|

市場調查報告書

商品編碼

1906262

歐洲硬質塑膠包裝市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Europe Rigid Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

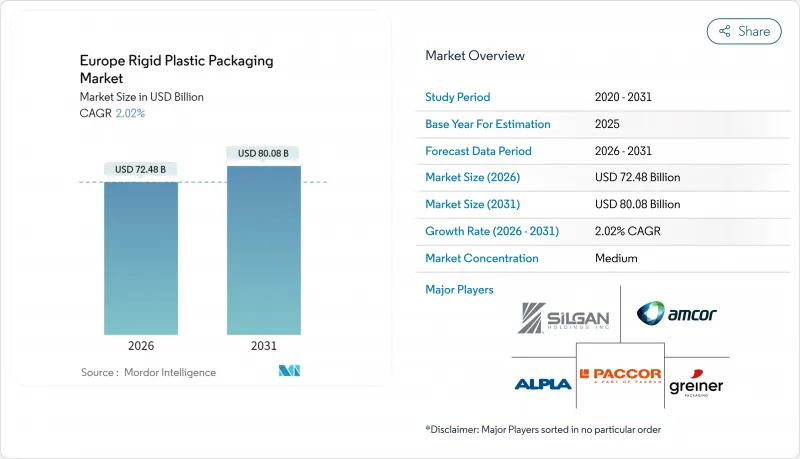

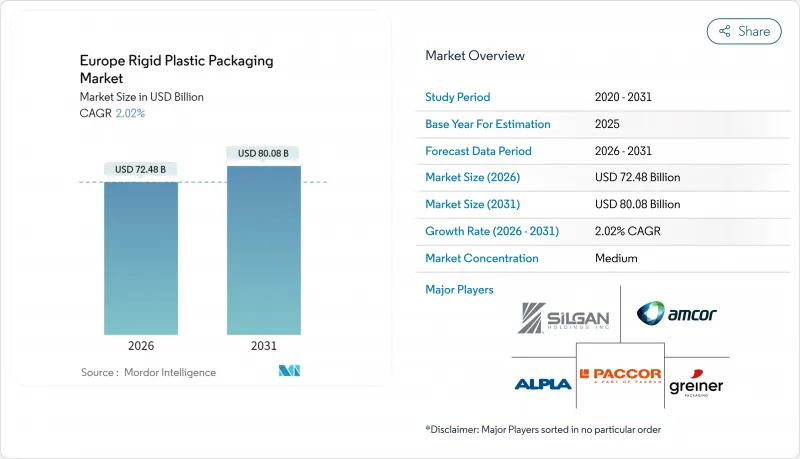

歐洲硬質塑膠包裝市場預計將從 2025 年的 710.4 億美元成長到 2026 年的 724.8 億美元,預計到 2031 年將達到 800.8 億美元,2026 年至 2031 年的複合年成長率為 2.02%。

更嚴格的回收目標、最低再生材料含量標準和材料稅正在重塑設計選擇、籌資策略和資本配置。押金返還計畫 (DRS) 正在推動對再生 PET 的需求成長,而能源價格波動和原料成本上漲則加速了營運效率提升計畫的實施。大規模加工商正在合併以共用合規資源,而早期投資於閉合迴路基礎設施的生產商正在與飲料、食品和醫療保健品牌所有者建立商業性優勢。來自纖維基替代品的材料替代壓力加劇了競爭,但在阻隔性、可回收性和抗衝擊性要求高於輕量化獎勵的領域,硬質塑膠仍然佔據主導地位。

歐洲硬質塑膠包裝市場趨勢與洞察

飲料業對可再生硬質寶特瓶的需求激增

在德國,押金返還制度的回收率已超過90%,促使歐盟其他地區也紛紛效仿,並提振了對食品級再生PET(rPET)的需求。葡萄牙的一個試點計畫驗證了該制度的技術可行性,僅使用一台反向自動販賣機,每天即可回收1281個容器。在回收的容器中,透明藍色PET佔絕大多數,凸顯了顏色標準化對於提高分類效率的重要性。歐盟規定,到2025年寶特瓶再生材料含量必須達到25%,到2030年達到30%,儘管歐洲擁有300萬噸的清洗能力和140萬噸的造粒能力,但仍導致再生原料供不應求。這促使品牌商簽訂雙邊承購協議,並推動清洗線和擠出反應器的改造。因此, 寶特瓶仍然是成長最快的硬包裝形式,支撐著未來塑膠回收投資計畫的一半以上。

快速成長的電子商務推動了防護性硬質包裝的發展

到2024年,線上銷售額將佔歐洲零售總額的22%以上,這將推動對能夠承受多站履約鏈衝擊的抗衝擊包裝的需求。為了降低小包裹在自動化分類中心的破損率和保固索賠,零售商正在採用硬質桶、硬桶和可堆疊式包裝。如果減少產品破損帶來的效益大於增加重量所帶來的損失,零售商願意接受材料重量的少量增加。預計到2030年,人均包裝廢棄物將達到209公斤,監管機構要求提供包裝尺寸合理性的證據。然而,防護性強、堅固耐用的包裝解決方案因其能夠預防產品全生命週期的損壞而備受青睞,這為致力於打造電商適用包裝設計的加工商帶來了持續的短期需求成長。

一次性塑膠稅和生產者延伸責任制

將於2025年生效的環境調整附加稅將對可回收性有限的硬質包裝徵收,這將增加傳統包裝設計的遵循成本。例如,義大利對聚苯乙烯托盤徵收每噸800歐元(866美元)的稅,法國對單一材料PET徵收每噸456附加稅(494美元)的稅,附加稅將促使包裝轉型和產品種類精簡。大型加工商可以透過規模經濟來分擔成本,而小規模模塑商則面臨利潤率下降甚至退出市場的風險,這將加速產業整合。

細分市場分析

到2025年,瓶罐包裝將佔歐洲硬質塑膠包裝市場307.1億美元,佔43.22%,預計到2031年將維持最快成長速度,年複合成長率達2.74%。這一成長動能主要得益於飲料業對符合DRS標準的PET容器的依賴,以及製藥業對可消毒HDPE片容器的需求。冷藏食品配送對托盤和容器的需求保持穩定,但PFAS禁令正在推動阻隔塗層技術的創新。蓋子與封口裝置正朝著固定式設計發展,到2024年7月,所有一次性飲料包裝都必須採用這種設計,這將促使封口供應商更新模具。

中型散貨箱和桶在化學品物流領域佔據穩固的地位。然而,電子商務小包裹的密度尚未達到足以柔軟性軟包裝被廣泛替代的程度。托盤和其他硬質配件的需求持續成長,這主要得益於回收站運營商對高密度聚苯乙烯)托盤的回收利用。因此,目前產品組合仍以瓶裝為主,預計PET和HDPE將繼續主導歐洲硬質塑膠包裝市場的樹脂消費量。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 飲料業對可再生硬質寶特瓶的需求激增

- 快速成長的電子商務推動了硬質防護包裝形式的發展

- 透過擴大歐盟押金退款計畫來加速收款基礎設施建設

- 可重複填充和再利用商店試點計畫推動高密度聚乙烯瓶重新設計

- 歐洲生質塑膠產能迅速擴張

- 由於醫藥低溫運輸的擴展,對阻隔性硬質包裝材料的需求增加。

- 市場限制

- 一次性塑膠稅和生產者延伸責任制(EPR)成本

- 轉向使用紙張和軟性替代品以減輕重量

- 再生PET(rPET)和再生高密度聚苯乙烯(rHDPE)價格的波動給加工商的利潤率帶來了壓力。

- 能源價格飆升推高了擠出和射出成型的成本。

- 產業供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 瓶子和罐子

- 托盤和容器

- 瓶蓋和封口

- 中型散貨箱(IBC)

- 鼓

- 調色盤

- 其他產品類型

- 材料

- 聚乙烯(PE)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 聚苯乙烯(PS)和發泡聚苯乙烯(EPS)

- 聚氯乙烯(PVC)

- 其他硬質塑膠材料

- 按最終用戶行業分類

- 食物

- 飲料

- 衛生保健

- 化妝品和個人護理

- 工業的

- 建築/施工

- 車

- 其他終端用戶產業

- 按國家/地區

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 波蘭

- 荷蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Alpla Werke Alwin Lehner GmbH & Co KG

- Mauser Packaging Solutions Holding Company

- Amcor plc

- Greiner Packaging International GmbH

- Greif, Inc.

- PACCOR Packaging GmbH(Faerch Group)

- Plastipak Holdings, Inc.

- Schoeller Allibert Services BV

- Silgan Holdings Inc.

- Albea Group

- Coda Plastics Ltd.

- Frapak Packaging BV

- Schutz GmbH & Co. KGaA

- WERIT Kunststoffwerke W. Schneider GmbH & Co. KG

- ACTI PACK SAS

- RETAL Industries Ltd.

- RIKUTEC Group

- AST Kunststoffverarbeitung GmbH

- Robinson plc

- Esterform Packaging Ltd.

第7章 市場機會與未來展望

The Europe rigid plastic packaging market is expected to grow from USD 71.04 billion in 2025 to USD 72.48 billion in 2026 and is forecast to reach USD 80.08 billion by 2031 at 2.02% CAGR over 2026-2031.

Stricter collection targets, minimum recycled-content thresholds, and material taxes are reshaping design choices, procurement strategies, and capital allocation. Deposit-return schemes (DRS) underpin rising recycled PET demand, while energy-price volatility and feedstock inflation accelerate operational efficiency programs. Large converters pursue mergers to pool compliance resources, and producers that invest early in closed-loop infrastructure secure commercial advantages with beverage, food, and healthcare brand owners. Material substitution pressures from fiber-based alternatives intensify competition, yet rigid formats retain defensible positions wherever high barrier, reusability, or impact resistance requirements outweigh lightweighting incentives.

Europe Rigid Plastic Packaging Market Trends and Insights

Surging Demand for Recyclable Rigid PET Bottles in Beverages

Deposit-return schemes already deliver collection rates above 90% in Germany and inspire similar adoption across the bloc, lifting demand for food-grade rPET feedstock. Portugal's pilot proved technical viability with 1,281 packages captured per reverse-vending unit daily, and transparent blue PET accounted for most returns, underlining the power of color standardization to streamline sorting. The EU obligation for 25% recycled content in PET bottles by 2025 and 30% by 2030 creates an undersupplied secondary-material pool despite Europe's 3 million-tonne washing and 1.4 million-tonne pellet capacity. Brand owners therefore lock in bilateral offtake agreements, stimulating retrofits of washing lines and extrusion reactors. As a result, PET bottles remain the fastest-growing rigid format and anchor more than half of the upcoming resin recycling investments.

Booming E-commerce Boosting Protective Rigid Formats

Online retail penetration exceeded 22% of total European goods sales in 2024, heightening the need for impact-resistant containers that survive multi-node fulfillment chains. Rigid drums, pails, and stackable tubs reduce breakage rates and warranty claims as parcels transit automated sorting hubs, and retailers accept marginal material increases when product-damage savings offset weight penalties. With packaging waste generation projected at 209 kg per capita by 2030, regulators now demand right-sizing evidence; nonetheless, protective rigid solutions often score favorably on life-cycle damage avoidance, sustaining a near-term boost for converters targeting e-commerce-ready designs.

Single-Use Plastic Taxes and Extended Producer Responsibility Fees

Eco-modulated fees, effective from 2025, penalize rigid packs with limited recyclability, inflating compliance outlays for legacy designs. Differential levies-EUR 800/ton (USD 866/ton) on polystyrene trays in Italy versus EUR 456/ton (USD 494/ton) on mono-material PET in France, drive format migration and prompt SKU rationalization. Large converters absorb charges via scale efficiencies, but small molders risk margin erosion or exit, accelerating sector consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Growth of EU Deposit-Return Schemes Accelerating Collection Infrastructure

- Rapid Scale-up of European Bioplastics Capacity

- Shift Toward Paper and Flexible Substitutes for Lightweighting

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bottles and jars contributed USD 30.71 billion, equal to 43.22% of Europe's rigid plastic packaging market size in 2025, and will keep expanding fastest at a 2.74% CAGR to 2031. This momentum stems from beverage-sector reliance on DRS-compatible PET formats and pharma demand for sterilizable HDPE pill containers. Tray and container demand hold steady in chilled-food distribution, yet PFAS bans compel barrier-coating innovation. Caps and closures evolve toward tethered designs, mandated on all single-use beverage packs by July 2024, spurring tooling upgrades across closure suppliers.

Intermediate bulk containers and drums carved a resilient niche in chemical logistics; however, e-commerce parcel density has yet to justify the broad replacement of flexible liners. Pallets and other rigid accessories maintain incremental growth, driven by circular pool operators that refurbish high-density polyethylene decks. The product mix thus remains weighted toward bottles, ensuring that PET and HDPE dominate resin off-take in the European rigid plastic packaging market.

The Europe Rigid Plastic Packaging Market Report is Segmented by Product Type (Bottles and Jars, Trays and Containers, Caps and Closures, Intermediate Bulk Containers, and More), Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), and More), End-User Industry (Food, Beverage, Healthcare, Cosmetics and Personal Care, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alpla Werke Alwin Lehner GmbH & Co KG

- Mauser Packaging Solutions Holding Company

- Amcor plc

- Greiner Packaging International GmbH

- Greif, Inc.

- PACCOR Packaging GmbH (Faerch Group)

- Plastipak Holdings, Inc.

- Schoeller Allibert Services B.V.

- Silgan Holdings Inc.

- Albea Group

- Coda Plastics Ltd.

- Frapak Packaging B.V.

- Schutz GmbH & Co. KGaA

- WERIT Kunststoffwerke W. Schneider GmbH & Co. KG

- ACTI PACK S.A.S.

- RETAL Industries Ltd.

- RIKUTEC Group

- AST Kunststoffverarbeitung GmbH

- Robinson plc

- Esterform Packaging Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for recyclable rigid PET bottles in beverages

- 4.2.2 Booming e-commerce boosting protective rigid formats

- 4.2.3 Growth of EU deposit-return schemes accelerating collection infrastructure

- 4.2.4 Refill-and-reuse store pilots driving HDPE bottle redesigns

- 4.2.5 Rapid scale-up of European bioplastics capacity

- 4.2.6 Pharma cold-chain expansion needing high-barrier rigid packs

- 4.3 Market Restraints

- 4.3.1 Single-use-plastic taxes and Extended Producer Responsibility fees

- 4.3.2 Shift toward paper and flexible substitutes for lightweighting

- 4.3.3 Volatile rPET and rHDPE prices squeezing converter margins

- 4.3.4 Energy-price shocks raising extrusion and injection costs

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Bottles and Jars

- 5.1.2 Trays and Containers

- 5.1.3 Caps and Closures

- 5.1.4 Intermediate Bulk Containers (IBCs)

- 5.1.5 Drums

- 5.1.6 Pallets

- 5.1.7 Other Product Types

- 5.2 By Material

- 5.2.1 Polyethylene (PE)

- 5.2.2 Polyethylene Terephthalate (PET)

- 5.2.3 Polypropylene (PP)

- 5.2.4 Polystyrene (PS) and Expanded PS (EPS)

- 5.2.5 Polyvinyl Chloride (PVC)

- 5.2.6 Other Rigid Plastic Materials

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial

- 5.3.6 Building and Construction

- 5.3.7 Automotive

- 5.3.8 Other End-user Industries

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Poland

- 5.4.7 Netherlands

- 5.4.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alpla Werke Alwin Lehner GmbH & Co KG

- 6.4.2 Mauser Packaging Solutions Holding Company

- 6.4.3 Amcor plc

- 6.4.4 Greiner Packaging International GmbH

- 6.4.5 Greif, Inc.

- 6.4.6 PACCOR Packaging GmbH (Faerch Group)

- 6.4.7 Plastipak Holdings, Inc.

- 6.4.8 Schoeller Allibert Services B.V.

- 6.4.9 Silgan Holdings Inc.

- 6.4.10 Albea Group

- 6.4.11 Coda Plastics Ltd.

- 6.4.12 Frapak Packaging B.V.

- 6.4.13 Schutz GmbH & Co. KGaA

- 6.4.14 WERIT Kunststoffwerke W. Schneider GmbH & Co. KG

- 6.4.15 ACTI PACK S.A.S.

- 6.4.16 RETAL Industries Ltd.

- 6.4.17 RIKUTEC Group

- 6.4.18 AST Kunststoffverarbeitung GmbH

- 6.4.19 Robinson plc

- 6.4.20 Esterform Packaging Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment