|

市場調查報告書

商品編碼

1907274

北美智慧製造市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)North America Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

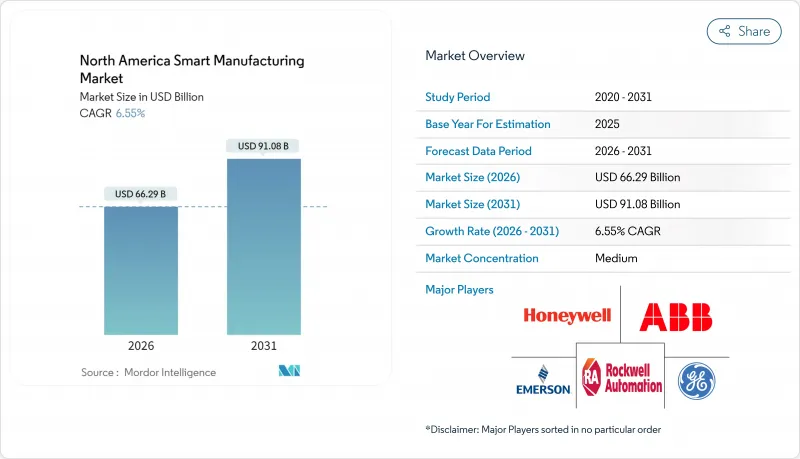

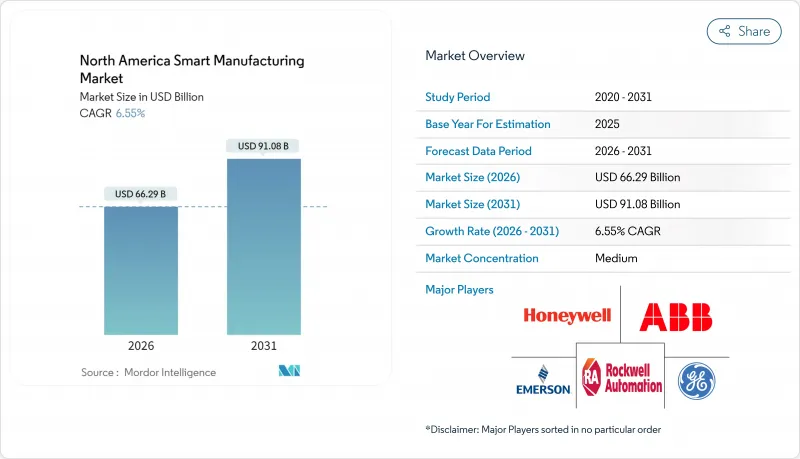

2025年北美智慧製造市場價值為622.1億美元,預計從2026年的662.9億美元成長到2031年的910.8億美元,在預測期(2026-2031年)內複合年成長率為6.55%。

這一成長勢頭得益於創紀錄的聯邦獎勵、強勁的私營部門資本形成,以及人工智慧 (AI)、5G 和網實整合系統 (CPS) 在離散製造和流程製造業的緊密整合。超過 93% 的製造商計劃在 2024 年啟動新的 AI舉措,這表明預測性、自最佳化生產環境正從試點階段邁向大規模部署。半導體產業的復甦、汽車電氣化強制令以及不斷擴大的電池供應鏈都在支撐市場需求,而製藥和生命科學企業也在加速設備升級,以滿足嚴格的合規要求。北美智慧製造市場也受到勞動力市場動態變化的影響,熟練工人的流動和網路保險成本的飆升限制了中小企業採用智慧製造技術的步伐。

北美智慧製造市場趨勢與洞察

美國離散製造業中人工智慧驅動的邊緣分析應用激增

人工智慧演算法現已嵌入機器層面,實現預測性維護,將非計劃停機時間減少高達 60%,並將設備壽命延長 20%。清潔能源與智慧製造創新研究院正透過其人才培養計畫擴大這些工具的使用範圍,協助彌合資料科學技能缺口。製造商發現,對於汽車和航太等對延遲高度敏感的應用而言,現場資料處理至關重要,因為毫秒級的反應速度直接影響產品品質。

加拿大工廠快速採用5G工業IoT網路

專用5G網路消除了傳統連接瓶頸。美國一家鋼鐵廠在實施5G區域網路解決方案後,營運中斷減少了70倍,每年節省了200萬美元。製造業已佔全球已公佈的專用5G部署的46%。加拿大無線通訊協會預測,到2025年,5G可望減少加拿大國內1,220萬噸二氧化碳排放。

營運技術(OT)和網路安全保險保費的持續上漲阻礙了數位轉型。

到2024年,65%的製造商將成為勒索軟體的受害者,擁有連網資產的公司的保險費上漲了30%以上。許多工廠仍缺乏持續的OT監控,加劇了感知風險與實際風險狀況之間的差距。

細分市場分析

到2025年,可程式邏輯控制器(PLC)的收入佔有率將達到21.60%,為數千家工廠的控制系統提供動力。同時,隨著製造商優先考慮安全的人機協作,北美協作機器人市場規模預計將以8.46%的複合年成長率成長。 OTTO Motors的自主移動機器人等案例研究表明,其投資回收期僅為11個月,在未發生任何安全事故的情況下,工作單元面積減少了15%。

混合邊緣到雲端架構正在整合PLC和AI推理引擎。羅克韋爾自動化和英偉達正在共同開發一種參考設計,使操作人員能夠將生成式AI應用於品質檢測流程。機器視覺結合了神經網路以確保零缺陷,而產品生命週期管理工具中的數位雙胞胎技術則有助於在實際執行之前對流程調整進行虛擬測試。

到2025年,控制硬體支出將佔總支出的54.30%,而軟體和服務支出將在2031年之前以9.86%的複合年成長率超過控制硬體。製造商正積極採用訂閱模式,將分析、網路安全和持續最佳化等服務捆綁在一起,以加快價值實現。通訊基礎設施,特別是專用5G和時間敏感型以太網,將支援此轉型,並促進工業IoT的可擴展性。

先進的視覺感測器代表了這一轉變。康耐視的 In-Sight L38 3D 系統將人工智慧與雙模成像相結合,透過最大限度地減少訓練資料需求來加速技術應用。從SCARA機器人到自主移動機器人,各種機器人組件套件提供了更大的柔軟性,而 MES 4.0 框架整合了 IT 和 OT 資料湖,在汽車試點項目中,庫存減少了 30%,人均收入提高了 75%。

北美智慧製造市場佔有率報告按技術(PLC、SCADA等)、組件(控制設備、通訊基礎設施等)、終端用戶產業(汽車、石油天然氣等)、部署模式(本地部署、雲端部署等)和國家(美國、加拿大)進行細分。市場規模和預測均以美元計價。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 價值/供應鏈分析

- 監理與科技趨勢(北美)

- 投資分析(資本流動、併購、創業融資)

- 宏觀經濟事件(新冠疫情、貿易政策、勞動力短缺)的影響

- 市場促進因素

- 美國離散製造業中人工智慧驅動的邊緣分析應用激增

- 加拿大工廠快速採用5G工業IoT網路

- 回流激勵措施(CHIPS 和科學法案、IRA)推動了數位化優先工廠的發展。

- 永續性的迫切需求推動了現有設施的智慧型能源管理維修。

- 在汽車叢集中引入網實整合系統以實現零缺陷生產

- 中小製造商對模組化、低程式碼MES的需求日益成長,訂單。

- 市場限制

- 營運技術保險和網路安全保險保費持續上漲限制了數位轉型

- 傳統PLC安裝基礎中存在的多廠商互通性差距

- 二級汽車零件製造商因通膨因素延後資本支出

- 北美熟練工人的離職率超過了技能提升工人的供應量。

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭強度

第5章 市場規模與成長預測

- 透過技術

- 監控與數據採集(SCADA)

- 分散式控制系統(DCS)

- 人機介面(HMI)

- 製造執行系統(MES)

- 產品生命週期管理(PLM)

- 企業資源規劃(ERP)

- 機器人技術與協作機器人

- 機器視覺和品質檢測

- 邊緣和雲端分析平台

- 按組件

- 控制設備(PLC、DCS、PAC)

- 通訊基礎設施(5G、工業乙太網)

- 感測器和致動器

- 機器視覺系統

- 機器人(關節型機器人、SCARA機器人、自主移動機器人)

- 軟體和服務(MES、數位雙胞胎、SaaS)

- 按最終用戶行業分類

- 車

- 航太/國防

- 石油和天然氣(上游、中游、下游)

- 化工/石油化工

- 製藥和生命科學

- 食品/飲料

- 金屬和採礦

- 電子和半導體

- 紙漿和造紙

- 其他(纖維、塑膠)

- 透過部署模式

- 本地部署

- 雲(SaaS)

- 混合

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 策略性舉措(合作關係、生產回流、與環境、社會及公司治理相關的融資)

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Emerson Electric Co.

- FANUC Corp.

- General Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corp.

- Robert Bosch GmbH(Bosch Rexroth)

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Texas Instruments Inc.

- Yokogawa Electric Corp.

- Omron Corp.

- PTC Inc.

- IBM Corp.

- Cisco Systems Inc.

- SAP SE

- Dassault Systemes SE

- Cognex Corp.

- Keyence Corp.

- Stratasys Ltd.

第7章 市場機會與未來展望

The North America smart manufacturing market was valued at USD 62.21 billion in 2025 and estimated to grow from USD 66.29 billion in 2026 to reach USD 91.08 billion by 2031, at a CAGR of 6.55% during the forecast period (2026-2031).

Momentum stems from record federal incentives, strong private-sector capital formation and the tight coupling of artificial intelligence, 5G and cyber-physical systems across discrete and process industries. More than 93% of manufacturers launched new AI initiatives in 2024, a signal that predictive, self-optimizing production environments are moving from pilots to scaled rollouts. Semiconductor reshoring, automotive electrification mandates and battery supply-chain buildouts anchor demand, while pharmaceutical and life-sciences facilities accelerate upgrades to meet stringent compliance requirements. The North America smart manufacturing market is also shaped by shifting workforce dynamics, with skilled-trades attrition and cyber-insurance cost spikes tempering adoption velocity among small and mid-sized enterprises.

North America Smart Manufacturing Market Trends and Insights

Surging Adoption of AI-Enabled Edge Analytics in U.S. Discrete Manufacturing

AI algorithms are now embedded at the machine layer, enabling predictive maintenance that cuts unplanned downtime by up to 60% and extends asset lifespans by 20%. The Clean Energy Smart Manufacturing Innovation Institute broadens access to these tools through workforce programs, helping close data-science skill gaps. Manufacturers view on-site data processing as essential for latency-sensitive applications in automotive and aerospace where millisecond-level responses govern quality.

Rapid Proliferation of 5G-Powered Industrial IoT Networks across Canadian Plants

Private 5G networks eliminate historical connectivity bottlenecks; one U.S. steel facility recorded a 70-fold reduction in operational disruptions and annual savings of USD 2 million after adopting a 5G LAN solution. Manufacturing already accounts for 46% of announced private 5G deployments worldwide. The Canadian Wireless Telecommunications Association forecasts that 5G could cut national emissions by 12.2 MtCO2e by 2025.

Persistent OT Cyber-Insurance Premium Hikes Limiting Digital Conversions

Ransomware incidents affected 65% of manufacturers in 2024, pushing premiums up more than 30% for firms introducing connected assets. Many plants still lack continuous OT monitoring, widening the gap between perceived and actual risk profiles.

Other drivers and restraints analyzed in the detailed report include:

- Reshoring Incentives Fueling Digital-First Factories

- Sustainability Mandates Driving Smart Energy-Management Retrofits

- North American Skilled-Trades Attrition Outpacing Upskilling Pipelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Programmable Logic Controllers held 21.60% revenue in 2025, anchoring the control layer across thousands of plants. The North America smart manufacturing market size for collaborative robotics, however, is projected to rise at an 8.46% CAGR as manufacturers prioritize safe human-robot collaboration. Deployments such as OTTO Motors' Autonomous Mobile Robots deliver 11-month paybacks and shrink work-cell footprints 15% without safety incidents.

Hybrid edge-to-cloud architectures increasingly unite PLCs with AI inference engines. Rockwell Automation and NVIDIA are co-developing reference designs that let operators apply generative AI for quality inspection flows. Machine vision now embeds neural networks for zero-defect assurance, while digital twins inside Product Lifecycle Management tools help test process tweaks virtually before physical execution.

Control hardware accounted for 54.30% of 2025 spending, yet software and services are forecast to outpace at a 9.86% CAGR through 2031. Manufacturers increasingly embrace subscription models that bundle analytics, cybersecurity and continuous optimization, reducing time-to-value. Communication infrastructure-especially private 5G and Time-Sensitive Networking Ethernet-underpins this pivot and supports Industrial IoT scalability.

Advanced vision sensors spotlight the transition. Cognex's In-Sight L38 3D system combines AI with dual-mode imaging to accelerate deployment by minimizing training data requirements. Robotics component kits, spanning SCARA to Autonomous Mobile Robots, further elevate flexibility, while MES 4.0 frameworks integrate IT and OT data lakes to slash inventory 30% and lift revenue per employee 75% in automotive trials.

North America Smart Manufacturing Market Share Report is Segmented by Technology (PLC, SCADA and More), Component (Control Devices, Communication Infrastructure, and More), End-User Industry (Automotive, Oil and Gas and More), Deployment Mode (On-Premise, Cloud and More), and Country (United States, Canada). The Market Size and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd.

- Emerson Electric Co.

- FANUC Corp.

- General Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corp.

- Robert Bosch GmbH (Bosch Rexroth)

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Texas Instruments Inc.

- Yokogawa Electric Corp.

- Omron Corp.

- PTC Inc.

- IBM Corp.

- Cisco Systems Inc.

- SAP SE

- Dassault Systemes SE

- Cognex Corp.

- Keyence Corp.

- Stratasys Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Value / Supply-Chain Analysis

- 4.2 Regulatory and Technological Outlook (North America)

- 4.3 Investment Analysis (capital flows, MandA, venture funding)

- 4.4 Impact of Macroeconomic Events (COVID-19, Trade-Policy, Labor Shortage)

- 4.5 Market Drivers

- 4.5.1 Surging Adoption of AI-enabled Edge Analytics in U.S. Discrete Manufacturing

- 4.5.2 Rapid Proliferation of 5G-powered Industrial IoT Networks across Canadian Plants

- 4.5.3 Reshoring Incentives (CHIPS and Science Act, IRA) Fueling Digital-First Factories

- 4.5.4 Sustainability Mandates Driving Smart Energy-Management Retrofits in Brown-field Sites

- 4.5.5 Adoption of Cyber-Physical Systems for Zero-Defect Production in Automotive Clusters

- 4.5.6 Growing Demand for Modular, Low-Code MES among SME Job-Shops

- 4.6 Market Restraints

- 4.6.1 Persistent OT Cyber-Insurance Premium Hikes Limiting Digital Conversions

- 4.6.2 Multi-vendor Interoperability Gaps in Legacy PLC Install-base

- 4.6.3 Inflation-driven CAPEX Deferrals in Tier-2 Automotive Suppliers

- 4.6.4 North American Skilled-Trades Attrition Outpacing Upskilling Pipelines

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Techonology

- 5.1.1 Supervisory Control and Data Acquisition (SCADA)

- 5.1.2 Distributed Control System (DCS)

- 5.1.3 Human-Machine Interface (HMI)

- 5.1.4 Manufacturing Execution System (MES)

- 5.1.5 Product Lifecycle Management (PLM)

- 5.1.6 Enterprise Resource Planning (ERP)

- 5.1.7 Robotics and Collaborative Robots

- 5.1.8 Machine Vision and Quality Inspection

- 5.1.9 Edge and Cloud Analytics Platforms

- 5.2 By Component

- 5.2.1 Control Devices (PLC, DCS, PAC)

- 5.2.2 Communication Infrastructure (5G, Industrial Ethernet)

- 5.2.3 Sensors and Actuators

- 5.2.4 Machine Vision Systems

- 5.2.5 Robotics (Articulated, SCARA, AMR)

- 5.2.6 Software and Services (MES, Digital Twin, SaaS)

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Oil and Gas (Upstream, Midstream, Downstream)

- 5.3.4 Chemicals and Petrochemicals

- 5.3.5 Pharmaceuticals and Life-Sciences

- 5.3.6 Food and Beverage

- 5.3.7 Metals and Mining

- 5.3.8 Electronics and Semiconductors

- 5.3.9 Pulp and Paper

- 5.3.10 Others (Textiles, Plastics)

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud (SaaS)

- 5.4.3 Hybrid

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves (Partnerships, Reshoring, ESG-linked Financing)

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.3.1 ABB Ltd.

- 6.3.2 Emerson Electric Co.

- 6.3.3 FANUC Corp.

- 6.3.4 General Electric Co.

- 6.3.5 Honeywell International Inc.

- 6.3.6 Mitsubishi Electric Corp.

- 6.3.7 Robert Bosch GmbH (Bosch Rexroth)

- 6.3.8 Rockwell Automation Inc.

- 6.3.9 Schneider Electric SE

- 6.3.10 Siemens AG

- 6.3.11 Texas Instruments Inc.

- 6.3.12 Yokogawa Electric Corp.

- 6.3.13 Omron Corp.

- 6.3.14 PTC Inc.

- 6.3.15 IBM Corp.

- 6.3.16 Cisco Systems Inc.

- 6.3.17 SAP SE

- 6.3.18 Dassault Systemes SE

- 6.3.19 Cognex Corp.

- 6.3.20 Keyence Corp.

- 6.3.21 Stratasys Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment