|

市場調查報告書

商品編碼

1906950

馬來西亞塑膠產業:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Malaysia Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

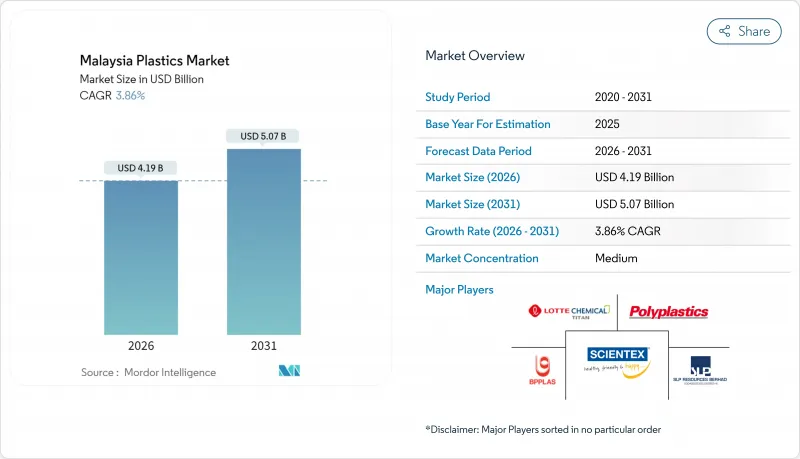

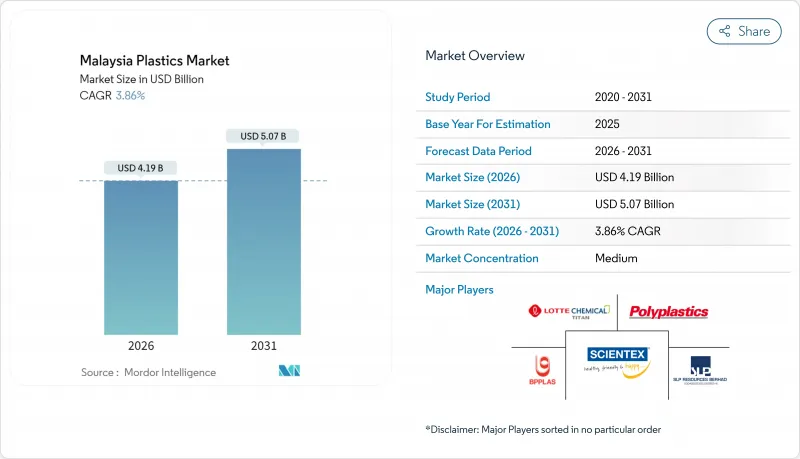

預計到2026年,馬來西亞塑膠市場規模將達到41.9億美元,高於2025年的40.4億美元。預計到2031年,該市場規模將達到50.7億美元,2026年至2031年的複合年成長率為3.86%。

馬來西亞作為區域石化原料供應中心和下游製造地,為東南亞電子、汽車和包裝價值鏈提供原料,其雙重角色支撐著馬來西亞石化產業的穩定擴張。馬來西亞國家石油公司(Petronas)的綜合工廠、雪蘭莪州、柔佛州和檳城州的出口導向製造群以及政府對下游石化行業的主導獎勵,共同增強了供應安全性和成本競爭力。此外,全球品牌對再生材料和生物基材料的需求、馬來西亞的零一次性塑膠藍圖以及為解決技能短缺問題而對自動化加工的投資,都推動了成長動能。同時,環境法規和原料價格波動限制了利潤率,促使企業轉向高附加價值應用領域,例如特殊等級產品和精密成型產品,這些產品可以獲得更高的溢價。

馬來西亞塑膠市場趨勢與洞察

食品和飲料包裝行業的需求不斷成長

食品飲料製造商依賴塑膠阻隔薄膜和多層結構來滿足出口市場的高食品安全標準。馬來西亞國家石油公司(PETRONAS)決定在其彭朗綜合設施內建造生物煉製廠,預示著本地生物基包裝樹脂供應即將到來。馬來西亞出口食品貿易中廣泛適用的清真認證法規要求使用特殊包裝,以確保產品在長途運輸過程中保持完整性。都市區收入水準的提高以及消費者對即食產品的日益偏好,推動了便捷包裝需求的成長。因此,為立式袋、殺菌袋和PET飲料瓶提供包裝的加工商,能夠獲得與產品性能和永續性認證相關的高額利潤。

不斷發展的電子製造生態系統

馬來西亞的國家半導體策略正吸引英飛凌等全球企業的新投資,推動後端封裝、測試和積體電路設計活動的擴張。用於5G基礎設施和電動車的半導體模組擴大採用具有高熱穩定性和阻燃性的工程塑膠。因此,在檳城峇六拜和居林高科技園區,微米級精準度的射出成型線正快速普及。自動化視覺檢測和閉合迴路成型系統使製造商能夠在滿足嚴格的缺陷率要求的同時,解決當地精密聚合物加工技術工人短缺的問題。

環境問題和一次性產品的禁令

馬來西亞的《2025-2030年零一次性塑膠藍圖》逐步限制一次性塑膠袋、吸管和發泡聚苯乙烯餐具的使用。 2025年7月收緊的塑膠廢料進口限制雖然切斷了一個低成本的原料來源,但也提高了公眾對家庭廢棄物的認知。無法轉型使用可回收或可堆肥產品的加工商將面臨吉隆坡大都會區、新山和喬治市更高的消費稅和更嚴格的執法。同時,擁有可堆肥薄膜生產線和可重複使用餐飲服務模式的公司正抓住機遇,轉型使用符合規定的替代方案。

細分市場分析

到2025年,聚乙烯和聚丙烯等傳統聚合物仍將佔據馬來西亞塑膠市場78.84%的佔有率,這主要得益於邊佳蘭一體化裂解聚合物生產線,該生產線支持低成本生產。同時,受可堆肥包裝品牌目標和馬來西亞禁止一次性產品的措辭推動,生物分解性塑膠預計將以4.86%的複合年成長率實現最快成長。用於電絕緣材料和汽車引擎艙蓋下部件的工程樹脂實現了適度的個位數成長,這主要得益於進口半成品化合物經本地重新配製後用於本地加工。

馬來西亞塑膠市場的生產商利用現有的從裂解到成膜的物流網路供應大眾市場應用,但不斷上漲的生產者延伸責任(EPR)附加稅正給利潤率帶來壓力。柔佛州一家綜合設施計劃建設的生物煉製廠將提供化石基PET和PE的替代品,使當地加工商能夠在出口競標中獲得高級回收積分。馬來西亞塑膠產業的特殊複合材料生產商透過提供阻燃、玻璃纖維增強和無鹵等級的產品(特別是用於智慧型裝置連接器的產品)而獲得溢價。材料科學領域日益成長的技能缺口凸顯了技術服務團隊的價值,這些團隊能夠對用於食品接觸應用和電子元件認證的新型生物基材料進行鑑定。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 食品和飲料包裝行業的需求不斷成長

- 不斷發展的電子製造生態系統

- 政府對下游石化產業的激勵措施

- 全球品牌對循環經濟的承諾

- 擴大醫療設備叢集

- 市場限制

- 環境問題和一次性產品的禁令

- 原物料價格波動

- 先進聚合物加工技能短缺

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格趨勢分析

- 進出口

第5章 市場規模與成長預測

- 按類型

- 傳統塑膠

- 工程塑膠

- 生質塑膠

- 透過技術

- 吹塑成型

- 擠出成型

- 射出成型

- 其他技術

- 透過使用

- 包裝

- 電氣和電子設備

- 建築/施工

- 汽車/運輸設備

- 家居用品

- 家具和床上用品

- 其他用途

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Behn Meyer

- BP Plastics Holding Bhd

- Commercial Plastic Industries Sdn Bhd

- CYL Corporation

- Ee-Lian Enterprise(M)Sdn. Bhd.

- Fu Fong Plastic Industries Sdn Bhd

- Guppy Group

- HICOM-Teck See

- Lam Seng Plastics Industries Sdn Bhd

- LOTTE CHEMICAL TITAN HOLDING BERHAD.

- Malayan Electro-Chemical Industry Co. Sdn Bhd

- Meditop International

- Megafoam Containers Enterprise Sdn Bhd(MEGAFOAM)

- Metro Plastic Manufacturer Sdn. Bhd.

- Polyplastics Co., Ltd.

- Sanko Plastics(M)Sdn Bhd

- Scientex Berhad

- SLP RESOURCES BERHAD

- Teck See Plastic Sdn Bhd(TSP)

- TORAY INDUSTRIES, INC.

第7章 市場機會與未來展望

The Malaysia Plastics Market size in 2026 is estimated at USD 4.19 billion, growing from 2025 value of USD 4.04 billion with 2031 projections showing USD 5.07 billion, growing at 3.86% CAGR over 2026-2031.

This steady expansion is anchored by Malaysia's dual role as a regional petrochemical feedstock hub and a downstream manufacturing base that supplies the electronics, automotive, and packaging value chains across Southeast Asia. Stable feedstock from PETRONAS's integrated complexes, export-oriented manufacturing clusters in Selangor, Johor, and Penang, and policy-driven incentives for downstream petro-chemicals together reinforce supply security and cost competitiveness. Momentum is further supported by global brands demanding recycled or bio-based content, Malaysia's zero single-use plastics roadmap, and investments in automated processing that counter skills shortages. Meanwhile, environmental regulation and feedstock price volatility continue to temper margins but also catalyze upgrades into higher-value applications where specialty grades and precision molding command premium pricing.

Malaysia Plastics Market Trends and Insights

Rising Demand From Food and Beverage Packaging

Food and beverage manufacturers rely on plastic barrier films and multilayer structures to meet higher food-safety standards in export markets. PETRONAS's decision to embed a biorefinery inside the Pengerang Integrated Complex signals an upcoming local supply of bio-based packaging resins. Halal certification rules, prevalent in Malaysia's export food trade, necessitate specialized packaging that maintains product integrity during long transit times. Rising urban income levels and a preference for ready-to-eat formats amplify the consumption of convenience packaging. As a result, converters supplying stand-up pouches, retort pouches, and PET beverage bottles are securing premium margins tied to performance and sustainability credentials.

Growth of Electronics Manufacturing Ecosystem

Malaysia's National Semiconductor Strategy has attracted fresh investments from global players such as Infineon to expand back-end packaging, testing, and IC design activities. Semiconductor modules for 5G infrastructure and electric vehicles increasingly specify engineering plastics with high thermal stability and flame-retardant performance. Injection molding lines capable of micron-level tolerances are therefore proliferating within Penang's Bayan Lepas and Kulim High-Tech parks. Automated vision inspection and closed-loop molding systems allow manufacturers to meet tight defect-rate requirements while offsetting the local skills gap in precision polymer processing.

Environmental Concerns and Single-Use Bans

Malaysia's 2025-2030 zero single-use plastics roadmap imposes phased restrictions on disposable bags, straws, and EPS foodware. Import controls on plastic scrap, tightened in July 2025, have removed low-cost feedstock streams but improved public perception of domestic waste handling. Converters that cannot pivot to recyclable or compostable formats face higher excise levies and tighter enforcement in Greater Kuala Lumpur, Johor Bahru, and George Town. Conversely, firms with compostable film lines and reusable food-service models are capturing the shift toward regulatory-compliant alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Downstream Petro-Chemicals

- Circular-Economy Commitments by Global Brands

- Feedstock Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traditional polymers such as polyethylene and polypropylene retained 78.84% Malaysia plastics market share in 2025, buoyed by Pengerang's integrated cracker and polymer lines that anchor low-cost output. Bioplastics, however, are forecast to grow fastest at a 4.86% CAGR, aided by brand targets for compostable packaging and the country's single-use ban trajectory. Engineering resins addressing electrical insulation and under-hood automotive parts achieved mid-single-digit growth, supported by imported semifinished compounds rewired for localized finishing.

Producers associated with the Malaysia plastics market leverage existing cracker-to-film logistics to supply high-volume FMCG applications, yet face mounting EPR levies that narrow margins. The upcoming biorefinery within Johor's complex will enable drop-in replacements for fossil-based PET and PE, positioning local converters to claim advanced recycling credit in export tenders. Specialty compounders catering to the Malaysia plastics industry gain premium prices by offering flame-retardant, glass-fiber, and halogen-free grades, particularly for smart-device connectors. A widening skills gap in materials science underscores the value of technical service teams able to qualify new bio-based grades for food-contact and electronic-component certification.

The Malaysia Plastics Market Report is Segmented by Type (Traditional Plastics, Engineering Plastics, and Bioplastics), Technology (Blow Molding, Extrusion, Injection Molding, and Other Technologies), and Application (Packaging, Electrical and Electronics, Building and Construction, Automotive and Transportation, Houseware, Furniture and Bedding, and Other Applications). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Behn Meyer

- BP Plastics Holding Bhd

- Commercial Plastic Industries Sdn Bhd

- CYL Corporation

- Ee-Lian Enterprise (M) Sdn. Bhd.

- Fu Fong Plastic Industries Sdn Bhd

- Guppy Group

- HICOM-Teck See

- Lam Seng Plastics Industries Sdn Bhd

- LOTTE CHEMICAL TITAN HOLDING BERHAD.

- Malayan Electro-Chemical Industry Co. Sdn Bhd

- Meditop International

- Megafoam Containers Enterprise Sdn Bhd (MEGAFOAM)

- Metro Plastic Manufacturer Sdn. Bhd.

- Polyplastics Co., Ltd.

- Sanko Plastics (M) Sdn Bhd

- Scientex Berhad

- SLP RESOURCES BERHAD

- Teck See Plastic Sdn Bhd (TSP)

- TORAY INDUSTRIES, INC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from food and beverage packaging

- 4.2.2 Growth of electronics manufacturing ecosystem

- 4.2.3 Government incentives for downstream petro-chemicals

- 4.2.4 Circular-economy commitments by global brands

- 4.2.5 Expansion of medical-device clusters

- 4.3 Market Restraints

- 4.3.1 Environmental concerns and single-use bans

- 4.3.2 Feed-stock price volatility

- 4.3.3 Skills gap in advanced polymer processing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Price Trend Analysis

- 4.7 Imports and Exports

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Traditional Plastics

- 5.1.2 Engineering Plastics

- 5.1.3 Bioplastics

- 5.2 By Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Houseware

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Behn Meyer

- 6.4.2 BP Plastics Holding Bhd

- 6.4.3 Commercial Plastic Industries Sdn Bhd

- 6.4.4 CYL Corporation

- 6.4.5 Ee-Lian Enterprise (M) Sdn. Bhd.

- 6.4.6 Fu Fong Plastic Industries Sdn Bhd

- 6.4.7 Guppy Group

- 6.4.8 HICOM-Teck See

- 6.4.9 Lam Seng Plastics Industries Sdn Bhd

- 6.4.10 LOTTE CHEMICAL TITAN HOLDING BERHAD.

- 6.4.11 Malayan Electro-Chemical Industry Co. Sdn Bhd

- 6.4.12 Meditop International

- 6.4.13 Megafoam Containers Enterprise Sdn Bhd (MEGAFOAM)

- 6.4.14 Metro Plastic Manufacturer Sdn. Bhd.

- 6.4.15 Polyplastics Co., Ltd.

- 6.4.16 Sanko Plastics (M) Sdn Bhd

- 6.4.17 Scientex Berhad

- 6.4.18 SLP RESOURCES BERHAD

- 6.4.19 Teck See Plastic Sdn Bhd (TSP)

- 6.4.20 TORAY INDUSTRIES, INC.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment