|

市場調查報告書

商品編碼

1910454

工業潤滑油:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Industrial Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

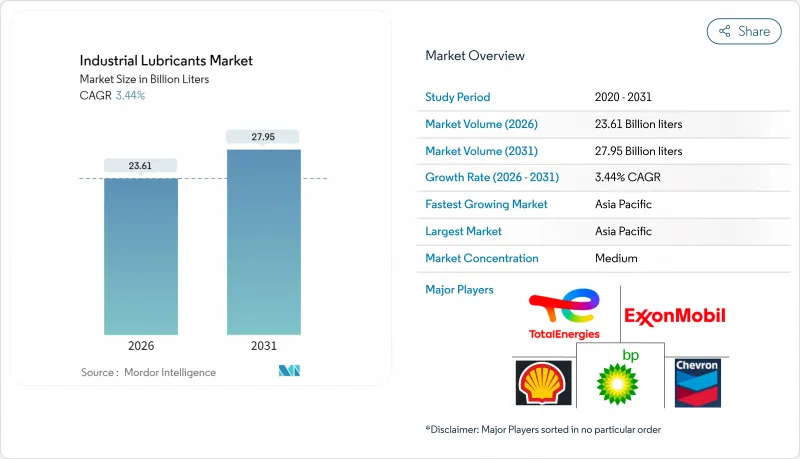

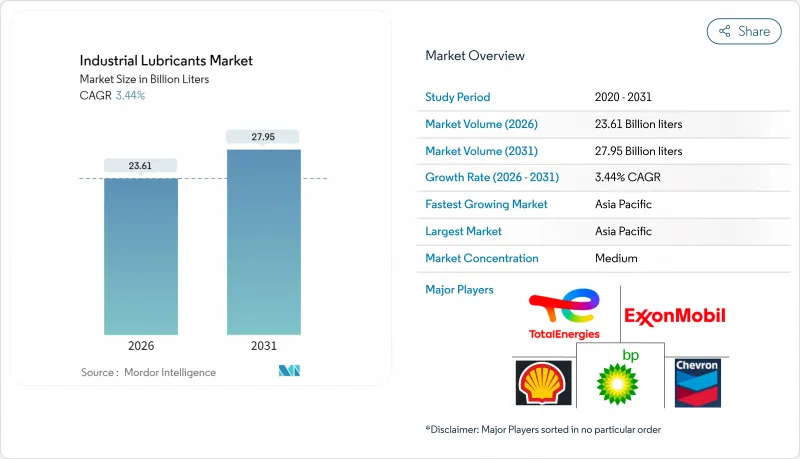

預計工業潤滑油市場將從 2025 年的 228.2 億公升成長到 2026 年的 236.1 億公升,到 2031 年將達到 279.5 億公升,2026 年至 2031 年的複合年成長率為 3.44%。

這種穩定成長的趨勢標誌著潤滑油產業正從大眾市場商品轉向客製化潤滑油,以最大限度地提高產能運轉率和能源效率。風力發電機機裝機量的快速成長以及向工業4.0的升級,使得潤滑油的性能要求超越了傳統規範,從而推動了對合成和生物基化學品的需求。亞太地區目前消費量,這主要得益於大規模的製造業投資以及煉油和石化一體化聯合企業佔據了高價值的潤滑油利潤。為了因應日益嚴格的環境法規和預測性維護的普及,全球製造商也主導研發不含PFAS的添加劑和狀態監測潤滑油。

全球工業潤滑油市場趨勢及展望

風力發電機機齒輪箱潤滑油需求激增

全球風力發電的擴張推動了對專用齒輪箱油的需求,而標準潤滑油無法滿足這項需求。預計到2023年12月,中國風電裝置容量將達到440吉瓦,許多風機故障都是因為潤滑不足造成的。添加了增強型抗磨劑和防腐蝕抑制劑的合成油可將換油週期從六個月延長至三年,從而降低離岸風電場的維護成本。優異的水分離性能對於偏遠地區的風扇至關重要,可最大限度地減少直升機維護的需求。開發人員擴大指定使用ISO VG 320-460 PAO混合油,這種混合油能夠在較大的溫度波動範圍內保持黏度,即使在強風等惡劣條件下也能保護兆瓦級齒輪箱。一台15兆瓦的離岸風力發電機每次換油週期可能消耗超過800公升潤滑油,因此,隨著機組功率的增大,工業潤滑油市場的需求預計將直接成長。

工業自動化和工業4.0中潤滑劑用量增加

智慧工廠配備了在高溫高速下運作的精密機械,因此需要黏度公差嚴格且感測器干擾最小的潤滑油。自動化潤滑系統是基於即時分析控制潤滑油的計量,在提高運轉率的同時,可降低30-40%的潤滑油消費量。添加劑的溶解度和金屬離子含量受到嚴格控制,即使在磁性塞和紅外線碎屑監測裝置的作用下,也能保持摩擦學穩定性。人工智慧平台現在可以讀取振動和溫度數據,動態調整配方建議。這迫使供應商開發模組化、可現場客製化的添加劑組合,加速工業潤滑油市場向高階合成和混合產品的長期結構轉變。

加強對廢油和溢油的監管

歐盟和美國多個州的 PFAS 逐步淘汰強制令迫使配方商重新設計傳統產品。替代化學品的認證會延長產品上市時間並增加研發預算。在使用者層面,回收系統必須記錄從生產到處置的可追溯性,這會增加處置成本和儲存設施的資本支出。洩漏預防指令要求使用雙層壁儲槽和即時洩漏警報系統,這會增加小規模工廠的基礎設施成本。雖然這些障礙限制了短期需求,但也為符合規範且利潤豐厚的工業潤滑油組合藥物創造了新的市場機會。

細分市場分析

預計到2025年,機油將佔總銷售額的23.29%,用於保護重工業應用中的關鍵發電機和固定式壓縮機。這一佔有率反映了根深蒂固的維護習慣,即傳統引擎傾向於使用單一黏度等級的SAE 40和15W-40多級黏度等級的潤滑油。然而,隨著原始設備製造商(OEM)轉向換油週期更長的燃氣引擎,對引擎油的需求趨於平穩。同時,受機器人、射出成型機和風力發電機變槳系統的擴張推動,液壓油和變速箱油預計將以3.92%的複合年成長率成長。金屬加工液將受益於亞太地區工具機的投資,而離子液體切削液將比礦物油基準產品提供更長的刀具壽命。

採用二硫化鉬和石墨配製的合成潤滑脂在承受200°C高溫窯爐出口的極壓軸承領域市佔率不斷擴大,而加工油的需求則與中國、印度和美國石化廠產能提升的直接相關。新興的電機冷卻油則體現了不斷變化的機械結構如何持續重塑工業潤滑油市場。

工業潤滑油市場報告按產品類型(引擎油、液壓油和變速箱油、金屬加工液等)、終端用戶產業(發電、重型機械、食品飲料加工、冶金和金屬加工、化學和製程工業、其他產業)以及地區(亞太地區、北美地區等)進行細分。市場預測以公升為單位。

區域分析

預計到2025年,亞太地區將佔全球潤滑油市場佔有率的46.88%,並在2031年之前以3.61%的複合年成長率成長。在中國,煉油商正日益整合化學品以提高潤滑油利潤率。印度正吸引大量外資,路博潤公司投資2億美元在奧蘭加巴德新建工廠,該工廠是印度第二大潤滑油工廠。東南亞國家歡迎工廠搬遷和可再生能源計劃,從而推動了對油壓油和齒輪油的需求。由於日本和韓國擁有精密製造業,且節能目標嚴格,兩國對合成油的採用率高於平均值。

北美和歐洲正著力研發不含全氟烷基和多氟烷基物質(PFAS)的配方,並提高碳效率。美國正在利用頁岩油衍生原料,而電動車的興起將逐步降低對傳統機油的需求。歐洲在主導,推動了配方的快速轉變。加拿大的油砂開採將繼續推動對高溫潤滑油的需求,而墨西哥的汽車產業投資也將增加當地的需求。

中東和非洲地區依賴油氣開採計劃來保障基礎油供應,並正向化工領域多元化發展。 Richful Farabi在沙烏地阿拉伯新建的添加劑工廠預計將縮短區域調配商的供應鏈。南非的深層採礦和奈及利亞的煉油升級正在創造利基市場機會。南美洲受益於巴西石化產業瓶頸的消除和智利銅礦的擴張,實現了強勁的局部成長,這將鞏固其作為工業潤滑油市場供應商規模雖小但重要的出口管道的地位。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 風力發電機機齒輪箱潤滑油需求激增

- 潤滑劑在工業自動化和工業4.0的應用

- 向長效合成油和半合成油過渡

- 擴大礦業及施工機械設備規模

- 碳定價對超低摩擦生物潤滑劑的需求驅動效應

- 市場限制

- 加強對廢油和洩漏的監管

- 原油衍生基礎油的價格波動

- 乾式驅動馬達降低了對油的需求

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 機油

- 液壓油和變速箱油

- 金屬加工油

- 通用工業油

- 齒輪油

- 潤滑脂

- 加工油

- 其他

- 按最終用戶行業分類

- 發電

- 重型機械

- 食品/飲料加工

- 冶金與金屬加工

- 化學和加工工業

- 其他行業(紙漿和造紙、航運等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 泰國

- 越南

- 馬來西亞

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AMSOIL Inc.

- Bharat Petroleum Corp. Ltd

- Blaser Swisslube AG

- BP plc(Castrol)

- Carl Bechem GmbH

- Chevron Corporation

- China National Petroleum Corporation(PetroChina)

- China Petroleum & Chemical Corp.(Sinopec)

- ENEOS Corporation

- Eni SpA

- Exxon Mobil Corporation

- FUCHS SE

- Gazprom Neft PJSC

- GS Caltex Corporation

- Gulf Oil International

- Hindustan Petroleum Corp. Ltd

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd.

- Kluber Lubrication

- LUKOIL

- Motul

- Petrobras

- Petronas Lubricants International

- Phillips 66 Company

- PT Pertamina(Persero)

- Repsol

- ROCOL

- ROSNEFT

- Shell plc

- TotalEnergies SE

- Valvoline Inc.

第7章 市場機會與未來展望

The Industrial Lubricants Market market is expected to grow from 22.82 billion liters in 2025 to 23.61 billion liters in 2026 and is forecast to reach 27.95 billion liters by 2031 at 3.44% CAGR over 2026-2031.

This steady trajectory shows the sector's shift from bulk commodity sales to tailor-made fluids that maximize equipment uptime and energy efficiency. Rapid wind-turbine installations and Industry 4.0 upgrades are expanding lubricant performance requirements beyond legacy specifications, spurring demand for synthetic and bio-based chemistries. Asia-Pacific dominates current consumption thanks to large-scale manufacturing investments and integrated refinery-petrochemical complexes that capture higher-value lubricant margins. Producers worldwide are also channeling R&D toward PFAS-free additives and condition-monitoring-ready fluids in response to tightening environmental rules and predictive-maintenance adoption.

Global Industrial Lubricants Market Trends and Insights

Surging Wind-Turbine Gearbox Lubricant Demand

Global wind-power build-outs are multiplying specialized gearbox-oil requirements that standard fluids cannot satisfy. China's installed wind capacity reached 440 GW by December 2023, with many turbine failures traced to lubrication shortcomings. Synthetic oils fortified with anti-wear and corrosion inhibitors extend service intervals from 6 months to 3 years, trimming offshore maintenance costs. Robust water-separation properties are essential because remote turbines must minimize helicopter-based servicing. Developers increasingly specify ISO VG 320-460 PAO blends that preserve viscosity across wide temperature swings, protecting multi-megawatt gearsets during harsh gust events. Each 15-MW offshore turbine can consume over 800 liters per service cycle, so the industrial lubricants market sees a direct volume lift from larger unit ratings.

Industrial Automation and Industry 4.0 Lubrication Intensity

Smart factories deploy precision equipment that runs hotter and faster, demanding fluids with narrow viscosity tolerances and negligible sensor interference. Automated lubrication systems meter doses based on real-time analytics, cutting consumption 30%-40% while boosting uptime. Fluids must keep tribological stability when exposed to magnetic-plug or infrared debris monitoring, so additive solubility and metal-ion content are tightly specified. Artificial-intelligence platforms now adjust formulation recommendations by reading vibration and temperature feeds, pushing suppliers to create modular additive packages for on-site customization. These developments anchor a long-term upward mix shift within the industrial lubricants market toward premium synthetic and hybrid products.

Stricter Waste-Oil and Spill Regulations

PFAS-phaseout mandates in the EU and several U.S. states force formulators to redesign long-standing products. Certification of alternative chemistries slows time-to-market and inflates R&D budgets. At the user level, collection systems must now document cradle-to-grave traceability, lifting disposal costs and capital outlays for containment. Spill-prevention directives require double-walled tanks and real-time leak alarms, raising infrastructure costs for small workshops. While these hurdles dampen short-term demand, they also open niches for compliant, higher-margin formulations within the industrial lubricants market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Synthetic and Semi-Synthetic Long-Drain Oils

- Expansion of Mining and Construction Equipment Fleets

- Crude-Derived Base-Oil Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine oil contributed 23.29% of 2025 sales, safeguarding critical generators and stationary compressors across heavy industries. This share underscores deep-rooted maintenance routines that favor monograde SAE 40 and 15W-40 multigrades compatible with legacy engines. Yet demand plateaus as OEMs pivot to gas engines with longer drain specifications. Hydraulic and transmission fluids, in contrast, are set to grow at a 3.92% CAGR as robotics, injection-molding machines, and wind-turbine pitch systems expand. Metalworking fluids benefit from Asia-Pacific machine-tool investments, and ionic-liquid cutting oils deliver longer tool life than mineral benchmarks.

Synthetic grease blends incorporating molybdenum disulfide and graphite are grabbing share in extreme-pressure bearings exposed to 200 °C kiln outlets. Meanwhile, demand for process oils ties directly to petrochemical debottlenecking in China, India, and the U.S. Up-and-coming electric-motor cooling oils illustrate how evolving machinery profiles continuously reshape the industrial lubricants market.

The Industrial Lubricants Market Report is Segmented by Product Type (Engine Oil, Hydraulic and Transmission Fluid, Metalworking Fluid, and More), End-User Industry (Power Generation, Heavy Equipment, Food and Beverage Processing, Metallurgy and Metalworking, Chemical and Process Industries, and Other Industries), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Volume (Liters).

Geography Analysis

Asia-Pacific accounted for 46.88% of 2025 volumes and is tracking a 3.61% CAGR through 2031, where Chinese refiners integrate chemicals to lift lubricant margins. India draws heavy foreign investment, with Lubrizol earmarking USD 200 million for a new Aurangabad plant that will be its second-largest worldwide. Southeast Asian countries welcome factory relocations and renewable-energy projects, driving hydraulic and gear oil uptake. Japan and South Korea sustain above-average synthetic penetration due to precision manufacturing and stringent energy-saving targets.

North America and Europe concentrate on PFAS-free formulations and carbon-linked efficiency gains. The U.S. leverages shale-derived feedstocks, yet EV adoption gradually curbs traditional engine oil demand. Europe leads the policy push that elevates bio-lubricants, compelling rapid formulation shifts. Canada's oil-sands mining keeps high-temperature lubricant requirements active, whereas Mexico's automotive investments broaden local demand.

The Middle-East and Africa rely on hydrocarbon extraction projects that underpin base oil supply and diversify into chemicals. A new additive plant from the Richful-Farabi venture in Saudi Arabia will shorten supply lines for regional blenders. South Africa's deep-level mining and Nigeria's refining upgrades contribute niche opportunities. South America shows pockets of high growth around Brazilian petrochemical debottlenecking and Chilean copper expansions, cementing its role as an important albeit smaller outlet for industrial lubricants market suppliers.

- AMSOIL Inc.

- Bharat Petroleum Corp. Ltd

- Blaser Swisslube AG

- BP p.l.c. (Castrol)

- Carl Bechem GmbH

- Chevron Corporation

- China National Petroleum Corporation (PetroChina)

- China Petroleum & Chemical Corp. (Sinopec)

- ENEOS Corporation

- Eni SpA

- Exxon Mobil Corporation

- FUCHS SE

- Gazprom Neft PJSC

- GS Caltex Corporation

- Gulf Oil International

- Hindustan Petroleum Corp. Ltd

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd.

- Kluber Lubrication

- LUKOIL

- Motul

- Petrobras

- Petronas Lubricants International

- Phillips 66 Company

- PT Pertamina (Persero)

- Repsol

- ROCOL

- ROSNEFT

- Shell plc

- TotalEnergies SE

- Valvoline Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging wind-turbine gearbox lubricant demand

- 4.2.2 Industrial automation and Industry 4.0 lubrication intensity

- 4.2.3 Shift toward synthetic and semi-synthetic long-drain oils

- 4.2.4 Expansion of mining and construction equipment fleets

- 4.2.5 Carbon-pricing pull for ultra-low-friction bio-lubricants

- 4.3 Market Restraints

- 4.3.1 Stricter waste-oil and spill regulations

- 4.3.2 Crude-derived base-oil price volatility

- 4.3.3 Dry-drive electric motors reducing oil demand

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oil

- 5.1.2 Hydraulic and Transmission Fluid

- 5.1.3 Metalworking Fluid

- 5.1.4 General Industrial Oil

- 5.1.5 Gear Oil

- 5.1.6 Grease

- 5.1.7 Process Oil

- 5.1.8 Others

- 5.2 By End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Heavy Equipment

- 5.2.3 Food and Beverage Processing

- 5.2.4 Metallurgy and Metalworking

- 5.2.5 Chemical and Process Industries

- 5.2.6 Other Industries (Pulp and Paper, Marine, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Thailand

- 5.3.1.7 Vietnam

- 5.3.1.8 Malaysia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AMSOIL Inc.

- 6.4.2 Bharat Petroleum Corp. Ltd

- 6.4.3 Blaser Swisslube AG

- 6.4.4 BP p.l.c. (Castrol)

- 6.4.5 Carl Bechem GmbH

- 6.4.6 Chevron Corporation

- 6.4.7 China National Petroleum Corporation (PetroChina)

- 6.4.8 China Petroleum & Chemical Corp. (Sinopec)

- 6.4.9 ENEOS Corporation

- 6.4.10 Eni SpA

- 6.4.11 Exxon Mobil Corporation

- 6.4.12 FUCHS SE

- 6.4.13 Gazprom Neft PJSC

- 6.4.14 GS Caltex Corporation

- 6.4.15 Gulf Oil International

- 6.4.16 Hindustan Petroleum Corp. Ltd

- 6.4.17 Idemitsu Kosan Co. Ltd

- 6.4.18 Indian Oil Corporation Ltd.

- 6.4.19 Kluber Lubrication

- 6.4.20 LUKOIL

- 6.4.21 Motul

- 6.4.22 Petrobras

- 6.4.23 Petronas Lubricants International

- 6.4.24 Phillips 66 Company

- 6.4.25 PT Pertamina (Persero)

- 6.4.26 Repsol

- 6.4.27 ROCOL

- 6.4.28 ROSNEFT

- 6.4.29 Shell plc

- 6.4.30 TotalEnergies SE

- 6.4.31 Valvoline Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment