|

市場調查報告書

商品編碼

1910438

電源管理積體電路(PMIC):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Power Management Integrated Circuit (PMIC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

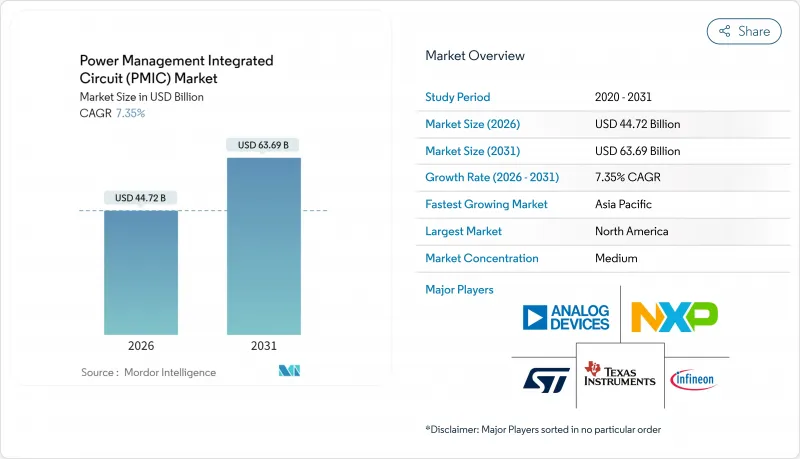

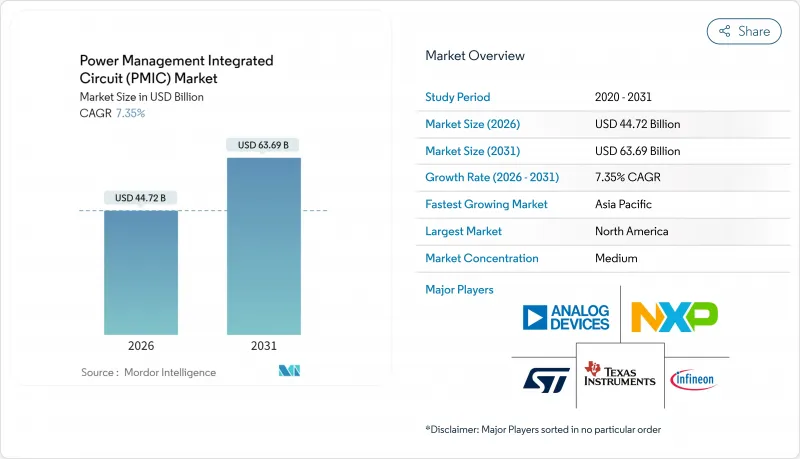

預計到 2026 年,電源管理 IC (PMIC) 市場規模將達到 447.2 億美元,從 2025 年的 416.6 億美元成長到 2031 年的 636.9 億美元。

預計從 2026 年到 2031 年,其複合年成長率將達到 7.35%。

電動車、旗艦智慧型手機和超低功耗物聯網設備的普及推動了對高效轉換拓撲結構、嚴格電壓容差和先進製程節點的需求。電池管理積體電路仍然是電源管理積體電路 (PMIC) 市場的基礎,而無線充電 PMIC、寬能能隙功率級和 20 奈米以下製程設計正成為推動市場成長的關鍵因素。競爭格局由兩類廠商主導:一類是利用專有智慧財產權 (IP) 捍衛市場佔有率的老字型大小企業,另一類是為垂直整合開發專有解決方案的處理器供應商。代工廠產能、超薄元件的散熱限制以及假冒偽劣產品的湧入,持續對整體市場發展構成風險。

全球電源管理積體電路(PMIC)市場趨勢與洞察

電動車和混合動力車的快速普及推動了對高電流、高效率電源管理積體電路(PMIC)的需求。

電動車架構正在重塑電源管理積體電路 (PMIC) 的市場規範。特斯拉的 4680 電池單元需要 PMIC 能夠處理高達 500A 的連續電流,同時將結溫維持在 125 度C以下,以驅動碳化矽 (SiC) 功率級和先進的散熱封裝。比亞迪的分散式電池管理設計實現了 10C 快充能力,凸顯了對電池級 PMIC 控制的需求。英飛凌的 CoolSiC 模組在 800V 車載充電器中實現了 98.5% 的效率,而車隊營運商則優先考慮 PMIC 的診斷功能以實現預測性維護。這些需求正在推動感測器介面和無線鏈路的整合,使 PMIC 從獨立的穩壓器轉變為智慧子系統。

利用較小的工程節點提高片上功率密度

向 20nm 及以下製程的過渡使得在單一晶粒上實現多個電源軌和控制邏輯成為可能,從而減少基板面積並降低寄生效應。台積電的 16nm FinFET 平台實現了超過 1W/mm² 的功率密度,而 65nm 製程的功率密度僅為 0.3W/mm²,同時保持了設計基板的散熱性能。聯發科的天璣 9400 整合了 12 個獨立的電源域,由片上電源管理積體電路 (PMIC) 管理,可針對 AI 工作負載執行亞微秒電壓調節。然而,由於量子效應導致漏電流波動性增加,迫使人們採用補償演算法,有人建議在 2nm 製程節點中引入環柵結構,旨在與目前的 3nm 製程相比降低 30% 的功耗。

類比和混合訊號節點代工產能的供應鏈週期性

類比元件產能擴張落後於數位裝置,預計到2024年底,台積電專用生產線的運轉率將達到95%,而電源管理積體電路(PMIC)的前置作業時間也從8週延長至16週。全球晶圓代工廠向成熟製程節點的策略轉型減少了合格汽車零件供應商的數量,加劇了地緣政治風險。隨著汽車項目簽訂五年合約,消費性電子公司競相爭奪日益減少的訂單佔有率,進一步加劇了分配風險。

細分市場分析

至2025年,電池管理IC將佔電源管理IC(PMIC)市場規模的33.15%,凸顯其在電動車電池組和固定式儲能系統中的不可或缺性。然而,隨著Qi2磁對準技術將15W無線充電的傳輸效率提升至85%,以及MagSafe等類似生態系的擴展,預計2031年,無線充電PMIC的複合年成長率將達到8.32%。

電源管理積體電路市場的需求主要集中在電池管理IC的安全診斷、電池均衡精度和熱控制方面,而異物檢測和自適應諧振控制則是無線充電PMIC的差異化優勢。 DC-DC轉換器PMIC在資料中心和筆記型電腦的電源軌領域依然保持著強勁的需求,而線性穩壓器則憑藉其低於10µV的噪音基底,在細分市場中佔據一席之地。工廠自動化的發展帶動了馬達驅動PMIC的需求。電壓基準和監控IC由於汽車功能安全標準的要求,仍然是穩定的收入來源。

到2025年,家用電子電器將佔據電源管理積體電路(PMIC)市場佔有率的42.25%,這主要得益於智慧型手機、筆記型電腦和平板電腦等設備整合了超過15個穩壓電源軌。受800V驅動系統和ADAS計算叢集的推動,汽車和電動出行領域預計將以8.55%的複合年成長率成長,超過其他所有領域。

工業和機器人應用需要具有精確扭矩的馬達驅動器,而 5G 基礎設施則需要高壓電源管理積體電路 (PMIC) 來處理 48V 的直接電源。醫療設備,尤其是植入,優先考慮亞微安培的待機電流,而物聯網終端則採用支援能源採集的 PMIC,其起始電壓可低至 380mV。由於各行業會根據可靠性、電壓調節和精確遙測等因素調整 PMIC 的藍圖,因此電源管理積體電路 (PMIC) 市場的供應商路線圖各不相同。

區域分析

到2025年,北美將佔全球營收的36.85%,這主要得益於特斯拉電池管理系統訂單的成長以及蘋果對客製化電源管理積體電路(PMIC)晶片的重視。該地區正受惠於日益完善的設計服務生態系統和強勁的電動車基礎設施建設。

亞太地區是主要的晶圓代工和消費性電子產品組裝基地,預計到 2031 年將以 10.21% 的複合年成長率成長。中國電動車的擴張和韓國的記憶體生產線正在推動電源管理積體電路 (PMIC) 的產量成長,而接近性晶圓廠則縮短了開發週期。

在歐洲,德國汽車製造商採用800V系統,加上嚴格的環保設計法規,推動了電氣化進程,從而帶來了穩定的需求。在北歐的可再生能源領域,用於併網逆變器的電源管理積體電路(PMIC)正在推廣,這些積體電路能夠最佳化最大功率點追蹤(MPPT)。在中東和非洲,太陽能微電網正在推動成長;而在南美洲,巴西的電動車激勵政策和阿根廷利用其鋰資源建立的本地電池供應網路也是促進成長的因素。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動車 (EV) 和混合動力汽車(xEV) 的快速普及推動了對高電流、高效率 PMIC 的需求。

- 透過小型化製程節點(小於20nm)實現高密度片上電源整合

- 旗艦智慧型手機採用先進電池健康管理PMIC

- 政府針對消費和工業電子設備的節能法規

- 邊緣人工智慧/物聯網的普及需要超低待機電流的電源管理積體電路(PMIC)。

- 快速充電器中的寬能能隙(GaN/SiC)功率級

- 市場限制

- 類比和混合訊號節點代工廠產能的供應鏈週轉率

- 設計複雜性的增加使得中小規模原始設備製造商難以承受非經常性工程成本。

- 超薄消費性電子設備的溫度控管局限性

- 假冒PMIC的日益增加影響了人們對可靠性的認知。

- 產業供應鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素的影響

- 波特五力分析

- 新進入者的威脅

- 買方和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依積體電路類型

- 線性穩壓器 PMIC

- DC-DC轉換器PMIC

- 電池管理積體電路

- 電壓基準和監控積體電路

- 用於馬達控制和驅動器的電源管理積體電路

- 無線充電 PMIC

- 透過使用

- 家用電子電器

- 汽車和電動旅行

- 工業機器人

- 電訊和網路

- 醫療和醫療設備

- 物聯網和邊緣設備

- 按晶圓節點

- 65奈米或以上

- 40~65 nm

- 20~40 nm

- 小於20奈米

- 按功率範圍

- 低功耗電源管理積體電路 (PMIC)

- 中功率 PMIC

- 高功率電源管理積體電路 (PMIC)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Texas Instruments Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- STMicroelectronics NV

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Qualcomm Incorporated

- Broadcom Inc.

- Skyworks Solutions, Inc.

- Dialog Semiconductor(Renesas)

- Rohm Co., Ltd.

- Maxim Integrated(ADI)

- Toshiba Electronic Devices and Storage Corp.

- MediaTek Inc.

- Power Integrations, Inc.

- Silicon Laboratories Inc.

- Monolithic Power Systems, Inc.

- Vishay Intertechnology, Inc.

- Littelfuse, Inc.

第7章 市場機會與未來展望

The power management integrated circuit market size in 2026 is estimated at USD 44.72 billion, growing from 2025 value of USD 41.66 billion with 2031 projections showing USD 63.69 billion, growing at 7.35% CAGR over 2026-2031.

An expanding pool of electric vehicles, flagship smartphones, and ultra-low-power IoT devices is boosting demand for highly efficient conversion topologies, tighter voltage tolerances, and advanced process nodes. Battery management ICs remain the cornerstone of the power management integrated circuit market, while wireless-charging PMICs, wide-bandgap power stages, and sub-20 nm designs are emerging as pivotal growth catalysts. The competitive landscape is shaped by analog stalwarts defending share through proprietary IP and by processor vendors developing captive solutions for vertical integration. Foundry capacity, thermal constraints in ultra-thin devices, and counterfeit-component infiltration continue to pose tangible risks to overall market momentum.

Global Power Management Integrated Circuit (PMIC) Market Trends and Insights

Rapid EV and xEV Penetration Elevating Demand for High-Current, High-Efficiency PMICs

Electric-vehicle architecture is reshaping specifications for the power management integrated circuit market. Tesla's 4680 battery cell demands PMICs that handle up to 500 A continuous current while remaining below 125°C junction temperature, prompting silicon-carbide power stages and advanced thermal packaging. BYD's distributed battery-management design delivers 10C fast-charge capability, illustrating the need for granular cell-level PMIC control. Infineon's CoolSiC modules reach 98.5% efficiency in 800 V on-board chargers, and fleet operators now prioritize PMIC diagnostics to enable predictive maintenance. These requirements spur integration of sensor interfaces and wireless links, transforming PMICs into smart subsystems rather than isolated regulators.

Shrinking Process Nodes Enabling Higher On-Chip Power Density

Sub-20 nm migration allows multiple power rails and control logics on a single die, shrinking board footprints and limiting parasitics. TSMC's 16 nm FinFET platform achieves power densities above 1 W/mm2 versus 0.3 W/mm2 at 65 nm while safeguarding thermal profiles through engineered substrates. MediaTek's Dimensity 9400 integrates 12 independent power domains managed by an on-die PMIC that performs sub-microsecond voltage scaling for AI workloads. Yet quantum effects boost leakage variance, forcing adoption of compensation algorithms and heralding gate-all-around structures in 2 nm nodes targeting 30% power drop relative to current 3 nm.

Supply-Chain Cyclicality of Foundry Capacity for Analog and Mixed-Signal Nodes

Analog production lags digital capacity expansion, reaching 95% utilization at TSMC's specialty lines in late 2024 and elongating PMIC lead times to 16 weeks from a historical 8 weeks. GlobalFoundries' strategy shift toward mature nodes leaves fewer suppliers for automotive-qualified lots, raising exposure to geopolitical events. With automotive programs locking five-year commitments, consumer electronics vie for shrinking slots, intensifying allocation risk.

Other drivers and restraints analyzed in the detailed report include:

- Flagship Smartphone Adoption of Advanced Battery-Health PMICs

- Government Energy-Efficiency Mandates for Consumer and Industrial Electronics

- Rising Design Complexity Driving NRE Costs Beyond Reach of Smaller OEMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery management ICs accounted for 33.15% of the power management integrated circuit market size in 2025, underscoring their indispensability in electric-vehicle packs and stationary storage. Wireless-charging PMICs, however, are expected to log an 8.32% CAGR through 2031 as Qi2 magnetic alignment boosts 15 W transmit efficiency to 85% and as MagSafe-like ecosystems proliferate.

Demand within the power management integrated circuit market pivots around safety diagnostics, cell-balancing accuracy, and thermal orchestration for battery management ICs, whereas foreign-object detection and adaptive resonance control differentiate wireless-charging PMICs. DC-DC converter PMICs still serve data-center and notebook rails, linear regulators reserve niches that need <10 µV noise floors, and motor-driver PMICs ride factory-automation growth. Voltage-reference and supervisor ICs remain a stable revenue bedrock, mandated by automotive functional-safety norms.

Consumer electronics generated 42.25% of 2025 revenue for the power management integrated circuit market share, reflecting smartphones, notebooks, and tablets that integrate upwards of 15 regulated rails per device. Automotive and e-mobility, supported by 800 V drivetrains and ADAS compute clusters, is forecast to post an 8.55% CAGR, outpacing all other verticals.

Industrial and robotics use cases require torque-accurate motor drives, whereas 5 G infrastructure calls for high-voltage PMICs handling 48 V direct feeds. Healthcare devices, especially implants, prioritize <1 µA standby current, and IoT endpoints adopt energy-harvesting PMICs capable of starting at 380 mV. Each vertical calibrates its PMIC specs around reliability, regulation voltage, and telemetry sophistication, fragmenting supplier roadmaps across the power management integrated circuit market.

The Power Management Integrated Circuit (PMIC) Market Report is Segmented by Type (Linear Regulator PMIC, DC-DC Converter PMIC, and More), Application (Consumer Electronics, Automotive and E-Mobility, and More), Wafer Node (Greater Than or Equal To 65 Nm, 40-65 Nm, and More), Power Range (Low Power PMICs, Medium Power PMICs, High Power PMICs), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 36.85% of global revenue in 2025, propelled by Tesla battery-management orders and Apple's emphasis on custom PMIC silicon. The region benefits from deep design-service ecosystems and a robust EV infrastructure build-out.

Asia-Pacific, home to leading foundries and consumer-electronics assembly, is projected to post a 10.21% CAGR through 2031. China's EV scale-up and South Korea's memory lines fuel PMIC volume, while proximity to fabs shortens iteration cycles.

Europe combines automotive electrification, where German OEMs adopt 800 V systems, with strict eco-design rules, sustaining steady demand. Nordic renewables deploy grid-tie inverter PMICs optimizing maximum-power-point tracking. Growth pockets in the Middle East and Africa arise from solar mini-grids, whereas South America leverages Brazilian EV incentives and Argentine lithium resources for localized battery supply chains.

- Texas Instruments Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Qualcomm Incorporated

- Broadcom Inc.

- Skyworks Solutions, Inc.

- Dialog Semiconductor (Renesas)

- Rohm Co., Ltd.

- Maxim Integrated (ADI)

- Toshiba Electronic Devices and Storage Corp.

- MediaTek Inc.

- Power Integrations, Inc.

- Silicon Laboratories Inc.

- Monolithic Power Systems, Inc.

- Vishay Intertechnology, Inc.

- Littelfuse, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid EV and xEV penetration elevating demand for high-current, high-efficiency PMICs

- 4.2.2 Shrinking process nodes (Less than 20 nm) enabling higher on-chip power density

- 4.2.3 Flagship smartphone adoption of advanced battery-health PMICs

- 4.2.4 Government energy-efficiency mandates for consumer and industrial electronics

- 4.2.5 Edge-AI/IoT proliferation requiring ultra-low-quiescent-current PMICs

- 4.2.6 Adoption of wide-bandgap (GaN/SiC) power stages in fast chargers

- 4.3 Market Restraints

- 4.3.1 Supply-chain cyclicality of foundry capacity for analog and mixed-signal nodes

- 4.3.2 Rising design complexity driving NRE costs beyond reach of smaller OEMs

- 4.3.3 Thermal-management limits in ultra-thin consumer devices

- 4.3.4 Increasing counterfeit PMIC influx affecting reliability perceptions

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (USD BILLION)

- 5.1 By IC Type

- 5.1.1 Linear Regulator PMIC

- 5.1.2 DC-DC Converter PMIC

- 5.1.3 Battery Management IC

- 5.1.4 Voltage Reference and Supervisor IC

- 5.1.5 Motor-Control and Driver PMIC

- 5.1.6 Wireless-Charging PMIC

- 5.2 By Application

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive and e-Mobility

- 5.2.3 Industrial and Robotics

- 5.2.4 Telecommunications and Networking

- 5.2.5 Healthcare and Medical Devices

- 5.2.6 IoT and Edge Devices

- 5.3 By Wafer Node

- 5.3.1 Greater than and Equal to 65 nm

- 5.3.2 40 - 65 nm

- 5.3.3 20 - 40 nm

- 5.3.4 Less than 20 nm

- 5.4 By Power Range

- 5.4.1 Low Power PMICs

- 5.4.2 Medium Power PMICs

- 5.4.3 High Power PMICs

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Texas Instruments Inc.

- 6.4.2 Analog Devices, Inc.

- 6.4.3 Infineon Technologies AG

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 STMicroelectronics N.V.

- 6.4.6 ON Semiconductor Corporation

- 6.4.7 Renesas Electronics Corporation

- 6.4.8 Qualcomm Incorporated

- 6.4.9 Broadcom Inc.

- 6.4.10 Skyworks Solutions, Inc.

- 6.4.11 Dialog Semiconductor (Renesas)

- 6.4.12 Rohm Co., Ltd.

- 6.4.13 Maxim Integrated (ADI)

- 6.4.14 Toshiba Electronic Devices and Storage Corp.

- 6.4.15 MediaTek Inc.

- 6.4.16 Power Integrations, Inc.

- 6.4.17 Silicon Laboratories Inc.

- 6.4.18 Monolithic Power Systems, Inc.

- 6.4.19 Vishay Intertechnology, Inc.

- 6.4.20 Littelfuse, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment