|

市場調查報告書

商品編碼

1910588

計劃物流:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Project Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

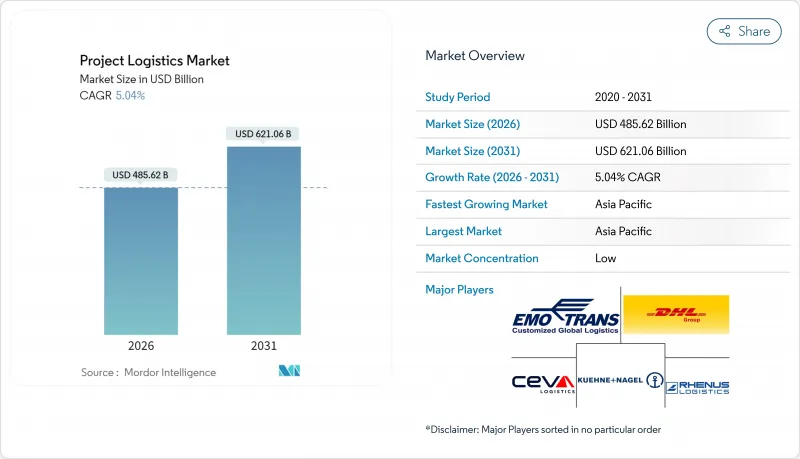

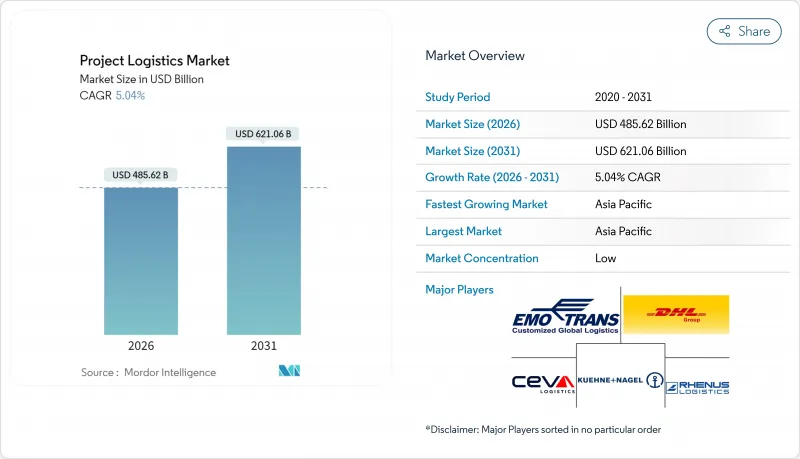

預計到 2026 年,計劃物流市場規模將達到 4,856.2 億美元,高於 2025 年的 4,623 億美元。

預計到 2031 年將達到 6,210.6 億美元,2026 年至 2031 年的複合年成長率為 5.04%。

可再生能源產能擴張、新興經濟體基礎設施投資同步成長以及跨歐亞鐵路走廊的成熟,正在擴大服務範圍並提升單次運輸價值。中型液化LNG接收站、氫氣管道改造和模組化建設計劃正在增加平均零件尺寸,從而推動對專用船舶、自航式模組化運輸車和溫控倉儲設施的需求。同時,人工智慧驅動的路線最佳化平台正在將端到端成本降低10-15%,並縮短交付時間,使營運商能夠更快地重新部署有限的資產。來自區域性專業營運商和技術主導新參與企業的競爭加劇,正在加速中型業者的整合,但市場集中度仍然較低,沒有一家業者的市佔率超過8%。持續存在的不利因素,包括運費波動、認證重型貨物裝卸人員短缺以及港口長期堵塞,正促使承運商投資於數位化視覺化工具、多模態樞紐和類比培訓計畫。

全球計劃物流市場趨勢與洞察

大型可再生能源計劃推動了對專業物流的需求。

離岸風力發電和綠氫能走廊正在重塑航運格局。如今,渦輪機葉片長度超過100米,需要專為15-20兆瓦渦輪機設計的自升式運輸船。 Venture Worldwide公司投資180億美元的普拉克明液化天然氣第三期擴建計劃標誌著零件尺寸的升級,而德國將一條400公里長的天然氣管道改造為氫氣運輸管道,則預示著一種新型低溫貨物的出現,這種貨物必須保持在-253°C以下的溫度。這些變化迫使營運商重新思考航線規劃、船舶選擇和庫存分配。

新興經濟體的基礎建設超級週期支撐長期成長

中國的「一帶一路」計劃促成了東非一個價值100億美元的港口項目和一個鐵路網路的建設,該鐵路網路將把運輸時間縮短多達50%。同時,跨里海國際航線預計到2024年將運輸27,000個標準箱,年增25倍。計劃物流市場受益於此可預測的、持續數十年的資本投入,為船隊擴張和區域倉庫擴建提供了充分的理由。

前期投資巨大會阻礙市場進入。

一台1000噸級的履帶起重機造價可能在5000萬美元到1億美元之間,而一艘風電場安裝船的造價可能超過2億美元。這些巨額投資阻礙了新進業者,迫使當地專業公司以高成本租賃設備,即使計劃規模不斷成長,利潤率也受到限制。

細分市場分析

到2025年,運輸業將佔計劃物流市場的60.45%,這反映了路線規劃、重型裝運船隻和超大貨物護航船的關鍵作用。倉儲、配送和庫存管理雖然規模較小,但卻是成長最快的細分市場,年複合成長率達5.18%。這一成長反映了模組化建築的興起,模組化建築需要溫控儲存和同步裝卸。隨著一體化供應商將倉儲與最後一公里組裝相結合,倉儲服務的計劃物流市場規模預計將會擴大。實施自動化庫存管理系統的營運商可以更清楚地了解組件的停留時間,從而減少閒置資金和逾期罰款。

隨著服務種類日益豐富,對現場物流協調、報關和風險諮詢的需求也隨之成長。 Highland-Fairview 的物流超級中心正是這種一站式模式的典範,其 4000 萬平方英尺的設施可滿足複雜的貨物流轉需求。隨著資產所有者將製造和安裝等環節的責任外包,計劃物流行業正從以運輸為中心的合約模式轉向以結果為導向的夥伴關係關係,從而提高客戶留存率和費用收入潛力。

計劃物流市場報告按服務(運輸、倉儲、配送及庫存管理、其他服務)、貨物類型(超大貨物、重型貨物、散裝貨物、其他)、最終用戶(石油天然氣、發電及輸電、建築及基礎設施、其他)和地區(北美、南美、亞太、歐洲、中東和非洲)進行細分。市場預測以美元以金額為準。

區域分析

亞太地區佔全球收入的38.60%,這主要得益於中國「一帶一路」沿線港口的蓬勃發展、印度高速公路網的建設以及澳洲可再生礦產資源。預計到2024年,跨里海航線的貨運量將增加25倍,達到27,000標準箱,凸顯了開發替代通道、減少對蘇伊士運河依賴的重要性。區域各國政府正在資助內陸堆場和數位化海關窗口的建設,使承運商能夠加快貨物週轉速度並降低滯期費。

北美位居第二,這主要得益於一系列走廊開發項目,例如墨西哥灣沿岸液化天然氣產能的擴張、一條40吉瓦的可再生能源管道以及耗資64億美元的戈迪·豪國際大橋(計劃於2025年底通車)。加拿大北極貿易走廊的Hudson灣鐵路維修將縮短運輸時間,從而促進關鍵礦產出口。核准程序的改革提高了運輸時間表的確定性,鼓勵物流公司簽訂長期包車協議。

歐洲、中東和非洲構成了一幅成熟和新興運輸路線交織的圖景。德國400公里長的氫氣管道改造計畫正在開闢新的貨物運輸類別,而埃及的港口擴建和沙烏地阿拉伯的陸橋計畫則刺激了對重型沿海起重機的需求。中國支持的東非港口,包括坦尚尼亞的巴加莫約港,正在重塑貿易路線,並吸引區域專家建立支線服務。南美洲的礦業走廊和可再生能源計畫正在開闢前沿機遇,為規避風險的營運商帶來豐厚回報。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 大型可再生能源計劃(離岸風電、綠氫能走廊)

- 新興經濟體的基礎建設超級週期

- 模組化建造和預製工廠規模化

- 中型液化天然氣出口終端數量迅速增加(美國墨西哥灣沿岸、西非)

- 透過「一帶一路」計劃推動跨歐亞鐵路走廊走向成熟

- 人工智慧驅動的路線和風險最佳化平台

- 市場限制

- 重型運輸資產需要高額的初始資本投入。

- 貨運和燃油成本波動對利潤率造成壓力。

- 重型起重作業人員嚴重短缺

- 港口許可證和壅塞延誤

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠疫情與地緣政治事件的影響

第5章 市場規模與成長預測

- 透過服務

- 運輸

- 路

- 鐵路

- 航空

- 海

- 倉儲管理、物流和庫存管理

- 附加價值服務及更多

- 運輸

- 按貨物類型

- 超大貨物(非標準貨物)

- 重型貨物

- 散貨

- 其他

- 按最終用戶行業分類

- 石油天然氣、採礦和採石

- 能源生產和輸送

- 建築和基礎設施

- 製造和工業工廠

- 航太/國防

- 其他(海事/造船、通訊等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 南美洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 東南亞(新加坡、馬來西亞、泰國、印尼、越南、菲律賓)

- 亞太其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Deutsche Post DHL

- Rhenus Logistics

- CEVA Logistics

- Kuehne+Nagel

- EMO Trans

- Hellmann Worldwide Logistics

- CH Robinson

- NMT Global Project Logistics

- Rohlig Logistics

- Expeditors International

- Kerry Logistics

- DSV A/S

- Fagioli group

- FLS Transportation

- Megalift

- Express Global Logistics(EXG)

- Yusen Logistics

- Geodis

- Crane Worldwide Logistics

- Transworld

第7章 市場機會與未來展望

Project logistics market size in 2026 is estimated at USD 485.62 billion, growing from 2025 value of USD 462.30 billion with 2031 projections showing USD 621.06 billion, growing at 5.04% CAGR over 2026-2031.

Capacity additions in renewable energy, synchronized infrastructure super-cycles in emerging economies, and the maturation of trans-Eurasian rail corridors are broadening service scope while lifting value per shipment. Mid-scale LNG terminals, hydrogen pipeline conversions, and modular construction projects are enlarging average component dimensions, boosting demand for specialized vessels, self-propelled modular transporters, and climate-controlled storage. In parallel, AI-enabled route-optimization platforms are trimming end-to-end costs by 10-15% and shortening delivery windows, allowing operators to redeploy scarce assets faster. Heightened competition, driven by regional specialists and technology-first entrants, is accelerating consolidation among mid-tier firms, yet market concentration remains low because no single provider exceeds 8% share. Persistent headwinds volatile freight rates, certified heavy-lift labor shortages, and chronic port congestion are pushing carriers to invest in digital visibility tools, multi-modal hubs, and simulation-based training programs.

Global Project Logistics Market Trends and Insights

Renewable-Energy Mega-Projects Drive Specialized Logistics Demand

Offshore wind farms and green-hydrogen corridors are rewriting transport blueprints. Turbine blades now surpass 100 meters, necessitating jack-up vessels designed for 15-20 MW turbines. Venture Global's USD 18 billion phase-three expansion at Plaquemines LNG embodies the boom in component scale, while Germany's conversion of 400 kilometers of natural-gas pipeline to hydrogen service signals a new class of cryogenic cargo that must be kept below -253 °C. These shifts require operators to recalibrate route planning, vessel selection, and inventory staging.

Infrastructure Super-Cycles in Emerging Economies Sustain Long-Term Growth

China's Belt and Road Initiative has spawned a USD 10 billion East-African port program and rail links that cut transit times by up to 50%. Simultaneously, the Trans-Caspian International Transport Route moved 27,000 TEU in 2024, a 25-fold jump over the prior year. The project logistics market benefits from this predictable, multi-decade capital pipeline that justifies fleet expansion and regional depot build-outs.

High Upfront Capital Requirements Constrain Market Entry

A 1,000-tonne crawler crane can cost USD 50-100 million, and wind-installation vessels exceed USD 200 million. These sums deter new entrants and force regional specialists to lease gear at premiums, curbing margin upside even as project volumes rise.

Other drivers and restraints analyzed in the detailed report include:

- Modular Construction Transforms Project Delivery Models

- Mid-Scale LNG Export Terminals Create Regional Hubs

- Volatile Freight and Fuel Costs Pressure Operating Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation captured 60.45% of the project logistics market in 2025, reflecting the indispensable role of route engineering, heavy-lift vessels, and escorts for oversized cargo. Warehousing, distribution, and inventory management, though smaller, is the fastest-expanding slice at a 5.18% CAGR. The uptick mirrors modular builds that need climate-controlled laydown yards and synchronized staging. The project logistics market size for warehousing services is set to climb as integrated providers bundle storage with last-mile assembly. Operators deploying automated inventory systems gain visibility over component dwell times, curbing idle capital and penalties.

A wider service mix also elevates demand for on-site logistics coordination, customs brokerage, and risk advisory. Highland Fairview's logistics megacenter embodies this one-stop model, offering 40 million square feet tailored for complex cargo streams. As asset owners outsource cradle-to-installation responsibility, the project logistics industry pivots from move-centric contracts to outcome-driven partnerships, raising stickiness and fee potential.

The Project Logistics Market Report is Segmented by Service (Transportation, Warehousing, Distribution & Inventory Management, Other Services), Cargo Type (Oversized, Heavy-Lift, Breakbulk, Others), End-User (Oil & Gas, Energy Generation/Transmission, Construction and Infrastructure, and More), and Geography (North America, South America, Asia-Pacific, Europe, Middle East and Africa). Market Forecasts are Provided in Value (USD).

Geography Analysis

Asia-Pacific contributes 38.60% of global revenue, supported by China's Belt and Road ports, India's highways, and Australia's renewable-minerals surge. The Trans-Caspian route's 25-fold volume jump to 27 000 TEU in 2024 underscores alternate corridors that reduce reliance on Suez passages. Regional governments fund inland depots and digital customs windows, enabling carriers to rotate assets faster and clip demurrage fees.

North America ranks second, driven by LNG build-outs along the Gulf, 40-GW renewable-energy pipelines, and corridor upgrades such as the USD 6.4 billion Gordie Howe International Bridge that will open in late 2025. Canada's Arctic Trade Corridor advances through Hudson Bay Railway refurbishments that shave transit times and unlock critical-mineral exports. Favorable permitting reforms bolster schedule certainty, encouraging logistics firms to lock in long-term charter commitments.

Europe, the Middle East, and Africa compose a mosaic of mature and emerging lanes. Germany's 400-kilometer hydrogen-pipeline conversion pioneers a new cargo category, while Egypt's port expansions and Saudi Arabia's Landbridge escalate demand for coastal heavy-lift cranes. China-backed East-African ports, including Bagamoyo in Tanzania, redirect trade loops and invite regional specialists to establish feeder services. South America's mining corridor and renewable plans open frontier opportunities that reward risk-ready operators.

- Deutsche Post DHL

- Rhenus Logistics

- CEVA Logistics

- Kuehne + Nagel

- EMO Trans

- Hellmann Worldwide Logistics

- C.H. Robinson

- NMT Global Project Logistics

- Rohlig Logistics

- Expeditors International

- Kerry Logistics

- DSV A/S

- Fagioli group

- FLS Transportation

- Megalift

- Express Global Logistics (EXG)

- Yusen Logistics

- Geodis

- Crane Worldwide Logistics

- Transworld

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Renewable-energy mega-projects (offshore wind, green-hydrogen corridors)

- 4.2.2 Infrastructure super-cycles in emerging economies

- 4.2.3 Up-scaling of modular construction and prefabricated plants

- 4.2.4 Surge in mid-scale LNG export terminals (U.S. Gulf, West Africa)

- 4.2.5 Belt-and-Road trans-Eurasian rail corridors maturing

- 4.2.6 AI-enabled route and risk optimization platforms

- 4.3 Market Restraints

- 4.3.1 High upfront capex for heavy-lift assets

- 4.3.2 Volatile freight and fuel costs eroding margins

- 4.3.3 Acute shortage of certified heavy-lift operators

- 4.3.4 Port-side permit and congestion delays

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of COVID-19 and Geo-Political Events

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Warehousing, Distribution and Inventory Management

- 5.1.3 Value-added Services and Others

- 5.1.1 Transportation

- 5.2 By Cargo Type

- 5.2.1 Oversized (Out-of-Gauge) Cargo

- 5.2.2 Heavy-Lift Cargo

- 5.2.3 Breakbulk Cargo

- 5.2.4 Others

- 5.3 By End-User Industry

- 5.3.1 Oil and Gas, Mining and Quarrying

- 5.3.2 Energy Generation and Transmission (Includes Renewable Energy)

- 5.3.3 Construction and Infrastructure

- 5.3.4 Manufacturing and Industrial Plants

- 5.3.5 Aerospace and Defense

- 5.3.6 Others (Maritime and Shipbuilding, Telecommunications, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Europe

- 5.4.4.1 United Kingdom

- 5.4.4.2 Germany

- 5.4.4.3 France

- 5.4.4.4 Spain

- 5.4.4.5 Italy

- 5.4.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.4.8 Rest of Europe

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab of Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East And Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deutsche Post DHL

- 6.4.2 Rhenus Logistics

- 6.4.3 CEVA Logistics

- 6.4.4 Kuehne + Nagel

- 6.4.5 EMO Trans

- 6.4.6 Hellmann Worldwide Logistics

- 6.4.7 C.H. Robinson

- 6.4.8 NMT Global Project Logistics

- 6.4.9 Rohlig Logistics

- 6.4.10 Expeditors International

- 6.4.11 Kerry Logistics

- 6.4.12 DSV A/S

- 6.4.13 Fagioli group

- 6.4.14 FLS Transportation

- 6.4.15 Megalift

- 6.4.16 Express Global Logistics (EXG)

- 6.4.17 Yusen Logistics

- 6.4.18 Geodis

- 6.4.19 Crane Worldwide Logistics

- 6.4.20 Transworld

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment