|

市場調查報告書

商品編碼

1907210

耐火材料:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Refractories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

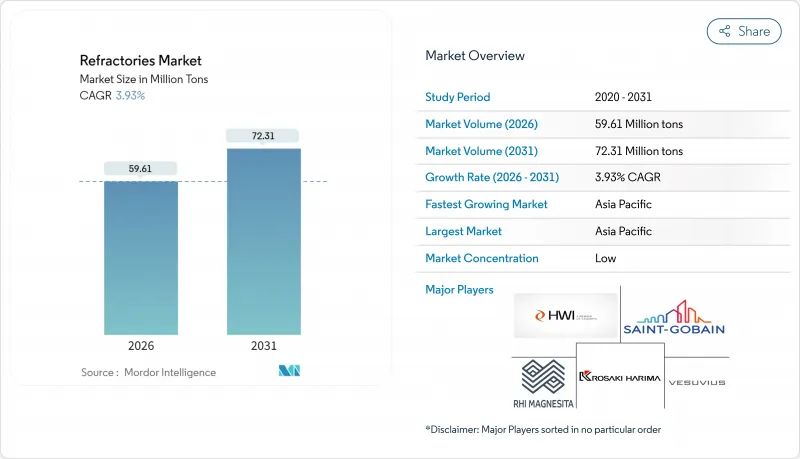

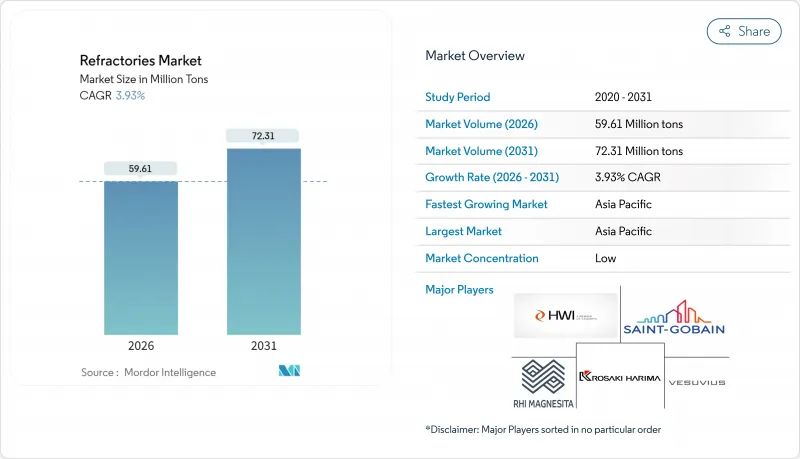

預計耐火材料市場將從 2025 年的 5,736 萬噸成長到 2026 年的 5,961 萬噸,到 2031 年將達到 7,231 萬噸,2026 年至 2031 年的複合年成長率為 3.93%。

這一成長趨勢反映了耐火材料市場適應不斷變化的煉鋼技術、不斷擴張的能源密集型產業以及日益嚴格的監管要求的能力。亞洲鋼鐵廠產能擴張、向氫基直接還原鐵(DRI)爐的轉型以及新一代電池、水泥和廢棄物發電設施的規模建設,都在推動近期需求成長。同時,日益嚴格的二氧化矽粉塵排放法規和碳邊境調節稅的引入,正在加速材料創新,並促進主要供應商之間的策略整合。例如,RHI Magnesita公司預測,儘管銷量下滑,但其2023年調整後息稅前利潤(EBITA)仍將達到4.09億歐元,較上年成長7%,這表明嚴格的定價策略和有針對性的收購可以緩解週期性波動。

全球耐火材料市場趨勢與洞察

亞洲鋼鐵廠產能快速擴張

亞洲鋼鐵產能的擴張正推動耐火材料需求空前高漲。 2024年上半年,中國投產12座新高爐,總產能達1,897萬噸。雖然用更有效率的爐子取代老舊設備有望延長運作運作,但不斷增加的熱負荷也使得耐火材料市場迫切需要開發高等級的氧化鎂碳產品和整體式解決方案。印度的快速成長同樣意義重大。 RHI Magnesita India Ltd.累計2023-2024會計年度營收將達到378.1億印度盧比(約4.53億美元),該公司在九個地點為700多家客戶提供服務,凸顯了印度國內市場的強勁需求。區域集中化有利於本地生產商縮短前置作業時間,而西方供應商則面臨維持市場佔有率的挑戰。同時,韓國2024年的耐火材料產量預計將下降5.7%,凸顯了耐火材料市場成長的不平衡。

向氫基直接還原鐵(DRI)爐過渡

氫基直接還原鐵(DRI)製程改變了溫度分佈和氣氛,因此需要具有優異抗熱衝擊性和抗氫脆性的耐火材料。根據《鎂業》雜誌的一項研究顯示,用於「綠色鋼」的電熔爐需要能夠耐受富氫氣體的新型耐火材料。雖然該製程可將煉鋼二氧化碳排放降低至每噸鋼0.1噸,但資本投資和能源價格仍是限制因素。安賽樂米塔爾公司於2025年退出德國的一個計劃並償還13億歐元的補貼,凸顯了經濟的不確定性。然而,能源經濟研究所預測,到2050年,DRI用鐵礦石的需求將成長十倍,這顯示特種DRI耐火材料具有長期的發展機會。

鎂碳磚的碳排放罰款

歐盟的碳邊境調節稅和北美的脫碳政策正在抑制對傳統鎂碳磚的需求。生命週期評估表明,無碳鎂替代品可以降低環境影響,但仍需在工業層面進行廣泛的示範應用。美國對來自中國和墨西哥的鎂碳磚徵收反傾銷稅(部分生產商的稅率高達236%),這加劇了成本壓力,並推動耐火材料市場向低碳解決方案轉型。 RHI Magnesita公司的高回收率鎂碳系列產品提供了一種過渡方案,但無碳粘合劑和陶瓷基質複合材料才是更長遠的發展方向。

細分市場分析

在研究期間,非黏土耐火材料的複合年成長率將達到 4.57%,並持續成長至 2031 年,超過黏土基耐火材料。其在氫基煉鋼、先進電池和廢棄物領域優異的耐腐蝕性和抗熱震性是推動成長的基礎。氧化鎂磚因其對爐渣化學成分的耐受性,在基礎煉鋼領域佔據主導地位;氧化鋯磚則在嚴苛的循環環境和極端溫度下表現出色。矽酸鹽磚是焦爐格柵牆的必需材料,但其使用受到結晶質二氧化矽暴露法規(粉塵濃度限值為 50 μg/m³)的限制。鉻酸鹽磚因其優異的抗金屬滲透性,在非鐵金屬冶煉領域保持重要地位。儘管黏土耐火材料在出貨量方面仍佔據主導地位,但這些非黏土耐火材料類別支撐了價值成長。

到2025年,包括高鋁耐火材料在內的黏土耐火材料將佔據耐火材料市場54.88%的佔有率,這充分證明了其在各種爐襯應用中的成本效益。耐火粘土磚用於中溫鋼包和鍋爐,而隔熱耐火材料則有助於各行業的節能。研究人員在飛灰無機聚合物磚中,於1100°C下燒製後,實現了84 MPa的抗壓強度,這為粘土耐火材料的循環經濟開闢了道路。聖戈班的超高溫陶瓷,特別是碳化矽(SiC)和氧化鋯,將性能極限推至1400°C以上,展現了混合配方如何模糊了傳統黏土/非黏土的界限。

耐火材料市場報告按產品類型(非粘土耐火材料和粘土耐火材料)、終端用戶行業(鋼鐵、水泥、能源化工、非鐵金屬、玻璃、陶瓷及其他終端用戶行業)和地區(亞太地區、北美、歐洲、南美以及中東和非洲)進行細分。市場預測以噸為單位。

區域分析

預計到2025年,亞太地區將佔全球耐火材料市場的73.20%,並在2031年之前以4.12%的複合年成長率成長。中國高爐現代化改造和老舊設施的關閉,推動了對高等級耐火磚和澆注料的持續需求。印度的成長速度明顯高於其他國家,RHI Magnesita執行長預測,該國耐火材料市場年增率將達到6%至13%,這反映了鋼鐵和水泥產業的大規模擴張。在日本,在JFE控股公司22.6億美元投資的推動下,日本正轉向電弧爐技術轉型,爐襯規範也正向電弧爐最佳化型基礎混合料轉變。韓國2024年的產量下降了5.7%,但仍致力於生產需要高品質耐火材料的高價值鋼鐵產品。中國和整個東南亞鋰離子電池超級工廠的加速建設,鞏固了該地區作為耐火材料市場成長中心的地位。

儘管北美市場已趨於成熟,但其戰略意義仍然重大。哈比森-沃克國際公司(Harbison-Walker International)在密蘇裡州富爾頓投資1,390萬美元進行擴建,將使輕質整體式耐火材料的產量提高60%,體現了該公司致力於在該地區開發高價值應用產品的承諾。美國職業安全與健康管理局(OSHA)日益嚴格的二氧化矽粉塵法規正在推動對封閉式加工技術和低粉塵材料的投資,促使產品系列。美國正尋求在生鐵出口領域佔據主導,這可能會刺激對特種直接還原鐵(DRI)耐火材料的需求。同時,美國反傾銷稅推高了鎂碳磚的成本,從而限制了墨西哥的競爭力。

歐洲在環境政策方面處於領先地位。歐盟碳邊境調節機制推高了高碳耐火材料的成本,促使人們採用無碳材料和回收解決方案。安賽樂米塔爾決定退還在德國氫能煉鋼計劃13億歐元的補貼,凸顯了綠色轉型帶來的經濟負擔。然而,研發投入依然強勁。聖戈班計劃在紐約州惠特菲爾德投資4000萬美元建設NorPro工廠,該工廠將位於美國,但將為歐洲供應催化劑,凸顯了跨大西洋供應鏈的整合。中東和非洲地區展現出新的潛力,沙烏地阿拉伯的產業多元化和南非的採礦業都體現了這一點,但政治不確定性和基礎設施不足阻礙了計劃的進展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲鋼鐵製造商產能迅速擴張

- 向氫基直接還原爐過渡

- 水泥窯轉向替代燃料

- 利用高溫陶瓷的大規模儲能電池的發展

- 用於廢棄物焚化發電廠的新型超低孔隙率磚

- 市場限制

- 鎂碳磚的碳排放處罰

- 冶金級礬土和菱鎂礦供應的波動性;

- 加強經合組織國家的職業性二氧化矽粉塵法規

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 非黏土耐火材料

- 鎂磚

- 氧化鋯磚

- 矽磚

- 鉻礦磚

- 其他(碳化物、矽酸鹽)

- 黏土耐火材料

- 高鋁

- 耐火粘土

- 絕緣

- 非黏土耐火材料

- 按最終用戶行業分類

- 鋼

- 水泥

- 能源與化工

- 非鐵金屬

- 玻璃

- 陶瓷製品

- 其他終端用戶產業(紙漿和造紙、廢棄物發電)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Chosun Refractories

- Gouda Refractories Group

- HarbisonWalker International

- IFGL

- Imerys

- Krosaki Harima Corporation

- Liaoning Qinghua Refractory Material Co., Ltd.

- Monolithisch India Limited

- Morgan Advanced Materials

- Puyang Refractories Group Co.,Ltd.

- Rath-Group

- Refratechnik

- RHI Magnesita

- Saint-Gobain

- SHINAGAWA REFRACTORIES CO., LTD.

- Vesuvius

第7章 市場機會與未來展望

The Refractories Market is expected to grow from 57.36 Million tons in 2025 to 59.61 Million tons in 2026 and is forecast to reach 72.31 Million tons by 2031 at 3.93% CAGR over 2026-2031.

This forward momentum reflects the ability of the refractories market to adapt to shifting steelmaking technologies, expanding energy-intensive industries, and rising regulatory expectations. Capacity expansions across Asian steel plants, the pivot toward hydrogen-based direct-reduced-iron (DRI) furnaces, and the scale-up of next-generation battery, cement, and waste-to-energy facilities all reinforce near-term demand. At the same time, tighter silica-dust limits and carbon-border tariffs are accelerating materials innovation and spurring strategic consolidation among leading suppliers. RHI Magnesita, for example, delivered 7% growth in 2023 Adjusted EBITA to EUR 409 million despite softer volumes, underscoring how disciplined pricing and targeted acquisitions can buffer cyclical swings.

Global Refractories Market Trends and Insights

Rapid Capacity Expansions in Asian Iron and Steel Plants

Steel capacity additions across Asia are driving unprecedented refractory demand, with China commissioning 12 new blast furnaces totaling 18.97 million tons in H1 2024. Replacing aging units with high-efficiency furnaces lengthens campaign life expectations and raises thermal loads, prompting the refractories market to innovate higher-grade magnesia-carbon and monolithic solutions. India's surge is equally pivotal; RHI Magnesita India posted INR 3,781 crore (USD 453 million) FY 2023-24 revenue while serving more than 700 customers across nine sites, highlighting the depth of domestic pull. Regional concentration benefits local producers through shorter lead times yet challenges Western suppliers to sustain share. Meanwhile, Korean production fell 5.7% in 2024, underscoring uneven growth within the broader refractories market.

Shift Toward Hydrogen-Based Direct-Reduced-Iron Furnaces

Hydrogen-based DRI alters temperature profiles and atmospheres, demanding refractories with superior thermal-shock resistance and hydrogen embrittlement resilienceMagnesita research confirms that electric melting furnaces intended for "green steel" require novel refractory chemistries capable of withstanding hydrogen-rich gases. Although the process can slash steelmaking CO2 emissions to 0.1 tons per ton of steel, capex and energy-price hurdles persist; ArcelorMittal's 2025 withdrawal from a German project and return of EUR 1.3 billion in subsidies highlights the economic uncertainties. Nevertheless, the Institute for Energy Economics forecasts a ten-fold rise in DR-grade iron ore demand by 2050, signaling long-run opportunities for specialized DRI refractories,

Carbon-Emission Penalties on Mag-Carbon Bricks

EU carbon-border tariffs and North American decarbonization policies are curbing demand for traditional magnesia-carbon bricks. Life-cycle assessments show that carbonless magnesia alternatives deliver lower environmental impacts but still need broader industrial validation. US antidumping duties on certain Chinese and Mexican mag-carbon bricks-reaching 236% for some producers-add cost pressure and push the refractories market toward lower-carbon solutions. RHI Magnesita's high-recycling mag-carbon series offers an interim path, yet long-term trajectories favor carbon-free bonds and ceramic-matrix composites.

Other drivers and restraints analyzed in the detailed report include:

- Cement Kilns Switching to Alternative Fuels

- Growth of Large Utility-Scale Energy-Storage Batteries Using High-Temperature Ceramics

- Volatility in Metallurgical-Grade Bauxite and Magnesite Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-clay refractories grew at a 4.57% CAGR during the review period and continue to outpace clay grades through 2031. They thrive on superior corrosion and thermal-shock resistance critical in hydrogen-based steelmaking, advanced batteries, and waste-to-energy incinerators. Magnesite bricks dominate basic steelmaking for their resistance to slag chemistry, while zirconia bricks excel in severe cycling and extremely high temperature zones. Silica bricks remain indispensable for coke-oven checker walls, yet usage is moderated by rising crystalline-silica exposure rules capping dust at 50 µg/m3. Chromite bricks maintain a foothold in non-ferrous smelting thanks to strong metal-penetration resistance. Together, these non-clay categories underpin value growth even as clay refractories retain volume leadership.

Clay refractories, topped by high-alumina variants, captured 54.88% of refractories market share in 2025, reflecting their cost-effectiveness across multiple furnace linings. Fireclay bricks serve moderate-temperature ladles and boilers, while insulating refractories unlock energy savings across industries. Researchers have achieved 84 MPa compressive strength in fly-ash geopolymer bricks after 1,100 °C exposure, hinting at circular-economy pathways for clay refractories. Saint-Gobain's ultra-high-temperature ceramics, particularly SiC and zirconia, stretch performance ceilings above 1,400 °C and illustrate how hybrid formulations blur the traditional clay/non-clay divide.

The Refractories Market Report is Segmented by Product Type (Non-Clay Refractories and Clay Refractories), End-User Industry (Iron and Steel, Cement, Energy and Chemicals, Non-Ferrous Metals, Glass, Ceramic, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific owned 73.20% of the refractories market in 2025 and is slated to grow at a 4.12% CAGR through 2031. China continues modernizing blast furnaces while shutting obsolete capacity, driving sustained uptake of higher-grade bricks and castables. India outpaces all peers; RHI Magnesita's CEO forecasts 6-13% annual domestic refractory growth, reflecting large-scale steel and cement expansions. Japan's shift toward EAF technology, supported by JFE Holdings' USD 2.26 billion investment, redirects lining specifications toward EAF-optimized basic mixes. South Korea encountered a 5.7% production dip in 2024 but aims to pivot toward higher-value steel products that still require premium refractories. Accelerating lithium-ion battery gigafactory construction across China and Southeast Asia cements the region's role as the growth nucleus of the refractories market.

North America remains a mature yet strategically vital arena. HarbisonWalker International's USD 13.9 million expansion in Fulton, Missouri, will lift lightweight monolithic output by 60% and embodies the region's commitment to high-value applications. Heightened OSHA silica-dust limits incentivize investment in sealed handling and low-dust materials, reshaping product portfolios. Canada eyes leadership in green-iron exports, which could stimulate specialized DRI refractory demand. Mexico's competitiveness, however, is tempered by US antidumping duties that inflate costs for mag-carbon bricks.

Europe sets the pace on environmental policy. The EU Carbon Border Adjustment Mechanism raises the cost of high-carbon refractories, propelling adoption of carbon-free bonds and recycling solutions. ArcelorMittal's decision to return EUR 1.3 billion in subsidies for a German hydrogen-steel project illustrates the economic strain in the green transition. Yet R&D pipelines stay robust; Saint-Gobain's planned USD 40 million NorPro plant in Wheatfield, New York, although US-based, will serve European catalysts and emphasizes trans-Atlantic supply-chain integration. The Middle East and Africa offer emergent promise through Saudi industrial diversification and South African mining ventures, although political certainty and infrastructure gaps influence project pacing.

- Chosun Refractories

- Gouda Refractories Group

- HarbisonWalker International

- IFGL

- Imerys

- Krosaki Harima Corporation

- Liaoning Qinghua Refractory Material Co., Ltd.

- Monolithisch India Limited

- Morgan Advanced Materials

- Puyang Refractories Group Co.,Ltd.

- Rath-Group

- Refratechnik

- RHI Magnesita

- Saint-Gobain

- SHINAGAWA REFRACTORIES CO., LTD.

- Vesuvius

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Capacity Expansions in Asian Iron and Steel Plants

- 4.2.2 Shift Toward Hydrogen-Based Direct-Reduced-Iron Furnaces

- 4.2.3 Cement Kilns Switching to Alternative Fuels

- 4.2.4 Growth of Large Utility-Scale Energy-Storage Batteries Using High-Temperature Ceramics

- 4.2.5 Novel Ultra-Low-Porosity Bricks for Waste-To-Energy Incinerators

- 4.3 Market Restraints

- 4.3.1 Carbon-Emission Penalties on Mag-Carbon Bricks

- 4.3.2 Volatility in Metallurgical-Grade Bauxite and Magnesite Supply

- 4.3.3 Occupational Silica-Dust Regulations Tightening in OECD Nations

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Non-clay Refractories

- 5.1.1.1 Magnesite Brick

- 5.1.1.2 Zirconia Brick

- 5.1.1.3 Silica Brick

- 5.1.1.4 Chromite Brick

- 5.1.1.5 Other (Carbides, Silicates)

- 5.1.2 Clay Refractories

- 5.1.2.1 High-Alumina

- 5.1.2.2 Fireclay

- 5.1.2.3 Insulating

- 5.1.1 Non-clay Refractories

- 5.2 By End-User Industry

- 5.2.1 Iron and Steel

- 5.2.2 Cement

- 5.2.3 Energy and Chemicals

- 5.2.4 Non-Ferrous Metals

- 5.2.5 Glass

- 5.2.6 Ceramic

- 5.2.7 Other End-user Industries (Pulp and Paper, Waste-to-Energy)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Chosun Refractories

- 6.4.2 Gouda Refractories Group

- 6.4.3 HarbisonWalker International

- 6.4.4 IFGL

- 6.4.5 Imerys

- 6.4.6 Krosaki Harima Corporation

- 6.4.7 Liaoning Qinghua Refractory Material Co., Ltd.

- 6.4.8 Monolithisch India Limited

- 6.4.9 Morgan Advanced Materials

- 6.4.10 Puyang Refractories Group Co.,Ltd.

- 6.4.11 Rath-Group

- 6.4.12 Refratechnik

- 6.4.13 RHI Magnesita

- 6.4.14 Saint-Gobain

- 6.4.15 SHINAGAWA REFRACTORIES CO., LTD.

- 6.4.16 Vesuvius

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Demand spike from EAF share rising in steel