|

市場調查報告書

商品編碼

1906941

鄰苯二甲酐:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Phthalic Anhydride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

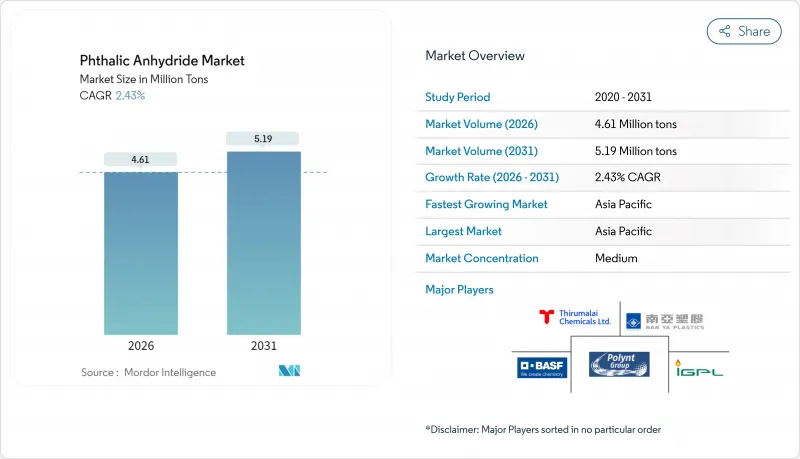

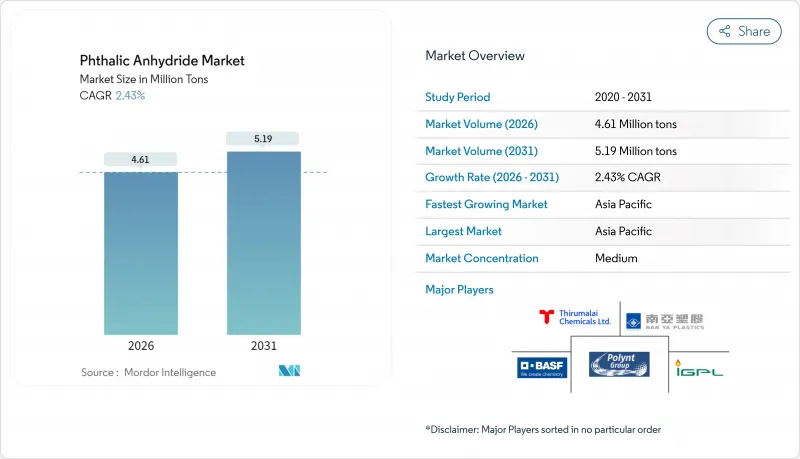

預計到 2026 年,鄰苯二甲酐市場規模將達到 461 萬噸,高於 2025 年的 450 萬噸。預計到 2031 年,市場規模將達到 519 萬噸,2026 年至 2031 年的複合年成長率為 2.43%。

這一轉型標誌著一個成熟階段,穩定的下游消費與日益嚴格的監管審查以及生物基替代品的逐步興起之間實現了平衡。需求韌性源自於建築相關的PVC應用、風力發電複合複合材料使用量的增加以及電動車的特殊需求。同時,原料價格波動,尤其是鄰二甲苯的價格波動,仍影響生產經濟效益,而亞洲產能的成長也持續擠壓著全球利潤率。因此,競爭策略的核心在於一體化生產、原料柔軟性以及加速研發毒性較低的化學品。

全球鄰苯二甲酐市場趨勢及洞察

亞太地區對PVC建築材料的需求激增

中國、印度、印尼和越南的建設活動持續推動PVC消費強勁成長,進而提振了對鄰苯二甲酸二辛酯及相關酯類塑化劑的需求。中國沿海一體化石化產業集群提供成本效益高的原料供應和下游加工叢集,但持續的供應過剩導致2024年全國平均運轉率僅57%。印度生產商,特別是IG Petrochemicals和Thirumalai Chemicals,正在擴大產能以應對國內供不應求和新的出口機會。預計中國2024年將出口約13.1萬噸鄰鄰苯二甲酐,印證了該地區深厚的貿易聯繫。 ISO 14001環境標準的逐步加強正促使生產商投資於餘熱回收和低氮氧化物燃燒器,以維持社會認可。

擴大不飽和聚酯樹脂(UPE)在風力發電機葉片的應用

2024年至2025年間風電裝置容量的激增帶動了對用於玻璃纖維葉片的不飽和聚酯樹脂的需求。歐洲的回收示範試驗表明,在水泥窯中對廢舊葉片進行共處理,既能提供熱能,又能回收礦物成分用於水泥熟料生產。這些舉措可望減少預計在2050年累積的4,300萬噸葉片廢棄物,並維持對下一代風力渦輪機新型樹脂的需求。由於鄰鄰苯二甲酐基樹脂系統具有優異的抗疲勞性能,離岸風計劃更傾向於使用此類樹脂。同時,生物基配方的逐步研發主要仍處於試驗階段。國際能源總署(IEA)「淨零排放藍圖」下的政策指引為複合材料原料需求的長期前景提供了支撐。

歐盟和美國基於毒性的鄰苯二甲酸酯法規

美國環保署 (EPA) 於 2025 年完成了對鄰苯二甲酸二異壬酯 (DINP) 和鄰苯二甲酸二異丁酯 (DIDP) 的《有毒物質控制法案》(TSCA)累積評估,指出其在某些噴塗應用中存在不合理的觀點。同時,針對鄰苯二甲酸丁酯 (BBP)、鄰苯二甲酸二(2-乙基己基)酯 (DEHP)、鄰苯二甲酸二丁酯 (DBP) 和鄰苯二甲酸二異丁酯 (DIBP) 的累積評估草案將引入全面的暴露視角,並可能導致更廣泛的監管。在歐盟,歐洲化學品管理局 (ECHA) 的監管需求評估將鄰苯二甲酸酐列為 REACH 法規下的限制候選物質,針對某些商用或消費應用。由於監管、替代測試和工人培訓的合規成本不斷上升,促使軟性聚氯乙烯 (PVC) 混煉商積極檢測 1,2-環己烷二羧酸酯和檸檬酸鹽。雖然中期需求下降僅限於小眾塗料和密封劑領域,但長期的不確定性正在阻礙北美和西歐對新塑化劑線的投資。

細分市場分析

2025年,萘基鄰苯二甲酸酐市場需求佔比高達83.08%,主要得益於中國高密度煤焦油蒸餾網路和成熟的固定台反應器技術。該領域資本支出優勢和供應穩定性使其平均出廠價格比中國當地二甲苯基鄰苯二甲酸酐價格低8-10%。因此,儘管有週期性供應過剩,萘基鄰苯二甲酸酐裝置的運轉率仍能維持在80%左右。同時,受中東和北美地區利用煉油產品進行芳烴一體化生產的推動,預計到2031年,鄰二甲苯基鄰苯二甲酸酐裝置的複合年成長率將達到3.28%,超過整個鄰鄰苯二甲酐市場的成長速度。先進的液相氧化反應器能夠降低消費量和廢水排放,進而改善環境足跡。

最終,區域供應情況將決定原料的選擇。波灣合作理事會(GCC)成員國的生產商正在利用過剩的芳烴重整油,而印度公司則將進口的鄰二甲苯與其自身生產的萘結合使用,以規避外匯波動風險。環境法規也是需要考慮的因素。鄰二甲苯生產過程產生的焦油廢棄物較少,因此更容易符合越南和菲律賓新的危險廢棄物法規。

鄰苯二甲酐報告按原料(鄰二甲苯和萘)、應用(塑化劑、醇酸樹脂、不飽和聚酯樹脂和其他應用)、終端用戶行業(汽車、電氣和電子、油漆和塗料、塑膠和其他終端用戶行業)以及地區(亞太地區、北美、歐洲、南美以及中東和非洲)進行細分。

區域分析

預計到2025年,亞太地區將佔全球整體的61.10%,並在2031年之前以3.02%的複合年成長率成長。中國在山西、陝西和內蒙古的煤化工綜合產業園區,以及江蘇沿海芳烴聯合體,使其擁有無可比擬的成本優勢。政府對先進環保法規的激勵措施正在推動催化焚燒爐和冷凝水回收裝置的維修,進一步降低排放強度。

歐洲面臨監管日益嚴格和成本上升的雙重挑戰。 REACH法規合規文件和能源價格波動推高了營運成本,並促使小規模獨立工廠關閉。BASF計畫於2025年對其路德維希港工廠進行精簡,便是這一趨勢的例證。然而,歐洲仍然是風力渦輪機葉片複合材料的生產中心,並持續支撐著對高規格UPE的需求。北美仍保持著自給自足,專注於特種等級產品,並為墨西哥快速成長的汽車線束產業提供供應。 TSCA政策的不確定性限制了大規模的再投資,但高純度等級產品和MOF前體等細分市場提供了較高的利潤率。在中東和非洲,消費量雖然仍僅佔全球總量的一小部分,但正從較低的基數持續成長。沙烏地阿拉伯和阿拉伯聯合大公國(阿拉伯聯合大公國)正在利用有利的石腦油和芳烴資源,它們在朱拜勒新建的一體化計劃還包括安裝一套下游鄰鄰苯二甲酐裝置。非洲的需求主要集中在埃及、南非和奈及利亞,這主要得益於基礎建設對PVC管道和電纜絕緣層的需求成長。南美洲的需求持續溫和成長。巴西從亞洲大量進口UPE作為其PVC和醇酸樹脂工廠的原料,而阿根廷正在進軍風力渦輪機葉片製造業,預計將推動對UPE的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區對PVC建築材料的需求快速成長

- 擴大UPE在風力發電機葉片中的應用

- 電動汽車電線電纜對塑化劑的需求不斷成長

- 亞洲PAN製造商擴大產能(降低成本)

- 採用聚丙烯腈基金屬有機框架(MOFs)進行碳捕獲、利用與封存(CCUS)

- 市場限制

- 歐盟和美國基於毒性的鄰苯二甲酸酯法規

- 生物基無水塗料的廣泛應用

- 揮發性鄰二甲苯原料價格

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 技術趨勢概述

- 定價分析

- 進出口趨勢

第5章 市場規模與成長預測

- 按原料

- 鄰二甲苯

- 萘

- 透過使用

- 塑化劑

- 醇酸樹脂

- 不飽和聚酯樹脂

- 其他用途(染料、顏料、殺蟲劑等)

- 按最終用戶行業分類

- 車

- 電氣和電子設備

- 油漆和塗料

- 塑膠

- 其他終端用戶產業(化工、農業等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AEKYUNG

- BASF

- EMCO Dyestuff

- IG Petrochemicals Ltd.

- Koppers Inc.

- LANXESS

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- NAN YA PLASTICS CORPORATION

- Paari Chem Resources

- Perstorp

- Polynt SpA

- Shandong Hongxin Chemical Co., Ltd.

- Stepan Company

- Thirumalai Chemicals

- UPC Technology Corporation

第7章 市場機會與未來展望

Phthalic Anhydride market size in 2026 is estimated at 4.61 Million tons, growing from 2025 value of 4.5 Million tons with 2031 projections showing 5.19 Million tons, growing at 2.43% CAGR over 2026-2031.

This trajectory indicates a maturing phase in which steady downstream consumption balances intensifying regulatory oversight and a gradual rise of bio-based substitutes. Demand resilience stems from construction-linked PVC applications, expanding composite use in wind energy, and specialized requirements in electric vehicles. At the same time, production economics remain exposed to feedstock swings, particularly for ortho-xylene, while increased Asian capacity keeps global margins under pressure. Competitive strategies therefore revolve around integrated production footprints, feedstock flexibility, and accelerated innovation in lower-toxicity chemistries.

Global Phthalic Anhydride Market Trends and Insights

Surge in PVC-Based Construction Demand in APAC

Construction activity across China, India, Indonesia, and Vietnam maintains a robust pull on PVC consumption, elevating demand for dioctyl phthalate and related ester plasticizers. Integrated petrochemical complexes in coastal China deliver cost-efficient feedstock and consolidate downstream processing clusters, although countrywide utilization averaged only 57% in 2024 owing to persistent oversupply. Indian producers, notably IG Petrochemicals and Thirumalai Chemicals, are boosting capacity to address local deficit and emerging export prospects. China exported around 131,000 tons of phthalic anhydride in 2024, underscoring deep regional trade ties. Incremental tightening of ISO 14001 environmental requirements is prompting producers to invest in waste-heat recovery and low-NOx burners to sustain social license to operate.

Expansion of UPE Use in Wind-Turbine Blades

Wind-energy installations rose sharply in 2024 and 2025, amplifying demand for unsaturated polyester resins used in glass-fiber blades. European recycling pilots demonstrate that co-processing spent blades in cement kilns can reclaim mineral content for clinker production while supplying thermal energy. Such initiatives mitigate the projected 43 million tons of cumulative blade waste by 2050 and sustain virgin resin needs for next-generation turbines. Offshore projects favor phthalic-anhydride-based resin systems because of proven fatigue resistance, while incremental bio-based formulations remain largely in developmental trials. Policy clarity under the International Energy Agency's net-zero road map supports long-range visibility for composite raw-material demand.

Toxicity-Driven Phthalate Regulations in EU and US

The U.S. EPA finalized TSCA risk evaluations for DINP and DIDP in 2025, citing unreasonable risks in specific spray applications. Parallel draft cumulative assessments covering BBP, DEHP, DBP, and DIBP introduce a holistic exposure lens that may yield broader restrictions. In the European Union, ECHA's Assessment of Regulatory Needs has listed phthalic anhydrides for possible restriction under REACH, targeting certain professional or consumer uses. Compliance costs for monitoring, alternative testing, and worker training are climbing, and formulators of flexible PVC are actively trialing 1,2-cyclohexane dicarboxylic esters and citrates. While mid-term demand erosion is limited to niche coatings and sealants, long-term uncertainty hinders investment in new plasticizer lines in North America and Western Europe.

Other drivers and restraints analyzed in the detailed report include:

- Rising EV Wire-and-Cable Plasticizer Needs

- Adoption of PAN-Based MOFs for CCUS

- Shift Toward Bio-Based Anhydrides in Coatings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Naphthalene supported 83.08% of phthalic anhydride market demand in 2025, buoyed by dense Chinese coal-tar distillation networks and established fixed-bed reactor technology. The segment's CAPEX advantage and supply security underpin average ex-plant costs that trend 8-10% below o-xylene-based production within mainland China. As a result, naphthalene-oriented plants consistently post utilization rates near 80% despite cyclical oversupply. Ortho-xylene, however, is forecast to advance at a 3.28% CAGR through 2031, outpacing overall phthalic anhydride market growth as integrated aromatics complexes in the Middle East and North America capitalize on refinery by-products. Advanced liquid-phase oxidation reactors reduce energy intensity and effluent load, improving environmental footprints.

Regional availability ultimately dictates feedstock choice. Gulf Cooperation Council producers exploit aromatic reformate surplus, whereas Indian players hedge between imported o-xylene and captive naphthalene to cushion forex swings. Environmental regulations are another consideration: o-xylene processes generate lower tar waste streams, easing compliance with emerging hazardous-waste statutes in Vietnam and the Philippines.

The Phthalic Anhydride Report is Segmented by Raw Material (Ortho-Xylene and Naphthalene), Application (Plasticizers, Alkyd Resins, Unsaturated Polyester Resins, and Other Applications), End-User Industry (Automotive, Electrical and Electronics, Paints and Coatings, Plastics, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 61.10% of global volume in 2025 and will expand at a 3.02% CAGR through 2031. Integrated coal-chemicals parks in Shanxi, Shaanxi, and Inner Mongolia, coupled with coastal aromatics complexes in Jiangsu, give China unmatched cost leadership. Government incentives for advanced environmental controls are spurring retrofits to catalytic incinerators and condensate recovery units, curbing emissions intensity.

Europe confronts regulatory and cost headwinds. REACH dossiers and energy-price volatility lift operating expenses, pushing smaller standalone units toward closure; BASF's Ludwigshafen line rationalization in 2025 is emblematic of this trend. Yet the continent remains central to wind-blade composite production, sustaining demand for high-spec UPE. North America maintains self-sufficiency, focusing on specialty grades and supplying Mexico's burgeoning automotive harness sector. TSCA policy uncertainty tempers large-scale reinvestment, but niche opportunities in high-purity grades and MOF precursors offer higher margins. In the Middle-East and Africa, consumption remains a fraction of global totals but grows off a low base. Saudi Arabia and the UAE leverage advantaged naphtha and aromatics streams, and new integrated projects in Jubail include provision for downstream phthalic anhydride units. African demand centers on Egypt, South Africa, and Nigeria, aligned with PVC pipe and cable-insulation growth for infrastructure initiatives. South America's trajectory stays moderate; Brazil imports bulk volumes from Asia to feed hosting PVC and alkyd resin plants, while Argentina ventures into wind-blade fabrication, creating incremental UPE demand.

- AEKYUNG

- BASF

- EMCO Dyestuff

- IG Petrochemicals Ltd.

- Koppers Inc.

- LANXESS

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- NAN YA PLASTICS CORPORATION

- Paari Chem Resources

- Perstorp

- Polynt S.p.A.

- Shandong Hongxin Chemical Co., Ltd.

- Stepan Company

- Thirumalai Chemicals

- UPC Technology Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in PVC-Based Construction Demand in APAC

- 4.2.2 Expansion of UPE Use in Wind-Turbine Blades

- 4.2.3 Rising Electric-Vehicle Wire-And-Cable Plasticizer Needs

- 4.2.4 Capacity Expansions by Asian PAN Producers (Lower Costs)

- 4.2.5 Adoption of PAN-Based Metal-Organic Frameworks for CCUS

- 4.3 Market Restraints

- 4.3.1 Toxicity-Driven Phthalate Regulations in EU and US

- 4.3.2 Shift Toward Bio-Based Anhydrides in Coatings

- 4.3.3 Volatile O-Xylene Feedstock Prices

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Technological Snapshot

- 4.7 Pricing Analysis

- 4.8 Import and Export Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Raw Material

- 5.1.1 Ortho-xylene

- 5.1.2 Naphthalene

- 5.2 By Application

- 5.2.1 Plasticizers

- 5.2.2 Alkyd Resins

- 5.2.3 Unsaturated Polyester Resins

- 5.2.4 Other Applications (Dyes and Pigments, Insecticides, etc.)

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Electrical and Electronics

- 5.3.3 Paints and Coatings

- 5.3.4 Plastics

- 5.3.5 Other End-user Industries (Chemicals, Agriculture, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AEKYUNG

- 6.4.2 BASF

- 6.4.3 EMCO Dyestuff

- 6.4.4 IG Petrochemicals Ltd.

- 6.4.5 Koppers Inc.

- 6.4.6 LANXESS

- 6.4.7 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.8 NAN YA PLASTICS CORPORATION

- 6.4.9 Paari Chem Resources

- 6.4.10 Perstorp

- 6.4.11 Polynt S.p.A.

- 6.4.12 Shandong Hongxin Chemical Co., Ltd.

- 6.4.13 Stepan Company

- 6.4.14 Thirumalai Chemicals

- 6.4.15 UPC Technology Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment