|

市場調查報告書

商品編碼

1906999

絕緣包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Insulated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

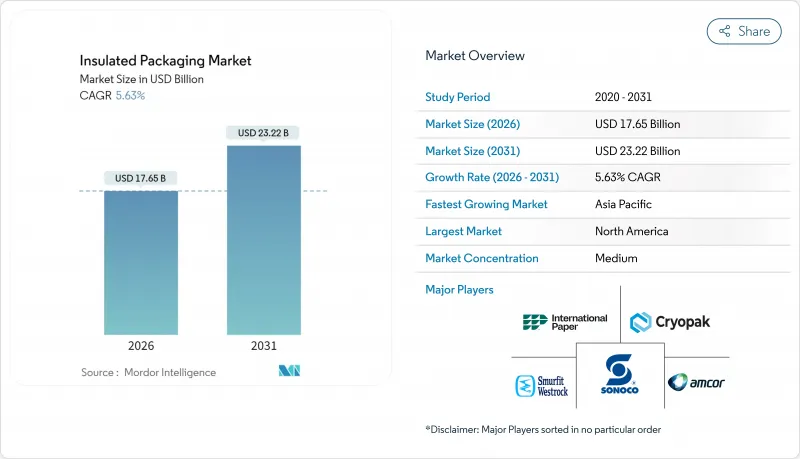

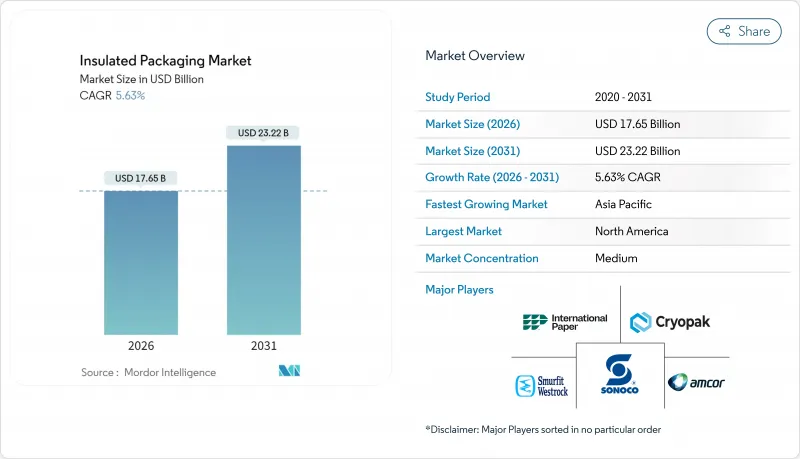

預計隔熱包裝市場將從 2025 年的 167.1 億美元成長到 2026 年的 176.5 億美元,到 2031 年將達到 232.2 億美元,2026 年至 2031 年的複合年成長率為 5.63%。

低溫運輸現代化、電子商務履約需求以及監管機構對永續材料的關注正在推動這一擴張。先進的相變材料 (PCM) 和真空絕熱板 (VIP) 延長了溫度敏感貨物的可接受運輸時間,降低了貨物變質風險,並為全球醫療物流提供支援。區域差異仍然存在:亞太地區的製藥業持續成長,並大力投資低溫運輸樞紐;而北美憑藉其成熟的電子商務網路,保持著 40.1% 的收入領先優勢。雖然塑膠仍然是最受歡迎的基材,但生物基氣凝膠的成長速度超過了所有競爭對手,這表明終端用戶除了關注性能指標外,也越來越關注處置成本和合規風險。在聚合物成本持續波動的情況下,保溫包裝製造商正在實現原料多元化,並採用閉合迴路模式來穩定利潤率。

全球保溫包裝市場趨勢與洞察

電子商務的擴張推動了對高效隔熱運輸貨櫃的需求

直接面對消費者的配送模式正在改變物流格局,要求供應商設計能夠應對多通路配送、送貨上門以及氣候變遷等挑戰的包裝,從而確保產品品質。亞馬遜投資建置溫控履約中心就是一個平台自建低溫運輸能力的典範,旨在保護品牌價值並減少變質索賠。食材自煮包品牌每週出貨量的成長意味著對保溫包裝的需求將更加穩定和頻繁。因此,保溫包裝市場正朝著輕量化、模組化的方向發展,以支援自動化分類並降低運費附加費。需求分析也促使生產商採用QR碼感測器,以便在包裹溫度異常時提醒承運商,並僅對超過設定閾值的包裹進行退款。展望2025年,各大電商零售商正擴大發布將供應商合約與已驗證的配送路線數據掛鉤的績效指標,從而鞏固對高性能隔熱材料的持續投資。

全球低溫運輸投資增加,涵蓋生物製藥和食材自煮包

細胞和基因療法、疫苗以及單株抗體需要低至-80°C的溫度控制,這迫使製藥公司投資建造包含冗餘電源、現場相變材料填充設備和檢驗的包裝材料的配送中心。同時,食材自煮包服務商也在擴展菜單,納入更多冷藏蛋白質和生鮮食品。這些趨勢推動了冷藏倉庫全年運轉率的提高,並持續刺激了對能夠填補週末服務空白的物流公司的需求。一些成功的包裝供應商現在提供通用系統,只需更換相變材料模組,即可同時滿足-20°C生物製藥和0-4°C生鮮食品的儲存需求,從而減少物流合作夥伴的庫存單位(SKU)數量。美國食品藥物管理局(FDA)和歐洲監管機構的審核進一步強化了合規性溢價,並加速了對可追蹤保溫生產線的投資。

聚合物價格波動對加工商的利潤率帶來壓力。

發泡聚苯乙烯和聚氨酯的生產依賴苯乙烯和異氰酸酯這兩種原料,而它們的價格與基準原油價格同步波動。這使得加工商面臨成本突然上漲的風險,而客戶合約通常會鎖定價格6到12個月。避險策略可以部分緩解此風險,但對於中型企業而言,這需要大量的流動資金投入。利潤率的壓縮阻礙了新模具和驗證研究的資本預算,從而延緩了保溫包裝產品的更新換代週期。一些加工商正在用回收材料取代原生聚合物以降低成本,但供應的波動限制了其在醫藥級包裝中的應用。持續的價格波動促使終端用戶嘗試使用纖維和生物聚合物替代品,抑制了保溫包裝市場對傳統發泡材解決方案的需求。

細分市場分析

到2025年,塑膠材料將佔據保溫包裝市場41.85%的佔有率,這得益於其成熟的供應鏈和優異的機械性能。然而,生物基氣凝膠的複合年成長率將達到7.74%,這將顯著蠶食發泡材在醫藥產業的市佔率。隨著可堆肥和可回收內襯的出現,採購負責人在計算廢棄物處理稅和用戶費用時,整體合規成本將降低,保溫包裝市場也將從中受益。木纖維複合材料製造商正在添加水性阻隔塗層以防止冷凝,擴大其在冷凍食品產業的應用。同時,對上游工程機械回收的投資正在生產可轉化為模塑塊的再生PET顆粒,這些模塑塊適用於堆疊。採用PET表層和纖維芯材的混合複合複合材料在較低的紙張重量下即可達到相同的保溫性能(R值),在保持隔熱性能的同時,包裝重量最多可減輕18%。因此,材料的選擇需要在保溫效率、與生產線自動化的兼容性以及不斷變化的掩埋稅之間取得平衡。

下游原料買家正透過拓展樹脂合約,將生物聚合物納入其中,以對沖苯乙烯價格波動風險。擁有垂直整合聚合製程的供應商保持著定價權,而第三方混配商則競相爭取快速固化化學品的認證,以縮短成型週期。生命週期評估(LCA)將於2025年到期,如今已成為競標文件中的標準內容,鼓勵生產商揭露其生產過程(從搖籃到大門)的碳足跡。在保溫包裝產業,大型零售商也日益要求提供認證,以驗證生物氣凝膠原料的農業殘餘物來源,這對森林管理計畫產生了影響。

預計到2025年,箱式容器仍將佔據保溫包裝市場37.95%的佔有率,這主要得益於其與多個行業的手動和自動化揀貨線的兼容性。然而,托盤式運輸正以7.62%的複合年成長率快速成長,反映出市場正轉向可重複使用的散裝包裝,以減少緩衝廢棄物和搬運次數。區域配送中心集中庫存並依賴包裹整合運輸,因此更傾向於使用預先檢驗儲存期限為48小時的托盤式容器。在保溫包裝市場,航空公司正在核准可裝載於較低層甲板的全托盤VIP貨箱,從而在嚴格的時限限制下擴大細胞療法出口的運力。此外,電子產品製造商正在採用內建相變材料(PCM)隔熱板的托盤式運輸容器,以確保鋰離子電池保持在國際航空運輸協會(IATA)核准的溫度範圍內。

雖然內襯包裝和緩衝材料對於小眾電商小包裹仍然重要,但快速零售的食品雜貨零售商正擴大用可直接與保溫櫃配合使用的模組化手提袋內襯來取代它們。輕質包裝袋麵臨可回收性的檢驗,促使製造商試用氣體阻隔塗層整體聚乙烯結構。未來的成長取決於能否將尺寸規格與部署在履約中心的自主移動機器人相匹配。能夠將模擬資料回饋給設計團隊的公司正在最佳化包裝形狀,以在保護有效載荷的同時降低運輸成本。

區域分析

到2025年,北美將佔總收入的39.60%,並將繼續保持最大的區域中心地位,這得益於其成熟的電子商務流程、龐大的藥品生產規模和統一的配送準則。履約中心正日益與微型配送中心連接,以縮短最後一公里配送距離,這迫使包裝設計師最佳化解決方案,以適應6-12小時的都會區環線配送。隨著連鎖藥局推出生物製藥當日送達服務,低溫運輸資本投資依然強勁,進一步支撐了國內保溫包裝的採購。

亞太地區以8.85%的複合年成長率成為全球保溫包裝市場成長最快的地區,這主要得益於疫苗生產群集的快速擴張、中階對餐飲服務需求的不斷成長以及政府對現代化冷藏基礎設施的補貼。跨國加工企業正在化工原料供應中心附近建立合資企業,以確保樹脂供應並規避進口關稅。韓國和新加坡等區域出口國正在採用VIP-PCM混合技術,以確保長途飛往歐洲和北美航班的運輸性能穩定。

歐洲在平衡永續性法規與先進醫療需求的同時,維持著穩定的個位數成長。隨著循環經濟指令提高了不可可再生發泡材的處置成本,大型食品零售商正轉向使用符合回收標準的纖維基襯。東歐成員國正利用歐盟區域基金擴大冷藏能力,確保從農場到藥局的溫度控制統一。同時,南美洲正在擴大魚貝類和水果出口,需要價格適中且經久耐用的EPS包裝箱用於空運。此外,中東和非洲正著力於基礎疫苗分發,隨著收入成長和供應鏈現代化,這兩個地區都擁有巨大的成長空間。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務的擴張帶動了對保溫運輸貨櫃的需求成長。

- 全球生物製藥和食材自煮包低溫運輸投資不斷成長

- PCM和VIP技術在最後一公里配送的快速應用

- 永續性加速了向纖維基隔熱材料的轉變

- 拓展生鮮速賣(Q commerce)網路

- 亞太地區溫度敏感型特用化學品出口

- 市場限制

- 聚合物價格波動對加工商的利潤率帶來壓力。

- 多層包裝袋挨家挨戶回收的局限性

- 不同地區的熱測試標準並不統一。

- 擴大生物基氣凝膠生產規模的資本投資障礙

- 產業價值鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素的影響

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 材料

- 塑膠

- 紙張和木纖維

- 玻璃

- 金屬箔

- 生物基氣凝膠

- 依產品類型

- 小袋和包裝袋

- 盒子和容器

- 托盤運輸公司

- 包裝材料和襯墊

- 透過絕緣技術

- 發泡聚苯乙烯(EPS)

- 真空絕熱板(VIP)

- 相變材料(PCM)系統

- 反光箔層壓板

- 按最終用戶行業分類

- 食品/飲料

- 製藥和生物技術

- 工業化學品

- 美容及個人護理

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 肯亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- International Paper Company

- Sonoco Products Company

- Sealed Air Corporation

- Smurfit WestRock

- Cryopak Industries Inc.

- Innovative Energy Inc.

- Providence Packaging Corporation

- The Wool Packaging Company Ltd

- Thermal Packaging Solutions Ltd

- Insulated Products Corporation

- Cold Chain Technologies LLC

- Pelican BioThermal LLC

- Mondi plc

- Packaging Corporation of America

- Tetra Pak International SA

- Clondalkin Group

- Huhtamaki Oyj

- Storopack Hans Reichenecker GmbH

- Ecovative Design LLC

第7章 市場機會與未來展望

The insulated packaging market is expected to grow from USD 16.71 billion in 2025 to USD 17.65 billion in 2026 and is forecast to reach USD 23.22 billion by 2031 at 5.63% CAGR over 2026-2031.

Cold-chain modern-ization, e-commerce fulfillment demands, and regulatory attention on sustainable materials jointly steer this expansion. Advanced phase-change materials (PCM) and vacuum insulated panels (VIP) lengthen allowable transit windows for temperature-sensitive goods, lowering spoilage risk and supporting global health logistics. Regional disparities persist: Asia-Pacific experiences sustained pharmaceutical manufacturing growth and invests heavily in cold-chain nodes, whereas North America leverages mature e-commerce networks to protect a 40.1% revenue lead. Plastic remains the most common substrate, yet bio-based aerogels outpace all rivals, showing that end-users now weigh disposal costs and compliance risks alongside performance metrics. As polymer cost volatility lingers, insulated packaging producers diversify feedstocks and adopt closed-loop models to stabilize margins.

Global Insulated Packaging Market Trends and Insights

Growing E-Commerce Driven Demand for Thermal-Efficient Shippers

Direct-to-consumer delivery has re-shaped logistics, forcing suppliers to design packaging that safeguards product integrity through multi-stop carrier networks, porch dwell times, and variable climates. Amazon's investment in temperature-controlled fulfillment centers illustrates how platforms internalize cold-chain functions to protect brand equity and reduce spoilage claims. Meal-kit brands further amplify weekly volume, translating to predictable, high-frequency orders for insulated shippers. As a result, the insulated packaging market pivots toward lighter, modular formats that fit sorting automation while cutting freight surcharges. Demand analytics also prompt producers to embed QR-coded sensors that warn shippers if thermal abuse occurs, supporting refunds only when packages breach set thresholds. Across 2025, large e-commerce retailers increasingly issue performance scorecards that link supplier contracts to proven lane data, anchoring sustained investment in higher-performing insulators.

Rising Global Cold-Chain Investments in Biologics and Meal-Kits

Cell and gene therapies, vaccines, and monoclonal antibodies require temperature windows down to -80 °C, compelling drug sponsors to fund distribution nodes that include redundant power, on-site PCM charging, and validated packaging fleets. Concurrently, meal-kit operators broaden menu offerings that rely on chilled proteins and fresh produce. Together these sectors elevate year-round utilization rates of cold-room space, which in turn sustains recurring demand for shippers that can endure weekend service gaps. Successful packaging suppliers now market universal systems adaptable to both -20 °C biologics and 0-4 °C perishables by swapping PCM bricks, reducing SKU proliferation for logistics partners. Regulatory audits by the FDA and European agencies further cement a compliance premium, accelerating spend on track-and-trace enabled insulation lines

Volatile Polymer Prices Squeezing Converter Margins

Expanded polystyrene and polyurethane rely on styrene and isocyanate feedstocks whose prices swing with crude benchmarks, exposing converters to sudden cost spikes while customer contracts often lock prices for six to twelve months. Hedging strategies offer partial relief but require liquidity outlays that strain mid-tier firms. Margin compression hinders capital budgets for new tooling or validation studies, slowing the refresh cycle of insulated formats. Some converters replace virgin polymer with recycled content to buffer costs, yet inconsistent supply streams limit usage in pharmaceutical-grade packs. Persistent volatility encourages end-users to test fiber or bio-polymer substitutes, moderating demand for conventional foam-based solutions within the insulated packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of PCM and VIP Technologies for Last-Mile Delivery

- Sustainability Mandates Accelerating Shift to Fiber-Based Insulators

- Limited Curbside Recyclability of Multi-Layer Pouches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic materials commanded 41.85% of the insulated packaging market size in 2025 owing to entrenched supply chains and robust mechanical properties. Yet, bio-based aerogels post an 7.74% CAGR that visibly erodes foam share in pharmaceutical corridors. The insulated packaging market benefits when procurement officers calculate disposal levies and user fees, because compostable and recyclable liners cut overall compliance spend. Manufacturers of wood-fiber composites add water-borne barrier coats to repel condensation, expanding addressable segments in frozen meals. Parallel investment in mechanical recycling upstream yields r-PET pellets that convert into molded bricks suited for pallet shippers. Hybrid composites combining PET skin with fiber core reach equivalent R-values at lower grammage, preserving thermal performance while dropping pack weight by up to 18%. Material choice therefore reflects a balancing act among insulation efficiency, line automation compatibility, and evolving landfill taxes.

Downstream, raw material buyers diversify resin contracts to include biopolymers, thus hedging against styrene volatility. Suppliers that vertically integrate polymerization steps maintain pricing power, while third-party compounders race to qualify rapid-cure chemistries enabling shorter molding cycles. Lifecycle assessments carried out in 2025 commonly form part of bid documents, nudging producers to publish cradle-to-gate carbon footprints. The insulated packaging industry also sees major retailers demand certificates verifying agricultural residue sourcing for bio-aerogels, influencing forest stewardship programs.

Boxes and containers preserved 37.95% of the insulated packaging market share in 2025 because they fit manual and automated picking lines across multiple sectors. Nonetheless, pallet shippers accelerate at 7.62% CAGR, reflecting a shift toward reusable macro-packs that cut dunnage waste and labor touches. Regional distribution centers pool inventory and rely on consolidated LTL moves, which favor pallet-level containers pre-validated for 48-hour hold times. The insulated packaging market sees airlines approve full-pallet VIP crates that ride in lower-deck positions, expanding capacity for cell therapy exports under stringent time windows. Furthermore, electronics manufacturers employ pallet shippers with PCM tiles to keep lithium-ion batteries within IATA approved temperature limits.

Liner wraps and cushions still serve niche e-commerce parcels, yet quick-commerce grocers substitute modular tote inserts that integrate directly with insulated lockers. Pouch formats, while lightweight, face recyclability scrutiny, pushing producers to trial mono-PE structures with gas-barrier coatings. Future growth hinges on harmonizing size matrices with autonomous mobile robots deployed in fulfillment hubs. Firms able to feed simulation data back to design teams optimize form factors that reduce outbound freight spend while safeguarding payloads.

The Insulated Packaging Market Report is Segmented by Material (Plastic, Paper and Wood-Fiber, Glass, Metal Foils, and More), Product Type (Pouches and Bags, Boxes and Containers, and More), Insulation Technology (Expanded Polystyrene, Vacuum Insulated Panels, and More), End-User Industry (Food and Beverage, Pharmaceutical and Biotechnology, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America represented 39.60% revenue in 2025 and remains the largest regional node thanks to mature e-commerce workflows, broad pharmaceutical manufacturing, and harmonized distribution guidelines. Fulfillment centers increasingly pair with micro-hubs to trim last-mile distance, thereby pushing pack designers to tailor solutions for six to 12-hour urban loops. Cold-chain capital spending remains robust as pharmacy chains roll out same-day biologics delivery, further sustaining domestic procurement of insulated packaging.

Asia-Pacific records a 8.85% CAGR, the fastest in the global insulated packaging market, driven by rapid expansion of vaccine production clusters, growing middle-class demand for meal services, and government subsidies for modern cold storage infrastructure. Multinational converters open joint-ventures near chemical feedstock hubs to secure resin supply while avoiding import tariffs. Regional exporters, especially in South Korea and Singapore, adopt VIP-PCM hybrids to achieve consistent lane performance on long-haul flights to Europe and North America.

Europe balances sustainability regulation with advanced healthcare needs, registering steady single-digit growth. The circular economy directive raises disposal fees on non-recyclable foams, spurring large grocers to adopt fiber-based liners that pass curbside collection tests. Eastern member states upgrade cold-room capacity via EU regional funds, ensuring harmonized temperature control from farm to pharmacy. Elsewhere, South America scales fish and fruit exports that necessitate affordable yet robust EPS boxes for airfreight, while Middle East and Africa focus on baseline vaccine distributionboth offering upside as incomes rise and supply chains modernize.

- Amcor plc

- International Paper Company

- Sonoco Products Company

- Sealed Air Corporation

- Smurfit WestRock

- Cryopak Industries Inc.

- Innovative Energy Inc.

- Providence Packaging Corporation

- The Wool Packaging Company Ltd

- Thermal Packaging Solutions Ltd

- Insulated Products Corporation

- Cold Chain Technologies LLC

- Pelican BioThermal LLC

- Mondi plc

- Packaging Corporation of America

- Tetra Pak International SA

- Clondalkin Group

- Huhtamaki Oyj

- Storopack Hans Reichenecker GmbH

- Ecovative Design LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing e-commerce driven demand for thermal-efficient shippers

- 4.2.2 Rising global cold-chain investments in biologics and meal-kits

- 4.2.3 Rapid adoption of PCM and VIP technologies for last-mile delivery

- 4.2.4 Sustainability mandates accelerating shift to fiber-based insulators

- 4.2.5 Expansion of grocery quick-commerce (q-commerce) networks

- 4.2.6 Temperature-sensitive speciality chemicals exports from Asia Pacific

- 4.3 Market Restraints

- 4.3.1 Volatile polymer prices squeezing converter margins

- 4.3.2 Limited curb-side recyclability of multi-layer pouches

- 4.3.3 Inconsistent thermal-test standards across regions

- 4.3.4 Capex hurdles for scaling bio-based aerogel production

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paper and Wood-fiber

- 5.1.3 Glass

- 5.1.4 Metal Foils

- 5.1.5 Bio-based Aerogels

- 5.2 By Product Type

- 5.2.1 Pouches and Bags

- 5.2.2 Boxes and Containers

- 5.2.3 Pallet Shippers

- 5.2.4 Wraps and Liners

- 5.3 By Insulation Technology

- 5.3.1 Expanded Polystyrene (EPS)

- 5.3.2 Vacuum Insulated Panels (VIP)

- 5.3.3 Phase-Change Material (PCM) Systems

- 5.3.4 Reflective Foil Laminate

- 5.4 By End-user Industry

- 5.4.1 Food and Beverage

- 5.4.2 Pharmaceutical and Biotechnology

- 5.4.3 Industrial Chemicals

- 5.4.4 Beauty and Personal Care

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 International Paper Company

- 6.4.3 Sonoco Products Company

- 6.4.4 Sealed Air Corporation

- 6.4.5 Smurfit WestRock

- 6.4.6 Cryopak Industries Inc.

- 6.4.7 Innovative Energy Inc.

- 6.4.8 Providence Packaging Corporation

- 6.4.9 The Wool Packaging Company Ltd

- 6.4.10 Thermal Packaging Solutions Ltd

- 6.4.11 Insulated Products Corporation

- 6.4.12 Cold Chain Technologies LLC

- 6.4.13 Pelican BioThermal LLC

- 6.4.14 Mondi plc

- 6.4.15 Packaging Corporation of America

- 6.4.16 Tetra Pak International SA

- 6.4.17 Clondalkin Group

- 6.4.18 Huhtamaki Oyj

- 6.4.19 Storopack Hans Reichenecker GmbH

- 6.4.20 Ecovative Design LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment