|

市場調查報告書

商品編碼

1910462

豪華車:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Luxury Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

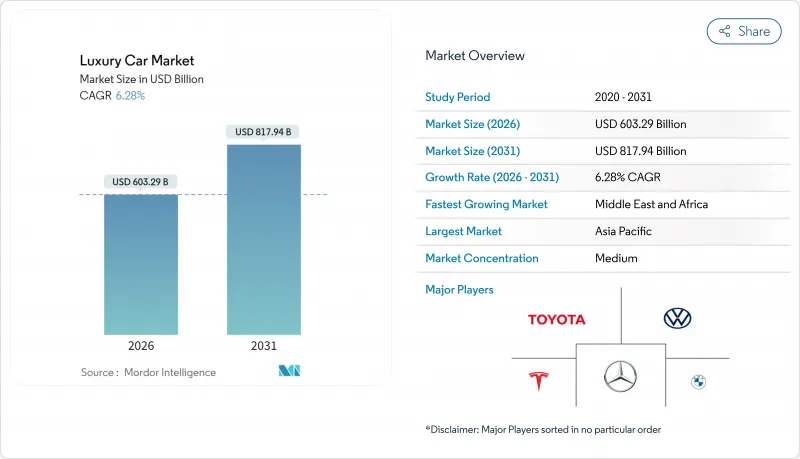

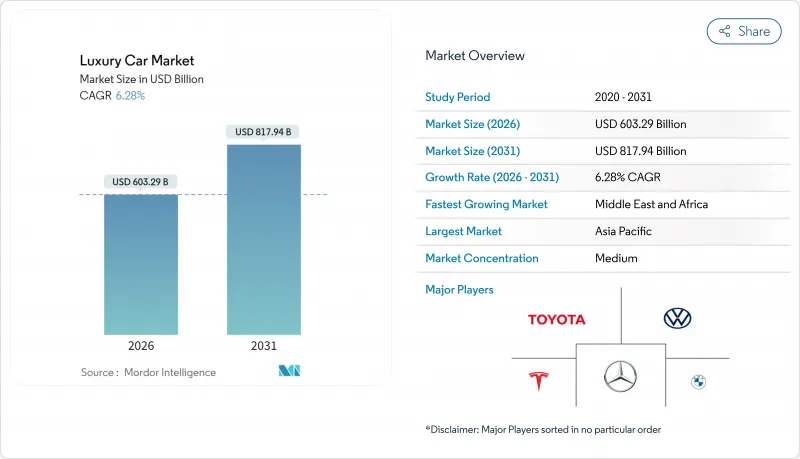

預計豪華車市場將從 2025 年的 5,676.5 億美元成長到 2026 年的 6,032.9 億美元,並預計到 2031 年將達到 8,179.4 億美元,2026 年至 2031 年的複合年成長率為 6.28%。

該地區快速成長的富裕人口、純電動車(BEV)旗艦車型的加速推廣以及對個人化、環保出行方式日益成長的關注,是推動這一成長的核心因素。儘管擁有成本不斷上升,供應鏈也面臨持續挑戰,但豪華車市場仍保持著領先整體汽車產業的成長速度,這得益於豪華車製造商在軟體、客製化和直銷通路獲利方面的不斷進步。隨著中國豪華品牌和特斯拉的純電動車策略不斷施壓,迫使西方老牌豪華車品牌加快電氣化進程、提供更強大的數位化服務並建立更有效率的零售網路,競爭壓力也日益加劇。

全球豪華車市場趨勢與洞察

高階車型快速電氣化

電池式電動車(BEV)是成長最快的動力衍生。高階汽車製造商將電動車定位為展示其靜謐性和先進技術的平台,而非僅僅為了應對監管要求,從而營造出一種「光環效應」。在印度,賓士的電動車銷量在本土生產的EQS 580 SUV的帶動下,截至2024年5月年增了94%。 BMW同年在印度售出1249輛純電動車,並透過在51個城市安裝快速充電樁來支持銷售。超豪華品牌則保持謹慎。阿斯頓馬丁將其首款電動車的發布推遲到2026年,以便進一步完善動力傳動系統。法拉利已申請一項人工排氣聲浪專利,旨在即使動力系統更加安靜,也能保持其情感吸引力。在豪華車市場,電動化的成功與否將取決於品牌能否在多大程度上保持其品牌特色,包括聲音、乘坐舒適性和精湛工藝。

亞洲和中東富裕人口的崛起

亞太地區豪華車市場正經歷快速成長,這主要得益於日益壯大的富裕消費群。隨著人們生活水準的提高,對豪華車的需求也在不斷成長,尤其是在首次購車者和考慮更換到更豪華車型的消費者群體中。印度在其中扮演關鍵角色,近年來其豪華車銷量加倍。預測顯示,超級富豪階級的數量將持續成長,這預示著消費者習慣的轉變以及長期市場前景的良好發展。

在沿岸地區,油價上漲推高了居民可支配收入,並支撐了對豪華汽車的強勁需求。 BMW等品牌銷量顯著成長,凸顯了該地區對高階汽車的熱情。經濟韌性和對豪華出行方式的偏好相結合,鞏固了沿岸地區作為豪華汽車製造商關鍵市場的地位。

半導體和元件短缺

儘管在2022年半導體短缺之後,新的晶圓製造廠陸續運作,但汽車專用微控制器的供應仍然緊張,尤其是資訊娛樂和舒適系統所需的關鍵組件。因此,高階汽車製造商面臨艱難的選擇:交貨缺少某些功能的車輛,要么推遲向客戶交付車輛。

例如,梅賽德斯-奔馳被迫推遲其旗艦車型S級的配額,這凸顯出即使是豪華車型也無法倖免於晶片短缺的影響。此類中斷對產量低、價值高的豪華車打擊最大,因為這些車型依賴專用零件,且生產調整空間有限。

細分市場分析

預計到2025年,SUV將佔豪華車市場的55.78%,並在2031年之前以7.84%的複合年成長率成長。賓士的SUV產品線創下了銷售紀錄,其中AMG G 63在上市首日便獲得了超過120輛的領先單。轎車在專職司機駕駛和超豪華細分市場中仍然保持著一定的文化價值,但隨著年輕消費者越來越重視SUV的多功能性,其相對市場佔有率正在下降。入門級豪華掀背車和MPV仍然局限於小規模區域市場,而超級跑車儘管銷量微乎其微,卻依然支撐著品牌的吸引力。 SUV的強勁成長勢頭鞏固了其在可預見的未來成為豪華車市場主要收入來源的地位。

目前,以SUV為中心的產品藍圖佔據了研發工作的主導地位。奧迪已將其旗艦PPE電動車的研發資源轉移到Q6 e-tron車型上,以應對寶馬iX和賓士EQ SUV的上市。路虎正在擴建其SV Bespoke客製化工作室,以滿足攬勝探測車對定製材料和顏色選擇的需求,這進一步強化了上述大規模客製化的趨勢。隨著排放氣體法規的日益嚴格,電動SUV車型將成為預設的合規策略,而非小眾衍生,這將使豪華車市場繼續保持以SUV主導的成長態勢。

儘管到2025年,內燃機車型仍將佔據豪華車市場68.35%的佔有率,但純電動車(BEV)的新興市場正以8.79%的複合年成長率快速成長。梅賽德斯-奔馳和寶馬已將400V架構應用於其旗艦車型,而保時捷則已宣佈在2027年後停止對新型內燃機平台的投資。在快充網路覆蓋不足的地區,混合動力汽車可作為過渡方案。Lexus為中國市場推出了LM MPV的混合動力汽車。超豪華品牌則傾向循序漸進地推出電動化車款。阿斯頓馬丁將其電動車的上市時間推遲至2026年,以進一步提升乘坐舒適性和車廂隔音效果。動力傳動系統多元化仍然是一項需要在監管要求、基礎設施建設和品牌傳承之間尋求平衡的挑戰,但從長遠來看,電動化終將主導豪華車市場。

純電動滑板也為軟體定義內裝提供了便利。特斯拉自主研發的晶片組和全自動駕駛升級使其在高階電動車市場佔據了顧客購買傾向率,迫使競爭對手深化垂直整合。賓士的MB.OS作業系統將從2025年起推廣至所有EQ車型,並支援付費的空中升級功能,預計四年內每輛車的收入將增加1200美元。這種數位化獲利模式進一步強化了加速純電動車市場佔有率成長的必要性。

區域分析

到2025年,亞太地區將佔據豪華車市場42.75%的佔有率,這主要得益於中國龐大的市場規模以及印度高階汽車銷量快速成長至5萬輛(相當於每小時6輛)。然而,梅賽德斯-奔馳警告稱,由於股市波動,2025年第一季的交付量可能疲軟,凸顯了該地區對資本市場波動的敏感性。隨著新能源汽車滲透率超過40.9%,中國本土品牌正在蠶食德國汽車的市場佔有率,迫使現有品牌尋求技術合作並進行品牌訊息在地化。

中東地區到2031年將維持最高的複合年成長率(CAGR),達到7.96%,這主要得益於石油帶來的可支配收入成長和基礎設施的持續改善。 BMW在波灣合作理事會成員國2024年的銷量成長了15.4%,主要受X7和7系列車型需求的推動。阿拉伯聯合大公國的汽車總銷量成長了15.7%,印證了強勁的宏觀經濟利好因素。南非和土耳其的銷售量也在穩定成長,但匯率波動可能會延遲消費者的購買決策。高階汽車製造商透過區域生產基地和美元結算方式來降低風險。

北美仍然是豪華車市場的穩定支柱,其成熟且富裕的人口結構抵消了利息支出上漲的影響。加拿大豐富的資源推動了豪華車的普及,而墨西哥不斷成長的中產階級財富以及信貸管道的改善,也正在推動消費者轉向豪華車。歐洲面臨最沉重的監管負擔,包括歐盟7排放標準和車隊二氧化碳排放罰款,但品牌忠誠度依然很高。汽車製造商正利用自有電池工廠、可再生能源積分以及對高收益電動SUV的專注,來抵銷合規成本並保障盈利。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 豪華SUV需求激增

- 高階車型快速電氣化

- 亞洲和中東富裕人口的崛起

- 先進的ADAS系統和不斷提高的安全期望

- 轉向線上/直接面對消費者的銷售

- 大規模客製化和特殊訂單選項

- 市場限制

- 高額的購置和擁有成本

- 半導體和元件短缺

- 宏觀經濟需求波動

- 氣候法規對SUV帶來壓力

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元),銷售量(單位))

- 按車輛類型

- 掀背車

- 轎車

- 運動型多用途車(SUV)

- 多用途汽車(MPV)

- 體育/異國風情

- 按驅動類型

- 內燃機(ICE)

- 油電混合車

- 電池式電動車

- 按車輛類別

- 入門級豪華

- 中檔豪華

- 超豪華/異國風情

- 按銷售管道

- 授權經銷商

- 直接面對消費者/線上

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mercedes-Benz Group AG

- BMW AG

- Volkswagen Group

- Toyota Motor Corporation(Lexus)

- Jaguar Land Rover Automotive PLC

- Stellantis NV(Maserati, Alfa Romeo)

- Tesla Inc.

- Volvo Car Group

- Hyundai Motor Group(Genesis)

- Nissan Motor Co.(Infiniti)

- Geely Holding(Lotus, Zeekr)

- FAW Group(Hongqi)

- SAIC Motor(IM, Roewe)

- BYD Co.(Yangwang)

- Lucid Group

- Rivian Automotive

- Ferrari NV

- Aston Martin Lagonda

- Rolls-Royce Motor Cars

- McLaren Automotive

第7章 市場機會與未來展望

The luxury car market is expected to grow from USD 567.65 billion in 2025 to USD 603.29 billion in 2026 and is forecast to reach USD 817.94 billion by 2031 at 6.28% CAGR over 2026-2031.

Rapid wealth creation in Asia-Pacific, the accelerating rollout of battery-electric flagships, and a widening emphasis on personalized, eco-conscious mobility are the core growth engines. Despite ownership-cost inflation and lingering supply-chain kinks, the luxury car market continues to outpace the broader auto sector as premium makers monetize software, customization, and direct sales channels. Competitive pressure is intensifying as Chinese up-market brands and Tesla's pure-play EV strategy push established European and U.S. marques toward faster electrification, richer digital services, and leaner retail footprints.

Global Luxury Car Market Trends and Insights

Rapid Electrification of Premium Models

Battery-electric derivatives represent the fastest-growing drivetrain, supported by premium makers that position EVs as halo showcases for quiet torque and cutting-edge tech rather than regulatory compliance plays. In India, Mercedes-Benz's EV sales grew 94% year-on-year through May 2024, led by the locally-built EQS 580 SUV. BMW delivered 1,249 pure EVs in India the same year, supporting them with fast chargers in 51 cities. Ultra-luxury brands remain cautious: Aston Martin shifted its first EV launch to 2026 for additional powertrain refinement. Ferrari filed patents for synthetic exhaust acoustics to retain emotional appeal in silent drivetrains. The luxury car market will increasingly judge electrification success on how well brands preserve identity traits such as sound, ride, and craftsmanship.

Rising HNWI Population in Asia and Middle East

Asia-Pacific's luxury vehicle market is surging, driven by an expanding base of affluent consumers. As wealth levels rise, especially among first-time buyers and those seeking upgrades, the demand for premium mobility intensifies. India is a pivotal player, with luxury vehicle sales doubling in recent years. Projections show a continued rise in ultra-high-net-worth individuals, hinting at a shift towards aspirational consumption and a promising long-term market outlook.

In the Gulf region, buoyant oil prices have bolstered disposable incomes, fueling a robust demand for luxury vehicles. Brands such as BMW have grown significantly, underscoring the region's enthusiasm for premium automotive offerings. With a blend of economic resilience and a penchant for high-end mobility, the Gulf solidifies its status as a prime market for luxury OEMs.

Semiconductor and Component Shortages

Even with new wafer fabrication facilities launching post the 2022 chip shortage, there's still a tight supply of specialty automotive microcontrollers. This is especially true for those integral to infotainment and comfort systems. As a result, premium OEMs face tough choices: they deliver vehicles missing certain features or push back customer handovers.

Take Mercedes-Benz, for instance. The luxury automaker recently had to delay allocations of its flagship S-Class, underscoring that even elite models aren't shielded from these chip shortages. Such disruptions hit hardest in low-volume, high-content luxury vehicles. These models, dependent on specialized components, have limited leeway in production adjustments.

Other drivers and restraints analyzed in the detailed report include:

- Enhanced ADAS and Safety Expectations

- Online/Direct-to-Consumer Retail Shift

- Anti-SUV Climate Regulation Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs controlled 55.78% of the luxury car market size in 2025 and are predicted to post an 7.84% CAGR to 2031. Mercedes-Benz's SUV roster secured record revenue and over 120 early orders for the AMG G 63 on its first retail day. Sedans keep cultural cachet in chauffeur-driven contexts and certain ultra-luxury niches; however, their relative share diminishes as younger owners prioritize the multi-utility profile of SUVs. Entry-luxury hatchbacks and MPVs remain minor, geography-specific plays, while supercars anchor brand desirability despite negligible volume. Ferocious SUV momentum cements the body style as the luxury car market's leading profit contributor for the foreseeable horizon.

SUV-centric product roadmaps now dominate R&D prioritization. Audi moved flagship PPE EV development resources toward its Q6 e-tron to pre-empt BMW iX and Mercedes EQS SUV launches. Land Rover is extending its SV Bespoke studio to cater to Range Rover clients seeking one-off materials and colorways, reinforcing the mass-customization uptick discussed earlier. As emission targets tighten, electrified SUV variants will become the default compliance strategy rather than a niche derivative, keeping the luxury car market on an SUV-led growth trajectory.

Internal-combustion models still represented 68.35% of the luxury car market size in 2025, but battery-electric entries are sprinting ahead at a 8.79% CAGR. Mercedes-Benz and BMW have already mainstreamed 400-volt architectures into core models, and Porsche has frozen new ICE platform investment beyond 2027. Hybrids offer a transitional buffer in regions lacking fast-charging density; Lexus saw a hybrid uptake for its LM minivan launch in China. Ultra-luxury marques favor a staggered roll-in; Aston Martin rescheduled its debut EV to 2026, arguing for additional refinement of ride and cabin sound characteristics. Powertrain diversification remains a balancing act between regulatory compulsion, infrastructure readiness, and brand heritage yet the long arc points toward electrified dominance within the luxury car market.

Electric-only skateboards also facilitate software-defined interiors. Tesla commands premium-EV mindshare via in-house chipsets and full-self-driving updates, nudging rivals toward deeper vertical integration. Mercedes' MB.OS will roll out across all EQ models after 2025, enabling paid feature over-the-air upgrades that could lift revenue per vehicle by USD 1,200 over a four-year cycle. Such digital monetization strengthens the rationale for accelerated BEV share gains.

The Luxury Car Market Report is Segmented by Vehicle Type (Hatchbacks, Sedans, Sports Utility Vehicles, and More), Drive Type (Internal Combustion Engine, and More), Vehicle Class (Entry-Level Luxury, and More), Sales Channel (Authorized Dealership and Direct-to-Consumer/Online), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific commanded 42.75% of the luxury car market share in 2025, underpinned by China's scale and India's meteoric rise to 50,000 premium units sold, equal to six vehicles every hour. Nevertheless, Mercedes-Benz warned of softer Q1 2025 deliveries amid equity volatility, validating the region's sensitivity to capital-market swings. China's domestic marques erode German share as NEV penetration tops 40.9%, pressuring incumbents to localize tech partnerships and brand messaging.

The Middle East shows the steepest 7.96% CAGR through 2031, buoyed by oil-linked disposable income and infrastructure expansion. BMW tallied a 15.4% volume uplift across Gulf Cooperation Council states 2024, led by X7 and 7 Series demand. UAE total automotive sales advanced 15.7%, confirming robust macro tailwinds. South Africa and Turkiye add incremental gains but are subject to currency gyrations that can delay purchase decisions; premium makers mitigate risk with regional production hubs and U.S.-dollar invoicing options.

North America remains a mature but steady pillar for the luxury car market, with affluent demographics offsetting interest-rate-driven payment inflation. Canada's resource windfall aids luxury penetration, while Mexico is graduating toward premium vehicles as rising middle-class wealth intersects with improved credit access. Europe faces the heaviest regulatory drag via Euro 7 and fleet CO2 fines, yet maintains entrenched brand loyalty. OEMs are converging on high-margin electric SUVs to absorb compliance costs, leveraging in-house battery plants and renewable-energy credits to defend profitability.

- Mercedes-Benz Group AG

- BMW AG

- Volkswagen Group

- Toyota Motor Corporation (Lexus)

- Jaguar Land Rover Automotive PLC

- Stellantis NV (Maserati, Alfa Romeo)

- Tesla Inc.

- Volvo Car Group

- Hyundai Motor Group (Genesis)

- Nissan Motor Co. (Infiniti)

- Geely Holding (Lotus, Zeekr)

- FAW Group (Hongqi)

- SAIC Motor (IM, Roewe)

- BYD Co. (Yangwang)

- Lucid Group

- Rivian Automotive

- Ferrari NV

- Aston Martin Lagonda

- Rolls-Royce Motor Cars

- McLaren Automotive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Luxury-SUV Demand Boom

- 4.2.2 Rapid Electrification of Premium Models

- 4.2.3 Rising HNWI Population in Asia and Middle East

- 4.2.4 Enhanced ADAS and Safety Expectations

- 4.2.5 Online/Direct-To-Consumer Retail Shift

- 4.2.6 Mass-Customization and Bespoke Options

- 4.3 Market Restraints

- 4.3.1 High Purchase and Ownership Cost

- 4.3.2 Semiconductor and Component Shortages

- 4.3.3 Macroeconomic Demand Volatility

- 4.3.4 Anti-SUV Climate Regulation Pressure

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD), Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sports Utility Vehicles (SUVs)

- 5.1.4 Multi-purpose Vehicles (MPVs)

- 5.1.5 Sports / Exotic

- 5.2 By Drive Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Hybrid Electric

- 5.2.3 Battery Electric

- 5.3 By Vehicle Class

- 5.3.1 Entry-level Luxury

- 5.3.2 Mid-level Luxury

- 5.3.3 Ultra-luxury / Exotic

- 5.4 By Sales Channel

- 5.4.1 Authorized Dealership

- 5.4.2 Direct-to-Consumer / Online

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle-East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mercedes-Benz Group AG

- 6.4.2 BMW AG

- 6.4.3 Volkswagen Group

- 6.4.4 Toyota Motor Corporation (Lexus)

- 6.4.5 Jaguar Land Rover Automotive PLC

- 6.4.6 Stellantis NV (Maserati, Alfa Romeo)

- 6.4.7 Tesla Inc.

- 6.4.8 Volvo Car Group

- 6.4.9 Hyundai Motor Group (Genesis)

- 6.4.10 Nissan Motor Co. (Infiniti)

- 6.4.11 Geely Holding (Lotus, Zeekr)

- 6.4.12 FAW Group (Hongqi)

- 6.4.13 SAIC Motor (IM, Roewe)

- 6.4.14 BYD Co. (Yangwang)

- 6.4.15 Lucid Group

- 6.4.16 Rivian Automotive

- 6.4.17 Ferrari NV

- 6.4.18 Aston Martin Lagonda

- 6.4.19 Rolls-Royce Motor Cars

- 6.4.20 McLaren Automotive