|

市場調查報告書

商品編碼

1907232

歐洲農業曳引機機械:市場佔有率分析、行業趨勢與統計、成長預測(2026-2031 年)Europe Agricultural Tractor Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

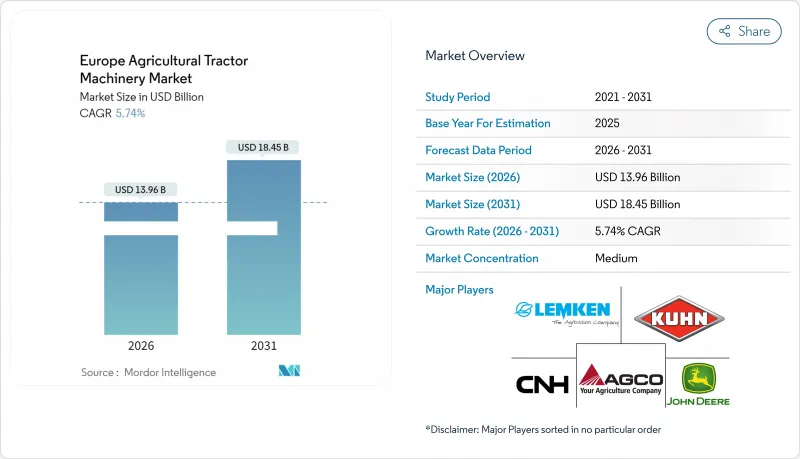

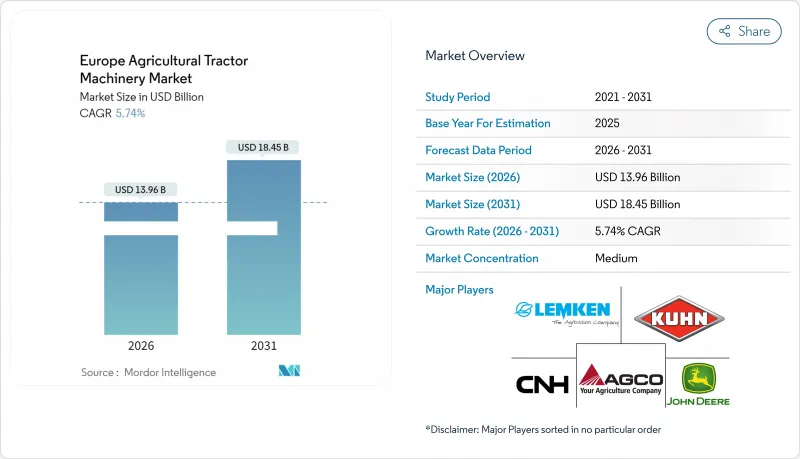

2025年歐洲農業曳引機機械市場價值132億美元,預計2031年將達到184.5億美元,高於2026年的139.6億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 5.74%。

需求成長主要受以下因素驅動:歐盟通用農業政策的生態計畫(Eco-Scheme),該計畫支持精密農業設備;第五階段排放氣體法規,加速了車輛更新換代;以及持續的勞動力短缺,推動了農業自動化。供應商正積極回應,推出可透過 ISO 11783 (ISOBUS)通訊協定整合的動力化和感測器化農具。同時,電氣化試點計畫也催生了對與電池驅動曳引機相容的電力消耗附件的需求。然而,經銷商自 2023 年起的庫存積壓、大宗商品價格波動以及混合車隊互通性方面的摩擦,限制了價格敏感的中東歐地區的市場接受度。競爭依然適中,前五名供應商為專注於條耕、果園除草和溫室應用等細分領域的專業廠商留出了發展空間。

歐洲農業曳引機機械市場趨勢與洞察

歐盟通用農業政策下的精密農業補貼(2025-2027財政年度)

強制性生態計畫將25%的直接補貼用於已證實能提高投入效率的計劃,鼓勵購買變數播種機、支援ISOBUS的噴霧器和產量測繪感測器。法國、德國和波蘭正在經歷此類升級。更廣泛的應用促進了數據共用;到2024年,Telena合作社38%的成員企業都採用了遙測技術,使設備使用壽命延長了15%。認證要求有利於符合ISO 11783標準的品牌,這使得外圍供應商無法獲得補貼,並將需求集中到少數大型遠端資訊處理生態系統中。

勞動力短缺推動了西歐和北歐對自動化的需求。

2024年,德國全職農業從業人員數量較去年同期下降12%。荷蘭園藝業也面臨類似的人手不足,推動了機器人播種機和視覺引導噴藥機的應用。迪爾公司報告稱,2024年其「See and Spray」(即視噴)系統在歐洲的出貨量成長了47%。丹麥Agro公司推出了15台可晝夜運作的自主割草和壓扁機,將乾草收成的人力成本降低了30%。因此,歐洲農業曳引機市場正朝著具備自主功能的動力農具方向發展,與傳統被動式農具的差距日益擴大。

從2023年起,經銷商持有的過剩庫存將抑制新訂單,這種情況將持續到2026年。

2024年初,歐洲經銷商的農機庫存量達到9.2個月的供應量(正常水準為5.5個月)。由於未售出的犁地和播種設備庫存高達3.4億歐元(3.6億美元),百威集團(Baiewa)將其2025年的採購計畫削減了22%。法國經銷商InVivo也同樣削減了18%的新訂單,並將業務重心轉向二手設備的維修。儘管製造商將付款期限延長至180天並提案寄售服務,但利潤率的壓力使得經銷商不願增加庫存,減緩了歐洲農業曳引機市場的短期成長。

細分市場分析

2025年,犁地及耕作設備佔歐洲農業曳引機市場收入的45.30%。受固定點駕駛規則和即時變數施肥演算法廣泛應用的推動,預計到2031年,播種設備將以7.66%的複合年成長率成長。法國合作社Accéreal在8.5萬公頃土地上安裝GPS分區控制系統後,每公頃種子成本降低了12%。

播種機械市場成長最為迅猛,主要得益於旨在減少種子浪費的環保補貼政策。萊姆肯(Lemken)的電動式計量式Azurit播種機價格高出28%,但在500公頃以上的農場,三個種植季即可收回成本。牧草和飼料機械在歐洲草原地區依然需求旺盛,但其需求依賴穩定的乳牛和肉牛數量。其他專用機械市場則較為分散。這一領域表明,補貼和數據能力正在推動歐洲農業曳引機機械市場利潤轉移到動力驅動和軟體定義型機械。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟通用農業政策(CAP)下的精密農業補貼(2025-2027財政年度)

- 勞動力短缺推動了西歐和北歐對自動化的需求。

- 第五階段排放氣體標準促進高效率動力輸出裝置農用設備的改造與升級

- 控制交通農業的普及推動了對作業寬度寬、重量輕的犁地工具的需求。

- 地中海國家葡萄園和果園的快速機械化

- 新興的電動曳引機生態系統需要低電力消耗、支援 ISOBUS 的農具。

- 市場限制

- 從2023年起,經銷商庫存過剩將抑制新訂單,這種情況將持續到2026年。

- 東歐小規模分散農場購置智慧農機設備成本高昂

- 複雜的互通性標準(ISOBUS、TIM)在中型農場的應用速度緩慢。

- 商品價格波動會減少農民用於購買設備的可用資金。

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 替代品的威脅

- 買方的議價能力

- 供應商的議價能力

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按機器類型

- 犁地機械

- 犁

- 光環

- 耕耘機

- 其他犁地和栽培機械

- 種植機械

- 播種機

- 播種機

- 撒佈器

- 其他播種機

- 乾草和飼料機械

- 收割者和護髮素

- 打包機

- 其他乾草和飼料機械

- 噴霧器

- 其他類型

- 犁地機械

- 按國家/地區

- 德國

- 法國

- 義大利

- 英國

- 西班牙

- 荷蘭

- 波蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation(Kubota Corporation)

- CLAAS KGaA mbH

- Kuhn Group(Bucher Industries AG)

- Lemken GmbH & Co. KG

- SDF Group

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Ltd

- Amazonen-Werke H. Dreyer SE

- Pottinger Landtechnik GmbH

- Vaderstad AB

- Maschio Gaspardo SpA

- Salford Group(Linamar Corporation)

第7章 市場機會與未來展望

The Europe agricultural tractor machinery market was valued at USD 13.2 billion in 2025 and estimated to grow from USD 13.96 billion in 2026 to reach USD 18.45 billion by 2031, at a CAGR of 5.74% during the forecast period (2026-2031).

Demand gains stem from the European Union Common Agricultural Policy eco-schemes that underwrite precision-farming hardware, Stage V emissions compliance that accelerates fleet renewal, and persistent labor shortages that nudge farms toward automation. Suppliers answer with powered, sensor-rich implements that integrate through the ISO 11783 (ISOBUS) protocol, while electrification pilots create a parallel pull for low-draw attachments compatible with battery tractors. At the same time, dealer inventory overhang from 2023, volatile commodity prices, and mixed-fleet interoperability frictions temper adoption in price-sensitive pockets of Central and Eastern Europe. Competitive intensity remains moderate because the top five vendors leave room for niche specialists that address strip-till, orchard under-vine mowing, or greenhouse applications.

Europe Agricultural Tractor Machinery Market Trends and Insights

Precision-Farming Subsidies Under the EU Common Agricultural Policy (2025-2027 Tranche)

Mandatory eco-schemes now channel 25% of direct payments into proven input-efficiency projects, pushing farms to buy variable-rate planters, ISOBUS sprayers, and yield-mapping sensors. France, Germany, and Poland are moving toward such upgrades. Adoption lifts data-sharing, cooperative Terrena saw 38% of members stream implement telemetry in 2024, extending equipment life by 15%. Certification requirements favor ISO 11783-compliant brands and squeeze fringe suppliers out of subsidy eligibility, consolidating demand around a few large telematics ecosystems.

Labor Shortages Accelerating Automation Demand in Western and Northern Europe

Full-time farm employment in Germany fell 12% year on year in 2024. Horticulture in the Netherlands faces similar gaps, spurring take-up of robotic planters and vision-guided sprayers. Deere and Company reported a 47% jump in European shipments of its See and Spray system during 2024. Danish Agro deployed 15 autonomous mower-conditioner units that cut hay harvest labor costs by 30% while running day and night. The Europe agricultural tractor machinery market, therefore, tilts toward powered implements with embedded autonomy, widening the gap with legacy passive tools.

Dealer Over-Inventory Amassed Since 2023 Suppressing Fresh Orders through 2026

European dealers carried 9.2 months of implement supply at the start of 2024 versus a normal 5.5 months. BayWa posted EUR 340 million (USD 360 million) in unsold tillage and seeding stock, then cut 2025 purchase plans by 22%. French distributor InVivo similarly trimmed new orders 18% and pivoted to refurbishing used assets. Manufacturers extended payment terms to 180 days and offered consignment, but the margin squeeze still discourages dealers from stocking incremental models, slowing near-term growth in the Europe agricultural tractor machinery market.

Other drivers and restraints analyzed in the detailed report include:

- Stage V Emissions Rules Propelling Retrofit and Replacement of PTO-Efficient Implements

- Growth of Controlled-Traffic Farming Boosting Demand for Lightweight, Wide-Working-Width Tillage Tools

- High Capital Cost for Smart Implements on Fragmented Small Holdings in Eastern Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plowing and cultivating machinery tools secured 45.30% of 2025 revenue in the Europe agricultural tractor machinery market. Planting machinery, aided by controlled-traffic mandates and real-time variable-rate algorithms, will grow at a 7.66% CAGR through 2031. French cooperative Axereal documented a 12% reduction in seed cost per hectare after rolling out GPS section control across 85,000 hectares.

Planting machinery capture the fastest expansion because eco-scheme payments specifically reward reductions in seed waste. Lemken's electric-meter Azurit planter sells at a 28% premium yet pays back within three seasons on farms above 500 hectares. Haying and forage machinery continue to serve the continent's grassland but hinge on stable dairy and beef herds. Other specialty implements remain fragmented. The segment illustrates how subsidy rules and data capability shift profits toward powered, software-defined machines within the wider Europe agricultural tractor machinery market size.

The Europe Agricultural Tractor Machinery Market Report is Segmented by Machinery Type (Plowing and Cultivating Machinery, Planting Machinery, and More) and by Geography (Germany, France, Italy, and More). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation (Kubota Corporation)

- CLAAS KGaA mbH

- Kuhn Group (Bucher Industries AG)

- Lemken GmbH & Co. KG

- SDF Group

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Ltd

- Amazonen-Werke H. Dreyer SE

- Pottinger Landtechnik GmbH

- Vaderstad AB

- Maschio Gaspardo S.p.A.

- Salford Group (Linamar Corporation)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Precision-farming subsidies under the EU Common Agricultural Policy (CAP) (2025-2027 tranche)

- 4.2.2 Labor shortages accelerating automation demand in Western and Northern Europe

- 4.2.3 Stage V emissions rules driving retrofit and replacement of PTO-efficient implements

- 4.2.4 Growth of controlled-traffic farming boosting demand for lightweight, wide-working-width tillage tools

- 4.2.5 Surge in vineyard/orchard mechanization in Mediterranean countries

- 4.2.6 Emerging electric-tractor ecosystem requiring low-draw, ISOBUS-ready implements

- 4.3 Market Restraints

- 4.3.1 Dealer over-inventory since 2023 suppressing fresh orders through 2026

- 4.3.2 High capital cost for smart implements on fragmented small holdings in Eastern Europe

- 4.3.3 Complex interoperability standards (ISOBUS, TIM) delaying adoption among mid-size farms

- 4.3.4 Volatile commodity prices lowering farmers cash flow for discretionary equipment

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Threat of Substitutes

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Bargaining Power of Suppliers

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Machinery Type

- 5.1.1 Plowing and Cultivating Machinery

- 5.1.1.1 Plows

- 5.1.1.2 Harrows

- 5.1.1.3 Rotovators and Cultivators

- 5.1.1.4 Other Plowing and Cultivating Machinery

- 5.1.2 Planting Machinery

- 5.1.2.1 Seed Drills

- 5.1.2.2 Planters

- 5.1.2.3 Spreaders

- 5.1.2.4 Other Planting Machinery

- 5.1.3 Haying and Forage Machinery

- 5.1.3.1 Mowers and Conditioners

- 5.1.3.2 Balers

- 5.1.3.3 Other Haying and Forage Machinery

- 5.1.4 Sprayers

- 5.1.5 Other Types

- 5.1.1 Plowing and Cultivating Machinery

- 5.2 By Country

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 Italy

- 5.2.4 United Kingdom

- 5.2.5 Spain

- 5.2.6 Netherlands

- 5.2.7 Poland

- 5.2.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial N.V.

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation (Kubota Corporation)

- 6.4.5 CLAAS KGaA mbH

- 6.4.6 Kuhn Group (Bucher Industries AG)

- 6.4.7 Lemken GmbH & Co. KG

- 6.4.8 SDF Group

- 6.4.9 Mahindra & Mahindra Ltd

- 6.4.10 Tractors and Farm Equipment Ltd

- 6.4.11 Amazonen-Werke H. Dreyer SE

- 6.4.12 Pottinger Landtechnik GmbH

- 6.4.13 Vaderstad AB

- 6.4.14 Maschio Gaspardo S.p.A.

- 6.4.15 Salford Group (Linamar Corporation)