|

市場調查報告書

商品編碼

1906918

綠建築材料:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Green Building Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

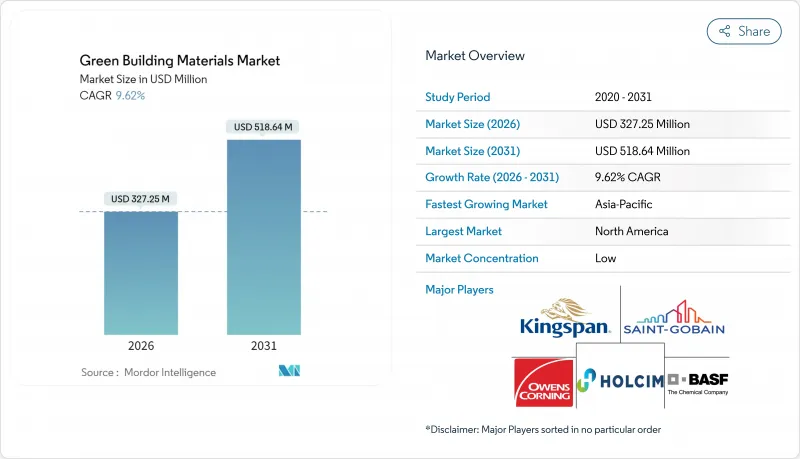

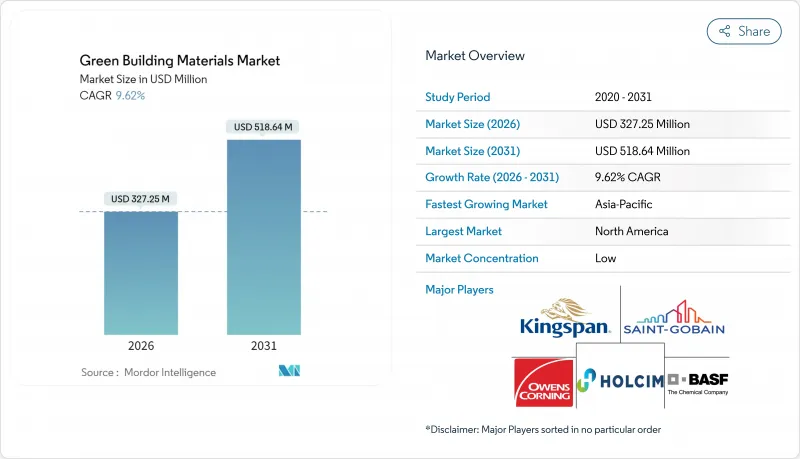

綠色建築材料市場預計將從 2025 年的 2.9852 億美元成長到 2026 年的 3.2725 億美元,預計到 2031 年將達到 5.1864 億美元,2026 年至 2031 年的複合年成長率為 9.62%。

這一前景反映了政府持續施壓推動零排放建築,企業對淨零排放目標的承諾日益增強,以及低碳建築材料技術的快速普及。歐盟、美國和其他主要經濟體的監管協調正在打破傳統的碎片化局面,使全球製造商能夠實現規模經濟並加速產品創新。財政獎勵進一步支撐了市場需求,縮小了綠色建築材料與傳統產品之間的價格差距,而數位化材料追蹤工具也開始將廢舊材料的價值鏈貨幣化。這些因素共同作用,造就了綠建材市場前所未有的快速引進週期。

全球綠建築材料市場趨勢與洞察

加強強制性節能標準

世界各地的建築規範正從自願性指南轉向具有約束力的性能標準。在歐洲,修訂後的《建築能源性能指令》要求所有新建建築到2030年實現零現場石化燃料排放,現有住宅存量也必須在同年維修,達到最低E級能源效率標準。美國也緊接著,2024年版《國際節能規範》(IECC)簡化了各州採納該規範的流程,並增加了生命週期碳排放的規定。更嚴格的標準推動了對高性能隔熱材料、低碳混凝土和先進建築幕牆的需求,並有利於那些能夠透過數位化合規平台檢驗其產品永續性的供應商。執法力度的加強進一步提高了傳統建築材料的合規成本,從而為經過認證的替代產品創造了永續的競爭優勢。

政府獎勵和認證計劃

稅額扣抵、綠色債券和優惠融資正在改變計劃的經濟格局。美國《通貨膨脹控制法》第45L條規定,符合條件的住宅最高可獲得5000美元的補貼,而179D稅收抵免政策的適用範圍已擴大至大規模商業維修。加拿大已撥款100億加幣用於清潔能源基礎建設,刺激了對認證材料的投資。 LEED、WELL和能源之星等認證項目,加上優惠融資,使開發商能夠抵消先進產品15%至25%的溢價。這些激勵措施加速了成本敏感市場對先進產品的採用,並為擁有現代化認證組合的製造商創造了穩定的收入來源。

認證材料的初始成本較高

認證產品通常會因檢測成本、特殊加工和小批量生產而產生15%至25%的溢價。這種溢價在住宅建築領域尤其顯著,因為買家主要關注初始成本,往往忽略了潛在的全生命週期成本節約。諸如負碳混凝土和生物基隔熱材料等新型產品也需要投入研發成本。雖然隨著產量增加和碳定價縮小成本差距,這些成本正在下降,但高昂的初始成本仍然是短期內推廣應用的障礙,尤其是在缺乏強力獎勵機制的發展中地區。

細分市場分析

到2025年,低碳混凝土和水泥將佔綠色建材市場24.17%的佔有率,凸顯了該產業迫切需要將全球溫室氣體排放傳統水泥減少8%。突破性技術,例如礦物碳化製程(可在保持強度的同時封存45%的二氧化碳),正從試驗階段走向有限的商業化規模。海德堡材料公司位於倫福特的計劃每年將捕獲7萬噸二氧化碳,展現了其作為主流技術的潛力。由於結構鋼通常含有93%的廢料,且在報廢時可達到98%的回收率,因此對再生金屬的需求保持穩定。工程木製品,特別是交錯層壓木材(CLT),隨著開發商利用其快速組裝、輕質基礎和現場碳儲存等優勢,市場持續成長。礦物棉隔熱材料憑藉其新型不燃產品系列,持續保持領先地位。同時,得益於可再生原料和優異的隔熱性能,纖維素和生物泡沫隔熱材料正以10.17%的複合年成長率成長。由於生命週期評估中對微塑膠脫落問題的擔憂,再生塑膠複合複合材料的成長更加謹慎,而木質聚合物板材則繼續滲透到外牆和建築幕牆細分市場。

不同材料的成長前景各不相同。低碳黏合劑受益於航空碳捕獲補貼,並將隨著碳定價的擴大而加速成長。大宗木材市場依賴於認證林業的擴張和建築規範中高度限制的修訂。纖維素的成長軌跡取決於能否確保充足的消費後廢紙原料供應以及酵素加工廠的規模化建設。總體而言,材料創新正在增強競爭優勢,並迫使現有企業將循環經濟特性、檢驗的碳足跡和數位護照等資訊整合到其所有產品線中。

區域分析

到2025年,北美將佔全球綠色建材市場規模的40.35%,這主要得益於北美長期以來推行的能源之星(ENERGY STAR)和LEED認證項目,以及各州實施的零能耗建築法規。根據《通膨控制法案》,聯邦稅額扣抵將加強全國範圍內的協調一致,而加州2025年的建築規範預計將進一步限制產品的碳含量。加拿大的「綠色家園舉措」 (Greener 住宅 Initiative)正在為維修提供低利率貸款,從而刺激了對纖維素和礦物棉隔熱材料的需求。

在歐洲,《建築能源性能指令》和即將實施的碳邊境調節機制透過提高高碳進口成本並鼓勵國內低碳生產,維持了較高的採納率。斯堪地那維亞國家已要求所有大型建築物進行生命週期碳排放評估,從而刺激了對數位通行證和大型木材的需求。德國和法國在公共部門採購低碳混凝土方面處於主導,而英國正在試點循環建築中心,以回收都市區拆除工程中的可重複使用材料。

亞太地區預計到2031年將以10.95%的複合年成長率成長,這主要得益於快速的都市化和不斷發展的綠色建築標準。中國將要求所有新計畫在2025年前至少達到基礎級綠建築認證標準,並且一些省份已經引入了製造業碳排放基準值。印度的節能建築規範和印尼的綠建築委員會評級體係正在推動綠建築標準的早期應用,但各城市間執行力度的不平衡將限制短期內的需求成長。澳洲和新加坡的綠色建築系統已經成熟,它們正在向全部區域輸出專業知識,推動供應鏈在地化並加強區域認證標準。

儘管南美洲、中東和非洲仍處於發展階段,但由於基礎設施投資不斷成長,這些地區已成為極具吸引力的市場。巴西的「Procel Edifica」認證系統和阿拉伯聯合大公國的「Estidama Pearl」評級系統正鼓勵材料供應商在當地生產,以滿足特定的氣候性能要求。雖然資金籌措仍然是一個主要障礙,但越來越多的多邊銀行綠色債券流入這些市場,正為在下一個規劃週期內加速推廣綠色環保奠定基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加強強制性節能標準

- 政府獎勵和認證計劃

- 企業淨零排放目標與碳包容性採購

- 老舊建築維修工程蓬勃發展

- 利用數位材料護照實現報廢價值貨幣化

- 市場限制

- 認證材料的初始成本較高

- 區域認證和績效複雜性

- 2027年起生物基原料供應短缺

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依材料類型

- 低碳混凝土和水泥

- 回收金屬

- 加工木材/再生木材

- 礦棉隔熱材料

- 纖維素和生物泡沫隔熱材料

- 再生塑膠複合複合材料

- 透過使用

- 框架

- 隔熱材料

- 屋頂材料

- 牆板

- 室內裝修

- 其他用途

- 按最終用戶行業分類

- 住宅

- 商業的

- 工業和公共設施

- 基礎設施

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BASF

- Binderholz GmbH

- Cemex SAB de CV

- Coromandel International Ltd.

- DuPont

- Heidelberg Materials

- Holcim Ltd

- Interface Inc.

- Kingspan Group

- Owens Corning

- PPG Industries Inc

- Rockwool A/S

- Saint-Gobain

- Sika AG

- SmartLam

- Steico SE

- Weyerhaeuser Company

第7章 市場機會與未來展望

The Green Building Materials Market is expected to grow from USD 298.52 million in 2025 to USD 327.25 million in 2026 and is forecast to reach USD 518.64 million by 2031 at 9.62% CAGR over 2026-2031.

The outlook reflects sustained policy pressure for zero-emission construction, rising corporate net-zero commitments and rapid scaling of low-carbon material technologies. Regulatory alignment between the European Union, the United States and other major economies is eliminating historical fragmentation, enabling global manufacturers to capture scale efficiencies and accelerate product innovation. Demand is further supported by financial incentives that narrow the price gap with conventional products, while digital material-tracking tools are beginning to monetise end-of-life value streams. Together, these forces are triggering the fastest adoption cycle the green building materials market has experienced to date.

Global Green Building Materials Market Trends and Insights

Mandatory Energy-Efficiency Codes Tightening

Worldwide building codes are shifting from voluntary guidelines to binding performance standards. In Europe, the revised Energy Performance of Buildings Directive requires all new buildings to achieve zero on-site fossil-fuel emissions by 2030, and existing residential stock must upgrade to at least an E rating by the same year. The United States is following with the 2024 International Energy Conservation Code, which streamlines state adoption and adds life-cycle carbon provisions. Stricter codes boost demand for high-performance insulation, low-carbon concrete and advanced facades, rewarding suppliers that can verify product sustainability through digital compliance platforms. Enhanced enforcement further raises compliance costs for traditional materials, creating durable competitive advantages for certified alternatives.

Government Incentives and Certification Schemes

Tax credits, green bonds and preferential financing are transforming project economics. The US Inflation Reduction Act's Section 45L offers up to USD 5,000 per qualifying housing unit, and the 179D deduction now covers larger commercial upgrades. Canada has earmarked CAD 10 billion for clean-energy infrastructure, funnelling capital toward certified materials. With programs such as LEED, WELL and ENERGY STAR now linked to discounted financing, developers can offset the 15-25% price premium associated with advanced products. These incentives accelerate adoption in cost-sensitive segments and create reliable revenue streams for manufacturers that maintain up-to-date certification portfolios.

High Upfront Cost of Certified Materials

Certified products typically command 15-25% price premiums owing to testing, specialised processing and smaller production runs. The premium is most acute in residential construction, where buyers focus on first-cost and may overlook lifecycle savings. Novel products such as carbon-negative concrete or bio-based insulation also carry R&D amortisation charges. While declining as volumes rise and carbon pricing narrows cost differentials, elevated upfront expense remains a near-term adoption barrier, particularly in developing regions without robust incentive programs.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Net-Zero, Embodied-Carbon Procurement

- Retrofit Wave for Ageing Building Stock

- Certification and Performance Complexity Across Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Low-carbon concrete and cement captured 24.17% of green building materials market share in 2025, underscoring industry urgency to abate the 8% of global greenhouse-gas emissions linked to conventional cement. Breakthrough technologies such as mineral-carbonation processes that sequester 45% CO2 while preserving strength have transitioned from pilot to limited commercial scale. Heidelberg Materials' Lengfurt project will capture 70,000 t of CO2 per year, signalling mainstream viability. Recycled metals retain reliable demand as structural steel routinely contains 93% scrap content and achieves 98% recovery rates at end-of-life. Engineered wood products, notably cross-laminated timber, are expanding as developers capitalise on faster assembly, lighter foundations and on-site carbon storage. Mineral-wool insulation remains a staple thanks to new non-combustible product lines, while cellulose and bio-foam insulation is progressing at a 10.17% CAGR, supported by renewable feedstocks and high thermal performance. Recycled-plastic composites are growing more selectively as lifecycle assessments raise concerns over micro-plastic shedding, although wood-polymer boards continue to penetrate exterior decking and facade niches.

Growth prospects vary across materials. Low-carbon binders benefit from inflight carbon-capture subsidies and will accelerate once carbon pricing regimes scale. Mass-timber markets hinge on expanded certified forestry capacity and revisions to height limits in building codes. Cellulose's trajectory depends on securing sufficient post-consumer paper streams and scaling enzymatic treatment plants. Overall, material innovation reinforces competitive differentiation, compelling incumbents to integrate circular-economy features, verified carbon footprints and digital passports into every product line.

The Green Building Materials Market Report is Segmented by Material Type (Low-Carbon Concrete and Cement, Recycled Metals, and More), Application (Framing, Insulation, and More), End-Use Industry (Residential, Commercial, Industrial and Institutional, and Infrastructure), and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 40.35% of the green building materials market size in 2025, reflecting long-standing ENERGY STAR and LEED programmes and state-level zero-energy-ready building mandates. Federal tax credits under the Inflation Reduction Act strengthen national alignment, while California's 2025 code cycle is expected to tighten embodied-carbon limits further. Canada's Greener Homes Initiative funnels low-interest loans into retrofit upgrades, stimulating demand for cellulose and mineral-wool insulation.

Europe maintains a high adoption baseline due to the Energy Performance of Buildings Directive and the forthcoming Carbon Border Adjustment Mechanism, which together raise the cost of high-carbon imports and incentivise domestic low-carbon production. Scandinavian countries have already mandated whole-life-carbon assessments for all large buildings, accelerating demand for digital passports and mass timber. Germany and France lead public-sector procurement of low-carbon concrete, while the United Kingdom pilots circular-construction hubs to harvest reusable materials from urban demolition.

Asia-Pacific is forecast to expand at an 10.95% CAGR through 2031 as rapid urbanisation meets evolving green-building codes. China requires all new projects to achieve at least Basic Grade green certification by 2025, while several provinces have introduced embodied-carbon benchmarks. India's Energy Conservation Building Code and Indonesia's Green Building Council rating system are driving early adoption, though fragmented municipal enforcement tempers near-term volumes. Australia and Singapore, already mature, are exporting expertise across the region, reinforcing supply-chain localisation and regional certification standards.

South America and the Middle East and Africa remain nascent but attractive as infrastructure investment expands. Brazil's Procel Edifica labelling system and the United Arab Emirates' Estidama Pearl Rating System are encouraging material suppliers to localise production to meet climate-specific performance needs. Financing remains the principal hurdle; however, multilateral banks increasingly channel green bonds into these markets, setting the stage for accelerated uptake during the next planning cycle.

- BASF

- Binderholz GmbH

- Cemex S.A.B. de C.V.

- Coromandel International Ltd.

- DuPont

- Heidelberg Materials

- Holcim Ltd

- Interface Inc.

- Kingspan Group

- Owens Corning

- PPG Industries Inc

- Rockwool A/S

- Saint-Gobain

- Sika AG

- SmartLam

- Steico SE

- Weyerhaeuser Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory Energy-Efficiency Codes Tightening

- 4.2.2 Government Incentives and Certification Schemes

- 4.2.3 Corporate Net-Zero, Embodied-Carbon Procurement

- 4.2.4 Retrofit Wave for Ageing Building Stock

- 4.2.5 Digital Material Passports Monetising End-Of-Life Value

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost of Certified Materials

- 4.3.2 Certification And Performance Complexity Across Regions

- 4.3.3 Bio-Based Feedstock Supply Crunch Post-2027

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Low-carbon Concrete and Cement

- 5.1.2 Recycled Metals

- 5.1.3 Engineered / Reclaimed Wood

- 5.1.4 Mineral-wool Insulation

- 5.1.5 Cellulose and Bio-foam Insulation

- 5.1.6 Recycled-plastic Composites

- 5.2 By Application

- 5.2.1 Framing

- 5.2.2 Insulation

- 5.2.3 Roofing

- 5.2.4 Exterior Siding

- 5.2.5 Interior Finishing

- 5.2.6 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial and Institutional

- 5.3.4 Infrastructure

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BASF

- 6.4.2 Binderholz GmbH

- 6.4.3 Cemex S.A.B. de C.V.

- 6.4.4 Coromandel International Ltd.

- 6.4.5 DuPont

- 6.4.6 Heidelberg Materials

- 6.4.7 Holcim Ltd

- 6.4.8 Interface Inc.

- 6.4.9 Kingspan Group

- 6.4.10 Owens Corning

- 6.4.11 PPG Industries Inc

- 6.4.12 Rockwool A/S

- 6.4.13 Saint-Gobain

- 6.4.14 Sika AG

- 6.4.15 SmartLam

- 6.4.16 Steico SE

- 6.4.17 Weyerhaeuser Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment