|

市場調查報告書

商品編碼

1907216

輻射探測、監測和安全:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031 年)Radiation Detection, Monitoring, And Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

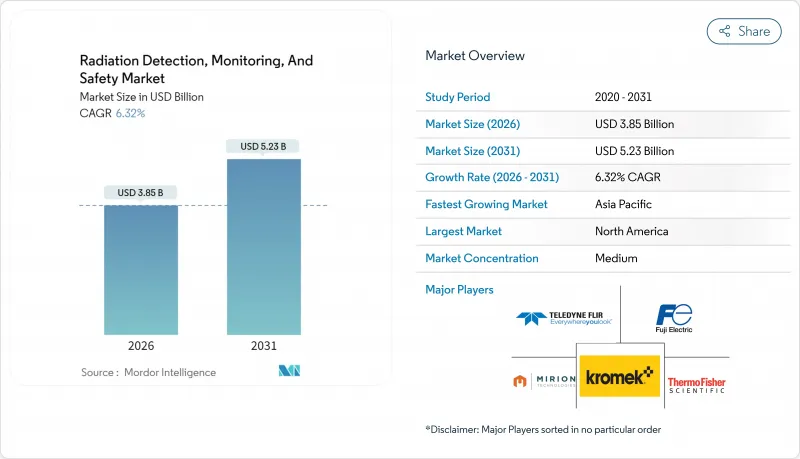

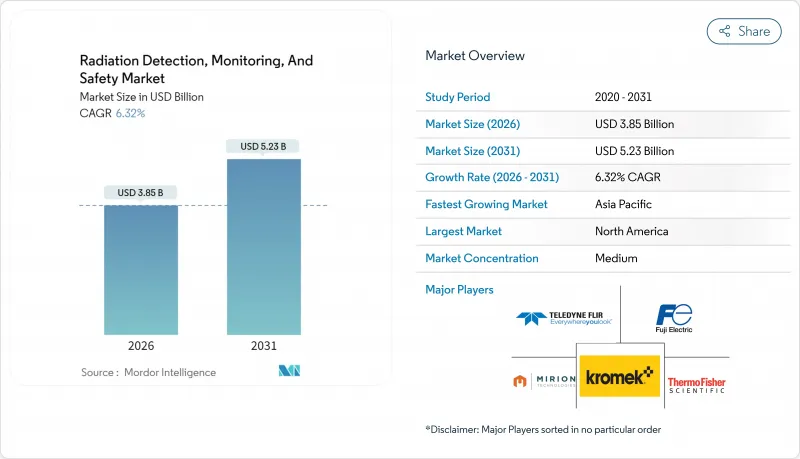

預計到 2026 年,輻射探測、監測和安全市場規模將達到 38.5 億美元,高於 2025 年的 36.2 億美元。

預計到 2031 年將達到 52.3 億美元,2026 年至 2031 年的複合年成長率為 6.32%。

這一成長趨勢主要受核醫學檢測的擴展、監管要求強制進行持續環境監測以及半導體檢測器性能的快速提升所驅動。此外,邊境管制、緊急應變和關鍵基礎設施日益成長的安全需求也推動了市場發展,而老舊核子反應爐的退役則進一步增加了對監測系統的需求。輻射探測、監測和安全市場正憑藉其雙重用途的價值提案(將民用醫療保健投資與國家安全支出連結起來)建構起強大的收入基礎。北美公用事業公司、歐洲核能退役專案以及亞太地區的核能發電廠建設正在加速傳統探測平台的更新換代。數位化連接、預測分析和雲端原生架構如今已成為高級產品的差異化優勢,為售後軟體收入和持續服務合約提供了支撐。

全球輻射探測、監測及安全市場趨勢及洞察

癌症和慢性病發生率上升

預計到2050年,全球癌症病例將達到3,500萬例,為精密劑量測定系統提供了廣泛的潛在市場。放射治療科室傾向於使用能夠捕捉劑量率高頻波動並滿足亞毫秒束流監測精度要求的固態檢測器。自適應治療計畫平台產生的數據量日益成長,臨床醫師也越來越依賴即時回饋迴路來調整分次劑量。這促使醫療系統為多通道劑量檢驗架、冗餘場校準器和基於雲端的劑量配準軟體分配預算,從而建立一個擴展輻射探測、監測和安全市場的生態系統。供應商的策略重點在於模組化檢測器頭和人工智慧輔助的品質保證儀表板,以提高直線加速器的運轉率。

擴大核子醫學和放射治療程序

2024年,核醫檢測將年增12%,主要受錒-225和鎦-177等治療性診斷同位素的推動。放射性藥物中心需要空氣傳播的α粒子監測器、用於熱室的γ能譜儀以及可與設施LIMS資料庫自動同步的個人劑量計。靠近患者群體的分散式迴旋加速器網路增加了屏蔽櫃、去污通道和洩漏測試套件的採購點。美國FDA 21 CFR第361部分規定的標準化要求採用了同位素特定的校準通訊協定,從而確保了檢測器重新校準服務供應商的持續外包機會。這些趨勢推高了平均售價(ASP),並擴大了售後市場的收入前景。

繁重的多司法管轄區合規負擔

檢測器原始設備製造商 (OEM) 必須獲得 FDA 510(k)核准、達到 IEC 60601-2-45 性能指標要求並獲得 CE 認證,而每項認證都需要單獨進行生物相容性、電磁相容性 (EMC) 和輻射模式測試。光是這些認證就足以大幅增加研發預算,迫使小規模的創新企業轉向授權授權或小眾學術市場。並行認證流程阻礙了韌體的快速更新,並減緩了設備在多個國家/地區部署後的功能推出速度。這導致設計採納週期長達四年以上,降低了輻射探測、監測和安全市場新技術投資的淨現值 (NPV),並限制了近期收入成長。

細分市場分析

到2025年,輻射探測和監測系統將佔總收入的50.74%,為需要持續檢驗輻射狀況的醫院、公共產業和國防組織提供採購預算支援。在輻射探測、監測和安全市場中,探測平台預計將與預測分析模組同步成長,這些模組能夠建議預防性維護週期。受ISO 2919防護設備標準統一化的推動,包括鉛防護衣、去污室和自動屏蔽門在內的安全設備預計將以7.55%的複合年成長率超越傳統成長速度。將即時伽馬探測器與電動屏蔽簾整合的解決方案縮短了從警報到屏蔽的時間,並提高了ALARA(盡可能合理地降低輻射劑量)原則的合規性。供應商正在利用交叉銷售的協同效應。醫院通常會在訂購閃爍探測器的同時訂閱劑量計,而核子反應爐運營商則會將周界防護門與就地避難通風系統捆綁銷售。監管要求推動了採購的緊迫性,限制了價格彈性,並維持了輻射探測、監控和安全行業中高價 SKU 的穩定銷售。

雲端儀錶板的增強功能、地理標記警報視覺化、基於角色的存取控制以及自動化合規報告生成,使檢測設備不再只是普通的通用設備。 SaaS 疊加功能帶來了顯著的毛利率,甚至超過了硬體本身的毛利率,從而構建了一個與硬體無關的生態系統。因此,通路合作夥伴更傾向於儲備整合了 NaI(Tl)、CZT 和中子模組的多重通訊協定閘道器,這些閘道器整合在一個監控人機介面 (HMI) 中。即時分析進一步降低了誤報率,從而減少了高成本的疏散事件。這些增值解決方案鞏固了 Detection Solutions 在輻射偵測、監測和安全市場的領先地位。

區域分析

北美地區預計到2025年將維持30.05%的收入佔有率,這反映了其現有的核能發電廠數量、廣泛的國防安全保障基礎設施以及率先採用相關技術的醫療保健系統。美國國家實驗室正在投入津貼,以縮小碲鋅鎘(CZT)檢測器的體積;加拿大自然資源部(NRCan)的框架正在津貼研究核子反應爐環境監測系統的升級。墨西哥放射性藥物出口的成長推動了對同位素生產用熱室監測器的需求增加。 ANSI N42標準下的跨境標準化正在提高設備互通性,並增強區域輻射探測、監測和安全市場的規模經濟效益。

亞太地區以8.05%的複合年成長率實現了最快成長,這主要得益於中國計劃在2060年運作150座核子反應爐。北京「中國製造2025」政策中蘊含的本土化要求鼓勵合資企業發展碲鋅鎘(CZT)晶圓代工廠,從而降低進口關稅和供應鏈脆弱性。日本在福島第一核能發電廠後管理體制正在資助在核子反應爐設施周圍安裝20公里長的伽馬射線防護網。同時,印度核能部正在資助為區域城市的癌症治療病房安裝低成本的輻射探測器。韓國正在擴大其18兆電子伏迴旋加速器網路,這將進一步增加服務醫院的數量,鞏固亞太地區作為全球輻射探測、監測和安全市場成長引擎的地位。

在歐洲,德國、比利時和西班牙的退役計劃推動了均衡成長,從而催生了對機載α粒子監測器和廢棄物桶分析系統的專業需求。法國在維持高比例核能發電的同時,專注於延長核電廠壽命的升級改造,這些改造必須符合法國核安局(ASN)嚴格的地震風險標準。 《歐洲核能共同體條約》(Euratom)規範了採購標準,並允許簽訂多年預算週期的大型跨境合約。中東歐國家正在對前蘇聯時代的科學研究核子反應爐進行現代化改造,需要包含訓練服務的承包偵測系統。

儘管中東和非洲地區仍處於發展初期,但在戰略港口引入中子貨物掃描儀以及基於迴旋加速器的放射性藥物實驗室的運作,預示著新興地區輻射探測、監測和安全市場的中期成長前景良好。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 癌症和慢性病發生率上升

- 核子醫學和放射治療程序的擴展

- 監管機構推動即時環境監測

- 小型化物聯網劑量計

- 利用無人機進行大面積放射線測繪

- 全球老舊核子反應爐的退役

- 市場限制

- 跨多個司法管轄區的嚴格合規負擔

- 持證輻射安全管理人員短缺

- 光譜級檢測器需要高資本投入

- 氦-3和閃爍晶體供應鏈的可變性

- 產業價值鏈分析

- 宏觀經濟因素如何影響市場

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 發現與監測

- 安全

- 透過檢測器技術

- 充氣式(蓋革-米勒計數器、比例計數器、電離室)

- 閃爍(NaI(Tl)、CsI、LaBr3、塑膠)

- 半導體(HPGe、CZT、SiPM)

- 個人劑量計(TLD、OSL、電子式)

- 按最終用戶行業分類

- 醫療保健

- 能源/電力(核能、常規)

- 國防安全保障/國防部

- 工業(石油和天然氣、採礦、製造業)

- 研究機構和學術研究中心

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mirion Technologies Inc.

- Thermo Fisher Scientific Inc.

- Teledyne FLIR LLC

- Fuji Electric Co., Ltd.

- Unfors RaySafe AB

- Arktis Radiation Detectors Ltd.

- Kromek Group plc

- Berthold Technologies GmbH & Co. KG

- Alpha-Spectra, Inc.

- Radiation Detection Company

- Centronic Ltd.

- Burlington Medical LLC

- Amray Group Ltd.

- Atomtex SPE

- Polimaster Ltd.

- Smiths Detection Group Ltd.

- Ludlum Measurements, Inc.

- Hitachi-Aloka Medical, Ltd.

- General Atomics Electronic Systems

- Else Nuclear srl

- Silena Group srl

第7章 市場機會與未來展望

The radiation detection, monitoring, and safety market size in 2026 is estimated at USD 3.85 billion, growing from 2025 value of USD 3.62 billion with 2031 projections showing USD 5.23 billion, growing at 6.32% CAGR over 2026-2031.

The expansion of nuclear-medicine procedures, regulatory mandates for continuous environmental surveillance, and rapid advancements in semiconductor-based detector performance underpin this trajectory. Heightened security concerns reinforce demand across border control, first-responder, and critical infrastructure segments, while aging reactor fleets drive the need for decommissioning-linked monitoring deployments. The radiation detection, monitoring, and safety market benefits from a dual-use value proposition that aligns civilian healthcare investments with national-security spending, creating a resilient revenue base. North American utilities, European nuclear-phase-out programs, and Asia-Pacific build-outs collectively accelerate replacement cycles for legacy detection platforms. Digital connectivity, predictive analytics, and cloud-native architectures now distinguish premium offerings, supporting aftermarket software revenues and recurring service contracts.

Global Radiation Detection, Monitoring, And Safety Market Trends and Insights

Rising Incidence of Cancer and Chronic Diseases

Cancer prevalence is climbing toward 35 million global cases by 2050, enlarging the addressable base for precision dosimetry systems.Radiotherapy departments now specify sub-millisecond beam-monitoring accuracy, favoring semiconductor detectors that capture high-frequency fluctuations in dose rate. Adaptive treatment planning platforms amplify data-generation volumes, and clinicians increasingly rely on real-time feedback loops to tune fractionated doses. Health systems, therefore, budget for multi-channel dose-verification racks, redundant field calibrators, and cloud-hosted dose-registry software, an ecosystem that broadens the radiation detection, monitoring, and safety market. Vendor strategies focus on modular detector heads and AI-assisted QA dashboards that enhance linear-accelerator uptime.

Expanding Nuclear Medicine and Radiotherapy Procedures

Nuclear medicine examinations grew 12% year-over-year in 2024, propelled by theranostic isotopes such as actinium-225 and lutetium-177.Radiopharmaceutical hubs require air-borne alpha-particle monitors, hot-cell gamma spectrometers, and personal dosimeters that auto-synchronize with facility LIMS databases. Decentralized cyclotron networks, positioned closer to patient populations, multiply procurement nodes for shielding cabinets, de-contamination portals, and leak-testing kits. Standardization under U.S. FDA 21 CFR Part 361 obliges isotope-specific calibration protocols, ensuring recurring outsourcing opportunities for detector-recalibration service providers. These trends elevate ASPs (average selling prices) and extend aftermarket revenue visibility.

Stringent Multi-Jurisdictional Compliance Burden

Detector OEMs must clear FDA 510(k) dossiers, satisfy IEC 60601-2-45 performance metrics, and attain CE marking conformity, each requiring discrete biocompatibility, EMC, and radiation pattern tests. Documentation alone inflates research and development budgets, steering smaller innovators toward licensing deals or niche academic markets. Parallel certification tracks hinder agile firmware updates once fielded devices enter multi-country footprints, slowing feature rollouts. The result is elongated design-win cycles that can exceed four years, diluting NPV on new technology investments and tempering near-term revenue acceleration within the radiation detection, monitoring, and safety market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Real-Time Environmental Monitoring

- Miniaturization and IoT-Enabled Dosimeters

- Shortage of Certified Radiation Safety Officers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Detection and monitoring systems generated 50.74% of 2025 revenue, anchoring procurement budgets for hospitals, utilities, and defense agencies that must continuously validate dose conditions. Within the radiation detection, monitoring, and safety market size, detection platforms are projected to grow alongside predictive analytics modules that recommend proactive maintenance intervals. Safety equipment, encompassing lead-lined apparel, decontamination booths, and automated containment doors, is outpacing historical norms with a 7.55% CAGR, buoyed by harmonized ISO 2919 protective device standards. Integrated offerings that unite real-time g-ray probes with motorized shielding curtains shorten alarm-to-containment times and improve ALARA (as low as reasonably achievable) compliance. Vendors leverage cross-selling synergies: hospitals ordering scintillation probes often append badge-dosimetry subscriptions, while reactor operators bundle perimeter portals with shelter-in-place ventilation systems. Price elasticity remains modest, as regulatory obligations heighten procurement urgency, ensuring premium SKUs maintain a steady pull-through across the radiation detection, monitoring, and safety industry.

The expanded functionality of cloud dashboards, geo-tagged alarm visualization, role-based access, and automated compliance report generation pushes detection gear beyond commodity status. SaaS overlays carry significant gross margin, outstripping hardware rates and encouraging hardware-agnostic ecosystems. Consequently, channel partners favor stocking multi-protocol gateways that integrate NaI(Tl), CZT, and neutron modules under one supervisory HMI. Real-time analytics further reduces false-positive occurrences, trimming costly evacuation incidents. Such value-added solutions reinforce the leadership of detection solutions within the broader radiation detection, monitoring, and safety market.

The Radiation Detection, Monitoring and Safety Market Report is Segmented by Product Type (Detection and Monitoring and Safety), Detector Technology (Gas-Filled, Scintillation, and More), End-User Industry (Medical and Healthcare, Energy and Power, Homeland Security and Defence, Industrial, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 30.05% revenue lead in 2025, reflecting entrenched nuclear-power fleets, extensive homeland-security infrastructures, and early-adopter healthcare systems. U.S. national laboratories are funneling research and development grants into CZT detector miniaturization, while the Canadian NRCan framework is subsidizing environmental-monitoring upgrades at research reactors. Mexico's expanding radiopharmaceutical exports add incremental volume for isotope-production hot-cell monitors. Cross-border standardization under ANSI N42 enhances equipment interoperability, thereby reinforcing economies of scale within the regional radiation detection, monitoring, and safety market.

Asia-Pacific records the fastest trajectory at an 8.05% CAGR, underwritten by China's plan to commission 150 reactors before 2060. The localization mandate embedded in Beijing's Made-in-China 2025 policy promotes joint-venture fabrication plants for CZT wafers, reducing import tariffs and mitigating supply-chain fragility. Japan's post-Fukushima regulatory regime finances perimeter gamma-ray meshes extending 20 km around reactor sites, while India's Department of Atomic Energy funds low-cost survey meters for cancer-therapy wards in tier-two cities. South Korea's expanding 18-MeV cyclotron network further widens the addressable hospital count, reinforcing the Asia-Pacific region's status as the global growth engine for the radiation detection, monitoring, and safety market.

Europe exhibits balanced growth as decommissioning projects in Germany, Belgium, and Spain create specialized demand for alpha-in-air monitors and waste-drum assay systems. France, maintaining a strong nuclear-electricity share, focuses on life-extension upgrades that must meet ASN's stringent seismic-risk criteria. The Euratom treaty standardizes procurement specifications, enabling cross-border volume contracts that leverage multi-year budget cycles. Central and Eastern European nations, modernizing Soviet-era research reactors, seek turnkey detection suites bundled with training services.

The Middle East and Africa, although nascent, are deploying neutron-cargo scanners at strategic ports and commissioning cyclotron-based radiopharmacy labs, foreshadowing medium-term momentum for the radiation detection, monitoring, and safety market in emerging geographies.

- Mirion Technologies Inc.

- Thermo Fisher Scientific Inc.

- Teledyne FLIR LLC

- Fuji Electric Co., Ltd.

- Unfors RaySafe AB

- Arktis Radiation Detectors Ltd.

- Kromek Group plc

- Berthold Technologies GmbH & Co. KG

- Alpha-Spectra, Inc.

- Radiation Detection Company

- Centronic Ltd.

- Burlington Medical LLC

- Amray Group Ltd.

- Atomtex SPE

- Polimaster Ltd.

- Smiths Detection Group Ltd.

- Ludlum Measurements, Inc.

- Hitachi-Aloka Medical, Ltd.

- General Atomics Electronic Systems

- Else Nuclear s.r.l.

- Silena Group s.r.l.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of cancer and chronic diseases

- 4.2.2 Expanding nuclear medicine and radiotherapy procedures

- 4.2.3 Regulatory push for real-time environmental monitoring

- 4.2.4 Miniaturisation and IoT-enabled dosimeters

- 4.2.5 UAV-based wide-area radiation mapping

- 4.2.6 De-commissioning of ageing nuclear reactors worldwide

- 4.3 Market Restraints

- 4.3.1 Stringent multi-jurisdictional compliance burden

- 4.3.2 Shortage of certified radiation safety officers

- 4.3.3 High capex for spectroscopic-grade detectors

- 4.3.4 Supply-chain volatility for He-3 and scintillator crystals

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors on the Market

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Detection and Monitoring

- 5.1.2 Safety

- 5.2 By Detector Technology

- 5.2.1 Gas-Filled (Geiger-Muller, Proportional, Ion-Chambers)

- 5.2.2 Scintillation (NaI(Tl), CsI, LaBr3, Plastic)

- 5.2.3 Semiconductor (HPGe, CZT, SiPM)

- 5.2.4 Personal Dosimeters (TLD, OSL, Electronic)

- 5.3 By End-user Industry

- 5.3.1 Medical and Healthcare

- 5.3.2 Energy and Power (Nuclear, Conventional)

- 5.3.3 Homeland Security and Defence

- 5.3.4 Industrial (Oil and Gas, Mining, Manufacturing)

- 5.3.5 Research and Academic Laboratories

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Spain

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core Segments, Financials, Strategic Info, Market Share, Products and Services, Recent Developments)

- 6.4.1 Mirion Technologies Inc.

- 6.4.2 Thermo Fisher Scientific Inc.

- 6.4.3 Teledyne FLIR LLC

- 6.4.4 Fuji Electric Co., Ltd.

- 6.4.5 Unfors RaySafe AB

- 6.4.6 Arktis Radiation Detectors Ltd.

- 6.4.7 Kromek Group plc

- 6.4.8 Berthold Technologies GmbH & Co. KG

- 6.4.9 Alpha-Spectra, Inc.

- 6.4.10 Radiation Detection Company

- 6.4.11 Centronic Ltd.

- 6.4.12 Burlington Medical LLC

- 6.4.13 Amray Group Ltd.

- 6.4.14 Atomtex SPE

- 6.4.15 Polimaster Ltd.

- 6.4.16 Smiths Detection Group Ltd.

- 6.4.17 Ludlum Measurements, Inc.

- 6.4.18 Hitachi-Aloka Medical, Ltd.

- 6.4.19 General Atomics Electronic Systems

- 6.4.20 Else Nuclear s.r.l.

- 6.4.21 Silena Group s.r.l.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment