|

市場調查報告書

商品編碼

1906920

直鏈烷基苯(LAB):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Linear Alkyl Benzene (LAB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

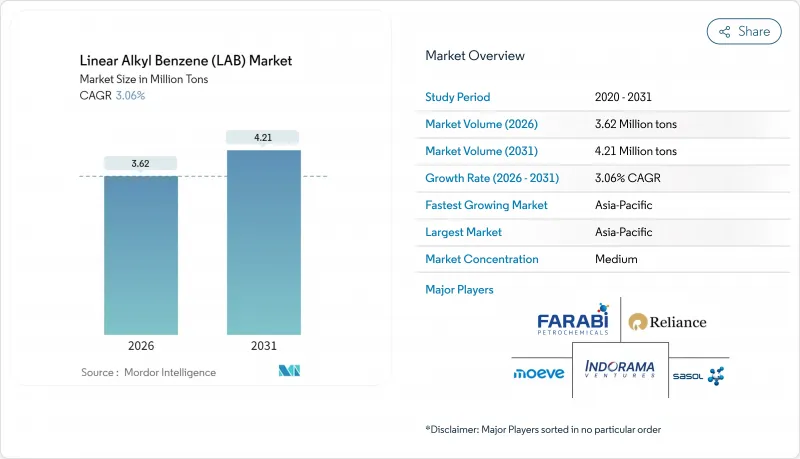

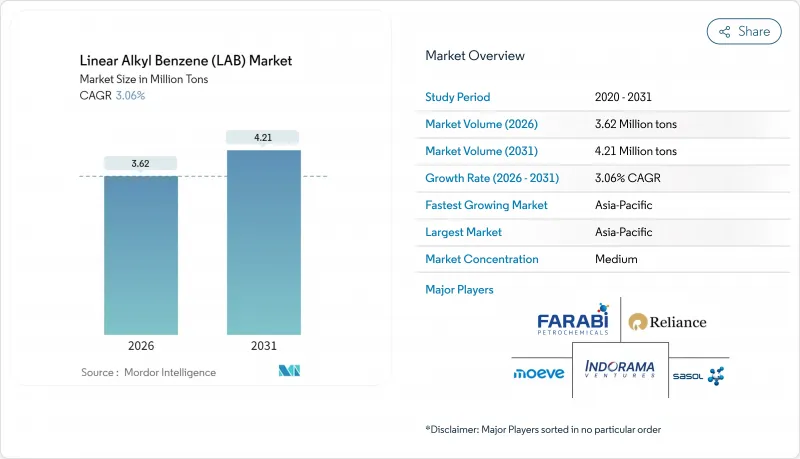

2025年,直鏈烷基苯市場價值為351萬噸,預計2031年將達到421萬噸,高於2026年的362萬噸。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.06%。

線性烷基苯作為線性磺酸鹽磺酸鹽的主要前體,其穩定的需求支撐著這一成長,而消費者和監管機構對可生物分解的陰離子界面活性劑而非傳統支鏈清潔劑的偏好日益增強,也推動了這一成長。人口稠密的新興經濟體中清潔劑滲透率的提高、疫情後人們對家庭和機構衛生持續關注,以及對數位化設備升級的持續投資,都為線性烷基苯市場帶來了更多機會。擁有強大的苯和石蠟一體化能力的生產商將增強其成本優勢,而持續的數位化設備維修將帶來降低碳排放和提高製程安全性的雙重效益。同時,對冷媒添加劑等高附加價值細分應用的探索將推動產量成長,並降低對相對成熟的清潔劑價值鏈的依賴。

全球線性烷基苯(LAB)市場趨勢與洞察

新興經濟體清潔劑滲透率不斷上升

新興經濟體的清潔劑消費量正持續縮小與已開發地區的差距,每年新增數百萬洗衣用戶。在家庭清潔劑更換週期中,預包裝合成清潔劑比傳統肥皂更受歡迎。這是因為基於線性烷基苯(LAS)的配方在農村和郊區常見的硬水環境中表現出更優異的性能。包裝清潔劑也採用小小袋,以適應低收入群體的購買習慣,從而為線性烷基苯市場創造了穩定的需求來源。在印度,政府的衛生宣傳活動和不斷擴大的零售網路正在推動清潔劑在全部區域的普及。撒哈拉以南非洲和部分中東經濟體也出現了類似的趨勢,進一步擴大了潛在基本客群。這些趨勢共同構成了一個結構性成長平台,將在中期內支持線性烷基苯市場的擴張。

監管機構推動可生物分解的LAS表面活性劑

環境監管機構正在收緊清潔劑的分解標準,加速向基於直鏈烷基苯的界面活性劑(LAS)過渡。歐盟的REACH法規結構強調了直鏈LAS相比支鏈LAS具有更高的分解速率,這使得直鏈烷基苯成為符合法規要求的理想原料。由於污水處理成本不斷上升,水資源緊張地區也開始採用類似的排放標準。品牌所有者透過將清潔劑和清潔劑標註為「可生物分解」來將合規性轉化為市場價值,從而支撐更高的平均售價。認證機構在評估界面活性劑的選擇時會參考ISO 14852和ASTM D-2667測試方法,這進一步鞏固了直鏈烷基苯的需求優勢。隨著各國調整其化學品策略以符合《巴黎協定》,生物基界面活性劑正成為跨國公司不可或缺的組成部分,從而鞏固了其長期需求前景。

原料價格波動給利潤率帶來壓力。

直鏈烷基苯生產商依賴苯和烷烴,而這兩種原料的價格與全球原油價格密切相關。季度價格波動往往會擠壓非一體化生產商的轉換價差。庫存持有策略可以緩解這種影響,但無法完全消除風險,尤其是在期貨曲線倒掛的情況下。一體化煉油廠雖然處於更有利的地位,但仍面臨著因避險成本和煉油廠計劃停產而導致的供應中斷風險。新興亞洲企業在結算原料進口時,也面臨美元外匯波動帶來的額外挑戰。原料價格持續波動會降低規劃的透明度,抑制可自由支配的資本投資,並削弱直鏈烷基苯市場的近期成長動能。

細分市場分析

界面活性劑應用預計將在2025年佔總產量的96.78%,鞏固了線性烷基苯作為日常清潔產品關鍵成分的地位。線性烷基苯(LAS)在清潔劑和液體清潔劑配方中,尤其是在消費廣泛地區普遍存在的硬水條件下,其卓越的性能是推動其佔據主導地位的主要原因。其他應用領域也以4.48%的複合年成長率成長,成長率超過整體市場,主要得益於配方師對冷卻劑添加劑和特定工業清潔劑的探索。從盈利角度來看,界面活性劑的需求確保了產能的高運轉率,而向特種應用領域的多元化發展則提高了利潤率,並幫助生產商抵禦清潔劑市場週期性波動的影響。

生產製程規範對C10-C13鍊長分佈有嚴格的要求,促使企業加強對原料精煉的投資,以滿足高階線性烷基苯(LAS)的要求。近期研究表明,硫酸洗滌處理能夠減少烯烴雜質,從而提高清潔劑的白度並降低配方穩定劑的用量。汽車冷卻液供應商優先考慮高氧化穩定性,並將新技術引入傳統上以大眾市場主導的市場。這些不斷發展的性能標準延長了數位化工廠的使用壽命,並持續生產出比傳統氫氟酸(HF)製程純度更高的產品。總而言之,這些趨勢再次印證了界面活性劑的重要性,同時促進了利基市場的穩定成長,並確保了線性烷基苯市場的均衡擴張。

線性烷基苯市場報告按應用領域(界面活性劑及其他應用)、終端用戶行業(清潔劑、輕型洗碗精、工業清潔劑清潔劑、家用清潔劑其他終端用戶行業)和地區(亞太地區、北美地區、歐洲地區、南美地區以及中東和非洲地區)進行細分。市場預測以公噸為單位。

區域分析

預計亞太地區將在2025年以53.72%的市佔率引領全球,並在2031年之前維持4.12%的複合年成長率。消費者人口結構變化和都市化,以及包裝清潔劑使用量的增加,正在推動苯供應的成長。中國、印度和中東的綜合芳烴生產設施確保了苯的穩定供應和具有競爭力的成本。近期啟動的烷烴脫氫裝置計劃進一步增強了該地區的自給自足能力,並降低了進口依賴性和運輸風險。中國沿海地區的產業叢集降低了原料和成品的末端物流成本,並將當地的汽油級烯烴快速轉化為高純度的直鏈烷基苯。

儘管歐洲的生產成長緩慢,但它在製定最佳環境標準方面發揮著至關重要的作用。歐盟委員會的《大規模生產的有機化學品》參考文件加強了廢水和排放指南,加速了現有工廠向Detal製程的維修。西班牙和比利時的生產商已經完成了產能升級,並提高了高純度產品的產量,同時降低了能源消耗。總部位於該地區的消費品牌正在採用“生命週期評估,包括生產前評估”,這鞏固了他們對Detal製程生產的表面活性劑的優先採購地位。

在北美,豐富的頁岩原料供應使得苯和烷烴的價格結構性地保持低位且穩定。然而,不斷上漲的氫氟酸監管成本加劇了競爭壓力,並引發了將資金重新分配至下游生產線的討論。美國沿岸地區的生產商正在探索下游線性烷基苯(LAS)一體化的優勢,以降低價格波動並在中間環節創造附加價值。美國《通貨膨脹控制法案》帶來的監管透明度使得節能維修能夠轉化為排碳權。這些因素共同作用,正穩定且策略性地推動線性烷基苯市場的發展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新興經濟體清潔劑滲透率不斷上升

- 推動可生物分解的LAS表面活性劑的監管

- 後新冠時代衛生管理與清潔的徹底性

- 透過 Detail-2 修改來減少 LAB 的碳足跡

- LAB在電動車冷卻液添加劑包的應用

- 市場限制

- 原料(苯和石蠟)價格波動

- HF路線遵守環境法規的成本

- 東協向棕櫚油基MES清潔劑的過渡

- 價值鏈分析

- 價格概覽

- 貿易分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過使用

- 界面活性劑

- 其他用途

- 按最終用戶行業分類

- 洗衣精

- 輕型清潔劑

- 工業清潔劑

- 家用清潔劑

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- CNPC(Fushun Petrochemical)

- Egyptian Petrochemicals Holding Company(ECHEM)

- Farabi Petrochemicals Company

- Formosan Union Chemical Corp.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited

- ISU Chemical

- JINTUNG Petrochemical Co., Ltd

- Kinef

- Moeve

- NIRMA

- PT Unggul Indah Cahaya Tbk

- QatarEnergy

- Reliance industries Limited

- SBK HOLDING

- Sasol

- Tamilnadu Petroproducts Limited

- Thai Oil Public Company Limited

第7章 市場機會與未來展望

The Linear Alkyl Benzene Market was valued at 3.51 Million tons in 2025 and estimated to grow from 3.62 Million tons in 2026 to reach 4.21 Million tons by 2031, at a CAGR of 3.06% during the forecast period (2026-2031).

Steady demand for linear alkyl benzene as the key precursor to linear alkyl benzene sulfonate underpins this growth as consumers and regulators favor biodegradable anionic surfactants over legacy branched-chain detergents. Rising detergent penetration across populous emerging economies, a sustained post-pandemic focus on household and institutional hygiene, and continued investments in upgraded Detal units collectively widen the linear alkyl benzene market opportunity set. Producers with secure benzene and paraffin integration deepen cost leadership, while ongoing Detal retrofits provide dual benefits of lower carbon intensity and improved process safety. Meanwhile, the pursuit of value-added niche applications such as coolant additives augments incremental volume growth and reduces reliance on the relatively mature detergent value chain.

Global Linear Alkyl Benzene (LAB) Market Trends and Insights

Rising Detergent Penetration in Emerging Economies

Emerging economies continue to close the detergent consumption gap with industrialized regions, adding millions of new wash-day users each year. Household upgrade cycles favor packaged synthetic detergents over traditional soap bars because LAS-based formulations excel in hard-water conditions that prevail in rural and peri-urban zones. Packaged detergents also leverage smaller sachet formats that align with low-income purchasing habits, creating a stable volume pull for the linear alkyl benzene market. In India, government sanitation campaigns and expanded retail access raise detergent adoption rates across rural districts. Similar dynamics in sub-Saharan Africa and selected Middle Eastern economies further enlarge the prospective customer base. Together these trends embed a structural growth floor that supports linear alkyl benzene market expansion over the medium term.

Regulatory Push for Biodegradable LAS Surfactants

Environmental regulators tighten degradability benchmarks for cleaning agents, accelerating the shift toward LAS derived from linear alkyl benzene. The European Union's REACH framework highlights faster breakdown of straight-chain LAS compared with branched analogs, making linear alkyl benzene a compliance-friendly feedstock. Water-stressed regions adopt similar discharge norms as wastewater treatment costs climb. Brand owners translate compliance into marketing premiums by labeling laundry and dishwashing detergents as biodegradable, supporting higher average selling prices. Certification bodies reference ISO 14852 and ASTM D-2667 methods when vetting surfactant choices, reinforcing the demand advantage enjoyed by linear alkyl benzene. As countries align with Paris-aligned chemical strategies, bio-favored surfactants become indispensable for multinationals, cementing the long-term demand outlook.

Feedstock Price Volatility Pressures Margins

Linear alkyl benzene producers rely on benzene and paraffin, whose price trajectories remain tethered to global crude oil swings. Quarter-to-quarter price variability tends to compress conversion spreads for non-integrated manufacturers. Inventory holding strategies mitigate but do not eliminate exposure, especially when forward curves invert. Integrated refiners fare better, yet they still confront hedging costs and occasional supply disruptions linked to refinery turnarounds. Emerging Asian players bear the additional challenge of currency fluctuations against the U.S. dollar when settling feedstock imports. Persistent input turbulence undermines planning visibility, discourages discretionary capital spending, and introduces a drag on short-term linear alkyl benzene market growth momentum.

Other drivers and restraints analyzed in the detailed report include:

- Post-COVID Hygiene and Cleaning Intensity

- Detal-2 Retrofits Cutting LAB Carbon Footprint

- HF-Route Environmental Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surfactant production accounted for 96.78% of the 2025 volume, reinforcing the linear alkyl benzene market position as an essential building block for everyday cleaning agents. This overwhelming share is anchored in the proven performance of LAS in powder and liquid detergent formulations, particularly under hard-water conditions that prevail across vast consumption territories. Other Applications outpace the headline market at 4.48% CAGR as formulators explore coolant additive packages and select industrial cleaners. From a profitability standpoint, surfactant demand ensures high asset utilization; however, diversification into specialty uses offers margin accretion and shields producers from cyclical detergent swings.

Process specifications dictate narrow C10-C13 chain-length distributions, encouraging producers to invest in feedstock purification to meet premium LAS requirements. Recent studies show that sulfuric acid wash treatments cut olefinic contaminants, thereby raising detergent brightness scores and reducing formulation stabilizer loadings. Producers supplying automotive coolant blends emphasize high oxidative stability, injecting new technical parameters into what was once a volume-driven market. These evolving performance criteria extend the life cycle of Detal plants that consistently deliver purer cuts than their HF predecessors. Taken together, these trends reinforce the primacy of surfactants while simultaneously cultivating a measured growth path for niche outlets, ensuring balanced expansion for the linear alkyl benzene market.

The Linear Alkyl Benzene Report is Segmented by Application (Surfactant and Other Applications), End-User Industry (Laundry Detergents, Light-Duty Dishwashing Liquids, Industrial Cleaners, Household Cleaners, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominates with a 53.72% share in 2025 and is set to grow at a 4.12% CAGR through 2031. Consumer demographics combine with urbanization to expand packaged detergent usage, while integrated aromatics complexes in China, India, and the Middle East ensure secure benzene supply at competitive cost. Recent paraffin dehydrogenation projects further reinforce regional self-sufficiency, lowering import dependence and freight exposure. Industry clusters in coastal China reduce last-mile logistics costs for both raw materials and finished goods, rapidly converting local gasoline-range olefins into high-purity linear alkyl benzene.

Europe registers modest volume growth but plays a pivotal role in setting best-practice environmental norms. The European Commission's Large Volume Organic Chemicals reference document strengthens effluent and emissions guidelines, accelerating Detal retrofits across legacy plants. Producers in Spain and Belgium have already completed capacity upgrades that boost high-purity yields while trimming energy intensity. Consumer brands headquartered in the region adopt cradle-to-gate life-cycle assessments, solidifying procurement preferences for Detal-produced surfactants.

North America benefits from ample shale-derived feedstock streams that offer structurally low benzene and paraffin costs. Competitive pressure nevertheless mounts as HF compliance costs climb, prompting debate over capital redeployment toward Detal lines. Gulf Coast producers weigh the merits of downstream LAS integration to capture additional value and mitigate volatility at the intermediate stage. Regulatory visibility provided by the U.S. Inflation Reduction Act paves the way for carbon-credit monetization of energy-efficient retrofits. Collectively, these factors produce a steady but strategically significant contribution to the linear alkyl benzene market.

- CNPC (Fushun Petrochemical)

- Egyptian Petrochemicals Holding Company (ECHEM)

- Farabi Petrochemicals Company

- Formosan Union Chemical Corp.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited

- ISU Chemical

- JINTUNG Petrochemical Co., Ltd

- Kinef

- Moeve

- NIRMA

- PT Unggul Indah Cahaya Tbk

- QatarEnergy

- Reliance industries Limited

- S.B.K HOLDING

- Sasol

- Tamilnadu Petroproducts Limited

- Thai Oil Public Company Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising detergent penetration in emerging economies

- 4.2.2 Regulatory push for biodegradable LAS surfactants

- 4.2.3 Post-COVID hygiene and cleaning intensity

- 4.2.4 Detal-2 retrofits cutting LAB carbon footprint

- 4.2.5 LAB use in EV coolant additive packages

- 4.3 Market Restraints

- 4.3.1 Feedstock (benzene and paraffin) price volatility

- 4.3.2 HF-route environmental compliance costs

- 4.3.3 ASEAN shift to palm-based MES detergents

- 4.4 Value Chain Analysis

- 4.5 Price Overview

- 4.6 Trade Analysis

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Surfactant

- 5.1.2 Other Applications

- 5.2 By End-User Industry

- 5.2.1 Laundry Detergents

- 5.2.2 Light-Duty Dishwashing Liquids

- 5.2.3 Industrial Cleaners

- 5.2.4 Household Cleaners

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CNPC (Fushun Petrochemical)

- 6.4.2 Egyptian Petrochemicals Holding Company (ECHEM)

- 6.4.3 Farabi Petrochemicals Company

- 6.4.4 Formosan Union Chemical Corp.

- 6.4.5 Indian Oil Corporation Ltd

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 ISU Chemical

- 6.4.8 JINTUNG Petrochemical Co., Ltd

- 6.4.9 Kinef

- 6.4.10 Moeve

- 6.4.11 NIRMA

- 6.4.12 PT Unggul Indah Cahaya Tbk

- 6.4.13 QatarEnergy

- 6.4.14 Reliance industries Limited

- 6.4.15 S.B.K HOLDING

- 6.4.16 Sasol

- 6.4.17 Tamilnadu Petroproducts Limited

- 6.4.18 Thai Oil Public Company Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment