|

市場調查報告書

商品編碼

1910463

中東和非洲電動車市場:佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Middle East And Africa Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

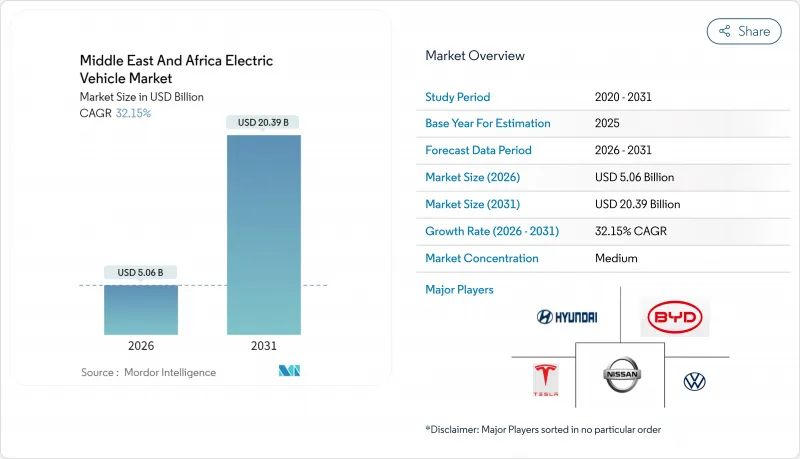

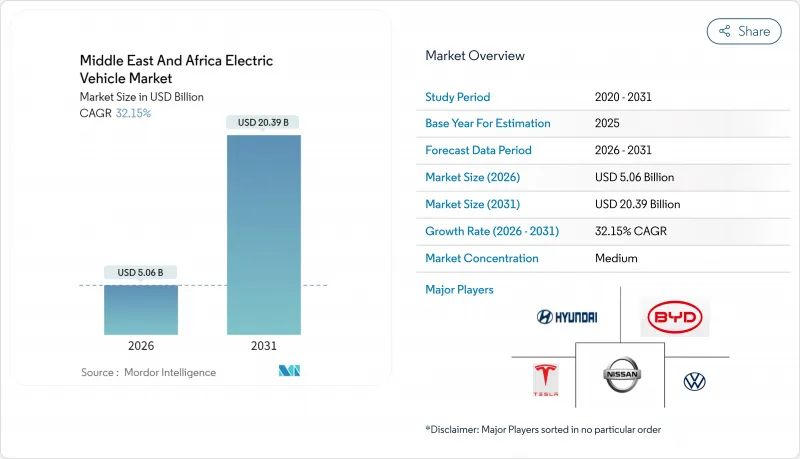

2025年中東和非洲電動車市場價值為38.3億美元,預計從2026年的50.6億美元成長到2031年的203.9億美元,在預測期(2026-2031年)內複合年成長率為32.15%。

主權財富基金正向國內生產生態系統注入數十億美元,石油出口國則利用其豐富的太陽能資源降低充電成本,吸引全球汽車製造商。具有約束力的脫碳義務、電池成本的下降以及公共快速充電走廊的建設正在推動需求成長,而二手內燃機汽車的進口則構成短期阻力。儘管乘用車仍然是最大的裝機量,但隨著油氣業者啟動大規模電氣化競標,商用車隊正佔據成長的大部分佔有率。主要能源公司與汽車製造商之間的策略合作,以及高溫環境下電池溫度控管技術的創新,正使該地區成為電動車在極端溫度下性能的技術試驗場。

中東及非洲電動車市場趨勢及分析

政府的脫碳指令與內燃機禁令目標

波灣合作理事會(GCC)成員國已將電動車配額納入國家發展議程,設定了汽車製造商(OEM)投資決策的最低需求標準。沙烏地阿拉伯的「2030願景」要求到2030年,利雅德30%的車輛必須為電動車;而阿拉伯聯合大公國的聯邦戰略則力爭2050年實現50%的車輛為電動車。這些強制性規定引導公共部門購買轉向零排放車型,鼓勵私家車改裝,統一海灣標準組織(GSO)的認證標準,並促進跨國貿易。從摩洛哥到2026年安裝2500個充電樁的強制規定,顯示強而有力的政策能夠加速基礎建設。具有法律約束力的目標與《巴黎協定》第二十八屆聯合國氣候變遷大會(COP28)的承諾一致,並為投資者提供長期可見性,從而抵消初期需求波動的影響。

快速部署公共直流快速充電走廊

城際快速充電走廊將使電動車從短途都市區出行轉變為跨區域出行。 EVIQ 在利雅得-卡西姆高速公路上建造的旗艦級 150kW 充電站證明了其在主要道路上的可行性,並預示著其將擴展到沙烏地阿拉伯王國十大最繁忙的高速公路。同時,阿拉伯聯合大公國計劃在 2030 年之前在阿布達比安裝 7 萬個公共充電樁,杜拜的目標是到 2025 年安裝 1000 個,從而有效消除酋長國內的里程焦慮。摩洛哥計劃連接卡薩布蘭卡、拉巴特和丹吉爾,屆時將使用可再生能源運作充電樁,實現 30 分鐘以內的快速充電。奈及利亞將於 2025 年運作西非最大的充電中心之一,將基礎設施覆蓋範圍擴展到新興市場。沿線充電密度的增加將大幅提高商用車輛的運作,並鼓勵傑貝阿里港等港口的貨運營運商實現電氣化。

高昂的車輛前期成本和有限的消費者融資

儘管電池價格下降,但高昂的購車成本阻礙了低收入群體對電動車的大規模普及。在埃及,由於分期付款計劃有限以及外匯支出有外匯風險,電動車僅佔新車銷量的0.1%。習慣為二手進口車輛提供證券化服務的傳統金融機構缺乏電動車貸款的殘值基準,導致利率利差較大。在二手以南非洲,小額信貸機構的目標客戶是兩輪計程車而非四輪汽車,這進一步阻礙了汽車製造商實現規模經濟。

細分市場分析

截至2025年,電池式電動車(BEV)佔據了電動車市場78.64%的佔有率。這印證了該地區對純電動驅動系統的偏好,並避免了與插電式混合動力汽車燃油稅相關的複雜性。純電動車的吸引力在於其易於維護,以及購物中心、機場、工業園區等場所目的地充電樁的日益普及。該細分市場強勁的利潤結構吸引了特斯拉、比亞迪和吉利等製造商推出繞過傳統經銷商網路的直銷平台。

車隊營運商正採用夜間在停車場充電的方式,以減少白天營運中斷的影響。隨著沙烏地阿拉伯在工業走廊周邊擴建綠色氫氣加氫站,燃料電池電動車(FCEV)預計到2031年將以35.90%的複合年成長率成長,凸顯了其在長程運輸領域的潛力。同時,插混合動力汽車仍是一種過渡性選擇,可在電網可靠性較低的地區提供續航里程保障。因此,動力系統構成比反映了基礎設施的成熟度,純電動車(BEV)在海灣地區的都市區沿岸地區佔據主導地位,而燃料電池汽車則在沙漠貨運路線上嶄露頭角。

2025年,乘用車收入佔比達到64.05%,而中重型商用車預計到2031年將以35.05%的複合年成長率加速成長,從而擴大企業採購通路的電動車市場規模。油田服務卡車和末端配送貨車由於每日行駛里程長,可大幅節省燃油成本並帶來碳審核效益。吉達自由貿易區的物流公司目前在競標中指定使用電動車型,以符合港務局的排放法規。開羅和開普敦的公車電動化試點計畫顯示公共交通需求不斷成長,而叫車服務供應商正在引入小型掀背車電動車,以符合城市地區的清潔空氣法規。原始設備製造商(OEM)正在透過客製化區域有效負載容量規格、增強型車廂空調系統和強化型越野懸吊來應對這一需求。隨著商用車銷量的成長,供應鏈在地化程度不斷加深,卡車車身、電池機殼和遠端資訊處理服務等均可在國內採購。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府的脫碳指令和禁止內燃機汽車的目標

- 進口電動車的補貼和免稅措施(海灣合作理事會國家)

- 快速部署公共直流快速充電走廊

- 電池組價格下降和續航里程延長

- 石油和天然氣車隊電氣化承諾推動大訂單

- 利用白天多餘的太陽能,實現超低成本充電費用

- 市場限制

- 車輛初始成本高,且消費者融資管道有限。

- 原始設備製造商限制高溫車型的供應

- 不穩定的電網限制了充電器的運作時間(撒哈拉以南地區)

- 廉價二手內燃機汽車進口量的增加損害了電動車的需求。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

5. 市場規模及成長預測(價值,百萬美元)

- 按驅動類型

- 電池式電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 燃料電池電動車(FCEV)

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型和重型商用車輛

- 公車和長途客車

- 二輪車和三輪車

- 電池化學

- 鋰離子電池(NMC/NCA/LFP)

- 鎳氫電池

- 其他

- 按電荷等級

- 交流充電功率低於 7kW(速度慢)

- 7kW 至 22kW 交流充電(半快充)

- 直流22千瓦或以上(高速/超高速)

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 埃及

- 南非

- 奈及利亞

- 肯亞

- 卡達

- 阿曼

- 其他中東和非洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Tesla Inc.

- BYD Co. Ltd.

- Hyundai Motor Co.

- Kia Corp.

- Volkswagen AG

- Nissan Motor Co. Ltd.

- BMW Group

- Toyota Motor Corp.

- Stellantis NV

- Mercedes-Benz Group AG

- Renault Group

- Jaguar Land Rover Ltd.

- Zhejiang Geely Holding

- Lucid Group

- Ceer Motors

- Togg AS

- General Motors Co.

- SAIC-MG Motor

- Ford Motor Co.

- Rivian Automotive Inc.

第7章 市場機會與未來展望

The electric vehicle market in the Middle East and Africa was valued at USD 3.83 billion in 2025 and estimated to grow from USD 5.06 billion in 2026 to reach USD 20.39 billion by 2031, at a CAGR of 32.15% during the forecast period (2026-2031).

Sovereign wealth funds are directing multibillion-dollar allocations toward domestic production ecosystems, and oil-exporting nations are leveraging abundant solar resources to lower charging costs and attract global original-equipment manufacturers (OEMs). Binding decarbonization mandates, falling battery costs, and the rollout of public fast-charging corridors reinforce demand momentum even as used internal-combustion-engine (ICE) imports remain a short-term headwind. Passenger cars retain the most extensive installed base, yet commercial fleets increasingly dominate incremental volume as oil-and-gas operators issue bulk electrification tenders. Strategic partnerships between energy majors and automakers and hot-climate battery-thermal innovations are positioning the region as a technical test bed for extreme-heat EV performance.

Middle East And Africa Electric Vehicle Market Trends and Insights

Government Decarbonization Mandates and ICE-Ban Targets

Gulf Cooperation Council (GCC) members have embedded electric-mobility quotas into national development agendas, creating demand floors that anchor OEM investment decisions. Saudi Arabia's Vision 2030 compels 30% of Riyadh's vehicles to be electric by 2030, while the UAE's federal strategy targets a 50% electric-vehicle mix by 2050. These directives funnel public-sector procurement toward zero-emission models, catalyze private-sector fleet conversions, and standardize certification under Gulf Standardization Organization (GSO) rules, which ease cross-border trade. Morocco's mandates 2,500 charging points by 2026, illustrating how firm policy anchors accelerate infrastructure scale-up. Binding targets dovetail with COP28 commitments, giving investors long-cycle visibility, compensating for initial demand volatility.

Rapid Rollout of Public DC Fast-Charging Corridors

Intercity fast-charging corridors convert EVs from urban runabouts into region-wide mobility options. EVIQ's flagship 150 kW site on the Riyadh-Qassim motorway demonstrates highway viability and signals forthcoming coverage of the kingdom's 10 busiest arterial routes. In parallel, the UAE plans 70,000 public chargers across Abu Dhabi by 2030, while Dubai targets 1,000 sites by 2025, effectively eliminating intra-emirate range anxiety. Morocco's plan links Casablanca, Rabat, and Tangier with green-energy-powered DC units that supply sub-30-minute stops. Nigeria's 2025 inauguration of West Africa's largest assembled charging hub widens the infrastructure map to frontier markets. Corridor density materially lifts commercial-vehicle uptime, unlocking electrification for freight operators serving ports such as Jebel Ali.

High Upfront Vehicle Price and Limited Consumer Financing

Purchase-price premiums continue to deter mass-market adoption in lower-income segments even as batteries cheapen. Egypt's EV share remains just 0.1% of new-car sales due to limited installment plans and hard-currency outlays that expose buyers to exchange-rate swings. Traditional lenders, accustomed to securitizing used imports, lack residual-value benchmarks for electric vehicle market loans, inflating interest spreads. In Sub-Saharan Africa, microfinance mechanisms target two-wheeler taxis rather than four-wheeler purchases, further stalling scale economics for OEMs.

Other drivers and restraints analyzed in the detailed report include:

- Day-Time Solar-PV Surplus Driving Ultra-Low-Cost Charging Tariffs

- Oil-and-Gas Fleet-Electrification Pledges Unlocking Bulk Orders

- Influx of Cheap Used ICE Imports Undermines EV Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery-electric vehicles (BEVs) commanded 78.64% of the electric vehicle market share in 2025, validating the region's preference for fully electric drivetrains and sidestepping the fuel-duty complexity of plug-in hybrids. BEV appeal stems from simpler maintenance and the rollout of destination chargers at malls, airports, and industrial parks. The segment's robust margin structure has enticed Tesla, BYD, and Geely to launch direct-to-consumer sales portals that bypass traditional dealerships.

Fleet operators adopt BEVs for depot-night charging, reducing daytime operational disruptions. Fuel-cell electric vehicles post a 35.90% CAGR through 2031 as Saudi Arabia scales green-hydrogen refueling nodes around its industrial corridors, underscoring their long-haul potential. Meanwhile, plug-in hybrids remain transitional, offering range security where grid reliability lags. The drive-type mix therefore mirrors infrastructure maturity, with BEVs prevailing in the urban Gulf and fuel-cells rising along desert freight links.

Passenger cars controlled 64.05% of 2025 revenue, yet medium and heavy commercial vehicles are forecast to outpace with a 35.05% CAGR to 2031, expanding the electric vehicle market size in corporate procurement channels. Oil-field service trucks and last-mile delivery vans accrue higher daily mileage, magnifying fuel savings and carbon audit benefits. Logistics firms in the Jeddah free zone now specify electric models in tenders to comply with port authority emissions limits. Bus electrification pilots in Cairo and Cape Town indicate growing public-transport appetite, while ride-hailing operators deploy small hatchback EVs to meet city-center clean-air mandates. OEMs are responding with region-tuned payload ratings, enhanced cabin HVAC, and reinforced suspensions for unpaved routes. As commercial volumes climb, supply-chain localization deepens because truck bodies, battery enclosures, and telematics services can all be sourced domestically.

The Middle East and Africa Electric Vehicle Market Report is Segmented by Drive Type (Battery-Electric, Plug-In Hybrid, and Fuel-Cell Electric), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Battery Chemistry (Lithium-Ion, Nickel-Metal Hydride, and Others), Charging Level (AC Below 7 KW, and More), and by Country. Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tesla Inc.

- BYD Co. Ltd.

- Hyundai Motor Co.

- Kia Corp.

- Volkswagen AG

- Nissan Motor Co. Ltd.

- BMW Group

- Toyota Motor Corp.

- Stellantis N.V.

- Mercedes-Benz Group AG

- Renault Group

- Jaguar Land Rover Ltd.

- Zhejiang Geely Holding

- Lucid Group

- Ceer Motors

- Togg A.S.

- General Motors Co.

- SAIC-MG Motor

- Ford Motor Co.

- Rivian Automotive Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Decarbonizations Mandates and ICE-Ban Targets

- 4.2.2 Subsidies And Zero-Customs Duties on EV Imports (GCC)

- 4.2.3 Rapid Rollout of Public DC Fast-Charging Corridors

- 4.2.4 Declining Battery Pack Prices and Longer Driving Range

- 4.2.5 Oil-and-Gas Fleet Electrification Pledges Unlocking Bulk Orders

- 4.2.6 Day-Time Solar-PV Surplus Driving Ultra-Low-Cost Charging Tariffs

- 4.3 Market Restraints

- 4.3.1 High Upfront Vehicle Price and Limited Consumer Financing

- 4.3.2 Restricted Hot-Climate Model Availability From OEMs

- 4.3.3 Grid Unreliability Curbing Charger Uptime (Sub-Saharan Sites)

- 4.3.4 Influx of Cheap Used ICE Imports Undermines EV Demand

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD Million)

- 5.1 By Drive Type

- 5.1.1 Battery-Electric (BEV)

- 5.1.2 Plug-in Hybrid (PHEV)

- 5.1.3 Fuel-Cell Electric (FCEV)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Buses and Coaches

- 5.2.5 Two and Three Wheelers

- 5.3 By Battery Chemistry

- 5.3.1 Lithium-ion (NMC / NCA / LFP)

- 5.3.2 Nickel-Metal Hydride

- 5.3.3 Others

- 5.4 By Charging Level

- 5.4.1 AC below 7 kW (Slow)

- 5.4.2 AC above 7 kW - 22 kW (Semi-fast)

- 5.4.3 DC above 22 kW (Fast / Ultra-fast)

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Israel

- 5.5.4 Egypt

- 5.5.5 South Africa

- 5.5.6 Nigeria

- 5.5.7 Kenya

- 5.5.8 Qatar

- 5.5.9 Oman

- 5.5.10 Rest of Middle East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Tesla Inc.

- 6.4.2 BYD Co. Ltd.

- 6.4.3 Hyundai Motor Co.

- 6.4.4 Kia Corp.

- 6.4.5 Volkswagen AG

- 6.4.6 Nissan Motor Co. Ltd.

- 6.4.7 BMW Group

- 6.4.8 Toyota Motor Corp.

- 6.4.9 Stellantis N.V.

- 6.4.10 Mercedes-Benz Group AG

- 6.4.11 Renault Group

- 6.4.12 Jaguar Land Rover Ltd.

- 6.4.13 Zhejiang Geely Holding

- 6.4.14 Lucid Group

- 6.4.15 Ceer Motors

- 6.4.16 Togg A.S.

- 6.4.17 General Motors Co.

- 6.4.18 SAIC-MG Motor

- 6.4.19 Ford Motor Co.

- 6.4.20 Rivian Automotive Inc.