|

市場調查報告書

商品編碼

1907330

即時定位系統:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Real Time Location System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

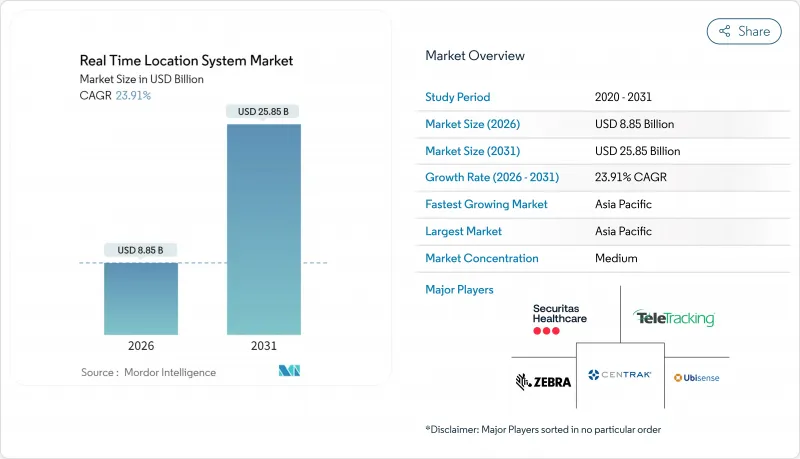

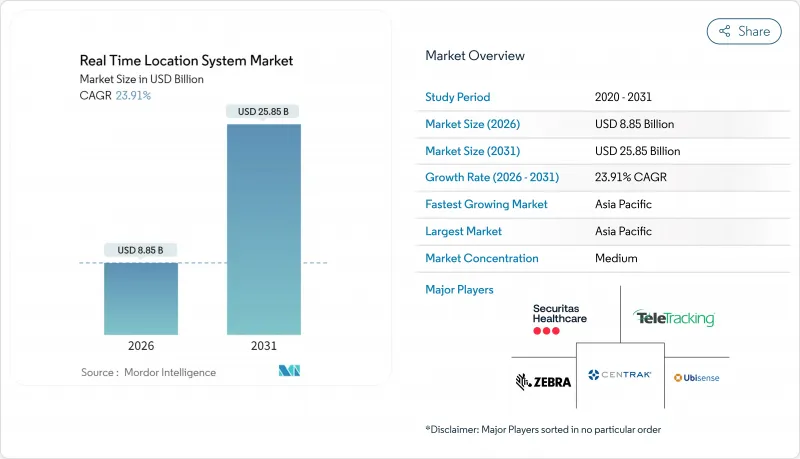

即時定位系統市場預計將從 2025 年的 71.4 億美元成長到 2026 年的 88.5 億美元,到 2031 年將達到 258.5 億美元,2026 年至 2031 年的複合年成長率為 23.91%。

醫療保健行業的強制性要求、超寬頻 (UWB) 技術精度的不斷提高以及數位雙胞胎技術的日益普及,正在推動即時定位系統市場的需求成長,同時,託管服務和雲端交付模式正在改變供應商的收入來源。隨著終端使用者從被動的資產管理轉向預測性的工作流程編排,競爭優勢取決於準確性、互通性和網路安全保障。 UWB、低功耗藍牙 (BLE) 和混合平台的部署選項不斷擴展,加上圍繞患者安全和職場合規性的監管力度,正在降低採用門檻。隨著企業尋求更快實現價值和可擴展的分析能力,資本支出正趨向於軟體和諮詢領域。

全球即時定位系統市場趨勢與洞察

降低成本和最佳化流程的必要性

醫院報告稱,光是設備追蹤一項每年就能節省近 20 萬美元,消除了以往佔臨床輪班時間 30% 的資產搜尋時間。製造工廠將即時定位系統 (RTLS) 疊加到數位雙胞胎儀錶板上,以識別瓶頸並實現預測性維護,從而減少 10% 的停機時間。人工智慧演算法分析即時位置數據,以可視化隱藏的流程浪費,在人手不足的環境下帶來可衡量的投資報酬率。這些優勢在人事費用上升和供應鏈波動顯著壓縮利潤率的行業尤為突出,使 RTLS 成為提高效率的策略工具。

醫療領域的快速發展以及對病患安全措施的需求

美國醫院協會 (AHA) 預測,到 2032 年,用於病患流程管理、人員精簡和感染控制的醫療保健即時定位系統 (RTLS) 的收入將增加四倍。與 RTLS 定位精度相連的緊急按鈕可將緊急回應時間縮短 30%。與徽章關聯的手部衛生監測可將醫療相關感染減少 40% 以上。法規結構正在加速完善,將 RTLS 定位為關鍵基礎設施,加快預算核准並規範部署方案。基於價值的醫療保健支付模式進一步增強了營運透明度,並將整個 RTLS 產業的財務績效連結起來。

最終用戶的傳統基礎設施

現有工廠通常使用頻寬受限的專有通訊協定,這會阻礙即時定位系統 (RTLS) 的資料流,並迫使企業進行成本高昂的網路升級和分階段部署。整合複雜性會增加服務支出、延長引進週期,並疏遠對預算敏感的產業。雲端原生 RTLS 和疊加網路目前為維修提供了一條途徑,但只有在進行廣泛的 IT 現代化改造後,才能充分發揮其優勢。

細分市場分析

到2025年,醫療保健產業將佔即時定位系統市場規模的41.62%,鞏固其作為支撐生態系統創新關鍵產業的地位。病患流程儀錶板將位置遙測資料與電子健康記錄連接起來,以縮短急診室的等待時間並改善報銷指標。預計在預測期內,交通運輸和物流行業將以24.72%的複合年成長率實現最快的收入成長,這主要得益於對最後一公里可視性和低溫運輸合規性的需求。隨著亞太地區工業4.0維修獲得政策支持,製造業也將緊跟其後。

受感染控制和人員安全相關法規日益嚴格的推動,醫療保健產業將佔據即時定位系統市場的主要佔有率,從而持續推動對臨床級精準解決方案的需求。同時,物流業者傾向於選擇堅固耐用的標籤和低功耗藍牙信標,以便在貨櫃和拖車上進行大規模部署。零售商正在利用貨架級追蹤技術來防止缺貨損失,而國防機構則正在試點使用抗欺騙超寬頻(UWB)技術的自主集群導航。

截至2025年,硬體在即時定位系統市場佔有率中佔比40.08%,這主要得益於持續的錨點更新周期和標籤小型化計劃。然而,託管服務收入正以28.13%的複合年成長率成長,反映出買家更傾向於將硬體、軟體和分析功能捆綁在一起的、基本契約。邊緣運算錨點韌體減少了校準工作量,促使整合商轉向訂閱模式。

目前,硬體創新主要集中在系統晶片超寬頻無線電技術並擁有多年電池壽命的BLE 5.3標籤上,而雲端協作套件則將原始XYZ數據轉化為熱圖和預測性警報,從而實現跨職能的投資回報率並維持服務續訂率。隨著中端市場買家的湧入,承包的「即時定位系統即服務」產品正在降低資本支出並縮短談判週期。

區域分析

到2025年,北美將佔據即時定位系統(RTLS)市場43.76%的佔有率,這主要得益於醫療保健行業的數位化以及符合美國職業安全與健康管理局(OSHA)規定的工人安全法規的實施。美國醫療機構正在採用RTLS來最佳化基於價值的報銷機制,加拿大醫院正在將HL7整合位置資料標準化,而墨西哥物流業者則正在投資拖車遠端資訊處理技術以提高區域物流密度。

預計到2031年,亞太地區將以22.88%的複合年成長率成長,這主要得益於中國智慧工廠扶持計畫(補貼超寬頻錨點安裝)以及日本汽車製造商將即時追蹤技術融入精實生產線。印度正透過公私合營加速醫院現代化進程,而韓國則在半導體工廠中整合即時定位系統(RTLS)和私有5G網路,以控制自主堆高機。

在歐洲,由於符合GDPR規範的設計和工業IoT框架,UWB-BLE混合網路的應用正在穩定成長。德國汽車製造商正在素車工廠部署混合UWB-BLE網路,英國國民醫療服務體系(NHS)信託機構正在擴大病患流量管理的試點計畫。中東和非洲在石油和天然氣行業的安全分區方面已初見成效,南美礦山正在使用RFID技術追蹤井下工人,這些都展現了多元化的發展路徑。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 降低成本和最佳化流程的必要性

- 醫療領域的迅速傳播和強制性患者安全措施

- UWB 精確和多模態追蹤平台的進步

- 與工業4.0數位雙胞胎概念的整合

- 人工智慧驅動的位置分析助力超自動化

- 加強對職場安全和接觸者追蹤合規性的監管

- 市場限制

- 終端用戶的傳統基礎設施

- 隱私和網路安全問題

- 高昂的初始硬體和校準成本

- 高密度物聯網環境中的射頻干擾風險

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按最終用戶行業分類

- 衛生保健

- 製造業

- 零售

- 運輸/物流

- 政府和國防部

- 石油和天然氣

- 航太航太

- 礦業

- 農業和畜牧業

- 教育

- 飯店和娛樂

- 按組件

- 硬體

- 軟體

- 服務

- 整合與諮詢

- 透過技術

- RFID(主動式和被動式)

- Wi-Fi

- Bluetooth Low Energy(BLE)

- 超寬頻(UWB)

- 紅外線 (IR)

- ZigBee

- GPS/GNSS

- 超音波

- 透過使用

- 資產追蹤

- 在製品管理

- 員工安全保障

- 患者/居民監測

- 庫存和供應鏈可視性

- 環境與狀態監測

- 手部衛生遵從性

- 接觸者追蹤

- 防盜和防損措施

- 近場行銷

- 車輛和車隊管理

- 自主平台導航

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Zebra Technologies Corporation

- Ubisense Limited

- Securitas Healthcare LLC(Securitas AB)

- TeleTracking Technologies Inc.

- Savi Technology Inc.

- CenTrak Inc.(Halma plc)

- AiRISTA Flow Inc.

- Midmark Corporation

- IDENTEC SOLUTIONS AG

- Sonitor Technologies AS

- Kontakt.io Inc.

- Alien Technology LLC

- Impinj Inc.

- Stanley Healthcare(Stanley Black & Decker)

- Ekahau Inc.

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company(Aruba Networks)

- Honeywell International Inc.

- Siemens Healthineers AG

- Trimble Inc.

- Quuppa Oy

- BlueIOT Technology Co. Ltd.

第7章 市場機會與未來展望

The Real Time Location System Market is expected to grow from USD 7.14 billion in 2025 to USD 8.85 billion in 2026 and is forecast to reach USD 25.85 billion by 2031 at 23.91% CAGR over 2026-2031.

Healthcare mandates, ultra-wideband (UWB) accuracy gains, and digital-twin rollouts underpin demand expansion in the real time loaction system market, while managed services and cloud delivery models reshape vendor revenue streams. Competitive advantage hinges on precision, interoperability, and cybersecurity assurance as end users migrate from reactive asset handling to predictive workflow orchestration. UWB, Bluetooth Low Energy (BLE), and hybrid platforms widen deployment choices, and regulatory momentum around patient safety and workplace compliance lowers adoption barriers. Capital spending tilts toward software and consulting as enterprises seek quick time-to-value and scalable analytics.

Global Real Time Location System Market Trends and Insights

Need for Cost Reduction and Process Optimisation

Hospitals cite annual savings nearing USD 200,000 from equipment tracking alone, cutting asset search time that once absorbed 30% of clinical shifts . Manufacturing plants overlay RTLS on digital-twin dashboards to flag bottlenecks and enable predictive maintenance that trims downtime by 10%. AI algorithms mine live location data to reveal hidden process waste, delivering measurable ROI in labor-constrained settings. These gains resonate most where payroll inflation and supply-chain volatility squeeze margins, positioning RTLS as a strategic lever for efficiency.

Rapid Adoption in Healthcare and Patient-Safety Mandates

The American Hospital Association expects healthcare RTLS revenue to quadruple by 2032 as systems tackle patient flow, staff duress, and infection control. Panic buttons tied to RTLS precision cut emergency response times by 30%. Hand-hygiene monitoring integrated with badges curbs healthcare-associated infections by more than 40%. Regulatory frameworks increasingly label RTLS as essential infrastructure, accelerating budget approvals and standardizing deployment blueprints. Value-based care payment models further reinforce the link between operational visibility and financial performance within the broader RTLS industry.

Legacy Infrastructure Across End Users

Brown-field factories often run on proprietary protocols with bandwidth limits that choke RTLS data streams, forcing costly network upgrades and phased rollouts. Integration complexity inflates services spend and prolongs deployment cycles, deterring budget-sensitive sectors. Cloud-native RTLS and overlay networks now offer retrofit pathways, but full benefits materialize only after broader IT modernization.

Other drivers and restraints analyzed in the detailed report include:

- Advances in UWB Accuracy and Multi-Modal Tracking Platforms

- Integration with Industry 4.0 Digital-Twin Initiatives

- Privacy and Cyber-Security Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare generated 41.62% of the real-time location system market size in 2025, reinforcing its role as the anchor vertical that finances ecosystem innovation. Patient flow dashboards tie location telemetry to electronic health records, shortening emergency department wait times and elevating reimbursement metrics. Over the forecast horizon, transportation and logistics will post the steepest revenue climb at a 24.72% CAGR, propelled by last-mile visibility and cold-chain compliance needs. Manufacturing follows as Industry 4.0 retrofits gain policy support in Asia-Pacific.

Healthcare's heavy share of the real-time location system market underscores its regulatory push around infection control and staff safety, creating durable demand for clinical-grade accuracy solutions. Conversely, logistics operators favor ruggedized tags and battery-sipping BLE beacons to scale across containers and trailers. Retailers apply shelf-level tracking to fight out-of-stock losses, while defense agencies pilot autonomous swarm navigation that leans on UWB's resilience to spoofing.

Hardware captured 40.08% of the real-time location system market share in 2025, led by ongoing anchor refresh cycles and tag miniaturization projects. Yet managed services revenue is expanding at 28.13% CAGR, reflecting buyers' preference for outcome-based contracts that bundle hardware, software, and analytics. Edge-ready anchor firmware reduces calibration labor, steering integrators toward subscription models.

Hardware innovation now centers on system-on-chip UWB radios and BLE 5.3 tags with multi-year battery life. Meanwhile, cloud orchestration suites translate raw X-Y-Z data into heatmaps and predictive alerts, unlocking cross-departmental ROI and sustaining services renewal rates. As mid-market buyers enter, turnkey "RTLS-as-a-service" offerings lower capex and shorten negotiation cycles.

The Real-Time Location System (RTLS) Market Report is Segmented by End-User Vertical (Healthcare, Transportation and Logistics, and More), Component (Hardware, Software, Services, and More), Technology (RFID, Wi-Fi, and More), Application (Asset Tracking, Work-In-Process Tracking, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 43.76% of the real-time location system market share in 2025 on the back of extensive healthcare digitization and OSHA-aligned worker safety rules. U.S. providers adopt RTLS to optimize value-based reimbursement, while Canadian hospitals standardize on HL7-integrated location feeds. Logistics carriers across Mexico invest in trailer telematics, widening regional density.

Asia-Pacific is forecast for a 22.88% CAGR through 2031 in the real-time location system (RTLS) market as Chinese smart-factory incentives subsidize UWB anchor installs and Japanese automakers embed real-time tracking in lean production lines. India accelerates hospital modernization via public-private partnerships, while South Korea combines RTLS with private 5G to steer autonomous forklifts in semiconductor fabs.

Europe records steady uptake driven by GDPR-compliant design and industrial IoT frameworks. German automakers deploy hybrid UWB-BLE grids in body-in-white shops, and British NHS trusts expand patient-flow pilots. Middle East and Africa see early wins in oil-and-gas safety zoning, whereas South American miners deploy RFID for underground personnel tracking, signaling diversified growth corridors.

- Zebra Technologies Corporation

- Ubisense Limited

- Securitas Healthcare LLC (Securitas AB)

- TeleTracking Technologies Inc.

- Savi Technology Inc.

- CenTrak Inc. (Halma plc)

- AiRISTA Flow Inc.

- Midmark Corporation

- IDENTEC SOLUTIONS AG

- Sonitor Technologies AS

- Kontakt.io Inc.

- Alien Technology LLC

- Impinj Inc.

- Stanley Healthcare (Stanley Black & Decker)

- Ekahau Inc.

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company (Aruba Networks)

- Honeywell International Inc.

- Siemens Healthineers AG

- Trimble Inc.

- Quuppa Oy

- BlueIOT Technology Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for cost reduction and process optimisation

- 4.2.2 Rapid adoption in healthcare and patient-safety mandates

- 4.2.3 Advances in UWB accuracy and multi-modal tracking platforms

- 4.2.4 Integration with Industry 4.0 digital-twin initiatives

- 4.2.5 AI-enabled location analytics for hyper-automation

- 4.2.6 Regulatory push for workplace-safety/contact-tracing compliance

- 4.3 Market Restraints

- 4.3.1 Legacy infrastructure across end users

- 4.3.2 Privacy and cyber-security concerns

- 4.3.3 High upfront hardware and calibration costs

- 4.3.4 RF interference risk in dense IoT environments

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-user Vertical

- 5.1.1 Healthcare

- 5.1.1.1 Major Applications

- 5.1.1.2 Segmentation by Technology

- 5.1.2 Manufacturing

- 5.1.2.1 Major Applications

- 5.1.2.2 Segmentation by Technology

- 5.1.3 Retail

- 5.1.4 Transportation and Logistics

- 5.1.5 Government and Defense

- 5.1.6 Oil and Gas

- 5.1.7 Aerospace and Aviation

- 5.1.8 Mining

- 5.1.9 Agriculture and Livestock

- 5.1.10 Education

- 5.1.11 Hospitality and Entertainment

- 5.1.1 Healthcare

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.2.4 Integration and Consulting

- 5.3 By Technology

- 5.3.1 RFID (Active and Passive)

- 5.3.2 Wi-Fi

- 5.3.3 Bluetooth Low Energy (BLE)

- 5.3.4 Ultra-Wideband (UWB)

- 5.3.5 Infrared (IR)

- 5.3.6 ZigBee

- 5.3.7 GPS / GNSS

- 5.3.8 Ultrasound

- 5.4 By Application

- 5.4.1 Asset Tracking

- 5.4.2 Work-in-Process Tracking

- 5.4.3 Personnel Safety and Security

- 5.4.4 Patient / Resident Monitoring

- 5.4.5 Inventory and Supply-Chain Visibility

- 5.4.6 Environmental and Condition Monitoring

- 5.4.7 Hand-Hygiene Compliance

- 5.4.8 Contact Tracing

- 5.4.9 Theft and Loss Prevention

- 5.4.10 Proximity-Based Marketing

- 5.4.11 Vehicle and Fleet Management

- 5.4.12 Autonomous-Platform Navigation

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Israel

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Turkey

- 5.5.5.1.5 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Zebra Technologies Corporation

- 6.4.2 Ubisense Limited

- 6.4.3 Securitas Healthcare LLC (Securitas AB)

- 6.4.4 TeleTracking Technologies Inc.

- 6.4.5 Savi Technology Inc.

- 6.4.6 CenTrak Inc. (Halma plc)

- 6.4.7 AiRISTA Flow Inc.

- 6.4.8 Midmark Corporation

- 6.4.9 IDENTEC SOLUTIONS AG

- 6.4.10 Sonitor Technologies AS

- 6.4.11 Kontakt.io Inc.

- 6.4.12 Alien Technology LLC

- 6.4.13 Impinj Inc.

- 6.4.14 Stanley Healthcare (Stanley Black & Decker)

- 6.4.15 Ekahau Inc.

- 6.4.16 Cisco Systems Inc.

- 6.4.17 Hewlett Packard Enterprise Company (Aruba Networks)

- 6.4.18 Honeywell International Inc.

- 6.4.19 Siemens Healthineers AG

- 6.4.20 Trimble Inc.

- 6.4.21 Quuppa Oy

- 6.4.22 BlueIOT Technology Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment