|

市場調查報告書

商品編碼

1907311

聚丙烯醯胺:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Polyacrylamide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

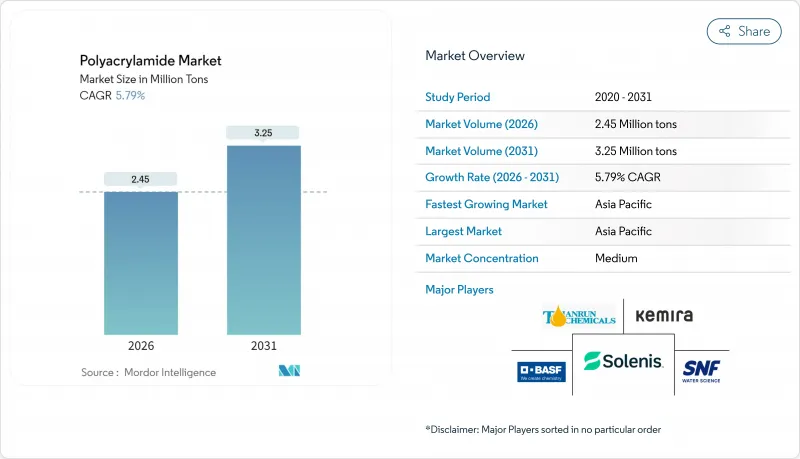

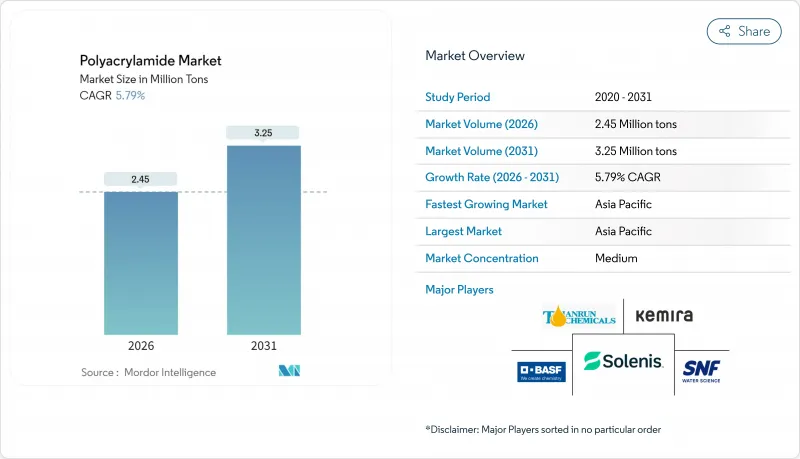

預計到2026年,聚丙烯醯胺市場規模將達到245萬噸,高於2025年的232萬噸。預計到2031年將達到325萬噸,2026年至2031年的複合年成長率為5.79%。

推動這項擴張的關鍵因素包括市政和工業污水處理對高性能凝聚劑的需求不斷成長、傳統型頁岩完井作業中超高分子量減磨劑的快速應用,以及日益嚴格的零液體排放法規。此外,中國對水利基礎設施的數十億美元投資以及BASF的大規模產能擴張也使市場相關人員受益,這確保了原料的穩定供應並縮短了供應鏈。

全球聚丙烯醯胺市場趨勢與洞察

在提高石油採收率(EOR)的應用日益廣泛

石油生產商正以高性能高聚丙烯醯胺(HPAM)配方取代水基驅油化學品,即使在具有挑戰性的儲存中,也能達到6%至27%的增採率。北美頁岩地層的現場試驗表明,超高分子量聚丙烯醯胺能夠在高鹽環境和低至120°C的溫度下穩定黏度,從而減少化學品補充頻率和停機時間。此外,氧化石墨烯增強的HPAM提高了熱穩定性,釋放了在高溫、高壓、深層儲存中進行三次採油的潛力。市場領導正在擴展專門的研發平台,以開發針對特定儲存化學性質的聚合物驅油方案。這使得企業能夠透過服務合約和高級產品定價創造價值,而提高採收率目前已成為聚丙烯醯胺市場成長最快的收入來源。

市政和工業污水處理中對凝聚劑的需求不斷成長

公共產業報告稱,與傳統凝聚劑相比,新型絮凝劑可降低高達 95% 的濁度,同時減少化學品消費量。亞太地區的工業用戶正在轉向採用先進的凝聚劑系統,以滿足美國環保署 (EPA) 的零排放標準並實現製程用水的再利用。用於去除重金屬的新配方正在填補鎘和鉻的監管空白,從而擴大目標客戶群。這些趨勢將支撐聚丙烯醯胺市場在水處理領域的長期擴張。

殘留丙烯醯胺單體的健康和致癌性問題

監管機構將食品接觸材料中的丙烯醯胺殘留量限制在0.2%以下,化妝品中的丙烯醯胺殘留量限制在0.1%以下,這迫使生產商投資於更嚴格的純化製程。加州65號提案的分類以及國際癌症研究機構(IARC)將其列為可能致癌性,都提高了標籤標註和監測的要求。合規措施可能會增加生產成本,並延遲產品核可,從而降低潛在需求。擁有先進品質保證實驗室的製造商可以將此限制轉化為競爭優勢,而中小企業則面臨被市場淘汰的風險,這可能會減緩聚丙烯醯胺市場的整體成長。

細分市場分析

預計到2025年,粉狀聚丙烯醯胺將佔聚丙烯醯胺市場規模的43.78%,這主要得益於其易於批量加工以及大規模市政計劃運輸成本低廉。然而,液態乳液正迅速普及,預計到2031年將以6.10%的年複合成長率(CAGR)成長,這主要歸功於其即時溶解性和分子量保持性,能夠減少頁岩完井作業和高溫工業迴路中的製程停機時間。

包裝形式的改變也反映了這一趨勢。北美正從桶裝轉向IBC噸桶,以提高現場計量精度;而中國供應商則在擴建反相乳液反應器,以將活性聚合物含量提高到50%。因此,儘管粉末在對成本高度敏感的供水事業仍保持優勢,但乳液在性能至關重要的細分市場中正獲得更高的附加價值,這標誌著聚丙烯醯胺行業正向特種化學品領域走向成熟。

本報告按物理形態(粉末、液體、乳液/分散體)、應用領域(提高石油採收率、水處理凝聚劑、土壤改良劑等)、終端用戶行業(水處理、石油天然氣、紙漿造紙等)和地區(亞太地區、北美、歐洲、南美、中東和非洲)對聚丙烯醯胺進行分析。市場預測以噸為單位。

區域分析

到2025年,亞太地區將佔據全球聚丙烯醯胺市場佔有率的49.92%,年複合成長率達6.20%,主要得益於中國450億美元的水處理項目。該地區產能擴張與本地需求的良性循環使其免受供應衝擊,並維持了定價權。印度的化學工業走廊和日本在膜技術領域的領先地位進一步推動了這一成長,而東南亞國家則受益於製造地的轉移,這些基地需要先進的廢水處理解決方案。

北美是高利潤率強化採油(EOR)和減摩級產品的關鍵市場,頁岩氣開發延長了產品生命週期,並為SNF等供應商提供了收購配套成品油公司的機會。美國環保署(EPA)的零排放法規進一步促進了工業污水計劃的穩定銷售。歐洲的銷售成長速度有所放緩,但仍是生物基創新領域的標竿。該地區的綠色採購政策正在推動可生物分解凝聚劑的研發,而化學和採礦業的特殊應用則支撐了對聚合物的潛在需求。

中東和非洲是新興成長型市場,豐富的油田和礦產資源推動了當地產能的擴張。在南美洲,銅和鋰的繁榮帶動了對沉澱助劑的需求,而政府主導的水利基礎設施現代化計劃也擴大了潛在需求。這種地理多元化是支撐聚丙烯醯胺市場永續成長的核心因素。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 在提高石油採收率(EOR)的應用日益廣泛

- 市政和工業污水處理中對凝聚劑的需求不斷成長

- 採礦活動的擴張帶動了對定居輔助用品的需求

- 政府關於零液體排放和污泥減量的法規

- 頁岩完井作業向超高分子減磨劑過渡

- 市場限制

- 殘留丙烯醯胺單體的健康和致癌性問題

- 歐洲對生物基凝聚劑的需求日益成長

- 中國和獨立國協丙烯腈原料供應鏈的脆弱性

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依實體形態

- 粉末

- 液體

- 乳液/分散體

- 透過使用

- 提高石油產量

- 水處理凝聚劑

- 土壤改良劑

- 化妝品中的黏合劑和穩定劑

- 其他用途

- 按最終用戶行業分類

- 水處理

- 石油和天然氣

- 紙漿和造紙

- 礦業

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AnHui JuCheng Fine Chemicals Co. Ltd

- Anhui Tianrun Chemical Industry Co. Ltd

- Ashland

- BASF

- Beijing Hengju Chemical Group Co. Ltd

- Beijing Xitao Technology Development Co. Ltd

- CHINAFLOC

- Envitech Chemical Specialities Pvt. Ltd

- Kemira

- Liaocheng Yongxing Environmental Protection Science & Technology Co. Ltd

- Qingdao Oubo Chemical Co. Ltd

- Shandong Tongli Chemical Co. Ltd

- SNF

- Solenis

- Syensqo

- Universal Fine Chemicals SPC

- Yixing Cleanwater Chemicals Co. Ltd

第7章 市場機會與未來展望

Polyacrylamide market size in 2026 is estimated at 2.45 million tons, growing from 2025 value of 2.32 million tons with 2031 projections showing 3.25 million tons, growing at 5.79% CAGR over 2026-2031.

Rising demand for high-performance flocculants in municipal and industrial wastewater treatment, the rapid adoption of ultra-high-molecular-weight friction reducers in unconventional shale completions, and stricter zero-liquid-discharge mandates are the primary forces driving this expansion. Market players are also benefiting from China's multibillion-dollar investments in water infrastructure and BASF's large-scale capacity additions, which secure raw material availability and shorten supply chains.

Global Polyacrylamide Market Trends and Insights

Growing Utilization in Enhanced Oil Recovery (EOR)

Oil producers are replacing water-based flooding reagents with high-performance HPAM formulations that add 6%-27% incremental recovery, even in harsh reservoirs. Field results from North American shale plays confirm that ultra-high-molecular-weight polyacrylamide stabilizes viscosity under high salinity and 120 °C, cutting chemical top-ups and downtime. Graphene-oxide-reinforced HPAM further boosts thermal stability, unlocking tertiary recovery opportunities in deep, hot reservoirs. Market leaders are scaling dedicated research and development platforms to tailor polymer flooding packages to reservoir-specific chemistries, capturing value through service contracts and premium product pricing. As a result, enhanced oil recovery now represents the fastest-growing revenue stream within the polyacrylamide market.

Increasing Demand for Flocculants in Municipal and Industrial Wastewater Treatment

Utilities report up to 95% turbidity reduction with lower chemical consumption versus conventional coagulants. Industrial users in Asia-Pacific are migrating to advanced flocculant systems to meet EPA-style zero-discharge limits and recycle process water. New formulations that target heavy-metal removal address cadmium and chromium compliance gaps, broadening the addressable client base. These dynamics underpin the long-term expansion of the polyacrylamide market in water treatment.

Health and Carcinogenicity Concerns Over Residual Acrylamide Monomer

Regulators limit residual acrylamide to below 0.2% in food-contact materials and 0.1% in cosmetics, forcing producers to invest in tighter purification regimes. California's Proposition 65 classification and IARC's probable carcinogen status intensify labeling and monitoring obligations. Compliance raises production costs and slows product approvals in consumer-facing segments, trimming potential demand. Producers with advanced QA laboratories can turn the constraint into a competitive edge, but smaller firms risk market exit, softening overall polyacrylamide market growth.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Mining Activities Driving Demand for Sedimentation Aids

- Government Mandates on Zero-Liquid-Discharge and Sludge Reduction

- Rising Preference for Bio-Based Flocculants in Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The powder segment held a 43.78% share of the polyacrylamide market size in 2025, supported by ease of bulk handling and lower freight costs for high-volume municipal projects. However, liquid emulsions are gaining rapid traction, with a 6.10% CAGR forecast to 2031, because instant solubility and molecular-weight preservation reduce process downtime in shale completions and high-temperature industrial circuits.

Packaging shifts illustrate the trend: drum-to-IBC conversions are rising in North America to improve onsite dosing precision, while Chinese suppliers are expanding inverse-emulsion reactors that raise active-polymer content to 50%. Powder therefore retains its stronghold in cost-sensitive water utilities, but emulsions capture incremental value in performance-critical niches, underscoring the maturation of the polyacrylamide industry toward specialized chemistries.

The Polyacrylamide Report is Segmented by Physical Form (Powder, Liquid, and Emulsion/Dispersions), Application (Enhanced Oil Recovery, Flocculants for Water Treatment, Soil Conditioner, and More), End-User Industry (Water Treatment, Oil and Gas, Pulp and Paper, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific captured 49.92% of the global polyacrylamide market share in 2025 and is growing at a 6.20% CAGR, propelled by China's USD 45 billion water-treatment program. The region's self-reinforcing loop of capacity expansion and local demand insulates it from supply shocks and sustains pricing power. India's chemicals corridor and Japan's membrane-technology leadership add further impetus, while Southeast Asian states benefit from manufacturing relocations that demand advanced effluent solutions.

North America remains a powerhouse for high-margin EOR and friction-reducer grades, with shale activity extending product lifecycles and enabling suppliers like SNF to acquire complementary completion-fluid firms. EPA zero-discharge rules further underpin steady sales into industrial wastewater projects. Europe shows slower volume growth but is a bellwether for bio-based innovation; its green-procurement policies stimulate research and development in biodegradable flocculants, while specialty applications in chemicals and mining uphold baseline polymer demand.

The Middle East and Africa are emerging growth theaters, leveraging abundant oilfields and mining prospects to justify local capacity additions. South America's copper and lithium boom likewise drives sedimentation-aid uptake, while government projects to modernize water infrastructure broaden addressable demand. Geographic diversification therefore remains central to sustaining resilient expansion in the polyacrylamide market.

- AnHui JuCheng Fine Chemicals Co. Ltd

- Anhui Tianrun Chemical Industry Co. Ltd

- Ashland

- BASF

- Beijing Hengju Chemical Group Co. Ltd

- Beijing Xitao Technology Development Co. Ltd

- CHINAFLOC

- Envitech Chemical Specialities Pvt. Ltd

- Kemira

- Liaocheng Yongxing Environmental Protection Science & Technology Co. Ltd

- Qingdao Oubo Chemical Co. Ltd

- Shandong Tongli Chemical Co. Ltd

- SNF

- Solenis

- Syensqo

- Universal Fine Chemicals SPC

- Yixing Cleanwater Chemicals Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Utilization in Enhanced Oil Recovery (EOR)

- 4.2.2 Increasing Demand for Flocculants in Municipal and Industrial Wastewater Treatment

- 4.2.3 Expansion of Mining Activities Driving Demand for Sedimentation Aids

- 4.2.4 Government Mandates on Zero-Liquid-Discharge and Sludge Reduction

- 4.2.5 Shift Toward Ultra-High-Molecular-Weight Friction Reducers for Shale Completions

- 4.3 Market Restraints

- 4.3.1 Health And Carcinogenicity Concerns over Residual Acrylamide Monomer

- 4.3.2 Rising Preference for Bio-Based Flocculants in Europe

- 4.3.3 Supply-Chain Vulnerability of Acrylonitrile Feedstock in China and CIS

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Physical Form

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.1.3 Emulsion/Dispersions

- 5.2 By Application

- 5.2.1 Enhanced Oil Recovery

- 5.2.2 Flocculants for Water Treatment

- 5.2.3 Soil Conditioner

- 5.2.4 Binders and Stabilizers in Cosmetics

- 5.2.5 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Water Treatment

- 5.3.2 Oil and Gas

- 5.3.3 Pulp and Paper

- 5.3.4 Mining

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AnHui JuCheng Fine Chemicals Co. Ltd

- 6.4.2 Anhui Tianrun Chemical Industry Co. Ltd

- 6.4.3 Ashland

- 6.4.4 BASF

- 6.4.5 Beijing Hengju Chemical Group Co. Ltd

- 6.4.6 Beijing Xitao Technology Development Co. Ltd

- 6.4.7 CHINAFLOC

- 6.4.8 Envitech Chemical Specialities Pvt. Ltd

- 6.4.9 Kemira

- 6.4.10 Liaocheng Yongxing Environmental Protection Science & Technology Co. Ltd

- 6.4.11 Qingdao Oubo Chemical Co. Ltd

- 6.4.12 Shandong Tongli Chemical Co. Ltd

- 6.4.13 SNF

- 6.4.14 Solenis

- 6.4.15 Syensqo

- 6.4.16 Universal Fine Chemicals SPC

- 6.4.17 Yixing Cleanwater Chemicals Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment