|

市場調查報告書

商品編碼

1910428

歐洲堆垛機:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Palletizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

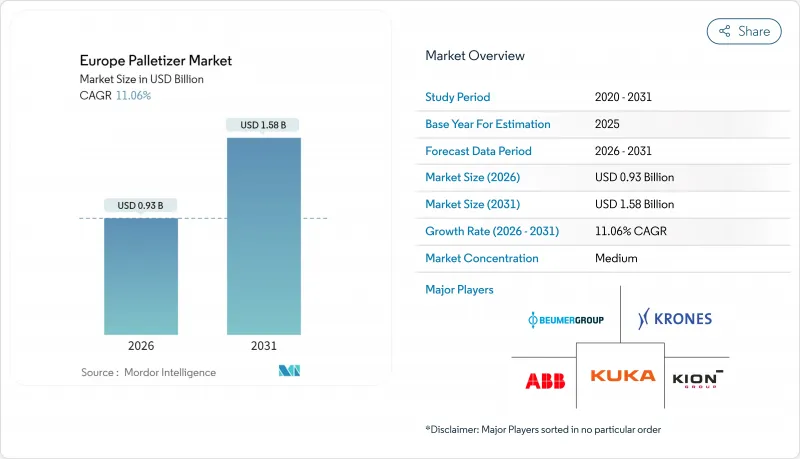

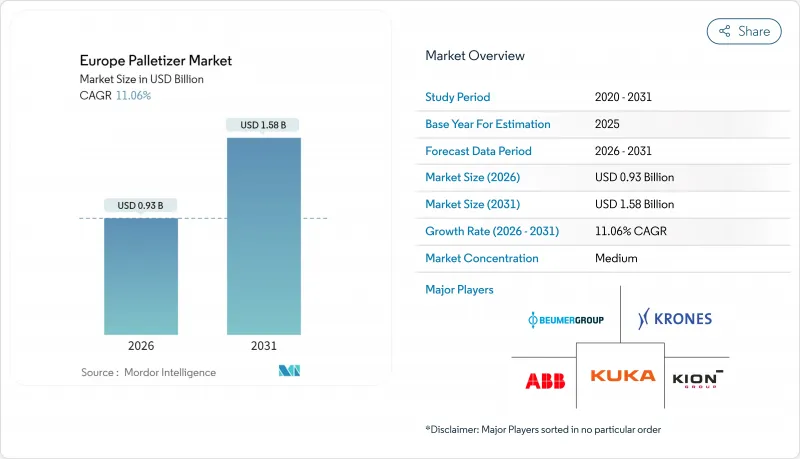

歐洲堆垛機市場預計將從 2025 年的 8.4 億美元成長到 2026 年的 9.3 億美元,預計到 2031 年將達到 15.8 億美元,2026 年至 2031 年的複合年成長率為 11.06%。

這一兩位數的成長軌跡反映了該地區向自動化包裝的果斷轉型,旨在應對勞動力嚴重短缺、工資上漲和更嚴格的安全法規等挑戰。節能自動化與碳中和物流目標相契合,進一步加速了採購決策,尤其是在各國政府將獎勵與永續性成果掛鉤的情況下。製造商也將碼垛視為工業4.0廣泛部署的基礎技術。這是因為機器能夠收集生產數據,為預測性維護模型提供資訊,並能輕鬆整合到倉庫管理系統(WES)中。競爭日益激烈,全球機器人製造商、歐洲專業整合商以及採用新型租賃模式的參與企業都將目標瞄準了傳統上依賴人工堆疊的中型工廠。最後,隨著電子商務履約中心和溫控藥品分銷網路對高吞吐量的需求,歐洲堆垛機市場正從傳統的工廠車間擴展到物流環境。

歐洲堆垛機市場趨勢與洞察

食品飲料加工產業自動化包裝生產線的擴建

食品飲料製造商正將堆疊定位為一個整合流程,而非下游附加環節。碼垛線直接與上游灌裝機對接,在不增加人工干預的情況下提高了產量。這種方法既能保障產品衛生,又能滿足零售商對大批量混合包裝的需求。設備製造商也積極回應,推出了符合衛生標準的不銹鋼衛生夾具和易於清潔的表面。視覺模組可在出貨前採集箱碼,進而增強可追溯性。堆垛機收集的數據還有助於管理產品召回,並提高工廠的合規性。由於托盤是根據即時訂單而非固定批次時間出貨,操作人員反映瓶頸現象減少。

西歐人事費用上升和勞動短缺

西歐勞動力老化導致重複性包裝工作的空缺率達到歷史新高,迫使工廠競相提高工資以爭奪稀缺勞動力。管理人員現在將生產損失納入投資回收期計算,結果顯示,機器人碼垛機可以在18到24個月內收回成本,而不是傳統的三年。早期採用者享受了更高的運轉率和穩定的產量,這轉化為客戶交貨評分的提高。勞動力短缺正在促使經營團隊主管討論自動化的重點從“需要”轉向“實施速度”,從而縮短了決策週期。培訓供應商正在幫助採購商克服人才短缺問題,並確保重複訂單。

全自動系統需要高額資本投入。

具備輸送機裝載、拉伸包裝和貼標功能的全系列堆垛機價格可能超過一條完整的填充線,令許多中小型工廠望而卻步。東歐企業的高昂借貸成本進一步拉大了與西方同行之間的差距。為了因應這一局面,供應商開始推出租賃和設備即服務(EaaS)模式,推動企業從資本支出轉向營運支出。與工人共用空間的協作單元也透過避免安保和土建費用來降低計劃成本。雖然這些方案擴大了設備的普及範圍,但它們缺乏頂級系統的純粹吞吐量,因此對於高產量工廠而言,這需要權衡取捨。

細分市場分析

預計到2025年,機器人堆垛機將佔據歐洲堆垛機市場50.85%的佔有率,年複合成長率(CAGR)為12.89%,這主要得益於安全人機協作技術的進步和編碼工具的簡化。無需機械改造即可靈活切換不同SKU的柔軟性,對於產品系列多樣化的工廠而言堪稱理想之選。傳統機器在超高產量飲料生產線中依然發揮著重要作用,其機械致動器能夠實現無與倫比的每小時循環次數。混合平台將機械層壓成型器與機器人角柱結合,在保持柔軟性的同時,也滿足了穩定性要求。預計在2025年進行試驗的第二代協作機器人,其最大舉重能力可達25公斤,從而開闢了以往需要大型封閉式機器人才能應用的新領域。隨著服務模式的日趨成熟,機器人供應商開始提供打包式運作保證,從而降低營運風險,並推動歐洲堆垛機市場在獨立買家群體中不斷擴張。

部署速度也是一個重要因素。預製單元以即插即用的撬裝形式交付,可在數天而非數月內試運行。智慧安全掃描器取代了硬質圍欄,釋放了寶貴的占地面積。機器人操作軟體為生產線主管提供即時OEE分析。供應商目前正透過OT-IT融合實現差異化,將托盤與ERP出貨數據關聯起來,從而實現可追溯性。這些數位化連接能力使機器人系統成為工廠數位化的“特洛伊木馬”,鞏固了其在歐洲堆垛機行業的主導地位。

疫情暴露了人工作業的瓶頸,製藥廠正轉向自動化。在低溫運輸法規的推動下,從管瓶到托盤的整個流程都必須嚴格控制,預計到2031年,該行業將以12.95%的複合年成長率成長。機器人能夠在冷藏室中可靠運作,並整合序列化攝影機,記錄每個紙箱的ID。到2025年,食品飲料行業將佔據歐洲堆垛機市場32.70%的最大佔有率,因為大批量瓶裝生產商和零食製造商需要持續生產以滿足零售貨架的需求。肉類和乳製品行業的交叉污染預防法規也促使人們青睞能夠承受高強度清潔的不銹鋼機器人夾具。

個人護理和化妝品公司正在部署堆垛機來處理與電商促銷相關的季節性組合包裝。高階產品需要投資溫和的真空吸盤工具來防止紙箱磨損。在化學產業,為了滿足安全標準,增加防爆外殼和防靜電組件,從而催生了對專業整合商的利基市場需求。供應商根據不同的應用情境客製化承包單元,從而降低驗證的複雜性,並擴大歐洲堆垛機市場的潛在客戶群。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 食品飲料加工產業自動化包裝生產線的擴張

- 西歐人事費用上升和勞動短缺

- 日益嚴格的職場安全法規推動了機器人堆垛機的應用

- 電子商務的快速成長正在推動對高容量倉庫的需求。

- 在中型工廠引入協同式碼垛單元

- 碳中和物流中心對節能型堆垛機的需求

- 市場限制

- 全自動系統需要高額資本投入。

- 由於複雜的機電一體化整合,存在停機風險。

- 多軸機器人熟練程式設計師短缺

- 托盤尺寸越來越多樣化,使得標準單元設計更加複雜。

- 產業供應鏈分析

- 監管環境

- 宏觀經濟因素如何影響市場

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

第5章 市場規模與成長預測

- 按類型

- 傳統的

- 機器人

- 按最終用戶行業分類

- 食品/飲料

- 製藥

- 個人護理及化妝品

- 化學品

- 透過系統配置

- 在線連續堆垛機

- 層壓堆垛機

- 龍門式/機械臂堆垛機

- 按載重能力

- 10公斤或以下

- 11~30 kg

- 超過30公斤

- 按自動化級別

- 半自動

- 全自動

- 按國家/地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 荷蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd

- Beumer Group GmbH and Co. KG

- KION Group AG(Dematic)

- Krones AG

- Kuka AG

- Honeywell International Inc.

- AetnaGroup SpA

- Concetti SpA

- Fuji Robotics Americas Inc.

- FANUC Europe Corporation SA

- Yaskawa Europe GmbH

- Sidel Group

- Ocme Srl

- Gebo Cermex

- Kawasaki Robotics GmbH

- Premier Tech Systems and Automation

- Columbia Machine Inc.

- MSK Verpackungs-Systeme GmbH

- Scott Automation NV

- Ehcolo A/S

- Bastian Solutions LLC

第7章 市場機會與未來展望

The Europe Palletizer market is expected to grow from USD 0.84 billion in 2025 to USD 0.93 billion in 2026 and is forecast to reach USD 1.58 billion by 2031 at 11.06% CAGR over 2026-2031.

This double-digit trajectory mirrors the region's decisive shift toward automated packaging, which addresses acute labor shortages, rising wages, and tighter safety regulations that favor robotic over manual handling. Energy-efficient automation that aligns with carbon-neutral logistics goals further accelerates purchasing decisions, especially when governments link incentives to sustainability outcomes. Manufacturers also view palletizing as a gateway technology for broader Industry 4.0 rollouts because the machines collect production data, feed predictive maintenance models, and integrate easily with warehouse execution systems. Competitive intensity is rising as global robot makers, European specialist integrators, and new rental-model disruptors all target mid-sized factories that historically relied on manual stacking. Finally, e-commerce fulfillment hubs and temperature-controlled pharmaceutical chains create high-throughput requirements that expand the Europe Palletizer market into logistics environments beyond the traditional factory floor.

Europe Palletizer Market Trends and Insights

Expansion of Automated Packaging Lines in Food and Beverage Processing

Food and beverage producers now treat palletizing as an integrated step rather than a downstream add-on. Lines link directly to upstream fillers, so throughput rises without extra human touches, an approach that protects product hygiene and matches retailer demand for high-volume mixed packs. Equipment builders respond with stainless-steel hygienic grippers and easy-wash surfaces that meet sanitation codes. Vision modules add traceability by capturing case codes before loads leave the plant. Data captured at the palletizer also supports recall management, providing factories with a compliance advantage. Operators report fewer bottlenecks because pallets exit in rhythm with real-time orders, rather than fixed batch windows.

Labor Cost Escalation and Scarcity Across Western Europe

Western Europe's aging workforce is pushing vacancy rates in repetitive packaging roles to record highs, forcing plants to compete for scarce labor at rapidly rising wages. Managers now factor lost production into payback calculations, revealing that robotic palletizers recoup their costs in 18-24 months, instead of the earlier three-year norm. Early adopters enjoy higher uptime and stable output, which translates into better customer delivery scores. The labor gap also shifts board-level conversations from "whether" to "how fast" to automate, shortening decision cycles. Vendors who bundle training help buyers overcome talent gaps and secure repeat orders.

High Capital Expenditure for Fully Automatic Systems

Full-line palletizers with conveyor in-feed, stretch wrapping, and labeling can exceed the price of an entire filling line, which places them out of reach for many small plants. Eastern European firms face higher borrowing costs, widening the gap with Western peers. In response, suppliers launch rental and equipment-as-a-service models that shift spend from capex to opex. Collaborative units that share space with workers also lower project costs because they avoid the costs of guarding and civil works. These options broaden access, yet cannot match the raw throughput of top-tier systems, leaving a trade-off at higher-volume sites.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Workplace Safety Regulations Favouring Robotic Palletizers

- E-Commerce Boom Driving High-Throughput Warehousing Needs

- Downtime Risk Due to Complex Mechatronic Integrations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Robotic palletizers accounted for 50.85% of the European palletizer market size in 2025 and are expected to grow at a 12.89% CAGR, driven by advances in safe human-robot collaboration and simplified coding tools. The flexibility to switch SKUs without mechanical changes suits plants with varied product portfolios. Conventional machines stay relevant in ultra-high-volume beverage lines where mechanical actuators deliver unmatched cycles per hour. Hybrid platforms now merge mechanical layer formers with robotic corner posts to meet stability demands while preserving flexibility. Second-generation cobots, tested in 2025, can lift to 25 kg, opening up new use cases that once required larger, fenced robots. As service models mature, robot suppliers bundle uptime guarantees that lower operational risk and expand the European Palletizer market among cautious buyers.

Implementation speed is another drawback. Pre-engineered cells arrive as plug-and-play skids, enabling commissioning within days instead of months. Smart safety scanners often replace hard fences, freeing up valuable floor space. Robot operating software also feeds line supervisors with live OEE analytics. Vendors now differentiate through OT-IT convergence by linking pallets to ERP dispatch data for traceability. These digital hooks make robotic systems a Trojan horse for wider factory digitalization, reinforcing their leadership in the European Palletizer industry.

Pharmaceutical plants have pivoted to automation after the pandemic exposed bottlenecks in manual handling. The segment is expected to advance at a 12.95% CAGR to 2031, driven by cold-chain regulations that mandate controlled handling from vial to pallet. Robots operate reliably in chilled rooms and integrate serialization cameras that record every carton ID. Food and beverage retained the largest 32.70% share of the European palletizer market size in 2025, as high-volume bottlers and snack makers require continuous output for retail shelves. Cross-contamination rules in the meat and dairy industries also favor stainless-steel robotic grippers that can withstand aggressive washdowns.

Personal care and cosmetics firms adopt palletizers to handle seasonal variety packs driven by e-commerce promotions. Their premium products justify investment in gentle vacuum tooling that prevents carton scuffing. The chemicals sector adds explosive-proof enclosures and antistatic components to meet safety codes, creating niche demand for specialized integrators. With each use case, suppliers tailor turnkey cells that reduce validation complexity and expand the addressable European palletizer market.

The Europe Palletizer Market Report is Segmented by Type (Conventional, Robotic), End-User Industry (Food and Beverages, Pharmaceuticals, and More), System Configuration (Inline, Layer, Gantry/Robotic Arm), Load Capacity (Up To 10 Kg, 11-30 Kg, Above 30 Kg), Automation Level (Semi-Automatic, Fully Automatic), and Geography (Germany, United Kingdom, Italy, Spain, and More). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd

- Beumer Group GmbH and Co. KG

- KION Group AG (Dematic)

- Krones AG

- Kuka AG

- Honeywell International Inc.

- AetnaGroup SpA

- Concetti SpA

- Fuji Robotics Americas Inc.

- FANUC Europe Corporation S.A.

- Yaskawa Europe GmbH

- Sidel Group

- Ocme S.r.l.

- Gebo Cermex

- Kawasaki Robotics GmbH

- Premier Tech Systems and Automation

- Columbia Machine Inc.

- MSK Verpackungs-Systeme GmbH

- Scott Automation NV

- Ehcolo A/S

- Bastian Solutions LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of automated packaging lines in food and beverage processing

- 4.2.2 Labour cost escalation and scarcity across Western Europe

- 4.2.3 Heightened workplace safety regulations favouring robotic palletizers

- 4.2.4 E-commerce boom driving high-throughput warehousing needs

- 4.2.5 Adoption of collaborative palletizing cells in mid-sized plants

- 4.2.6 Carbon-neutral logistics hubs demanding energy-efficient palletizers

- 4.3 Market Restraints

- 4.3.1 High capital expenditure for fully automatic systems

- 4.3.2 Downtime risk due to complex mechatronic integrations

- 4.3.3 Shortage of skilled programmers for multi-axis robots

- 4.3.4 Rising pallet size diversity complicating standard cell design

- 4.4 Industry Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors on the Market

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Intensity of Competitive Rivalry

- 4.8.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Conventional

- 5.1.2 Robotic

- 5.2 By End-user Industry

- 5.2.1 Food and Beverages

- 5.2.2 Pharmaceuticals

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Chemicals

- 5.3 By System Configuration

- 5.3.1 Inline Palletizers

- 5.3.2 Layer Palletizers

- 5.3.3 Gantry / Robotic Arm Palletizers

- 5.4 By Load Capacity

- 5.4.1 Up to 10 kg

- 5.4.2 11 - 30 kg

- 5.4.3 Above 30 kg

- 5.5 By Automation Level

- 5.5.1 Semi-automatic

- 5.5.2 Fully Automatic

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 France

- 5.6.3 United Kingdom

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Russia

- 5.6.7 Netherlands

- 5.6.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Beumer Group GmbH and Co. KG

- 6.4.3 KION Group AG (Dematic)

- 6.4.4 Krones AG

- 6.4.5 Kuka AG

- 6.4.6 Honeywell International Inc.

- 6.4.7 AetnaGroup SpA

- 6.4.8 Concetti SpA

- 6.4.9 Fuji Robotics Americas Inc.

- 6.4.10 FANUC Europe Corporation S.A.

- 6.4.11 Yaskawa Europe GmbH

- 6.4.12 Sidel Group

- 6.4.13 Ocme S.r.l.

- 6.4.14 Gebo Cermex

- 6.4.15 Kawasaki Robotics GmbH

- 6.4.16 Premier Tech Systems and Automation

- 6.4.17 Columbia Machine Inc.

- 6.4.18 MSK Verpackungs-Systeme GmbH

- 6.4.19 Scott Automation NV

- 6.4.20 Ehcolo A/S

- 6.4.21 Bastian Solutions LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment