|

市場調查報告書

商品編碼

1906996

本安型設備(IS設備):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Intrinsically Safe Equipment (IS Equipment) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

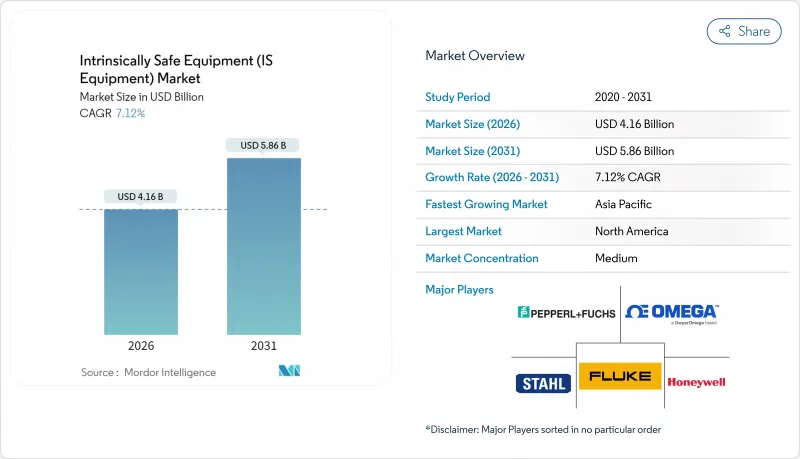

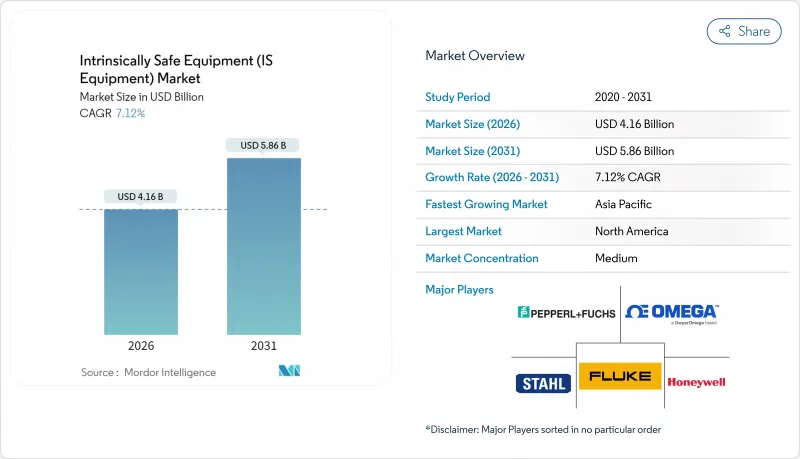

預計到 2025 年,本質安全設備(IS 設備)市場規模將達到 38.8 億美元,從 2026 年的 41.6 億美元成長到 2031 年的 58.6 億美元,在預測期(2026-2031 年)內,複合年成長率將達到 7.12%。

這種擴張反映了從笨重、防爆外殼向數位化、本質安全架構的轉變,後者將合規性與工業4.0連接性結合。日益嚴格的全球標準、採礦和加工產業的擴張,以及無線模組使得以往被認為無利可圖的維修計劃得以實現,都推動了市場需求的加速成長。雖然石油和天然氣業者仍然是主要客戶,但隨著易揮發溶劑被引入生產線,離散元件製造商也正在採用經過認證的自動化技術。由於設施所有者在選擇新系統時會考慮生命週期成本、供應鏈穩定性以及預測性維護能力,因此,同時掌握認證和網路安全技術的公司將獲得最大的價值。

全球本質安全型設備(IS設備)市場趨勢與洞察

世界各地日益嚴格的防爆安全法規

2024年1月發布的IEC 60079-11第七版引入了173項技術修訂,包括更嚴格的電池測試以及禁止在IIC類環境中使用催化感測器,從而鼓勵對現有裝置進行維修。 EN IEC 60079-11:2024於2024年12月在歐盟官方公報上發布,為強制升級設定了明確的時間表,因為2012版將於2027年12月之前停止使用。跨國公司正爭相遵守ATEX和IECEx文件要求,但儘管技術上已趨於一致,提交時間表的同步仍未實現。該法規的適用範圍也從設備擴展到IEC 60079-14:2024規定的現場佈線,從而推動了對認證安裝和再認證服務的需求。隨著營運商更換不符合新法規的設備並簽訂符合新法規的長期維護契約,這些發展正在推動本質安全設備市場的成長。

工業4.0推動對本質安全型感測器和儀器的需求

數位化轉型推動了對危險區域即時數據採集的日益成長的需求,而本質安全型感測器則成為實現這一目標的關鍵技術。乙太網路APL技術允許透過單一雙絞線傳輸長達1公里的電力和數據,使工廠業主能夠在1區和2區安裝智慧儀器,而不會影響效能。無線節點降低了佈線成本並簡化了維修,例如SmartPower模組,即使在惡劣環境下也能提供長達數年的電池壽命。地下礦井正在使用這些設備將氣體濃度和資產狀態即時傳輸到地面作業中心,將安全保障從一系列定期檢查轉變為持續監測。同樣的架構也是預測性維護的基礎,邊緣分析技術能夠偵測異常振動並在故障發生前發出服務需求訊號。這使得設施業主能夠同時確保合規性和提高生產力,從而加速亞太地區和波灣合作理事會(GCC)國家的採購。

高昂的認證成本和複雜的設計

每款產品獲得ATEX認證的費用在1.5萬至5萬歐元之間,而IECEx測試則需額外花費2萬至6萬美元,迫使中小企業退出競爭。第七版法規的變更要求進行額外的電池壓力測試、火花點火測試和元件間距測試,這通常需要多次修改設計。企業還必須維持ISO 9001認證和品質保證審核才能保持認證有效,這增加了每條產品線的持續營運成本。這些費用使得競爭向擁有內部實驗室和專門合規團隊的跨國公司傾斜,集中了智慧財產權,並阻礙了新進入者。新興市場的供應商處境最為艱難,因為缺乏本地實驗室能力迫使他們將測試轉移到海外,從而延長了前置作業時間並加重了預算負擔。

細分市場分析

截至2025年,1區應用將佔本質安全設備市場的38.15%,證實了其在煉油廠和化工廠的普遍應用,這些場所的維護過程中會產生爆炸性氣體環境。由於傳統佈線與新型物聯網設備結合,簡化了預測性維護,1區支出將保持穩定。同時,0區將呈現8.31%的複合年成長率,因為印刷感測器和無線集線器最終實現了在持續存在可燃性氣體的環境中進行即時監測。這一成長表明人們的觀念正在從隔離轉向主動風險緩解,尤其是在海底油井和製藥反應器等停機成本遠超設備溢價的場所。 2區在裝卸碼頭和倉庫中仍然至關重要,這些場所需要低成本的合規解決方案。同時,粉塵較多的20-22區的需求正隨著食品和製藥企業對自動化投資的增加而溫和成長。供應商目前正在開發模組化基板,這些電路板可以透過韌體或熔斷器的變更來滿足多個區域的要求,從而縮短開發週期並減少庫存。

經1區認證的無線閘道器現在可以透過單線乙太網路與安全區域內的歷史系統進行連接,無需額外的電纜配線架即可擴展本質安全設備市場支援的終端範圍。整合商非常青睞這些閘道器,因為它們可以減少複雜屏障運算所需的工程時間。隨著標準機構不斷完善多氣體和多粉塵區域的指南,跨區域架構將成為設計最佳實踐,從而確保即使在當前維修需求高峰過後,0區產品的出貨量仍能保持兩位數的成長。

1 類系統主要針對氣體和蒸氣危害,預計到 2025 年將佔總收入的 62.10%,並在 2031 年前以 8.76% 的複合年成長率成長,這主要得益於對甲烷檢測、氫氣洩漏監測和液化天然氣 (LNG) 處理感測器升級的需求。營運商透過對管道進行改造,加裝光學氣體成像攝影機和本質安全型邊緣盒,顯著縮短了維修時間,這些設備可提供基於人工智慧的現場洩漏量化分析。 2 類粉塵控制設備在生質能發電廠和積層製造廠找到了新的買家,這些場所先前忽略了細粉塵的點燃風險。隨著越來越多的國家採用基於 NFPA 652 標準的法規,2 類本質安全型設備的市場規模預計將溫和成長。

3 類應用目前仍屬於小眾領域,尤其是在紡織和木工行業,但由於日益自動化的切割線排放的空氣中纖維,市場需求正在趨於穩定。供應商正尋求透過更換墊圈和添加防塵過濾器來重複利用 1 類設計,從而降低測試成本。乙太網路 APL 尤其受到 1 類系統的青睞,因為氣體組的額定功率高於粉塵組,從而簡化了交換器的部署。這種相容性進一步鞏固了 1 類系統作為新型本質安全網路概念試驗場的地位,而這些概念最終也將擴展到粉塵和紡織業。

本質安全設備報告按區域(例如,0 區、20 區、1 區)、等級(例如,1 級、2 級、3 級)、產品類型(例如,感測器、檢測器、開關)、最終用戶(例如,石油天然氣、採礦、電力和公共產業、化學和石化、加工和製造)以及地區進行細分。市場預測以美元價值 (USD) 為單位。

區域分析

預計到2025年,北美地區將佔霍尼韋爾總收入的38.20%,這主要得益於美國職業安全與健康管理局 (OSHA) 和美國消防協會 (NFPA) 的相關法規支持頁岩盆地、墨西哥灣沿岸煉油廠和地下礦山持續推進現代化改造。Honeywell在2024年進行了重組,將其感測和安全技術合併為一個自動化部門,這表明這家領先的供應商正致力於提供一套軟硬體一體化的解決方案,以滿足安全性和生產力的雙重需求。此外,美國營運商也主導部署本質安全型LTE/5G閘道器,以應對勞動力短缺問題。

預計到2031年,亞太地區將以8.55%的複合年成長率實現最快成長,主要得益於中國新建煉油廠、印度石化產業擴張以及澳洲大規模銅鋰礦開採。各國政府正將出口許可證與IEC或ATEX合規性掛鉤,鼓勵本地製造商取得認證組件。中國自動化供應商正與歐洲測試機構合作,縮短認證週期,從而擴大區域供應商生態系統,並刺激本質安全設備市場的發展。歐洲現有大規模設施均符合ATEX指令,預計到2027年將強制實施EN IEC 60079-11:2024標準,這將加速設備更新換代。德國在先進化工聯合體領域主導,這些聯合體整合了跨境區域感測器網路,以滿足排放目標。英國和挪威繼續投資於符合北海過渡管理局製定的本質安全和網路安全法規的近海設備。在其他地區,中東國家石油公司 (NOC) 在大型天然氣計劃中推出本質安全型 SCADA 系統升級等區域趨勢,以及巴西糖廠和乙醇蒸餾廠從防爆電機轉向本質安全型變頻驅動裝置以降低能源消耗等趨勢,共同支撐了強勁的全球需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的全球防爆安全法規

- 工業4.0推動了對IS感測器和測量設備的需求。

- 不斷擴大的石油、天然氣和採礦活動

- 從 Ex d 架構遷移到 Ex i 架構以降低防爆成本

- 用於遠端和預測性維護的無線資訊系統模組的成長

- 印刷式超低功耗感測器陣列開闢了維修市場

- 市場限制

- 高昂的認證成本和複雜的設計

- 不同地區的核准時間不同

- IS認證電子元件短缺

- 資訊系統無線設備的網路安全措施成本不斷上升

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按區域

- 0區

- 20區

- 1區

- 21區

- 2區

- 22區

- 按班級

- 一年級

- 二年級

- 三年級

- 依產品類型

- 感應器

- 檢測器

- 轉變

- 發送器

- 隔離器和屏障

- LED指示燈

- 其他類型

- 最終用戶

- 石油和天然氣

- 礦業

- 電力/公共產業

- 化工和石油化工

- 加工/製造

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Pepperl+Fuchs SE

- Honeywell International Inc.

- ABB Ltd.

- Siemens AG

- Eaton Corporation plc

- Schneider Electric SE

- R. Stahl AG

- BARTEC Top Holding GmbH

- Emerson Electric Co.

- Rockwell Automation Inc.

- MSA Safety Inc.

- Dragerwerk AG and Co. KGaA

- OMEGA Engineering(Spectris plc)

- Fluke Corporation(Fortive)

- Banner Engineering Corp.

- Extronics Ltd.

- CorDEX Instruments Ltd.

- Bayco Products Inc.

- Kyland Technology Co. Ltd.

- Georgin SAS

- ABB Measurement and Analytics(added sub-brand)

- Teledyne FLIR LLC

- PATLITE Corp.

- GM International srl

- RAE Systems by Honeywell

第7章 市場機會與未來展望

The intrinsically safe equipment market was valued at USD 3.88 billion in 2025 and estimated to grow from USD 4.16 billion in 2026 to reach USD 5.86 billion by 2031, at a CAGR of 7.12% during the forecast period (2026-2031).

This expansion traces a shift from heavy flameproof housings toward digitally enabled, intrinsically safe architectures that blend regulatory compliance with Industry 4.0 connectivity. Demand accelerates as global standards tighten, mining and process industries expand, and wireless modules unlock retrofit projects once deemed uneconomic. Oil and gas operators remain the anchor customers, yet discrete manufacturers now adopt certified automation as volatile solvents enter production lines. Companies that master both certification and cybersecurity capture the most value as facility owners weigh lifecycle costs, supply-chain certainty, and predictive-maintenance capabilities when specifying new systems.

Global Intrinsically Safe Equipment (IS Equipment) Market Trends and Insights

Stringent Global Explosion-Safety Regulations

IEC 60079-11 Edition 7, released in January 2024, introduced 173 technical amendments, including tougher battery tests and a ban on catalytic sensors in Group IIC service, compelling retrofit spending across existing installations. EN IEC 60079-11:2024 entered the Official Journal in December 2024, and the prior 2012 edition will be de-harmonized by December 2027, which fixes a clear window for mandatory upgrades. Multinational plants juggle ATEX and IECEx paperwork that still lacks synchronized submission schedules despite technical alignment. The regulation also broadens scope beyond equipment to cover field wiring under IEC 60079-14:2024, stimulating demand for certified installation and recertification services. Together these actions boost the intrinsically safe equipment market as operators replace non-compliant assets and lock in long-term maintenance contracts tied to the new rules.

Industry 4.0-Driven Demand for IS Sensors and Instrumentation

Digital transformation raises the need for real-time data from hazardous zones, positioning intrinsically safe sensors as frontline enablers. Ethernet-APL now carries power and data on a single twisted pair up to 1 km, letting plant owners place smart instruments in Zone 1 and Zone 2 with no performance trade-off. Wireless nodes reduce cabling costs and simplify retrofits, as shown by SmartPower modules that support multi-year battery life in harsh areas. Underground mines adopt these devices to stream gas levels and equipment health to surface operations centers, shifting safety from periodic checks to continuous oversight. The same architecture underpins predictive maintenance, where edge analytics detect abnormal vibrations and flag service needs before breakdowns occur. Facility owners thus gain both compliance assurance and productivity improvements, accelerating purchases across Asia-Pacific and the Gulf Cooperation Council states.

High Certification Cost and Design Complexity

Gaining ATEX approval can cost EUR 15,000-50,000 per variant, and IECEx tests add USD 20,000-60,000, sums that push smaller firms out of contention. Edition 7 rule changes require additional battery stress, spark ignition, and component spacing tests, often driving multiple design revisions. Firms must also maintain ISO 9001 and QA audits to keep certificates active, embedding recurring overhead into each product line. The expense skews competition toward multinationals with in-house labs and dedicated compliance teams, concentrating intellectual property and deterring fresh entrants. Emerging-market suppliers struggle the most, as local labs lack throughput, forcing overseas testing that lengthens lead times and inflates budgets.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Oil and Gas and Mining Activities

- Cost-Saving Shift from Ex d to Ex i Architectures

- Shortage of Certified IS-Grade Electronic Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Zone 1 applications commanded 38.15% of the intrinsically safe equipment market share in 2025, underscoring their ubiquity in refineries and chemical plants where explosive atmospheres arise during maintenance. Zone 1 spending remains steady as operators blend legacy wiring with new IoT-ready devices that streamline predictive maintenance. In contrast, Zone 0 displays a 8.31% CAGR as printed sensors and wireless hubs finally make real-time monitoring feasible where flammable gases persist continuously. This uptick signals a philosophical shift from isolation toward active risk mitigation, especially in subsea wells and pharmaceutical reactors where downtime costs outweigh device premiums. Zone 2 retains relevance for loading docks and warehouses needing inexpensive compliance solutions, while dust Zones 20-22 gain modest traction in food and pharma sites investing in automation. Suppliers now build modular boards that meet multiple zone requirements via firmware toggles and fuse changes, compressing development cycles and inventory.

Wireless gateways certified for Zone 1 now talk to safe-area historians over single-pair Ethernet. The broader intrinsically safe equipment market therefore enjoys expanded addressable endpoints without extra cable trays. Integrators value such gateways because they reduce engineer-hours on complex barrier calculations. As standards bodies refine guidance for multi-gas, multi-dust areas, zone-crossing architectures will cement themselves as design best practices, ensuring continued double-digit shipments into Zone 0 even after the current retrofit surge subsides.

Class 1 systems focused on gas and vapor hazards held 62.10% of 2025 revenue and are forecast to grow at a 8.76% CAGR through 2031 as methane detection, hydrogen leak monitoring, and LNG handling drive sensor upgrades. Operators retrofit pipelines with optical gas-imaging cameras linked to intrinsically safe edge boxes that perform AI-based leak quantification on site, slashing remediation time. Class 2 dust equipment finds new purchasers in biomass power plants and additive-manufacturing shops, where fine powders present ignition risks previously overlooked. The intrinsically safe equipment market size for Class 2 is projected to expand modestly as more countries adopt NFPA 652-style regulations.

Class 3 applications remain niche, serving textiles and woodworking, yet demand holds steady thanks to rising automation of cutting lines that create airborne fibers. Suppliers aim to reuse Class 1 designs by replacing gaskets and adding dust filters, saving test costs. Ethernet-APL especially benefits Class 1 because gas groups allow higher permissible power than dust, simplifying switch deployment. This compatibility further entrenches Class 1 as the proving ground for new intrinsically safe networking concepts that later trickle to dust and fiber sectors.

The Intrinsically Safe Equipment Report is Segmented by Zone (Zone 0, Zone 20, Zone 1, and More), Class (Class 1, Class 2, and Class 3), Product Type (Sensors, Detectors, Switches, and More), End User (Oil and Gas, Mining, Power and Utilities, Chemical and Petrochemical, Processing and Manufacturing, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 38.20% of 2025 revenue as OSHA and NFPA rules anchored continuous modernization across shale basins, Gulf Coast refineries, and underground mines. Honeywell's 2024 reorganization consolidated sensing and safety technologies into a single automation division, signaling that major suppliers aim to deliver unified hardware-software stacks that meet both safety and productivity needs. U.S. operators also lead in adopting intrinsically safe LTE/5G gateways, seeing the technology as a hedge against workforce shortages.

Asia-Pacific posts the fastest 8.55% CAGR through 2031, fueled by new refinery builds in China, petrochemical expansion in India, and large-scale copper and lithium mining in Australia. Governments link export licenses to IEC or ATEX compliance, steering local manufacturers toward certified components. Chinese automation vendors collaborate with European test houses to shorten certification schedules, enlarging the regional supplier ecosystem and boosting the intrinsically safe equipment market. Europe retains a sizable installed base under the ATEX directive, and EN IEC 60079-11:2024 will likely become mandatory by 2027, driving accelerated replacements. Germany leads in advanced chemical complexes, integrating Zone-crossing sensor networks to achieve emissions targets. The United Kingdom and Norway continue to invest in offshore intervention equipment that meets both intrinsic safety and cybersecurity rules dictated by the North Sea Transition Authority. Elsewhere, Middle East NOCs deploy intrinsically safe SCADA upgrades across large gas projects, while Brazilian sugar-ethanol distilleries switch from explosionproof motors to intrinsically safe variable-frequency drives that cut energy use. Collectively these regional narratives sustain robust global demand.

- Pepperl + Fuchs SE

- Honeywell International Inc.

- ABB Ltd.

- Siemens AG

- Eaton Corporation plc

- Schneider Electric SE

- R. Stahl AG

- BARTEC Top Holding GmbH

- Emerson Electric Co.

- Rockwell Automation Inc.

- MSA Safety Inc.

- Dragerwerk AG and Co. KGaA

- OMEGA Engineering (Spectris plc)

- Fluke Corporation (Fortive)

- Banner Engineering Corp.

- Extronics Ltd.

- CorDEX Instruments Ltd.

- Bayco Products Inc.

- Kyland Technology Co. Ltd.

- Georgin SAS

- ABB Measurement and Analytics (added sub-brand)

- Teledyne FLIR LLC

- PATLITE Corp.

- G.M. International srl

- RAE Systems by Honeywell

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent global explosion-safety regulations

- 4.2.2 Industry 4.0-driven demand for IS sensors and instrumentation

- 4.2.3 Expansion of oil and gas and mining activities

- 4.2.4 Cost-saving shift from Ex d to Ex i architectures

- 4.2.5 Growth of wireless IS modules for remote, predictive maintenance

- 4.2.6 Printed, ultra-low-power sensor arrays unlocking retrofit markets

- 4.3 Market Restraints

- 4.3.1 High certification cost and design complexity

- 4.3.2 Fragmented approval timelines across regions

- 4.3.3 Shortage of certified IS-grade electronic components

- 4.3.4 Rising cybersecurity-compliance cost for IS wireless devices

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Zone

- 5.1.1 Zone 0

- 5.1.2 Zone 20

- 5.1.3 Zone 1

- 5.1.4 Zone 21

- 5.1.5 Zone 2

- 5.1.6 Zone 22

- 5.2 By Class

- 5.2.1 Class 1

- 5.2.2 Class 2

- 5.2.3 Class 3

- 5.3 By Product Type

- 5.3.1 Sensors

- 5.3.2 Detectors

- 5.3.3 Switches

- 5.3.4 Transmitters

- 5.3.5 Isolators and Barriers

- 5.3.6 LED Indicators

- 5.3.7 Other Types

- 5.4 By End User

- 5.4.1 Oil and Gas

- 5.4.2 Mining

- 5.4.3 Power and Utilities

- 5.4.4 Chemical and Petrochemical

- 5.4.5 Processing and Manufacturing

- 5.4.6 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Pepperl + Fuchs SE

- 6.4.2 Honeywell International Inc.

- 6.4.3 ABB Ltd.

- 6.4.4 Siemens AG

- 6.4.5 Eaton Corporation plc

- 6.4.6 Schneider Electric SE

- 6.4.7 R. Stahl AG

- 6.4.8 BARTEC Top Holding GmbH

- 6.4.9 Emerson Electric Co.

- 6.4.10 Rockwell Automation Inc.

- 6.4.11 MSA Safety Inc.

- 6.4.12 Dragerwerk AG and Co. KGaA

- 6.4.13 OMEGA Engineering (Spectris plc)

- 6.4.14 Fluke Corporation (Fortive)

- 6.4.15 Banner Engineering Corp.

- 6.4.16 Extronics Ltd.

- 6.4.17 CorDEX Instruments Ltd.

- 6.4.18 Bayco Products Inc.

- 6.4.19 Kyland Technology Co. Ltd.

- 6.4.20 Georgin SAS

- 6.4.21 ABB Measurement and Analytics (added sub-brand)

- 6.4.22 Teledyne FLIR LLC

- 6.4.23 PATLITE Corp.

- 6.4.24 G.M. International srl

- 6.4.25 RAE Systems by Honeywell

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment