|

市場調查報告書

商品編碼

1910597

機器人感測器:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Robotic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

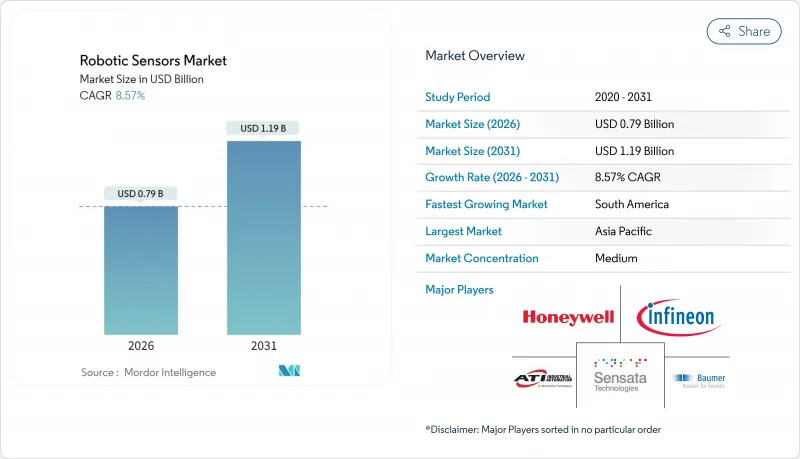

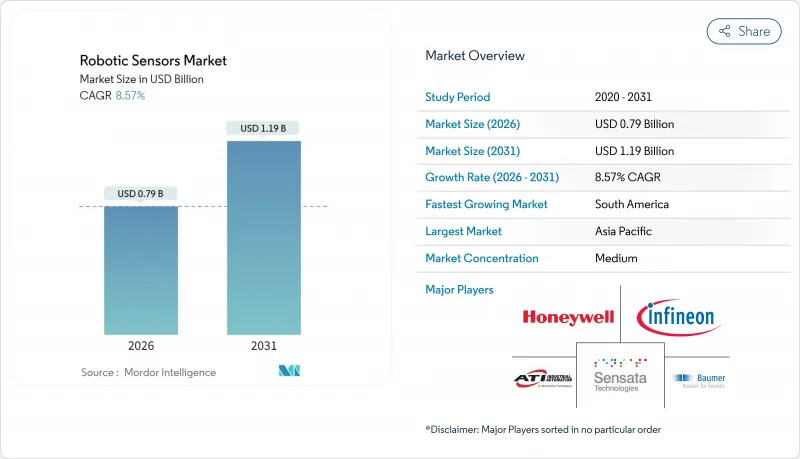

預計機器人感測器市場將從 2025 年的 7.3 億美元成長到 2026 年的 7.9 億美元,到 2031 年將達到 11.9 億美元,2026 年至 2031 年的複合年成長率為 8.57%。

這一成長得益於工業機器人部署量創歷史新高、協作機器人和人形機器人平台的快速普及,以及邊緣人工智慧模組的穩定應用,這些模組能夠提升感知精度和響應速度。力矩測量設備為精密組裝提供支持,而隨著深度學習模型從雲端遷移到機械臂,視覺系統也在加速發展。半導體製造商正在將感測、處理和安全邏輯整合到單一晶片上,從而降低工廠的延遲並增強其網實整合韌性。汽車、電動車和醫療產業的終端用戶正在加大對多模態感測技術的投資,以提高產量比率、可追溯性和人機協作能力。從區域來看,亞太地區密集的製造地和政策獎勵有助於實現規模經濟,而南美洲的自動化追趕需求則為快速成長奠定了基礎。

全球機器人感測器市場趨勢與洞察

工業機器人安裝數量創歷史新高

預計到2024年,全球運作將超過400萬台,製造商正努力超越編碼器,採用包含視覺、力覺和觸覺等多種模式的先進感測套件。 FANUC的500i-A數控控制設備(CPU吞吐量提升2.7倍)展示了更快的板載運算如何即時處理複雜的感測器資料流。協作單元推動了對冗餘安全感測的需求,而Delta的D-Bot協作機器人則透過與負載容量專用的即插即用感測器套件簡化了整合。不斷成長的安裝量正在縮短先進感知技術的投資回報期,並鞏固了機器人感測器市場的訂單。

電子商務物流領域對配備感測器的自主移動機器人(AMR)的需求

強勁的線上零售推動全球移動機器人市場規模在2024年達到45億美元,促使動態倉庫對廣角感知、地圖繪製和包裹品質評估的需求日益成長。像Sonair這樣的低成本3D超音波陣列可提供180x180度的覆蓋範圍,價格比雷射雷達低80%,降低了中型履約中心的資本門檻。人工智慧增強的視覺系統可以識別托盤貨架、堆高機和員工著裝,從而提高運作和吞吐量。觸控式機械手使自主移動機器人(AMR)能夠處理易碎的庫存單位(SKU),拓展了應用場景,並推動了對感測器的需求。

MEMS供應鏈持續波動

鎵和銻的貿易限制,以及亞洲晶圓代工廠面臨的自然災害風險,正在壓縮前置作業時間並推高晶粒級成本。 Sourceability預測,晶圓啟動瓶頸將持續到2026年,導致高引腳數感測器ASIC的供應更加緊張。勞動力短缺也加劇了不確定性,一些OEM廠商正在考慮採用雙重採購或轉移後端封裝,但這些措施會增加資本密集度和營運複雜性。

細分市場分析

預計從2026年到2031年,視覺感測器將以13.27%的複合年成長率成長,超過所有其他類別。同時,力/扭力感測器在2025年仍將佔據機器人感測器市場27.62%的佔有率。高速視覺檢測和拾取放置操作的普及,使得投資板載GPU和ASIC晶片以將推理延遲降低到30毫秒以下變得合理。隨著相機價格的下降,即使是中階OEM廠商也開始採用雙感光元件立體感光元件來支援深度估計。力感測在壓入配合、去毛邊和電子連接器組裝中仍然至關重要,亞牛頓級的精確度可以確保產量比率。康耐視2023年8.375億美元的營收表明,隨著資本支出的復甦,對機器視覺硬體的周期性需求仍然強勁。

感測器小型化使得接近感測器、溫度感測器和視覺模組能夠整合到機器人纖細的手腕中,從而減少佈線和電磁干擾。觸覺陣列具有0.1克力靈敏度,例如XELA Robotics的uSkin,可以提高抓取器的靈巧性,但在機器人感測器市場中仍屬於「其他」類別。立體視覺、慣性測量單元(IMU)和力向量融合技術增強了不規則零件組裝過程中的柔順性控制,這項特性在穿戴式裝置生產線和客製化整形外科器材中備受重視。標準化的M12連接器和乙太網路供電(PoE)技術簡化了安裝,降低了中小企業的進入門檻。預計在預測期內,提供模組化、人工智慧視覺套件的供應商將在該細分市場中佔據更大的增量機器人感測器市場。

工業機器人一直是需求的基石,預計到2025年將佔據機器人感測器市場規模的54.62%。它們在焊接、噴塗和電子組裝等領域的強大作用確保了其持續的更新換代。然而,在持續的創業投資流入和零件成本下降的推動下,人形機器人平台預計將在2031年之前以36.7%的複合年成長率推動市場成長。 Tacta Systems的資金籌措進一步印證了人們的信念:一旦人形機器人達到人類層面的安全性和靈巧性,它們就能解決物流、零售和老年護理等領域的挑戰。

協作機器人正持續在中型工廠中廣泛應用,這些工廠需要靈活切換生產線,但又無法負擔大規模防護設備的成本。邊緣人工智慧子系統支援「零編程」示教模式,降低了技術門檻,擴大了目標使用者群體。醫院和機場正在快速採用商用服務機器人,因為感染控制和旅客服務運作需要可靠的感知能力和精細的操作能力。安川馬達的「MOTOMAN NEXT」系列展示了自最佳化運動規劃功能,預示著平台感測器數量的成長趨勢,旨在提升情境察覺。未來,人形機器人的加速普及將推動機器人感測器市場進一步多元化,並在傳統工業自動化之外創造新的市場。

區域分析

亞太地區將在2025年以34.72%的營收佔有率佔據全球榜首,這主要得益於中國的產業升級補貼、日本的「社會5.0」計畫以及韓國在記憶體晶片領域的投資熱潮。OMRON8761億日圓的淨銷售額印證了該地區對感測器驅動自動化技術的強勁需求。接近性MEMS晶圓廠縮短了前置作業時間,而當地頂尖的汽車製造商和電子巨頭也確保了基礎設施需求。然而,圍繞晶片出口限制的地緣政治摩擦可能會導致供應鏈重組和額外成本。

在德國工業4.0藍圖和嚴格安全標準的推動下,歐洲市場對認證感測系統的需求日益成長。 SICK公司2024年的銷售額預計將達到23.7億歐元,顯示其成長動能良好,尤其是在汽車和物流行業。在南歐,協作機器人的日益普及推動了市場規模的擴大, FANUC在伊比利半島的擴張便是一個例證。北歐企業正積極推動離岸風力發電和採礦領域的突破性應用,防塵、防水和抗震感測器正逐漸成為業界標準。

北美是創新中心,美國實驗室不斷改進邊緣人工智慧感知技術,加拿大礦業公司則採用堅固耐用的感測器用於自動駕駛車輛。墨西哥的近岸外包趨勢正將生產線集中在巴希奧走廊沿線,推動了對具成本效益感測技術的需求。儘管南美洲的裝機量較小,但預計其複合年成長率將達到10.45%,成為成長最快的地區。這主要得益於巴西汽車製造商、阿根廷糧食加工商和智利鋰精煉商為應對勞動力短缺和滿足環境、社會及治理(ESG)審核要求而提高自動化程度。區域開發銀行和跨國公司正在聯合資助先導計畫,為機器人感測器市場的長期需求播下種子。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 工業機器人的安裝數量已達到歷史最高水準。

- 電子商務物流對配備感測器的自主移動機器人(AMR)的需求

- 六軸力/扭力感測器價格突然下降

- 人機協作的監理激勵措施

- 用於人形機器人的邊緣AI感測器融合模組

- 開放原始碼ROS2 硬體參考設計

- 市場限制

- MEMS供應鏈持續波動

- 新興市場中小企業資本投資的障礙

- 智慧感測器的網路安全認證成本

- 先進觸覺積體電路的出口管制限制

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依感測器類型

- 力和扭矩感測器

- 視覺感測器

- 接近感測器

- 位置/編碼器

- 溫度感測器

- 壓力感測器

- 其他(觸覺、LiDAR、超音波)

- 按機器人類型

- 工業機器人

- 協作機器人(cobots)

- 服務機器人 - 專業人士之選

- 服務機器人 - 家用

- 人形機器人

- 按最終用戶行業分類

- 汽車和電動車

- 電子和半導體

- 物流/倉儲業

- 食品/飲料

- 醫療和醫療設備

- 其他行業(金屬、塑膠等)

- 透過檢測技術

- 應變計

- 電容式

- 光學(CMOS、雷射雷達)

- 磁效應和霍爾效應

- 壓電

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ATI Industrial Automation(Novanta Inc.)

- Bota Systems AG

- Baumer Group

- FANUC Corporation

- FUTEK Advanced Sensor Technology, Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- OMRON Corporation

- Sensata Technologies Holding plc

- TE Connectivity Ltd.

- Tekscan, Inc.

- Sick AG

- Keyence Corporation

- Cognex Corporation

- Epson Robotics(Seiko Epson Corp.)

- Yaskawa Electric Corporation

- Delta Electronics, Inc.

- DENSO Wave Incorporated

- Bosch Rexroth AG

- Rockwell Automation, Inc.

- Schunk GmbH and Co. KG

第7章 市場機會與未來展望

The robotic sensors market is expected to grow from USD 0.73 billion in 2025 to USD 0.79 billion in 2026 and is forecast to reach USD 1.19 billion by 2031 at 8.57% CAGR over 2026-2031.

Growth stems from record-high industrial-robot deployments, rapid gains in collaborative and humanoid platforms, and the steady infusion of edge-AI modules that elevate perception accuracy and response times. Force-torque devices underpin precision assembly lines, while vision systems accelerate as deep-learning models migrate from the cloud to the robot arm. Semiconductor makers now bundle sensing, processing, and safety logic on a single chip, giving factories lower latency and better cyber-physical resilience. End-users in automotive, electric-vehicle, and healthcare domains intensify spending on multimodal sensing to improve yield, traceability, and human-machine cooperation. Regionally, Asia-Pacific's dense manufacturing base and policy incentives support scale economics, whereas South America's automation catch-up provides a high-growth runway.

Global Robotic Sensors Market Trends and Insights

Industrial-robot installations hit record levels

Global operational stock crossed 4 million units in 2024, forcing manufacturers to adopt richer sensing suites that go beyond encoders to vision, force, and tactile modalities. FANUC's 500i-A CNC control, with 2.7X CPU throughput, illustrates how faster on-board computing now digests complex sensor streams in real time. Collaborative cells amplify demand for redundant safety sensing, while Delta's D-Bot cobots demonstrate payload-specific plug-and-play sensor packages that simplify integration. High install volumes shorten the payback period for advanced perception, locking in orders across the robotic sensors market.

E-commerce logistics demand for sensorised AMRs

Robust online retail lifted the global mobile-robot space to USD 4.5 billion in 2024, propelling need for wide-angle perception, mapping, and package-quality assessment inside dynamic warehouses. Low-cost 3D ultrasonic arrays such as Sonair's deliver 180 X 180 degree coverage while undercutting LiDAR by up to 80%, trimming capital hurdles for mid-tier fulfilment centers. AI-enhanced vision now differentiates between pallet racks, forklifts, and staff apparel, boosting uptime and throughput. Touch-enabled grippers let AMRs handle fragile SKUs, expanding use cases and fuelling sensor volumes.

Persistent MEMS supply-chain volatility

Trade restrictions on gallium and antimony alongside natural-disaster risks at Asian foundries strain lead times and elevate die-level costs. Sourceability forecasts continued wafer-start bottlenecks through 2026, squeezing availability for high-pin-count sensor ASICs. Labor shortages add uncertainty, prompting some OEMs to dual-source or relocate backend packaging, yet such moves raise capital intensity and operational complexity.

Other drivers and restraints analyzed in the detailed report include:

- Rapid price decline of six-axis force-torque sensors

- Regulatory incentives for human-robot collaboration

- CapEx barriers for SMEs in emerging markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vision sensors are forecast to post a 13.27% CAGR from 2026-2031, outpacing all other categories. At the same time, force-torque devices retained 27.62% share of the robotic sensors market in 2025. The mass adoption of high-speed visual inspection and pick-and-place tasks legitimises investment in on-board GPUs and ASICs that compress inference latency below 30 ms. As camera prices slide, even mid-tier OEMs adopt dual-sensor stereo rigs to tackle depth estimation. Force sensing stays indispensable for press-fit, deburring, and electronic-connector assembly, where sub-newton accuracy safeguards yield. Cognex's 2023 revenue of USD 837.5 million signals cyclical yet resilient appetite for machine vision hardware when capex rebounds.

Sensor miniaturization lets builders co-locate proximity, temperature, and vision modules within tight robot wrists, reducing cabling and electromagnetic noise. Tactile arrays such as XELA Robotics' uSkin, with 0.1 gram-force sensitivity, deepen dexterity on grippers, but they still sit in the "others" bucket of the robotic sensors market. The fusion of stereo vision, IMU, and force vectors bolsters compliance control during assembly of irregular parts, a capability prized in wearable-device lines and customised orthopedics. Standardised M12 connectors and Power-over-Ethernet streamline installation, widening accessibility for SMEs. Over the forecast window, suppliers that offer modular, AI-ready vision suites are expected to capture a disproportionate slice of incremental robotic sensors market size in this segment.

Industrial robots have historically anchored demand, accounting for 54.62% of the robotic sensors market size in 2025. Their entrenched role in welding, painting, and electronics assembly ensures a stable replacement cycle. However, humanoid platforms are projected to lead growth with a 36.7% CAGR through 2031, energised by sustained venture capital inflows and component cost deflation. Tacta Systems' capital raise underscores confidence that humanoids can address logistics, retail, and eldercare gaps once safety and dexterity reach human parity.

Collaborative robots continue to win midsize factories that need flexible line changeovers and cannot afford extensive guarding. Edge-AI subsystems now allow 'zero-programming' teach modes, lowering skill thresholds and expanding the addressable user base. Professional service robots surge across hospitals and airports, where infection-control or passenger-service tasks require reliable perception and gentle interaction. Yaskawa's MOTOMAN NEXT family demonstrates self-optimising motion planning, a trend that multiplies sensor count per unit as platforms aim for situational awareness. Over the horizon, accelerated adoption in humanoids will further diversify the robotic sensors market, giving suppliers a potent new volume pool beyond classical industrial automation.

The Robotic Sensors Market Report is Segmented by Sensor Type (Force & Torque Sensors, Vision Sensors, and More), Robot Type (Industrial Robots, Collaborative Robots, Service Robots - Professional, and More), End-User Industry (Automotive & EV, Electronics & Semiconductor, and More), Sensing Technology (Strain-Gauge, Capacitive, Optical, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 34.72% revenue share in 2025, buoyed by China's industrial-upgrade subsidies, Japan's Society 5.0 blueprint, and South Korea's memory-chip investment wave. OMRON's JPY 876.1 billion net sales validate robust regional appetite for sensor-driven automation. Close proximity to MEMS fabs compresses lead times, while local tier-one automakers and electronics giants guarantee baseline demand. Geopolitical frictions around chip export controls, however, may force supply-chain re-routing and incremental costs.

Europe follows, anchored by Germany's Industry 4.0 roadmap and rigorous safety statutes that elevate certified sensing systems. SICK's EUR 2.307 billion turnover in 2024 underscores healthy momentum, especially in automotive and logistics hubs. Southern Europe's growing cobot footprint, exemplified by FANUC's Iberia expansion, widens market breadth. Nordic firms push envelope applications in offshore wind and mining, where IP-rated, vibration-hardy sensors prevail.

North America remains innovation-centric, with US labs refining AI-on-edge perception and Canadian mines adopting rugged sensors for autonomous hauling. Mexico's near-shoring trend channels production lines into Bajio corridors, pulling demand for cost-effective sensing. South America, despite lower installed base, is on track for the fastest CAGR at 10.45% as Brazilian automakers, Argentinian grain handlers, and Chilean lithium refiners automate to offset labor shortages and meet ESG audits. Regional development banks and multinationals co-finance pilot projects, seeding long-run sensor demand across the robotic sensors market.

- ATI Industrial Automation (Novanta Inc.)

- Bota Systems AG

- Baumer Group

- FANUC Corporation

- FUTEK Advanced Sensor Technology, Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- OMRON Corporation

- Sensata Technologies Holding plc

- TE Connectivity Ltd.

- Tekscan, Inc.

- Sick AG

- Keyence Corporation

- Cognex Corporation

- Epson Robotics (Seiko Epson Corp.)

- Yaskawa Electric Corporation

- Delta Electronics, Inc.

- DENSO Wave Incorporated

- Bosch Rexroth AG

- Rockwell Automation, Inc.

- Schunk GmbH and Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industrial-robot installations hit record levels

- 4.2.2 E-commerce logistics demand for sensorised AMRs

- 4.2.3 Rapid price decline of six-axis force-torque sensors

- 4.2.4 Regulatory incentives for human-robot collaboration

- 4.2.5 Edge-AI sensor fusion modules for humanoid robots

- 4.2.6 Open-source ROS2 hardware reference designs

- 4.3 Market Restraints

- 4.3.1 Persistent MEMS supply-chain volatility

- 4.3.2 CapEx barriers for SMEs in emerging markets

- 4.3.3 Cyber-security certification costs for smart sensors

- 4.3.4 Export-control limits on advanced tactile ICs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Force and Torque Sensors

- 5.1.2 Vision Sensors

- 5.1.3 Proximity Sensors

- 5.1.4 Position/Encoders

- 5.1.5 Temperature Sensors

- 5.1.6 Pressure Sensors

- 5.1.7 Others (Tactile, LiDAR, Ultrasonic)

- 5.2 By Robot Type

- 5.2.1 Industrial Robots

- 5.2.2 Collaborative Robots (Cobots)

- 5.2.3 Service Robots - Professional

- 5.2.4 Service Robots - Domestic

- 5.2.5 Humanoid Robots

- 5.3 By End-user Industry

- 5.3.1 Automotive and EV

- 5.3.2 Electronics and Semiconductor

- 5.3.3 Logistics and Warehousing

- 5.3.4 Food and Beverage

- 5.3.5 Healthcare and Medical Devices

- 5.3.6 Other Industries (Metals, Plastics, etc.)

- 5.4 By Sensing Technology

- 5.4.1 Strain-gauge

- 5.4.2 Capacitive

- 5.4.3 Optical (CMOS, LiDAR)

- 5.4.4 Magnetic and Hall-effect

- 5.4.5 Piezoelectric

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ATI Industrial Automation (Novanta Inc.)

- 6.4.2 Bota Systems AG

- 6.4.3 Baumer Group

- 6.4.4 FANUC Corporation

- 6.4.5 FUTEK Advanced Sensor Technology, Inc.

- 6.4.6 Honeywell International Inc.

- 6.4.7 Infineon Technologies AG

- 6.4.8 OMRON Corporation

- 6.4.9 Sensata Technologies Holding plc

- 6.4.10 TE Connectivity Ltd.

- 6.4.11 Tekscan, Inc.

- 6.4.12 Sick AG

- 6.4.13 Keyence Corporation

- 6.4.14 Cognex Corporation

- 6.4.15 Epson Robotics (Seiko Epson Corp.)

- 6.4.16 Yaskawa Electric Corporation

- 6.4.17 Delta Electronics, Inc.

- 6.4.18 DENSO Wave Incorporated

- 6.4.19 Bosch Rexroth AG

- 6.4.20 Rockwell Automation, Inc.

- 6.4.21 Schunk GmbH and Co. KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment