|

市場調查報告書

商品編碼

1910431

袋裝包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Pouch Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

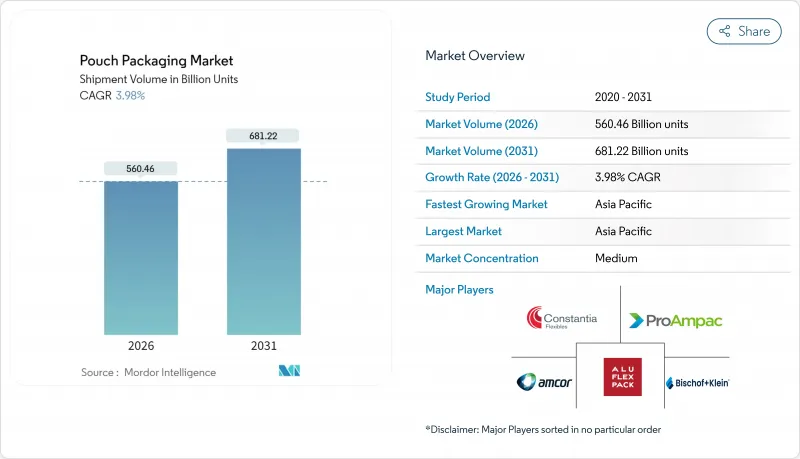

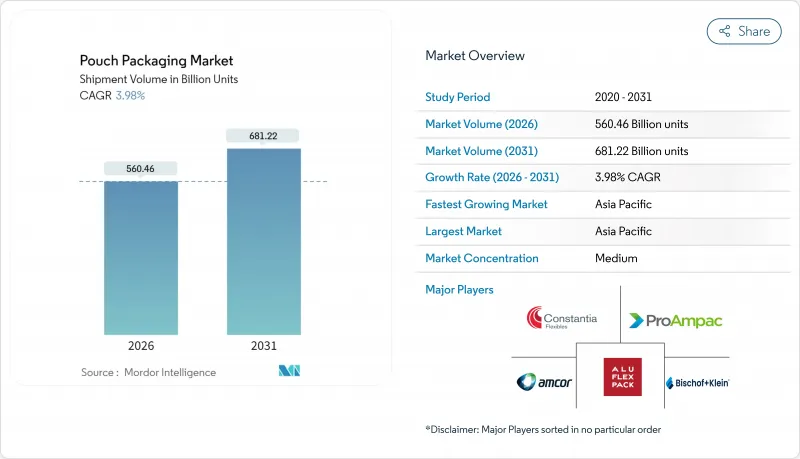

2025年,袋裝包裝市場價值為5,390.1億美元,預計到2031年將達到6,812.2億美元,而2026年為5,604.6億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.98%。

這種穩定成長的趨勢表明,軟包裝市場正從早期快速成長階段過渡到更為謹慎的擴張階段,而電子商務物流、便利食品趨勢以及更嚴格的永續性法規都為其提供了支撐。品牌所有者仍然傾向於選擇軟包裝而非硬包裝,因為軟包裝具有更高的材料利用率;監管機構也鼓勵採用輕量化解決方案,以減少運輸排放。技術投資目前優先考慮單一材料阻隔薄膜和可回收性,競爭優勢也正從單純的規模經濟轉向其他方面。

全球軟包裝市場趨勢與洞察

對經濟實惠的包裝和品牌差異化的需求日益成長

消費品利潤率面臨的通膨壓力不斷增加,促使企業尋求既能減少材料用量又不影響貨架陳列效果的包裝形式。與同類硬質包裝相比,軟包裝袋通常可減少70%的基材用量,並提供更大的印刷面積,從而實現高解析度影像。根據ProAmpac發布的2024年報告,可回收的軟包裝袋可為品牌所有者節省15-20%的材料成本。小型品牌正利用這些成本優勢,實現與跨國公司相同的視覺衝擊力,從而推動市場細分,並在價格敏感型品類中提升銷售量。

便利食品和即食食品消費激增

都市化加快和家庭規模縮小導致人們對單份微波爐加熱食品的依賴性增強,而這類食品非常適合軟包裝。根據美國農業部數據顯示,中國二線城市的調理食品市場正以每年12%的速度成長,其中,能夠均勻加熱和排放蒸氣的袋裝包裝佔了越來越大的市場佔有率。像「Once Upon a Farm」這樣的高階嬰幼兒食品生產商,正利用吸嘴袋延長保存期限並提供更優的功能,從而為其產品設定更高的價格。

日益嚴重的環境與回收問題

柔軟性薄膜的回收基礎設施遠落後於寶特瓶和金屬罐,這使得品牌商面臨承擔生產者延伸責任(EPR)成本的風險。據軟包裝協會稱,美國僅有4%的柔軟性薄膜以機械方式回收,迫使加工商投入資金資金籌措高成本的回收系統。同時,提案的PFAS禁令威脅到對食品安全至關重要的阻隔化學技術,造成不確定性,並減緩了對新生產線的資本投資。

細分市場分析

到2025年,塑膠仍將佔據軟包裝市場60.72%的佔有率,這主要得益於聚乙烯和聚丙烯的低成本和易加工性。然而,隨著監管機構發出訊號,未來廢棄物處理解決方案的性價比將超越傳統的成本績效,生物基和可堆肥材料將穩定成長,年複合成長率將達到6.05%。領先的加工商正在將植物來源樹脂與奈米纖維素基阻隔塗層相結合,以開發出在氧氣阻隔性能方面可與EVOH媲美的產品。

軟包裝市場正青睞那些既能確保產品保護又能實現可回收性的單一材料創新。預計到2024年,結構簡化相關的專利申請將成長40%,預示著材料科學領域的競爭將日益激烈。投資於相容劑和無溶劑複合技術的加工商已做好充分準備,能夠在2030年截止日期前滿足歐盟的回收標準。同時,在對氧氣滲透要求極高的高階應用中,鋁箔的使用量保持穩定,而對更薄壁材的需求仍在持續。

扁平袋仍佔袋裝包裝市場36.33%的佔有率,反映出其在乾貨領域的廣泛應用。然而,隨著零售商重視在擁擠的貨架上展示垂直標識,立式袋正以5.43%的複合年成長率加速成長。品牌商正利用風琴式底部和逼真的印刷技術,即使在零食堅果和寵物食品等質化品類中,也能傳遞高階價值。

功能性包裝形式不斷擴展:殺菌袋可用於生產常溫保存的蒸餾食品,無菌複合技術瞄準飲料市場,條狀包裝則主導單份營養補充劑市場。從捲材到填充的一體化工作流程為大批量生產的單品提供了成本優勢,而預製包裝則適用於小批量生產。 Guarapac 在巴西提供的整合式複合-注塑-射出成型解決方案就是一個很好的例子,它展示了端到端控制如何降低故障率並加快產品上市速度。

區域分析

亞太地區預計到2025年將佔據全球軟包裝市場39.54%的佔有率,並預計在2031年之前以6.74%的複合年成長率持續成長。中國市場需求的快速成長得益於其對包裝食品的快速消費,而這又受到有組織零售業和嚴格的食品安全法規的推動。在印度,現代化分銷網路的擴張正在推動銷售成長;而在韓國,韓妝產業正將軟性化妝品包裝出口到全球各地。區域性加工商正利用其接近性原生樹脂供應商和具有成本優勢的勞動力資源,強化其本地化的供應鏈,同時,跨國品牌所有者也在尋求包裝規格的全球統一化。

北美市場的需求模式日趨成熟,優質化和電子商務成為主導。輕量化設計降低了以體積重量計價下的運輸成本,促使零售商採用自有品牌袋。在歐洲,監管部門為提高可回收性而採取的措施加速了單一材料產品的推廣,軟包裝在生命週期指標方面優於硬質玻璃和多層紙盒。斯堪地那維亞市場正在試行軟包裝薄膜押金制度,為歐盟範圍內的推廣提供數據支援。

南美洲、中東和整個非洲都蘊藏著新的成長潛力。巴西乳製品產業正在採用吸嘴袋包裝酵母菌飲料,因為這種包裝可以節省低溫運輸能源。波灣合作理事會(GCC)國家正在進口袋裝蒸餾食品,這種包裝能夠適應沙漠地區的物流運輸。非洲最大的城市則使用小袋包裝經濟實惠的必需品。儘管基礎設施挑戰依然存在,但人口成長動能和可支配收入的增加將逐步縮小與已開發地區的差距。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對經濟高效的包裝和品牌差異化的需求日益成長

- 簡便食品和即食食品的消費量激增

- 向永續性、輕巧、靈活的包裝轉型

- 加速電子商務和直接面對消費者的物流

- 工業散裝應用中自吸袋的成長

- 創新研發出高阻隔單材料薄膜,使其可回收利用

- 市場限制

- 日益嚴重的環境與回收問題

- 塑膠樹脂原料價格波動

- 來自新興纖維基軟性包裝材料的競爭

- 生物基高阻隔樹脂的供應限制

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

- 回收和永續性趨勢

第5章 市場規模與成長預測

- 材料

- 塑膠

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚氯乙烯樹脂(PVC)

- 其他塑膠

- 紙

- 鋁箔

- 可生物分解/可堆肥

- 塑膠

- 依產品類型

- 平型(枕形和側邊密封)

- 起來

- 噴口

- 蒸餾

- 無菌

- 條狀包裝/小袋

- 卷材/預製袋

- 封裝類型

- 緊固件

- 壺嘴和蓋子

- 蒂爾諾奇

- 滑桿

- 其他封裝類型

- 按最終用戶行業分類

- 食物

- 糖果和糖果甜點

- 冷凍食品

- 生鮮食品

- 乳製品

- 乾貨和穀物

- 肉類、家禽和水產品

- 寵物食品

- 其他食品(醬料、調味品、抹醬)

- 飲料

- 酒精飲料

- 不含酒精的飲料

- 醫療/製藥

- 個人護理和化妝品

- 家居護理和家用產品

- 其他終端用戶產業

- 食物

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 肯亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- Mondi plc

- ProAmpac Intermediate, Inc.

- Constantia Flexibles Group GmbH

- Huhtamaki Oyj

- Sealed Air Corporation

- Sonoco Products Company

- Coveris Management GmbH

- Bischof+Klein SE and Co. KG

- FlexPak Services, LLC

- Goglio SpA

- Scholle IPN Corporation

- Gualapack SpA

- Aluflexpack AG

- Flair Flexible Packaging Corporation

- Hood Packaging Corporation

- Toppan Printing Co., Ltd.

- Winpak Ltd.

- Glenroy, Inc.

第7章 市場機會與未來展望

The pouch packaging market was valued at USD 539.01 billion in 2025 and estimated to grow from USD 560.46 billion in 2026 to reach USD 681.22 billion by 2031, at a CAGR of 3.98% during the forecast period (2026-2031).

This steady trajectory underscores the pouch packaging market's transition from rapid early-stage growth to a more measured expansion supported by e-commerce logistics, convenience food trends, and tightening sustainability regulations. Brand owners continue to favor material-efficient flexible packs over rigid formats, while regulatory bodies endorse lightweight solutions that cut transport emissions. Technology investments now prioritize mono-material barrier films and recyclability compliance, shifting competitive advantage away from pure scale economics.

Global Pouch Packaging Market Trends and Insights

Rising Demand for Cost-Effective Packaging and Brand Differentiation

Inflationary pressure on consumer goods margins intensifies the search for packaging formats that cut material usage without compromising shelf appeal. Pouches typically use 70% less substrate than comparable rigid packs and provide a larger printable surface that supports high-resolution graphics. ProAmpac's 2024 report shows curbside-recyclable pouches delivering 15-20% material cost savings for brand owners. Smaller brands leverage these economics to match the visual impact of multinationals, fostering market fragmentation and stimulating additional unit volumes across price-sensitive categories.

Surge in Convenience and Ready-to-Eat Food Consumption

Rising urbanization and smaller household sizes translate into greater reliance on single-serve, microwave-ready meals best suited to flexible formats. USDA data indicates 12% annual growth in ready meals across China's tier-2 cities, with pouches gaining share due to uniform heating and steam venting capabilities. Premium baby-food players such as Once Upon a Farm capitalize on spouted pouches that extend shelf life and justify price premiums through superior functionality.

Escalating Environmental and Recycling Challenges

Flexible-film recycling infrastructure lags far behind that of PET bottles or metal cans, exposing brands to Extended Producer Responsibility fees. The Flexible Packaging Association notes only 4% of flexible films are mechanically recycled in the United States, leaving converters to fund costly take-back schemes. Meanwhile, proposed PFAS bans threaten barrier chemistries vital for food safety, creating uncertainty that slows capital spending on new lines.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-Driven Shift Toward Lightweight Flexible Packs

- Acceleration of E-Commerce and Direct-to-Consumer Logistics

- Volatility in Plastic-Resin Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics retained a 60.72% pouch packaging market share in 2025, anchored by the affordability and processability of polyethylene and polypropylene. Yet bio-based and compostable materials are gaining a 6.05% CAGR foothold as regulators signal a future where end-of-life solutions trump historic cost-performance ratios. Leading converters integrate plant-derived resins with barrier coatings based on nanofibrillated cellulose that rival EVOH in oxygen-blocking capacity.

The pouch packaging market rewards mono-material breakthroughs that ensure recyclability while maintaining product protection. Patent filings for simplified structures rose 40% in 2024, demonstrating a material-science arms race. Converters investing in compatibilizers and solvent-free lamination position themselves to meet EU recyclability quotas ahead of the 2030 deadline. Meanwhile, aluminum foil usage holds steady in premium applications that demand near-zero oxygen ingress, though downgauging efforts continue.

Flat formats still constitute 36.33% of the pouch packaging market size, reflecting entrenched applications in dry goods. Stand-up pouches, however, outpace at a 5.43% CAGR as retailers reward the vertical billboard effect on crowded shelves. Brands exploit gusseted bases and photo-realistic printing to signal premium value, even in commoditized categories such as snack nuts or pet treats.

Function-specific variants proliferate. Retort pouches enable shelf-stable ready meals, aseptic laminates chase beverage opportunities, and stick packs dominate single-serve nutraceuticals. Integrated rollstock-to-fill workflows deliver cost advantages for high-volume SKUs, whereas premade formats suit small batch runs. Gualapack's integrated laminate, injection, and filling solution in Brazil exemplifies how end-to-end control lowers failure rates while accelerating time to market.

The Pouch Packaging Market Report is Segmented by Material (Plastics, Paper, Aluminum Foil, Bio-degradable/Compostable), Product Type (Flat, Stand-Up, Spouted, Retort, Aseptic, Stick-Pack/Sachet, Rollstock/Premade Pouch), Closure Type (Zipper, Spout and Cap, and More), End-User Industry (Food, Beverage, Medical and Pharmaceutical, and More), and Geography. The Market Forecasts are Provided in Terms of Volume (Units).

Geography Analysis

Asia-Pacific led with 39.54% of the pouch packaging market share in 2025 and is forecast to record a 6.74% CAGR to 2031. China's rapid shift toward packaged foods, propelled by organized retail and stringent food-safety laws, keeps demand buoyant. India's modern trade expansion drives volume gains, while South Korea's K-Beauty ecosystem exports flexible cosmetic packs worldwide. Regional converters benefit from proximity to virgin resin suppliers and cost-competitive labor, reinforcing localized supply chains even as multinational brand owners demand global harmonization of pack specifications.

North America exhibits a mature demand profile focused on premiumization and e-commerce readiness. Lightweight designs translate into shipping cost savings under dimensional-weight tariffs, pushing retailers toward house-brand pouch adoption. Europe's regulatory drive toward recyclability accelerates mono-material rollouts, positioning flexible packs ahead of rigid glass and multilayer cartons on lifecycle metrics. Scandinavian markets pilot deposit schemes for flexible films, providing data for broader EU implementation.

South America and the Middle East, and Africa collectively offer emerging upside. Brazil's dairy sector adopts spouted pouches for yogurt drinks, citing cold-chain energy savings. Gulf Cooperation Council nations import pouch-packed ready meals that withstand desert logistics, and African megacities rely on small-sachet formats for affordable daily necessities. Infrastructure hurdles remain, yet demographic momentum and rising disposable incomes will progressively close the gap with developed regions.

- Amcor plc

- Mondi plc

- ProAmpac Intermediate, Inc.

- Constantia Flexibles Group GmbH

- Huhtamaki Oyj

- Sealed Air Corporation

- Sonoco Products Company

- Coveris Management GmbH

- Bischof + Klein SE and Co. KG

- FlexPak Services, LLC

- Goglio SpA

- Scholle IPN Corporation

- Gualapack SpA

- Aluflexpack AG

- Flair Flexible Packaging Corporation

- Hood Packaging Corporation

- Toppan Printing Co., Ltd.

- Winpak Ltd.

- Glenroy, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for cost-effective packaging and brand differentiation

- 4.2.2 Surge in convenience and ready-to-eat food consumption

- 4.2.3 Sustainability-driven shift toward lightweight flexible packs

- 4.2.4 Acceleration of e-commerce and direct-to-consumer logistics

- 4.2.5 Expansion of spouted pouches in industrial bulk applications

- 4.2.6 High-barrier mono-material film breakthroughs enabling recyclability

- 4.3 Market Restraints

- 4.3.1 Escalating environmental and recycling challenges

- 4.3.2 Volatility in plastic-resin feedstock prices

- 4.3.3 Competition from emerging fiber-based flexible formats

- 4.3.4 Supply constraints for bio-based high-barrier resins

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 The Impact of Macroeconomic Factors on the Market

- 4.9 Recycling and Sustainability Landscape

5 MARKET SIZE AND GROWTH FORECASTS(VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polypropylene (PP)

- 5.1.1.3 Polyethylene Terephthalate (PET)

- 5.1.1.4 Polyvinyl Chloride resin (PVC)

- 5.1.1.5 Other Plastics

- 5.1.2 Paper

- 5.1.3 Aluminum Foil

- 5.1.4 Bio-degradable/Compostable

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Flat (Pillow and Side-Seal)

- 5.2.2 Stand-Up

- 5.2.3 Spouted

- 5.2.4 Retort

- 5.2.5 Aseptic

- 5.2.6 Stick-Pack / Sachet

- 5.2.7 Rollstock / Premade Pouch

- 5.3 By Closure Type

- 5.3.1 Zipper

- 5.3.2 Spout and Cap

- 5.3.3 Tear-Notch

- 5.3.4 Slider

- 5.3.5 Other Closure Type

- 5.4 By End-User Industry

- 5.4.1 Food

- 5.4.1.1 Candy and Confectionery

- 5.4.1.2 Frozen Foods

- 5.4.1.3 Fresh Produce

- 5.4.1.4 Dairy Products

- 5.4.1.5 Dry Foods and Cereals

- 5.4.1.6 Meat, Poultry and Seafood

- 5.4.1.7 Pet Food

- 5.4.1.8 Other Foods (Sauces, Condiments, Spreads)

- 5.4.2 Beverage

- 5.4.2.1 Alcoholic

- 5.4.2.2 Non-Alcoholic

- 5.4.3 Medical and Pharmaceutical

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Home Care and Household

- 5.4.6 Other End-User Industry

- 5.4.1 Food

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi plc

- 6.4.3 ProAmpac Intermediate, Inc.

- 6.4.4 Constantia Flexibles Group GmbH

- 6.4.5 Huhtamaki Oyj

- 6.4.6 Sealed Air Corporation

- 6.4.7 Sonoco Products Company

- 6.4.8 Coveris Management GmbH

- 6.4.9 Bischof + Klein SE and Co. KG

- 6.4.10 FlexPak Services, LLC

- 6.4.11 Goglio SpA

- 6.4.12 Scholle IPN Corporation

- 6.4.13 Gualapack SpA

- 6.4.14 Aluflexpack AG

- 6.4.15 Flair Flexible Packaging Corporation

- 6.4.16 Hood Packaging Corporation

- 6.4.17 Toppan Printing Co., Ltd.

- 6.4.18 Winpak Ltd.

- 6.4.19 Glenroy, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment