|

市場調查報告書

商品編碼

1910563

歐洲焊接設備市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Europe Welding Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

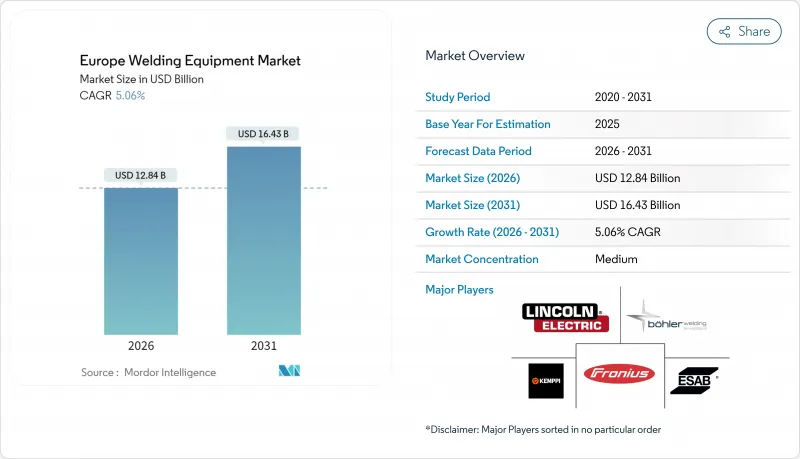

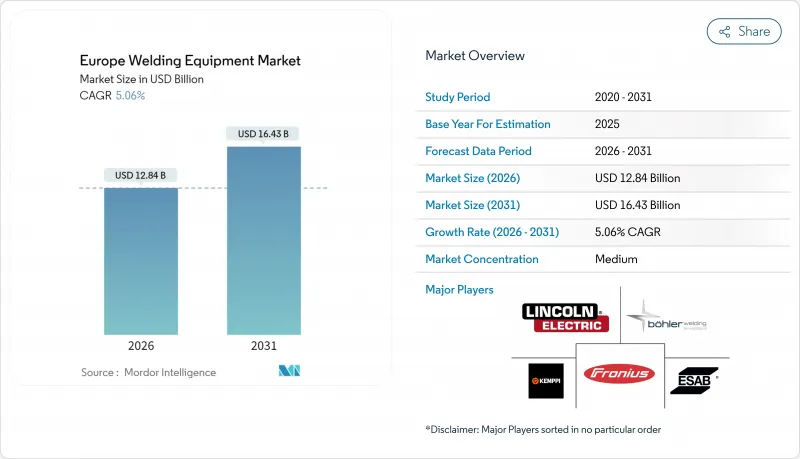

歐洲焊接設備市場預計到 2026 年將達到 128.4 億美元,高於 2025 年的 122.2 億美元。

預計到 2031 年將達到 164.3 億美元,2026 年至 2031 年的複合年成長率為 5.06%。

市場擴張反映了設備現代化進程的加速,製造商正朝著整合感測器、軟體和機器人技術的工業4.0生產單元邁進。電動車電池組組裝和輕型鋁材連接領域的需求成長尤為顯著,而綠色交易基礎設施計畫也推動了公共部門大型焊接系統的採購。供應商不再僅僅在價格上競爭,而是致力於製程創新,例如高光束品質的雷射光源、低電磁輻射的逆變電源以及焊接數據分析平台。合格焊工的持續短缺正在推動自動化投資,中型企業紛紛部署協作機器人單元以應對勞動力波動。

歐洲焊接設備市場趨勢與洞察

自動化和機器人技術在歐洲生產線中的滲透

歐洲各地的製造商正在部署機器人焊接單元,以填補30萬焊工的缺口並滿足ISO 3834品質要求。自適應控制演算法可即時調節電流和焊接速度,進而提高複雜接頭幾何形狀的輪胎邊緣一致性。一家德國汽車供應商報告稱,在整合與人類操作員共用的協作機器人後,其生產週期縮短了40%。數位雙胞胎模擬正在最佳化部署前的焊接路徑,縮短試運行週期並提高整體設備效率(OEE)。隨著模組化單元價格更加親民,並透過三至五年的租賃協議資金籌措,其應用範圍正從一級OEM廠商擴展到中級供應商。由此帶來的生產力提升正在將勞動力短缺從瓶頸轉變為現代化的催化劑。

電動車相關焊接需求快速成長

電池托盤和機殼的生產需要將鋁材與鋼材連接,同時限制熱影響區。工作波長為 1030 奈米的光纖雷射可達到超過每分鐘 10 公尺的穿透速度,取代電阻點焊,並省去了 6000 系列擠壓件的後後處理工序。這項轉變滿足了聯合國歐洲經濟委員會 (UN ECE) R100 安全法規對電池組嚴格公差的要求。隨著歐洲系統整合商擴大生產線以滿足不斷成長的電動車產量,通快 (TRUMPF) 延長了其多千瓦雷射系統的前置作業時間。製程監控模組可記錄熔池尺寸和能量輸入,產生車輛類型認證所需的可追溯性記錄。因此,雷射焊接的投資能夠同時應對生產效率和合規性的兩大關鍵挑戰。

對先進系統和雷射系統的大量資本投入

雷射焊接單元的單價可能在20萬至200萬歐元之間,而輔助設備(例如通風和防護設備)可能會使計劃總成本翻倍。儘管雷射焊接單元能夠提高生產效率,但超過五年的投資回收期阻礙了中小企業採用該技術。由於高功率雷射設備的殘值不確定,租賃公司會收取高額風險溢價,導致資金籌措缺口進一步擴大。每年高達5萬歐元的維護合約費用(用於光學元件、冷卻系統和軟體更新)也推高了總擁有成本。因此,即使精度要求更高,許多小規模製造商仍繼續使用半自動的MAG設備,而忽略了雷射解決方案的優勢。

細分市場分析

到2025年,電弧焊接將佔據歐洲焊接設備市場56.12%的佔有率,並在2031年之前以4.94%的複合年成長率成長。電弧焊接市場規模的成長主要得益於土木工程、造船和工廠維護等領域,這些領域對電弧焊的便攜性和厚壁加工能力的需求依然十分迫切。雷射和等離子焊接系統正經歷最快的收入成長,這主要得益於使用者對鋁製車身零件和薄板電子機殼所需的窄熱影響區和高焊接速度的需求。其他焊接工藝,例如釬焊、硬焊和鍛焊,在歐洲焊接設備市場規模方面呈現7.92%的複合年成長率,這主要受電子產品小型化和歷史建築修復的推動。耗材供應商正在推出用於異種金屬連接的鋁鎳合金熔填材料,而監測Start-Ups則在產品中整合光學感測器,用於記錄輪胎邊緣形狀並實現即時品質警報。日益嚴格的焊接煙塵排放法規進一步推動了從氣焊到熔敷效率更高的逆變式MIG焊接機的轉變。隨著積層製造技術的普及,電弧沉積頭可以螺栓固定到現有的機器人上,從而無需更換整個單元即可增加收入。

第二代電弧電源採用多進程韌體,可在MIG焊接、TIG焊接和手工電弧焊接模式之間無縫切換,從而提升了代工企業的設備柔軟性。電阻點焊在汽車大批量生產線中仍將佔據一席之地,但遠端雷射焊接正逐漸取代鋁製電池機殼的部分製程。等離子焊接的細分市場正在航太引擎專案中不斷擴大,這些專案需要對鎳基高溫合金進行深熔和最小變形焊接。因此,製程多樣化反映了歐洲多元化的製造業基礎,其產品涵蓋從重型鋼結構到精密醫療設備的各個領域。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 自動化和機器人技術在歐洲生產線的普及

- 電動車焊接需求(電池托盤和輕質鋁材)快速成長

- 歐盟綠色交易下的基礎設施更新支出

- 根據歐盟電磁場暴露指令 2013/35/EU 進行合規性維修

- 手持式光纖雷射焊接機在中小企業中越來越受歡迎。

- ESG審核可追溯性平台(焊接資料分析)

- 市場限制

- 先進雷射系統需要高資本投入

- 合格焊工和培訓人員短缺

- 鋼鐵和鋁價格波動

- 電磁場 (EMF) 和煙塵暴露限值的合規成本不斷上升

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過流程

- 電弧焊接

- 電阻焊接

- 雷射焊接

- 等離子焊接

- 氣焊

- 其他焊接方法-釬焊、硬焊、鍛焊等。

- 最終用戶

- 建築和基礎設施

- 石油、天然氣和石化

- 能源與發電

- 汽車/運輸設備

- 重工業和工業設備

- 航太/國防

- 其他(特殊應用-小規模製造研討會、維護和維修、客製化焊接服務)

- 按自動化級別

- 手動的

- 半自動

- 自動/機器人控制

- 按地區

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Lincoln Electric Holdings Inc.

- ESAB Corp.

- Fronius International GmbH

- Kemppi Oy

- voestalpine Bohler Welding

- Carl Cloos SchweiBtechnik GmbH

- AMADA WELD TECH

- EWM AG

- Hobart Welders

- Denyo Co. Ltd

- WW Grainger Inc.

- Obara Corporation

- Polysoude SAS

- CEBORA SpA

- TRUMPF Group

- Air Liquide SA

- Panasonic Industry Europe GmbH

- Daihen Corp.

- IPG Photonics(EU operations)

- Plansee SE

第7章 市場機會與未來展望

The Europe Welding Equipment Market size in 2026 is estimated at USD 12.84 billion, growing from 2025 value of USD 12.22 billion with 2031 projections showing USD 16.43 billion, growing at 5.06% CAGR over 2026-2031.

Market expansion reflects accelerated equipment modernization as manufacturers migrate toward Industry 4.0 production cells that integrate sensors, software, and robotics Demand intensity rises most sharply in battery-pack assembly and lightweight aluminum joining for electric vehicles, while Green Deal infrastructure programs sustain public-sector procurement of heavy-duty welding systems. Suppliers compete on process innovations laser sources with higher beam quality, inverter-based power supplies with lower electromagnetic emissions, and weld-data analytics platforms rather than on pure pricing. Continued shortages of certified welders reinforce automation investments, and mid-sized enterprises adopt collaborative robot cells to hedge against labor volatility.

Europe Welding Equipment Market Trends and Insights

Automation & Robotics Penetration Across European Production Lines

Manufacturers across the continent install robot welding cells to offset the 300,000-worker welder gap and to meet ISO 3834 quality demands. Adaptive control algorithms adjust current and travel speed in real time, improving bead consistency on complex joint geometries. German automotive suppliers report 40% cycle-time reductions after integrating collaborative robots that share work zones with human operators. Digital twin simulations optimize weld paths before deployment, shrinking commissioning cycles and boosting overall equipment effectiveness. Adoption cascades from tier-one OEMs to mid-tier suppliers as modular cells become affordable and financeable on three- to five-year leases. The resulting productivity gains convert labor scarcity from a bottleneck into a catalyst for modernization.

Surge in EV-Related Welding Needs

Battery-tray and enclosure fabrication requires joining aluminum and steel while limiting heat-affected zones. Fiber-laser sources operating at 1,030 nm deliver penetration at speeds above 10 m/min, replacing resistance spot welding and eliminating post-processing on 6000-series extrusions. The transition supports tighter battery-pack tolerances demanded by UN ECE R100 safety rules. TRUMPF extended lead times for multi-kilowatt laser systems as European integrators ramp up lines to meet rising EV output. Process monitoring modules log melt-pool dimensions and energy input, generating traceability records essential for automotive homologation audits. Consequently, laser welding investments align with the twin imperatives of productivity and compliance.

High Capex for Advanced & Laser Systems

Laser welding cells cost EUR 200k - 2 million each, and ancillary ventilation or guarding can double project outlays. Payback horizons of five or more years deter SME buyers despite throughput benefits. Financing gaps widen as leasing companies apply higher risk premiums to high-power laser assets with uncertain residual values. Annual service contracts of EUR 50,000 for optics, chillers, and software updates inflate the total cost of ownership. Consequently, many small fabricators continue using semi-automatic MAG units even when precision demands favor laser solutions.

Other drivers and restraints analyzed in the detailed report include:

- EU Green Deal Infrastructure Spending

- Hand-Held Fiber-Laser Welders Gaining SME Adoption

- Shortage of Certified Welders & Trainers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Arc welding held 56.12% of the Europe welding equipment market share in 2025, and the segment is forecast to advance at a 4.94% CAGR through 2031. The arc category's scale is anchored in civil construction, shipbuilding, and plant-maintenance jobs where portability and thick-section capability remain essential. Laser and plasma systems capture the fastest revenue acceleration as users pursue narrow heat-affected zones and higher line speeds for aluminum body components and thin-gauge electronics housings. The European welding equipment market size tied to "other" processes soldering, brazing, forge welding posts a 7.92% CAGR on the back of electronics miniaturization and heritage-structure restoration. Consumable vendors respond with aluminum-nickel fillers for dissimilar-metal joints, while monitoring start-ups embed optical sensors that log bead geometry for real-time quality alerts. Regulations curbing welding fumes further motivate a shift from gas welding toward inverter-based MIG units that offer higher deposition efficiency. As additive manufacturing gains traction, wire-arc deposition heads bolt onto existing robots, unlocking incremental revenue without replacing the entire cell.

Second-generation arc power sources ship with multiprocess firmware that toggles seamlessly between MIG, TIG, and stick modes, boosting asset flexibility for job shops. Resistance spot welding preserves share within high-volume automotive lines, though remote-seam lasers begin to replace some stations for aluminum battery enclosures. Plasma welding's niche expands inside aerospace engine programs that require deep penetration in nickel super-alloys with minimal distortion. Process diversification, therefore, mirrors Europe's multi-speed manufacturing base, stretching from heavy steel fabrication to precision medical devices.

The Europe Welding Equipment Market Report is Segmented by Process (Arc Welding, Resistance Welding and More), by End-User (Construction & Infrastructure, Oil Gas & Petrochemicals and More), by Automation Level (Manual, Semi-Automatic and More), and by Geography (United Kingdom, Germany, France and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Lincoln Electric Holdings Inc.

- ESAB Corp.

- Fronius International GmbH

- Kemppi Oy

- voestalpine Bohler Welding

- Carl Cloos SchweiBtechnik GmbH

- AMADA WELD TECH

- EWM AG

- Hobart Welders

- Denyo Co. Ltd

- W.W. Grainger Inc.

- Obara Corporation

- Polysoude SAS

- CEBORA S.p.A

- TRUMPF Group

- Air Liquide SA

- Panasonic Industry Europe GmbH

- Daihen Corp.

- IPG Photonics (EU operations)

- Plansee SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automation & robotics penetration across European production lines

- 4.2.2 Surge in EV-related welding needs (battery trays & lightweight aluminium)

- 4.2.3 EU Green Deal infrastructure-renewal spending

- 4.2.4 Compliance retrofits triggered by EU EMF-exposure directive 2013/35/EU

- 4.2.5 Hand-held fibre-laser welders gaining SME adoption

- 4.2.6 Traceability platforms (weld-data analytics) aligned with ESG audits

- 4.3 Market Restraints

- 4.3.1 High capex for advanced & laser systems

- 4.3.2 Shortage of certified welders & trainers

- 4.3.3 Steel & aluminium price volatility

- 4.3.4 Rising compliance cost for EMF & fume-exposure limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Values, In USD Billion)

- 5.1 By Process

- 5.1.1 Arc Welding

- 5.1.2 Resistance Welding

- 5.1.3 Leser Welding

- 5.1.4 Plasma Welding

- 5.1.5 Gas Welding

- 5.1.6 Others - Soldering & Brazing, Forge Welding, etc.

- 5.2 By End-user

- 5.2.1 Construction & Infrastructure

- 5.2.2 Oil, Gas & Petrochemicals

- 5.2.3 Energy & Power Generation

- 5.2.4 Automotive & Transportation

- 5.2.5 Heavy Engineering & Industrial Equipment

- 5.2.6 Aerospace & Defence

- 5.2.7 Others (Specialized Applications - Small-scale fabrication workshops, maintenance & repair, and custom welding services)

- 5.3 By Automation Level

- 5.3.1 Manual

- 5.3.2 Semi-automatic

- 5.3.3 Automatic / Robotic

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Lincoln Electric Holdings Inc.

- 6.4.2 ESAB Corp.

- 6.4.3 Fronius International GmbH

- 6.4.4 Kemppi Oy

- 6.4.5 voestalpine Bohler Welding

- 6.4.6 Carl Cloos SchweiBtechnik GmbH

- 6.4.7 AMADA WELD TECH

- 6.4.8 EWM AG

- 6.4.9 Hobart Welders

- 6.4.10 Denyo Co. Ltd

- 6.4.11 W.W. Grainger Inc.

- 6.4.12 Obara Corporation

- 6.4.13 Polysoude SAS

- 6.4.14 CEBORA S.p.A

- 6.4.15 TRUMPF Group

- 6.4.16 Air Liquide SA

- 6.4.17 Panasonic Industry Europe GmbH

- 6.4.18 Daihen Corp.

- 6.4.19 IPG Photonics (EU operations)

- 6.4.20 Plansee SE

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment