|

市場調查報告書

商品編碼

1910506

紅外線感測器:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Infrared Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

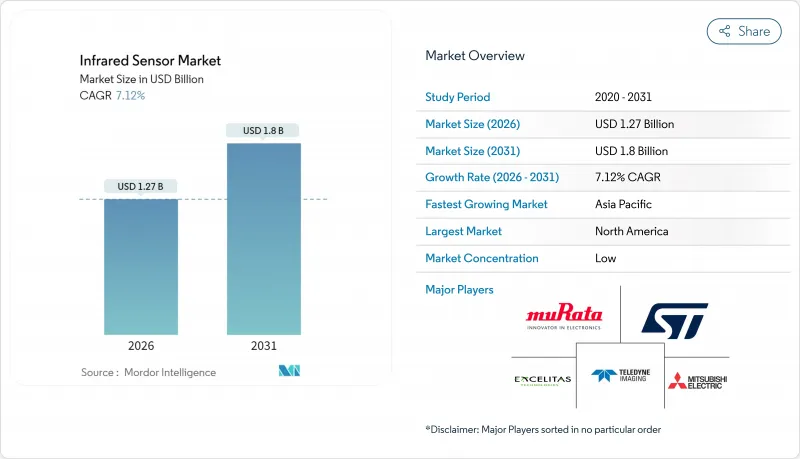

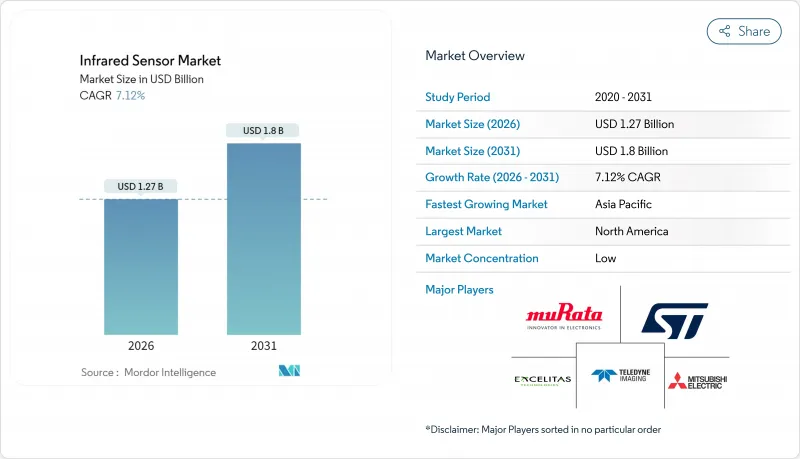

預計紅外線感測器市場規模將從 2025 年的 11.9 億美元成長到 2026 年的 12.7 億美元,到 2031 年將達到 18 億美元,2026 年至 2031 年的複合年成長率為 7.12%。

這一成長得益於工業4.0自動化計劃的不斷推進、日益嚴格的汽車安全法規以及提升檢測器靈敏度和成本效益的材料級創新。儘管近紅外線(NIR)裝置仍是收入的主要來源,但由於熱感成像技術在汽車、工業和醫療領域的廣泛應用,遠紅外線(FIR)陣列正經歷著最快的成長。封裝技術的創新(主要是晶圓級真空技術)持續降低組件成本,而人工智慧賦能的晶片處理技術正將設計重點轉向節能型、事件驅動型架構。量子效率、像素間距和動態範圍的逐步提升,為預測性維護、氣體監測和自適應駕駛輔助等領域創造了新的機遇,同時也加劇了傳統半導體製造商與敏捷材料專家之間的競爭。

全球紅外線感測器市場趨勢及展望

工業4.0自動化熱潮

將熱感儀整合到預測性維護框架中,可在保持高影像品質的同時,將非計劃性停機時間減少 53%,從而縮短工廠維修的投資回收期。結合紅外線熱成像和聲發射技術的雙感測器節點,可實現積層製造爐和軋延中的異常檢測。案例研究表明,採用熱電發電機的免維護工業物聯網節點正在興起,可將電池廢棄物減少 94%,並將總感測成本降低 70%。基於變壓器的預測模型在識別資產健康狀況方面達到了 99% 的準確率,使紅外線數據成為人工智慧驅動的維護計劃的可靠輸入。這些技術的進步,共同推動了紅外線感測器市場深入融入工業價值鏈,即使在利潤率較低的工廠維修領域,也實現了銷售成長。

擴展智慧家庭和家用電子電器平台

封裝技術的進步使得基於TMOS的人體存在檢測感測器無需笨重的聚光器即可檢測4公尺範圍內的人體,從而將紅外線感測技術擴展到電池供電的智慧恆溫器和手勢控制設備。多區域飛行時間測距技術將白天的檢測距離從170厘米擴展到285厘米,同時將功耗從4.5毫瓦降低到1.6毫瓦。這種效率對於穿戴式裝置和智慧音箱至關重要。無鉛量子點光電二極體可在1390奈米波長下進行短波紅外線(SWIR)成像,滿足環保法規要求,並可在OLED顯示器後實現安全的臉部認證。對0.05°C溫度變化敏感的軟性光熱電薄膜為新興的電子皮膚和擴增實境觸覺技術提供了支援。這些創新鞏固了家用電子電器作為紅外線感測器市場持續需求驅動力的地位。

冷卻式紅外線檢測器高成本且需要低溫冷卻

由於需要史特靈引擎或焦耳-湯姆森冷卻器來維持低溫設定點以抑制光子噪聲,冷卻式檢測器組件會產生大量的購買成本和營運成本。即使多級熱電模組取得了進步,也尚未能縮小與非冷卻式微測輻射熱計的成本差距,這限制了它們在價格彈性較大的大眾消費品和建築自動化應用中的普及。

細分市場分析

截至2025年,近紅外線模組佔整個紅外線感測器市場的37.45%。這主要是因為矽基光電二極體和CMOS-ToF晶片的成本曲線符合家用電子電器的水平。意法半導體(STMicroelectronics)的量子點短波紅外線(SWIR)原型機,像素間距為1.62µm,量子效率高達60%,實現了個位數美元的晶粒,從而將附加值擴展到了高利潤的頻譜頻寬。同時,NEC的奈米碳管成像器將室溫靈敏度提高了三倍,實現了先前只有非製冷型HgCdTe焦平面陣列才能達到的性能。在熱感成像需求快速成長的推動下,遠紅外線(FIR)細分市場正以7.35%的複合年成長率成長,預計將在十年內縮小與近紅外線模組的收入差距。

製造商正在推出混合模組,將近紅外線 (NIR) 和遠紅外線 (FIR) 整合到單一光學系統中,從而簡化相機對準並增強移動機器人的場景理解能力。這些雙波段平台正在拓展紅外線感測器在加值分析領域的市場,尤其是在環境光線變化或煙霧導致能見度低,影響 RGB 視覺的情況下。

被動式紅外線感測器功耗低至毫瓦級,是電池供電的智慧家庭節點不可或缺的一部分,預計到2025年將佔據紅外線感測器市場61.20%的佔有率。在全球範圍內,新建商業建築的能源標準強制要求安裝人體感應感測器,這進一步鞏固了市場需求,光是加州第24號法規修正案就推動了數千萬台感測器的年銷售量。同時,在雷射雷達相關應用的推動下,主動式紅外線感測器預計到2031年將以7.55%的複合年成長率成長。這些應用利用客製化光束,為室內機器人和自動導引運輸車(AGV)提供深度感知。低成本的850奈米和940奈米垂直共振腔面射型雷射(VCSEL)現已與單光子崩潰式二極體整合在同一塊印刷電路板(PCB)上,即使在明亮的日光條件下,也能實現公分級、最遠15公尺的偵測距離。結合被動運動偵測和主動檢驗脈衝的雙技術檢測器在商業安防領域越來越受歡迎,因為誤報率直接影響保險成本。

消費性電子產品待機功耗低於0.5W的監管壓力促使被動式架構發展,而車載資訊娛樂系統對手勢姿態辨識和人機互動的需求則推動汽車製造商轉向主動式近紅外線陣列。最終,我們預期軟體定義感測器將實現融合,根據環境和電池狀態動態切換被動式和主動式模式。

區域分析

北美地區預計在2025年將佔總收入的31.55%,這主要得益於成熟的航太供應商、健全的汽車安全法規結構以及積極的智慧製造獎勵。聯邦政府對半導體產業回流的津貼進一步推動了國內晶圓產能的擴張,並降低了該地區相機製造商面臨的地緣政治風險。歐洲緊隨其後,這得益於強勁的一級汽車供應商整合和高度的工業自動化,但消費性電子產品成長放緩抑制了其整體擴張速度,使其不如亞太地區。

亞太地區紅外線感測器市場正以7.95%的複合年成長率成長,這主要得益於智慧型手機的大規模生產、智慧城市建設的蓬勃發展以及政策支持的自動化升級。中國的鍺出口配額政策鼓勵了區域內對替代光學材料的投資,加速了當地生態系統的多元化發展。日本憑藉NEC和濱松光子學等公司不斷突破檢測器的物理極限,保持著技術領先地位;而韓國則利用其先進的封裝技術,為民用無人機和安防攝影機提供微測輻射熱計。

新興的中東和非洲市場正開始試用熱感攝影機,用於邊防安全和電廠安防,這些計畫通常由主權財富舉措資助。拉丁美洲在採礦和農業自動化方面正逐步取得進展,利用紅外線無人機進行作物監測的試驗計畫顯示出可觀的投資回報,但這些計畫易受匯率波動和進口關稅的影響。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 快速採用工業4.0自動化

- 擴展智慧家庭和家用電子電器基礎設施

- 高級駕駛輔助系統和自動駕駛汽車的需求不斷成長

- 嚴格的安全和環境法規推動了氣體監測的發展。

- 晶圓級真空封裝降低了紅外線感測器的成本

- 用於超低功耗事件驅動感測的片上人工智慧

- 市場限制

- 冷卻式紅外線檢測器高成本且需要低溫冷卻

- 溫度漂移導致的重新校準開銷

- 紅外線化合物半導體的供應瓶頸

- 長波紅外線(LWIR)技術的出口管制限制

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 對宏觀經濟趨勢的市場評估

第5章 市場規模與成長預測

- 按類型

- 近紅外線(NIR)

- 紅外線的

- 遠紅外線 (FIR)

- 透過運作機制

- 積極的

- 被動的

- 透過使用

- 運動感應

- 溫度測量

- 安全與監控

- 氣體和火災偵測

- 光譜學

- 其他用途

- 按最終用戶行業分類

- 衛生保健

- 航太與國防

- 車

- 商業用途

- 製造業

- 石油和天然氣

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Murata Manufacturing Co. Ltd

- STMicroelectronics NV

- Excelitas Technologies

- Teledyne Imaging Inc.

- Mitsubishi Electric Corporation

- Amphenol Advanced Sensors(Amphenol Corporation)

- SENBA Sensing Technology Co. Ltd

- Nippon Ceramic Co. Ltd

- Panasonic Corporation

- Broadcom Inc.

- Melexis NV

- Hamamatsu Photonics kk

- InfraTec GmbH

- Honeywell International Inc.

- Texas Instruments Incorporated

- Analog Devices Inc.

- ifm electronic GmbH

- In-situ Inc.

- OMRON Corporation

- Sensirion AG

第7章 市場機會與未來展望

The Infrared Sensor market is expected to grow from USD 1.19 billion in 2025 to USD 1.27 billion in 2026 and is forecast to reach USD 1.8 billion by 2031 at 7.12% CAGR over 2026-2031.

The expansion is underpinned by rising Industry 4.0 automation projects, stricter automotive safety mandates, and material-level breakthroughs that improve detector sensitivity and cost efficiency. Near-infrared (NIR) devices remain the revenue cornerstone, yet far-infrared (FIR) arrays are moving fastest as thermal imaging proliferates in automotive, industrial, and medical settings. Packaging innovation chiefly wafer-level vacuum techniques, continues to compress bill-of-materials costs, while AI-enabled on-chip processing reshapes design priorities toward power-aware, event-driven architectures. Incremental gains in quantum efficiency, pixel pitch, and dynamic range are translating into new opportunities in predictive maintenance, gas monitoring, and adaptive driver assistance, thereby sharpening competition among established semiconductor houses and agile materials specialists.

Global Infrared Sensor Market Trends and Insights

Surging Adoption of Industry 4.0 Automation

Thermal cameras, embedded in predictive-maintenance frameworks, now reduce unplanned downtime by 53% while maintaining high image fidelity, thereby accelerating payback periods for factory retrofits. Dual-sensor nodes that merge infrared thermography with acoustic emission enable anomaly detection in additive-manufacturing furnaces and rolling mills. Deployments increasingly exploit thermoelectric harvesters to power maintenance-free IIoT nodes that cut battery waste 94% and shrink total sensing cost 70%. Transformer-based predictive models are achieving 99% identification accuracy for equipment health, making infrared data a trusted input for AI-driven maintenance schedules. Together, these advances embed the infrared sensor market more deeply in industrial value chains, driving volume growth even in low-margin plant retrofits.

Expanding Smart-Home and Consumer Electronics Base

Packaging advances allow TMOS-based presence sensors to detect humans four meters away without bulky concentrators, pushing infrared sensing into battery-powered smart thermostats and gesture-controlled appliances. Multi-zone time-of-flight ranging now extends daytime detection from 170 cm to 285 cm while cutting power from 4.5 mW to 1.6 mW, an efficiency leap critical for wearables and smart speakers. Lead-free quantum-dot photodiodes deliver SWIR imaging at 1,390 nm, meeting environmental directives and enabling secure face authentication behind OLED displays. Flexible photothermoelectric films, sensitive to 0.05 °C changes, underpin emerging electronic-skin and AR-haptics categories. These innovations cement consumer electronics as an enduring demand engine for the infrared sensor market.

High Cost and Cryogenic Cooling of Cooled IR Detectors

Cooled detector assemblies impose significant capital and operating expense because Stirling engines or Joule-Thomson coolers must maintain cryogenic set-points for photon noise suppression. Even advances in multi-stage thermoelectric modules have not yet closed the cost gap against uncooled microbolometers, restraining adoption in mass-volume consumer and building-automation niches where price elasticity is high.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand from ADAS and Autonomous Vehicles

- Stricter Safety and Environmental Regulations Driving Gas Monitoring

- Temperature-Drift Induced Recalibration Overheads

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Near-infrared modules held 37.45% of overall infrared sensor market share in 2025, largely because silicon-based photodiodes and CMOS-ToF chips align with consumer-electronics cost curves. Quantum-dot SWIR prototypes from STMicroelectronics, featuring 1.62 µm pixel pitch and 60% quantum efficiency, promise single-digit-dollar dies that could swing incremental value toward higher-margin spectral bands. Meanwhile, carbon-nanotube imagers from NEC triple sensitivity at room temperature, creating an uncooled path to performance once reserved for HgCdTe focal-plane arrays. The FIR subset, buoyed by rapid thermal-imaging uptake, is tracking a 7.35% CAGR and is on course to narrow the revenue gap by the decade's close.

Manufacturers are fielding hybrid modules that fuse NIR and FIR into a single optical train, easing camera alignment and broadening scene understanding in mobile robotics. Such dual-band platforms deepen the infrared sensor market size for value-added analytics, particularly where ambient-light variability or smoke obscuration challenges RGB-only vision.

Passive infrared maintained a 61.20% hold on the infrared sensor market size during 2025 owing to its milliwatt-level power draw, which makes it indispensable in battery-powered smart-home nodes. The global roll-out of energy-code-mandated occupancy sensors in new commercial buildings has cemented demand, with California Title 24 revisions alone driving tens of millions of yearly unit sales. Conversely, active infrared is slated for a 7.55% CAGR through 2031, fueled by LiDAR-adjacent applications that exploit modulated beams for depth perception in indoor robotics and AGVs. Low-cost vertical-cavity surface-emitting lasers (VCSELs) at 850 nm and 940 nm now pair with single-photon avalanche diodes on the same PCB, enabling centimeter-grade ranging up to 15 m in broad daylight. Dual-technology detectors combining passive motion triggers with active verification pulses are gaining popularity in commercial security where false alarm rates have direct insurance cost implications.

Regulatory pressure to cut standby energy use below 0.5 W in consumer electronics favors passive architectures, but the drive for gesture recognition and human-machine interaction in infotainment systems is tipping automakers toward active NIR arrays. The eventual convergence is likely to see software-defined sensors that dynamically toggle between passive and active modes based on ambient conditions and battery state.

The Infrared Sensor Market Report is Segmented by Type (Near Infrared (NIR), Infrared, and Far Infrared (FIR)), Working Mechanism (Active, and Passive), Application (Motion Sensing, Temperature Measurement, Security and Surveillance, Spectroscopy, and More), End-User Industry (Healthcare, Aerospace and Defense, Automotive, Commercial Applications, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 31.55% of 2025 revenue on the back of entrenched aerospace suppliers, a robust automotive safety framework, and active smart-manufacturing incentives. Federal grants directed at semiconductor reshoring further encourage domestic wafer capacity additions, lowering geopolitical risk for local downstream camera makers. Europe follows with strong automotive tier-1 integration and industrial-automation depth; however, slower consumer-electronics growth moderates total expansion relative to Asia-Pacific.

The Asia-Pacific infrared sensor market is tracking an 7.95% CAGR, supported by volume smartphone production, aggressive smart-city rollouts, and policy-backed automation upgrades. China's germanium export quotas sparked regional investment in alternative optical materials, catalyzing local ecosystem diversification. Japan maintains technology leadership via firms such as NEC and Hamamatsu that continually push detector physics boundaries, while South Korea leverages advanced packaging prowess to supply microbolometers for consumer drones and security cameras.

Emerging Middle East and Africa markets are beginning to trial thermal cameras for border security and power-plant safety, with funding often sourced from sovereign-wealth initiatives. Latin America demonstrates gradual traction in mining and agricultural automation; pilot programs deploying infrared-enabled drones for crop-health surveys show promising ROI but remain sensitive to currency volatility and import tariffs.

- Murata Manufacturing Co. Ltd

- STMicroelectronics NV

- Excelitas Technologies

- Teledyne Imaging Inc.

- Mitsubishi Electric Corporation

- Amphenol Advanced Sensors (Amphenol Corporation)

- SENBA Sensing Technology Co. Ltd

- Nippon Ceramic Co. Ltd

- Panasonic Corporation

- Broadcom Inc.

- Melexis NV

- Hamamatsu Photonics kk

- InfraTec GmbH

- Honeywell International Inc.

- Texas Instruments Incorporated

- Analog Devices Inc.

- ifm electronic GmbH

- In-situ Inc.

- OMRON Corporation

- Sensirion AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging adoption of Industry 4.0 automation

- 4.2.2 Expanding smart-home and consumer electronics base

- 4.2.3 Rising demand from ADAS and autonomous vehicles

- 4.2.4 Stricter safety and environmental regulations driving gas monitoring

- 4.2.5 Wafer-level vacuum packaging cutting IR sensor costs

- 4.2.6 On-chip AI enabling ultra-low-power event-driven sensing

- 4.3 Market Restraints

- 4.3.1 High cost and cryogenic cooling of cooled IR detectors

- 4.3.2 Temperature-drift induced recalibration overheads

- 4.3.3 Supply bottlenecks for IR-grade compound semiconductors

- 4.3.4 Export-control restrictions on LWIR technologies

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro-economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Near Infrared (NIR)

- 5.1.2 Infrared

- 5.1.3 Far Infrared (FIR)

- 5.2 By Working Mechanism

- 5.2.1 Active

- 5.2.2 Passive

- 5.3 By Application

- 5.3.1 Motion Sensing

- 5.3.2 Temperature Measurement

- 5.3.3 Security and Surveillance

- 5.3.4 Gas and Fire Detection

- 5.3.5 Spectroscopy

- 5.3.6 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Healthcare

- 5.4.2 Aerospace and Defense

- 5.4.3 Automotive

- 5.4.4 Commercial Applications

- 5.4.5 Manufacturing

- 5.4.6 Oil and Gas

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Murata Manufacturing Co. Ltd

- 6.4.2 STMicroelectronics NV

- 6.4.3 Excelitas Technologies

- 6.4.4 Teledyne Imaging Inc.

- 6.4.5 Mitsubishi Electric Corporation

- 6.4.6 Amphenol Advanced Sensors (Amphenol Corporation)

- 6.4.7 SENBA Sensing Technology Co. Ltd

- 6.4.8 Nippon Ceramic Co. Ltd

- 6.4.9 Panasonic Corporation

- 6.4.10 Broadcom Inc.

- 6.4.11 Melexis NV

- 6.4.12 Hamamatsu Photonics kk

- 6.4.13 InfraTec GmbH

- 6.4.14 Honeywell International Inc.

- 6.4.15 Texas Instruments Incorporated

- 6.4.16 Analog Devices Inc.

- 6.4.17 ifm electronic GmbH

- 6.4.18 In-situ Inc.

- 6.4.19 OMRON Corporation

- 6.4.20 Sensirion AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment