|

市場調查報告書

商品編碼

1910583

家用冷藏庫和冷凍庫:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Household Refrigerators And Freezers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

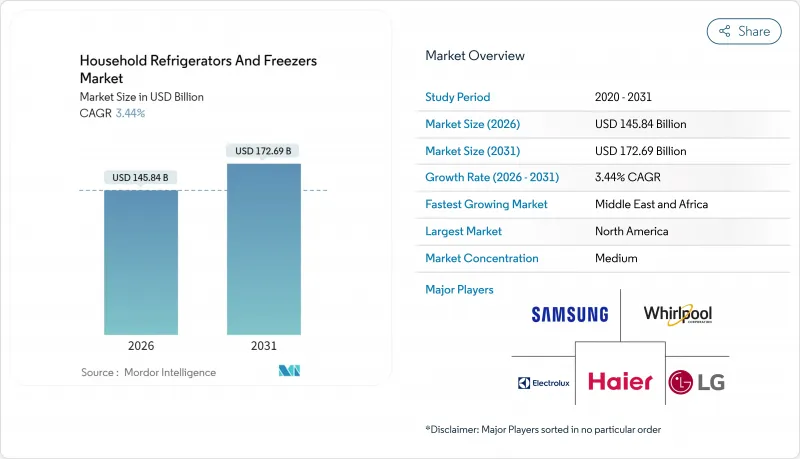

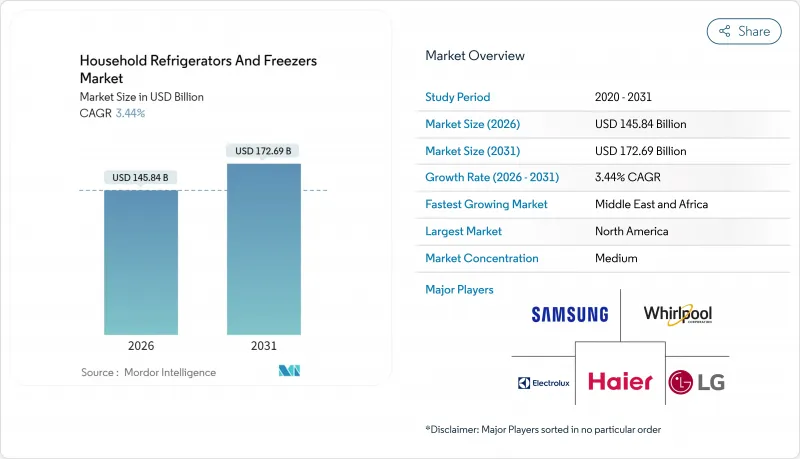

預計到 2026 年,家用冷藏庫和冷凍庫市場價值將達到 1,458.4 億美元,高於 2025 年的 1,409.9 億美元。

預計到 2031 年,該產業規模將達到 1,726.9 億美元,2026 年至 2031 年的複合年成長率為 3.44%。

北美和歐盟的能源效率法規、高全球暖化潛值(GWP)冷媒的快速淘汰以及亞洲新興國家的穩步都市化進程,共同推動了家用冰箱和冷櫃市場的漸進式持續擴張。對智慧連網機型的需求不斷成長,R600a和R290等天然冷媒的日益普及,以及成熟經濟體持續的廚房維修週期,進一步促進了高級產品的市場需求。同時,由於半導體短缺和部分開發中國家電費上漲,生產前置作業時間延長,限制了更換週期。因此,領先的製造商正致力於加強內部零件採購,建造區域工廠以縮短供應鏈,並增加對人工智慧驅動的食品管理功能的研發投入。這些趨勢共同推動了家用冷藏庫和冷凍庫市場的持續創新和價值成長。

全球家用冷藏庫及冷凍庫市場趨勢及洞察

節能法規

在成熟經濟體中,由於能源效率標準的日益嚴格,產品更新換代週期正在加速。美國能源局已最終確定2029年和2030年的冷藏庫標準,要求年度能耗降低兩位數百分比。同時,歐盟修訂後的氟碳化合物法規將於2026年1月起禁止在家用電器中使用含氟冷媒,並敦促全面過渡到異丁烷或丙烷系統。主要原始設備製造商(OEM)已完成向天然氣冷媒的過渡。通用電氣家電公司(GE Appliances)已於2024年完成了R600a冷媒的多年推廣,並指出其能源效率提升了10%,且臭氧消耗潛能值為零。諸如「能源之星」(ENERGY STAR)之類的配套標籤計劃可以識別冷媒類型,並鼓勵消費者選擇全球暖化潛勢值(GWP)更低的替代品。

新興亞洲地區可支配所得不斷成長

新興亞洲市場首次購屋需求強勁,主要得益於中產階級的壯大和都市化的加速。印度冷媒市場與家電普及率密切相關,預計未來五年將以6-8%的複合年成長率成長,這主要得益於低全球暖化潛值(GWP)冷媒的日益普及和家電擁有率的提高。中國政府於2025年1月擴大了八類家電的更換補貼計劃,將直接惠及海爾等主要製造商,海爾約佔國內冷藏庫市場40-50%的佔有率。該地區的消費模式偏向大容量和多嵌入式設計,中國消費者也越來越傾向選擇嵌入式冰箱,而嵌入式冰箱的平均價格是傳統冰箱的1.4倍。複雜的監理合規也是一大挑戰。印度於2021年批准了《基加利修正案》,該修正案將於2024年開始實施氫氟碳化合物(HFC)的逐步淘汰要求,這將為Refex Industries等供應商創造機會。該公司在 2024-2025 會計年度供應了 1370 公噸冷媒,其中包括透過與 LG 和 Voltas 的合作。

半導體供應不穩定

持續的半導體短缺已將高階冷藏庫的前置作業時間延長至六個月以上。據Thermador公司稱,包括對開門冰箱在內的所有主要品類都受到電源管理積體電路和微控制器供不應求的限制。這種影響不僅限於高階品牌,還波及整體現代冷藏庫系統節能智慧功能所必需的半導體和電子元件。在與冷藏庫共用供應鏈的印度空調市場,零件短缺可能導致單價上漲18-24美元(1500-2000盧比,漲幅4-5%)。此外,壓縮機短缺和BIS認證延遲也使每台冰箱的成本增加了12-14.50美元(1000-1200盧比)。中國製造商正在透過供應鏈多元化來應對這項挑戰。海爾在全球擁有143個製造地,而美的則營運40多個大型生產設施,降低了物流和貿易風險。

細分市場分析

到2025年,上置式冷凍冷藏庫將主導家用冷藏庫和冷凍庫市場,佔42.79%的市場佔有率,這主要得益於其價格優勢和緊湊的面積。然而,法式對開門冰箱細分市場預計將在2031年之前保持最高的複合年成長率(CAGR),達到8.37%,這主要受消費者對更寬敞的內部空間、更寬的擱架和更先進的溫控區域的追求所驅動。三星2025年推出的Bespoke AI法式對開門冰箱產品線整合了混合壓縮機、珀爾帖冷卻技術和食物識別視覺軟體,這項組合在提升產品感知價值的同時,也滿足了即將實施的能源標準。雖然並排式冰箱因其生鮮食品和冷凍食品比例均衡而在北美仍然很受歡迎,但下置式冷凍冰箱正受到注重健康的消費者的青睞,他們更看重的是能夠輕鬆取用食材。目前,壁厚減薄是冰箱創新的方向。惠而浦的SlimTech真空隔熱技術透過將櫃體壁厚度減少66%,同時增加25%的內部容積,直接解決了都市區空間有限的問題。消費者對一體化廚房的需求日益成長,使得能夠與櫥櫃無縫融合的多門冰箱更具優勢,從而擴大了家用冷藏庫和冷凍庫市場的高階機會。

次要趨勢包括互聯功能和抗菌內膽的普及。 LG的門中門「敲擊」面板使用戶能夠提前查看內部物品,從而減少冷氣流失和年度能耗。內建的UV-C紫外線殺菌模組可有效抑制異味和細菌滋生。根據中國零售分析公司預測,2024年上半年,多門冰箱將佔線上銷售額的58%以上,印證了全球冰箱設計向分門式佈局的轉變趨勢。為了確保更高的利潤率,製造商正根據生活風格主題(例如家庭、健康、都會生活)對產品線進行細分。預計到2031年,這些多方面的設計變革將顯著推動家用冷藏庫和冷凍庫市場規模的成長。

區域分析

北美地區推動了營收成長,預計到2025年將佔據家用冷藏庫和冷凍庫市場31.05%的佔有率,這主要得益於市場飽和、強勁的更換週期以及對智慧功能的需求。三星和LG都專注於美國製造的嵌入式產品,分別利用其Dacor和Signature Kitchen Suite品牌與建築商建立合作關係,並實現了兩位數的溢價成長。通用電氣家電計畫在2029年投資30億美元,擴大在美國11家工廠的冷藏庫產能,展現持續的回流動能。儘管該地區3.74%的複合年成長率低於全球平均水平,但由於其穩定且不斷改善的價格結構,它仍然是家用冷藏庫和冷凍庫市場中盈利能力最強的地區。亞太地區正經歷最快的複合年成長率,達到6.32%,這主要得益於都市化、首次購屋者的需求以及本地製造業投資。預計2024年,中國家電出貨量將達到44.8億台,年增20.8%。這反映了出口多元化和國內補貼機制。印度的家用電器產業正受益於中產階級的壯大,儘管人均普及率仍然較低。與此同時,零件短缺推高了價格。當地法規鼓勵使用天然冷媒,而印度基於《基加利協議》逐步淘汰氫氟碳化合物(HFC)的舉措,正在推動中檔機型採用R290冷媒,進一步契合了應對氣候變遷的措施。

歐洲預計將以2.84%的複合年成長率實現溫和成長,充滿挑戰的經濟狀況和監管轉型雖然增加了合規成本,但也刺激了創新。歐盟的《氟碳化合物法規》將於2026年1月起禁止在家用冷藏庫中使用含氟溫室氣體,這給產業帶來了直接的轉型壓力。然而,像博世家電(BSH)這樣的製造商正在大力投資以符合新規,包括在墨西哥新建一家製冷工廠,並擴大研發投入(總額近8.5億歐元/9.18億美元)。歐洲產業協會強調,監管碎片化、電力成本是美國兩到三倍的高昂成本以及關鍵材料供應鏈集中等因素,都帶來了嚴峻的競爭挑戰。中東和非洲地區預計將以6.87%的複合年成長率實現最快成長,這得益於戰略投資,例如夏普在埃及投資3000萬美元成立合資企業,以及海爾在該地區26.8%的銷售額成長。這主要歸功於當地生產和產品開發,以適應不穩定的電力基礎設施。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 主流節能法規

- 新興亞洲國家可支配所得不斷成長

- 都市區的住宅成長和廚房維修

- 全通路零售的興起

- 碳中和冷媒的引入,卻鮮少受到關注。

- 基於人工智慧的壓縮機預測性維護

- 市場限制

- 半導體供應鏈波動

- 開發中國家的高電費

- 稀土元素磁鐵價格波動風險

- 在線二手家電市場的擴張

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 上置式冷凍冷藏庫

- 底部開啟式冷凍庫附冷藏庫

- 對開門冷藏庫

- 法式對開門冷藏庫

- 按產能

- 少於300公升

- 300至500升

- 超過500公升

- 透過分銷管道

- 多品牌商店

- 專賣店

- 線上

- 其他分銷管道

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 東南亞(新加坡、馬來西亞、泰國、印尼、越南、菲律賓)

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Whirlpool Corp.

- Haier Smart Home Co.

- LG Electronics Inc.

- Samsung Electronics Co.

- Electrolux AB

- Panasonic Corp.

- Bosch-Siemens Hausgerate GmbH

- Midea Group

- Hisense Co.

- Hitachi Global Life Solutions

- GE Appliances(Haier)

- Liebherr-Hausgerate

- Sub-Zero Group

- Arcelik AS(Beko, Grundig)

- Godrej Appliances

- Sharp Corp.

- TCL Technology

- PC Richard & Son(private label)

- Glen Dimplex(Home Appliances)

- SMEs & Local Players(collective)

第7章 市場機會與未來展望

The household refrigerators and freezers market size in 2026 is estimated at USD 145.84 billion, growing from 2025 value of USD 140.99 billion with 2031 projections showing USD 172.69 billion, growing at 3.44% CAGR over 2026-2031.

Energy-efficiency mandates in North America and the European Union, the rapid phase-out of high-GWP refrigerants, and steady urbanization across emerging Asia together underpin this moderate yet durable expansion. Rising demand for smart-connected models, wider adoption of natural refrigerants such as R600a and R290, and ongoing kitchen renovation cycles in mature economies further stimulate premium product uptake. At the same time, semiconductor shortages continue to lengthen production lead times, while elevated electricity tariffs in several developing countries temper replacement cycles. Leading manufacturers are therefore doubling down on in-house component sourcing, building regional factories to shorten supply chains, and intensifying R&D outlays targeting AI-driven food-management functions. These dynamics collectively sustain innovation while supporting incremental value growth throughout the household refrigerators and freezers market.

Global Household Refrigerators And Freezers Market Trends and Insights

Energy-Efficiency Regulations

Mandatory efficiency upgrades are accelerating replacement cycles across mature economies. The U.S. Department of Energy has finalized refrigerator standards taking effect in 2029 and 2030, demanding double-digit percentage cuts in annual energy use. In parallel, the EU's revised F-Gas Regulation bans fluorinated refrigerants in domestic units from January 2026, prompting full conversion to isobutane or propane systems. Leading OEMs have already transitioned to natural gases; GE Appliances finished a multiyear R600a roll-out during 2024, citing 10% efficiency gains and zero ozone-depletion potential. Complementary labelling schemes such as ENERGY STAR now spotlight refrigerant type, nudging consumers toward low-GWP alternatives.

Rising Disposable Income in Emerging Asia

Emerging Asian markets demonstrate robust first-time purchase demand driven by middle-class expansion and urbanization trends. India's refrigerant market, closely tied to appliance penetration, is forecast to grow 6-8% CAGR over the next five years as adoption of low-GWP refrigerants increases alongside appliance ownership. China's government trade-in subsidy program for eight home appliance categories, expanded in January 2025, directly benefits major manufacturers like Haier, which holds an estimated 40-50% share in the domestic refrigeration segment. The region's demand patterns favor larger-capacity units and multi-door configurations, with Chinese consumers increasingly selecting embedded (built-in) designs that command average prices 1.4x conventional models. Regulatory compliance adds complexity, as India's ratification of the Kigali Amendment in 2021 initiated HFC phase-down requirements in 2024, creating opportunities for suppliers like Refex Industries, which supplied 1,370 MT of refrigerants in FY24-25 with partnerships including LG and Voltas.

Semiconductor Supply Volatility

Persistent chip shortages extend refrigerator led times to upward of six months for high-end brands. Thermador notes that every major category, including side-by-side units, remains constrained owing to power-management IC and microcontroller gaps. The impact extends beyond premium brands, as semiconductors and electronic components are integral to modern refrigeration systems' energy efficiency and smart features. India's air conditioning market, which shares component supply chains with refrigeration, faces component shortages that may increase unit prices by USD 18-24 (Rs 1,500-2,000) (4-5%), with compressor shortages and BIS certification delays adding USD 12 -14.50 (Rs 1,000-1,200) per unit. Chinese manufacturers are responding through supply chain diversification, with Haier expanding to 143 global manufacturing centers and Midea operating over 40 major production bases to mitigate logistics and trade risks.

Other drivers and restraints analyzed in the detailed report include:

- Urban Housing Growth & Kitchen Renovations

- Omnichannel Retail Expansion

- High Electricity Tariffs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Top-freezer units accounted for 42.79% of the household refrigerators and freezers market share in 2025, anchoring sales through their price advantage and compact footprint. Yet the French-door sub-segment is forecast to register the highest 8.37% CAGR through 2031 as consumers gravitate toward spacious interiors, wide shelves, and advanced climate zones. Samsung's 2025 Bespoke AI French-door portfolio integrates hybrid compressor-Peltier cooling and Food Recognition Vision software, a combination that elevates perceived value while meeting forthcoming energy benchmarks. Side-by-side configurations remain popular in North America for their balanced fresh-to-frozen ratio, whereas bottom-freezer models gain traction among wellness-focused buyers prioritizing eye-level produce access. Innovation now targets wall-thickness reduction; Whirlpool's SlimTech vacuum insulation trims cabinet walls by 66% and boosts interior volume by 25%, directly addressing urban space constraints. Growing demand for integrated kitchens further favors multi-door units that blend seamlessly with cabinetry, broadening premium opportunities within the household refrigerators and freezers market.

Second-tier trends include connectivity adoption and antimicrobial interiors. LG's door-in-door "knock" panels let users preview contents, cutting cold-air loss and lowering annual consumption, while built-in UV-C modules promise odor and germ suppression. Chinese retail analytics show that multi-door styles surpassed 58% online share in 2024H1, reinforcing a global pivot toward compartmentalized layouts. Manufacturers are therefore segmenting lines by lifestyle themes, family, wellness, and urban loft to command higher margins. These multifaceted design shifts collectively underpin the French-door segment's outsize contribution to household refrigerators and freezers market size expansion through 2031.

The Household Refrigerators and Freezers Market Report is Segmented by Type (Top-Freezer Refrigerators, Bottom-Freezer Refrigerators, Side-By-Side Refrigerators, French Door Refrigerators), Capacity (Less Than 300 Litres, 300 - 500 Litres, Greater Than 500 Litres), Distribution Channel (Multi-Branded Stores, and Other), and Geography (North America and Other). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led revenue with a 31.05% household refrigerators and freezers market share in 2025, sustained by near-saturated ownership, brisk replacement cycles, and demand for smart features. Samsung and LG both prioritized the U.S.-built-in segment, leveraging Dacor and Signature Kitchen Suite, respectively, to secure builder partnerships and achieve double-digit premium growth. GE Appliances committed USD 3 billion through 2029 to expand fridge output across 11 domestic plants, underlining continued reshoring momentum. Although the region's 3.74% CAGR trails global averages, steady price-mix gains keep it the largest profit pool in the household refrigerators and freezers market. APAC delivers the fastest 6.32% CAGR, propelled by urbanization, first-time purchasing, and local manufacturing investments. China shipped 4.48 billion home appliances in 2024, up 20.8% year-on-year, reflecting export diversification and domestic subsidy schemes. India's appliances segment, still at low per-capita penetration, benefits from an expanding middle class even as component shortages nudge prices higher. Regional regulations favor natural refrigerants; India's Kigali-based HFC phase-down fosters uptake of R290 in mid-capacity models, reinforcing climate alignment.

Europe faces moderate growth at a 2.84% CAGR amid challenging economic conditions and regulatory transitions that increase compliance costs while driving innovation. The EU F-gas Regulation's January 2026 prohibition on fluorinated greenhouse gases in domestic refrigerators creates immediate transition pressure, though manufacturers like BSH have invested heavily in compliance, including a new refrigeration factory in Mexico and enhanced R&D spending approaching €850 million (USD 918 million). European industry associations emphasize competitiveness challenges from fragmented regulations, high electricity costs 2-3x US levels, and supply chain concentration for critical materials. The Middle East & Africa region exhibits the fastest forecast growth at 6.87% CAGR, supported by strategic investments like Sharp's USD 30 million joint venture in Egypt and Haier's 26.8% revenue growth in the region, driven by localized production and products adapted to unreliable power infrastructure.

- Whirlpool Corp.

- Haier Smart Home Co.

- LG Electronics Inc.

- Samsung Electronics Co.

- Electrolux AB

- Panasonic Corp.

- Bosch-Siemens Hausgerate GmbH

- Midea Group

- Hisense Co.

- Hitachi Global Life Solutions

- GE Appliances (Haier)

- Liebherr-Hausgerate

- Sub-Zero Group

- Arcelik A.S. (Beko, Grundig)

- Godrej Appliances

- Sharp Corp.

- TCL Technology

- P.C. Richard & Son (private label)

- Glen Dimplex (Home Appliances)

- SMEs & Local Players (collective)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Energy-efficiency Regulations

- 4.2.2 Rising Disposable Income in Emerging Asia

- 4.2.3 Urban Housing Growth & Kitchen Renovations

- 4.2.4 Omnichannel Retail Expansion

- 4.2.5 Under-the-Radar Carbon-Neutral Refrigerant Adoption

- 4.2.6 AI-Enabled Predictive Maintenance for Compressors

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Volatility for Semiconductors

- 4.3.2 High Electricity Tariffs in Developing Nations

- 4.3.3 Rare-Earth Magnet Price Shocks

- 4.3.4 Growing Second-Hand Appliance Market Online

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Top-freezer Refrigerators

- 5.1.2 Bottom-freezer Refrigerators

- 5.1.3 Side-by-Side Refrigerators

- 5.1.4 French Door Refrigerators

- 5.2 By Capacity

- 5.2.1 Less than 300 Litres

- 5.2.2 300 - 500 Liters

- 5.2.3 Greater than 500 Liters

- 5.3 By Distribution Channel

- 5.3.1 Multi-branded Stores

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 APAC

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Whirlpool Corp.

- 6.4.2 Haier Smart Home Co.

- 6.4.3 LG Electronics Inc.

- 6.4.4 Samsung Electronics Co.

- 6.4.5 Electrolux AB

- 6.4.6 Panasonic Corp.

- 6.4.7 Bosch-Siemens Hausgerate GmbH

- 6.4.8 Midea Group

- 6.4.9 Hisense Co.

- 6.4.10 Hitachi Global Life Solutions

- 6.4.11 GE Appliances (Haier)

- 6.4.12 Liebherr-Hausgerate

- 6.4.13 Sub-Zero Group

- 6.4.14 Arcelik A.S. (Beko, Grundig)

- 6.4.15 Godrej Appliances

- 6.4.16 Sharp Corp.

- 6.4.17 TCL Technology

- 6.4.18 P.C. Richard & Son (private label)

- 6.4.19 Glen Dimplex (Home Appliances)

- 6.4.20 SMEs & Local Players (collective)

7 Market Opportunities & Future Outlook

- 7.1 Connected-Home Interoperability Platforms

- 7.2 Circular-Economy Certified Refurbishment Programs