|

市場調查報告書

商品編碼

1906942

液體包裝紙盒:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Liquid Packaging Cartons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

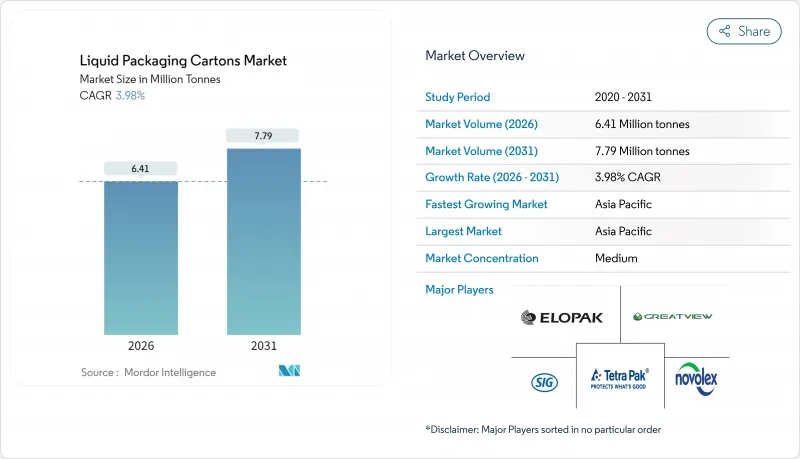

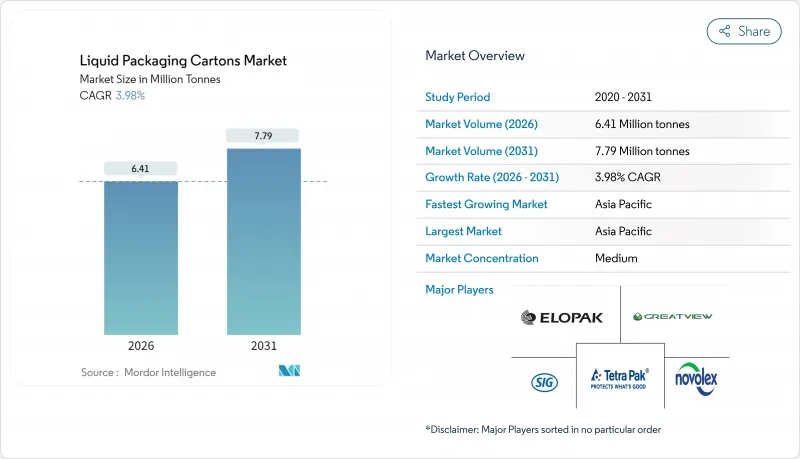

2025 年液體包裝紙盒市場價值為 616 萬噸,預計從 2026 年的 641 萬噸成長到 2031 年的 779 萬噸,在預測期(2026-2031 年)內以 3.98% 的複合年成長率成長。

有利於纖維基材料的監管政策、延長保存期限阻隔技術的創新以及食品零售業的快速數位化,正在推動成熟經濟體和新興經濟體液體包裝紙盒市場的擴張。亞太地區預計將實現最強勁的成長,因為公共營養計劃和不斷變化的食品接觸法規推動了對保存期限長包裝的需求。同時,乳製品和植物性飲料的優質化趨勢正在推動增值紙盒形式的應用。與永續性相關的資金籌措管道也引導資金流向纖維材料創新。隨著現有企業透過大力投資脫碳和回收能力來捍衛市場佔有率,而區域專家則利用本地成本優勢和靈活的打入市場策略,競爭日益激烈。

全球液體包裝紙盒市場趨勢與洞察

新興亞洲地區對超高溫滅菌乳製品的需求

印尼的免費營養計畫預計,該國乳製品消費量將從2024年的420萬噸增加到2025年的530萬噸,從而對無需冷藏且能適應熱帶物流的無菌紙盒產生永續的需求。中國的GB 4806食品接觸標準提高了合規溢價,並賦予獲得認證的紙盒供應商在液體包裝紙盒市場中的定價權。這些因素共同鞏固了亞太地區在價值和銷售成長方面的主導地位,鼓勵跨國公司促進本地生產,並與國內加工商簽訂長期供應協議。中產階級收入的成長進一步加速了家庭對常溫保存乳製品的接受度。這些因素共同推動亞太地區對全球液體包裝紙盒市場的貢獻顯著超過歷史平均值。

電子商務驅動的食品市場成長推動了室溫儲存

預計到2025年,線上食品雜貨市場將佔全球零售市場的61%,這將推動常溫產品的需求,因為常溫產品可以簡化低溫運輸流程並降低配送成本。液體包裝紙盒市場被視為提升電商效率的直接促進者,其中常溫飲料受益最大。零售商正優先考慮可堆疊、輕巧且可回收的纖維基包裝,進一步加速了這項轉型。這些優勢在都市區尤其顯著,因為「最後一公里」的排放和交通堵塞會影響包裝的選擇。

更輕的寶特瓶縮小了碳排放差距

隨著PET材質重量的減輕,紙盒在其整個生命週期中的碳排放優勢正在逐漸消失,在某些飲料應用場景下,從生產到廢棄的碳排放量差距縮小至每1000公升不足20公斤二氧化碳當量。隨著PET回收率的提高,其成本績效也隨之提升,促使對價格敏感的果汁和水品牌繼續使用PET塑膠瓶。因此,紙盒供應商,尤其是在PET生態系統已較成熟的北美和歐盟市場,必須加快阻隔性能創新和回收率提升,以防止消費者轉向其他替代材料。

細分市場分析

截至2025年,牛奶在液體包裝紙盒市場的佔有率將維持在48.30%(約300萬噸)。然而,由於飲食習慣的改變、乳糖不耐受問題的日益突出以及消費者對道德消費行為的日益關注,非乳製品替代飲料預計將以5.42%的複合年成長率成長,到2031年其市場佔有率將擴大至21.80%。燕麥、杏仁和豆奶飲料的液體包裝紙盒市場規模受益於無菌加工技術,這些技術無需添加劑即可保留營養成分。剪切響應均質化和酵素輔助黏度控制等技術改進需要使用性能優異的阻隔材料來抑制氧化造成的風味劣化。因此,加工商正與灌裝商合作,開發兼顧保存期限和成本的客製化產品規格。

營養強化和風味添加的優質配方提升了產品價值,使品牌所有者能夠承擔高成本。在消費習慣根深蒂固的地區,乳製品仍然十分重要,尤其是在政府主導的學生營養計畫實施地區。然而,即使在乳製品領域,消費者對低脂和維生素強化產品的需求也在不斷成長,因此更青睞支持高解析度印刷和包裝故事敘述的紙盒。在預測期內,乳製品和植物性產品的共存預計將擴大液體包裝紙盒市場,而不是蠶食現有市場。

液體包裝紙盒市場報告按液體類型(乳製品、非乳製品、果汁、機能飲料和機能飲料等)、包裝類型(無菌紙盒、山形蓋頂紙盒)、開啟方式(螺旋蓋、吸管孔、拉環)和地區(北美、歐洲、亞太、南美、中東和非洲)進行細分。市場預測以公噸為單位。

區域分析

亞太地區預計到2025年將佔全球出貨量的45.38%(約280萬噸),並預計到2031年將超過395萬噸,年複合成長率達5.92%。這一成長主要得益於印尼覆蓋8,200萬受益者的學校供餐舉措,以及中國因監管標準加強而優先選擇符合標準的紙盒供應商。東南亞地區日益加速的都市化進程也推動了人們對即飲飲料的需求,進而帶動了對拉環包裝和小包裝無菌包裝的需求。

北美市場已趨於成熟,但在高附加價值領域佔據主導地位。隨著植物奶日益普及,預計市場將持續成長;同時,更嚴格的生產者責任延伸(EPR)法規也推動了國內回收生產線的投資。歐洲市場需求穩定,這得益於糖稅改革帶來的產品改進以及優先使用纖維材料而非PET的ESG融資。然而,由於市場迅速轉向更輕的PET容器,液體紙盒在折扣自有品牌果汁市場正逐漸失去市場佔有率。

在拉丁美洲,乳製品強化計畫和不斷壯大的中產階級的購買力正在推動市場成長,但貨幣波動和供應鏈脆弱性限制了近期的成長。中東和非洲地區正經歷緩慢但穩定的成長,常溫包裝有助於在冷藏成本仍然較高的地區獲得乳製品。地域多角化有助於全球液體紙盒市場減輕區域衝擊的影響,為跨洲均衡擴張奠定基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新興亞洲對超高溫滅菌乳製品的需求

- 電子商務生鮮銷售的成長推動了常溫保存期限的延長

- 與環境、社會及公司治理(ESG)相關的融資有利於紡織包裝產業。

- 糖稅推動產品改進,促進果汁盒裝產品的普及。

- 纖維素基阻隔技術的創新減少了聚合物層

- 乳製品和植物來源產品領域高附加價值品牌的崛起,正在推動高價值紙盒包裝的需求。

- 市場限制

- 透過減輕寶特瓶的重量來縮小碳排放差距

- 缺乏無菌回收基礎設施

- 紙漿短缺導致液態紙板價格波動

- 隨著全球監管日益嚴格,遵守標籤和食品接觸法規的成本也不斷上升。

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按液體類型

- 乳製品

- 植物奶

- 汁

- 機能飲料和機能飲料

- 其他液體類型

- 按包裝類型

- 無菌紙盒

- 蓋布爾頂紙箱

- 按建立格式

- 螺帽

- 吸管孔

- 拉環

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 印尼

- 泰國

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Tetra Pak International SA

- SIG Group AG

- Pactiv Evergreen Inc.(Novolex)

- Elopak AS

- Greatview Aseptic Packaging Co. Ltd

- Nippon Paper Industries Co. Ltd

- UFlex Limited(ASEPTO)

- IPI Srl(Coesia)

- Lami Packaging(Kunshan)Co. Ltd

- Visy Industries

- Klabin SA

- Obeikan Industrial Investment Group

- Nampak Ltd

- Italpack Srl

- Parksons Packaging Ltd

- Shandong Bihai Packaging Materials Co. Ltd

- Southern Packaging Group Ltd

第7章 市場機會與未來展望

The liquid packaging cartons market was valued at 6.16 million tonnes in 2025 and estimated to grow from 6.41 million tonnes in 2026 to reach 7.79 million tonnes by 2031, at a CAGR of 3.98% during the forecast period (2026-2031).

Regulatory momentum favoring fiber-based materials, barrier-technology breakthroughs that prolong shelf life, and the rapid digitization of grocery retail are enlarging the liquid packaging cartons market footprint across both mature and emerging economies. Asia-Pacific delivers the strongest uplift as public nutrition programs and evolving food-contact rules deepen demand for ambient-stable packs. Simultaneously, premiumization trends in dairy and plant-based beverages advance the adoption of value-added carton formats, while sustainability-linked financing channels funnel capital toward fiber innovations. Competitive intensity is mounting as incumbents invest heavily in decarbonization and recycling capacity to defend share against regional specialists that exploit local cost advantages and agile market entry strategies.

Global Liquid Packaging Cartons Market Trends and Insights

UHT Dairy Demand in Emerging Asia

Indonesia's Free Nutritious Meals Program pushes the nation's dairy intake from 4.2 million tonnes in 2024 to 5.3 million tonnes in 2025, generating sustained uptake of aseptic cartons that tolerate tropical logistics without refrigeration. China's GB 4806 food-contact rules elevate compliance premiums, granting certified carton suppliers pricing power within the liquid packaging cartons market. These forces reinforce the region's leadership in value and volume growth, encouraging multinationals to localize production and forge long-term supply contracts with domestic processors. Rising middle-class incomes further spur household penetration of shelf-stable dairy. Collectively, these factors lift Asia-Pacific's contribution to the global liquid packaging cartons market well above historic averages.

E-commerce Grocery Growth Pushing Ambient Formats

Online grocery is forecast to control 61% of global retail by 2025, channeling demand toward ambient products that remove cold-chain complexity and lessen fulfillment costs. Ambient-stable beverages benefit most, positioning the liquid packaging cartons market as a direct enabler of e-commerce efficiency. Retailers prioritize fiber-based packs that are stackable, lightweight, and recyclable, further reinforcing the shift. These advantages resonate strongly in urban zones where last-mile emissions and congestion drive packaging choices.

PET Bottle Lightweighting Narrowing Carbon Gap

Lightweight PET advances erode cartons' life-cycle carbon lead, with cradle-to-grave differentials contracting under 20 kg CO2e per 1,000 litres in some beverage use cases.As PET incorporates higher recycled content, cost-performance ratios improve, tempting price-sensitive juice and water brands to retain polymer bottles. Carton suppliers must therefore accelerate barrier innovation and recycling rates to prevent substitution, especially in North American and EU markets where PET ecosystems are already well capitalized.

Other drivers and restraints analyzed in the detailed report include:

- Cellulose-Based Barrier Breakthroughs Cutting Polymer Layers

- Brand Premiumization in Dairy and Plant-Based Segments Boosting Value-Added Carton Formats

- Volatile Liquid Board Prices Tied to Pulp Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dairy milk retained 48.30% share of the liquid packaging cartons market in 2025, translating to nearly 3 million tonnes. Non-dairy alternatives, however, outpaced with a 5.42% CAGR that will lift their contribution to 21.80% by 2031, propelled by dietary shifts, lactose-free preferences, and ethical purchasing drivers. The liquid packaging cartons market size for oat, almond, and soy beverages benefits from aseptic processing that preserves nutrients without additives. Technical adaptations, such as shear-sensitive homogenization and enzyme-assisted viscosity control, demand robust barrier materials to curb oxidative flavor degradation. Consequently, converters collaborate with fillers on customized specifications that balance shelf life and cost.

Premium formulations with fortification or added flavors increase product value, allowing brand owners to absorb higher carton costs. Dairy milk remains vital in regions with established consumption patterns, especially where government initiatives bolster student nutrition. Yet even within dairy, value migrates toward low-fat, vitamin-enriched products that favor cartons capable of high-graphic print for on-pack storytelling. Over the forecast horizon, the co-existence of dairy and plant-based categories broadens the addressable liquid packaging cartons market rather than cannibalizing volume.

The Liquid Packaging Cartons Market Report is Segmented by Liquid Type (Dairy-Based Milk, Non-Dairy Milk, Juices, Energy and Functional Drinks, and More), Packaging Type (Aseptic Cartons, and Gable Top Cartons), Opening Format (Screw Cap, Straw Hole, and Pull Tab), and Geography (North America, Europe, Asia Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Volume (Tonnes).

Geography Analysis

Asia-Pacific accounted for 45.38% of 2025 shipments, roughly 2.8 million tonnes, and its 5.92% CAGR positions the region to exceed 3.95 million tonnes by 2031. Expansion is driven by Indonesia's school meal initiative serving 82 million beneficiaries and China's elevated regulatory standards that reward compliant carton suppliers.Southeast Asian urbanization accelerates on-the-go beverage demand, boosting pull tab and small-format aseptic packs.

North America trails with a mature but high-value presence. Incremental growth aligns with plant-based milk adoption, while tightening EPR regulations spur investment in domestic recycling lines. European demand remains steady, underpinned by sugar-tax reformulation and ESG financing that favor fiber over PET. However, aggressive PET lightweighting erodes the liquid packaging cartons market share in discounted private-label juices.

Latin America benefits from dairy fortification programs and expanding middle-class purchasing power, yet currency volatility and supply-chain fragility curb immediate upside. The Middle East and Africa register modest but steady gains as ambient-stable packaging supports dairy access in climates where refrigeration costs remain prohibitive. Collectively, geography diversification cushions the global liquid packaging cartons market against regional shocks and positions the industry for balanced, multi-continent expansion.

- Tetra Pak International SA

- SIG Group AG

- Pactiv Evergreen Inc. (Novolex)

- Elopak AS

- Greatview Aseptic Packaging Co. Ltd

- Nippon Paper Industries Co. Ltd

- UFlex Limited (ASEPTO)

- IPI Srl (Coesia)

- Lami Packaging (Kunshan) Co. Ltd

- Visy Industries

- Klabin SA

- Obeikan Industrial Investment Group

- Nampak Ltd

- Italpack Srl

- Parksons Packaging Ltd

- Shandong Bihai Packaging Materials Co. Ltd

- Southern Packaging Group Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 UHT dairy demand in emerging Asia

- 4.2.2 E-commerce grocery growth pushing ambient formats

- 4.2.3 ESG-linked financing favouring fibre-based packs

- 4.2.4 Sugar-tax led reformulations increasing juice carton adoption

- 4.2.5 Cellulose-based barrier breakthroughs cutting polymer layers

- 4.2.6 Brand premiumisation in dairy and plant-based segments boosting value-added carton formats

- 4.3 Market Restraints

- 4.3.1 PET bottle lightweighting narrowing carbon gap

- 4.3.2 Aseptic recycling infrastructure deficits

- 4.3.3 Volatile liquid board prices tied to pulp shortages

- 4.3.4 Labelling and food-contact compliance costs rising with stricter global regulations

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of Substitutes

- 4.7.4 Threat of New Entrants

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VOLUME)

- 5.1 By Liquid Type

- 5.1.1 Dairy-based Milk

- 5.1.2 Non-dairy Milk

- 5.1.3 Juices

- 5.1.4 Energy and Functional Drinks

- 5.1.5 Other Liquid Types

- 5.2 By Packaging Type

- 5.2.1 Aseptic Cartons

- 5.2.2 Gable Top Cartons

- 5.3 By Opening Format

- 5.3.1 Screw Cap

- 5.3.2 Straw Hole

- 5.3.3 Pull Tab

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 Australia and New Zealand

- 5.4.4.5 Indonesia

- 5.4.4.6 Thailand

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 United Arab Emirates

- 5.4.5.1.2 Saudi Arabia

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Tetra Pak International SA

- 6.4.2 SIG Group AG

- 6.4.3 Pactiv Evergreen Inc. (Novolex)

- 6.4.4 Elopak AS

- 6.4.5 Greatview Aseptic Packaging Co. Ltd

- 6.4.6 Nippon Paper Industries Co. Ltd

- 6.4.7 UFlex Limited (ASEPTO)

- 6.4.8 IPI Srl (Coesia)

- 6.4.9 Lami Packaging (Kunshan) Co. Ltd

- 6.4.10 Visy Industries

- 6.4.11 Klabin SA

- 6.4.12 Obeikan Industrial Investment Group

- 6.4.13 Nampak Ltd

- 6.4.14 Italpack Srl

- 6.4.15 Parksons Packaging Ltd

- 6.4.16 Shandong Bihai Packaging Materials Co. Ltd

- 6.4.17 Southern Packaging Group Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment