|

市場調查報告書

商品編碼

1910497

聚偏聚二氟亞乙烯(PVDF):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Polyvinylidene Fluoride (PVDF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

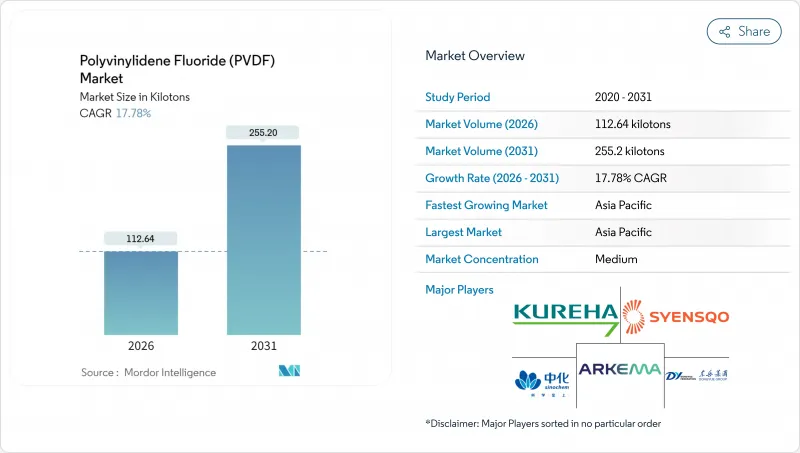

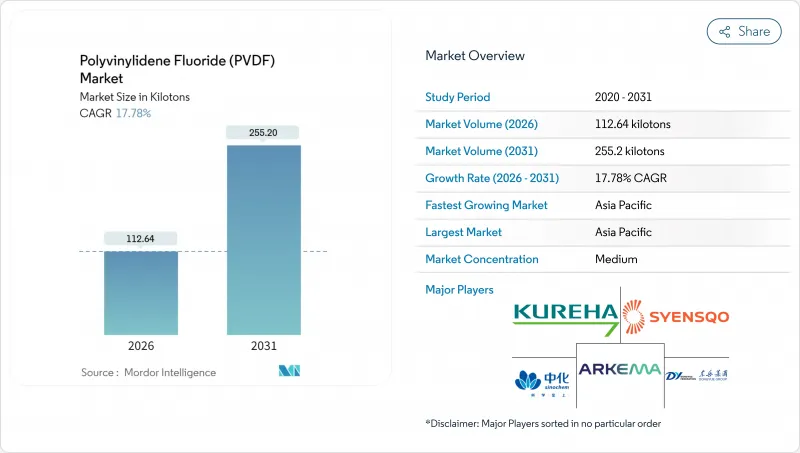

預計聚二氟亞乙烯市場將從 2025 年的 95.64 千噸成長到 2026 年的 112.64 千噸,到 2031 年將達到 255.2 千噸,2026 年至 2031 年的複合年成長率為 17.78%。

交通運輸的持續電氣化、用於生產10奈米以下晶片的無塵室建設的加速推進,以及基礎設施計劃對長壽命建築飾面材料的指定,都支撐著未來幾年持續成長的需求。那些能夠後向整合二氟乙烯單體生產、在電池製造地附近建立本地生產能力,並為無塵室系統提供應用工程支援的製造商,將擁有永續的競爭優勢。同時,中國現貨市場供應過剩導致的價格波動,凸顯了審慎擴張產能和簽訂長期原料採購協議的必要性。政府激勵措施,特別是來自美國的1.78億美元津貼(這將為北美首個世界級規模的工廠奠定基礎),表明戰略性政策支持在平衡區域供應結構和確保關鍵行業PVDF穩定供應方面仍然至關重要。

全球聚二氟亞乙烯(PVDF)市場趨勢與洞察

電動車電池產量激增

汽車製造商數十億美元的電氣化藍圖直接推動了對專用黏合劑的需求,這些黏合劑能夠確保電極在數千次充放電循環中保持完整性。 Syensqo位於奧古斯塔的工廠每年為超過500萬個電動車電池組供應PVDF。這一規模得益於美國能源局提供的1.78億美元津貼,該撥款為建立國內正極黏合劑供應鏈奠定了基礎。隨著主要電池製造商的垂直整合程度不斷提高,規格範圍正在縮小,每個電池組的PVDF用量也隨之增加到15-50克/千瓦時,德國汽車工業協會(VDA)已證實了這一點。隨著美國、歐洲和印度超級工廠的擴張,擁有本地生產能力的製造商享有運輸成本優勢和認證接近性,從而增強了區域供應安全。這些趨勢共同推高了PVDF的基準消費量和分銷利潤率,使聚二氟亞乙烯市場成為電動車轉型的主要受益者。

對耐化學腐蝕塗料的需求

建築設計師正持續轉向採用PVDF線圈塗布系統,這些塗料在保色性、光澤穩定性和抗粉化性方面均超越了AAMA 2605性能標準。佛羅裡達州、德克薩斯州以及颱風頻繁的亞太地區的建築規範強制要求採用這些高品質的塗料,從而將重塗週期延長至30年,並降低建築幕牆的生命週期成本。工業領域也呈現類似的趨勢,化學公司正在對鋼製儲槽維修,採用耐強酸強鹼的PVDF面漆,從而減少因腐蝕導致的停機和監管處罰。隨著基礎設施獎勵策略法案優先考慮建造具有韌性的公共建築,即使在景氣衰退的情況下,塗料價值鏈也有望實現穩定的銷售成長,這進一步鞏固了聚二氟亞乙烯市場的防禦優勢。

原物料價格波動 (VF2)

過去六個月,由於產能快速擴張超過了鋰離子電池黏合劑的需求,中國PVDF現貨價格持續下跌。由於偏二氟乙烯成本佔PVDF現金成本的65%至70%,這種價格波動擠壓了利潤空間,並擾亂了長期採購合約。西方加工商透過與指數掛鉤的配方合約來對沖風險,而亞洲中型擠出製造商仍然面臨風險,投機性庫存積壓加劇了市場波動。在供應趨於合理化之前,採購部門可能會優先考慮原料來源多元化,並探索代工加工契約,以穩定聚聚二氟亞乙烯市場的原料供應。

細分市場分析

截至2025年,鋰離子電池黏合劑在聚二氟亞乙烯)市場佔據了33.62%的主導佔有率,預計到2031年將以31.05%的複合年成長率成長,這反映了該材料在高能量密度電池化學系統中確立的重要作用。由於其他聚合物會影響循環壽命和倍率性能,主要汽車製造商正在指定PVDF黏合劑用於下一代高鎳正極材料。同時,矽增強型負極中更高的負載量也推高了單節電池的消費量,使基礎噸位需求加倍。

塗料和油漆領域預計將保持穩定、適度的個位數成長,這主要得益於美國建築幕牆維修的加速以及歐洲綠色建築法規的推行。電線電纜絕緣材料在資料中心電力網路中的佔有率不斷成長,低煙無鹵標準正在取代PVC護套。薄膜、片材和膜材填補了從氣體分離模組到強溶劑專用包裝等各種細分市場,PVDF優異的阻隔性能使其能夠獲得較高的溢價。管道和管件服務於半導體和化學工藝,其產量受工廠擴建週期的影響,並在聚二氟亞乙烯市場中擁有最高的毛利率。

聚偏聚二氟亞乙烯市場報告按應用領域(鋰離子電池黏合劑、油漆和塗料、管道和配件、薄膜和片材等)、終端用戶產業(航太、汽車、建築和施工、電氣和電子等)以及地區(亞太地區、北美地區、歐洲地區等)進行細分。市場預測以數量(噸)和價值(美元)為單位。

區域分析

預計到2025年,亞太地區將佔全球出貨量的56.12%,並在2031年之前以20.10%的複合年成長率成長。儘管供應的快速擴張導致價格波動,但客戶的接近性和規模經濟效應已幫助該地區穩固確立了其作為低成本生產中心的地位。為進一步鞏固日本的技術優勢,KUREHA株式會社計劃投資4.7億美元(700億日圓)擴建其位於磐城的工廠,以供應用於高鎳陰極材料的特種等級產品。政府補貼確保了其戰略自主性。在印度和韓國,新興的超級工廠計劃和家電組裝行業的擴張帶來了不斷成長的需求,從而擴大了聚二氟亞乙烯)市場的區域深度。

由於製造業回流政策和《通膨控制法案》(該法案要求使用美國製造的電池材料才能完全符合電動車稅額扣抵),北美市場佔有率正在擴大。 Scienceco位於奧古斯塔的工廠將成為北美最大的單線PVDF工廠之一,每年可為當地供應500萬顆電池。為了補充黏合劑的需求,Arkema將其位於卡爾弗特城的工廠擴建了15%,以確保為在亞利桑那州和俄亥俄州建廠的半導體客戶提供高純度等級的PVDF。來自多個領域的需求也在成長,包括沿著墨西哥邊境的製造業走廊進口美國製造的PVDF用於汽車線束,以及加拿大油砂運營商指定使用耐腐蝕管道。

在歐洲,綠色交易正逐步淘汰非必要包裝中的全氟烷基和多氟烷基物質(PFAS),但允許電池和航太應用領域例外,以平衡成長與監管審查。德國的需求主要由一家汽車製造商的電池合資企業和BASF的陰極活性材料計劃支撐,而法國和荷蘭的需求則主要來自旨在實現建築圍護結構淨零排放的維修項目中對建築塗料的需求。該地區嚴格的環境標準推動了具有成熟生命週期優勢的聚偏二氟乙烯(PVDF)解決方案的採用,但也增加了合規成本。這造成了一種兩極分化的市場格局:頂級供應商在監管日益嚴格的聚聚二氟亞乙烯市場中蓬勃發展。

南美洲以及中東和非洲仍是新興市場。巴西的鹽層下油田和沙烏地阿拉伯的下游化學聯合企業需要PVDF管道,儘管用量較小。非洲的採礦計劃正在探索將PVDF膜技術應用於酸性礦山排水處理,這為該技術在資源主導經濟體中創造了獨特的成長機會。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動車電池產量快速成長

- 對耐化學腐蝕塗料的需求

- 半導體潔淨室擴建

- 石油和天然氣管道防腐蝕

- 航太零件的3D列印

- 市場限制

- 原物料(VF2)價格波動

- 加強對 PFAS 相關法規的監管

- VF2單體生產能力有限

- 價值鏈分析

- 監管環境

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 新進入者的威脅

- 終端用戶產業趨勢

- 航太(航太零件生產收入)

- 汽車(汽車產量)

- 建築與施工(新建建築占地面積)

- 電氣和電子(電氣和電子產品生產收入)

- 包裝(塑膠包裝量)

第5章 市場規模及成長預測(以金額為準及數量)

- 透過使用

- 鋰離子電池黏合劑

- 塗料和油漆

- 管道和配件

- 薄膜和片材

- 電線電纜絕緣

- 其他(膜等)

- 按最終用戶行業分類

- 航太工業

- 車

- 建築/施工

- 電氣和電子設備

- 工業和機械

- 包裝

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Arkema

- Dongyue Group

- Gujarat Fluorochemicals Limited

- Hubei Everflon Polymer Co., Ltd.

- Kureha Corporation

- RTP Company

- Sinochem

- Syensqo

- Zhejiang Juhua Co., Ltd.

- ZheJiang Yonghe Refrigerant Co.,Ltd

第7章 市場機會與未來展望

第8章:執行長面臨的關鍵策略挑戰

The Polyvinylidene Fluoride market is expected to grow from 95.64 kilotons in 2025 to 112.64 kilotons in 2026 and is forecast to reach 255.2 kilotons by 2031 at 17.78% CAGR over 2026-2031.

Persistent electrification of transportation, accelerating clean-room construction for sub-10 nm chips, and infrastructure projects that specify longer-lasting architectural finishes all reinforce a multi-year demand runway. Producers that combine backward integration into vinylidene fluoride monomer, localized capacity near cell-manufacturing hubs, and application-engineering support in clean-room systems secure durable competitive advantages. Conversely, price volatility in China's oversupplied spot market highlights the need for disciplined capacity addition and long-term feedstock contracts. Government incentives-most notably the United States' USD 178 million grant that anchors North America's first world-scale plant-signal that strategic policy support will remain pivotal in balancing regional supply maps and ensuring PVDF availability for critical industries.

Global Polyvinylidene Fluoride (PVDF) Market Trends and Insights

EV-battery production surge

Automakers' multibillion-dollar electrification roadmaps create direct pull-through for specialized binders that maintain electrode integrity across thousands of charge cycles. Syensqo's Augusta complex will supply PVDF for more than 5 million EV battery packs annually, a scale made viable by the USD 178 million Department of Energy award that anchors domestic cathode-binder chains. Vertical integration by leading cell makers tightens specification windows, raising per-pack PVDF loading to 15-50 g kWh as confirmed by the German automotive association VDA. As gigafactory clusters proliferate in the United States, Europe, and India, producers with local capacity gain freight-cost advantages and proximity to qualification, reinforcing regional supply security. These dynamics collectively raise baseline consumption and channel margins, making the Polyvinylidene Fluoride market a core beneficiary of the EV pivot.

Demand for chemical-resistant coatings

Architectural specifiers continue to migrate to PVDF coil-coating systems that surpass AAMA 2605 performance thresholds in terms of color retention, gloss stability, and chalk resistance. Building codes in Florida, Texas, and typhoon-prone APAC coastal zones increasingly mandate these premium finishes, extending repaint cycles to 30 years and lowering whole-life facade costs. Industrial segments echo the trend: chemical processors retrofit steel tanks with PVDF topcoats that endure aggressive acids and bases, mitigating corrosion downtime and regulatory penalties. With infrastructure stimulus bills prioritizing resilient public buildings, the coatings value chain expects stable volume growth even in macro-downturn scenarios, reinforcing the Polyvinylidene Fluoride market's defensive attributes.

Raw-material (VF2) price volatility

China's spot PVDF price dropped within six months as rapid capacity expansion outstripped Li-ion binder demand. Because vinylidene fluoride accounts for 65-70% of PVDF cash cost, such swings compress margins and disrupt long-term purchasing agreements. Western converters shield themselves through index-linked formula contracts, but Asian mid-tier extruders remain exposed, prompting speculative stock builds that amplify volatility. Until supply rationalizes, procurement teams will prioritize diversified sourcing and consider tolling arrangements to stabilize feedstock availability in the Polyvinylidene Fluoride market.

Other drivers and restraints analyzed in the detailed report include:

- Semiconductor clean-room expansion

- Oil and gas corrosion-control piping

- PFAS-related regulatory scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Li-ion battery binders held a commanding 33.62% share of the Polyvinylidene Fluoride market size in 2025 and are forecast to grow at a 31.05% CAGR through 2031, reflecting the material's entrenched role in high-energy-density cell chemistries. Leading automakers specify PVDF binders for next-generation nickel-rich cathodes because alternative polymers undermine cycle life and rate capability. Simultaneously, higher loading levels in silicon-enhanced anodes elevate per-cell consumption, multiplying baseline tonnage requirements.

Coatings and paints are expected to contribute steady mid-single-digit growth as infrastructure funding accelerates facade retrofits in the United States and green-building mandates in Europe. Wire and cable insulation gains a share in data-center power networks, where low-smoke, halogen-free standards are displacing PVC jackets. Films, sheets, and membranes address niche segments-ranging from gas-separation modules to specialty packaging for aggressive solvents-where PVDF's barrier properties justify premium pricing. Pipes and fittings serve semiconductor and chemical processes, with unit volumes sensitive to fab expansion cycles, yet they command the highest gross margins in the Polyvinylidene Fluoride market.

The Polyvinylidene Fluoride Market Report is Segmented by Application (Li-Ion Battery Binders, Coatings and Paints, Pipes and Fittings, Films and Sheets, and More), End-User Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

The Asia-Pacific region accounted for 56.12% of global shipments in 2025 and is projected to grow at a 20.10% CAGR through 2031. Although rapid supply buildouts sparked price volatility, proximity to customers and scale economies keep APAC firmly positioned as the hub of low-cost production. Japan reinforces the region's technology edge: Kureha's USD 470 million (JPY 70 billion) expansion at its Iwaki plant will deliver specialty grades tailor-made for high-nickel cathodes while government subsidies safeguard strategic autonomy. India and South Korea are adding incremental demand through nascent gigafactory pipelines and growing consumer electronics assembly, broadening regional depth within the Polyvinylidene Fluoride market.

North America's share advances on the back of re-shoring policies and the Inflation Reduction Act, which requires U.S.-sourced battery materials to unlock full EV tax credits. Syensqo's Augusta facility will be the continent's largest single-line PVDF plant, underpinning local supply for five million batteries each year. Complementing binders, Arkema's 15% capacity hike at Calvert City secures high-purity grades for semiconductor customers building fabs in Arizona and Ohio. Mexico's border manufacturing corridor imports U.S. PVDF for automotive harnesses, while Canada's oil-sands operators specify corrosion-proof piping, adding multi-segment pull.

Europe balances growth with regulatory scrutiny as the bloc's Green Deal phases out PFAS in non-essential packaging but preserves exemptions for battery and aerospace uses. Germany anchors demand through automaker battery JVs and BASF's cathode-active-material projects, whereas France and the Netherlands drive architectural-coating volumes for retrofit programs that target net-zero building envelopes. The region's stringent environmental standards promote the adoption of PVDF solutions with proven life-cycle benefits, yet they also increase compliance costs, creating a bifurcated landscape where best-in-class suppliers thrive amid tightening regulations in the Polyvinylidene Fluoride market.

South America, the Middle East, and Africa remain emerging theatres. Brazil's pre-salt oil fields and Saudi Arabia's downstream chemical complexes require PVDF pipe, albeit in lower total tonnage. African mining ventures are exploring PVDF membrane technology for acid-mine drainage treatment, creating niche growth opportunities that elevate the technology's profile in resource-driven economies.

- Arkema

- Dongyue Group

- Gujarat Fluorochemicals Limited

- Hubei Everflon Polymer Co., Ltd.

- Kureha Corporation

- RTP Company

- Sinochem

- Syensqo

- Zhejiang Juhua Co., Ltd.

- ZheJiang Yonghe Refrigerant Co.,Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-battery Production Surge

- 4.2.2 Demand for Chemical-resistant Coatings

- 4.2.3 Semiconductor Clean-room Expansion

- 4.2.4 Oil and Gas Corrosion-control Piping

- 4.2.5 3-D-printing Aerospace Parts

- 4.3 Market Restraints

- 4.3.1 Raw-material (VF2) Price Volatility

- 4.3.2 PFAS-related Regulatory Scrutiny

- 4.3.3 Limited VF2 Monomer Capacity

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of Substitutes

- 4.6.4 Competitive Rivalry

- 4.6.5 Threat of New Entrants

- 4.7 End-use Sector Trends

- 4.7.1 Aerospace (Aerospace Component Production Revenue)

- 4.7.2 Automotive (Automobile Production)

- 4.7.3 Building and Construction (New Construction Floor Area)

- 4.7.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.7.5 Packaging (Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Application

- 5.1.1 Li-ion Battery Binders

- 5.1.2 Coatings and Paints

- 5.1.3 Pipes and Fittings

- 5.1.4 Films and Sheets

- 5.1.5 Wire and Cable Insulation

- 5.1.6 Others (Membranes, etc.)

- 5.2 By End-User Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Industrial and Machinery

- 5.2.6 Packaging

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Arkema

- 6.4.2 Dongyue Group

- 6.4.3 Gujarat Fluorochemicals Limited

- 6.4.4 Hubei Everflon Polymer Co., Ltd.

- 6.4.5 Kureha Corporation

- 6.4.6 RTP Company

- 6.4.7 Sinochem

- 6.4.8 Syensqo

- 6.4.9 Zhejiang Juhua Co., Ltd.

- 6.4.10 ZheJiang Yonghe Refrigerant Co.,Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment