|

市場調查報告書

商品編碼

1907229

二苯基甲烷二異氰酸酯(MDI):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Methylene Diphenyl Di-isocyanate (MDI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

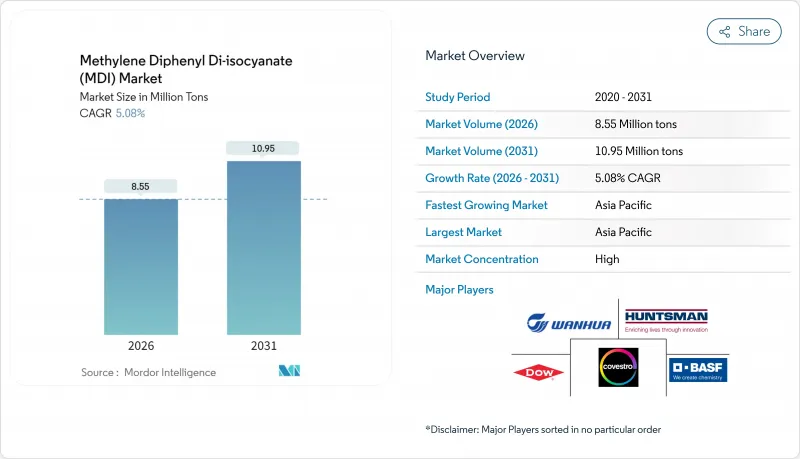

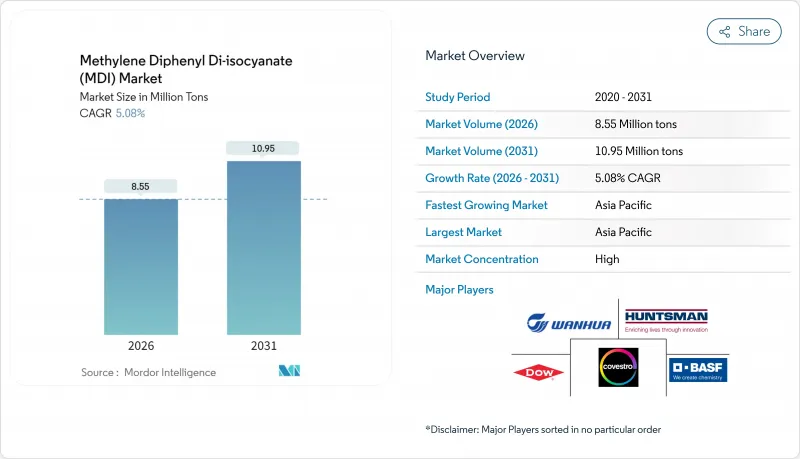

預計二苯基甲烷二異氰酸酯(MDI) 市場將從 2025 年的 814 萬噸成長到 2026 年的 855 萬噸,到 2031 年將達到 1095 萬噸,2026 年至 2031 年的複合年成長率為 5.08%。

亞太地區具有成本競爭力的供應擴張,以及北美和歐洲淨零建築法規和電器能源效率標準的實施,都為此成長軌跡提供了支撐。產業領導企業正在擴大生物回收和物料平衡等級產品的生產,以維持客戶忠誠度,而無光氣試驗生產線的投產則預示著製程的長期轉型。儘管原物料價格波動(預計2025年苯胺價格將年減36.81%)將導致利潤率波動,但一體化生產商擁有更強的緩衝能力。更嚴格的工人接觸法規以及新工廠的高資本密集度將維持企業的競爭優勢,並加速以技術領先的現有企業為中心的產業整合。

全球二苯基甲烷二異氰酸酯(MDI)市場趨勢及展望

淨零能耗建築推動了聚氨酯隔熱材料需求的激增。

歐盟《建築能源性能指令》要求成員國到2030年投資3.5兆歐元(3.8兆美元)提高能源效率。新建建築必須達到近零能耗目標,現有建築必須進行大規模維修,並建議使用導熱係數低於0.022 W/m*K的硬質聚氨酯板。加州2025年建築規範中的類似規定正在推動北美地區對MDI的需求。隨著先進控制系統對隔熱性能要求的提高,建築自動化規範將進一步推動MDI的消費。這種監管和性能方面的協同作用已使硬質泡沫穩固地成為MDI市場中成長最快的細分市場。

擴大食品和藥品低溫運輸設施

疫情後的疫苗物流凸顯了溫度波動帶來的成本,推動了醫藥供應鏈轉型為超低溫儲存的。印度的補貼低溫運輸計畫將新建採用聚氨酯系統的倉庫,其保溫性能可低至-80°C。受城市生活方式轉變的推動,食品低溫運輸也將促進東協和拉丁美洲冷藏運輸和零售包裝的升級。高性能規格的提升提高了優質MDI等級產品的利潤率,並在原料價格上漲的情況下增強了銷售量韌性。

收緊二異氰酸酯的工人暴露限值

歐盟已將職場的NCO暴露量限制在6µg/m³以內,並強制要求所有操作人員接受認證培訓,美國職業安全與健康管理局(OSHA)也採取了類似措施。合規要求需要在通風、監測和醫療監護方面進行投資,這增加了噴塗泡沫安裝商和小家電生產線的固定成本。這種負擔正在加速市場集中於資金雄厚的加工商手中,並使需求轉向價格較高但需要配方專業知識的低單體或預聚物解決方案。

細分市場分析

到2025年,硬質泡沫將佔MDI市場規模的36.78%,預計到2031年將以5.63%的複合年成長率成長。這一類別受益於聚異氰酸酯板材,其導熱係數低至0.022 W/m*K,是同類產品中的佼佼者,使住宅和商業建築能夠達到淨零能耗標準。軟質泡棉在床墊和汽車座椅領域保持著需求,但其市場成熟度限制了成長潛力。塗料和彈性體支撐著基準產量,這得益於工業維護和物料搬運應用領域的持續需求。新興應用,例如電動車電池封裝,要求在熱循環下保持尺寸穩定性,這體現了MDI化學的多功能性。硬質泡沫在屋頂維修和幕牆系統中的日益普及幾乎可以確保其在MDI市場中繼續佔據主導地位。

隨著全球建築規範日益嚴格,保險公司和金融機構強制要求最低隔熱性能值(R值),而這只有使用薄壁結構中的硬質聚氨酯或聚異氰脲酸酯(PIR)產品才能實現。 Leticel 的「Eurowall Impact」板材含有 25% 的回收生物成分,在不犧牲隔熱性能的前提下,生產過程中二氧化碳排放減少了 43%。黏合劑和密封劑在汽車和基礎設施維修領域構成了一個小眾但盈利的細分市場,其中 MDI 具有快速固化和結構黏合的優勢。特殊彈性體在礦用篩網和工業車輪中發揮關鍵作用,並創造了穩定的售後市場收入。總而言之,這些細分市場使硬質泡沫成為 MDI 市場長期成長的關鍵驅動力。

二苯基甲烷二異氰酸酯(MDI) 市場報告按應用(硬質泡沫、軟質泡沫、塗料、彈性體、黏合劑和密封劑、其他)、終端用戶行業(建築、家具和室內裝飾、電子和家用電器、汽車、鞋類、其他)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行分析。

區域分析

預計到2025年,亞太地區將佔MDI市場46.35%的佔有率,並在2031年之前以5.90%的複合年成長率保持區域領先成長。中國綠色建築標準和基礎設施建設的蓬勃發展將帶動對硬質發泡體的巨大需求,而印度疫苗物流的推進則推動了冷藏儲存能力的擴張。錦湖三井化學株式會社計劃增產20萬噸(透過改造其麗水工廠,將產能提升至61萬噸)等擴建計劃也為當地供應提供了支撐。

由於維修獎勵和有利於高性能住宅的第45L條稅額扣抵,北美市場仍然十分重要。特別是,科思創向凱雷建築材料公司供應的生物再生MDI,與化石基MDI相比,可減少99%的上游工程碳排放。當地家電製造商也指定使用高密度泡棉材料,以符合2025年能源法規的要求,從而支撐了穩定的基礎設施需求。

歐洲的政策主導正在創造超過內部成長的合成需求。歐盟建築能源性能指令 (EPBD) 制定的 3.5 兆歐元維修計畫正在加速硬質泡棉材料的應用,而 6 微克的暴露限值也促使配方師轉向低單體配方。生產商的關注點與循環經濟一致,例如BASF剝離了其上海合資企業,並最佳化了其 190 萬噸的全球 MDI 生產網路,從而釋放資源用於物料平衡生產。同時,中東和非洲地區正藉助物流園區和氣候控制農業實現追趕式成長,但許多產品仍依賴從歐洲和亞洲進口。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 淨零能耗建築對聚氨酯隔熱材料的需求激增

- 擴大食品和藥品低溫運輸能力

- 暖通空調能源效率法規促進電器發泡的使用

- 電動車電池組溫度控管泡沫的興起

- 透過循環經濟促進實現物料平衡/ISCC-Plus MDI

- 市場限制

- 收緊二異氰酸酯的工人暴露限值

- 原油價格波動會影響苯胺原料。

- 光氣化裝置資本密集度高

- 價值鏈分析

- 監理政策分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 生產流程分析

- 技術授權和專利分析

- 價格趨勢情景

第5章 市場規模與成長預測

- 透過使用

- 硬泡沫

- 軟性泡沫

- 塗層

- 彈性體

- 黏合劑和密封劑

- 其他

- 按最終用戶行業分類

- 建造

- 家具和室內裝飾

- 家用電器

- 車

- 鞋類

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BASF

- Covestro AG

- Dow

- Hexion Inc.

- Huntsman International LLC

- Karoon Petrochemical Company

- Kumho Mitsui Chemicals Inc

- KURMY CORPORATIONS

- Sadara

- Shanghai Lianheng Isocyanate Co. Ltd

- Sumitomo Chemical Co. Ltd

- Tosoh Corporation

- Vardhman Chemicals

- Wanhua

第7章 市場機會與未來展望

The Methylene Diphenyl Di-isocyanate market is expected to grow from 8.14 Million tons in 2025 to 8.55 Million tons in 2026 and is forecast to reach 10.95 Million tons by 2031 at 5.08% CAGR over 2026-2031.

Cost-competitive supply expansions in Asia-Pacific, paired with net-zero building mandates and appliance efficiency standards across North America and Europe, underpin this growth trajectory. Industry leaders are scaling bio-circular and mass-balanced grades to retain customer loyalty, while phosgene-free pilot lines point to longer-term process disruption. Feedstock price swings-aniline fell 36.81% year-on-year in 2025-add margin volatility, yet integrated producers remain better cushioned. Intensifying worker-exposure regulations and the capital intensity of new plants keep the competitive moat high and accelerate consolidation around technology-rich incumbents.

Global Methylene Diphenyl Di-isocyanate (MDI) Market Trends and Insights

Surge in PU-Insulation Demand from Net-Zero Buildings

The Energy Performance of Buildings Directive obliges EU member states to invest EUR 3.5 trillion (USD 3.8 trillion) in energy upgrades by 2030. New builds must meet near-zero energy targets, while older stock faces mandatory deep retrofits that favor rigid polyurethane panels with thermal conductivity down to 0.022 W/m*K. Comparable rules in California's 2025 codes replicate this pull in North America. Building automation specifications further boost MDI consumption because advanced controls demand tighter thermal envelopes. The synergy between regulation and performance cements rigid foams as the highest-growth slice of the MDI market.

Cold-Chain Capacity Build-Out for Food and Pharma

Post-pandemic vaccine logistics illustrated the cost of temperature excursions, pivoting pharma supply chains toward ultralow-temperature storage. India's subsidized cold-chain programs add greenfield warehouses that rely on polyurethane systems capable of -80 °C thermal integrity. Parallel food cold-chains, driven by urban lifestyle changes, upscale refrigerated transport and retail cases across ASEAN and Latin America. Higher performance specs elevate margin profiles for premium MDI grades, strengthening volume resilience even amid raw-material inflation.

Stricter Worker-Exposure Limits for Diisocyanates

The EU capped workplace exposure at 6 µg NCO/m3 and mandated certified training for all handlers. OSHA is following suit. Compliance forces investments in ventilation, monitoring and medical surveillance, raising fixed costs for spray-foam contractors and small appliance lines. The burden accelerates market consolidation toward capital-rich processors and biases demand toward low-monomer or prepolymer solutions that command price premiums but require formulation know-how.

Other drivers and restraints analyzed in the detailed report include:

- HVAC Efficiency Regulations Boosting Appliance Foams

- Rise of Battery-Thermal-Management Foams in EV Packs

- High Capital Intensity of Phosgenation Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid foams contributed 36.78% of the MDI market size in 2025 and are expected to climb at a 5.63% CAGR to 2031. The category benefits from polyisocyanurate panels delivering best-in-class 0.022 W/m*K thermal conductivity, enabling compliance with net-zero standards in residential and commercial construction. Flexible foams maintain relevance in bedding and automotive seats, though maturity limits upside. Coatings and elastomers secure recurring demand from industrial maintenance and materials-handling applications, reinforcing baseline volumes. Emerging uses include EV battery encapsulants that need dimensional stability under thermal cycling, highlighting the versatility of MDI chemistry. Rigid foams' rising uptake in re-roofing and curtain-wall systems all but assures their continued dominance within the MDI market.

With building codes tightening globally, insurers and financiers are prescribing minimum R-values that only rigid polyurethane or PIR products can feasibly meet at slim wall sections. Recticel's Eurowall Impact board, featuring 25% bio-circular content, cut embodied CO2 by 43% without compromising thermal performance. Adhesives and sealants form a niche yet profitable sub-segment in automotive and infrastructure repair, where MDI imparts fast cure and structural bonding. Specialty elastomers carry weight in mining screens and industrial wheels, generating steady aftermarket revenue. Collectively, these sub-segments make rigid foams the linchpin of long-term growth for the MDI market.

The Methylene Diphenyl Di-Isocyanate (MDI) Market Report is Segmented by Application (Rigid Foams, Flexible Foams, Coatings, Elastomers, Adhesives and Sealants, and Others), End-User Industry (Construction, Furniture and Interiors, Electronics and Appliances, Automotive, Footwear, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 46.35% of the MDI market in 2025 and is projected to expand at a region-leading 5.90% CAGR to 2031. China's green-building codes and infrastructure boom absorb vast rigid-foam volumes, while India's vaccine logistics push inflate cold-storage capacity. Expansion projects, such as Kumho Mitsui's 200 kt debottlenecking that lifted its Yeosu complex to 610 kt, underpin local supply.

North America remains significant through retrofit incentives and the Section 45L tax credit that rewards high-performance residential buildings. Notably, Covestro supplies bio-circular MDI to Carlisle Construction Materials, cutting upstream carbon 99% relative to fossil-based grades. Local appliance makers also specify higher-density foams to satisfy 2025 energy rules, anchoring stable base demand.

Europe's policy leadership creates a synthetic pull exceeding organic growth. The EPBD's EUR 3.5 trillion retrofit agenda accelerates rigid-foam adoption, while the 6 µg exposure cap motivates formulators to shift toward low-monomer variants. Producer focus aligns with circularity: BASF separated its Shanghai joint venture to optimize its 1.9 million-ton global MDI grid, freeing assets for mass-balanced production. Meanwhile, Middle East and Africa register catch-up growth driven by logistics parks and climate-controlled agriculture, though most product still ships in from Europe and Asia.

- BASF

- Covestro AG

- Dow

- Hexion Inc.

- Huntsman International LLC

- Karoon Petrochemical Company

- Kumho Mitsui Chemicals Inc

- KURMY CORPORATIONS

- Sadara

- Shanghai Lianheng Isocyanate Co. Ltd

- Sumitomo Chemical Co. Ltd

- Tosoh Corporation

- Vardhman Chemicals

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in PU-insulation demand from net-zero buildings

- 4.2.2 Cold-chain capacity build-out for food and pharma

- 4.2.3 HVAC efficiency regulations boosting appliance foams

- 4.2.4 Rise of battery-thermal-management foams in EV packs

- 4.2.5 Circular-economy push for mass-balanced/ISCC-Plus MDI

- 4.3 Market Restraints

- 4.3.1 Stricter worker-exposure limits for diisocyanates

- 4.3.2 Crude-oil price volatility hitting aniline feedstock

- 4.3.3 High capital intensity of phosgenation plants

- 4.4 Value Chain Analysis

- 4.5 Regulatory Policy Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

- 4.7 Production Process Analysis

- 4.8 Technology Licensing and Patent Analysis

- 4.9 Price Trend Scenario

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Rigid Foams

- 5.1.2 Flexible Foams

- 5.1.3 Coatings

- 5.1.4 Elastomers

- 5.1.5 Adhesives and Sealants

- 5.1.6 Others

- 5.2 By End-user Industry

- 5.2.1 Construction

- 5.2.2 Furniture and Interiors

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Footwear

- 5.2.6 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Hexion Inc.

- 6.4.5 Huntsman International LLC

- 6.4.6 Karoon Petrochemical Company

- 6.4.7 Kumho Mitsui Chemicals Inc

- 6.4.8 KURMY CORPORATIONS

- 6.4.9 Sadara

- 6.4.10 Shanghai Lianheng Isocyanate Co. Ltd

- 6.4.11 Sumitomo Chemical Co. Ltd

- 6.4.12 Tosoh Corporation

- 6.4.13 Vardhman Chemicals

- 6.4.14 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Phosgene-free MDI Production Process