|

市場調查報告書

商品編碼

1906280

硬木:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Hardwood - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

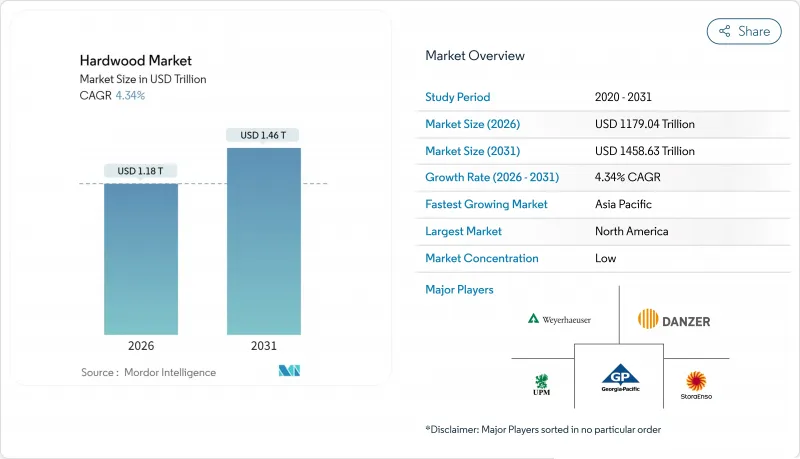

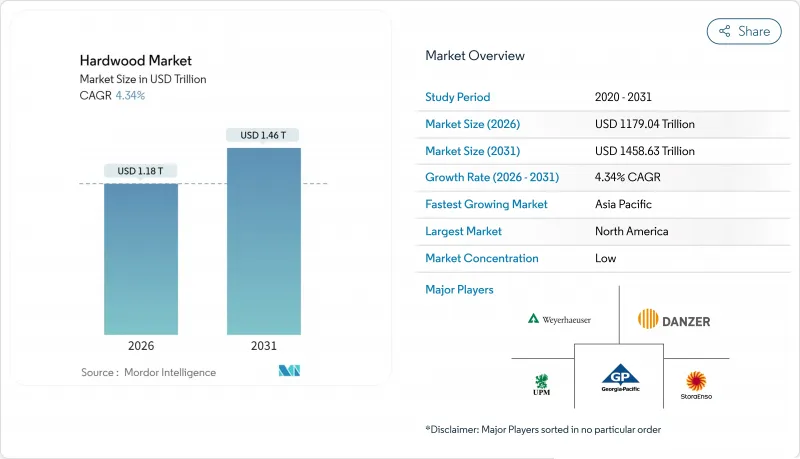

2025年硬木市場價值11300億美元,預計到2031年將達到14586.3億美元,而2026年為11790.4億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.34%。

成長的驅動力來自日益完善的永續性法規,例如歐盟的《森林砍伐條例》(EUDR),以及建築、地板材料和高階家具等終端用戶強勁的需求。市場領導正投資於垂直整合的供應鏈,以降低原料採購風險;與此同時,全球範圍內對非法伐木的打擊力度加大,推高了合規成本,並進一步推高了認證木材的溢價。亞太地區的成長速度得益於持續的都市化和不斷壯大的中產階級消費群體,這與北美和歐洲雖然成長速度稍慢但仍然龐大的消費群體形成鮮明對比。在供應方面,鋸木廠自動化帶來的效率提升、數位化可追溯性的廣泛應用以及美國旨在加速國內伐木的政策舉措,都預示著一個以生產力為導向、紀律主導的成長時代的到來。

全球硬木市場趨勢與洞察

全球綠色建築計劃對經認證的永續硬木木材的需求不斷成長

截至2025年,約有2.8億公頃森林將獲得PEFC(森林認證系統核准計畫)或FSC(森林管理委員會)認證,第三方認證將從一種市場增值因素轉變為進入要求。將於2024年12月生效的歐盟毀林法規(EUDR)將要求出口商提供每批貨物的地理位置資訊,迫使供應商在其分散的運營中建立數字化可追溯性。為此,FSC推出了專門的「監管模組」以減輕合規負擔。認證溢價正在歐洲以外地區擴展,東亞和東南亞的進口商擴大要求提供檢驗的原產地證明,以確保下游產品能夠進入經濟合作暨發展組織(OECD)市場。必維國際檢驗集團(Bureau Veritas)觀察到,將FSC、PEFC和合法性檢查整合到一次現場審核中的多體系審核顯著增加,從而降低了重複合規成本。

全球中產階級在高檔木製家具上的支出正在上升

亞太地區收入的成長重新運作了對實木家具的需求,但短期銷售額與住宅交易趨勢同步波動。威廉布萊爾的分析顯示,二手住宅交易與家具銷售之間存在很強的相關性,這解釋了為何儘管長期基礎良好,但銷售量卻較為緩慢。較高的運費和通貨緊縮的價格趨勢持續擠壓利潤空間,但人口結構的利多因素,例如在家工作環境的改善,支撐著4%至6%的穩定成長。 2024年初,美國對印度的硬木出口額達287萬美元,其中以白橡木、山胡桃木和紅橡木為主。這顯示印度的進口基礎薄弱,但對優質硬木樹種的需求卻被壓抑已久。

由於國際反非法伐木法規(歐盟非法伐木法規、萊西法案)的加強,導致供應不穩定。

包括歐盟《森林砍伐條例》和美國《萊西法案》在內的嚴格法規要求對所有跨境硬木運輸進行全程追蹤,這增加了每筆交易的文件編制和檢驗負擔。這種額外的審查增加了進出口商的成本,並已導致一些買家減少從難以證明合法採伐的地區訂購木材。儘管歐盟委員會2025年4月發布的指導意見允許進行年度實質審查報告,但仍要求提交每批貨物的地理數據,這增加了貨源多元化供應商的固定成本。

細分市場分析

橡木將佔據硬木市場最大佔有率,到2025年將佔消費量的27.74%。賓州和密蘇裡州的立木價格報告顯示,白橡木單板的價格上限顯著提高,但混合鋸材的平均價格穩定在每千板英尺約260美元,凸顯了不同等級木材之間價格差異的擴大。胡桃木在高階家具和吸音板應用的推動下,預計將獲得顯著的市場佔有率,年複合成長率將達到5.71%,超過整體硬木市場的成長速度。由於受到《瀕危野生動植物種國際貿易公約》(CITES)的管制,紅木的產能持續受限,而櫻桃木的市場成長則隨著其流行週期的消退而趨於平緩。鵝掌楸和山毛櫸等次要樹種由於認證溢價而在特定計劃規格中得到應用,但其規模尚未達到橡木和胡桃木的水平。擁有多元化樹種組合的綜合性公司可以利用區域價格差異來平滑收入,並對沖氣候變遷導致的樹種分佈變化風險。

隨著消費者選擇樹種時不僅考慮其美觀性,也更加重視透明度,可追溯的價值鏈變得日益重要。這種良性循環使投資於森林管理委員會 (FSC) 和森林認證促進計劃 (PEFC)審核的森林所有者受益,維持的價格差異足以抵消審核和產銷監管鏈 (CoC) 的成本。

區域分析

北美地區佔2025年銷售額的36.55%,這得益於其豐富的森林資源、成熟的基礎設施以及有利於認證林業的法規環境。美國2025年3月發布的《擴大伐木行政命令》旨在加強野火預防措施並減少對進口的依賴。然而,鋸木廠的關閉,例如Canfor公司位於南卡羅來納州的工廠關閉(導致產能減少3.5億板英尺),凸顯了市場週期可能超越政策預期。加拿大作為美國主要供應商的地位仍然至關重要。潛在的反補貼稅可能會重塑跨境貿易格局,並影響中西部和東北部地區的計劃經濟效益。墨西哥正利用美墨加協定(USMCA)提供的免稅准入,但其加工規模不足限制了其對美國邊境附近區域家具產業叢集的貢獻。

亞太走廊預計將以5.42%的複合年成長率成長,並成為硬木市場的重要成長引擎。 2024年,中國將進口998萬立方公尺硬木原木,平均價格為每立方公尺277美元,儘管整體建設活動低迷,但中國仍將轉向進口優質樹種。印度的硬木市場仍具有巨大的成長潛力,美國木材僅佔其構成比的5%。一旦物流和關稅摩擦得到緩解,預計樹種多樣化將帶來顯著的成長潛力。東南亞出口國,尤其是越南,正在滿足全球家具訂單,但印尼的膠合板市場卻面臨需求下降的困境,凸顯了該地區內部業績的差異。

在歐洲,由於認證標準的實施,需求保持穩定。同時,歐盟木材法規(EUDR)正在重組供應鏈,有利於那些擁有良好管理記錄的本土和北歐生產商。德國軟木進口量大幅下降(預計2024年將下降34%),預示著結構性替代趨勢的轉變,這一趨勢可能會蔓延至硬木市場。在中東和非洲,由於大型國家計劃的推進,預計需求將會成長,但物流不穩定和窯爐產能有限限制了硬木市場短期內的擴張。然而,隨著區域標準的推進,碳正建築材料的發展前景仍然樂觀。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全球綠色建築計劃對經認證的永續硬木木材的需求不斷成長

- 全球中產階級在高級硬木家具上的支出不斷成長

- 硬木單板工程木材製造的成長

- 全球住宅維修中實木地板的使用率不斷上升

- 透過收割和鋸木的技術創新來提高產量和供應效率

- 市場限制

- 由於加強了對非法採伐的國際法規(歐盟非法採伐條例、萊西法案),導致供應波動。

- 全球市場中來自更便宜的軟木和複合材料替代品的價格壓力

- 貿易中斷和關稅不確定性對硬木出口流量的影響

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察市場最新趨勢與創新

- 深入了解市場近期發展動態(新產品發表、策略性舉措、投資、合作、合資、擴張、併購等)

第5章 市場規模與成長預測

- 按物種

- 橡木

- 楓

- 櫻桃

- 核桃

- 桃花心木

- 其他

- 透過使用

- 地板材料

- 家具

- 建造

- 室內設計與裝飾

- 工業包裝和托盤

- 木製品

- 其他用途

- 透過分銷管道

- 直銷

- 分銷商/批發商

- 零售(線下和線上)

- 其他分銷管道

- 按地區

- 北美洲

- 加拿大

- 美國

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 東南亞(新加坡、馬來西亞、泰國、印尼、越南、菲律賓)

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Weyerhaeuser Company

- Georgia-Pacific LLC

- Danzer Group

- Baillie Lumber Co.

- Stora Enso Oyj

- UPM-Kymmene Oyj

- Mohawk Industries, Inc.

- Armstrong Flooring, Inc.

- Rougier Afrique International

- Samling Group

- Greenply Industries Ltd.

- Arauco

- Sumitomo Forestry Co., Ltd.

- Dongwha International

- Columbia Forest Products

- Century Plyboards Ltd.

- Norbord Inc.

- Kronospan Limited

- Mannington Mills, Inc.

- Roseburg Forest Products

- Holzindustrie Schweighofer(HS Timber Group)

- Stella-Jones Inc.

第7章 市場機會與未來展望

The Hardwood Market was valued at USD 1130 billion in 2025 and estimated to grow from USD 1179.04 billion in 2026 to reach USD 1458.63 billion by 2031, at a CAGR of 4.34% during the forecast period (2026-2031).

Growth is underpinned by tightening sustainability regulations-most notably the European Union Deforestation Regulation (EUDR)-and by resilient end-use demand in construction, flooring, and high-end furniture. Market leaders are funding vertically integrated supply chains to de-risk raw-material availability, while tighter global enforcement against illegal logging is raising compliance costs yet reinforcing the premium for certified wood. Asia-Pacific's pace, buoyed by ongoing urbanization and rising middle-class spending, balances the cooler but still sizable consumption base in North America and Europe. On the supply side, efficiency-boosting sawmill automation, wider deployment of digital traceability, and U.S. policy moves to accelerate domestic harvesting all point to an era of disciplined, productivity-led growth.

Global Hardwood Market Trends and Insights

Rising Demand for Certified Sustainable Hardwood in Global Green Building Projects

Roughly 280 million hectares of forests carried either PEFC (Programme for the Endorsement of Forest Certification systems) or Forest Stewardship Council (FSC) certification in 2025, turning third-party validation into an entry requirement rather than a marketing add-on . The EU Deforestation Regulation (EUDR), effective December 2024, forces exporters to present geolocation data for every shipment, pushing suppliers to retrofit digital traceability across fragmented operations. FSC reacted with a dedicated "Regulatory Module" to ease compliance . The certification premium is migrating beyond Europe, as importers in East and South-East Asia increasingly ask for verified provenance to protect their downstream access to Organisation for Economic Co-operation and Development (OECD) markets. Bureau Veritas confirms a marked rise in multi-scheme audits that bundle FSC, PEFC, and legality checks into one field mission, thereby trimming compliance overlap costs.

Expanding Middle-Class Expenditure on Premium Hardwood Furniture Worldwide

Income gains across Asia-Pacific have reset aspirations toward solid-wood furniture, yet short-term sales fluctuate with housing turnover. An assessment by William Blair shows a tight correlation between existing-home transactions and furniture receipts, explaining subdued volumes despite intact long-term fundamentals. Freight rates and deflationary price trends continue to squeeze margins, though demographic tailwinds-such as remote-work configurations that elevate home-office quality-anchor a 4%-6% steady-state growth band. Early-2024 U.S. hardwood exports to India reached USD 2.87 million, led by white oak, hickory, and red oak, underscoring the gap between India's low import base and its latent appetite for premium hardwood species.

Supply Volatility Due to Stricter International Anti-Illegal Logging Regulations (EUDR, Lacey Act)

Stringent rules, including the EU Deforestation Regulation and the U.S. Lacey Act, now demand end-to-end tracking for every load of hardwood that crosses a border, adding layers of paperwork and verification to each transaction. The extra scrutiny raises costs for importers and exporters alike and has already pushed some buyers to scale back orders from regions where proving a legal harvest is difficult. The European Commission's April 2025 guidance allows annual due diligence filings but still demands shipment-level geodata, raising fixed costs for suppliers handling diverse sourcing pools.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Engineered Wood Manufacturing Utilizing Hardwood Veneers

- Increasing Adoption of Hardwood Flooring in Residential Renovations Globally

- Price Pressure from Cheaper Softwood and Composite Substitutes in Global Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oak controlled 27.74% of 2025 consumption, giving it the single-largest slice of the hardwood market. Pennsylvania and Missouri stumpage reports reveal impressive ceiling prices for white oak veneer, yet mixed sawlog averages settled near USD 260 per thousand board feet, spotlighting widening value bands across grades. Walnut, propelled by luxury furniture and acoustic-panel applications, is set to capture an outsized wallet share as its 5.71% CAGR outstrips overall hardwood market growth. Mahogany remains capacity-constrained under CITES (Convention on International Trade in Endangered Species) listing, while cherry treaded water after fashion cycles cooled. Secondary species, including tulipwood and beech, ride certification premiums into niche project specifications but lack the scale of oak or walnut. Diversified species portfolios allow integrated firms to exploit regional price differentials, smoothing earnings and hedging against climate-induced shifts in species distribution.

Consumers increasingly choose species not only for aesthetics but also for transparency credentials, amplifying the strategic value of traceable supply chains. That virtuous loop rewards forest owners investing in Forest Stewardship Council or Programme for the Endorsement of Forest Certification audits, sustaining a price delta that compensates for audit and chain-of-custody costs.

The Hardwood Market is Segmented by Species (Oak, Maple, and More), Application (Flooring, Furniture, and More), Distribution Channel (Direct Sales, Distributors/Wholesalers, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.55% of 2025 turnover thanks to expansive forest inventories, mature infrastructure, and a regulatory environment conducive to certified forestry. The March 2025 U.S. executive order to expand harvesting aims to fortify wildfire mitigation and reduce import reliance, although sawmill closures such as Canfor's South Carolina operations-which will remove 350 million board feet of capacity-underscore how market cycles can still override policy intent. Canada's role as a top U.S. supplier remains pivotal; potential countervailing duties could reshape cross-border trade flows and influence project economics across the Midwest and Northeast. Mexico leverages USMCA tariff-free access but lacks processing scale, limiting its upside to regional furniture clusters near the U.S. border.

The Asia-Pacific corridor, growing at 5.42% CAGR, is the hardwood market's chief momentum engine. China imported 9.98 million m3 of hardwood logs in 2024 at an average USD 277 per m3, pivoting toward premium species despite overall tepid construction activity. India's hardwood market remains under-indexed; U.S. lumber constitutes just 5% of its import mix, leaving significant runway for species diversification once logistics and tariff frictions ease. Southeast Asian exporters-Vietnam, particularly-are filling global furniture orders, yet Indonesia's plywood segment wrestles with demand slumps, pointing to heterogeneous performance across the region.

Europe delivers stable, certification-led demand but is rewriting supply chains through the EUDR filter, effectively favoring domestic and Nordic producers with robust chain-of-custody records. Germany's softwood import collapse (-34% in 2024) hints at structural substitution into engineered products, likely to spill over into hardwood patterns. The Middle East and Africa pool gains from sovereign mega-projects; however, volatile logistics and limited kiln-dry capacity restrict near-term hardwood roll-outs, while long-term visibility remains promising as local standards embrace carbon-positive building materials.

- Weyerhaeuser Company

- Georgia-Pacific LLC

- Danzer Group

- Baillie Lumber Co.

- Stora Enso Oyj

- UPM-Kymmene Oyj

- Mohawk Industries, Inc.

- Armstrong Flooring, Inc.

- Rougier Afrique International

- Samling Group

- Greenply Industries Ltd.

- Arauco

- Sumitomo Forestry Co., Ltd.

- Dongwha International

- Columbia Forest Products

- Century Plyboards Ltd.

- Norbord Inc.

- Kronospan Limited

- Mannington Mills, Inc.

- Roseburg Forest Products

- Holzindustrie Schweighofer (HS Timber Group)

- Stella-Jones Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Certified Sustainable Hardwood in Global Green Building Projects

- 4.2.2 Expanding Middle-Class Expenditure on Premium Hardwood Furniture Worldwide

- 4.2.3 Growth of Engineered Wood Manufacturing Utilizing Hardwood Veneers

- 4.2.4 Increasing Adoption of Hardwood Flooring in Residential Renovations Globally

- 4.2.5 Technological Advancements in Harvesting & Sawmilling Enhancing Yield and Supply Efficiency

- 4.3 Market Restraints

- 4.3.1 Supply Volatility Due to Stricter International Anti-Illegal Logging Regulations (EUDR, Lacey Act)

- 4.3.2 Price Pressure from Cheaper Softwood and Composite Substitutes in Global Markets

- 4.3.3 Trade Disruptions and Tariff Uncertainties Impacting Hardwood Export Flows

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Species

- 5.1.1 Oak

- 5.1.2 Maple

- 5.1.3 Cherry

- 5.1.4 Walnut

- 5.1.5 Mahogany

- 5.1.6 Others

- 5.2 By Application

- 5.2.1 Flooring

- 5.2.2 Furniture

- 5.2.3 Construction

- 5.2.4 Interior Design & Decoration

- 5.2.5 Industrial Packaging & Pallets

- 5.2.6 Millwork

- 5.2.7 Other Applications

- 5.3 By Distribution Channel

- 5.3.1 Direct Sales

- 5.3.2 Distributors/Wholesalers

- 5.3.3 Retailers (offline and online)

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East And Africa

- 5.4.5.1 United Arab of Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East And Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Weyerhaeuser Company

- 6.4.2 Georgia-Pacific LLC

- 6.4.3 Danzer Group

- 6.4.4 Baillie Lumber Co.

- 6.4.5 Stora Enso Oyj

- 6.4.6 UPM-Kymmene Oyj

- 6.4.7 Mohawk Industries, Inc.

- 6.4.8 Armstrong Flooring, Inc.

- 6.4.9 Rougier Afrique International

- 6.4.10 Samling Group

- 6.4.11 Greenply Industries Ltd.

- 6.4.12 Arauco

- 6.4.13 Sumitomo Forestry Co., Ltd.

- 6.4.14 Dongwha International

- 6.4.15 Columbia Forest Products

- 6.4.16 Century Plyboards Ltd.

- 6.4.17 Norbord Inc.

- 6.4.18 Kronospan Limited

- 6.4.19 Mannington Mills, Inc.

- 6.4.20 Roseburg Forest Products

- 6.4.21 Holzindustrie Schweighofer (HS Timber Group)

- 6.4.22 Stella-Jones Inc.

7 Market Opportunities & Future Outlook

- 7.1 Demand for Sustainable and Certified Hardwood

- 7.1.1 Custom and Modular Furniture Trends