StayNTouch, Inc.

- Cloudbeds, LLC

- Maestro PMS (Northwind Canada Inc.)

- Springer-Miller Systems, LLC

- Guestline Limited

- innRoad, Inc.

- AppFolio, Inc.

- RMS Cloud (RMS (Aust) Pty Ltd)

- Hotelogix (HMS InfoTech Pvt. Ltd.)

- Protel Hotelsoftware GmbH

- RoomKeyPMS (NSightUSA)

- SkyTouch Technology, Inc.

- Sabre Hospitality Solutions, LLC

- Frontdesk Anywhere, Inc.

- Clock Software Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption among small- and medium-scale properties

- 4.2.2 Rapid shift from on-premise to cloud-based SaaS models

- 4.2.3 Expansion of OTA/meta-search integrations driving unified inventory

- 4.2.4 API-first, composable PMS architectures unlocking ecosystem innovation

- 4.2.5 AI-driven revenue-management add-ons boosting ROI

- 4.2.6 ESG-reporting mandates requiring usage-data capture in PMS

- 4.3 Market Restraints

- 4.3.1 Integration complexity with legacy and third-party systems

- 4.3.2 Heightened data-security / privacy compliance costs

- 4.3.3 Escalating OTA API-fee structure inflating total cost of ownership

- 4.3.4 Shortage of skilled IT talent across independent hotels

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Property Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By Property Type

- 5.3.1 Hotels and Resorts

- 5.3.2 Motels and Lodges

- 5.3.3 Homestay Accommodations

- 5.3.4 Serviced Apartments

- 5.3.5 Other Property Types

- 5.4 By Ownership Model

- 5.4.1 Independent Properties

- 5.4.2 Chain-affiliated Properties

- 5.5 By Functionality Module

- 5.5.1 Front Desk and Operations

- 5.5.2 Booking and Reservations

- 5.5.3 Revenue Management

- 5.5.4 Channel Management

- 5.5.5 Housekeeping

- 5.5.6 Other Modules

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Colombia

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Netherlands

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 Singapore

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Oracle Corporation

- 6.4.2 Infor, Inc.

- 6.4.3 Agilysys, Inc.

- 6.4.4 Mews Systems B.V.

- 6.4.5 Planet Payment Group Holdings Limited

- 6.4.6 StayNTouch, Inc.

- 6.4.7 Cloudbeds, LLC

- 6.4.8 Maestro PMS (Northwind Canada Inc.)

- 6.4.9 Springer-Miller Systems, LLC

- 6.4.10 Guestline Limited

- 6.4.11 innRoad, Inc.

- 6.4.12 AppFolio, Inc.

- 6.4.13 RMS Cloud (RMS (Aust) Pty Ltd)

- 6.4.14 Hotelogix (HMS InfoTech Pvt. Ltd.)

- 6.4.15 Protel Hotelsoftware GmbH

- 6.4.16 RoomKeyPMS (NSightUSA)

- 6.4.17 SkyTouch Technology, Inc.

- 6.4.18 Sabre Hospitality Solutions, LLC

- 6.4.19 Frontdesk Anywhere, Inc.

- 6.4.20 Clock Software Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment