|

市場調查報告書

商品編碼

1910535

機器人流程自動化 (RPA) – 市場佔有率分析、產業趨勢與統計、成長預測 (2026-2031)Robotic Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

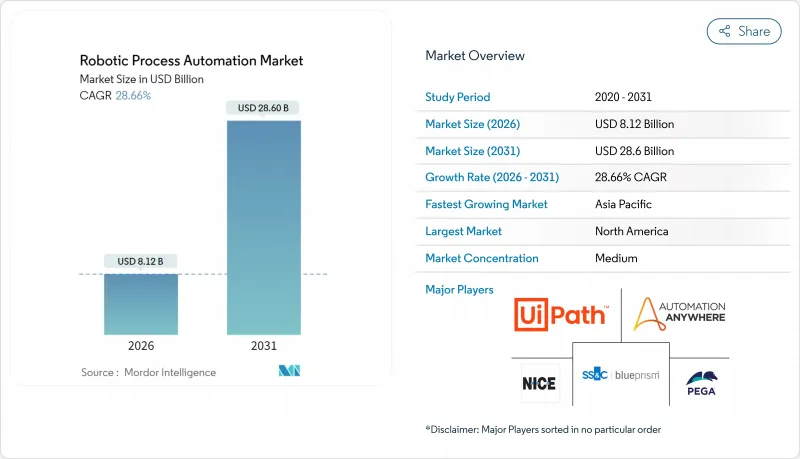

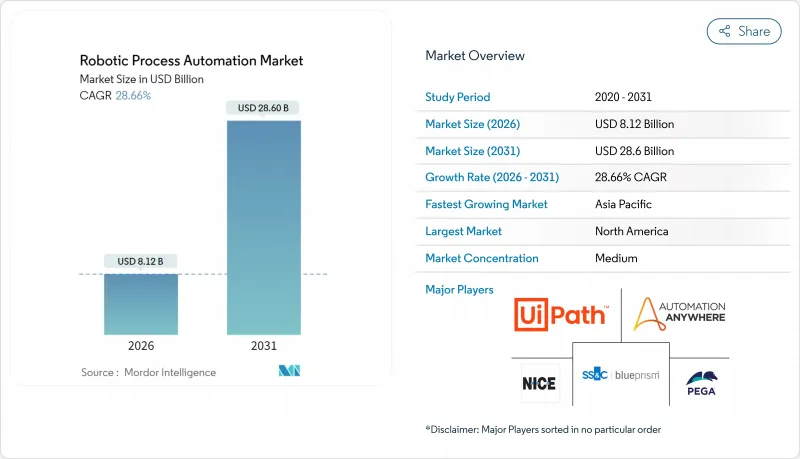

預計到 2025 年,機器人流程自動化 (RPA) 市場價值為 63.1 億美元,到 2026 年將成長至 81.2 億美元,到 2031 年將達到 286 億美元,預測期(2026-2031 年)的複合年成長率為 28.66%。

生成式人工智慧與現有RPA平台的日益融合,正在拓展可自動化任務的範圍,使企業能夠處理以往需要人工干預的非結構化流程。雲端原生部署縮短了引進週期,並將支出轉移到營運預算中,也推動了市場擴張。北美地區憑藉著嚴格的合規要求和成熟的技術生態系統,預計到2024年將佔據機器人流程自動化市場39.6%的最大佔有率。同時,亞太地區在政府支持的自動化項目以及中小企業採用計量收費機器人的推動下,實現了34.5%的最高區域複合年成長率。供應商之間的競爭日益激烈,各公司透過專注於人工智慧的收購和合作,將智慧文件處理、低程式碼設計和自主代理功能整合到其平台藍圖中。

全球機器人流程自動化市場趨勢與洞察

零售全通路訂單履行自動化

為了滿足消費者對即時購物的需求,零售商正在實現庫存核對、出貨協調和退貨管理的自動化。 Grupo Exito 在實施了一項企業級 RPA 專案後,將訂單處理時間縮短了高達 75%。此專案將電商前端與原有 ERP 資料連接起來。即使在高峰期,電腦視覺模組的整合也能保持 98% 以上的準確率,而人工智慧輔助的需求預測則有助於在供應鏈波動的情況下管理利潤率。因此,無論是在成熟市場還是新興電商市場,零售商都將自動化視為應對物流中斷和勞動力短缺的必要措施。

中小企業採用雲端原生RPA平台

計量收費的SaaS模式降低了中小企業的進入門檻。 Jana Small Finance Bank在遷移到UiPath雲端服務後,關鍵流程的處理時間縮短了約70%,而且無需任何本地基礎設施。超大規模服務供應商正在將RPA整合到其市場中,使中小企業能夠在幾天內部署安全的機器人,並僅根據交易量的成長擴展許可證。分析師預測,到2027年,隨著公民開發者工具的成熟和產業專用的模板的普及,中小企業將推動超過40%的新機器人部署。

由於使用者介面變更,機器人問題持續存在。

企業和SaaS應用中頻繁的介面更新會導致選擇器失效,使機器人無法運行,從而導致高達40%的年度自動化預算被用於被動維護。 Tarsus Distribution由於供應商格式變更被迫重新設計其發票工作流程,凸顯了其舊版螢幕抓取機器人的脆弱性。儘管新世代平台增加了物件式的選擇器和自癒功能,但缺乏變更管理仍然會拖慢擴展計畫的步伐,並降低人們對早期專案的信心。

細分市場分析

在機器人流程自動化 (RPA) 市場,受監管產業對本地管理的需求驅動,到 2025 年,本地部署仍將佔據主導地位,市場佔有率達 53.62%。然而,隨著安全認證的普及,雲端部署將以 36.95% 的複合年成長率 (CAGR) 實現最高成長,並縮小與本地部署的差距。據 UiPath 稱,超過 80% 的新契約來自雲端訂閱,客戶的部署速度比本地部署快 50%。混合模式正變得越來越流行,歐洲銀行將敏感的支付工作流程保留在內部,同時利用雲端租戶進行設計、測試和分析。這種柔軟性使企業能夠在滿足居住要求的同時,保持擴充性。

隨著邊緣運算技術的成熟,供應商開始提供輕量級執行環境,這些環境可在本地運行,但由雲端進行編配。此類架構可降低工廠車間機器人的延遲,同時最大限度地減少伺服器管理開銷。因此,許多製造商計劃在未來三年內將其非生產機器人遷移到SaaS平台,因為SaaS簡化了修補程式管理,並可即時獲得AI升級。預計這一轉變將推動訂閱收入從永久授權收入成長,從而持續擴大機器人流程自動化市場。

到2025年,軟體平台將佔總營收的51.05%,而服務板塊正以34.1%的複合年成長率快速成長,因為各組織逐漸意識到以人為本的變革管理是成功的關鍵。採用者正擴大整合探索、重塑和公民開發者輔導,這些環節合計約佔整體轉型預算的60%。 SS&C Technologies將Blue Prism軟體與諮詢服務結合,使其機器人數量增加了兩倍,並節省了1億美元的成本。

對持續改進服務合約的需求也在不斷成長,因為持續調整人工智慧模型對於智慧自動化至關重要。供應商現在提供的託管服務是基於服務等級協定 (SLA) 而非單一計劃里程碑來保證成果。這種轉變進一步擴大了 RPA 服務市場的佔有率,並凸顯了該行業從工具實施向企業級業務模式重塑的演變。

機器人流程自動化市場按部署類型(本地部署/雲端部署/SaaS)、解決方案組件(軟體/服務)、公司規模(中小企業/大型企業)、技術類型(有人值守RPA/無人值守RPA/智慧RPA/認知RPA)、最終用戶產業(金融/保險/證券/IT/電信/醫療保健等)和地區進行細分。市場預測以美元計價。

區域分析

北美地區在2025年仍保持領先地位,市佔率達到39.12%,主要得益於早期採用趨勢以及政府和金融服務領域嚴格的合規要求。例如,美國住房與城市發展部等機構正在採用RPA和機器學習相結合的方法來改善福利處理流程。加州機動車輛管理局(DMV)等州級機構則利用機器人來加速數位化駕照發放服務,從而確保在疫情期間業務的持續運作。供應商格局受益於豐富的系統整合能力和熟練的自動化專業人員,這將確保市場持續成長。

亞太地區是成長最快的地區,複合年成長率高達33.6%。日本的RPA(機器人流程自動化)解決方案「Robopat DX」在中小企業中的安裝量已超過1700套,這表明在人手不足的市場中,該技術擁有強大的市場基礎。印度馬尼帕爾醫院已實現財務工作流程自動化,以符合不斷改進的數位化醫療法規。政府補貼和對本地語言介面的支持預計將進一步推動製造業和外包地區的RPA應用,從而進一步擴大該地區的RPA市場。

歐洲的發展趨勢正受到《數位業務韌性法案》的影響,該法案要求銀行記錄並對其自動化工作流程進行壓力測試。金融機構已撥出高達1500萬歐元的多年預算,以確保在2025年之前達到合規要求。德國製造商正在推動後勤部門營運的進階自動化,北歐醫療保健系統則在各地區部署共用的機器人庫。混合部署結構(資料儲存在本地,但透過雲端主機進行管理)正逐漸成為常態,機器人流程自動化市場在歐盟成員國的佔有率也在穩步成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全通路零售中的訂單履行自動化

- 中小企業雲端原生RPA平台採用現狀

- 基於生成式人工智慧的機器人設計助手

- 超大規模市場的計量收費機器人

- DORA 和 HIPAA 的合規主導自動化

- 全球共用服務中心人才短缺

- 市場限制

- 由於使用者介面變更,機器人問題持續存在。

- 無人機器人的管治與倫理監督

- 從傳統RPA套件轉換過來成本高昂

- 新興市場流程標準化程度低

- 產業價值鏈分析

- 監管環境

- 技術展望

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 透過部署

- 本地部署

- 雲/SaaS

- 按解決方案組件

- 軟體(平台和許可)

- 服務(實施、卓越中心、支援)

- 按公司規模

- 中小企業

- 主要企業

- 依技術類型

- 參加了RPA

- 無人值守的RPA

- 智慧型/認知型RPA

- 按最終用戶行業分類

- BFSI

- 資訊科技和電信

- 衛生保健

- 零售與消費品包裝 (CPG)

- 製造業

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 新加坡

- 馬來西亞

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- UiPath Inc.

- Automation Anywhere Inc.

- SS&C Blue Prism Ltd.

- NICE Ltd.(Robotic Automation)

- Pegasystems Inc.

- Kofax Inc.

- WorkFusion Inc.

- Kryon Systems Ltd.

- EdgeVerve Systems Ltd.

- AntWorks Pte Ltd.

- Laiye Technology Ltd.

- Cyclone Robotics Co. Ltd.

- AutomationEdge Technologies Inc.

- Datamatics Global Services Ltd.

- Nividous Software Solutions

- Soroco

- Redwood Software Inc.

- Microsoft Corp.(Power Automate)

- Servicetrace GmbH

- Jidoka(Novayre Solutions)

- Fortra LLC(ex-HelpSystems)

- ElectroNeek Robotics Inc.

- Robocorp Technologies Inc.

- Robiquity Ltd.

- Rocketbot SpA

- OpenConnect Systems Inc.

第7章 投資分析

第8章:市場機會與未來趨勢

- 評估差距和未滿足的需求

The Robotic Process Automation Market was valued at USD 6.31 billion in 2025 and estimated to grow from USD 8.12 billion in 2026 to reach USD 28.6 billion by 2031, at a CAGR of 28.66% during the forecast period (2026-2031).

Increasing integration of generative AI with established RPA platforms widens the range of automatable tasks and lets enterprises address unstructured processes that once required human intervention. Expansion is also fueled by cloud-native deployments that shorten implementation cycles and shift spending to operating budgets. North America held the largest Robotic Process Automation market share at 39.6% in 2024, supported by stringent compliance mandates and mature technology ecosystems, while Asia-Pacific is registering the fastest regional CAGR of 34.5% as governments sponsor automation programs and SMEs adopt pay-as-you-go bots. Vendor competition is intensifying through AI-focused acquisitions and partnerships that bundle intelligent document processing, low-code design, and autonomous agent capabilities into platform roadmaps.

Global Robotic Process Automation Market Trends and Insights

Retail Omni-Channel Order-Fulfilment Automation

Retailers are automating inventory reconciliation, shipment orchestration, and return management to keep pace with real-time consumer expectations. Grupo Exito cut order-processing times by up to 75% after deploying an enterprise-wide RPA program that links e-commerce front ends with legacy ERP data. Integration of computer-vision modules maintains accuracy above 98% during peak seasons, while AI-assisted demand forecasting helps retailers manage margin pressure amid supply-chain volatility. Retailers in both mature and emerging e-commerce markets, therefore, view automation as an essential hedge against logistics disruptions and labor shortages.

SME Adoption of Cloud-Native RPA Platforms

Consumption-based SaaS models are lowering entry barriers for small firms. Jana Small Finance Bank shortened critical process turnaround times by nearly 70% after migrating to UiPath's cloud service, with no on-premise infrastructure required. As hyperscale providers embed RPA into their marketplaces, SMEs can deploy secure bots within days and scale licenses only when transaction volumes rise. Analysts expect SMEs to drive more than 40% of net-new bot deployments by 2027 as citizen-developer tools mature and industry-specific templates proliferate.

Persistent Bot Breakage from UI Changes

Frequent interface updates in enterprise and SaaS apps disrupt selectors and render bots inoperable, consuming up to 40% of annual automation budgets for reactive maintenance. Tarsus Distribution had to redesign invoice workflows when supplier formats shifted, highlighting the fragility of legacy, screen-scraping bots. Newer platforms add object-based selectors and self-healing functions, yet change-management shortcomings continue to delay scaling plans and erode confidence in early-stage programs.

Other drivers and restraints analyzed in the detailed report include:

- Gen-AI-Powered Bot-Design Assistants

- Pay-as-You-Go Bots on Hyperscale Marketplaces

- Governance and Ethical Scrutiny of Unattended Bots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise installations remained dominant at 53.62% of the Robotic Process Automation market in 2025 because heavily regulated sectors required local control. Cloud deployments nevertheless posted the highest 36.95% CAGR and will narrow the gap as security certifications expand. UiPath stated that more than 80% of new bookings stem from cloud subscriptions, and customers achieve rollouts 50% faster than on-premise equivalents. The hybrid pattern is gaining ground as European banks keep sensitive payment workflows in-house while using cloud tenants for design, test, and analytics. This flexibility lets firms satisfy residency mandates without forfeiting elastic capacity.

As edge computing matures, vendors package lightweight run-times that execute locally yet receive orchestration from the cloud. Such architectures reduce latency for factory-floor bots while minimizing server administration overhead. Consequently, many manufacturers plan to migrate their non-production robots to SaaS within three years, citing simplified patching and immediate access to AI upgrades. The resulting shift will continue to boost the Robotic Process Automation market as subscription revenue overtakes perpetual licenses.

Software platforms controlled 51.05% of revenue in 2025, but services are expanding at a 34.1% CAGR as organizations recognize that people-centric change management dictates success. Implementers increasingly bundle discovery, re-engineering, and citizen-developer coaching, representing roughly 60% of total transformation budgets. SS&C Technologies realized USD 100 million in cost savings by pairing Blue Prism software with advisory services that tripled its bot count.

Demand for continuous-improvement retainers is also rising because intelligent automation requires ongoing AI model tuning. Vendors now position managed service offers that guarantee SLA-based outcomes rather than discrete project milestones. This pivot further inflates the Robotic Process Automation market size allocated to services and underscores the sector's progression from tool adoption toward enterprise-wide operating model redesign.

Robotic Process Automation Market is Segmented by Deployment (On-Premise and Cloud/SaaS), Solution Component (Software and Services), Enterprise Size (Small and Medium Enterprises and Large Enterprises), Technology Type (Attended RPA, Unattended RPA, and Intelligent/Cognitive RPA), End-User Industry (BFSI, IT and Telecom, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with a 39.12% share in 2025, propelled by early adoption curves and rigorous compliance mandates across government and financial services. Agencies such as the U.S. Department of Housing and Urban Development employ combined RPA and machine-learning approaches to modernize benefit processing. State entities like the California DMV leveraged bots to accelerate digital licensing services, allowing continuity during pandemic disruptions. The vendor landscape benefits from abundant system-integrator capacity and skilled automation professionals, ensuring continuous pipeline growth.

Asia-Pacific is the fastest-growing geography at 33.6% CAGR. Japan's RPA Robopat DX passed 1,700 SME implementations, signaling grassroots demand in a tight labor market. India's Manipal Hospitals automated finance workflows to comply with expanding digital health regulations. Government subsidy schemes and local-language interface support will further widen adoption among manufacturers and outsourcing hubs, magnifying the Robotic Process Automation market in the region.

Europe's trajectory is shaped by the Digital Operational Resilience Act, which compels banks to document and stress-test automated workflows. Institutions have earmarked multi-year budgets reaching EUR 15 million per entity to meet the 2025 compliance deadline. German manufacturers showcase deep back-office automation, while Nordic healthcare systems deploy region-wide shared-bot libraries. Hybrid deployment structures that retain data on-premise yet orchestrate via cloud consoles are becoming the norm, steadily increasing the Robotic Process Automation market presence across European Union member states.

- UiPath Inc.

- Automation Anywhere Inc.

- SS&C Blue Prism Ltd.

- NICE Ltd. (Robotic Automation)

- Pegasystems Inc.

- Kofax Inc.

- WorkFusion Inc.

- Kryon Systems Ltd.

- EdgeVerve Systems Ltd.

- AntWorks Pte Ltd.

- Laiye Technology Ltd.

- Cyclone Robotics Co. Ltd.

- AutomationEdge Technologies Inc.

- Datamatics Global Services Ltd.

- Nividous Software Solutions

- Soroco

- Redwood Software Inc.

- Microsoft Corp. (Power Automate)

- Servicetrace GmbH

- Jidoka (Novayre Solutions)

- Fortra LLC (ex-HelpSystems)

- ElectroNeek Robotics Inc.

- Robocorp Technologies Inc.

- Robiquity Ltd.

- Rocketbot SpA

- OpenConnect Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Retail omni-channel order-fulfilment automation

- 4.2.2 SME adoption of cloud-native RPA platforms

- 4.2.3 Gen-AI powered bot-design assistants

- 4.2.4 Pay-as-you-go bots on hyperscale marketplaces

- 4.2.5 Compliance-driven automation post-DORA and HIPAA

- 4.2.6 Global talent shortages in shared-service centres

- 4.3 Market Restraints

- 4.3.1 Persistent bot breakage from UI changes

- 4.3.2 Governance and ethical scrutiny of unattended bots

- 4.3.3 High switching cost from legacy RPA suites

- 4.3.4 Low process standardisation in emerging markets

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud/SaaS

- 5.2 By Solution Component

- 5.2.1 Software (Platforms and Licences)

- 5.2.2 Services (Implementation, CoE, Support)

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By Technology Type

- 5.4.1 Attended RPA

- 5.4.2 Unattended RPA

- 5.4.3 Intelligent/Cognitive RPA

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Healthcare

- 5.5.4 Retail and CPG

- 5.5.5 Manufacturing

- 5.5.6 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Malaysia

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 UiPath Inc.

- 6.4.2 Automation Anywhere Inc.

- 6.4.3 SS&C Blue Prism Ltd.

- 6.4.4 NICE Ltd. (Robotic Automation)

- 6.4.5 Pegasystems Inc.

- 6.4.6 Kofax Inc.

- 6.4.7 WorkFusion Inc.

- 6.4.8 Kryon Systems Ltd.

- 6.4.9 EdgeVerve Systems Ltd.

- 6.4.10 AntWorks Pte Ltd.

- 6.4.11 Laiye Technology Ltd.

- 6.4.12 Cyclone Robotics Co. Ltd.

- 6.4.13 AutomationEdge Technologies Inc.

- 6.4.14 Datamatics Global Services Ltd.

- 6.4.15 Nividous Software Solutions

- 6.4.16 Soroco

- 6.4.17 Redwood Software Inc.

- 6.4.18 Microsoft Corp. (Power Automate)

- 6.4.19 Servicetrace GmbH

- 6.4.20 Jidoka (Novayre Solutions)

- 6.4.21 Fortra LLC (ex-HelpSystems)

- 6.4.22 ElectroNeek Robotics Inc.

- 6.4.23 Robocorp Technologies Inc.

- 6.4.24 Robiquity Ltd.

- 6.4.25 Rocketbot SpA

- 6.4.26 OpenConnect Systems Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 White-Space and Unmet-Need Assessment