|

市場調查報告書

商品編碼

1907238

木質素產品:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Lignin Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

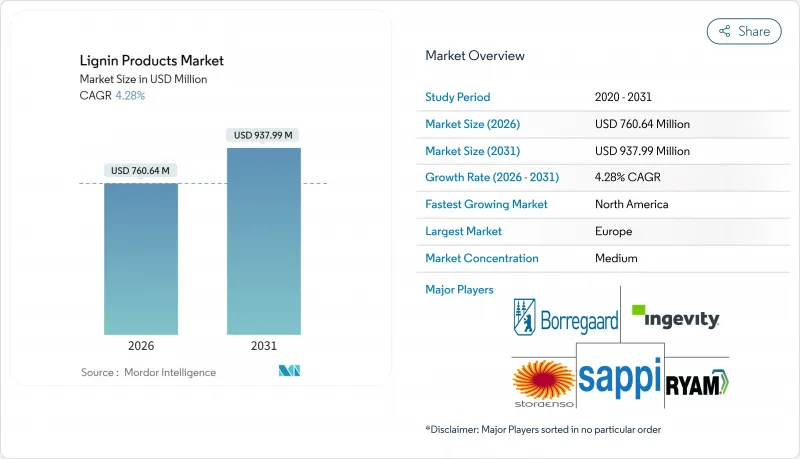

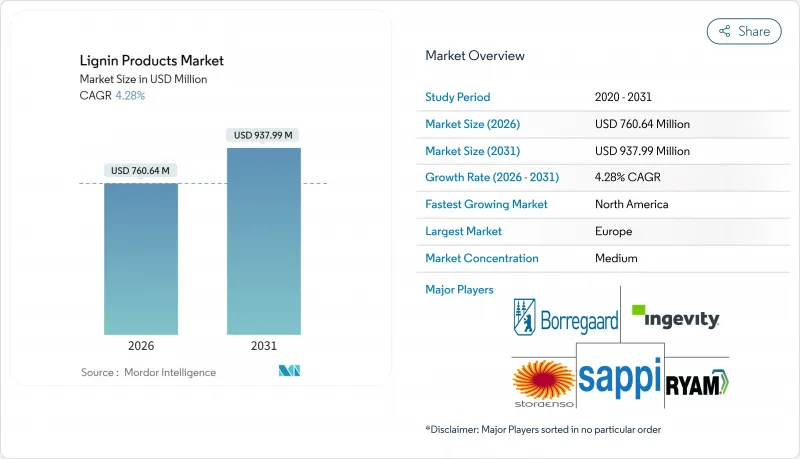

預計木質素產品市場將從 2025 年的 7.2942 億美元成長到 2026 年的 7.6064 億美元,到 2031 年將達到 9.3799 億美元,2026 年至 2031 年的複合年成長率為 4.28%。

這一成長主要受以下因素驅動:對低碳建設化學品的需求不斷成長、成熟經濟體永續永續性法規的日益嚴格,以及生物轉化途徑的持續創新,這些創新為木質素基芳烴的高價值應用開闢了道路。從廢棄物處理向一體化高附加價值生物煉製廠的轉變,增強了企業的定價權,尤其是對醫藥和電子價值鏈所需的高純度等級產品而言。歐洲憑藉其長期累積的紙漿廠基礎設施,保持著先發優勢;而北美則受益於纖維素乙醇強制摻混政策和汽車輕量化計劃,實現了最快成長。市場競爭強度仍然適中,一體化紙漿生產商利用規模經濟優勢來保護其利潤,抵禦小規模特種加工商的競爭。

全球木質素產品市場趨勢及洞察

對高性能混凝土外加劑的需求不斷成長

亞太和拉丁美洲的基礎設施擴張推動了對高效減水劑的需求,這種減水劑能夠提高混凝土的流動性並減少水泥消費量。木質素基外加劑可降低水灰比,使混凝土抗壓強度提高15-20%,水泥用量減少8-12%。致力於獲得LEED認證的建設公司傾向於採用這些生物基解決方案,以減少高層建築和交通運輸計劃的碳蘊藏量。中國和印度的綠建築標準現已推薦使用天然外加劑,這項監管措施將加速其商業化進程。製造商正在擴大產能,以滿足大規模城市和公路項目對高性能混凝土的要求。預計智慧城市投資的穩定成長將在中期內持續推動對木質素高效減水劑的需求。

在動物營養學中引入木質素基飼料粘合劑

歐洲限制抗生素生長促進劑的法規正促使飼料生產商轉向磺酸鹽粘合劑。研究表明,與糖蜜基系統相比,木質素磺酸鹽黏合劑可將顆粒飼料的耐久性提高25%至30%,從而減少飼料粉塵和運輸損失。某些木質素成分具有益生元活性,能夠改善反芻動物的腸道微生物群,使飼料生產商能夠以更高的價格出售產品。丹麥和荷蘭的生產商報告稱,透過從當地紙漿廠在地採購木質素衍生物,物流成本降低了12%至15%。隨著大型綜合企業尋求建構無抗生素價值鏈,北美生產商也正在採取類似的策略。隨著亞太地區畜牧業生產商轉向高價值蛋白質並尋求更高的複合飼料效率,長期前景仍然強勁。

萃取過程導致品質差異

硫酸鹽木質素、亞硫酸鹽木質素和鹼木質素在硫含量和分子量上的差異,使得對規格要求一致的用戶採購產品變得複雜。亞硫酸鹽木質素的硫含量比其他木質素高出20-30%,這會影響樹脂固化速度,並需要特殊的加工通訊協定。下游企業需要維護平行庫存和雙重認證程序,導致供應鏈成本增加8-12%。小規模工廠很少有分析實驗室來認證每一批產品,這限制了其市場進入。在建立通用測試標準和雲端追溯平台成熟之前,不確定性在短期內仍將存在。因此,品質協調統一對於其在特種應用領域的廣泛應用至關重要。

細分市場分析

到2025年,與硫酸鹽紙漿生產相關的木質素產品市場規模將佔據全球市場總規模的絕大部分,達到76.62%,這主要得益於其充足的供應和作為分散劑的成熟性能。纖維素乙醇工廠雖然規模不大,但利潤豐厚,是成長最快的來源類別,預計2031年將以4.95%的複合年成長率成長。美國可再生燃料標準(RFS)和歐盟可再生能源指令II(RED-II)的生產獎勵鼓勵生物煉製廠整合木質素分離裝置,這將帶來相當於乙醇銷售額12-15%的額外收入。主要位於歐洲和中國的硫酸鹽紙漿生產商正透過最佳化回收率和推出用於混凝土和飼料的客製化等級產品來鞏固其市場地位。蘇打紙漿在印度和東南亞地區仍保持著重要的地位,這些地區將農業廢棄物加工成低灰分木質素,為該地區的紡織化學品提供原料。

與硫酸鹽原料相比,纖維素乙醇衍生的木質素通常具有較低的灰分含量和較窄的分子量分佈,因此在特殊聚合物應用領域具有溢價優勢。汽車複合材料的先導用戶對其可預測的流變性能讚賞有加,這有助於連續纖維紡絲。隨著乙醇生產商擴大產能,這種高品質木質素的供應量也在增加,進一步加強了其與生質燃料和特殊化學品產業鏈的整合。雖然亞硫酸鹽衍生的生產方式在其他來源中佔據主導地位,但競爭優勢取決於每噸價值,而不僅僅是產量,尤其是在碳排放收入影響盈利的情況下。

區域分析

到2025年,歐洲將佔全球木質素價值的33.55%,這得益於綜合林業和嚴格的氣候政策促進了木質素的早期增值利用。芬蘭和瑞典的紙漿廠正在維修提取生產線以開拓新的收入來源,而德國混凝土和汽車產業的需求則保持穩定。 REACH化學品法規鼓勵複合材料生產商轉向生物基原料,從而改善了市場需求前景。歐盟「地平線歐洲」研究津貼計畫正在加速香草醛和碳纖維的試點計畫部署,鞏固了該地區的創新主導。

預計到2031年,北美將以5.08%的複合年成長率實現最快成長,這主要得益於聯邦纖維素燃料強制令將擴大木質素供應,以及汽車輕量化舉措將推動對永續複合材料的需求。美國混凝土外加劑用木質素產品市場將受益於兩黨共同推動的橋樑和交通現代化基礎設施立法而擴大。加拿大林業公司正利用豐富的北方森林資源,在各州碳定價計畫的支持下,將業務從紙漿生產拓展到特種木質素領域,這些計畫有利於低排放材料的開發。墨西哥的建築熱潮也將為外加劑進口創造空間,從而補充整個北美大陸的需求。

亞太地區在應用木質素超塑化劑方面尚處於起步階段,但成長潛力巨大。中國快速的都市化推動了混凝土消費,國家標準也開始認可木質素超塑化劑。印度正擴大利用農業廢棄物生產蘇打漿的規模,以生產具有成本競爭力的木質素,用於當地的飼料和染料分散劑。日本正在利用木質素的芳香骨架生產電子樹脂,韓國已將木質素基化學品納入其綠色採購清單。東南亞國協的基礎設施發展計畫和不斷擴大的肉類生產正在推動多元化的需求,但統一的標準對於跨境貿易至關重要。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對高性能混凝土外加劑的需求不斷成長

- 木質素基飼料粘合劑在動物營養上的應用現狀

- 透過為每個紙漿廠產品增加價值來產生收入

- 一種從木質素到香草醛的創新生物轉化路線

- 促進木質素衍生生物碳纖維在汽車產業的應用

- 市場限制

- 萃取工藝之間的品質差異

- 對醣類衍生生物芳香化合物的競爭

- 缺乏國際木質素產品標準

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按來源

- 亞硫酸鹽紙漿

- 纖維素乙醇

- 牛皮紙漿生產

- 蘇打漿法

- 依產品類型

- 磺酸鹽

- 硫酸鹽木質素

- 高純度木質素

- 蘇打木質素

- 其他產品類型

- 透過使用

- 分散劑

- 混凝土添加劑

- 飼料

- 樹脂

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率/排名分析

- 公司簡介

- Borregaard AS

- Burgo Group SpA

- Domsjo Fabriker AB

- Ingevity

- Lignin Industries AB

- MetGen

- Metsa Group

- NIPPON PAPER INDUSTRIES CO., LTD.

- RYAM

- Sappi Ltd

- Stora Enso

- Suzano S/A

- UPM Biochemicals

- Valmet

第7章 市場機會與未來展望

The Lignin Products market is expected to grow from USD 729.42 million in 2025 to USD 760.64 million in 2026 and is forecast to reach USD 937.99 million by 2031 at 4.28% CAGR over 2026-2031.

Performance gains stem from rising demand for low-carbon construction chemicals, stricter sustainability regulations across mature economies, and continuing breakthroughs in bioconversion pathways that open high-value outlets for lignin-based aromatics. The shift from waste-stream disposal toward value-added biorefinery integration reinforces pricing power, especially for high-purity grades supplied to the pharmaceutical and electronics value chains. Europe preserves first-mover advantage thanks to long-standing pulp-mill infrastructure, while North America records the fastest growth on the back of cellulosic ethanol mandates and automotive lightweighting programs. Competitive intensity remains moderate, with integrated pulp producers leveraging scale to protect margins against smaller specialty processors

Global Lignin Products Market Trends and Insights

Rising Demand for High-Performance Concrete Admixtures

Infrastructure expansion across Asia-Pacific and Latin America raises the need for superplasticizers that improve flow while lowering cement consumption. Lignin-based admixtures reduce water-cement ratios, boosting compressive strength by 15-20% and cutting cement use by 8-12%. Construction firms pursuing LEED certification favor these bio-based solutions because they lower embodied carbon in high-rise and transportation projects. Green-building codes in China and India now endorse natural admixtures, providing a regulatory pull that accelerates commercialization. Producers scale up capacity to keep pace with large metro and highway contracts that specify performance concrete. Steady gains in smart-city investments anticipate durable demand for lignin superplasticizers through the medium term.

Uptake of Lignin-Based Feed Binders in Animal Nutrition

European regulations that restrict antibiotic growth promoters have moved feed formulators toward lignosulfonate binders. Studies show 25-30% better pellet durability versus molasses systems, translating into lower feed dust and reduced transport losses. Specific lignin fractions exhibit prebiotic activity that enhances ruminant gut microbiota, allowing feed companies to price at a premium. Danish and Dutch manufacturers report 12-15% logistics cost savings after sourcing local lignin derivatives from regional pulp mills. North American producers adopt similar strategies as large integrators target antibiotic-free supply chains. The long-term outlook remains strong as Asia-Pacific livestock operators shift toward higher-value protein and require efficiency gains in compound feed.

Quality Variability Across Extraction Processes

Differences in sulfur content and molecular weight between kraft, sulfite, and soda lignin complicate procurement for users that require consistent specifications. Sulfite variants carry 20-30% higher sulfur, impacting resin cure kinetics and demanding tailored processing protocols. Downstream firms maintain parallel inventories and dual qualification programs, inflating supply-chain spending by 8-12%. Smaller mills rarely possess analytical labs to certify each batch, restricting market access to low-margin outlets. Near-term uncertainty remains until shared testing standards emerge and cloud-based traceability platforms mature. Quality harmonization is therefore pivotal for broader adoption in specialty segments.

Other drivers and restraints analyzed in the detailed report include:

- Valorisation of Pulp-Mill Side-Streams for Circular Revenue

- Breakthrough Lignin-to-Vanillin Bioconversion Routes

- Competition from Sugar-Derived Bio-Aromatics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The lignin products market size linked to sulfite pulping totaled the bulk of global value, securing 76.62% in 2025 on the back of abundant volumes and well-known performance in dispersants. Cellulosic ethanol plants offer much smaller but higher-margin flows, and their 4.95% CAGR makes them the most dynamic source category to 2031. Production incentives under the U.S. Renewable Fuel Standard and EU RED-II encourage biorefineries to integrate lignin separation units, adding revenue equal to 12-15% of ethanol sales. Sulfite operators, chiefly in Europe and China, defend position by optimizing recovery yields and launching tailor-made grades for concrete and feed. Soda pulping keeps niche importance in India and Southeast Asia, processing agricultural residues into low-ash lignin for regional textile chemicals.

Cellulosic ethanol lignin typically displays lower ash and narrower molecular-weight distribution than kraft material, granting it a premium in specialty polymers. Pilot users in automotive composites value the predictable rheology that aids continuous fiber spinning. As ethanol producers scale capacity, supply of this high-quality lignin grows, tightening integration between biofuel and specialty chemical chains. Although sulfite volumes dwarf other sources, competitive dynamics hinge on value per ton rather than tonnage alone, especially as carbon revenue streams influence profitability.

The Lignin Products Market Report is Segmented by Source (Sulfite Pulping, Cellulosic Ethanol, Kraft Pulping, and Soda Pulping), Product Type (Lignosulfonate, Kraft Lignin, and Other Product Types), Application (Dispersant, Concrete Additive, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe held 33.55% of global value in 2025 because integrated forest industries and strict climate policies foster early lignin valorization. Pulp mills in Finland and Sweden retrofit extraction lines to capture new revenue, while German concrete and automotive sectors absorb steady volumes. REACH chemicals regulation nudges formulators toward bio-derived inputs, improving demand visibility. Horizon Europe research grants accelerate pilot deployments in vanillin and carbon-fibre, solidifying the region's innovation leadership.

North America posts the fastest 5.08% CAGR through 2031 as federal cellulosic fuel mandates widen lignin supply and automotive lightweighting efforts raise the bar on sustainable composites. The lignin products market size for concrete admixtures climbs in the United States on the back of the Bipartisan Infrastructure Law, which modernizes bridges and transit. Canadian forestry companies leverage abundant boreal resources to diversify beyond pulp into specialty lignin, supported by provincial carbon-pricing mechanisms that favor low-emission materials. Mexico's construction boom also creates room for admixture imports, rounding out continental demand.

Asia-Pacific stands at an earlier adoption curve yet offers vast upside. China's rapid urbanization elevates concrete consumption, and state standards begin to recognize lignin superplasticizers. India scales soda pulping for agri-residue, producing cost-competitive lignin for local feed and dye dispersants. Japan exploits lignin's aromatic backbone in electronics resins, while South Korea includes lignin-based chemicals in green-procurement lists. Ongoing ASEAN infrastructure initiatives and growing meat production foster multipronged demand, though standards harmonization will be critical for cross-border trade.

- Borregaard AS

- Burgo Group S.p.A.

- Domsjo Fabriker AB

- Ingevity

- Lignin Industries AB

- MetGen

- Metsa Group

- NIPPON PAPER INDUSTRIES CO., LTD.

- RYAM

- Sappi Ltd

- Stora Enso

- Suzano S/A

- UPM Biochemicals

- Valmet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for High-Performance Concrete Admixtures

- 4.2.2 Uptake of Lignin-Based Feed Binders in Animal Nutrition

- 4.2.3 Valorisation of Pulp-Mill Side-Streams for Circular Revenue

- 4.2.4 Breakthrough Lignin-To-Vanillin Bioconversion Routes

- 4.2.5 Automotive Push for Lignin-Derived Bio-Carbon Fibre

- 4.3 Market Restraints

- 4.3.1 Quality Variability Across Extraction Processes

- 4.3.2 Competition from Sugar-Derived Bio-Aromatics

- 4.3.3 Lack of International Lignin Product Standards

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Source

- 5.1.1 Sulfite Pulping

- 5.1.2 Cellulosic Ethanol

- 5.1.3 Kraft Pulping

- 5.1.4 Soda Pulping

- 5.2 By Product Type

- 5.2.1 Lignosulfonate

- 5.2.2 Kraft Lignin

- 5.2.3 High-Purity Lignin

- 5.2.4 Soda Lignin

- 5.2.5 Other Product Types

- 5.3 By Application

- 5.3.1 Dispersant

- 5.3.2 Concrete Additive

- 5.3.3 Animal Feed

- 5.3.4 Resins

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Borregaard AS

- 6.4.2 Burgo Group S.p.A.

- 6.4.3 Domsjo Fabriker AB

- 6.4.4 Ingevity

- 6.4.5 Lignin Industries AB

- 6.4.6 MetGen

- 6.4.7 Metsa Group

- 6.4.8 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.9 RYAM

- 6.4.10 Sappi Ltd

- 6.4.11 Stora Enso

- 6.4.12 Suzano S/A

- 6.4.13 UPM Biochemicals

- 6.4.14 Valmet

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment