|

市場調查報告書

商品編碼

1907282

聚丙烯纖維:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Polypropylene Fibers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

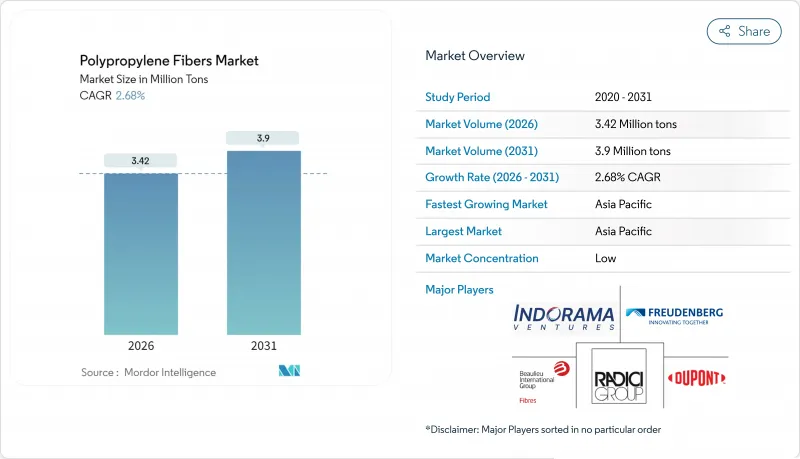

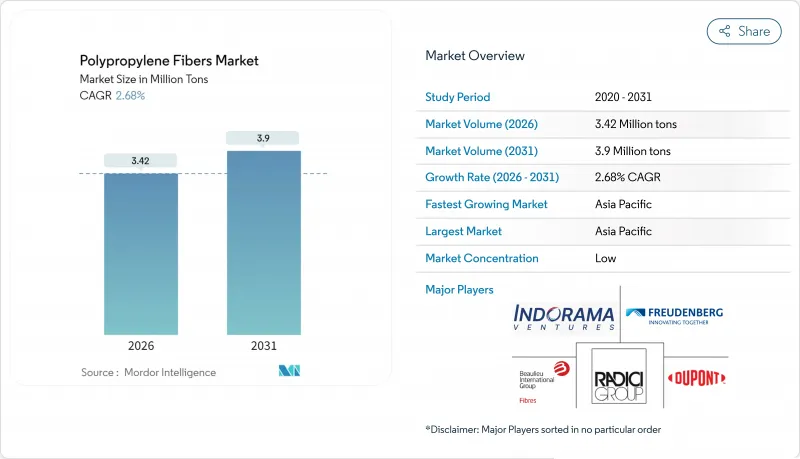

預計聚丙烯纖維市場將從 2025 年的 333 萬噸成長到 2026 年的 342 萬噸,到 2031 年達到 390 萬噸,2026 年至 2031 年的複合年成長率為 2.68%。

這一成長反映了聚丙烯纖維市場在應對日益嚴格的微塑膠法規和來自再生聚酯的價格競爭的同時,仍能滿足衛生、建築和汽車應用領域的穩定需求。 2024年至2026年間,中國每年新增1,870萬噸聚丙烯樹脂產能,有助於降低原料成本,進而維持聚丙烯纖維市場的成本優勢。亞太地區終端用戶需求的成長,尤其是在一次性衛生用品和基礎設施領域,抵消了北美和歐洲成長放緩的影響,在這些地區,回收的強制性規定抑制了對原生纖維的需求。

全球聚丙烯纖維市場趨勢及展望

衛生和醫療一次性用品的使用量增加

2024年,紡粘聚丙烯不織布在全球衛生不織布市場佔據主導地位,這主要得益於對尿布、女性用衛生用品和外科用覆蓋巾的需求。醫院目前正在採用一次性醫療用品通訊協定,並繼續利用熔噴無紡布的生產能力(該產能曾在新冠疫情期間激增),這鞏固了聚丙烯纖維在一次性醫療用品領域的地位。印度的衛生用品產業預計將迎來顯著成長,這主要得益於衛生棉使用量的增加和女性勞動力的成長,從而推動了當地對聚丙烯纖維的需求。印尼、越南和泰國也出現了類似的趨勢,都市區收入的成長正在推動尿布的使用。儘管聚丙烯因其疏水性、透氣性和與滅菌的兼容性而在歐盟醫療設備法規(MDR 2017/745)中被列為優先材料,但在高階成人失禁用品領域,情況正在發生顯著變化。這些產品對柔軟性的重視,促使人們對雙組分聚乙烯-聚丙烯混合物越來越感興趣,從而推動纖維製造商實現產品線多元化。

建築領域向宏觀合成纖維混凝土加固的過渡。

宏觀合成聚丙烯纖維(3-5 kg/m³)因其能減少塑性收縮裂縫、降低安裝成本(與鋼材相比)以及減少鏽蝕相關的維護,正被廣泛應用於大規模地板材料和隧道計劃中。印度已將纖維增強混凝土的相關條款納入Bharatmala高速公路和Sagarmala港口計畫的競標文件中。由於承包商青睞無需使用鋼筋網,ASTM C1399和EN 14889-2標準中提高的殘餘強度規範也推動了聚丙烯纖維市場的發展。儘管由於監管方面的不足,聚丙烯纖維在住宅領域的應用仍然有限,但印度混凝土協會發布的新指南旨在促進其在熱帶氣候地區的應用。

低成本PET及再生PET纖維供應情況

隨著瓶罐回收網路和化學回收技術的進步,再生PET(rPET)產能迅速擴張,其溢價有所下降,這增加了其在諸如地毯襯裡、服裝襯裡和家具裝飾等領域被替代的風險。鞋服產業的主要全球品牌已承諾提高再生聚酯纖維的含量,並調整了採購預算,減少了對聚丙烯的傳統偏好。這種轉變給聚丙烯纖維市場帶來了壓力,尤其是在時尚領域。由於熔融強度低和顏料污染等問題,聚丙烯的回收率低於PET。這些限制阻礙了循環利用的宣傳,並使成本比較結果顯示rPET更具優勢。在衛生用品領域,普通紡粘纖維在速度方面優於PET。然而,除非聚丙烯提供顯著的價格折扣,否則紡織業正日益傾向於使用rPET。

細分市場分析

2025年,紗線部分佔總產量的84.46%,預計到2031年將以2.72%的複合年成長率成長。這項成長速度比聚丙烯纖維市場整體成長高出4個基點,鞏固了其在編織地工織物和地毯背襯領域的基礎性地位。編織地工織物的織造機需要連續長絲,避免了因接縫造成的生產中斷,從而確保了需求的持續性。蓬鬆度高的連續長絲滿足了地毯紗線一半的需求,而高強度扁平紗則用於簇絨和縫紉紗線。地毯背襯每年吸收大量的紗線,這得益於紗線的耐污性和相對於尼龍的成本優勢。

短纖維佔據剩餘佔有率,是針刺汽車襯墊、縐紋衛生吸水層和複合過過濾的基礎材料。短纖維產品的生產方法是將長絲切割成 38–102 毫米的長度,然後梳理成熱粘合或機械粘合的網狀物,從而獲得蓬鬆度和柔軟度。使用含再生材料的 15–25 旦短纖維混紡的汽車後備箱襯墊,其降噪係數已超過 0.6,表明儘管紗線消費量占主導地位,但短纖維仍能保持其價值。然而,與紡粘法(其加工速度可達 800 公尺/分鐘,集長絲成型和網狀粘合於一體)相比,短纖維的加工速度存在差異,這阻礙了其市場擴張。除非梳理速度得到提升或回收法規有利於短纖維,否則預計到 2031 年,紗線仍將保持主導。

聚丙烯纖維市場報告按類型(短纖維和紗)、終端用戶行業(紡織、建築、醫療衛生及其他終端用戶行業)和地區(亞太、北美、歐洲、南美以及中東和非洲)進行細分。市場預測以噸為單位。

區域分析

預計到2025年,亞太地區將佔全球市場佔有率的51.05%,並在2031年之前以每年3.33%的速度成長。該地區預計將保持主導地位,並在2031年之前保持穩定成長。中國強大的丙烯生產基礎將大量資源投入聚丙烯生產,造成樹脂供應過剩,並為國內纖維生產商提供了支持。值得注意的是,這些生產商近年來擴大了紡絲產能。供應過剩導致聚丙烯纖維出口激增,主要出口到東南亞市場。受衛生用品需求和「印度地工織物計畫」(Bharatmala Program)道路用地工織物規範的推動,印度的不織布產業預計將迎來顯著成長。同時,佔該地區需求很大一部分的東南亞國協的都市區收入水準正在提高。這一趨勢正在推動一次性尿布和衛生棉消費量的成長。同時,印尼和越南的本地加工商正在擴大其紡粘生產線。

北美在全球市場佔據重要佔有率,但其成長速度正在放緩。這項放緩是由於汽車生產日趨成熟以及地工織物回收強制令的實施,抵消了電動車相關複合材料的成長。儘管德克薩斯州新建的聚丙烯工廠增強了樹脂供應,但2024年新增的纖維紡絲產能卻十分運作。這種有限的擴張凸顯了市場對射出成型成型和薄膜級材料的偏好。歐洲在全球市場也佔據重要佔有率,並保持著穩定成長的勢頭。該地區在循環經濟領域也處於領先地位。值得關注的計劃包括地工織物的回收和再生利用。這些項目目前正在檢驗其經濟可行性,但也面臨挑戰。如果沒有補貼,其成本仍高於原生聚丙烯。此外,歐盟將於2023年生效的微塑膠法規要求對過濾設備維修。此舉不僅增加了合規成本,而且往往有利於市場上的大規模垂直整合企業。

南美洲和中東及非洲地區在全球需求中佔據相當大的佔有率,目前正經歷穩定成長。這一成長主要得益於大型企劃和衛生標準的廣泛普及。巴西的不織布需求也呈現強勁成長,這主要得益於某些地區一次性尿布使用量的增加。同時,沙烏地阿拉伯的「2030願景」計畫強制要求其工廠使用聚丙烯地工織物和宏觀合成纖維。預計這將推動到2028年的年度需求成長,儘管具體實施時間表仍存在不確定性。然而,這兩個地區都高度依賴進口,且極易受到運費波動的影響。例如,從亞洲運輸的成本可能會推高到岸成本。這種情況為國內PET生產商提供了競爭優勢,尤其是在貨幣貶值時期(正如近期貨幣貶值所顯示的)。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 衛生和醫療一次性用品的使用量增加

- 建設產業向宏觀合成混凝土加固的過渡

- 地工織物在道路和海岸工程的應用現狀。

- 對低密度、輕量汽車內部裝潢建材的需求

- 聚丙烯纖維增強複合複合材料的3D列印

- 市場限制

- 低成本PET和再生PET纖維的供應

- 低熔點限制了其在高溫領域的應用。

- 微塑膠洩漏的ESG審核

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

第5章 市場規模與成長預測

- 按類型

- 史泰博

- 線

- 按最終用戶行業分類

- 纖維

- 建造

- 醫療與衛生

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- ABC Polymer Industries LLC

- Beaulieu Fibres International(BFI)

- Belgian Fibers

- Chemosvit Fibrochem SRO

- China National Petroleum Corporation

- DuPont

- Fiberpartner Aps

- Freudenberg Group

- Huimin Taili Chemical Fiber Products Co. Ltd

- Indorama Ventures

- International Fibres Group

- Kolon Fiber Inc.

- Mitsubishi Chemical Corporation

- Radici Partecipazioni SpA

- Sika AG

- Tri Ocean Textile Co. Ltd

- W. Barnet GmbH & Co. KG

- Zenith Fibres Ltd

第7章 市場機會與未來展望

The Polypropylene Fibers market is expected to grow from 3.33 million tons in 2025 to 3.42 million tons in 2026 and is forecast to reach 3.9 million tons by 2031 at 2.68% CAGR over 2026-2031.

Growth reflects the polypropylene fiber market's ability to meet steady demand from hygiene, construction, and automotive applications while navigating tighter microplastics regulations and price competition from recycled polyester. China's addition of 18.7 million tons per year of polypropylene resin capacity between 2024 and 2026 keeps raw-material costs low and sustains the polypropylene fiber market's cost advantage. End-use expansion within the Asia-Pacific, particularly in disposable hygiene and infrastructure, offsets slower gains in North America and Europe, where recycling mandates temper demand for virgin fiber.

Global Polypropylene Fibers Market Trends and Insights

Rising Usage in Hygiene and Medical Disposables

In 2024, spunbond polypropylene nonwovens dominated the global hygiene nonwoven market, driven by demand for diapers, feminine care products, and surgical drapes. Hospitals, now adopting single-use protocols, continue to utilize the meltblown capacity that surged during the COVID-19 pandemic, solidifying polypropylene fiber's presence in medical disposables. India's hygiene sector, buoyed by the broader distribution of sanitary napkins and a growing female workforce, is poised for significant growth, thereby bolstering regional consumption of polypropylene fibers. A similar trend is observed in Indonesia, Vietnam, and Thailand, where increasing urban incomes are driving the adoption of diapers. While polypropylene's hydrophobicity, breathability, and compatibility with sterilization make it the preferred choice under EU MDR 2017/745, there's a notable shift in premium adult incontinence products. These are increasingly favoring bicomponent polyethylene-polypropylene blends for their softness, leading fiber producers to diversify their offerings.

Construction-Sector Shift to Macro-Synthetic Concrete Reinforcement

Macro-synthetic polypropylene fibers, dosed at 3-5 kg/m3, curtail plastic-shrinkage cracking, reduce installed costs relative to steel, and cut rust-related maintenance, supporting sustained inclusion in large flooring and tunnel projects. The Bharatmala highway and Sagarmala port programs have incorporated fiber-reinforced concrete clauses into Indian tenders. Contractors value the elimination of steel-mesh placement, while the polypropylene fiber market benefits from higher residual-strength specifications in ASTM C1399 and EN 14889-2. Residential uptake remains limited by code gaps; however, new guidelines from the Indian Concrete Institute aim to accelerate adoption in tropical climates.

Availability of Lower-Cost PET and Recycled-PET Fibers

As recycled PET capacity rapidly expands-bolstered by bottle collection networks and advancements in chemical recycling-the premium for rPET has decreased, heightening the risk of substitution in areas such as carpet backing, apparel linings, and upholstery. Major global brands in footwear and apparel, now committing to higher recycled-polyester content, are reallocating procurement budgets away from their traditional preference for polypropylene. This shift puts pressure on the polypropylene fiber market, particularly in the fashion segment. While recycling yields for polypropylene trail those of PET due to challenges such as lower melt strength and pigment contamination, these limitations hinder circularity claims and bolster cost comparisons in favor of rPET. In the hygiene sector, commodity spunbond boasts a speed edge compared to PET. However, the textile industry is increasingly leaning towards rPET, unless polypropylene offers a substantial price discount.

Other drivers and restraints analyzed in the detailed report include:

- Geotextile Penetration in Road and Coastal Engineering

- Demand for Low-Density Lightweight Automotive Interiors

- Low Melting Point Restricts High-Temperature Applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Yarn generated 84.46% of 2025 volume and is forecast to increase at a 2.72% CAGR to 2031, outpacing the broader polypropylene fiber market by 4 basis points and reinforcing its foundational role in woven geotextiles and carpet backing. Woven-geotextile looms require continuous filament, and any splice halts production, ensuring demand continuity. Bulk continuous filament grades, texturized for loft, supply half of the carpet yarn demand, while high-tenacity flat yarn supports tufting and sewing thread. Carpet backing, capitalizing on yarn's stain resistance and a cost advantage over nylon, absorbs a significant amount annually.

Staple fiber captures the remaining share and underpins needle-punched automotive liners, crimped hygiene acquisition layers, and composite filtration webs. Staple products deliver loft and softness by cutting filament into lengths of 38-102 mm, then carding it into webs that bond thermally or mechanically. Automotive trunk liners achieve noise-reduction coefficients greater than 0.6 using 15-25 denier staple blends with recycled content, illustrating value retention even as yarn volume dominates. However, staple's share is capped by the throughput gap with spunbond, which integrates filament formation and web bonding at 800 m/min. Unless carding speeds rise or recyclability rules favor discontinuous fibers, yarn will retain leadership through 2031.

The Polypropylene Fiber Market Report is Segmented by Type (Staple and Yarn), End-User Industry (Textile, Construction, Healthcare and Hygiene, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

The Asia-Pacific region accounted for 51.05% of the 2025 volume and is projected to grow at a rate of 3.33% annually through 2031. The region is set to maintain its lead, with steady growth projected through 2031. China's robust propylene base dedicates a significant portion to polypropylene, resulting in a surplus resin supply that bolsters domestic fiber producers. Notably, these producers have expanded their spinning capacity in recent years. With an oversupply in hand, PP fiber exports surged, primarily targeting Southeast Asian markets. India's nonwoven industry, driven by hygiene demands and highway geotextile specifications under the Bharatmala program, is poised for significant growth. Meanwhile, ASEAN economies, accounting for a notable portion of the region's demand, are witnessing a rise in urban incomes. This uptick has led to increased consumption of diapers and sanitary napkins. Concurrently, local converters are expanding their spunbond lines in both Indonesia and Vietnam.

North America, holding a considerable share in the global market, is experiencing a tempered growth rate. This muted pace can be attributed to a balance between mature automotive outputs and geotextile recycling mandates, which counterbalance the growth seen in EV-related composites. While new polypropylene plants in Texas have bolstered resin supplies, the market saw limited new fiber spinning capacity come online in 2024. This limited expansion highlights a market preference for injection-molding and film grades. Europe, commanding a significant portion of the market volume, is charting a steady growth trajectory. The region is also at the forefront of pioneering circular initiatives. Notable projects include geotextile recycling and reclamation efforts. While these initiatives are testing economic viability, they face a challenge: costs remain higher than virgin PP unless subsidized. Additionally, the EU's microplastics regulation, effective from 2023, mandates filtration retrofits. This move not only increases compliance costs but also appears to favor larger, vertically integrated players in the market.

The South America and Middle East-Africa regions, each accounting for a notable portion of the global demand, are witnessing steady growth. This growth is largely driven by advancements in infrastructure megaprojects and a rising adoption of hygiene standards. In Brazil, nonwoven volumes are climbing at a strong rate, spurred by increased diaper penetration in certain regions. Meanwhile, in Saudi Arabia, venues under the Vision 2030 initiative are mandating the use of polypropylene geotextiles and macro-synthetic fibers. This specification translates to an anticipated annual demand pull through 2028, although the execution timelines remain somewhat fluid. However, both regions face import dependencies, making them vulnerable to fluctuations in freight costs. For instance, shipping costs from Asia can inflate landed costs. This dynamic offers a competitive edge to domestic PET producers, especially when currencies decline, as highlighted by recent devaluations.

- ABC Polymer Industries LLC

- Beaulieu Fibres International (BFI)

- Belgian Fibers

- Chemosvit Fibrochem SRO

- China National Petroleum Corporation

- DuPont

- Fiberpartner Aps

- Freudenberg Group

- Huimin Taili Chemical Fiber Products Co. Ltd

- Indorama Ventures

- International Fibres Group

- Kolon Fiber Inc.

- Mitsubishi Chemical Corporation

- Radici Partecipazioni SpA

- Sika AG

- Tri Ocean Textile Co. Ltd

- W. Barnet GmbH & Co. KG

- Zenith Fibres Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising usage in hygiene and medical disposables

- 4.2.2 Construction-sector shift to macro-synthetic concrete reinforcement

- 4.2.3 Geotextile penetration in road and coastal engineering

- 4.2.4 Demand for low-density lightweight automotive interiors

- 4.2.5 3-D printing of PP fibre-reinforced composites

- 4.3 Market Restraints

- 4.3.1 Availability of lower-cost PET and recycled-PET fibres

- 4.3.2 Low melting point restricts high-temperature applications

- 4.3.3 ESG scrutiny on micro-plastics leakage

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Raw-Material Analysis

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Staple

- 5.1.2 Yarn

- 5.2 By End-User Industry

- 5.2.1 Textile

- 5.2.2 Construction

- 5.2.3 Healthcare and Hygiene

- 5.2.4 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABC Polymer Industries LLC

- 6.4.2 Beaulieu Fibres International (BFI)

- 6.4.3 Belgian Fibers

- 6.4.4 Chemosvit Fibrochem SRO

- 6.4.5 China National Petroleum Corporation

- 6.4.6 DuPont

- 6.4.7 Fiberpartner Aps

- 6.4.8 Freudenberg Group

- 6.4.9 Huimin Taili Chemical Fiber Products Co. Ltd

- 6.4.10 Indorama Ventures

- 6.4.11 International Fibres Group

- 6.4.12 Kolon Fiber Inc.

- 6.4.13 Mitsubishi Chemical Corporation

- 6.4.14 Radici Partecipazioni SpA

- 6.4.15 Sika AG

- 6.4.16 Tri Ocean Textile Co. Ltd

- 6.4.17 W. Barnet GmbH & Co. KG

- 6.4.18 Zenith Fibres Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment