|

市場調查報告書

商品編碼

1910543

驅蟲劑:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Insect Repellent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

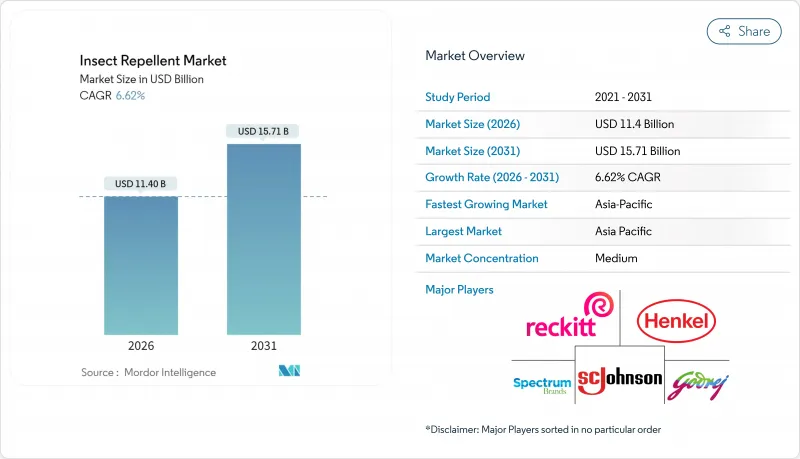

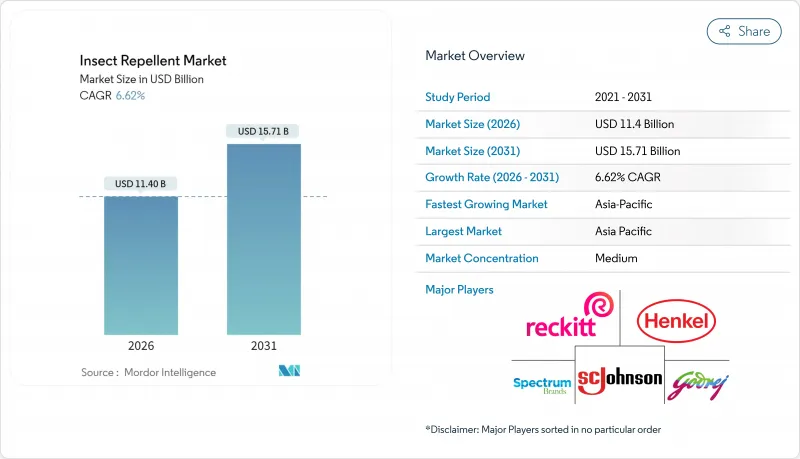

據估計,到 2026 年,驅蟲劑市場價值將達到 114 億美元,高於 2025 年的 106.9 億美元,預計到 2031 年將達到 157.1 億美元。

預計2026年至2031年年複合成長率(CAGR)為6.62%。

這一成長趨勢主要受以下因素驅動:全球對蟲媒疾病日益成長的關注、戶外生活方式的普及以及不斷創新的給藥系統,這些創新既提升了防護效果,又提高了用戶便利性。歐盟委員會已將海地和巴西列為拉丁美洲和加勒比海地區蟲媒疾病風險最高的國家。截至2025年,這兩個國家茲卡病毒和登革熱等疾病的風險指數分別為8.9和8.8。亞太地區仍然是重要的區域中心,但由於氣候變遷導致蚊蟲棲息地擴張,北美和歐洲的需求正在激增。雖然天然活性成分和空間處理方法正受到越來越多的關注,但N,N-二乙基-間-甲苯醯胺(DEET)和擬除蟲菊酯類殺蟲劑等傳統產品因其確切的功效和監管核准而保持優勢。市場參與企業正致力於研發投入、季節性促銷和加強電子商務,同時在價格敏感度和優質化之間尋求微妙的平衡。

全球驅蟲劑市場趨勢及洞察

蟲媒疾病增加

全球範圍內,蟲媒疾病呈上升趨勢。世界衛生組織(世衛組織)在2024年9月發布的情況說明書中指出,由蚊子和蜱蟲等節肢動物傳播的疾病每年造成的死亡人數將超過70萬人。氣候變遷正推動蟲媒棲地向北遷移,使瘧疾和登革熱的威脅蔓延至以往較安全的溫帶地區。根據美國疾病管制與預防中心(CDC)統計,2024年北美、中美洲、南美洲和加勒比海地區報告的登革熱病例超過1,300萬例。預計這些地區的登革熱感染率在2025年仍將居高不下。疫情的激增推動了新受影響地區對驅蚊劑的需求。此外,瘧疾傳播蚊子對擬除蟲菊酯類殺蟲劑的抗藥性是一個全球性問題,目前已影響超過80%的監測區域。這種抗藥性促使消費者尋求替代活性成分,並推動了新配方的研發。為因應這些挑戰,各國政府衛生機構正在加強個人防護措施的建議。特別是,美國疾病管制與預防中心(CDC)已將避蚊胺(DEET)、派卡瑞丁(picaridin)和IR3535列為有效防護疾病媒介的首選產品。

增加戶外休閒活動

疫情引發的生活型態改變導致戶外休閒參與度顯著提升。例如,戶外基金會報告稱,到2024年,美國將有超過6,340萬人至少參與一次健行。這是自2010年以來的最高參與率,比過去15年增加了約31個百分點。探險旅遊和戶外運動裝備的銷售與驅蟲劑市場的成長呈正相關,因為消費者擴大將驅蟲功能融入他們的休閒裝備中。這一趨勢正從傳統的露營和健行擴展到戶外用餐、節日慶典和都市區綠地利用等領域,從而將市場範圍擴大到自然愛好者之外。此外,建設業、農業和園林綠化等領域的專業戶外工作者(這些領域以往往往被忽視)也顯著推動了對商用驅蟲劑的需求。

與替代保護措施衝突

替代防護技術正日益進入傳統驅蚊產品市場。儘管其有效性仍有爭議,但經Permethrin處理的衣物、蚊帳和電子設備等產品正吸引消費者的目光。系統性綜述表明,電子驅蚊器無法有效防止蚊蟲叮咬。然而,消費者仍然青睞這些產品,因為它們方便易用且不含化學物質。雖然經Permethrin處理的衣物比外用驅蚊劑具有更持久的防護效果,但這種優勢也帶來了市場替代風險,尤其是在戶外專業人士和軍人使用者中。在住宅環境中,結合環境改造、生物防治和物理屏障的綜合蟲害管理策略正在減少人們對個人驅蚊產品的依賴。此外,儘管科學證據與之相悖,但聲稱具有超音波驅蚊功能的智慧型手機應用程式的興起也凸顯了消費者的這一趨勢。這意味著,消費者探索替代技術的意願可能會減緩他們從傳統產品中退出的步伐。

細分市場分析

到2025年,噴霧和氣霧劑產品將佔據45.72%的市場佔有率,這主要得益於其便利性、便攜性和即時性,深受消費者歡迎。同時,液體加濕器將成為成長最快的細分市場,到2031年複合年成長率將達到7.32%。這項快速成長得益於空間防護技術的進步以及消費者對免手動操作、持久加濕效果的需求不斷成長。儘管人們對燃燒副產物有所擔憂,但線圈式加濕器在價格敏感型市場仍具有一定的市場地位。而墊式加濕器則兼具傳統線圈式加濕器和現代液體加濕器的優點。用於綜合蟲害管理的誘餌產品由於監管障礙和複雜的施用方法,面臨著成長方面的挑戰。

液體驅蚊器受益於多項專利創新,尤其是在緩釋機制和揮發性擬除蟲菊酯配方方面。值得一提的是,Godrej Consumer Products 於 2024 年 7 月推出了“Lenofluthrin”,這是印度首個專為液體驅蚊器研發的國產驅蚊分子。這些先進配方承諾每盒驅蚊液可提供 12 小時的防護,確保活性成分的持續釋放。這項創新滿足了消費者對持久功效的需求,並減少了頻繁補塗的需要。穿戴式裝置和電子驅蚊器等新興產品類別正在將驅蚊功能融入日常用品中,但由於其有效性尚未得到檢驗且成本尚未降低,目前市場佔有率仍然有限。

截至2025年,傳統驅蚊劑將佔據82.10%的市場佔有率,這得益於其數十年來久經考驗的有效性、監管部門的核准以及DEET、派卡瑞丁和擬除蟲菊酯類製劑的成熟生產基地。同時,天然驅蚊劑正處於成長階段,預計2031年將達到8.05%的複合年成長率。這一快速成長的驅動力來自消費者健康意識的提高以及對檸檬桉油和各種精油混合物等植物活性成分的監管支持。成長率的差異顯示消費者優先事項正在轉變,越來越多的消費者願意接受較短的防護期,以換取更高的安全性和環境永續性。

研究證實了天然成分的有效性。例如,在適當濃度下,PMD(對氨基苯甲酸-3,8-二醇)對主要媒介昆蟲的驅避效果與避蚊胺(DEET)相當。此外,奈米乳化技術等進步正在提高植物組成的穩定性和生物利用度。這項創新解決了植物來源驅蚊劑的傳統難題,例如快速分解和功效不穩定。雖然消費者對天然產品的高價接受度不斷提高,顯示其具有更高的利潤潛力,但植物成分來源的匱乏可能會限制市場佔有率的快速成長。

區域分析

到2025年,亞太地區將佔全球收入的49.10%,並在2031年之前保持9.15%的最高區域複合年成長率。這主要得益於大眾對登革熱和瘧疾的持續關注。政府主導的宣傳活動以及大眾媒體的宣傳活動,顯著提高了驅蚊產品的使用率。印度的「Goodknight Flash」(含氟菊酯)展現了其本土研發能力,不僅有助於降低進口成本,也增強了供應的穩定性。可支配收入的成長正推動都市區家庭從傳統的蚊香轉向液體驅蚊劑,進一步擴大了該地區的驅蚊產品市場。

北美市場雖然落後於其他地區,但由於戶外休閒活動頻繁以及蟲媒疾病的流行,仍然是一個重要的市場。預計到2024年,美國零售額將達到3.769億美元。該地區消費者對植物來源成分的偏好使得產品可以定價較高,進而為創新產品帶來豐厚的利潤。此外,氣候變遷延長了北部各州的蚊蟲活躍期,使得驅蚊產品的需求不再局限於傳統的夏季高峰,而是呈現出穩定的月度需求。

歐洲的成長受到嚴格的化學品法規制約,該行業正轉向符合生態毒理學標準的天然配方。德國和法國走在前列,積極推廣永續性認證並鼓勵使用可回收包裝。

在中東和非洲,捐助者資助的瘧疾流行地區計畫正在加速推廣驅蚊劑的使用,並幫助低收入社區增加獲得驅蚊劑的機會。

同時,在拉丁美洲,隨著城市向熱帶地區擴張,與疾病媒介接觸的機會也隨之增加,導致對擴大和多樣化產品線以及本地生產的投資激增。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 蟲媒感染疾病增加

- 增加戶外休閒活動

- 寵物飼養量增加

- 消費者對天然產品的偏好正在改變

- 快速的技術進步推動創新

- 政府和公共衛生宣傳活動

- 市場限制

- 與其他保護方法的衝突

- 消費者對化學品的健康擔憂

- 殺蟲劑抗藥性

- 仿冒品經銷

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 餵食

- 線圈

- 噴霧/氣霧劑

- 墊

- 液體汽化器

- 其他產品類型

- 依成分類型

- 天然驅蟲劑

- 傳統驅蟲劑

- 最終用戶

- 成人

- 兒童/孩子

- 透過分銷管道

- 超級市場/大賣場

- 便利商店

- 線上零售商

- 其他分銷管道

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 瑞典

- 比利時

- 波蘭

- 荷蘭

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 泰國

- 新加坡

- 印尼

- 韓國

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 奈及利亞

- 埃及

- 摩洛哥

- 土耳其

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- SC Johnson & Son Inc.

- Reckitt Benckiser Group PLC

- Spectrum Brands Holdings Inc.

- Godrej Consumer Products Ltd.

- Dabur India Ltd.

- Henkel AG & Co. KGaA

- Newell Brands Inc.

- Enesis Group

- Quantum Health

- Jyothy Labs Limited

- Sawyer Products Inc.

- Avon Products Inc.

- Tender Corporation(Natrapel)

- Kao Corporation

- The Coleman Company, Inc.

- Merck KGaA(IR3535)

- 3M

- Coleman(Repel brand)

- Wondercide Inc.

- Sawyer Products, Inc.

- Enesis Group

第7章 市場機會與未來展望

Insect repellent market size in 2026 is estimated at USD 11.4 billion, growing from 2025 value of USD 10.69 billion with 2031 projections showing USD 15.71 billion, growing at 6.62% CAGR over 2026-2031.

This growth trajectory is largely driven by escalating global apprehensions regarding vector-borne diseases, a burgeoning outdoor lifestyle, and ongoing innovations in delivery systems that enhance both protection and user convenience. The European Commission highlights Haiti and Brazil as the foremost nations at risk of vector-borne diseases in Latin America and the Caribbean. In 2025, these countries registered index scores of 8.9 and 8.8, respectively, for diseases like the Zika virus and Dengue fever. While Asia-Pacific continues to dominate as the primary regional hub, North America and Europe are witnessing a surge in demand, spurred by climate change's expansion of mosquito habitats. Although natural active ingredients and spatial formats are gaining popularity, traditional offerings like N, N-diethyl-meta-toluamide (DEET) and pyrethroids maintain their edge due to established efficacy and regulatory acceptance. Players in the market are focusing on research and development investments, seasonal promotions, and bolstering e-commerce presence, navigating the delicate balance between price sensitivity and the trend towards premiumization.

Global Insect Repellent Market Trends and Insights

Rise in Vector-borne Diseases

Vector-borne diseases are on the rise worldwide. The World Health Organization (WHO) highlighted in its September 2024 factsheet that over 700,000 deaths occur annually due to diseases spread by mosquitoes, ticks, and other arthropods. Climate change is pushing vector habitats further north, bringing malaria and dengue threats to temperate regions that were once safe. According to the Centers for Disease Control and Prevention, in 2024, more than 13 million cases of dengue were reported in North, Central, and South America and the Caribbean. Dengue transmission in these areas remains high in 2025. This surge has led to a heightened demand for repellents in these newly at-risk areas. Furthermore, pyrethroid resistance in malaria vectors is now a global concern, affecting over 80% of monitored sites. This resistance is steering consumers towards alternative active ingredients and spurring innovation in new formulations. In response to these challenges, government health agencies are amplifying their recommendations for personal protective measures. Notably, the CDC has highlighted DEET, picaridin, and IR3535 as top choices for effective protection against disease vectors.

Increasing Outdoor Recreational Activities

In the wake of pandemic-induced lifestyle changes, outdoor recreation saw a notable uptick in participation. For example, the Outdoor Foundation reported that in 2024, over 63.4 million individuals in the U.S. engaged in hiking activities at least once. This marks the highest participation rate since 2010, showcasing a growth of approximately 31 percentage points over the past 15 years. As consumers increasingly incorporate pest protection into their recreational gear, sales in adventure tourism and outdoor sports equipment have seen a direct correlation with the growth of the repellent market. This trend isn't limited to traditional activities like camping and hiking; it now encompasses outdoor dining, festivals, and the use of urban green spaces, expanding the market's reach beyond just wilderness enthusiasts. Moreover, professional outdoor workers from sectors like construction, agriculture, and landscaping, often overlooked, are significantly boosting the demand for commercial-grade repellents.

Competition from Alternative Protection Methods

Alternative protection technologies are increasingly encroaching on the traditional repellent market. Products like permethrin-treated clothing, bed nets, and electronic devices are drawing consumer interest, even as evidence of their efficacy remains mixed. Systematic reviews indicate that electronic mosquito repellents fail to offer measurable protection against mosquito landings. Yet, consumers continue to adopt them, swayed by their perceived convenience and the allure of being chemical-free. While permethrin-treated clothing boasts a longer protection duration than topical repellents, this advantage poses a substitution risk in the market, especially for outdoor professionals and military users. In residential settings, integrated pest management strategies, merging environmental tweaks, biological controls, and physical barriers, are diminishing the dependence on personal repellent products. Furthermore, the rise of smartphone apps touting ultrasonic repellent features, despite scientific evidence debunking their effectiveness, underscores a consumer trend: a willingness to explore alternative technologies, potentially postponing the shift away from traditional products.

Other drivers and restraints analyzed in the detailed report include:

- Growing Pet Ownership

- Shifting Consumer Preferences Towards Natural Products

- Consumer Health Concerns Over Chemicals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, sprays and aerosols command the market with a 45.72% share, capitalizing on their convenience, portability, and instant application appeal to a wide range of consumers. Meanwhile, liquid vaporizers are the fastest-growing segment, boasting a 7.32% CAGR through 2031. This surge is fueled by tech advancements in spatial protection and a consumer shift towards hands-free, continuous coverage. While coils hold their ground in price-sensitive markets, despite concerns over combustion byproducts, mats strike a balance between traditional coils and modern liquid systems. Bait products, tailored for integrated pest management, face growth challenges due to regulatory hurdles and complex applications.

Liquid vaporizers are reaping the rewards of patent innovations, especially in controlled-release mechanisms and volatile pyrethroid formulations. Notably, in July 2024, Godrej Consumer Products unveiled 'Renofluthrin', India's inaugural indigenous mosquito repellent molecule, tailored for liquid vaporizers. These advanced formulations promise 12-hour protection per cartridge, ensuring a steady release of active ingredients. This innovation meets consumer demands for prolonged efficacy, reducing the need for frequent reapplications. Emerging categories like wearable devices and electronic dispensers are weaving repellent delivery into everyday products, but their market presence is still modest, awaiting validation of efficacy and a drop in costs.

In 2025, conventional insect repellents command an 82.10% market share, bolstered by decades of proven efficacy, regulatory endorsements, and a well-established manufacturing base for DEET, picaridin, and pyrethroid formulations. Meanwhile, natural insect repellents are on a growth trajectory, boasting an 8.05% CAGR through 2031. This surge is fueled by a rising consumer health consciousness and regulatory backing for botanical active ingredients, such as oil of lemon eucalyptus and various essential oil blends. The disparity in growth rates underscores a shift in consumer priorities: many now prefer shorter protection durations if it means enhanced safety and environmental sustainability.

Research underscores the efficacy of natural ingredients. For instance, PMD (para-menthane-3,8-diol) matches DEET's performance against major vector species, provided it's used in the right concentrations. Furthermore, advancements like nano-emulsion technologies bolster the stability and bioavailability of botanical ingredients. This innovation addresses the traditional challenges of plant-based repellents, such as swift degradation and variable efficacy. While there's a growing acceptance of premium pricing for natural products, hinting at potential margin expansions, challenges in sourcing botanical ingredients could temper swift market share growth.

The Insect Repellent Market is Segmented by Product Type (Bait, Coils, Sprays/Aerosols, Mats, Liquid Vaporizer, and More), by Ingredient Type (Natural Insect Repellent and Conventional Insect Repellent), by End User (Adults and Kids/Children), by Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, the Asia-Pacific region accounted for 49.10% of global revenue, and the region also registers the strongest regional CAGR at 9.15% during the period to 2031, primarily driven by the ongoing public health focus on dengue and malaria. Government-led awareness initiatives, bolstered by mass media campaigns, have significantly increased the adoption of repellents. A testament to local research and development capabilities, India's Goodknight Flash, featuring Renofluthrin, not only cuts down on import costs but also fortifies supply resilience. With rising disposable incomes, urban households are upgrading from traditional coils to liquid vaporizers, further expanding the regional insect repellent market.

North America, while trailing, boasts substantial figures, largely due to outdoor recreational activities and the spread of insect-borne diseases. In 2024, retail sales in the U.S. reached an impressive USD 376.9 million. The region's strong preference for botanical ingredients allows for premium pricing and higher margins for innovators. Additionally, climate change has lengthened the mosquito season in northern states, leading to a more consistent monthly demand for insect repellents, rather than the previously sharp summer peak.

Europe's growth is tempered by stringent chemical regulations, pushing the industry towards natural formulations that align with eco-toxicology standards. Germany and France are at the forefront, championing sustainability certifications and driving the adoption of recyclable packaging.

In the Middle East and Africa, donor-funded initiatives are bolstering distribution in malaria-prone areas, making repellents more accessible to lower-income communities.

Meanwhile, Latin America's urban sprawl into tropical regions is increasing contact with disease vectors, prompting a surge in diverse product offerings and investments in localized manufacturing.

- S.C. Johnson & Son Inc.

- Reckitt Benckiser Group PLC

- Spectrum Brands Holdings Inc.

- Godrej Consumer Products Ltd.

- Dabur India Ltd.

- Henkel AG & Co. KGaA

- Newell Brands Inc.

- Enesis Group

- Quantum Health

- Jyothy Labs Limited

- Sawyer Products Inc.

- Avon Products Inc.

- Tender Corporation (Natrapel)

- Kao Corporation

- The Coleman Company, Inc.

- Merck KGaA (IR3535)

- 3M

- Coleman (Repel brand)

- Wondercide Inc.

- Sawyer Products, Inc.

- Enesis Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Vector-borne Diseases

- 4.2.2 Increasing Outdoor Recreational Activities

- 4.2.3 Growing Pet Ownership

- 4.2.4 Shifting Consumer Preferences Towards Natural Products

- 4.2.5 Rapid Technological Advancements Driving Innovation

- 4.2.6 Government and Public Health Campaigns

- 4.3 Market Restraints

- 4.3.1 Competition from Alternative Protection Methods

- 4.3.2 Consumer Health Concerns Over Chemicals

- 4.3.3 Insecticide Resistance

- 4.3.4 Availability of Counterfeit Products

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Bait

- 5.1.2 Coils

- 5.1.3 Sprays/Aerosols

- 5.1.4 Mats

- 5.1.5 Liquid Vaporizer

- 5.1.6 Other Product Types

- 5.2 By Ingredient Type

- 5.2.1 Natural Insect Repellent

- 5.2.2 Conventional Insect Repellent

- 5.3 By End User

- 5.3.1 Adults

- 5.3.2 Kids/Children

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 S.C. Johnson & Son Inc.

- 6.4.2 Reckitt Benckiser Group PLC

- 6.4.3 Spectrum Brands Holdings Inc.

- 6.4.4 Godrej Consumer Products Ltd.

- 6.4.5 Dabur India Ltd.

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Newell Brands Inc.

- 6.4.8 Enesis Group

- 6.4.9 Quantum Health

- 6.4.10 Jyothy Labs Limited

- 6.4.11 Sawyer Products Inc.

- 6.4.12 Avon Products Inc.

- 6.4.13 Tender Corporation (Natrapel)

- 6.4.14 Kao Corporation

- 6.4.15 The Coleman Company, Inc.

- 6.4.16 Merck KGaA (IR3535)

- 6.4.17 3M

- 6.4.18 Coleman (Repel brand)

- 6.4.19 Wondercide Inc.

- 6.4.20 Sawyer Products, Inc.

- 6.4.21 Enesis Group