|

市場調查報告書

商品編碼

1910478

針狀焦:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Needle Coke - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

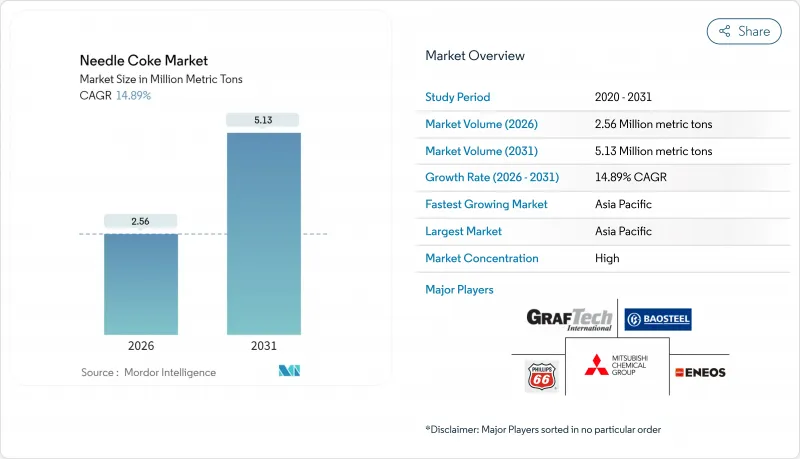

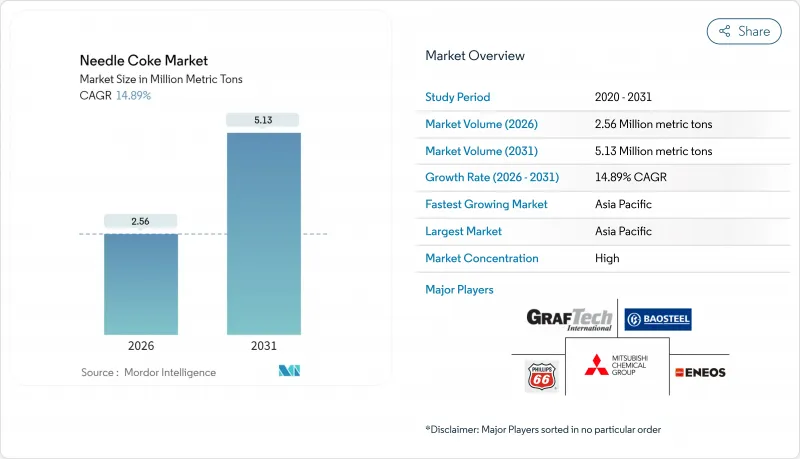

2025年針狀焦市場價值為223萬噸,預計2031年將達到513萬噸,高於2026年的256萬噸。

預測期(2026-2031 年)的複合年成長率預計為 14.89%。

這項急劇成長主要受電弧爐煉鋼和鋰離子電池製造的同步發展所驅動,這兩個產業正在重塑全球碳材料需求格局。鋼鐵業向電弧爐技術的轉型加速了對超高功率石墨電極的需求,而電動車的蓬勃發展則推動了對合成石墨負極材料的需求。原料供應緊張、生產集中以及新的貿易限制等因素共同導致針狀焦市場持續供不應求,加劇了價格上漲趨勢。擁有穩定油料供應和先進延遲焦化設備的生產商仍然掌握定價權。

全球針焦市場趨勢及展望

增加對電鋼生產能力的投資

全球鋼鐵生產商正加速從高爐煉鋼向電弧爐(EAF)技術轉型,以減少碳排放並提高原料柔軟性。目前,電弧爐產能已佔全球鋼鐵產量的30%,並佔2025年底計畫新增產能的43%。印度的國家鋼鐵政策目標是到2030年電弧爐產能佔比達到40%,而中國則計畫在2025年實現15%的電弧爐產能佔比。新建電弧爐需要使用由優質石油針狀焦製成的超高功率電極,而鋼鐵脫碳直接導致針狀焦需求總量增加。儘管亞太地區仍是電弧爐計劃的主要運作來源地,但北美主要鋼鐵生產商也在增建電弧爐,以實現永續性目標並利用豐富的廢鋼供應。這一趨勢正在推動綜合焦炭生產商擴大產能,並已簽訂多年期承購協議。

電動車用鋰離子電池生產快速擴張

鋰離子電池製造業的擴張速度遠超預期。預計到2023年,全球電動車電池工廠將消耗超過63萬噸石墨,隨著新的超級工廠投入運作,到2020年代中期,這一數字預計將翻倍。合成石墨在快速充電穩定性和純度方面具有顯著的性能優勢,從而推動了高能量密度負極材料的日益普及。為確保供應,汽車製造商正與針狀焦基合成石墨供應商簽訂長期合約。例如,Panasonic能源已與NOVONIX公司簽署契約,並將於2025年開始交付。負極材料需求的快速成長正將石油基針狀焦從其傳統的煉鋼客戶轉向其他用途,導致全球原料供應緊張。這也推高了針狀焦市場主要生產商的利潤率。

延遲焦炭生產中的職業和環境危害。

美國環保署 (EPA) 2024 年焦爐法規要求爐門零洩漏並持續監測苯排放,迫使業者對排放控制設備進行維修。 40 CFR 第 63 部分的類似措施加強了對煉油廠焦炭罐的監管,增加了遵循成本和停機風險。這些強制性規定可能在短期內對產量造成壓力,抑制產能擴張,並將新增產能轉移到監管較少的地區。供應限制很可能在需求放緩之前顯現,從而加劇針狀焦市場的價格波動。

細分市場分析

2025年,石油基原料佔針狀焦市場佔有率的85.12%,預計到2031年將以16.05%的複合年成長率成長。此細分市場受益於成熟的延遲焦化基礎設施、可靠的FCC脫氫器油供應以及優異的晶體取向,從而滿足高功率電極的精度要求。預計到2025年,市場規模將成長至約190萬噸,到2031年將超過450萬噸,凸顯了石油基針狀焦市場在整個碳材料價值鏈上的擴張趨勢。雖然合成石墨陽極的應用將進一步推動市場成長,但美國和西歐煉廠的合理化改造正在造成區域性原料短缺。亞洲煉廠繼續運作靈活的焦化裝置,部分抵消了其他地區的供應下降。

煤焦油瀝青基產品佔據了剩餘的市場佔有率,為電極和電池製造商提供了一條重要的多元化發展途徑。儘管面臨技術挑戰,兩家商業化煤針焦工廠仍維持了穩定的生產,直至2024年。與冶金焦爐的上游整合,為營運商在鋼鐵業蓬勃發展的周期中提供了額外的成本優勢。瀝青供應的限制限制了成長潛力,但逐步消除瓶頸將確保該細分市場保持其重要性。催化劑輔助石墨化技術的研究進展可望提高煤針焦的質量,並有可能提升該產品在針焦市場的佔有率。

本針狀焦市場報告按產品類型(石油基針狀焦、煤焦油瀝青基針狀焦)、應用領域(石墨電極、鋰離子電池及其他應用)和地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲地區)對市場進行分析。市場預測以數量(公噸)為單位。

區域分析

亞太地區佔針狀焦市場87.74%的佔有率,預計到2031年將維持15.49%的複合年成長率。中國是針狀焦供需的雙重驅動力,2023年粗鋼產量超過9億噸,並擁有全球最大的電池負極材料產能。 2023年底,中國開始實施高純度石墨出口許可證制度,導致北京的出口量較去年同期下降91%。此舉加劇了西方買家對供應鏈的擔憂。印度已成為需求驅動力,其目標是到2035年實現年產2.4億至2.6億噸鋼鐵,並計劃將其電弧爐(EAF)普及率提高到40%。

北美市場規模雖小,但其策略重要性正透過在地化策略日益凸顯。美國提案對中國石墨徵收93.5%的關稅,凸顯了對自給自足的重視。隨著政策支持循環經濟鋼鐵生產和電池回收,預計歐洲市場將出現溫和的銷售成長。芬蘭斯道拉恩索的木質素和石墨工廠象徵芬蘭對低碳負極材料的承諾。

南美洲、中東和非洲等地區雖然仍處於技術應用的早期階段,但已展現出日益濃厚的興趣。沙烏地阿拉伯於2024年授予雪佛龍拉姆斯全球公司一項年產7.5萬噸針狀焦聯合裝置的生產許可證,這標誌著該地區首次大規模涉足特種焦領域。同時,埃及和巴西等新興鋼鐵產業叢集正在探索在地化供應電極的可能性,以減少對進口的依賴。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 增加電爐煉鋼產能的投資

- 電動車用鋰離子電池產量快速成長

- 中國和歐盟的廢鋼強制回收規定

- 煉油廠升級改造增加了低硫離心油的供應。

- 閉合迴路石墨回收計劃

- 市場限制

- 延遲焦化過程中的職業和環境危害。

- 原料價格波動(蒸餾油、煤焦油)

- 生物基硬碳負極材料的前景

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格概覽

第5章 市場規模與成長預測

- 依產品類型

- 石油基針狀焦

- 煤焦油瀝青基針狀焦

- 透過使用

- 石墨電極

- 鋰離子電池

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Baosteel Group

- China National Petroleum Corporation

- ENEOS Corporation

- GrafTech International

- Indian Oil Corporation

- Mitsubishi Chemical Group Corporation

- Nippon Steel Corporation

- PetroChina

- Phillips 66 Company

- POSCO Future M

- Shandong Yida New Materials Co., Ltd.

- Shanxi Hongte Coal Chemical Co Ltd

- Sinopec

- Tokai Carbon Co., Ltd

第7章 市場機會與未來展望

The Needle Coke Market was valued at 2.23 million metric tons in 2025 and estimated to grow from 2.56 million metric tons in 2026 to reach 5.13 million metric tons by 2031, at a CAGR of 14.89% during the forecast period (2026-2031).

This rapid upswing stems from the parallel rise of electric-arc-furnace (EAF) steelmaking and lithium-ion battery manufacturing, two sectors that together reshape global carbon material demand. The steel industry's move toward EAF technology is intensifying the call for ultra-high-power graphite electrodes, while the electric-vehicle boom is expanding synthetic-graphite anode requirements. Tight feedstock availability, geographic concentration of production, and new trade controls are creating persistent supply tension that reinforces upward pricing trends across the needle coke market. Producers with secure decant-oil supply and advanced delayed-coking assets continue to control pricing power.

Global Needle Coke Market Trends and Insights

Increasing Investments in EAF Steel Capacity

Global steelmakers are accelerating the shift from blast furnaces to EAF technology to cut carbon emissions and improve raw-material flexibility. EAF installations already contribute 30% of world steel output and account for 43% of planned capacity additions slated for late 2025. India's National Steel Policy targets an EAF share of up to 40% by 2030, while China seeks a 15% EAF contribution by 2025. Each new furnace requires ultra-high-power electrodes that rely on premium petroleum-needle coke, so steel decarbonization directly enlarges overall needle coke market demand. Capital spending on EAF projects remains focused in Asia-Pacific, yet North American steel majors are also adding arc furnaces to meet sustainability goals and capitalize on abundant scrap supply. The trend locks in multi-year offtake commitments and encourages integrated coke producers to expand capacity.

Soaring Li-ion Battery Production for EVs

Lithium-ion battery manufacturing is scaling at a pace that exceeds earlier forecasts. Global EV battery plants consumed more than 630,000 tons of graphite in 2023, a figure expected to multiply by mid-decade as new giga-factories begin operations. Synthetic graphite holds critical performance advantages in fast-charge stability and purity, underpinning rising penetration rates within high-energy-density anodes. To secure supply, automotive OEMs have struck long-term agreements with needle-coke-based synthetic-graphite suppliers such as Panasonic Energy's pact with NOVONIX that commences deliveries in 2025. The surge in anode demand draws petroleum-based needle coke away from traditional steel customers, tightening the global feedstock pool and supporting elevated margins for qualified producers inside the needle coke market.

Occupational and Environmental Hazards in Delayed Coking

The U.S. Environmental Protection Agency's 2024 coke-oven rule mandates zero leaking doors and continuous benzene monitoring, pushing operators to retrofit emission controls. Similar measures under 40 CFR Part 63 tighten oversight of refinery coking drums, escalating compliance spend and downtime risk. These obligations strain output in the near term, curb expansion appetite, and may shift new capacity to regions with less stringent frameworks. For the needle coke market, supply constraints materialize faster than demand moderation, amplifying volatility.

Other drivers and restraints analyzed in the detailed report include:

- Scrap-Steel Mandates in China and EU

- Refinery Upgrades Boosting Low-Sulphur Decant-Oil Supply

- Raw-Material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Petroleum-based material captured 85.12% of the needle coke market share in 2025 and is forecast to advance at a 16.05% CAGR to 2031. The segment benefits from established delayed-coking infrastructure, reliable FCC decant-oil supply, and superior crystalline orientation that meets ultra-high-power electrode tolerances. It grew to roughly 1.90 million tons in 2025 and should exceed 4.50 million tons by 2031, underscoring the rising petroleum needle coke market size within the larger carbon-materials value chain. Adoption of synthetic-graphite anodes injects additional momentum, but refinery rationalization in the United States and Western Europe introduces regional feed shortages. Asian refiners continue to commission flexi-coker units, offsetting partial supply loss elsewhere.

Coal-tar-pitch-based products occupy the remaining volume but supply an important diversification lever for electrode and battery producers. Despite technical hurdles, the two commercial coal-needle plants maintained stable output through 2024. Upstream integration with metallurgical coke ovens gives operators incremental cost advantages when steel cycles are favorable. Growth potential stays capped by limited pitch availability, yet incremental debottlenecking keeps the segment relevant. Ongoing research into catalyst-assisted graphitization may elevate coal-needle quality, broadening its addressable share in the needle coke market.

The Needle Coke Market Report is Segmented by Product Type (Petroleum-Based Needle Coke and Coal-Tar Pitch-Based Needle Coke), Application (Graphite Electrodes, Lithium-Ion Batteries, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Metric Tons).

Geography Analysis

Asia-Pacific leads with 87.74% of the needle coke market and is projected to preserve a 15.49% CAGR through 2031. China anchors both supply and demand, producing more than 900 million tons of crude steel in 2023 and operating the world's largest battery-anode capacity. Beijing's export license requirement for high-purity graphite introduced in late 2023 reduced outbound shipments by 91% year on year, a development that heightened supply-chain vigilance among Western buyers. India emerges as a demand multiplier as it targets 240-260 million tons of annual steel by 2035 and intends to lift EAF penetration to 40%.

North America accounts for a smaller base yet gains strategic relevance through localization. Tariff proposals of 93.5% on Chinese graphite underscore Washington's focus on self-reliance. Europe holds moderate volume growth as policy favors circular-economy steel production and battery recycling. Stora Enso's lignin-graphite plant in Finland signals commitment to lower-carbon anode material.

Other territories such as South America, the Middle East, and Africa are at earlier adoption stages but record growing interest. Saudi Arabia awarded Chevron Lummus Global a 75,000 TPA needle-coke complex license in 2024, marking the Middle East's first large-scale entry into specialty coke, while emerging steel clusters in Egypt and Brazil explore local electrode supply to reduce import exposure.

- Baosteel Group

- China National Petroleum Corporation

- ENEOS Corporation

- GrafTech International

- Indian Oil Corporation

- Mitsubishi Chemical Group Corporation

- Nippon Steel Corporation

- PetroChina

- Phillips 66 Company

- POSCO Future M

- Shandong Yida New Materials Co., Ltd.

- Shanxi Hongte Coal Chemical Co Ltd

- Sinopec

- Tokai Carbon Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Investments in EAF Steel Capacity

- 4.2.2 Soaring Li-Ion Battery Production for Evs

- 4.2.3 Scrap-Steel Mandates in China and EU

- 4.2.4 Refinery Upgrades Boosting Low-Sulphur Decant Oil Supply

- 4.2.5 Closed-Loop Graphite Recycling Initiatives

- 4.3 Market Restraints

- 4.3.1 Occupational and Environmental Hazards in Delayed Coking

- 4.3.2 Raw-Material Price Volatility (Decanter Oil, Coal Tar)

- 4.3.3 Prospect of Bio-Based Hard-Carbon Anode Materials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Price Overview

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Petroleum-based Needle Coke

- 5.1.2 Coal-tar Pitch-based Needle Coke

- 5.2 By Application

- 5.2.1 Graphite Electrodes

- 5.2.2 Lithium-ion Batteries

- 5.2.3 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Baosteel Group

- 6.4.2 China National Petroleum Corporation

- 6.4.3 ENEOS Corporation

- 6.4.4 GrafTech International

- 6.4.5 Indian Oil Corporation

- 6.4.6 Mitsubishi Chemical Group Corporation

- 6.4.7 Nippon Steel Corporation

- 6.4.8 PetroChina

- 6.4.9 Phillips 66 Company

- 6.4.10 POSCO Future M

- 6.4.11 Shandong Yida New Materials Co., Ltd.

- 6.4.12 Shanxi Hongte Coal Chemical Co Ltd

- 6.4.13 Sinopec

- 6.4.14 Tokai Carbon Co., Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment