|

市場調查報告書

商品編碼

1907247

三聚氰胺:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Melamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

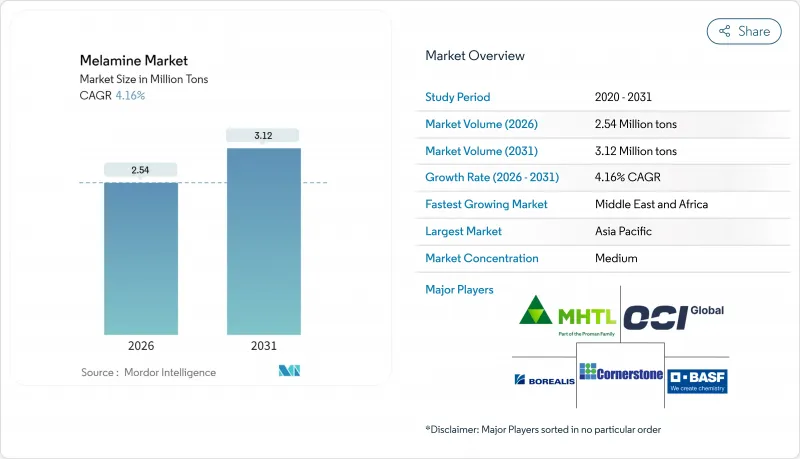

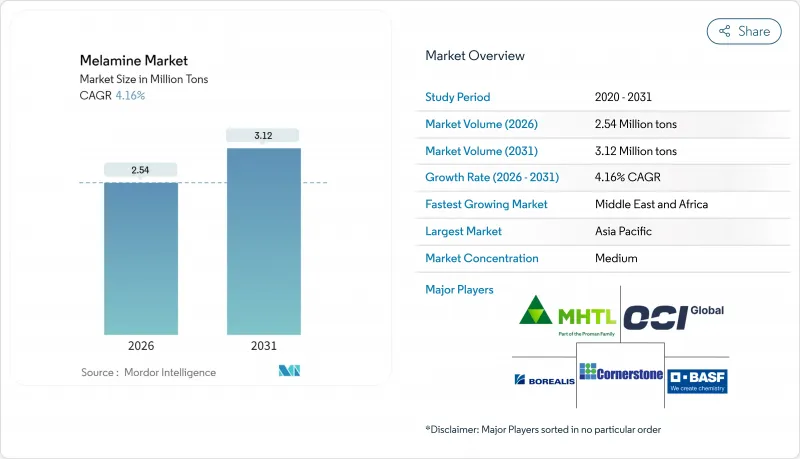

預計到 2026 年,三聚氰胺市場規模將達到 254 萬噸,高於 2025 年的 244 萬噸。

預計到 2031 年,產量將達到 312 萬短噸,2026 年至 2031 年的複合年成長率為 4.16%。

亞太地區活躍的建設活動、北美和歐洲強勁的翻新和重建投資,以及多家工廠減產導致的全球供應趨緊,持續支撐著價格上漲和擴張。新興市場對強化複合地板的快速接受度、超低甲醛釋放樹脂技術的進步,以及歐洲對高價值生質能平衡等級產品的採用,進一步推動了需求。在供應方面,卡達和中國的產能擴張部分抵銷了歐洲的永久性停產,而持續的能源價格波動和高企的尿素原料價格則導致庫存週期縮短,現貨價格居高不下。將尿素追溯整合與碳減排藍圖相結合的供應商正在獲得結構性成本優勢和合規優勢,從而推動區域自給自足策略和旨在消除三聚氰胺市場瓶頸的投資。

全球三聚氰胺市場趨勢與洞察

新興國家複合地板和家俱生產快速成長

中國、印度、越南和印尼的都市化以及中階消費的成長,刺激了裝飾層壓板和家具升級的需求。中國2024年國家經濟規劃優先發展石化產業最佳化和下游一體化,推動了國內對三聚氰胺樹脂的投資。產能的擴大確保了原料供應,使板材生產商能夠從脲醛體系過渡到具有更佳防潮性能的三聚氰胺脲醛體系。印度化工產業的積極擴張,將新建的化肥聯合企業與三聚氰胺衍生工廠連接起來,縮短了板材生產商的前置作業時間。塑合板產量不斷成長,而傳統上較少使用的木材,如榿木和樺木,需要高性能樹脂才能達到黏合標準。這些因素共同支撐著三聚氰胺市場銷量的穩定成長。

美國和歐盟建設業的復甦帶動了對木材黏合劑的需求。

預計這兩個地區的住宅開工量將在2024年趨於穩定,並在2026年之前保持溫和成長。這將促進定向纖維板(OSB)和中密度纖維板(MDF)消費量的復甦,這兩種板材都需要使用三聚氰胺增強黏合劑。歐盟建商也尋求符合REACH法規規定的甲醛排放限值(0.062 mg/m³)的板材等級,該法規將於2026年8月生效。北美生產商正在研發符合美國環保署《有毒物質管制法案》(TSCA)第6章規定的低排放量三聚氰胺-脲-甲醛樹脂。歐洲客戶擴大採用生質能平衡樹脂,例如Finsa等早期採用者已整合了OCI的生物基三聚氰胺等級產品,與傳統進口產品相比,其產品的碳足跡減少了約50%。

歐盟和北美收緊甲醛排放法規

歐盟0.062毫克/立方米的排放限值以及美國環保署《有毒物質控制法案》(TSCA)第6章相應的閾值均要求進行昂貴的認證、實驗室檢測和供應鏈文件編制。未能達到新標準的生產商將面臨被市場淘汰的風險。雖然三聚氰胺-甲醛樹脂的排放通常低於脲醛樹脂,但合規認證的額外成本正在擠壓利潤空間,並嚇退中小型加工商。瑞典更進一步,將排放限值設定為0.124毫克/立方米,這可能很快就會成為其他北歐市場的基準。

細分市場分析

預計到2025年,三聚氰胺樹脂將保持64.70%的市場佔有率,成為裝飾層壓板、塑合板貼面和高壓層壓板的主要材料。亞太地區強勁的地板材料更換週期以及歐洲甲醛法規的壓力將推動樹脂市場在2031年之前持續成長。同時,儘管基數發泡體,但由於航太、電動車和鐵路業優先考慮超輕型隔音材料,預計三聚氰胺泡棉市場規模將以4.72%的複合年成長率成長。發泡體製造商正在擴大連續塊狀和桶狀泡沫的生產規模,以供應用於室內裝飾的大尺寸面板。BASF的EcoBalanced計畫表明,再生能源和生質能原料無需重新認證即可將產品碳足跡減少高達50%,這為致力於實現淨零排放的原始設備製造商(OEM)提供了競爭優勢。

樹脂混煉商正致力於研發超低莫耳比體系,將甲醛排放降至0.05 mg/m³以下,以保障對歐盟的板材出口。擁有自有尿素回收設施和三聚氰胺反應器的綜合生產商,能夠確保原料的穩定供應,並利用規模經濟在尿素價格波動時期維持利潤率。 2024年Grupa Azoti的暫時停產凸顯了依賴市售尿素和高成本氣體的工廠的脆弱性。

三聚氰胺市場報告按產品類型(三聚氰胺晶體、三聚氰胺樹脂、三聚氰胺泡沫及其他)、應用領域(層壓板、木材黏合劑及其他)、終端用戶產業(建築與基礎設施、家具與木工及其他)以及地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲地區)進行細分。市場預測以噸為單位。

區域分析

到2025年,亞太地區將佔據三聚氰胺市場51.05%的佔有率,這主要得益於中國龐大的樹脂化產能和印度對裝飾板材的穩定需求。山東和內蒙古的氨-尿素-三聚氰胺一體化生產聯合體受益於煤炭或低成本天然氣原料,進一步鞏固了該地區的價格主導。日本和韓國對半導體和造船業使用的高純度模塑膠和吸音泡沫保持著高階市場需求。東南亞家具出口的快速成長推動了樹脂投資的增加,儘管該地區仍依賴進口三聚氰胺晶體,但這有助於提高其自給自足能力。

北美是一個重要的市場,但其供應結構仍然供不應求,並依賴單一的國內生產商。颶風造成的停工和維護停產使板材和地板材料製造商面臨供應中斷的風險。對來自德國、卡達、特立尼達和多巴哥以及印度的產品徵收的反補貼稅限制了進口依賴。同時,建築商正利用抵押房屋抵押貸款利率下調和基礎設施支出增加的機會來維持板材消費,從而支撐了樹脂需求的穩定。

儘管歐洲面臨最嚴格的排放法規,但它在生質能平衡三聚氰胺領域擁有先發優勢。中東和非洲地區雖然目前小規模,但成長率高達4.28%,卡達能源公司及其附屬公司正利用當地豐富的低成本天然氣原料擴大三聚氰胺產能。從拉斯拉凡出發的新型石化走廊旨在向亞洲和歐洲供應產品,但美國的關稅限制了其直接進入北美市場。南美市場仍然保持著機會主義,在套利機會出現時,會從特立尼達和多巴哥以及歐洲進口現貨貨物。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新興經濟體複合地板和家俱生產快速成長

- 美國和歐盟建設業的復甦正在推動對木材黏合劑的需求。

- 亞太地區產業擴張推動高壓層壓板和模塑膠的發展

- 用於飛機和鐵路聲學的輕質耐熱三聚氰胺泡沫

- 低碳尿素製三聚氰胺製程創新

- 市場限制

- 歐盟和北美收緊甲醛排放法規

- 生物基黏合劑替代品(大豆、木質素、液化木材)

- 化肥市場中斷導致尿素價格波動

- 價值鏈分析

- 監管環境

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析及趨勢

- 生產過程

- 進出口趨勢

- 價格趨勢

- 專利分析

第5章 市場規模與成長預測

- 按產品形式

- 三聚氰胺晶體

- 三聚氰胺樹脂(HPL、LPL、浸漬紙)

- 三聚氰胺泡沫

- 其他(浸漬裝飾紙、阻燃混合物)

- 透過使用

- 層壓材料

- 木工黏合劑

- 模塑化合物

- 油漆和塗料

- 阻燃劑和紡織樹脂

- 按最終用戶行業分類

- 建築和基礎設施

- 家具和木工

- 汽車/運輸設備

- 化學品和塗料

- 家用電器和電氣設備

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BASF SE

- Borealis AG

- Cornerstone Chemical Company

- EuroChem Group

- Fushun Huaxing Petroleum Chemical Co., Ltd

- Grupa Azoty

- Gujarat State Fertilizers & Chemicals Ltd(GSFC)

- Henan Xinlianxin Chemicals Group Co. Ltd

- Hexion Inc.

- Methanol Holdings(Trinidad)Ltd(MHTL)

- Mitsui Chemicals Inc.

- Nissan Chemical Corporation

- OCI NV

- Prefere Resins Holding GmbH

- Qatar Melamine Company

- Sichuan Chemical Works Group Ltd

第7章 市場機會與未來展望

Melamine Market size in 2026 is estimated at 2.54 million tons, growing from 2025 value of 2.44 million tons with 2031 projections showing 3.12 million tons, growing at 4.16% CAGR over 2026-2031.

Strong construction activity in the Asia-Pacific region, resilient repair-and-remodel investment in North America and Europe, and tight global supply following multiple plant curtailments continue to support price realization and reinforce expansion. Demand is further boosted by the rapid adoption of laminated flooring in emerging economies, technological advancements that enable ultra-low formaldehyde-emission resins, and the premium adoption of biomass-balanced grades in Europe. On the supply side, capacity additions in Qatar and China partially offset permanent shutdowns in Europe, yet lingering energy volatility and urea feedstock spikes keep inventory cycles short and spot prices elevated. Suppliers that combine backward urea integration with carbon-reduction road maps gain a structural cost and regulatory compliance edge, encouraging regional self-sufficiency strategies and targeted debottlenecking investments across the melamine market.

Global Melamine Market Trends and Insights

Surge in laminated flooring and furniture production in emerging economies

Urbanization and growing middle-class spending in China, India, Vietnam, and Indonesia are stimulating a boom in decorative laminates and furniture upgrades. China's 2024 national economic plan prioritizes petrochemical optimization and downstream integration, which favors local investments in melamine resin. Capacity additions ensure feedstock availability, enabling panel producers to transition from urea-formaldehyde to melamine-urea-formaldehyde systems, which offer improved moisture resistance. India's aggressive chemical build-out couples new fertilizer complexes with derivative melamine plants, shortening lead times to panel firms. Particleboard output is growing, and lesser-used species, such as alder and birch, will require higher-performance resins to meet bonding standards. Together, these factors support steady volume gains for the melamine market.

Construction recovery in United States/European Union spurring wood-adhesive demand

Housing starts stabilized in 2024 and are expected to rise modestly through 2026 in both regions, reviving consumption of oriented strand board and medium-density fiberboard, which rely on melamine-enhanced adhesives. EU builders also seek panel grades that meet upcoming REACH formaldehyde limits of 0.062 mg/m3, effective August 2026. North American producers align with EPA TSCA Title VI, driving substitution toward lower-emission melamine-urea-formaldehyde formulations. European customers are increasingly specifying biomass-balanced resins, with early adopters such as Finsa integrating OCI's bio-melamine grades, which reduce the product's carbon footprint by roughly 50% compared to conventional imports.

Stricter formaldehyde-emission regulations in EU and North America

The EU limit of 0.062 mg/m3 and aligned EPA TSCA Title VI thresholds mandate expensive certification, laboratory testing, and supply-chain documentation. Producers unable to meet the new bar risk market exclusion. While melamine-formaldehyde typically exhibits lower emissions than urea-formaldehyde, the incremental cost to prove compliance compresses margins and deters smaller converters. Sweden has taken a further step with a 0.124 mg/m3 limit, which may soon serve as a benchmark for other Nordic markets.

Other drivers and restraints analyzed in the detailed report include:

- Industrial expansion in Asia-Pacific boosting HPL and molding compounds

- Lightweight heat-resistant melamine foams for aerospace and rail acoustics

- Bio-based adhesive substitutes (soy, lignin, liquefied wood)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Melamine resins retained a 64.70% market share of melamine in 2025, serving as the backbone for decorative laminates, particleboard overlays, and high-pressure laminates. Robust flooring replacement cycles in Asia-Pacific and formaldehyde compliance pressures in Europe underpin growth for resins through 2031. In parallel, the melamine market size for foam is projected to expand at a 4.72% CAGR, albeit from a lower base, because aerospace, EV, and rail sectors prioritize ultra-light acoustic insulation. Foam manufacturers are scaling continuous blocks and bun stock production to supply large panels for interior trimming. BASF's EcoBalanced launch demonstrates how renewable electricity and biomass feedstock can deliver up to 50% lower product carbon footprint without requalification, a competitive differentiator for Original Equipment Manufacturers targeting Net Zero.

Resin formulators are focusing on ultra-low molar ratio systems to reduce formaldehyde emissions below 0.05 mg/m3, thereby protecting panel exports to the EU. Integrated producers that own urea capture and melamine reactors achieve feedstock security and leverage economies of scale to safeguard margins when urea volatility peaks. Grupa Azoty's temporary shutdown in 2024 highlights the exposure of plants that rely on merchant urea and high-cost gas inputs.

The Melamine Market Report is Segmented by Product Form (Melamine Crystals, Melamine Resins, Melamine Foam, and Others), Application (Laminates, Wood Adhesives, and More), End-User Industry (Construction and Infrastructure, Furniture and Woodworking, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific controlled 51.05% melamine market share in 2025, underpinned by China's vast resinification capacity and steady Indian demand for decorative panels. Integrated ammonia-urea-melamine complexes in Shandong and Inner Mongolia benefit from coal or low-cost gas feedstock, reinforcing regional price leadership. Japan and South Korea maintain a premium niche demand for high-purity molding compounds and acoustic foams used in the semiconductor and shipbuilding industries. Southeast Asia's fast-growing furniture exports attract incremental resin investment, boosting regional self-sufficiency despite reliance on imported melamine crystals.

North America is a significant market but remains structurally short, relying on a single domestic producer. Hurricane-related outages and maintenance downtime expose panel and flooring manufacturers to supply disruptions. Import reliance is moderated by countervailing duties placed on products from Germany, Qatar, Trinidad and Tobago, and India. Builders, meanwhile, capitalize on mellower mortgage rates and infrastructure spending to sustain panel consumption, underpinning stable resin demand.

Europe grapples with the strictest emission rules yet enjoys an early-mover advantage in biomass-balanced melamine. The Middle-East and Africa, while currently small, exhibit the highest growth rate of 4.28%, as QatarEnergy and its affiliates push melamine capacity linked to abundant, low-cost gas feedstock. New petrochemical corridors from Ras Laffan aim to serve Asian and European offtakers, yet U.S. duties constrain direct North American access. South America remains opportunistic, drawing spot cargoes from Trinidad and Tobago and Europe when arbitrage allows.

- BASF SE

- Borealis AG

- Cornerstone Chemical Company

- EuroChem Group

- Fushun Huaxing Petroleum Chemical Co., Ltd

- Grupa Azoty

- Gujarat State Fertilizers & Chemicals Ltd (GSFC)

- Henan Xinlianxin Chemicals Group Co. Ltd

- Hexion Inc.

- Methanol Holdings (Trinidad) Ltd (MHTL)

- Mitsui Chemicals Inc.

- Nissan Chemical Corporation

- OCI NV

- Prefere Resins Holding GmbH

- Qatar Melamine Company

- Sichuan Chemical Works Group Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in laminated flooring and furniture production in emerging economies

- 4.2.2 Construction recovery in United States/European union spurring wood-adhesive demand

- 4.2.3 Industrial expansion in APAC boosting HPL and molding compounds

- 4.2.4 Lightweight heat-resistant melamine foams for aero and rail acoustics

- 4.2.5 Low-carbon urea-to-melamine process innovations

- 4.3 Market Restraints

- 4.3.1 Stricter formaldehyde-emission regulations in European Union and North America

- 4.3.2 Bio-based adhesive substitutes (soy, lignin, liquefied wood)

- 4.3.3 Urea-price volatility tied to fertilizer-market disruptions

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Feedstock Analysis and Trends

- 4.8 Production Process

- 4.9 Import-Export Trends

- 4.10 Price Trends

- 4.11 Patent Analysis

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Form

- 5.1.1 Melamine Crystals

- 5.1.2 Melamine Resins (HPL, LPL, Impregnated Paper)

- 5.1.3 Melamine Foam

- 5.1.4 Others (Impregnated Decor Paper, Flame-retardant Blends)

- 5.2 By Application

- 5.2.1 Laminates

- 5.2.2 Wood Adhesives

- 5.2.3 Molding Compounds

- 5.2.4 Paints and Coatings

- 5.2.5 Flame-retardants and Textile Resins

- 5.3 By End-user Industry

- 5.3.1 Construction and Infrastructure

- 5.3.2 Furniture and Woodworking

- 5.3.3 Automotive and Transportation

- 5.3.4 Chemicals and Coatings

- 5.3.5 Appliances and Electrical

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Borealis AG

- 6.4.3 Cornerstone Chemical Company

- 6.4.4 EuroChem Group

- 6.4.5 Fushun Huaxing Petroleum Chemical Co., Ltd

- 6.4.6 Grupa Azoty

- 6.4.7 Gujarat State Fertilizers & Chemicals Ltd (GSFC)

- 6.4.8 Henan Xinlianxin Chemicals Group Co. Ltd

- 6.4.9 Hexion Inc.

- 6.4.10 Methanol Holdings (Trinidad) Ltd (MHTL)

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Nissan Chemical Corporation

- 6.4.13 OCI NV

- 6.4.14 Prefere Resins Holding GmbH

- 6.4.15 Qatar Melamine Company

- 6.4.16 Sichuan Chemical Works Group Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment