|

市場調查報告書

商品編碼

1910477

錳:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Manganese - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

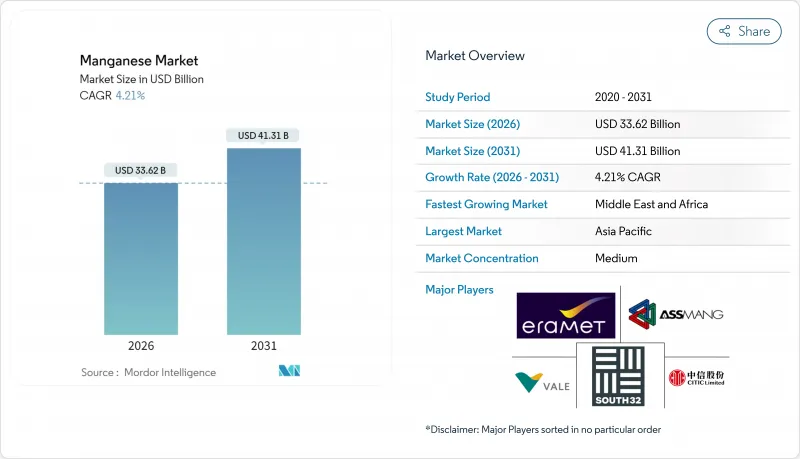

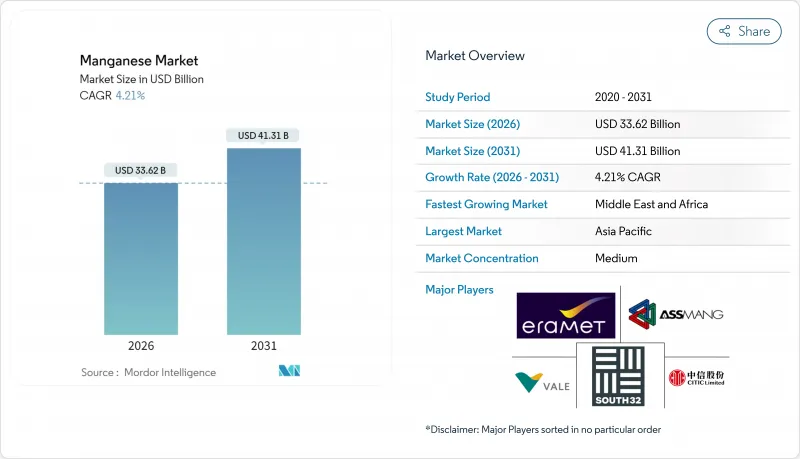

預計錳市場規模將從 2025 年的 322.6 億美元成長到 2026 年的 336.2 億美元,到 2031 年將達到 413.1 億美元,2026 年至 2031 年的複合年成長率為 4.21%。

儘管傳統鋼合金仍佔據主導地位,但電池級鋼材和高純度特殊鋼材的快速成長正在重塑貿易路線,並刺激中國以外地區新的提煉投資。南32集團旗下GEMCO礦遭受颶風破壞,以及加彭的勞工動盪,導致礦石供應緊張,推高現貨價格,並促使西方買家簽訂長期合約。歐洲和印度的氫基直接還原鐵(DRI)計劃正在增加每噸粗鋼所需的錳鐵消費量。同時,用於重型電動車的磷酸錳鋰(LMFP)正極材料正在推動對高純度錳的需求。美國和沙烏地阿拉伯政府正在補貼國內鐵合金和硫酸錳的生產能力,以減少對中國提煉的依賴,這項政策措施可能進一步鞏固錳市場成長超過GDP成長的局面。

全球錳市場趨勢及展望

重型車輛的電氣化將加速對高純度錳的需求。

重型電動卡車和巴士擴大使用錳含量高於傳統磷酸鐵鋰(LFP)陰極的液態金屬磷酸鐵鋰(LMFP)陰極,這實際上提高了每千瓦時錳的用量。 Element 25公司位於路易斯安那州的冶煉廠由美國能源局(DOE)津貼,生產並供應高純度硫酸錳,無需通過中國中間商。值得注意的是,汽車製造商現在願意為可追溯的低碳原料支付溢價,這在錳市場中形成了雙層定價結構。為此,歐美國家的政策獎勵正在提振對電池級材料的需求,預計即使鋼鐵週期出現波動,這種需求仍將持續成長。在這種不斷變化的市場格局下,傳統礦業公司正在尋求下游擴張或與精煉商建立合作關係,以維持其市場地位。

鋼鐵製造商轉向氫化直接還原鐵(DRI)增加了對高碳錳鐵的需求

與高爐煉鐵製程相比,氫基直接還原鐵電弧爐煉鐵製程需要更高的錳添加量。這主要是由於直接還原鐵球團礦的殘餘錳含量較低。瑞典和德國的先導工廠已證實,2024年運作後,需要增加合金添加量。印度的「國家綠色氫能計畫」旨在2030年擴大綠色氫的生產,這可能會增加該國對錳鐵的需求。使用低碳電力生產的錳鐵供應商預計將從中受益匪淺,尤其是在歐盟碳邊境調節稅對進口的煤炭密集型錳礦徵收附加稅的情況下。合金消費量的激增不僅鞏固了當前市場,也為錳市場的長期成長鋪平了道路。

快速採用磷酸鐵鋰(LFP)抑制陰極級錳的成長

2024年,搭乘用電動車製造商將採用更高比例的磷酸鋰鐵鋰(LFP)正極材料,取代錳基材料,這使得近期正極材料的需求前景不明朗。磷酸鐵鋰的興起意味著硫酸錳需求的下降。如果磷酸鐵鋰的市佔率在2028年之前持續成長,電池錳產業的表現可能會低於先前的預期。生產商正在透過提升提煉的產能來應對這項挑戰,使其能夠將錳轉化為用於煉鋼添加劑的電解金屬,但這種柔軟性的提升也帶來了資本支出的增加。因此,儘管磷酸鐵鋰也在同步發展,但錳市場的成長仍受到限制。

細分市場分析

至2025年,合金將佔錳市場需求的67.75%,這主要得益於成品鋼中添加錳鐵和矽錳合金。歐洲和印度氫化直接還原鐵(DRI)產能的擴張推動了合金用量的增加,從而支撐了錳市場銷售的穩定成長。電解錳預計將成長6.17%,主要受攜帶式電子產品和新興電網儲能計劃需求的驅動。其他終端用途,包括飼料、水處理和陶瓷,也隨著GDP的成長而同步成長,為錳市場提供了穩定的銷售。電解(EMD)的復甦,主要得益於鋅錳電池的需求,並引起了加州能源部(DOE)公用事業規模先導計畫的關注。此外,面臨歐盟碳關稅的鋼鐵製造商正在增加對經認證的低碳合金的需求,從而在更廣泛的商品市場中創造了一個高階細分市場。

本錳市場報告按應用領域(合金、電解二氧化錳、電解金屬、其他應用)、終端用戶行業(工業、建築、儲能及電力、其他終端用戶行業)、礦石等級(電池級、高純度級、標準級、工業級)和地區(亞太地區等)對市場進行分析。市場預測以美元以金額為準。

區域分析

到2025年,亞太地區將佔全球錳市場的54.20%,這主要得益於中國對鋼鐵和電池材料的強勁需求。印度也做出了顯著貢獻,這得益於基礎設施投資以及塔塔鋼鐵和印度金屬氧化物有限公司(MOIL)矽錳業務的擴張。日本和韓國已成為電解金屬產業的主要參與者,並向全部區域出口高純度產品。資源豐富的非洲由於精煉能力有限,國內錳礦加工能力有限,大部分錳礦用於出口。預計到2031年,中東和非洲錳市場將以5.86%的複合年成長率成長,這主要得益於南非放寬鐵路運輸限制的舉措以及沙烏地阿拉伯的下游投資。

預計到2025年,北美在全球錳需求中所佔佔有率較小,但路易斯安那州Element 25冶煉廠的運作有望提升這一佔有率,因為在地採購正在增加。加拿大正積極開發魁北克省的錳礦礦床,墨西哥鋼鐵廠也正在擴大產能以滿足美國汽車製造商的需求。歐洲的錳需求佔有率中等,但面臨碳邊境調節機制(CBAM)帶來的挑戰,買方正轉向挪威的水力發電,以獲取合金和再生材料。特別是Eramet旗下的「eraLow」品牌,已與歐盟使用再生能源的扁鋼製造商簽訂了合約。

儘管南美洲在全球錳需求中所佔佔有率較小,但巴西卻是合金消費和出口的領頭羊,其主要出口產品來自淡水河谷的阿祖爾礦。同時,阿根廷蓬勃發展的鋰產業間接推動了錳的需求,尤其是正極材料的需求。發展區域電池供應鏈的努力可望提高南美洲的錳加工能力,進而可能重塑錳市場動態。拉丁美洲國家能否在價值鏈中向上攀升,將取決於基礎建設和綠色能源政策。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 重型車輛的電氣化將加速對高純度錳的需求

- 鋼鐵廠改用氫化直接還原鐵會增加碳氫化合物錳鐵的使用量。

- 西方原始設備製造商 (OEM) 與 HPMSM 簽訂的承購協議有助於實現供應來源多元化。

- 印度和東協對基礎設施級矽錳的需求

- 地緣政治動盪導致礦產供應中斷(例如加彭和澳洲),推高礦產價格。

- 市場限制

- 快速採用磷酸鐵鋰將抑制陰極級錳需求的成長。

- 南非礦石港口瓶頸限制了出口量

- 高碳鐵合金的二氧化碳排放需繳納碳關稅。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過使用

- 合金

- 電解錳

- 電解金屬

- 其他用途

- 按最終用途行業分類

- 產業

- 建造

- 儲能和電力

- 其他最終用途領域

- 按礦石品位

- 電池級

- 高純度

- 標準級

- 技術級

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- African Rainbow Minerals Limited.

- Anglo American plc

- Assore Limited(Assmang Proprietary Limited)

- BHP

- CITIC LIMITED

- Consolidated Minerals Limited.

- Element 25 Limited

- Eramet

- Giyani Metals Corp

- Jupiter Mines Limited

- Manganese Metal Company(Pty)Ltd.

- MOIL LIMITED

- Ningxia Tianyuan Manganese Industry Group Co. Ltd

- NIPPON DENKO CO. LTD

- OM Holdings Ltd.

- POSCO M-TECH.

- South32

- Tata Steel

- Vale

- Vibrantz

第7章 市場機會與未來展望

The Manganese market is expected to grow from USD 32.26 billion in 2025 to USD 33.62 billion in 2026 and is forecast to reach USD 41.31 billion by 2031 at 4.21% CAGR over 2026-2031.

Traditional steel-grade alloys still dominate; however, rapid growth in battery-grade and high-purity specialties is reshaping trade routes and prompting new refinery investments outside China. Cyclone damage at South32's GEMCO mine and labor unrest in Gabon have tightened ore supply, elevating spot prices and prompting Western buyers to secure long-term contracts. Hydrogen-based direct reduced iron (DRI) projects in Europe and India are raising ferromanganese intensity per tonne of crude steel, while lithium-manganese-iron-phosphate (LMFP) cathodes for heavy-duty electric vehicles are expanding high-purity manganese demand. Governments in the United States and Saudi Arabia are subsidizing domestic ferroalloy and sulfate capacity to reduce dependence on Chinese refining, a policy trend likely to reinforce above-GDP expansion in the Manganese market.

Global Manganese Market Trends and Insights

Electrification of Heavy-Duty Vehicles Accelerates HP-Mn Demand

Heavy-duty electric trucks and buses are increasingly turning to LMFP cathodes, which have a higher manganese content than traditional LFP chemistries, effectively increasing the manganese usage per kilowatt-hour. Element 25's Louisiana refinery, backed by a U.S. DOE grant, will produce and supply high-purity manganese sulfate, circumventing Chinese intermediaries. In a notable shift, automakers are now willing to pay a premium for feedstock that is both traceable and low-carbon, leading to the establishment of a two-tier pricing structure in the manganese market. As a result of these developments, Western policy incentives are driving up demand for battery-grade supplies, ensuring continued growth even amid fluctuations in steel cycles. This evolving landscape is prompting traditional ore miners to either move downstream or collaborate with refiners, all in an effort to maintain their market foothold.

Steelmakers' Switch to Hydrogen-DRI Raises HC FeMn Intensity

Hydrogen-based DRI-EAF pathways necessitate more manganese additions compared to blast-furnace routes, primarily because DRI pellets have a lower residual manganese content. Pilot plants in Sweden and Germany validated these increased alloy additions during their 2024 commissioning. India's National Green Hydrogen Mission, which aims to boost green hydrogen production by 2030, could increase the country's demand for ferromanganese. Suppliers of ferromanganese harnessing low-carbon power are set to gain significantly, especially as EU carbon border taxes impose penalties on coal-intensive grade imports. This surge in alloy consumption not only strengthens the current market but also paves the way for the long-term growth of the Manganese market.

Rapid LFP Adoption Curbs Cathode-Grade Mn Growth

In 2024, passenger EV manufacturers increased the share of LFP cathodes, displacing manganese-based chemistries and casting a shadow on the immediate demand for cathode-grade materials. A rise in LFP translates to a reduction in manganese sulfate demand. Should LFP's market share continue to increase by 2028, the battery-grade manganese sector may fall short of previous projections. While producers are adapting by crafting refineries that can switch to electrolytic metals for steel additives, this added flexibility comes with a hike in capital expenses. As a result, the Manganese market's growth is being restrained, even as LMFP sees parallel advancements.

Other drivers and restraints analyzed in the detailed report include:

- Western OEM Off-Take Deals for HPMSM Diversify Supply

- Infrastructure-Grade Silico-Manganese Demand in India and ASEAN

- Ore-Port Bottlenecks in South Africa Cap Export Volumes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alloys accounted for 67.75% of the manganese market demand in 2025, primarily driven by the addition of ferromanganese and silicomanganese to finished steel. With rising hydrogen-DRI capacities in Europe and India, alloy intensity has increased, supporting steady volume growth. Electrolytic manganese dioxide is poised for 6.17% growth, driven by demand from portable electronics and emerging grid-storage initiatives. Other end-uses, including feed, water treatment, and ceramics, are growing in tandem with GDP, providing volume stability to the manganese market. The resurgence of EMD is largely attributed to zinc-manganese batteries, which have caught the attention of utility-scale pilots in California's DOE. Additionally, steelmakers grappling with EU carbon tariffs are increasingly seeking certified low-carbon alloys, creating a premium niche in the broader commodity market.

The Manganese Market Report is Segmented by Application (Alloys, Electrolytic Manganese Dioxide, Electrolytic Manganese Metals, and Other Applications), End-Use Sector (Industrial, Construction, Power Storage and Electricity, and Other End-Use Sectors), Ore Grade (Battery Grade, High Purity Grade, Standard Grade, and Technical Grade), and Geography (Asia-Pacific, and More). Market Forecasts are Provided in Value (USD).

Geography Analysis

The Asia-Pacific region absorbed 54.20% of the global manganese market in 2025, primarily driven by China's demand, which was largely for steel and battery materials. India, buoyed by infrastructure investments and expansions in silico-manganese at Tata Steel and MOIL, also made significant contributions. Japan and South Korea have established themselves as key players in the electrolytic manganese metal industry, exporting high-purity products throughout the region. Despite being resource-rich, Africa processed only a small portion of its manganese ore domestically, with the bulk exported, a consequence of its limited refining capacity. The Middle East and Africa Manganese market is forecast to grow at a 5.86% CAGR to 2031, driven by South Africa's efforts to alleviate rail constraints and Saudi Arabia's push for downstream investments.

North America accounted for a smaller share of global manganese demand in 2025. However, with the commissioning of Element 25's refinery in Louisiana, the localization of battery-grade supply could bolster this share. Canada is actively pursuing manganese deposits in Quebec, while Mexican steel mills are ramping up capacity to cater to U.S. automotive clients. Europe, holding a moderate share, grapples with challenges from the Carbon Border Adjustment Mechanism (CBAM), nudging buyers towards Norwegian hydro-powered alloys and recycled feedstock. Notably, Eramet's "eraLow" brand is capitalizing on renewable electricity to secure contracts with EU flat-steel producers.

South America, contributing a smaller portion to global manganese demand, sees Brazil leading in alloy consumption and exports from Vale's Azul mine. Meanwhile, Argentina's burgeoning lithium sector is indirectly driving up demand for manganese, particularly for cathode precursors. With regional efforts to cultivate battery supply chains, there's potential for increased intra-continental processing, reshaping the Manganese market dynamics. The trajectory of Latin American nations moving up the value chain will hinge on infrastructure enhancements and green energy initiatives.

- African Rainbow Minerals Limited.

- Anglo American plc

- Assore Limited (Assmang Proprietary Limited)

- BHP

- CITIC LIMITED

- Consolidated Minerals Limited.

- Element 25 Limited

- Eramet

- Giyani Metals Corp

- Jupiter Mines Limited

- Manganese Metal Company (Pty) Ltd.

- MOIL LIMITED

- Ningxia Tianyuan Manganese Industry Group Co. Ltd

- NIPPON DENKO CO. LTD

- OM Holdings Ltd.

- POSCO M-TECH.

- South32

- Tata Steel

- Vale

- Vibrantz

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of heavy-duty vehicles accelerates HP-Mn demand

- 4.2.2 Steelmakers' switch to hydrogen-DRI raises HC FeMn intensity

- 4.2.3 Western OEM off-take deals for HPMSM diversify supply

- 4.2.4 Infrastructure-grade silico-manganese demand in India and ASEAN

- 4.2.5 Geo-political ore disruptions (Gabon, Australia) lift prices

- 4.3 Market Restraints

- 4.3.1 Rapid LFP adoption curbs cathode-grade Mn growth

- 4.3.2 Ore-port bottlenecks in South Africa cap export volumes

- 4.3.3 High-carbon ferroalloy CO2-footprint faces carbon-border taxes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Alloys

- 5.1.2 Electrolytic Manganese Dioxide

- 5.1.3 Electrolytic Manganese Metals

- 5.1.4 Other Applications

- 5.2 By End-use Sector

- 5.2.1 Industrial

- 5.2.2 Construction

- 5.2.3 Power Storage and Electricity

- 5.2.4 Other End-use Sectors

- 5.3 By Ore Grade

- 5.3.1 Battery Grade

- 5.3.2 High Purity Grade

- 5.3.3 Standard Grade

- 5.3.4 Technical Grade

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 African Rainbow Minerals Limited.

- 6.4.2 Anglo American plc

- 6.4.3 Assore Limited (Assmang Proprietary Limited)

- 6.4.4 BHP

- 6.4.5 CITIC LIMITED

- 6.4.6 Consolidated Minerals Limited.

- 6.4.7 Element 25 Limited

- 6.4.8 Eramet

- 6.4.9 Giyani Metals Corp

- 6.4.10 Jupiter Mines Limited

- 6.4.11 Manganese Metal Company (Pty) Ltd.

- 6.4.12 MOIL LIMITED

- 6.4.13 Ningxia Tianyuan Manganese Industry Group Co. Ltd

- 6.4.14 NIPPON DENKO CO. LTD

- 6.4.15 OM Holdings Ltd.

- 6.4.16 POSCO M-TECH.

- 6.4.17 South32

- 6.4.18 Tata Steel

- 6.4.19 Vale

- 6.4.20 Vibrantz

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment