|

市場調查報告書

商品編碼

1910531

臉部認證:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Facial Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

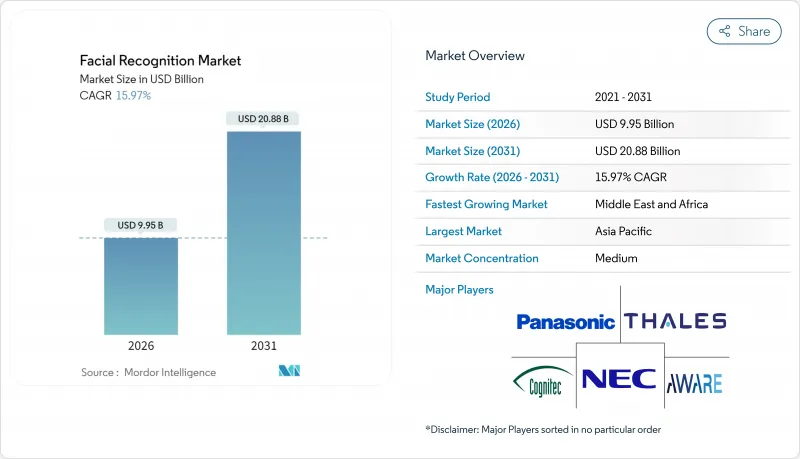

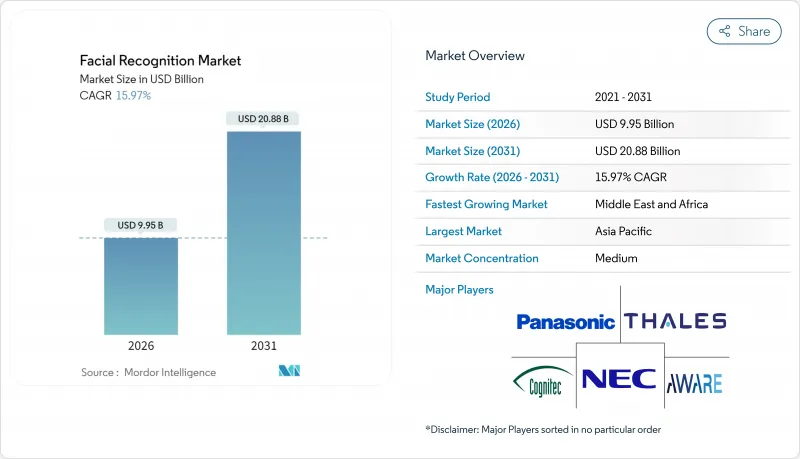

預計臉部辨識市場將從 2025 年的 85.8 億美元成長到 2026 年的 99.5 億美元,到 2031 年將達到 208.8 億美元,2026 年至 2031 年的複合年成長率為 15.97%。

目前的成長依賴於邊緣運算架構,該架構能夠在亞秒級推理的同時,將生物識別資料保存在設備端,這是諸如中國《臉部辨識技術安全管理方法》等新法規所要求的。歐盟人工智慧法律中嚴格的使用者同意規則引導歐洲買家選擇隱私保護型設計,並鼓勵供應商預設整合差分隱私、同態加密和聯邦學習等技術。硬體小型化和低功耗人工智慧加速器使得智慧型手機、執法記錄器和自助服務終端能夠作為註冊點,將目標用戶群擴展到固定CCTV之外。最後,支付、乘客互動和零售分析等應用程式正在補充傳統的安全應用場景,實現收入來源多元化,並平滑各地區的需求週期。

全球臉部辨識市場趨勢與洞察

加快新興亞洲國家採用國民身分證和電子護照的步伐

越南計畫在2025年在所有邊境生物識別。新加坡的目標是到2026年將樟宜機場免護照通道的等待時間縮短40%,並實現95%的自動化。馬來西亞和巴布亞紐幾內亞也計劃在全國推廣生物辨識技術,這將使亞太地區的註冊用戶總數超過8億,打造全球最大的設備臉部認證系統測試平台。供應商將獲得授權收入和參考架構,這些架構都將影響從非洲到拉丁美洲的公共部門競標。透過這些計劃開發的互通性標準將降低金融服務提供者日後重複使用相同身分錢包時的整合風險。這將帶動臉部認證市場對軟體、邊緣硬體和合規管理服務的結構性需求成長。

基於邊緣運算的智慧攝影機在零售連鎖店中迅速普及

預計到2024年,美國有組織零售犯罪造成的損失將超過1,000億美元,這將加速邊緣人工智慧攝影機的普及應用。這些攝影機無需將資料傳輸到雲端伺服器即可分析人臉和行為。 Asda與FaceTech合作的試點計畫實現了99.992%的準確率,即時刪除不匹配的資料以滿足GDPR的要求。美國排名前50的雜貨店中有15家正在使用臉部辨識技術來辨識慣犯並偵測員工與顧客之間的串通行為(例如「甜心詐騙」)。基於Nvidia Jetson或EdgeCortix SAKURA-II開發板的即時分析可以減少商品損失,並為行銷系統產生客戶分析數據,從而在幾個月內為零售商帶來明顯的投資收益(ROI)。由於臉部辨識損失預防和個人化客戶體驗的雙重優勢,零售業仍是私部門中人臉辨識技術應用成長最快的領域。

更嚴格的GDPR生物識別同意要求(歐盟27國)

歐盟人工智慧法將遠端生物識別列為「高風險」技術,並禁止執法機關即時使用,僅有少數例外情況。該法也禁止在職場使用情緒辨識技術。企業必須進行資料保護影響評估,證明其合法權益,並在存在權力不對等的情況下獲得明確同意。隨著整合商添加遮罩功能、設備端處理和審核日誌,合規成本將增加20%至30%。雖然開發歐盟相容版本的供應商傾向於在其他市場重複使用隱私納入設計架構,但隨著小型公司選擇退出或推遲進入歐洲市場,臉部辨識的近期普及速度正在放緩。

細分市場分析

2025年,隨著演算法改進將誤報率降低至0.1%以下,軟體將佔全球收入的57.20%,從而能夠在標準CPU上部署。邊緣硬體將成為成長最快的細分市場,複合年成長率將達到18.76%,因為金融和醫療保健行業的合規團隊要求生物識別模板不得離開辦公室。 SAKURA-II晶片能夠在10W的功耗預算內運行複雜的模型,從而支援便利商店和交通樞紐的自助服務終端。

基於 API 的授權模式使開發者能夠在數小時內將臉部認證功能整合到行動應用中,從而避免了傳統承包計劃通常需要數年才能完成的週期。同時,供應商將電腦視覺 SDK 與安全元件儲存和專用加速器捆綁銷售,確保了持續的收入來源,因為每個新的分析模組都以韌體提供。這種雙邊模式在推動軟體普及的同時,也提高了臉部辨識市場的轉換成本。

基於現有CCTV基礎設施的2D演算法將在2025年佔據43.10%的收入佔有率。然而,能夠分析微表情、注意力持續時間和困倦程度的「情緒人工智慧」引擎將以18.11%的複合年成長率成長,從而重塑客戶體驗和道路安全應用。隨著零售商、保險公司和汽車製造商將行為分析洞察轉化為實際收益,預計到2031年,基於分析主導模組的臉部辨識市場規模將增加3.4倍。

此混合堆疊將 3D 深度資訊與 2D RGB 幀融合,以防止偽造並實現符合 ISO/IEC 30107-3 標準的生物識別驗證。 Suprema 的 Q-Vision Pro 每台機器最多可驗證 50,000 個用戶,並為所有交易提供端對端加密,使 ATM 運營商能夠取消 PIN 碼墊片。這種安全和分析技術的結合持續推動著豐富的研發投入,並實現了授權、硬體和服務層面的多元化收入來源。

區域分析

至2025年,亞洲將佔NEC總收入的38.25%,這主要得益於各國政府致力於將臉部認證融入數位公共基礎設施。中國的「安全管理措施」要求所有儲存超過10萬個模板的企業向省級網路安全部門註冊,這構成了一道篩選門檻,有利於擁有安全供應鏈的成熟供應商。在2025年日本大阪關西博覽會上,NEC的臉部認證支付系統將投入120萬參觀者使用,這為NEC向東南亞地區拓展出口業務提供了絕佳的示範機會。

預計中東地區將以16.88%的複合年成長率成長,阿拉伯聯合大公國的生物辨識身分識別系統將取代銀行、醫療保健和公共入口網站的塑膠卡。杜拜機場正計劃推出一套無需護照的旅行系統,將乘客的臉部資料與報到和零售錢包連接起來,使該地區成為無摩擦出行的試驗場。海灣國家政府正在資助試點項目,並迅速將其轉化為國家政策,從而縮短了引進週期,並加快了臉部認證市場供應商的收入成長。

北美地區由於航空公司部署和執法機關預算的重要性,仍佔據重要地位,但也面臨最高的訴訟風險。儘管客運量成長毋庸置疑,但國會對美國運輸安全管理局(TSA)擴張的審查凸顯了公民自由的擔憂。運輸安全局的碎片化導致各州法律五花八門,例如伊利諾伊州的《生物識別資訊隱私法案》(BIPA)和加州的《加州消費者隱私法案》(CPRA),這使得跨州部署變得複雜。歐洲嚴格的監管雖然減緩了城市即時監控的速度,但也增加了對能夠進行設備端編輯和授權管理的邊緣設備的需求,從而使隱私技術供應商在臉部辨識行業站穩了腳跟。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 目錄

第2章 引言

- 研究假設和市場定義

- 調查範圍

第3章調查方法

第4章執行摘要

第5章 市場情勢

- 市場促進因素

- 加快新興亞洲國家採用國民身分證和電子護照的步伐

- 零售連鎖店對邊緣智慧攝影機的需求激增

- 北美航空公司將強制使用生物識別登機

- 海灣合作理事會金融科技領域迅速普及臉部認證支付與簡易身分驗證錢包

- 市場限制

- 更嚴格的GDPR生物識別同意要求(歐盟27國)

- 美國演算法偏見訴訟風險

- 中國網路安全2.0硬體認證瓶頸

- 市民反對擴大全市監視錄影機覆蓋範圍

- 監理展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第6章 市場規模與成長預測

- 按組件

- 硬體

- 網路攝影機和感測器

- 邊緣人工智慧晶片

- 軟體

- 臉部偵測和對齊

- 特徵提取與匹配

- 活體檢測

- 服務

- 託管服務

- 專業服務

- 硬體

- 透過技術

- 2D人臉部認證

- 3D臉部辨識

- 熱感/紅外線臉部認證

- 臉部分析和情緒人工智慧

- 混合和多模態演算法

- 透過部署

- 本地部署

- 基於雲端的

- 邊緣/設備端

- 依設備類型

- 固定監視錄影機

- 行動和穿戴裝置

- 智慧型手機

- 執法記錄儀

- 自助服務終端和存取終端

- 透過使用

- 安全與監控

- 邊境管制/電子門

- 公共區域CCTV分析

- 存取控制

- 企業和校園入口

- 智慧鎖(住宅專用)

- 身份驗證/電子KYC

- 數位銀行註冊

- SIM卡註冊

- 支付和交易

- Face Pay(零售POS)

- 客戶分析與個人化

- 店內定向廣告

- 安全與監控

- 最終用戶

- 政府和執法機關

- BFSI

- 零售與電子商務

- 衛生保健

- 汽車/運輸設備

- 通訊/IT

- 飯店和娛樂

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- ASEAN

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第7章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- NEC Corporation

- Thales Group

- IDEMIA

- Panasonic Corp.

- Aware, Inc.

- Cognitec Systems GmbH

- Face++, Megvii Technology

- SenseTime Holdings

- Clearview AI

- Daon, Inc.

- FacePhi Biometria SA

- AnyVision(now Oosto)

- SAFR(RealNetworks Inc.)

- CyberLink Corp.

- Innovatrics

- Suprema Inc.

- Herta Security

- iProov Ltd.

- Corsight AI

- VisionLabs

第8章:市場機會與未來展望

- 閒置頻段與未滿足需求評估

The Facial Recognition market is expected to grow from USD 8.58 billion in 2025 to USD 9.95 billion in 2026 and is forecast to reach USD 20.88 billion by 2031 at 15.97% CAGR over 2026-2031.

Growth now relies on edge-based architectures that deliver sub-second inference while allowing biometric data to remain on-device, a requirement embedded in new laws such as China's Security Management Measures for Facial Recognition Technology. Stricter consent rules under the EU AI Act steer European buyers toward privacy-preserving designs, pushing vendors to integrate differential privacy, homomorphic encryption, and federated learning by default. Hardware miniaturization and low-power AI accelerators have turned smartphones, body cameras, and kiosks into enrolment points, broadening the addressable base well beyond fixed CCTV. Finally, payments, passenger facilitation, and retail analytics now complement traditional security use cases, diversifying revenue streams and smoothing demand cycles across regions.

Global Facial Recognition Market Trends and Insights

Accelerating National ID and e-Passport Roll-outs in Emerging Asia

By 2025 Vietnam requires biometric authentication at every border, while Singapore's passport-free lanes at Changi have cut wait times by 40% and target 95% automated use by 2026. Malaysia and Papua New Guinea have scheduled nationwide deployments that push cumulative APAC enrolments above 800 million citizens, creating the world's largest testing ground for on-device facial verification systems. Vendors gain not only licence revenue but also reference architectures that influence public-sector bids from Africa to Latin America. Interoperability standards drafted in these projects reduce integration risk for financial-service players that later reuse the same ID wallets. The result is a structural pull-through for software, edge hardware, and managed compliance services across the facial recognition market.

Soaring Adoption of Edge-Based Smart Cameras in Retail Chains

Organized retail crime exceeded USD 100 billion in the United States in 2024, accelerating deployment of edge AI cameras that analyse faces and behaviours without streaming to cloud servers. Asda's pilot with FaiceTech achieves 99.992% accuracy and deletes non-matches instantly to satisfy GDPR mandates. Fifteen of the top 50 US grocers now use facial recognition to flag repeat offenders and detect employee-customer "sweethearting" fraud. Real-time analytics delivered on Nvidia Jetson or EdgeCortix SAKURA-II boards reduce shrinkage and generate footfall intelligence that feeds marketing systems, giving retailers a hard ROI within months. This twin benefit of loss prevention and experience personalisation keeps retail the fastest-growing private-sector adopter in the facial recognition market.

Strict GDPR Biometric Consent Requirements (EU-27)

The EU AI Act classifies remote biometric identification as "high-risk," banning real-time use for law enforcement except under narrow exemptions and prohibiting emotion recognition at work. Deployers must run Data Protection Impact Assessments, justify legitimate interest, and obtain explicit consent where power imbalances exist. Compliance costs rise 20-30% as integrators add masking, on-device processing, and audit logs. Vendors building EU-ready versions often re-use the privacy-by-design stack for other markets, but smaller firms exit or defer Europe, slowing short-term diffusion of the facial recognition market.

Other drivers and restraints analyzed in the detailed report include:

- Mandated Biometric Boarding by North-American Airlines

- Rapid Uptake of Face Pay and KYC-Lite Wallets in GCC Fintech

- Algorithmic Bias Litigation Risk in the United States

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software accounted for 57.20% of global revenue in 2025 as algorithmic improvements lowered false accept rates to below 0.1% and enabled deployment on standard CPUs. Edge hardware remains the fastest-growing slice at 18.76% CAGR because compliance teams in finance and healthcare insist that biometric templates never leave the premises. SAKURA-II chips run complex models within 10 W power budgets, making autonomous kiosks viable inside convenience stores and transit hubs.

API-based licensing lets developers embed facial verification into mobile apps in hours, eliminating the multi-year cycles typical of earlier turnkey projects. At the same time, hardware vendors bundle computer-vision SDKs with secure-element storage and dedicated accelerators, locking in annuity streams as every new analytics module becomes a firmware download. This two-sided model keeps software sticky while raising switching costs for the entire facial recognition market.

2-D algorithms still ride on existing CCTV infrastructure and therefore generated 43.10% of 2025 revenue. Yet "emotion AI" engines that map micro-expressions, attention span, or drowsiness will grow at 18.11% CAGR, reshaping customer-experience and road-safety applications. The facial recognition market size for analytics-driven modules is forecast to rise 3.40 X by 2031 as retailers, insurers, and automakers monetise behavioural insights.

Hybrid stacks blend 3-D depth cues with 2-D RGB frames to thwart spoofing and deliver liveness checks that comply with ISO/IEC 30107-3. Suprema's Q-Vision Pro validates up to 50,000 users per device and encrypts every transaction end-to-end, allowing ATM operators to eliminate PIN pads. Such crossover of security and analytics keeps R&D pipelines full and diversifies revenue across licence, hardware, and service layers.

Facial Recognition Market Report is Segmented by Component (Hardware, Software, Services), Technology (2-D, 3-D, Thermal, Facial Analytics, Hybrid), Deployment (On-Premise, Cloud, Edge), Device (Fixed Cameras, Mobile, Smartphones, Kiosks), Application (Security, Identity Verification, Payments), End-User (Government, BFSI, Retail, Healthcare and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia held 38.25% of 2025 revenue thanks to states that embed facial recognition into digital public infrastructure. China's Security Management Measures force any entity that stores templates for more than 100,000 persons to register with provincial cyber authorities, establishing a vetting hurdle that favours established vendors with secure supply chains. Japan's 2025 Osaka-Kansai Expo will run NEC face-payments for an anticipated 1.2 million visitors, a live showcase that can seed exports across Southeast Asia.

The Middle East will expand at a 16.88% CAGR as UAE's biometric ID replaces plastic cards across banking, healthcare, and public portals. Dubai Airport plans passport-free travel that links passengers' faces to boarding and retail wallets in one corridor, positioning the region as a laboratory for frictionless mobility. Gulf governments bankroll proof-of-concepts and rapidly convert them to nationwide policies, compressing adoption cycles and accelerating revenue capture for suppliers within the facial recognition market.

North America remains pivotal through airline rollouts and law-enforcement budgets but faces the strongest litigation risk. Congressional scrutiny over TSA's expansion highlights civil-liberty concerns even as passenger throughput gains are undeniable. Federal fragmentation spawns a patchwork of state laws Illinois' BIPA, California's CPRA making cross-border deployments complex. Europe's strict regime slows real-time city surveillance but ramps demand for edge devices running on-device redaction and consent management, giving privacy-tech vendors a foothold in the facial recognition industry.

- NEC Corporation

- Thales Group

- IDEMIA

- Panasonic Corp.

- Aware, Inc.

- Cognitec Systems GmbH

- Face++, Megvii Technology

- SenseTime Holdings

- Clearview AI

- Daon, Inc.

- FacePhi Biometria SA

- AnyVision (now Oosto)

- SAFR (RealNetworks Inc.)

- CyberLink Corp.

- Innovatrics

- Suprema Inc.

- Herta Security

- iProov Ltd.

- Corsight AI

- VisionLabs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents

2 INTRODUCTION

- 2.1 Study Assumptions and Market Definition

- 2.2 Scope of the Study

3 RESEARCH METHODOLOGY

4 EXECUTIVE SUMMARY

5 MARKET LANDSCAPE

- 5.1 Market Drivers

- 5.1.1 Accelerating National ID and e-Passport Roll-outs in Emerging Asia

- 5.1.2 Soaring Adoption of Edge-based Smart Cameras in Retail Chains

- 5.1.3 Mandated Biometric Boarding by North-American Airlines

- 5.1.4 Rapid Uptake of Face Pay and KYC-lite Wallets in GCC Fintech

- 5.2 Market Restraints

- 5.2.1 Strict GDPR Biometric Consent Requirements (EU-27)

- 5.2.2 Algorithmic Bias Litigation Risk in the U.S.

- 5.2.3 China Cyber-Security Classified Protection 2.0 Hardware Certification Bottlenecks

- 5.2.4 Public Push-back on City-wide Camera Expansion

- 5.3 Regulatory Outlook

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Cameras and Sensors

- 6.1.1.2 Edge AI Chips

- 6.1.2 Software

- 6.1.2.1 Face Detection and Alignment

- 6.1.2.2 Feature Extraction and Matching

- 6.1.2.3 Liveness Detection

- 6.1.3 Services

- 6.1.3.1 Managed Services

- 6.1.3.2 Professional Services

- 6.1.1 Hardware

- 6.2 By Technology

- 6.2.1 2-D Facial Recognition

- 6.2.2 3-D Facial Recognition

- 6.2.3 Thermal/Infra-red Facial Recognition

- 6.2.4 Facial Analytics and Emotion AI

- 6.2.5 Hybrid and Multimodal Algorithms

- 6.3 By Deployment

- 6.3.1 On-premise

- 6.3.2 Cloud-based

- 6.3.3 Edge / On-device

- 6.4 By Device Form-factor

- 6.4.1 Fixed Surveillance Cameras

- 6.4.2 Mobile and Wearables

- 6.4.2.1 Smartphones

- 6.4.2.2 Body-worn Cameras

- 6.4.3 Kiosks and Access Terminals

- 6.5 By Application

- 6.5.1 Security and Surveillance

- 6.5.1.1 Border Control / e-Gates

- 6.5.1.2 Public Area CCTV Analytics

- 6.5.2 Access Control

- 6.5.2.1 Corporate and Campus Entry

- 6.5.2.2 Smart Locks (Residential)

- 6.5.3 Identity Verification / e-KYC

- 6.5.3.1 Digital Banking On-boarding

- 6.5.3.2 SIM Registration

- 6.5.4 Payments and Transactions

- 6.5.4.1 Face Pay (Retail POS)

- 6.5.5 Customer Analytics and Personalisation

- 6.5.5.1 In-store Targeted Advertising

- 6.5.1 Security and Surveillance

- 6.6 By End-user

- 6.6.1 Government and Law-Enforcement

- 6.6.2 BFSI

- 6.6.3 Retail and E-commerce

- 6.6.4 Healthcare

- 6.6.5 Automotive and Transportation

- 6.6.6 Telecom and IT

- 6.6.7 Hospitality and Entertainment

- 6.7 By Geography

- 6.7.1 North America

- 6.7.1.1 United States

- 6.7.1.2 Canada

- 6.7.1.3 Mexico

- 6.7.2 South America

- 6.7.2.1 Brazil

- 6.7.2.2 Argentina

- 6.7.2.3 Chile

- 6.7.2.4 Rest of South America

- 6.7.3 Europe

- 6.7.3.1 Germany

- 6.7.3.2 United Kingdom

- 6.7.3.3 France

- 6.7.3.4 Italy

- 6.7.3.5 Spain

- 6.7.3.6 Nordics

- 6.7.3.7 Rest of Europe

- 6.7.4 Asia Pacific

- 6.7.4.1 China

- 6.7.4.2 Japan

- 6.7.4.3 South Korea

- 6.7.4.4 India

- 6.7.4.5 ASEAN

- 6.7.4.6 Australia and New Zealand

- 6.7.4.7 Rest of Asia Pacific

- 6.7.5 Middle East and Africa

- 6.7.5.1 Middle East

- 6.7.5.1.1 GCC

- 6.7.5.1.2 Turkey

- 6.7.5.1.3 Rest of Middle East

- 6.7.5.2 Africa

- 6.7.5.2.1 South Africa

- 6.7.5.2.2 Nigeria

- 6.7.5.2.3 Rest of Africa

- 6.7.5.1 Middle East

- 6.7.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 NEC Corporation

- 7.4.2 Thales Group

- 7.4.3 IDEMIA

- 7.4.4 Panasonic Corp.

- 7.4.5 Aware, Inc.

- 7.4.6 Cognitec Systems GmbH

- 7.4.7 Face++, Megvii Technology

- 7.4.8 SenseTime Holdings

- 7.4.9 Clearview AI

- 7.4.10 Daon, Inc.

- 7.4.11 FacePhi Biometria SA

- 7.4.12 AnyVision (now Oosto)

- 7.4.13 SAFR (RealNetworks Inc.)

- 7.4.14 CyberLink Corp.

- 7.4.15 Innovatrics

- 7.4.16 Suprema Inc.

- 7.4.17 Herta Security

- 7.4.18 iProov Ltd.

- 7.4.19 Corsight AI

- 7.4.20 VisionLabs

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-Need Assessment