|

市場調查報告書

商品編碼

1907337

聚甲基丙烯酸甲酯(PMMA):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Polymethyl Methacrylate (PMMA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

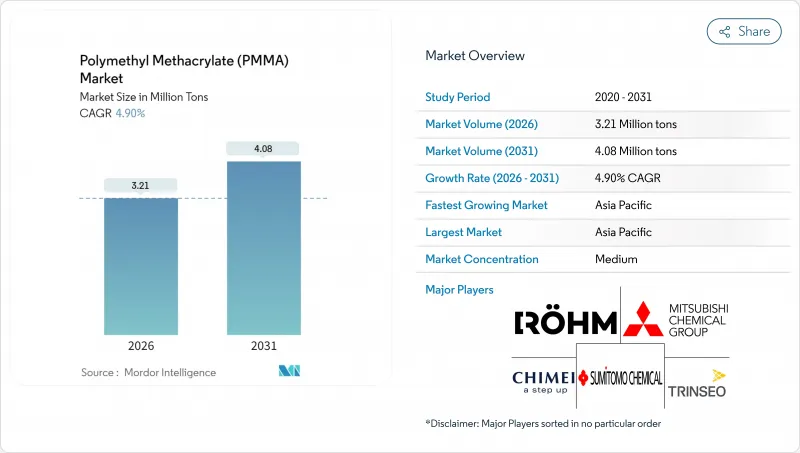

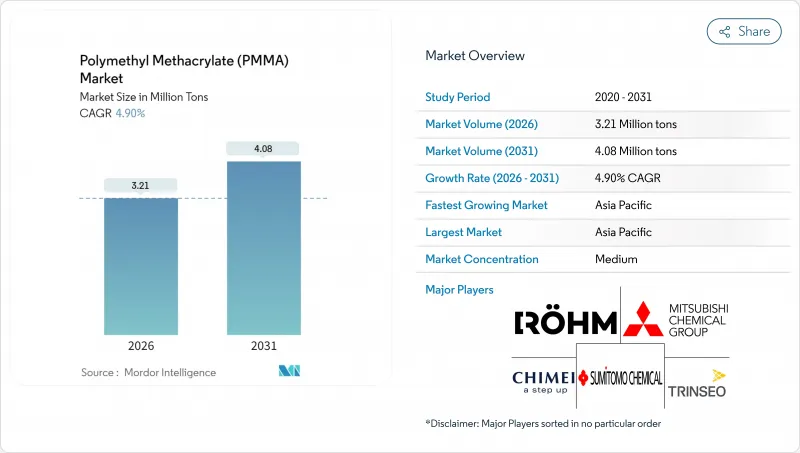

預計到 2026 年,聚甲基丙烯酸甲酯 (PMMA) 市場規模將達到 321 萬噸。

這意味著產量將從 2025 年的 306 萬噸增加到 2031 年的 408 萬噸。預計從 2026 年到 2031 年,產量將繼續以 4.90% 的複合年成長率成長。

儘管甲基丙烯酸甲酯 (MMA) 原料成本持續波動,但汽車輕量化、建築玻璃和 LED 顯示器的強勁需求支撐著 PMMA 市場的成長。 PMMA 的光學透明度、紫外線穩定性和易加工性使其在眾多競爭聚合物中脫穎而出,並在許多關鍵應用領域保護了其產能免受替代壓力。區域產能過剩(尤其是在中國)使價格保持競爭力,而創新的化學回收先導計畫正在為循環生產模式鋪平道路。生產商正將垂直整合和特種等級產品的開發作為 PMMA 市場的防禦策略。

全球聚甲基丙烯酸甲酯(PMMA)市場趨勢與洞察

汽車輕量化和照明需求

電動車製造商指定使用PMMA(聚甲基丙烯酸甲酯)製造全景天窗、尾燈罩和感測器外殼,因為這種聚合物比玻璃輕50%,同時又具有很高的光學品質。向自適應LED系統的技術轉型推動了對ROHM光管理等級產品的需求,這些產品能夠產生精確的光束模式。此外,自動駕駛汽車的雷射雷達透鏡也需要低屈光,這進一步增加了對PMMA的需求。儘管新型抗衝擊聚碳酸酯(PC)共聚物不斷湧現,但在成本和抗紫外線性能比強度提升幅度更大的領域,PMMA市場依然保持著強勁的韌性。

在建築嵌裝玻璃和建築幕牆的應用

智慧建築外觀採用內建感測器和加熱元件的PMMA板材,可實現自然採光、冷凝管理和自清潔功能。 PMMA的可見光透過率高達92-93%(PC板材為86-89%),符合歐洲建築標準的節能性能評估要求。 PMMA板材上的數位印刷技術無需使用複合材料即可實現複雜的建築幕牆設計,從而縮短施工時間。雖然高層計劃的消防法規仍限制了PMMA板材的廣泛應用,但其長期保固和抗紫外線性能使其在注重透明度和美觀性的領域保持競爭力。

MMA原物料價格波動

MMA價格的波動反映了石化原料的價格走勢,並因該製程的高能耗特性而加劇。 2025年3月,由於丙烯成本大幅上漲,Trineo將歐洲市場的PMMA價格上調了250歐元/噸,擠壓了加工商的利潤空間。像歐洲這樣依賴進口的地區,在生物基或再生MMA實現商業化普及之前,可能會持續受到影響。擁有後向整合丙酮生產製程的亞洲生產商獲得了成本優勢,進一步擴大了全球價格差距。

細分市場分析

預計到2025年,片材產品將佔PMMA市場佔有率的38.19%,並在2031年之前以5.36%的複合年成長率成長。這將推動該品類美元收入的成長,並與PMMA整體市場規模保持一致。薄壁擠出生產線具有高機械穩定性,能夠滿足汽車天窗的負載要求,使汽車製造商能夠在不影響安全裕度的前提下減輕重量。澆鑄壓克力板材因其嚴格的厚度公差可最大限度地減少光學缺陷,因此在LED側發光面板領域,尤其是在LED側發光面板領域,保持著高階地位。

珠粒和顆粒仍是射出成型鏡片、電器旋鈕和醫療組件的主要原料。衝擊改質劑和紫外線吸收劑擴大被添加到配方中,提高了戶外標誌的耐用性,但同時也犧牲了一些透明度。專為雷射雕刻設計的顆粒正在獎杯和禮品領域開闢新的收入來源。雖然樹脂化合物的成長速度不如片材,但它們支援各種快速客製化產品的生產,從而支撐了PMMA市場的穩定需求。

PMMA市場報告按產品類型(片材、珠粒/顆粒、樹脂化合物、顆粒劑)、終端用戶行業(汽車、建築、電氣電子、航太、工業機械設備及其他)和地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以數量(噸)和價值(美元)為單位。

區域分析

預計到2025年,亞太地區將佔據PMMA市場50.30%的佔有率,主要得益於中國龐大的加工基地和印度不斷發展的基礎設施。然而,中國的產能過剩正擠壓利潤空間,促使國內製造商轉向出口特殊應用產品,並抑制新增產能。印度正投資11億美元建造一座MMA-PMMA一體化工廠,旨在降低進口依賴度,並在2027年前提升區域市場佔有率。日本和韓國則立足於電子和光學等高附加價值細分市場,從而減輕了大宗商品價格下跌的影響。

北美市場成熟且盈利豐厚,永續性屬性推動了其溢價。 LG化學計畫於2025年開始生產生物丙烯酸,這將使北美加工商能夠提供含有可再生原料的PMMA產品,用於化妝品包裝。航太業的復甦和對電動車的投資支撐了潛在需求,儘管面臨進口板材的競爭,但需求仍然強勁。

歐洲正著力發展循環經濟,德國和荷蘭的化學回收試點計畫已獲得政策支持,並開始生產符合再生材料含量標準的首批商業產品。然而,由於歐洲PMMA製造商高度依賴進口MMA原料,極易受到能源價格波動導致的成本飆升的影響。儘管規模較小,但南美和中東市場前景廣闊,因為大型計劃對透明隔音牆和大型標誌的需求旺盛。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車產業的輕量化和照明需求

- 建築玻璃和建築幕牆採用

- LED標誌和顯示器產業的擴張

- PMMA在醫療和牙科領域的應用日益廣泛

- PMMA化學回收經濟性取得突破

- 市場限制

- MMA原物料價格波動

- 聚碳酸酯和玻璃替代的威脅

- 嚴格的一次性塑膠製品法規

- 價值鏈分析

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 進出口趨勢

- 價格趨勢

- 監管環境

- 終端用戶產業趨勢

- 航太(航太零件生產收入)

- 汽車(汽車生產)

- 建築與施工(新增建築面積)

- 電氣電子設備(電氣電子設備生產收入)

- 包裝(塑膠包裝數量)

第5章 市場規模與成長預測

- 按產品形式

- 床單

- 珠子和顆粒

- 樹脂化合物和顆粒

- 按最終用戶行業分類

- 車

- 建築/施工

- 電氣和電子設備

- 航太

- 工業機械和設備

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Asahi Kasei Corporation

- CHIMEI

- Kuraray Co., Ltd.

- LOTTE MCC Corp.

- Lucite International Alpha BV

- LX MMA(LX Group)

- Mitsubishi Chemical Corporation

- Rohm GmbH

- Sanors

- Sumitomo Chemical Co., Ltd.

- Suzhou Double Elephant Optical Materials Co., Ltd.

- Trinseo

- Wanhua

第7章 市場機會與未來展望

第8章:執行長面臨的關鍵策略挑戰

Polymethyl Methacrylate (PMMA) market size in 2026 is estimated at 3.21 Million tons, growing from 2025 value of 3.06 Million tons with 2031 projections showing 4.08 Million tons, growing at 4.90% CAGR over 2026-2031.

Solid demand from automotive lightweighting, architectural glazing, and LED displays sustains growth even as methyl methacrylate (MMA) feedstock costs remain volatile. PMMA's optical clarity, UV stability, and straightforward processing differentiate it from competing polymers, shielding volumes from substitution pressure in many core uses. Regional overcapacity-especially in China-keeps pricing competitive, while breakthrough chemical-recycling pilots open a pathway to circular production models. Producers prioritize vertical integration and specialty-grade development as defensive strategies in the PMMA market.

Global Polymethyl Methacrylate (PMMA) Market Trends and Insights

Automotive lightweight and lighting demand

Electric-vehicle makers specify PMMA for panoramic sunroofs, tail-lamp covers, and sensor housings because the polymer weighs 50% less than glass yet offers high optical quality. The technology shift toward adaptive LED systems amplifies demand for Rohm's light-management grades that shape precise beam patterns. Additional pull comes from autonomous-vehicle LiDAR lenses requiring low birefringence. Despite new impact-resistant polycarbonate (PC) copolymers, PMMA market resilience persists where cost and UV durability outweigh marginal toughness gains.

Architectural Glazing and Facade Adoption

Smart-building envelopes now integrate PMMA sheets embedded with sensors and heating elements that manage daylight, condensation, and self-cleaning functions. PMMA transmits 92-93% visible light versus 86-89% for PC, supporting energy-efficiency credits under European building codes. Digital printing on PMMA panels enables complex facade designs without multi-material assemblies, reducing installation time. Fire-code restrictions in high-rise projects still cap penetration, yet long-term warranties and UV resistance keep PMMA competitive where clarity and aesthetics dominate.

Volatile MMA Feedstock Pricing

MMA price swings mirror petrochemical feedstock trends, magnified by energy-intensive processes. Trinseo raised European PMMA prices by EUR 250 / t in March 2025 after propylene costs surged, compressing converter margins. Import-dependent regions such as Europe remain exposed until bio-based or recycled MMA scales commercially. Asian producers with back-integrated acetone routes gain cost advantage, exacerbating global price disparities.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of LED Signage & Display Industry

- Growth in Medical & Dental PMMA Use

- Substitution Threat from Polycarbonate and Glass

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sheets captured 38.19% of PMMA market share in 2025 and will expand at a 5.36% CAGR through 2031, underpinning USD-denominated sales growth proportionate with the overall PMMA market size for this category. Thinner-gauge extrusion lines now deliver robust mechanical stability that satisfies automotive sunroof load requirements, enabling vehicle makers to shave weight without sacrificing safety margins. Cast-acrylic sheets retain premium positioning-especially in LED edge-lit panels-thanks to tighter thickness tolerances that minimize optical defects.

Beads and pellets follow as the workhorse feedstocks for injection-molded lenses, appliance knobs, and medical parts. Formulators increasingly incorporate impact modifiers and UV absorbers at the compounding stage, trading some transparency for higher durability in outdoor signage. Granules tailored for laser engraving open niche revenue streams in trophy and giftware segments. Although growth lags the sheet category, resin compounds support consistent PMMA market demand by serving a wider span of short-run customized products.

The PMMA Market Report is Segmented by Product Form (Sheets, Beads and Pellets, Resin Compounds and Granules), End-User Industry (Automotive, Building and Construction, Electrical and Electronics, Aerospace, Industrial Machinery and Equipment, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific accounted for 50.30% of PMMA market share in 2025 on the strength of China's large converter base and India's infrastructure build-out. However, Chinese overcapacity compresses margins, pushing domestic players toward specialty exports and prompting new capacity curtailments. India's commitment of USD 1.1 billion to an integrated MMA-PMMA complex aims to cut import reliance and seize regional share by 2027. Japan and South Korea anchor high-value niches tied to electronics and optics, mitigating price erosion seen in commodity grades.

North America remains a mature but lucrative arena where sustainability attributes command premiums. LG Chem's 2025 bio-acrylic acid launch positions North American converters to offer renewable-content PMMA products in cosmetics packaging. Aerospace recovery and electric-vehicle investments bolster baseline volumes despite imported sheet competition.

Europe focuses on circularity; chemical-recycling pilots in Germany and the Netherlands receive policy support and generate early commercial lots that meet recycled-content quotas. Nevertheless, exposure to imported MMA feedstocks leaves European PMMA producers vulnerable to energy-driven cost spikes. South American and Middle-Eastern markets remain small but promising as infrastructure megaprojects demand transparent noise barriers and large-format signage.

- Asahi Kasei Corporation

- CHIMEI

- Kuraray Co., Ltd.

- LOTTE MCC Corp.

- Lucite International Alpha B.V.

- LX MMA (LX Group)

- Mitsubishi Chemical Corporation

- Rohm GmbH

- Sanors

- Sumitomo Chemical Co., Ltd.

- Suzhou Double Elephant Optical Materials Co., Ltd.

- Trinseo

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive lightweight and lighting demand

- 4.2.2 Architectural glazing and facade adoption

- 4.2.3 Expansion of LED signage and display industry

- 4.2.4 Growth in medical and dental PMMA use

- 4.2.5 Breakthroughs in PMMA chemical-recycling economics

- 4.3 Market Restraints

- 4.3.1 Volatile MMA feedstock pricing

- 4.3.2 Substitution threat from polycarbonate and glass

- 4.3.3 Stringent single-use plastics regulation

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Import and Export Trends

- 4.7 Pricing Trends

- 4.8 Regulatory Landscape

- 4.9 End-use Sector Trends

- 4.9.1 Aerospace (Aerospace Component Production Revenue)

- 4.9.2 Automotive (Automobile Production)

- 4.9.3 Building and Construction (New Construction Floor Area)

- 4.9.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.9.5 Packaging(Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Form

- 5.1.1 Sheets

- 5.1.2 Beads and Pellets

- 5.1.3 Resin Compounds and Granules

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Electrical and Electronics

- 5.2.4 Aerospace

- 5.2.5 Industrial Machinery and Equipment

- 5.2.6 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 CHIMEI

- 6.4.3 Kuraray Co., Ltd.

- 6.4.4 LOTTE MCC Corp.

- 6.4.5 Lucite International Alpha B.V.

- 6.4.6 LX MMA (LX Group)

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 Rohm GmbH

- 6.4.9 Sanors

- 6.4.10 Sumitomo Chemical Co., Ltd.

- 6.4.11 Suzhou Double Elephant Optical Materials Co., Ltd.

- 6.4.12 Trinseo

- 6.4.13 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment