|

市場調查報告書

商品編碼

1906924

紙漿和造紙化學品:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031 年)Pulp And Paper Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

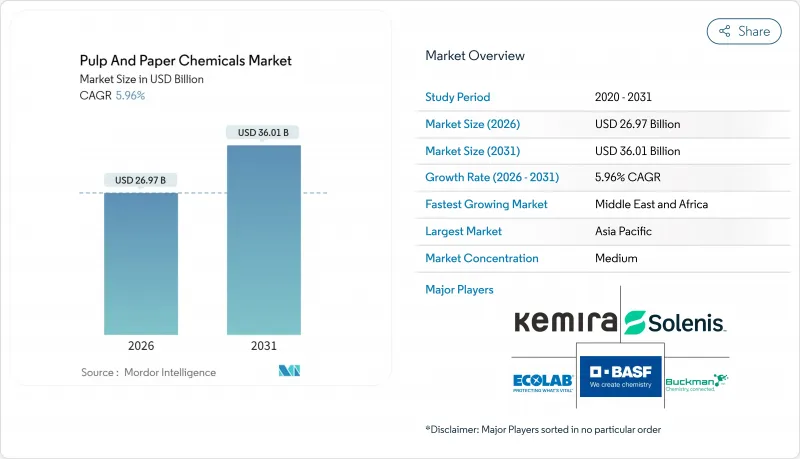

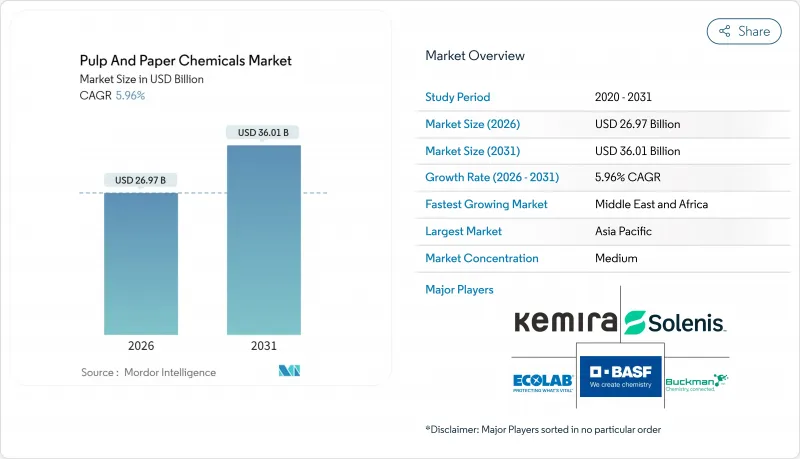

預計紙漿和造紙化學品市場將從 2025 年的 254.5 億美元成長到 2026 年的 269.7 億美元,到 2031 年將達到 360.1 億美元,2026 年至 2031 年的複合年成長率為 5.96%。

包裝紙需求的成長、漂白和施膠技術的快速進步以及永續性需求,共同構成了推動和阻礙紙業持續成長的利好和挑戰。亞太地區產能的擴張、電子商務的持續成長以及再生纖維的顯著普及,都促使企業增加對特種化學品的需求,這些化學品能夠提高紙張的白度、強度並減少淡水消耗。同時,更嚴格的排放法規、原料價格的波動以及高能耗的傳統工藝,迫使供應商進行創新,尤其是在酶基、生物基和閉合迴路解決方案方面。競爭優勢的關鍵在於提供能夠最佳化紙張留白、排水和阻隔性能,同時幫助造紙廠實現碳排放和廢水排放目標的綜合方案。因此,行業現有企業正專注於有針對性的收購、區域性生產佈局以及能夠減少停機時間和化學品過剩的數位化服務模式。

全球紙漿和造紙化學品市場趨勢與洞察

擴大亞洲包裝紙產能

大型資本計劃,例如綠灣包裝公司(Green Bay Packaging)投資10億美元的工廠和蘇扎諾公司(Suzano)投資16.6億雷亞爾的項目,正在推動下游對助留劑、廢水處理劑和專用於高速造紙機的表面上漿劑產生前所未有的需求。這些大型造紙廠優先考慮在地採購以避免運輸成本增加,迫使供應商建立區域工廠和服務實驗室。產能的提升加劇了全球纖維供需平衡的緊張,間接推動了該地區其他出口型造紙廠的添加劑消耗。能夠使其技術團隊與終端用戶啟動計劃保持一致的供應商可以搶佔早期需求並簽訂長期供應合約。最後,區域產能過剩風險的日益加劇,促使企業需要製定成本最佳化方案,這使得能夠提供將化學品與即時分析相結合的解決方案的供應商更具優勢。

再生纖維材料的使用量迅速成長

在循環經濟的推動和品牌所有者的計劃下,平均再生紙含量正在上升,尤其是在歐洲和北美。再生纖維中污染物、黏性和油墨殘留的增加,促使造紙廠採用先進的浮選化學品、酵素基脫墨製程以及高電荷微粒,以維持紙張的白度和抗張強度。一體化的「全線」化學品包簡化了採購流程,而數據豐富的監測則減少了添加劑的過度使用。採用100%再生紙的箱板紙和生活用紙廠的機會成長最為迅速。

更嚴格的AOX和COD排放標準

歐盟和美國監管機構正在降低酸性有機物 (AOX) 和化學需氧量 (COD) 的允許基準值,迫使造紙廠重新設計漂白製程或安裝成本高昂的三級處理設施。對於缺乏規模經濟的小規模造紙廠而言,合規成本可能增加 15% 至 20% 的年度營運成本。化學品供應商正積極應對,推出低 AOX螢光增白劑、污泥脫水助劑以及具有審核性能驗證功能的線上感測器。

細分市場分析

漂白水將在紙漿和造紙化學品市場佔據主導地位,預計2025年將佔32.45%的市場佔有率。此細分市場的主導地位源於其在實現白度目標方面的關鍵作用,以及從二氧化氯體係向過氧化氫-氧氣體系的日益成長的轉變。這種轉變是由日益嚴格的AOX法規和消費者對氯基殘留物日益嚴格的審查所驅動的。供應商正在投資研發穩定性過氧化物、高效活化劑和分散劑,以降低化學需氧量(COD)。

雖然施膠劑的絕對值較小,但它是成長最快的細分市場,預計到2031年將以6.31%的複合年成長率成長。生物基和酵素基施膠劑能夠為加工商提供餐飲服務和電商包裝所需的油墨保持性、耐油性和碳減排方面的平衡。製漿化學品與一體化牛皮紙漿廠緊密相連,保持著穩定的市場基礎,而填料(例如GCC和PCC)則受益於輕量化和高遮蓋力(每克)的趨勢。黏合劑,特別是用於再生紙巾和毛巾的濕強樹脂,由於衛生用品的強勁需求,呈現出溫和的成長。

區域分析

受強勁的資本投資和人均包裝消費量成長的推動,亞太地區預計到2025年將佔全球紙漿和造紙化學品市場46.85%的佔有率。中國最新的五年規劃將箱板紙和特殊紙巾列為戰略產業,並大力扶持節能型化學包裝。印度紙巾產業的蓬勃發展帶動了對軟強度樹脂和調味技術的需求。東南亞正受惠於供應鏈多元化,越南和印尼吸引了大量外資建設牛皮紙襯紙廠。

在北美,受輕質箱板紙需求成長以及加州等州對再生纖維日益嚴格的要求推動,市場需求保持穩定。造紙廠正投資氧脫木素維修和二氧化碳捕集先導計畫,以實現企業淨零排放目標。在歐洲,綠色交易和嚴格的包裝指令正在領先生物基施膠劑和不含PFAS的阻隔塗層的應用。

預計到2031年,中東和非洲地區將以6.05%的複合年成長率成長,主要受基礎建設和食品飲料包裝在地化生產的推動。沙烏地阿拉伯和埃及新建的紙巾運作將帶動對添加劑的需求,而蘇哈爾石化公司在阿曼的投資將加強脂肪酸衍生物的本地採購。南美洲預計將保持穩定成長,這得益於巴西紙漿產能的擴張,以及化學供應商將木質原料整合到上游工程中。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大亞洲包裝紙產能

- 再生纖維材料的使用量迅速成長

- 無水酶漂白技術的創新

- 碳負排放生物上漿劑

- 電子商務主導的SKU成長推動特種化學品發展

- 市場限制

- 更嚴格的AOX和COD排放標準

- 與替代基材相比,能量強度高

- 僅氯的價格波動

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 活頁夾

- 漂白

- 填料

- 紙漿製造化學品

- 上漿劑

- 其他類型

- 透過使用

- 報紙紙張

- 包裝和工業用紙

- 印刷和書寫用紙

- 紙漿廠和水處理

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率/排名分析

- 公司簡介

- Arkema

- Ashland Inc.

- BASF

- Buckman

- Cargill Incorporated

- Celanese

- Chemours

- Clariant

- Ecolab

- ERCO Worldwide

- Georgia-Pacific

- Imerys SA

- Kemira

- Nouryon

- Omya International AG

- Solenis

- Solvay

- Stora Enso

- UPM

- Valmet

第7章 市場機會與未來展望

The Pulp & Paper Chemicals market is expected to grow from USD 25.45 billion in 2025 to USD 26.97 billion in 2026 and is forecast to reach USD 36.01 billion by 2031 at 5.96% CAGR over 2026-2031.

The rising demand for packaging-grade paper, rapid technological upgrades in bleaching and sizing, and intensifying sustainability mandates are combining to create persistent growth headwinds and tailwinds. Capacity additions in the Asia-Pacific region, continued e-commerce expansion, and a pronounced shift toward recycled fiber have all contributed to an increase in the consumption of specialty chemistries that enhance brightness, improve strength, and reduce freshwater use. At the same time, tightening discharge rules, volatile input prices, and energy-intensive legacy processes compel suppliers to innovate around enzymatic, bio-based, and closed-loop solutions. Competitive differentiation hinges on bundled programs that optimize retention, drainage, and barrier performance while helping mills meet carbon and effluent targets. Industry incumbents, therefore, focus on targeted acquisitions, regional production footprints, and digital service models that reduce downtime and chemical over-feed.

Global Pulp And Paper Chemicals Market Trends and Insights

Expansion of Packaging-Grade Paper Capacity in Asia

Massive capital projects such as Green Bay Packaging's USD 1 billion facility and Suzano's R$1.66 billion investment have triggered unprecedented downstream demand for retention aids, drainage chemistries, and surface sizing tailored for high-speed machines. These mega-mills prefer local chemical sourcing to avoid freight penalties, prompting suppliers to deploy regional plants and service labs. Capacity additions also tighten global fiber balances, indirectly boosting additive consumption in export-oriented mills elsewhere. Suppliers that align technical teams with end-user start-up schedules capture early-cycle volume and long-term supply contracts. Finally, regional overcapacity risks heighten the need for cost-optimizing programs, favoring vendors that can bundle chemistries with real-time analytics.

Surge in Recycled-Fiber Furnish Adoption

Circular-economy mandates and brand owner commitments push average recycled-content ratios higher, especially in Europe and North America. Increased contaminants, stickies, and ink residues in secondary fiber prompt mills to employ advanced flotation reagents, enzyme-based de-inking, and high-charge microparticles that preserve brightness and tensile strength. Integrated "full-line" chemical packages simplify procurement, while data-rich monitoring cuts additive overdosing. Opportunities grow fastest in containerboard and tissue mills adopting 100% recycled furnish.

Tightening AOX and COD Discharge Norms

EU and US regulators are lowering allowable AOX and COD baselines, compelling mills to redesign bleach sequences or install high-capex tertiary treatment. Compliance adds 15-20% to annual operating costs for smaller sites that lack economies of scale. Chemical suppliers respond with low-AOX brightening agents, sludge de-watering aids, and online sensors that prove performance to auditors.

Other drivers and restraints analyzed in the detailed report include:

- Water-Free Enzymatic Bleaching Breakthroughs

- Carbon-Negative Bio-Based Sizing Agents

- High Energy Intensity Vis-a-Vis Alternative Substrates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bleaching agents dominated the pulp and paper chemicals market, accounting for a 32.45% share in 2025. The segment's primacy stems from its indispensable role in brightness targets and its ongoing migration from chlorine dioxide toward hydrogen peroxide and oxygen sequences. This shift is reinforced by regulatory curbs on AOX and consumer scrutiny of chlorinated residues. Suppliers invest in stabilized peroxide grades, high-efficacy activators, and dispersants that lower total chemical oxygen demand.

Sizing agents, although smaller in absolute dollar terms, represent the fastest-growing segment with a 6.31% CAGR through 2031. Bio-based and enzymatic sizing gives converters the balance of ink hold-out, grease resistance, and carbon reduction they need for food-service and e-commerce packaging. Pulping chemicals maintain a steady baseline tied to integrated kraft mills, while fillers such as GCC and PCC benefit from lightweighting trends that call for higher opacity per gram. Binders, particularly wet-strength resins used in recycled tissue and towel grades, show moderate gains as hygiene product demand remains defensive.

The Pulp and Paper Chemicals Market Report is Segmented by Type (Binders, Bleaching Agents, Fillers, Pulping Chemicals, Sizing Agents, and More), Application (Newsprint, Packaging and Industrial Papers, Printing and Writing Papers, Pulp Mills and Water Treatment, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region commanded a 46.85% share of the pulp and paper chemicals market in 2025, driven by robust capital investment and rising per-capita packaging consumption. China's latest five-year plan earmarks containerboard and specialty tissue as strategic segments, spurring subsidies for energy-efficient chemical packages. India's tissue boom intensifies demand for soft-strength resins and fragrance-incorporation technologies. Southeast Asia benefits from supply-chain diversification, with Vietnam and Indonesia courting foreign investment for kraft liner mills.

North America registers stable demand grounded in lightweight containerboard conversions and progressive recycled-fiber mandates in states such as California. Mills invest in oxygen delignification retrofits and carbon-capture pilots to align with corporate net-zero commitments. Europe leads the adoption of bio-based sizing agents and PFAS-free barrier coatings, driven by the Green Deal and strict packaging directives.

The Middle East and Africa region is projected to grow at a 6.05% CAGR through 2031, supported by infrastructure build-out and the localization of food and beverage packaging. New tissue machines in Saudi Arabia and Egypt fuel additive demand, while Oman's SOHAR petrochemical investments improve regional sourcing of fatty-acid derivatives. South America enjoys steady gains anchored by Brazil's pulp capacity expansions, with chemical suppliers integrating upstream to secure wood-derived feedstocks.

- Arkema

- Ashland Inc.

- BASF

- Buckman

- Cargill Incorporated

- Celanese

- Chemours

- Clariant

- Ecolab

- ERCO Worldwide

- Georgia-Pacific

- Imerys S.A.

- Kemira

- Nouryon

- Omya International AG

- Solenis

- Solvay

- Stora Enso

- UPM

- Valmet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of packaging-grade paper capacity in Asia

- 4.2.2 Surge in recycled-fiber furnish adoption

- 4.2.3 Water-free enzymatic bleaching breakthroughs

- 4.2.4 Carbon-negative bio-based sizing agents

- 4.2.5 E-commerce led SKU proliferation driving speciality chemicals

- 4.3 Market Restraints

- 4.3.1 Tightening AOX and COD discharge norms

- 4.3.2 High energy intensity vis-a-vis alternative substrates

- 4.3.3 Volatility in elemental chlorine prices

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Binders

- 5.1.2 Bleaching Agents

- 5.1.3 Fillers

- 5.1.4 Pulping Chemicals

- 5.1.5 Sizing Agents

- 5.1.6 Other Types

- 5.2 By Application

- 5.2.1 Newsprint

- 5.2.2 Packaging and Industrial Papers

- 5.2.3 Printing and Writing Papers

- 5.2.4 Pulp Mills and Water Treatment

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 UAE

- 5.3.5.3 Turkey

- 5.3.5.4 South Africa

- 5.3.5.5 Egypt

- 5.3.5.6 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core segments, Financials, Strategic info, Market rank/share, Products & Services, Recent developments)

- 6.4.1 Arkema

- 6.4.2 Ashland Inc.

- 6.4.3 BASF

- 6.4.4 Buckman

- 6.4.5 Cargill Incorporated

- 6.4.6 Celanese

- 6.4.7 Chemours

- 6.4.8 Clariant

- 6.4.9 Ecolab

- 6.4.10 ERCO Worldwide

- 6.4.11 Georgia-Pacific

- 6.4.12 Imerys S.A.

- 6.4.13 Kemira

- 6.4.14 Nouryon

- 6.4.15 Omya International AG

- 6.4.16 Solenis

- 6.4.17 Solvay

- 6.4.18 Stora Enso

- 6.4.19 UPM

- 6.4.20 Valmet

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-Need Assessment